I Have A Chronic Condition What Types Of Health Insurance Are Best For Me

Chronic conditions could require regular medication and more frequent doctor appointments, even costly hospital stays and/or surgeries. Consider a health plan that helps minimize out-of-pocket costs based on what you anticipate for doctor care, specialist visits, prescription medications, etc.

A little bit of time spent planning will help you in choosing the right types of health insurance.

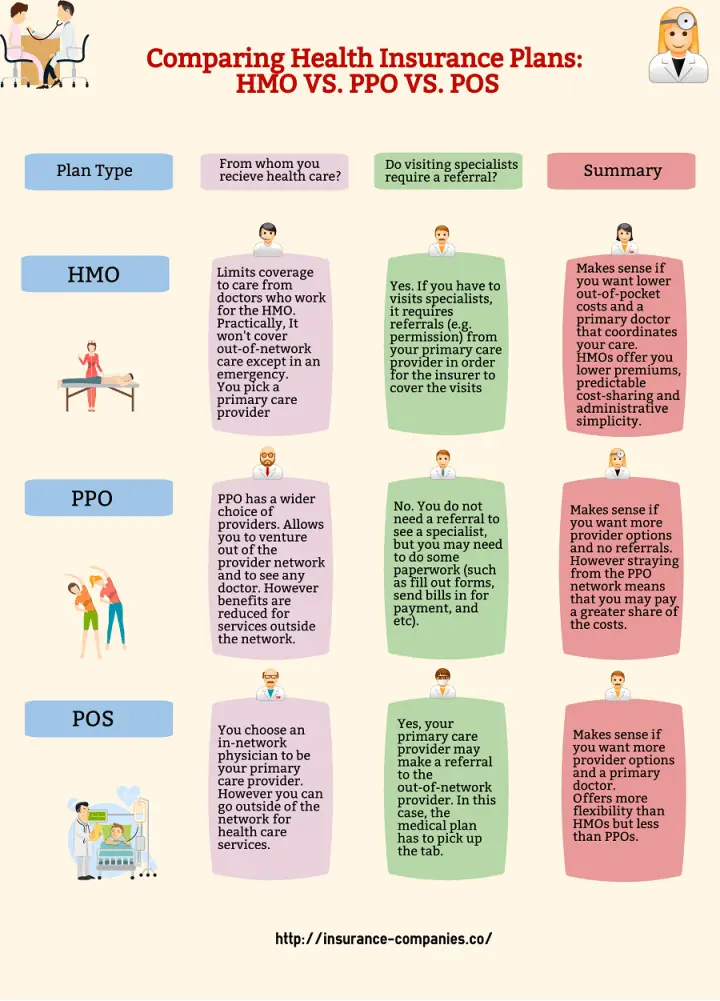

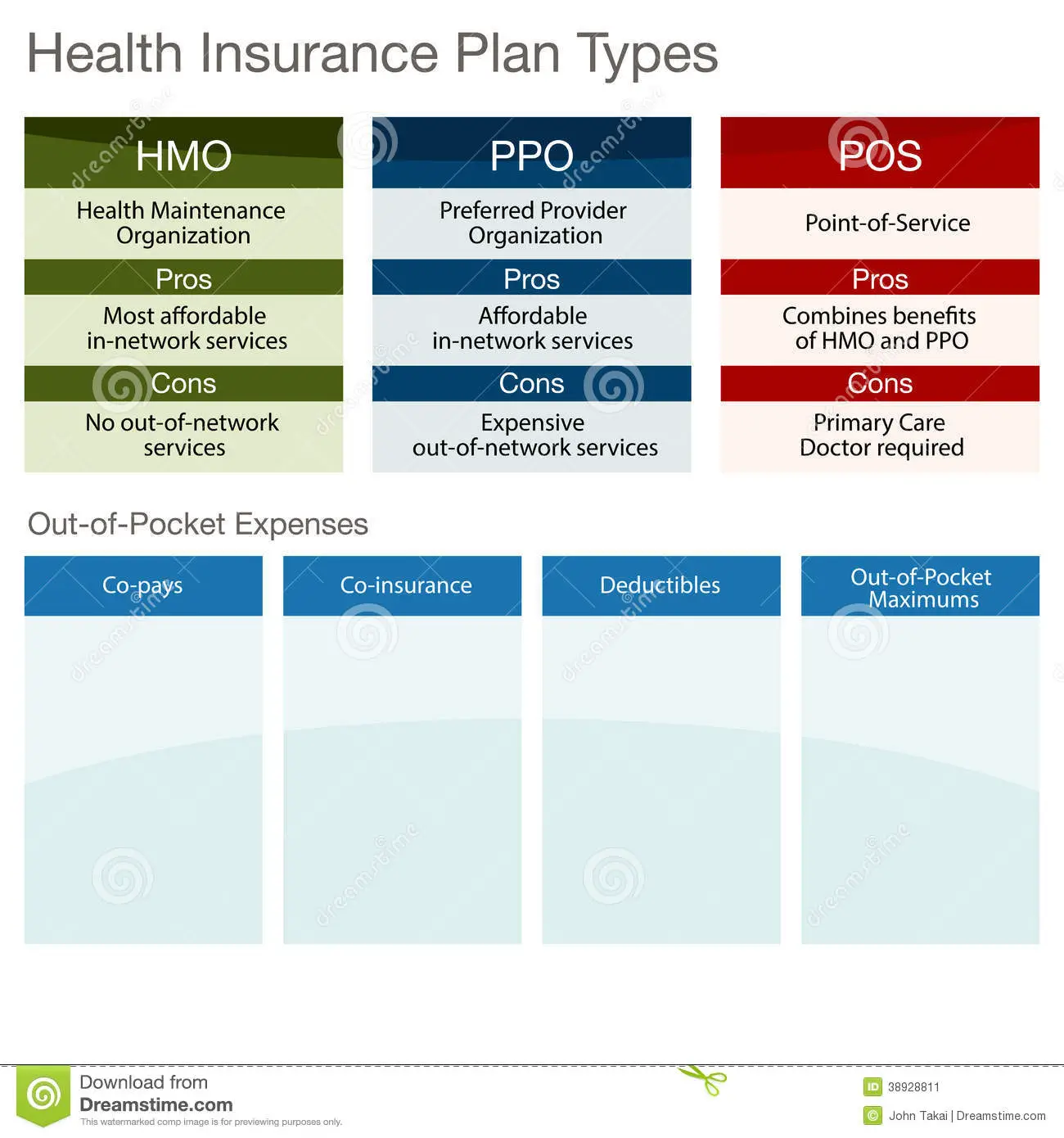

Comparing Costs Between Hmo Ppo Pos And Epo Health Care Plans

In 2020, employees with some sort of employer-sponsored health insurance plan paid an average annual premium of $5,588 for family coverage, according to the Kaiser Family Foundation 2020 Employer Health Benefits Survey. Single coverage cost an average annual premium of $1,243 per employee . The Kaiser Family Foundation also found that 47% of the employees surveyed were enrolled in a PPO plan, 13% in an HMO, and 8% in a POS plan.

Of all the plans, HMOs tend to be the least expensive. According to the Kaiser Family Foundation survey, employees paid an annual premium of $1,212 for an HMO plan with single coverage in 2020.

The survey did not single out costs for EPOs, but in the past, the Kaiser Family Foundation has defined EPO and HMO plans as a single HMO plan. EPOs can also be cost-efficient, as long as you stay in-network. If you get the services outside of the EPO network or member hospitals, you could pay the costs entirely out of pocket.

And even though they were the most popular plan in 2020, according to the Kaiser Family Foundation, PPO plans may be more expensive than other plan types because you’ll pay more out-of-pocket costs, such as a higher monthly premium. The survey found that employees paid an average annual premium of $1,335 for single coverage in 2020.

Call your health insurance company before seeing an out-of-network health care provider. This could help prevent your claim from being denied, and make sure you don’t pay too much out of pocket.

When Can I Buy Private Health Insurance

Most types of health insurance have an open enrollment period during which you can sign up for private health insurance. This is true whether you are buying insurance via the Affordable Care Act health insurance exchange in your state, sign up directly through the insurer, enroll in the plan your employer offers, or sign up for Medicare.

Certain life events can trigger a special enrollment period, which will allow you to change your health insurance coverage outside of the normal enrollment period. These events include getting married or divorced, having a baby, losing your job-based health insurance, or moving out of your health plans service area.

You May Like: What Is The Cheapest Health Insurance In Florida

Benefits Of Travel Insurance

The following aspects are covered under travel insurance plans:

- Cover Flight Delay –Flight delays or cancellations can lead to significant losses for the passenger. If you buy travel insurance, you can claim such financial losses from the insurer.

- Baggage Loss/Delay-Travel insurance lets you claim monetary assistance if there is a delay or you happen to lose your luggage during the trip. With this amount, you can purchase some of the necessary items.

- Reclaim Lost Travel Documents -Visa and passport are essential documents during an international trip. Opting for international travel insurance ensures that you have the necessary financial backing to reapply for interim or replacement documents as and when necessary.

- Trip Cancellation Cover – A sudden death in the family or a medical emergency may play spoilsport with your travel arrangements. Thankfully, international travel insurance plans support trip cancellations in such events. You can claim financial assistance to pay penalties and cancellation charges for flights, hotels, etc.

Make sure that you choose an insurer carefully, especially a company that is reliable and available 24×7 to assist you.

What Is Health Insurance Definition

Health insurance is a type of insurance coverage against the risks of occurring medical costs.Your health insurance pays the costs for medical and surgical expenses in case you need them.

How does it work?

In simple words, you chose a health insurance plan and pay a monthly premium to the health insurance company.In return, if you receive health care the insurance company pay all of the costs, depending on the details of the plan.

Depending on your health insurance type, either you pay expenses out-of-pocket and are then reimbursed, or your insurance company pays directly to your health care provider

Why Do I Need Health Insurance?

As we mentioned above, the purpose of health insurance is to help you pay for medical care in case you need it.

It provides a financial protection to you and your family if an unexpected illness and injury happen. As you know, there are illnesses and injuries that are really expensive to recover from them.

Health insurance has also one important benefit you are more likely to get preventive care if you have it.

The future is always unpredictable and unfortunately you can not predict what your medical expenses would be in a case of illness.

Yes, in some times you may have low costs but also there is a possibility for very high expenses in other times.

Health insurance gives you peace that you are protected from most of the medical costs. It reduces the risks and unpredictability inherent in your cost of health care.

Don’t Miss: Do You Have To Have Health Insurance In Arizona

What Are Health Insurance Plans Through Work

Around 49% of Americans get health insurance coverage through their employers. Thats nearly 157 million people.1 Employer-sponsored health plans play a big role in benefits packages. Depending on your employer, there may be several health plans for you to choose from. If you get your health plan through work, check into UnitedHealthcare plans to learn what benefits are included with our plans. From personalized support to helpful digital tools and large provider networks there’s a lot to consider when making your choice.

Best For The Midwest: Healthpartners

HealthPartners

Under the names Group Health Plan, Inc and HealthPartners Insurance Company, this company sells Medicare plans in Minnesota, Wisconsin, North Dakota, South Dakota, Iowa and Illinois. All three of its private plans garnered 4.5 overall scores from NCQA.

Those who have diabetes may like this plan, as one of HealthPartners’ promises to consumers is to provide monthly supplies of insulin for no more than $25.

Overall, the company offers three separate plans in Minnesota and two separate plans in Wisconsin, depending on where you live and your specific coverage needs. Those living in the HealthPartners Insurance area of Minnesota have the most options available.

Don’t Miss: Can I Use My Health Insurance In A Different State

What Is A No Claim Bonus

No claim bonus refers to a discount that is offered to policyholders for every non-claim year of a health or a motor insurance policy. With the NCB policyholders can either avail a higher sum insured amount for health insurance or a discount on their premium amount for motor insurance policies upon renewing their policy.

No claim bonus refers to a discount that is offered to policyholders for every non-claim year of a health or a motor insurance policy. With the NCB policyholders can either avail a higher sum insured amount for health insurance or a discount on their premium amount for motor insurance policies upon renewing their policy.

Pros And Cons Explained

When you have a managed health care plan, you have guaranteed access to a network of health care providers. And as long as you visit one of the in-network doctors or specialists, you’ll benefit from reduced rates, compared to if you went out-of-network.

When you visit doctors in-network, there’s a billing system that helps make the paperwork and claims process easier. This could speed up the process, too.

Physicians and providers also benefit from managed health care plans because they are likely to see more patients who are in the network. That gives them a steady stream of clients and consistent work.

However, compared to indemnity or FFS plans, there is less flexibility because you’re required to go to an in-network doctor, or risk paying more to see another health care provider. You may also need a referral to visit a specialist.

Don’t Miss: What State Has The Cheapest Health Insurance Rates

What Are Preferred Provider Organizations

PPOs typically offer you a large network of participating providers so you have a lot of doctors, hospitals, and other health care professionals and facilities to choose from. You may also choose to see providers from outside of the plans network, but you will pay more out-of-pocket.

Choosing a primary care provider is not required with these types of health plans, and you can see specialists without a referral.

Where Can I Buy Private Health Insurance

A good place to start looking for coverage is the Health Insurance Marketplace created in 2014 by the Affordable Care Act . On the marketplace for your state, you can look through the details of private health insurance plans, and compare the cost and benefits of each. If your state does not have its own marketplace, use Healthcare.gov.

Recommended Reading: Does Health Insurance Cover Plan B

If Youre A Senior Citizen

If youâre above the age of 65, you qualify for Medicare. We go into more detail into Medicare below, but the gist of it is that itâs a federal program designed to help you cover health care costs into old age.

You can also purchase supplemental insurance, called Medigap, that can help pay for your deductibles, copayments, and coinsurance. Medigap plans may or may not make sense for you â make sure you know what youâre buying before you start to pay for it.

The 10 Essential Benefits Every Health Insurance Plan Must Provide

The Affordable Care Act, also known as Obamacare, made covering certain health care services a requirement for all health insurance plans available to consumers. These required services are known as the 10 health essential benefits. These 10 categories of services are:

-

Ambulatory patient services

-

Hospitalization for surgery, overnight stays, and other conditions

-

Pregnancy, maternity, and newborn care

-

Mental health and substance use disorder services

-

Rehabilitative and habilitative services and devices

-

Laboratory services

-

Preventive and wellness services, as well as chronic disease management

-

Pediatric services, including dental and vision coverage for children

Note that these are categories of services, and that the specific services offered within these categories may differ from state to state. Typically states require that plans offer more services to their customers, rather than restricting services you would expect to find under these categories. State, federal, and private exchanges will show you exactly which services each plan covers before you apply.

One thing private health insurance is not required to cover is durable medical equipment , such as wheelchairs and ventilators. Because many people rely on this life-saving devices, be sure to get a health insurance plan that offers coverage for DME.

You May Like: How Much Is Health Insurance In Costa Rica

How To Find An Affordable Health Insurance Plan

Finding a health insurance plan that fits you and your needs doesn’t have to be a pain. When shopping for an affordable health insurance plan, it’s important to know what makes a plan affordable to you, specifically. Do you rarely utilize health care services? A high deductible, low premium plan probably makes sense for you. Are you managing a chronic illness? A health insurance plan that has higher premiums, but has lower out-of-pocket costs, will probably be more affordable in the long run.

Learn more in this guide on how to get affordable health insurance.

More on Health Insurance

Family Floater Health Insurance

If you want an affordable health insurance policy for all the members of your family then Family Floater Health Insurance should be your choice.

Under a Family Floater Health Insurance, single Sum Insured floats for all the members covered under the policy. A Family Floater Health Insurance Plan is beneficial because the premium is comparatively lower than the Individual Health Insurance policy. This policy can cover yourself, your spouse, children and parents.

You should not consider adding members of your family who are above 60 years of age. They are more prone to illness and hence it will impact the premium.

If you or the eldest member of your family is below 60 years of age, then you should buy a family floater policy.

Also Check: How Much Do You Pay For Health Insurance

Health Maintenance Organization Plans

Next up is the health maintenance organization plan. These plans offer a wide range of healthcare services through a network of providers that contract exclusively with the HMO, or who agree to provide services to members. Employees participating in HMO plans will typically need to select a primary care physician to provide most of their healthcare and refer them on to an HMO specialist as needed.

Unit Linked Health Plans

These plans are more interesting than the others. In this type of health insurance policy, one gets to make investments and receive insurance simultaneously. So, as an individual, you can choose according to your budget and preference. Either way, you will receive several benefits. The premiums here are used in the stock markets too. So, the returns you receive are based on the market performance.

You May Like: How Much Is Health Insurance Through Work

Compare The Best Companies Selling Insurance In The Us

Consumer ReportsOncology TimesMEDICAThe New York Times MagazinePsychology TodaySports Illustrated

We publish unbiased product reviews our opinions are our own and are not influenced by payment we receive from our advertising partners. Learn more about how we review products and read our advertiser disclosure for how we make money.

Which are the best health insurance companies in the United States? It’s hard to know how to even begin sorting through the multiple options when your employer offers a choice of health plans or you need to select a private health insurance policy.

We’ve done some of the legwork for you by examining which health insurance companies in the U.S. are ranked highest on such factors as prevention, treatment, and customer satisfaction. We selected 9 companies that have a wide range of available products, including national providers and a few highly-rated regional companies.

To find the best policies for you and your family, you can start by entering your zip code and then other information at the companies’ websites. You will be directed to the policies available in your area that are appropriate for your circumstances, at which point you can compare local physician, hospital, and pharmacy choices. You can also find the combination of premium, deductible, and other out-of-pocket expenses that is the best option for you.

Self Insured Health Plans

Many large employers are self-insured. A self-insured employer has a large pool of money and uses it to pay for the health care of employees. The employer most often contracts with insurance companies to manage the health benefits.

It is important to know if your employer is self-insured! Why? You may not have the same protections and benefits as other types of coverage. Self-insured plans do not have to follow California laws on essential health benefits, complaints, and coverage.

Self-insured plans issued by private companies follow the Federal Employee Retirement Income Security Act of 1974 and are regulated by the U.S. Department of Labor, Employee Benefits Security Administration . Visit the Ask EBSA page for more information or call them at 1-866-444-3272.

Also Check: How To Get A Health Insurance Exemption

Benefits Of Cycle Insurance

The advantages of availing such an insurance policy are:

- Worldwide Coverage – Depending on the insurance provider, cycle insurance policies provide financial assistance regardless of where your bicycle undergoes damage. Even if you meet with a cycling accident in a different country, such a plan will offer aid.

- Protection against Fires and Riots -If your bicycle sustains damage due to accidental fires and/or rioting, insurance policies will provide the necessary financial assistance to repair or undo the damage.

- Accidental Death Benefit -If you pass away due to bicycle accidents, the insurance policy for the cycle would offer a lump-sum payout to your surviving family members.

Regardless of your cycles price, opting for insurance can reduce your financial liabilities significantly.

How Us Health Insurance Works

Health care in the United States can be very expensive. A single doctors office visit may cost several hundred dollars and an average three-day hospital stay can run tens of thousands of dollars depending on the type of care provided. Most of us could not afford to pay such large sums if we get sick, especially since we dont know when we might become ill or injured or how much care we might need. Health insurance offers a way to reduce such costs to more reasonable amounts.

The way it typically works is that the consumer pays an up front premium to a health insurance company and that payment allows you to share “risk” with lots of other people who are making similar payments. Since most people are healthy most of the time, the premium dollars paid to the insurance company can be used to cover the expenses of the small number of enrollees who get sick or are injured. Insurance companies, as you can imagine, have studied risk extensively, and their goal is to collect enough premium to cover medical costs of the enrollees. There are many, many different types of health insurance plans in the U.S. and many different rules and arrangements regarding care.

Following are three important questions you should ask when making a decision about the health insurance that will work best for you:

Also Check: How To Get The Most Out Of My Health Insurance

Is Claim Settlement Ratio An Important Factor For Choosing An Insurance Provider

Yes, claim settlement ratio refers to the total number of claims settled by an insurance company against the total number of claims raised. Availing the services of an insurance provider with a higher claim settlement ratio allows you to reduce the chances of your claim getting rejected.

Yes, claim settlement ratio refers to the total number of claims settled by an insurance company against the total number of claims raised. Availing the services of an insurance provider with a higher claim settlement ratio allows you to reduce the chances of your claim getting rejected.

Please try one more time!