How To Choose The Best Health Insurance For Seniors

When selecting the right health insurance coverage, its essential to tailor a health plan to your needs.

Seniors should consider how much coverage they want based on their health history, Fassieux says.

So, for instance, if you regularly see a doctor, you may want a plan with a lower deductible. If you dont need much healthcare, a health insurance plan with a higher deductible and lower premium might be a better fit.

There are many effective ways to zero in on the policy that is best for you, says Casey Schwarz, senior counsel, education and federal policy at the Medicare Rights Center.

People just take in information differently, she says. Some people like to read everything and research it and figure out for themselves. Some people want someone to sort of walk them through it.

If youre overwhelmed by the process, a little help can go a long way.

Finding a good local broker in their community can assist the senior in selecting the best coverage that meets their health care needs and budget, Fassieux says.

She recommends seniors look for free local and unbiased information from their State Health Insurance Assistance Program .

There is one in every state in the union, Fassieux says. The SHIP telephone number is printed on the back cover of the Medicare & You booklet that all Medicare beneficiaries receive.

Seniors have a yearly opportunity to review their coverage options during the annual open enrollment period between Oct. 15 and Dec. 7.

What Happens At Tax Time

Unless you have a supernatural ability to predict the future, theres a good chance you wont perfectly estimate your annual income on your application. Dont worryeverything gets sorted out at tax time. If you make more money during the year than you expected , youll repay a portion of your subsidy. If you make less, youll receive a refund.

Get Started With A Subsidy Estimate

Health insurance can be a hefty financial investment. However, without health insurance, surprise medical bills can cost tens of thousands of dollars, leaving you with a difficult choice: invest heavily in a health plan, or run the risk of high health costs?

Fortunately, theres a good chance youll qualify for a health insurance subsidy, especially if youre self-employed most Stride members qualify for $4,800 a year in health insurance savings. A health insurance subsidy gives you the security of quality coverage without draining your bank account.

The quickest way to find what you could save on health insurance is to use our subsidy calculator.

Read Also: Kroger Health Insurance Part-time

Best Health Insurance Companies For Retirees

If you decide to get coverage through Medicare Advantage, you have plenty of options to sort through. As with shopping for any health insurance plan, some policies are likely to serve your needs better than others.

Medicare has identified 13 plans with a “five-star rating.” These are among the options that include the best health insurance for seniors. Plans that rank highly based on reviews of 45 different quality and performance measures from health care providers, member satisfaction surveys and the health plans themselves.

Medicare rates Medicare Advantage plans on up to 45 different quality and performance measures, including:

- Breast cancer screening

The American Rescue Plan And Subsidies

The American Rescue Plan Act , signed into law byPresident Biden in 2021, expanded eligibility for subsidies to make healthinsurance affordable for even more Americans. People that are already enrolledin health plans through the marketplace may find they qualify for moresubsidies to bring down the cost of their monthly premiums. Those that couldnot afford to enroll in a plan due to the subsidy cliff may now have theopportunity to sign up for coverage.

The new law allows people with incomes below 150% of the poverty level to enroll in silver plans with a zero premium. Deductibles for these plans will also be dramatically reduced allowing individuals and families with lower incomes the ability to have affordable health benefits. The ARPA also reduces the amount people must pay if they have income between 100% and 400% of the federal poverty level.

The ARPA also provides subsidies for some people with income between 400% and 600% of the poverty line, those considered on the subsidy cliff in the past. This may allow individuals and families within these income levels to find more affordable, ACA-compliant plans, which could positively impact more than 2 million people. Check out our guide to the American Rescue Plan Act to find out more about how it may affect your ability to qualify for subsidies.

Also Check: Starbucks Part Time Health Insurance

Example Of How To Calculate The Health Insurance Subsidy

Keep in mind that the exchange will do all of these calculations for you. But if you’re curious about how they come up with your subsidy amount, or if you want to double-check that your subsidy is correct, here’s what you need to know:

Tom is single with an ACA-specific modified adjusted gross income of $24,000 in 2021. FPL for 2020 is $12,760 for a single individual.

What Is The Average Cost Of Health Insurance For A Family Of 4

Consumers buying for a family of 4 pay an average monthly premium of $1,437 for non-subsidized health insurance. This monthly premium cost reflects a modest increase from $1,403 in 2019.

Plan selection can affect monthly premiums. Usually the more coverage the plan offers, the higher your monthly premium. For family coverage , only the Bronze family plan premiums decreased between 2019 and 2020.

| Metallic Plans |

Recommended Reading: What Benefits Does Starbucks Offer Employees

A Review Of The Metal Tiers

As a quick review, health care plans available through a health insurance marketplace are categorized into four levels, each of which is named after a metal: Bronze, Silver, Gold, Platinum. Bronze plans usually have the lowest premiums, followed by Silver plans.

The level of the plan is unrelated to the quality of the plans coverage. The difference is in how the insurance company splits the costs with you. So if you have a Bronze plan, the insurance provider will generally cover 60% of your insurance costs, which mostly applies after you hit your deductible.

Which type of subsidy you are trying to get will determine which of the metal tiers you can use. The advance premium tax credit is available for any metal tier, but cost-sharing reductions require you to use a Silver plan, as we will discuss in the next sections.

What Are The Income Limits For Health Care Subsidies In 2022

ACA premium subsidies are available if you:

- Are a legal United States resident

- File your tax returns jointly, if married

- Earn a modified adjusted gross income at least equal to the FPL, but not more than 400% of the FPL

- Do not have access to employer-sponsored coverage, Medicare, Medicaid, or other types of health coverage

The following table shows the federal poverty guidelines for 2022.

Federal Poverty Guidelines for 2022 Health Insurance Coverage

| Number in Household |

|---|

Tammy Burns is an experienced health insurance advisor. She earned her nursing degree in 1990 from Jacksonville State University, obtained her insurance billing and coding certification in 1995, and holds a health and life insurance license in Alabama, Georgia, Iowa, Mississippi, and Tennessee. Burns is Affordable Care Act -certified for health insurance and other ancillary, life, and annuity products. She maintains an active nursing license and practices private-duty nursing.

Seeing firsthand how unsuspecting patients are frequently confused by an overly complex system they dont understand led Burns to become an insurance agent and health care consultant, now helping people understand the medical system. Since becoming an insurance agent in 2013, she has worked with some of the largest and most reputable insurance carriers and agencies in the nation, and she has built a large and loyal clientele by way of her commitment to transparency and personalized service.

Also Check: Can You Add A Boyfriend To Your Health Insurance

Purchase Of Individual Coverage By Families Not Offered Group Plan

Price Elasticity

Estimates of the price elasticity of demand for individual insurance by families in California who do not have access to group coverage are given in Table 3.9 . Our overall elasticity estimate of 0.2 to 0.4 is similar to those found in earlier studies. But we find significant differences in the price elasticities between younger and older families =4.2, p< .05 in Census data, 2=10.7, p< .05 in NHIS data), the self-employed and others =2.9, p< .10 in Census data, 2=3.3, p< .10 in NHIS data), and by poverty group=117.03, p< .05 in Census data, 2=136.81, p< .05 in NHIS data). The price elasticities and the income elasticity estimates did not differ significantly between the CPS and SIPP data =4.8, p> .10), so we present the pooled estimate. The elasticity estimates for some of the subgroups were statistically higher from the NHIS data than the point estimates made from the Census data, but the general pattern of results was very similar.10. We also explored whether price response differs when premiums are high or low. We found a statistically significant greater response when the minimum offer premium was less than $45 per month than at higher premiums in all datasets. However, the effect was very small. The elasticities shown in Table 3 are estimates at higher premium levels at lower premium levels, the overall elasticity increases from .20 to .25 in the Census data the increase in the NHIS data is from .44 to .46 and was not statistically significant.

Definition And Examples Of Supplemental Health Insurance

Supplemental health insurance is a plan that covers costs above and beyond what standard health policies will pay. It may provide extra coverage. It may even pay for costs not covered by a traditional health plan, such as coinsurance, copays, and deductibles. It all depends on the type of supplemental health plan you choose.

Examples of these health plans include dental plans, critical illness plans, and vision plans. They include disability plans, long-term care plans, and travel insurance for health care coverage when you are outside your health plan network.

Medicare supplement plans are supplemental plans, as the name suggests. So are cancer policies, accidental death and dismemberment insurance, and hospital indemnity plans.

Read Also: What Benefits Does Starbucks Offer

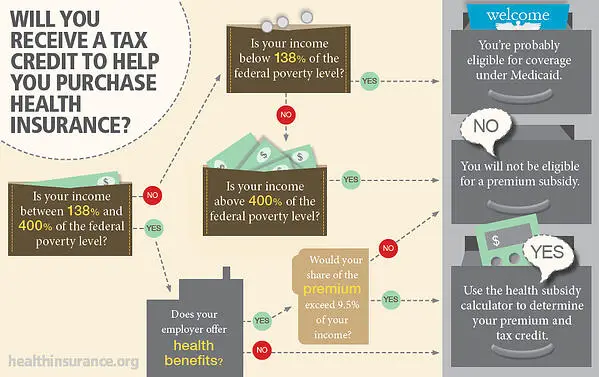

Are You Eligible For Health Insurance Subsidy

Depending on your household size and income, you may qualify for this assistance.

- People age 18 and older, even students, who file their own federal taxes, may be able to get both types of aid.

- People who dont have a job and don’t have COBRA coverage may also be able to get one or both types of aid.

- Native Americans and Alaskan natives may also be able to get help with their Marketplace or Tribal health plan.

What About Medical Expenses

Medical expenses can be deducted if you itemize your deductions on Schedule A . You can deduct medical expenses that add up to more than 7.5% of your adjusted gross income. The expenses can include money you spent to diagnose, cure, mitigate, treat, or prevent disease, as well as payments to treat any function or structure of the body. You can also include payments made for insurance premiums that exceed the amount of net income you earned in a year.

Also Check: Starbucks Health Coverage

What Can You Deduct

You can deduct the total amount you spent on premiums for medical, dental, and qualified long-term care insurance for you, your spouse, and your dependents.

However, there are some exceptions. You cant deduct:

- Amounts paid during months you were eligible to sign up for a health plan subsidized by your employer or the employer of your spouse, dependant, or child.

- Amounts paid by retired public safety officers from nontaxable retirement plan distributions.

- Amounts that were used to claim the Health Coverage Tax Credit or receive reimbursement of the HCTC during the year.

- Amounts paid for coverage where you received HCTC monthly advances.

The self-employed health insurance deduction only includes qualifying premium payments. You cant deduct other medical expenses like deductibles and coinsurance.

Health Insurance For Low Income

Everyone needs health care, but not everyone can afford health insurance. Learn about your options for coverage with low income.

- VII.

Health insurance premiums are too expensive for some individuals and families. But going without health insurance is risky. If you were to face an unexpected illness or injury, the medical bills could be overwhelming, especially if you need ongoing care.

You May Like: Starbucks Benefits For Part Time

Understanding The Aca’s Premium Tax Credit Health Insurance Subsidy

The Affordable Care Act includes government subsidies to help people pay their health insurance costs. One of these health insurance subsidies is the premium tax credit which helps pay your monthly health insurance premiums.

Despite significant debate in Congress over the last few years, premium subsidies continue to be available in the health insurance marketplace/exchange in every state. And the American Rescue Plan has made the subsidies larger and more widely available for 2021 and 2022.

The premium tax credit/subsidy is complicated. In order to get the financial aid and use it correctly, you have to understand how the health insurance subsidy works. Here’s what you need to know to get the help you qualify for and use that help wisely.

Cost Sharing Reductions Lower Your Other Costs

Cost sharing reductions lower the amount you have to pay out of pocket when you get care, costs like deductibles, copayments and coinsurance. To take advantage of these savings, you must qualify and enroll in a Marketplace Silver qualified health plan. There is no option to get cost sharing reductions by filing a year-end tax return. If you qualify for this type of aid, you pay less out of pocket for things like deductibles, copayments, and coinsurance when you get care.

Also Check: Starbucks Part Time Insurance

What Is Private Health Insurance

Private health insurance refers to health insurance plans marketed by the private health insurance industry, as opposed to government-run insurance programs. Private health insurance currently covers a little more than half of the U.S. population.

Private health insurance includes employer-sponsored plans, which cover about half of the American population. Another 6 percent of Americans purchase private coverage outside of the workplace in the individual/family health insurance market, both on and off-exchange.

There are also a variety of types of private health insurance that are much less regulated than regular major medical coverage. This includes short-term health plans, fixed indemnity plans, critical illness plans, accident supplements, dental and vision insurance, etc. These types of coverage are all sold by private health insurance companies, but are generally only suitable to serve as supplemental coverage as opposed to a persons only health coverage .

Applying For Obamacare Subsidies

You can apply for Obamacare subsidies through the government-run health insurance Marketplace in your state or through qualifying licensed agents, and private online Marketplaces that cooperate with the government marketplace. A good source for meeting all your insurance coverage needs is eHealth. We offer you online tools to help you determine if you are eligible for Obamacare subsidies and Marketplace plans available where you live. We also have licensed agents to help you find insurance plans that meet your needs and budget. With 24//7 support and a wide selection of plans available, you can rest assured eHealth is here to help you find and maintain the best plans for you and your family.

Keep in mind the government makes the final determination on your eligibility for a subsidy. While you can shop through eHealth to select a plan, the subsidy comes through the government-run marketplace. If you are ready to begin comparing plans, check out all of your individual and family health insurance options with eHealth.

Recommended Reading: Substitute Teacher Health Insurance

Improving Aca Subsidies For Low

Lower-income people are much more likely to lack insurance, and they comprise the majority of the marketplace-eligible uninsured. The Affordable Care Act has extended health coverage to more than 20 million people and has made coverage better or more affordable for millions more. Yet about 30 million non-elderly people remain without health insurance, about 12 million of them people for whom ACA marketplace plans are the relevant coverage option. Public discussion has mostly focused on how to address the affordability challenges facing people with incomes too high to qualify for the ACAs premium and cost-sharing subsidies . However, lower-income people are much more likely to lack insurance, and they comprise the majority of the marketplace-eligible uninsured. Evidence from state policies and federal policy changes shows that improving subsidies is key to increasing coverage for this group and therefore to driving down overall uninsured rates.