Follow The Cobra Appeals Process

If your employer refuses to help you get reinstated, then your last option is to go through the COBRA appeals process. The COBRA administrator runs the appeals process.

Remember to be calm and polite when explaining your situation. Whoever you will be talking to likely spends most of his/her day hearing lots of complaints. Make yourself stand out as someone who is respectful and courteous and this could go a long way in helping your case. Make sure you are prepared and bring as much documentation as you can, including the notes you took during Steps 2 and 3.

Finding out you have been dropped from COBRA can be a scary and frustrating experience. Taking the steps above maximizes the likelihood of getting reinstated. If you dont want to take them on yourself, Bernard Health can do it for you we do this stuff all the time and actually like it

Consumer Frequently Asked Questions: Cobra Coverage

Does my employer have to offer me the opportunity to elect continuation of my health insurance coverage?

Answer: In general, most employers with 20 or more employees who provide group health plans must offer each “qualified beneficiary” who would otherwise lose coverage under the plan because of a “qualifying event” an opportunity to elect continuation of the coverage received immediately before the qualifying event.

Who is a qualified beneficiary?

Answer: Generally, a qualified beneficiary is any individual who, on the day before a qualifying event, is covered under a group health plan maintained by the employer of a covered employee by virtue of being: the covered employee, the spouse of the covered employee, or the dependent child of the covered employee. Exceptions include Medicare eligible individuals and certain nonresident aliens.

What is a “qualifying event”?

If I voluntarily leave my employment, is that considered to be a qualifying event?

Answer: Yes. Unless the covered employee was terminated due to gross misconduct, it does not matter whether the employee voluntarily terminated employment or was discharged.

What benefits are available under COBRA?

Answer: If a qualifying event occurs, each qualified beneficiary is entitled to elect to continue to receive coverage identical to that being provided under the plan to “similarly situated beneficiaries” to whom a qualifying event has not occurred.

What is the cost of continuation of coverage under COBRA?

Answer: Yes.

Can You Afford To Keep Your Cobra

When you keep the same employer health insurance, you pay the entire premium. Many people find COBRA to be expensive and will want to look for an alternative. Unfortunately, you are only able to enroll in an Affordable Care Act Qualified Health Plan during an open enrollment period. Even then, you are paying the high costs of a major medical plan.

Recommended Reading: How Much Is Travel Health Insurance

Applying For Cobra Coverage

In order to begin COBRA coverage, an individual must confirm that they are eligible for assistance according to the requirements listed above. Typically, an eligible individual will receive a letter from either an employer or a health insurer outlining COBRA benefits. Some individuals find this notification difficult to understand because it includes a large amount of required legal information and language. If you have any difficulty determining whether you are eligible for COBRA or how to begin coverage through this program, contact either the insurer or your former employer’s HR department.

For individuals either not eligible for COBRA or those searching for alternatives, there are other options, such as a spouse’s health insurance plan.

For individuals either not eligible for COBRA or those searching for alternatives, there are other options. In some cases, a spouse’s health insurance plan may be a possibility. Or you might explore your options on the federal health insurance marketplace or a state insurance marketplace. Loss of a job will open up a special enrollment period.

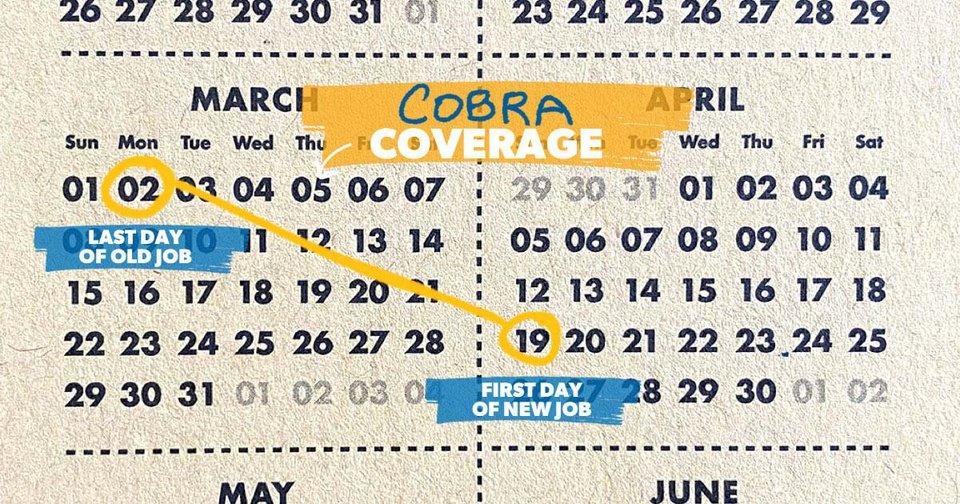

When Does Cobra Coverage Begin And How Long Does It Last

COBRA coverage begins the date your health insurance policy ends because of a qualifying event. For an employee covered under a qualifying event, COBRA coverage can last for 18 months from the date you elect coverage. However, dependents can receive up to 36 months of coverage if you switch to Medicare, get divorced, or die. Otherwise, theyre covered for 18 months as well.

You May Like: What Is Private Health Insurance

Call The Cobra Administrator To Get Their Version Of Events

Next you should call your COBRA administrator to get their version of events. Verify why and when you have been terminated and double check for any discrepancies between your version of events and their version. If there are discrepancies, focus on them and ask questions to understand from where they are pulling their information.

Let the first call be an information-gathering call. Now is not the time to get into an argument about whose version of events is correct. It is also not the right time to explain that you had extenuating circumstances. Just listen, write down what they say, and get the name of the person you spoke to and reference code for the call if they use them.

When you get off the phone, review your notes. If there are discrepancies, try to figure out why that may be. If you have some ideas as to what might have happened, write those down, too.

Who Is Best Suited For Cobra Other Benefits And Drawbacks

If you are leaving your job to pursue self-employment, you may be able to get health coverage that is as good as or better than COBRA for less money. The packet you receive in the mail with the sign-up materials articulates this pretty forcefully! You are definitely encouraged to pursue other options.

If you have other options when searching for insurance, such as your spouses or parents plan, that may also be a better choice than COBRA. And as one HR rep who posted in the comments of my previous article pointed out, if you are fired for gross misconduct, you may not be eligible for COBRA. So youd have to find another option in that event. According to another commenter, if you have an FSA and opt for COBRA, you may have additional hurdles and headaches coming your way.

However, COBRA was the right solution for me so while it may not be the good side of quitting, I imagine its an option that is not going to be eliminated, even with the Affordable Care Act on the scene.

Read more: Beware of ER-like facilities that look like urgent care

- Show CommentsHide Comments

You May Like: Will Health Insurance Go Down

Other Billing Issues Arose Too

Since the COBRA plan I opted for was the exact same plan I had been on at my employer, I thought that my physical therapist had processed my claims without any issue during this time. However, in early May, I received a bill from them for over $350. Whoa!

Fortunately, there was an email address for their insurance processor on the invoice. So I exchanged a few emails with her and provided my COBRA information, and she was able to resubmit the claim and process it without a hitch. Since I had already made the co-pays when I went in for my sessions, I didnt have to pay anything additional. Whew!

When I got the invoice in the mail, I knew that I had insurance that was valid during the time of my visits. However, I thought that the process of resubmitting the claim was going to be a lot more difficult than it turned out to be . Your mileage may vary, obviously.

Read more: Why you may want to pay cash for that medical procedure

You Failed To Pay Your Cobra Premiums On Time

If you intend to continue COBRA coverage, it is important to note the premium due dates and amounts. Late payments may result in a loss of coverage. You are at the mercy of the plan sponsor. The plan sponsor determines if they will accept late payment and reinstate coverage after the payment grace period. To ensure continuous, uninterrupted coverage, always pay your premiums by the due date. When you enrolled in COBRA, you likely received a coupon book to easily track payment amounts and due dates.

Note on starting alternative coverages. If you terminate your COBRA coverage early, you generally wont be able to get a Federal Marketplace plan outside of the open enrollment period.

Also Check: How To Get Health Insurance For My Family

Cost Of Cobra Health Insurance

The term “group rate” may be incorrectly perceived as a discount offer, but in reality, it may turn out to be comparatively expensive. During the employment term, the employer often pays a significant portion of the actual health insurance premium , while the employee pays the remainder. After employment, the individual is required to pay the entire premium, and at times it may be topped up with an extra 2% toward administrative charges. Costs may not exceed 102% of the cost for the plan for employees who haven’t experienced a qualifying event.

Therefore, despite the group rates being available for the COBRA continued plan in the post-employment period, the cost to the ex-employee may increase significantly when compared to prior insurance costs. In essence, the cost remains the same but has to be borne completely by the individual with no contribution from the employer.

COBRA may still be less expensive than other individual health coverage plans. It is important to compare it to coverage the former employee might be eligible for under the Affordable Care Act, especially if they qualify for a subsidy. The employer’s human resources department can provide precise details of the cost.

If you have lost your health insurance due to job loss during the 2020 economic crisis, you qualify for a “special enrollment” period on the federal exchanges, which gives you 60 days to sign up. This may be a way to find a cheaper insurance option than COBRA.

You Become Eligible For Medicare

If you already have COBRA when you enroll in Medicare, your COBRA coverage usually ends on the date you enroll in Medicare. If you have COBRA and become Medicare-eligible, you should enroll in Part B immediately because you are not entitled to a Special Enrollment Period when COBRA ends. Your spouse and dependents may keep COBRA for up to 36 months if certain conditions are met, regardless of whether you enroll in Medicare during that time.

Note on COBRA and Medicare coverage. You may also be able to keep COBRA coverage once you get Medicare for services that Medicare does not cover. For example, if you have COBRA dental insurance, you may be allowed to keep paying a premium for the dental coverage for as long as you are entitled to COBRA.

Also Check: How Do I Get A Health Insurance Card

How The Affordable Care Act Affects Cobra

The Affordable Care Act offers affordable health insurance for people, including those with cancer and other serious conditions. It makes sure that most insurance plans cover the health care that cancer patients and survivors might need.

The state insurance marketplaces offer health insurance options to people who dont have access through their employers. It can also help those who leave their jobs and lose their employers group insurance. And for some people, buying insurance through their states marketplace may cost less than paying for COBRA coverage.

What Is Cobra Continuation Coverage

Large employers in the U.S., those with 50 or more full-time workers, are required to provide health insurance to their qualifying employees by paying a part of insurance premiums. If an employee becomes ineligible to receive an employer’s health insurance benefitswhich can happen for a variety of reasons the employer may stop paying its share of the employee’s insurance premiums. In that case, COBRA allows an employee and their dependents to retain the same insurance coverage for a limited period of time, provided they are willing to pay for it on their own.

As part of the American Rescue Plan Act of 2021, the federal government will pay COBRA insurance premiums for individuals that lost their job as a result of the 2020 economic crisis from April 1 through Sept. 30, 2021.

Under COBRA, former employees, spouses, former spouses, and dependent children must be offered the option of continued health insurance coverage at group rates, which otherwise would be terminated. While these individuals are likely to pay more for health insurance coverage through COBRA than they did as employees , COBRA coverage might be less expensive than an individual insurance plan would be.

It’s important to note that COBRA is a health insurance coverage program and plans may cover costs toward prescription drugs, dental treatments, and vision care. It does not include life insurance and disability insurance.

Read Also: Where Do You Go If You Have No Health Insurance

Who Is Eligible For Continuation

Your COBRA continuation rights are described in the Federal/State Notifications Section online. Both you and your dependents should take the time to read that section carefully. This section provides additional information about continuation coverage.

State and Grad only:

- You do not have to provide evidence of insurability to enroll in continuation coverage. However, coverage is limited to the plan you had as an active employee or covered dependent. You may select another plan during the annual open enrollment period or if you move. If family coverage is in effect when continuation is first offered, each dependent may independently elect individual continuation coverage. A family of two may select two individual contracts at a lower cost than the premium for a family contract. The health plan will bill you directly. There can be no lapse in coverage, so multiple premiums may be required.

- If you terminate employment and have less than 20 years of , you will be offered an 18-month continuation coverage period. A second qualifying event while on continuation will not serve to extend your period of continuation. Coverage will be limited to the original 18 months. At the end of the continuation period, you will be allowed to enroll in a Marketplace or an individual conversion plan through the health plan.

You Enroll Under Another Group Health Plan

COBRA is commonly used to provide continuous group health coverage between employment. You got the new job! The benefits are awesome. The only problem, you have a waiting period before you are eligible to enroll. So you enroll in COBRA to avoid a gap in coverage. Your benefits finally kick-in and you no longer need COBRA. You will need to notify the plan sponsor to terminate your COBRA coverage. Be sure to specify the date your new group coverage begins and COBRA coverage ends. Any overpayment of premiums is returned to you.

Also Check: Do You Need Health Insurance To Go To Planned Parenthood

Cobra Continuation Coverage Questions And Answers

Q1: What is COBRA continuation coverage?

The Consolidated Omnibus Budget Reconciliation Act of 1986 amended the Public Health Service Act, the Internal Revenue Code and the Employee Retirement Income Security Act to require employers with 20 or more employees to provide temporary continuation of group health coverage in certain situations where it would otherwise be terminated.

Q2: What is public sector COBRA?

Title XXII of the Public Health Service Act, 42 U.S.C. §§ 300bb-1 through 300bb-8, applies COBRA requirements to group health plans that are sponsored by state or local government employers. It is sometimes referred to as public sector COBRA to distinguish it from the ERISA and Internal Revenue Code requirements that apply to private employers.

Q3: Who has jurisdiction with respect to public sector COBRA?

The U.S. Department of Health and Human Services, through the Centers for Medicare & Medicaid Services has jurisdiction with respect to the COBRA continuation coverage requirements of the PHS Act that apply to state and local government employers, including counties, municipalities and public school districts, and the group health plans that they sponsor.

Q4: What is a qualified beneficiary?

Q5: What is a qualifying event?

Q6: What are some examples of qualifying events?

Q7: How long does COBRA last?

Q8: How is COBRA affected if I am disabled?

Q10: What notification requirements apply when there is a qualifying event?

What Is Cobra Insurance

COBRA, which stands for the Consolidated Omnibus Budget Reconciliation Act, bridges the insurance gap for people who lose their jobs.

You’re able to stay on your former employer’s plan for a limited time. Its the same plan. You get the same care and benefits. The only difference is you dont get help from your former employer. You pay for all the costs.

Though COBRA typically costs much more than a standard employer-based health plan, the American Rescue Plan of 2021 included a provision to help people with COBRA.

Through September 2021, the plan will pay 100% of COBRA coverage costs for people recently laid off because of the COVID-19 pandemic. After September, COBRA plan members will again pay the full cost of COBRA insurance.

Not everyone is eligible for the subsidies. People who can sign up for Medicare or a group health plan, such as a spouse’s plan, cant receive the COBRA subsidies.

Reach out to your former employer about the COBRA subsidies.

Don’t Miss: Can You Put Boyfriend On Health Insurance

You May Cancel Cobra At Any Time

To cancel your your COBRA coverage you will need to notify your previous employer or the plan administrator in writing. After you stop your COBRA insurance, your former employer should send you a letter affirming termination of that health insurance. You should then receive a certificate of credible coverage for the length of time you were on the plan.

Keep in mind, your COBRA is qualified major medical insurance and certified by the Affordable Care Act. You may only enroll in new marketplace health insurance during federal open enrollment periods. Open enrollment typically happens each year in November.

Billing Mismatch Was Just The Beginning

As I stated in my previous article, I needed COBRA only for the period between April 15 and May 1, when my insurance at my new employer was set to kick in.

However, my states Department of Administration bills by the month, so they took the first check I sent them and applied it to the second half of April then they applied the rest to the first half of May. The first bill I received was for the remainder of May.

I know that somehow the DOA knew that I had insurance through my new job because they sent me a letter to that effect. However, the letter indicated that the State wouldnt cancel my insurance I was responsible for that.

I called the number on my DOA invoice and, after a long hold, spoke to someone who gave me instructions for canceling.

I had to draft a letter and mail it to the address on my COBRA bill, along with some enclosures. Heres a copy of what I sent in case it is useful to other people.

You May Like: Do Employers Pay For Health Insurance