How Do Health Insurance Subsidies Work In The Usa

A health insurance subsidy provides government assistance to contribute to the cost of cover in the USA, the Affordable Care Act provides a sliding scale of support to US citizens and legal residents earning four times the federal poverty level or less.

In 2021, the federal poverty level is $12,880 for an individual, so individuals earning less than $51,520 may be entitled to subsidised health insurance.

Applications are made through the government-run health insurance marketplaces in each state. Changes to incomes may affect eligibility, so applicants sometimes need to pay subsidies back if circumstances change.

How Much Short Or Long

Along with life insurance and health insurance, disability insurance is a critical tool for protecting your familys financial future. Some financial advisors consider it the most valuable type of insurance coverage you can own because it helps replace your income while youre still alive and with your loved ones.

Jump ahead to these sections:

In this article, well briefly review what disability insurance is , answer the important question of how to determine how much disability insurance you need, look at the cost of coverage, as well as answer other FAQs about disability insurance.

What Is The Cheapest Health Insurance

As you can see from the factors listed above, theres a lot that goes into determining the price of insurance. There isnt a single healthcare plan thats the most affordable for everyone. But finding the right plan for your needs is easy with HealthMarkets. Our free FitScore® technology helps you shop, compare and apply for a healthcare plan in minutes. We can even check to see if you may qualify for a tax credit. To get a better look at what plans could cost you and your family, get started now.

46698-HM-1120* Subsidy amounts are based on a 40-year-old nonsmoker making $30,000 per year.

References:

Also Check: How Much Does Starbucks Health Insurance Cost

What Happens If I Dont Take Out Health Insurance

- If you do not take out basic Dutch health insurance within four months, and the government becomes aware that you are not covered, then you will receive a letter from the CAK asking to you to sign up for health insurance within three months.

- If you do not get health insurance within that period, then the CAK will issue you with a fine .

- If you still havent taken action after six months then you will receive a second fine for the same amount.

- If you still havent obtained health insurance within nine months of the first letter, then the CAK will register you with an insurer on your behalf and they will deduct the monthly premium from your salary.

If you are uncertain about whether you need to take out health insurance in the Netherlands then you can contact the Sociale Verzekeringsbank to check whether your circumstances require you to have Dutch health insurance.

If you become sick and you have no health insurance to cover treatment in the Netherlands, then you must pay for medical costs yourself.

International Health Insurance For Us Citizens Living Abroad Whats Covered

How much youll pay for health insurance isnt a number you can guess. Its affected by many factors, few of which you control.

With William Russell, international health insurance can cover US citizens for:

- Doctor visits, consultations, hospital care and mental health treatment in multiple overseas territories .

- Up to $100,000 for unexpected elective medical care and $250,000 in emergency treatment costs during short visits back to US soil, for reassurance when you visit family or head home for the holidays .

Also Check: Evolve Medical Insurance

What Is The Average Cost Of Health Insurance

Maybe youre wondering, How much does individual health insurance cost? Heres what you can expect. The average individual in America pays $452 per month for marketplace health insurance in 2021.2 The average family pays $1,779 per month.3

But the cost of health insurance varies widely based on a bunch of factors. Some things are in your control, some arent. Things like your age, how many people are on your plan, how much coverage you need, where you live and who your employer is all play a role in the price of your coverage.

Heres a breakdown showing the average costs depending on your state:

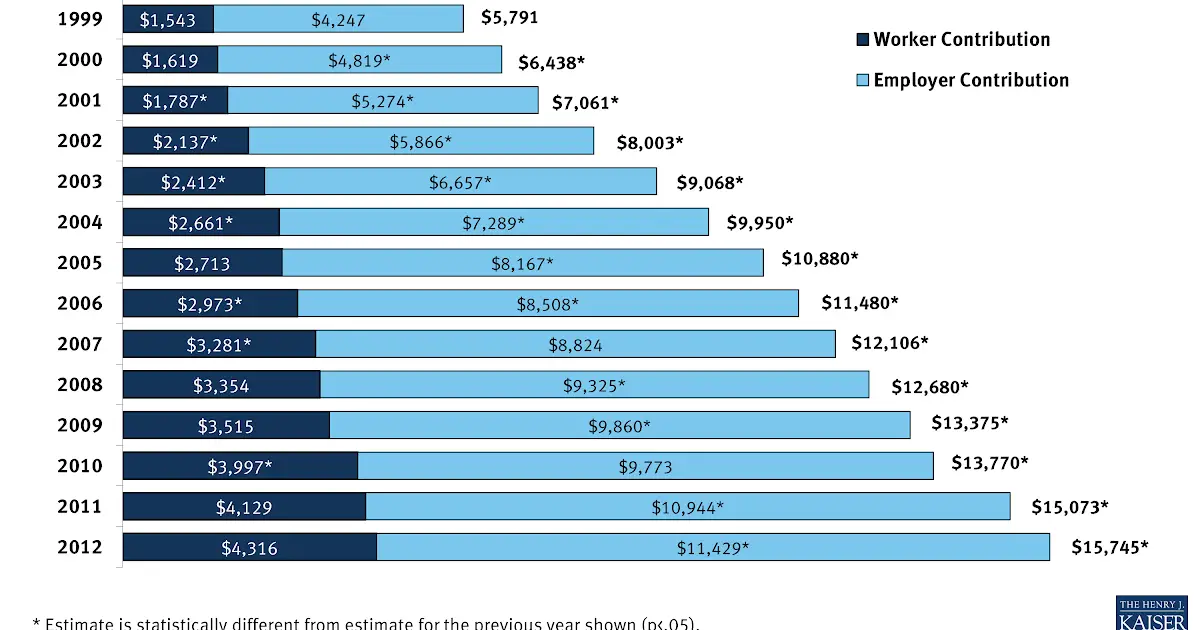

Kaiser Family Foundation, 2021.

How To Get Disability Insurance

There are two ways to get short-term and long-term disability insurance: through your employer or as an individual.

Many medium to large-sized companies and organizations offer both STD and LTD as part of their benefits package. Getting disability insurance protection as a group member can be advantageous since group insurance premiums are typically lower than those for an individual policy. In addition, some employers also pay a portion of their employees premiums, further reducing your cost.

However, there are a couple of drawbacks to group disability insurance coverage.

First, your policy isnt portable, meaning that if you leave the group, you cant bring your coverage with you. This can be problematic if your health has declined since you started with your employer, which may make it difficult for you to be approved by an insurer for individual disability insurance coverage.

The other drawback to getting your coverage through a group is that your rates will be higher when you leave and apply for new coverage elsewhere because youre older than when you enrolled in your previous group disability insurance coverage.

There is one other significant difference between employer-provided disability insurance and individual disability insurance. If your employer pays part or all of your monthly premiums, a portion or all of your benefit will be considered taxable income by the IRS, reducing your net benefit.

Don’t Miss: Does Starbucks Offer Health Insurance To Part Time Employees

Purchase A Policy From An Insurance Company Directly

Only a limited number of insurance plans are available through the Health Insurance Marketplace. Depending on your coverage requirements and budget, you may be able to find a plan outside the market that is more affordable.

On a single insurer’s website, you will only be able to see coverage options from that insurer. To see all of your options when purchasing directly from an insurer, you’ll need to look around on the websites of a few different companies, naics workers comp codes.

Plans that comply with the Affordable Care Act outside of federal and state exchanges must cover pre existing conditions, provide essential benefits, and provide free preventative care before you hit your deductible in order to be considered ACA-compliant, naics workers comp codes.

Short-term plans that are not ACA-compliant can have more exclusions and fewer benefits if purchased outside of the exchanges.

If you’re weighing your options for health insurance, it’s understandable that you’d rather have some coverage than none at all. ACA-compliant insurance with lower premiums is promoted by short-term health insurance programmes as an alternative, naics workers comp codes.

Lower expenses, on the other hand, may not always imply the same amount of coverage for the consumer. Most short-term plans reject coverage to those with pre-existing diseases and dramatically reduce important health benefits under the Affordable Care Act.

Canadian Costs Versus The World

So where does this leave our average family of four? In their 2015 report, the Canadian Institute of Health Information noted that Canadians were among the highest health care spenders in the world. They estimated the average spend at $5,782 per person.

That put the personal spending above the average but nowhere near the biggest spenders. As it has for years, the average American spent twice as much as $11,916. An average family in Sweden spent slightly more at $6,601 and the same family in the UK spent $5,170.

Recommended Reading: Evolve Health Insurance

The Average Cost Of Health Insurance In 2022

Everyone knows that health care is expensive, but just how much is health insurance for one person? The average health insurance cost per month for a 40-year-old individual is $477, or nearly $6,000 per year. However, keep in mind that premiums vary widely based on where you live, along with your age, family size and type of insurance plan.

This national average is for private health insurance you buy on the governments Health Insurance Marketplace created by the Affordable Care Act, often called Obamacare.

MoneyGeek researched national data and analyzed how health insurance rates change based on the type of insurance plan, the number of people covered and the location of that coverage, among other factors.

Many Americans qualify for subsidies that make buying health insurance on the Marketplace more affordable. You may also have lower-cost options if your employer offers health benefits or you’re eligible for government insurance programs such as Medicaid or Medicare, which offer comprehensive plans like Medicare Advantage for affordable prices.

Key Takeaways

The average health insurance premium for a 40-year-old is $477 per month.

Age, location, family size and plan type are all influential factors in the cost of health insurance.

Factors That Impact Health Insurance Rates

For a particular health insurance plan, the cost of coverage is determined by certain factors that have been set by law. States can limit the degree to which these factors impact your rates: For instance, some states like California and New York don’t allow the cost of health insurance to differ based on tobacco use.

- Age: The health care cost per person covered by a policy will be set according to their age, with rates increasing as the individual gets older. Children up to the age of 14 will cost a flat rate to add to a health plan, but premiums typically increase annually beginning at age 15.

- Where you live: Health insurance companies determine the set of policies offered and the cost of coverage based on the state and county you live in. So a resident of Miami-Dade County in southern Florida, for instance, may pay lower rates for the same policy than a resident of Jackson County, in the Florida Panhandle.

- Smoking/tobacco use: If you smoke, you could pay up to 50% higher rates for health insurance, though the maximum increase is determined by the state.

- Number of people insured: The total cost of a health plan is set according to the number of people covered by it, as well as each person’s age and possibly their tobacco use. For example, a family of three, with two adults and a child, would pay a much higher monthly health insurance premium than an individual.

Also Check: Starbucks Insurance Benefits

Total Out Of Pocket Costs

What people do see is their out-of-pocket expenses. Changes to supplemental insurance programs over the past years have impacted deductible rates as well as items covered.

Pre-existing conditions can also play a big part in how much you pay for health care. Your condition may prevent you from being able to get supplemental coverage. Most often, however, it means there are exclusions in your health plan or higher deductibles. Both of these mean higher costs to you.

Is There Ever A Right Amount Or Coverage That One Needs To Look At

The right amount of coverage depends on several factors like the type of hospital you prefer, current age and health conditions of yourself and your family members, your affordability etc. Healthcare costs vary significantly by hospital and the facilities opted. For example, the cost of a knee replacement surgery nearly doubles if you opt for an imported implant instead of an indigenous one. This way, the size of your Health Insurance should be linked to your income and lifestyle.

While there is no ideal sum assured for Health Insurance policy for an individual, there are two market-broadly-accepted rules on its quantum. First, your health cover should be at least 50% of your annual income. And second, the insurance cover should at least cover the cost of a coronary artery bypass graft in a hospital of your choice. Most personal finance experts recommend a minimum health cover of Rs 5 lakh. You can have similar sum assured as a family floater to include your family members.

The rising costs of medicines and treatments may render your individual Health Insurance cover inadequate to cover all expenses. The basic Health Insurance policy may not cover expenses related to recovery phase such as extensive nursing care, counseling sessions, rehabilitation. But you can substantially enhance your health cover over and above your basic policy with tools like Riders and Top-Ups without corresponding increase in the premium.

Also Check: Starbucks Health Insurance Deductible

Expats From Outside The Eu/eea

If you are not from the EU/EEA you are eligible for a Dutch health insurance if you have a permanent Dutch residence permit.

You must take out Dutch health insurance within four months of your permanent residence permit coming into force.

Dutch Government

You are not qualified for Dutch health insurance if:

- You are here for study purposes only

- You are working for an employer outside The Netherlands

- You are paying income tax in another country

If you are not eligible for Dutch health insurance, you could take out expat health insurance.

The Importance Of Subsidies

The good news is that many who purchase marketplace plans will pay lower premiums through what the government calls advanced premium tax credits, otherwise known as subsidies. In 2019, 88% of people who enrolled at HealthCare.gov were eligible for advanced premium tax credits.

What are these subsidies? They are credits the government applies to your health insurance premiums each month to make them affordable. Essentially, the government pays part of your premium directly to your health insurance company, and you’re responsible for the rest.

As part of the American Rescue Plan Act passed in March 2021, subsidies have increased for lower-income Americans and extended to those with higher incomes. The ARPA expanded marketplace subsidies above 400% of the poverty level and increased subsidies for those making between 100% and 400% of the poverty level.

You can take your advance premium tax credit in one of three ways: equal amounts each month more in some months and less in others, which is helpful if your income is irregular or as a credit against your income tax liability when you file your annual tax return, which could mean you owe less tax or get a bigger refund. The tax credit is designed to make premiums affordable based on your household size and income.

You May Like: Starbucks Open Enrollment

Does Affordable Care Act Apply To Expats

Unfortunately, not anymore. Today, the US Government does not require anyone to subscribe to an ACA-compliant health insurance policy. However, a handful of states still impose a penalty on people who do not comply with the ACA. These are:

- California

- Massachusetts

- New Jersey

Other states are also currently processing legislation that will make health insurance compulsory, so before you move to the USA, check your new states laws.

OHIP provides full coverage for many medical necessities.

OHIP covers part or all of:

- Doctor visits

- Cosmetic procedures

- Immunizations for travel

Services not covered under OHIP are expensive and can bring on a massive financial burden when you are least able to deal with them. We highly recommend getting a private insurance plan.

It can help you not only access better care when you need it but also offer peace of mind that you will be covered for large, unexpected expenses that will avoid out-of-pocket costs.

Choose A Medical Cover Abroad

The Dutch basic health insurance covers emergency medical care abroad up to the Dutch tariffs. Treatments in other countries may be more expensive, meaning you need to pay a percentage of the bill yourself.

To extend your cover, you may choose either Europe or Global cover to get a higher reimbursement for treatments abroad .

Note: every time you select a filter, the comparison program will find the cheapest health providers in your situation, and sort them by monthly premium.

Don’t Miss: Starbucks Health Insurance Cost

The Dutch Health Insurance System

In contrast to many other European systems, the Dutch government is responsible for the accessibility and quality of the healthcare system in the Netherlands, but not in charge of its management. The Dutch health insurance system is a combination of private health plans with social conditions built on the principles of solidarity, efficiency and value for the patient. Healthcare in the Netherlands is funded through taxation: mandatory health insurance fees and taxation of income .

Health insurance in the Netherlands is mandatory if you are here on a long-term stay and is designed to cover the cost of medical care. As a rule, all expats must have Dutch health insurance even if they are already insured for healthcare in their homeland . Within four months of receiving your residence permit you are subject to Dutch social security legislation and thus must obtain basic health insurance package.

Why Are Monthly Health Insurance Premiums So Expensive

Health insurance prices have continued their upward climb for many reasons. One reason is that the ACA has put an additional 20 million people in the insurance pool and made it illegal for insurance companies to deny coverage because of pre-existing conditions.

That means healthcare insurers are required to cover the expenses of some of the more costly patients within the healthcare delivery system, for example, those with one or more pre-existing or chronic conditions.

Prior to the ACA, underwriting practices placed those without pre-existing conditions and those with pre-existing conditions into separate pools , with one group enjoying lower premiums because they were âhealthierâ .

Individuals with serious chronic conditions often couldnât obtain coverage at all because they were considered a high risk. And those somewhere in between paid higher premiums and/or deductibles, or had certain benefits excluded from their policies but they could still obtain a policy.

Now, because pre-existing conditions must be covered by ACA-qualifying plans, it means that all of those individuals are in the same general pool and are no longer differentiated by risk.

Naturally, that means that younger, healthier people may be paying a little more for their coverage than they otherwise would if the old risk pools were being used. And older, sicker people may be paying a little less for their coverage than they otherwise would.

- Current health status

| $1,655 |

Also Check: Do Starbucks Employees Get Health Insurance