Hospital & Doctor Insurance

Health ProtectorGuard fixed indemnity insurance,3 underwritten by Golden Rule Insurance Company, can supplement your major medical plan by paying cash for eligible, covered medical services, like a doctor visit, a trip to urgent care or a surgical procedure.

- No deductibles or copays to pay first

- Benefits paid regardless of other insurance

- Money to pay costs not covered by major medical plans, like a deductible

Taking Medicaid Coverage Away From People Not Meeting Work Requirements Will Reduce Low

Beginning in 2018, the Trump Administration encouraged states to adopt policies taking Medicaid coverage away from people not meeting work requirements. While 12 states received approval for these policies, several were blocked by the courts, and none are currently in effect. But data from Arkansas ten-month implementation of its policy and brief implementation in Michigan and New Hampshire provide direct evidence of these policies harmful effects.

How Much Is Health Insurance In Idaho

Types of marketplace health insurance plans.

You can buy cheap health insurance in Idaho through the Your Health Idaho health insurance marketplace or obtain coverage by applying to Medicaid.

After comparing health insurance plans provided in the five largest counties in the state, we established that the IDID Southwest Silver 60 offered by Blue Cross of Idaho was the cheapest Silver metal tier health plan offered in Idaho. Even though this is the most affordable Silver policy in terms of monthly premiums, it may not be offered in your county. Some health insurance companies do not provide plans in every region of the state.

Recommended Reading: What Health Insurance Does Starbucks Offer

Health Insurance Plan Type

How much should you expect to pay monthly in AR? These are the average rates for each plan type in the state for a middle-aged resident in 2020:

2020 Arkansas Martketplace Plan Rates| Bronze |

|---|

| Kaiser Family Foundation, Change in Average Marketplace Premiums by Metal Tier |

Gold plans cost about 44 percent more than bronze plans. Thats not much of a surprise, considering gold plans cover 80 percent of medical costs, whereas bronze plans cover 60 percent of costs.

Some people also qualify for a catastrophic plan, the lowest level of coverage available. Catastrophic plans come with a $8,150 yearly deductible and theyre designed to save you from bankruptcy after an unexpected medical issue. Even with a higher monthly premium, youll save money with a bronze or silver plan if you need to use your health insurance.

Four Types Of Arkansas Small Business Health Insurance Plans

Whether youre looking at individual health insurance or group health insurance, there are several different types of health plans available. The four you should absolutely know are:

PPO Health Insurance Plans,

HSA-Qualified Health Insurance Plans, and

Indemnity Health Insurance Plans.

The plan type that is best for you and your employees depends on what you and your employees want, and how much you are willing to spend. Heres a brief review of the four popular types of health insurance plans:

Also Check: Starbucks Medical Insurance

Can You Get Medicare At Age 62

So, having great health insurance for age 62 to 65 plan today is imperative. This way you protect yourself against high healthcare costs.

Just make sure that you discover about various family medical health insurance before 65 to 70 plan protection out there. Make a price comparison, to get a lot so you can get the strategy you need without cramping your budget.

Article Source: Top 10 Best insurance for age 62 to 65 Years Old Age Compare Rates.

What Is The Average Cost Of Health Insurance

Maybe youre wondering, How much does individual health insurance cost? Heres what you can expect. The average individual in America pays $452 per month for marketplace health insurance in 2021.2 The average family pays $1,779 per month.3

But the cost of health insurance varies widely based on a bunch of factors. Some things are in your control, some arent. Things like your age, how many people are on your plan, how much coverage you need, where you live and who your employer is all play a role in the price of your coverage.

Heres a breakdown showing the average costs depending on your state:

Kaiser Family Foundation, 2021.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

Small Business Health Insurance Tax Credits

Small businesses with up to 25 full-time equivalent employees may qualify for a tax credit for offering employee health benefits. The credit is broken in to two phases. Phase 1 includes a tax credit worth up to 35% of a small businesss health insurance costs. Phase 2 includes a tax credit up to 50% of a small businesss health insurance costs.

Public School Employees Premium Plan

The Premium plan offers the lowest deductible for in-network services. Wellness benefits are available at no charge when obtained by a participating provider. This plan offers out of network coverage at a higher cost share. The plan allows medical and pharmacy copays, coinsurance, and deductible amounts to count towards the True Out-of-Pocket Maximum for cost sharing.

You May Like: Part Time Starbucks Benefits

How Much Is Health Insurance Per Month For One Person

Monthly premiums for ACA Marketplace plans vary by state and can be reduced by subsidies. The average national monthly health insurance cost for one person on an Affordable Care Act plan in 2019 was $612 before tax subsidies and $143 after tax subsidies are applied.

Wondering how insurance premiums are decided? The Affordable Care Act ensures that insurance companies cannot discriminate based on gender, current health status, or medical history. Here are factors that determine health insurance premiums.

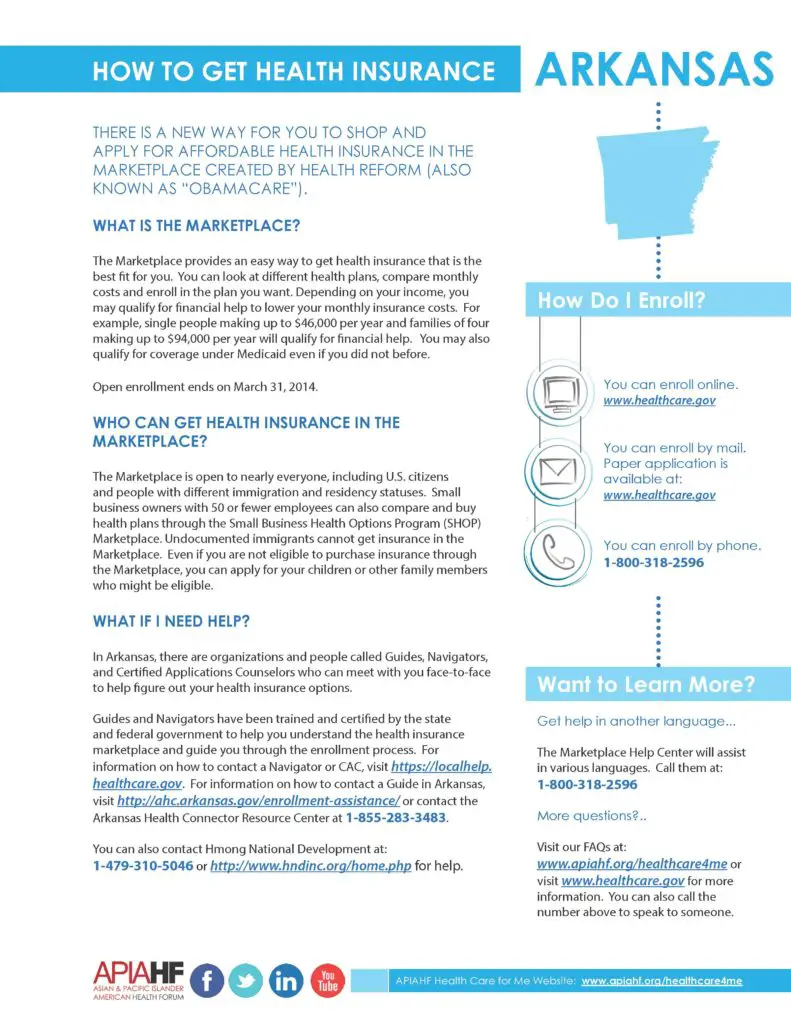

Arkansas Individual And Family Health Insurance

Open Enrollment begins Monday, November 1, 2021

You can enroll in or change to a different plan for the rest of 2021 if you qualify for a Special Enrollment Period due to a life event – like changing jobs, moving, getting married or having a baby. You usually have 60 days from the life event to enroll. to find local personalized assistance with Special Enrollment.

If you don’t qualify for a Special Enrollment Period, you can enroll in coverage for 2022 during Open Enrollment from Monday, November 1, 2021 – Saturday, January 15, 2022. Enroll by December 15, 2021 for coverage that starts January 1, 2022.

You may be able to get more savings and lower costs on Marketplace health insurance coverage due to the American Rescue Plan Act of 2021. Under the new law:

- More people than ever before will qualify for help paying for health coverage, even those who werent eligible in the past.

- Most people currently enrolled in a Marketplace plan may qualify for more tax credits.

- Health insurance premiums after these new savings will go down.

ATENCIÓN: si habla español, tiene a su disposición servicios gratuitos de asistencia lingüística. Llame al 1-800-318-2596.

CHÚ Ý: Nu bn nói Ting Vit, có các dch v h tr ngôn ng min phí dành cho bn. Gi s 1-800-318-2596.

LALE: Ñe kwj knono Kajin aj, kwomaroñ bk jerbal in jipañ ilo kajin e a ejjek wn. Kaalk 1-800-318-2596

1-800-318-2596

Don’t Miss: Does Starbucks Offer Health Insurance

Public School Employees Basic Plan

The Basic plan is a high deductible plan that qualifies for a Health Savings Account . Wellness benefits are available at no charge when obtained by a participating provider. Basic plan members can enroll in a Health Savings Account through Connect Your Care. There is no coverage for out of network providers.

Health Advantage is an Independent Licensee of the Blue Cross and Blue Shield Association and is licensed to offer health plans in all 75 counties of Arkansas.

Linking disclaimer

IE support ending soon

Looks like you’re using an old browser. The site may not work properly. The Internet Explorer 11 browser application will be retired and go out of support on June 15, 2022. We’re encouraging our users to go ahead and switch to Microsoft Edge, Google Chrome, Safari or Firefox.

To learn more read Microsoft’s help article.

Health Services Use By Arkansas Residents

The tables below show the frequency with which residents use health services. The data are collected from insurance company filings with the state insurance department. The number of enrollees on which data was collected is as follows: Group insurance, 247,687 Individual insurance, 391,687 and Medicare Advantage, 125,442. Arkansas does not have a Medicaid managed care program. For that reason there are no numbers in the Medicaid section of the chart above.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

How Much Does The Average Person Pay For Insurance

8 Minute Read | September 27, 2021

One bad car wreck. One raging kitchen fire. One major surgery. If youre not careful, just one thing can derail years of financial progress.

Thats where insurance comes into play. Every good financial plan has an offense and a defense. Insurance is your defense. It protects you from anything life might throw your way.

No matter who you are, there are certain types of insurance you absolutely need to have in place right nowthree of which are auto insurance, homeowners insurance and health insurance. And if youre married, have kids or have someone in your life who depends on your income, you can add termlife insurance to the list as well.

But its no secret that insurance can get pretty expensive. Just how expensive?

Lets break down the costs behind each of these four types of insurance so you can figure out how much room you need in your budget to protect yourself and your family.

Group Coverage Also Known As Employer

Companies that provide health insurance to employees as a benefit provide an insurance type known as group insurance. The cost of this type of health plan is based on total premiums paid to the insurance company. Premiums include payments from both employers and employees. Premiums do not include payments for services such as deductibles, co-pays or other out-of-pocket costs. Group coverage includes: Health Maintenance Organizations , Preferred Provider Organizations , Point-of-Service Plans and High-Deductible Health Plans.

Recommended Reading: Does Starbucks Have Health Insurance

Small Business Health Insurance Tax Penalties

Starting January 1, 2014, Employers with 50 or more full-time equivalents who do not offer minimum essential coverage can face monthly penalties if at least one employee uses a premium tax credit to obtain health insurance through the state health exchange. If you do not have more than 50 employees, you are not subject to these penalties.

Average Health Insurance Costs

With so many different variables impacting how much health insurance will cost a person on a monthly or yearly basis, we’re better off breaking things down instead of giving one general number.

So what are some of the biggest factors in determining how health insurance costs can vary? Certainly, the type of plan someone has and the tier of the plan she has to go a long way. Medical history — not to mention whether the person is a smoker — can play a role in whether insurers give a higher rate. Someone in need of insurance for a family is going to have a higher premium than someone seeking an individual plan.

Two factors that can also play a large role in healthcare rates and premiums is how old someone is and where he lives.

Don’t Miss: Do Starbucks Employees Get Health Insurance

Are There Other Ways To Save On Health Insurance Premiums

Aside from premium tax credits, your employer can also help you with the cost of your individual health insurance plan by setting up a health reimbursement arrangement .

Through an HRA, you choose your own individual insurance plan, and your employer reimburses you for the cost of the premium and other qualifying medical expenses up to your monthly allowance.

Whats more, if youre enrolled in the qualified small employer HRA you can even coordinate your premium tax credits with your HRA allowanceyour premium tax credit will simply be reduced by your allowance amount.

Ar Doctor Visits Per Person Per Year By Insurance Type

This type of care includes visits to doctors in which the patient was not in an institution such as a hospital.

The frequency of doctor visits among residents with group and individual coverage is well below the national average. Medicare Advantage enrollees experienced roughly an equivalent frequency of doctor visits as the national average. Arkansas does not have a Medicaid managed care program. For that reason there are no numbers in the Medicaid section of the chart above.

Read Also: Does Starbucks Offer Benefits

Arkansas Health Insurance Premiums

Qualified plans available on and off the Marketplace are organized by levels of cost-sharing, referred to as metal tiers.

Arkansas health insurance premiums for qualified plans have increased moderately over the past three open enrollment seasons . Following is the average monthly cost for a 40 year old for bronze, silver, and gold plans sold through the Arkansas Marketplace.14

| Average Premiums for |

| $394 |

How Do Marketplace Subsidies Work

Most people are eligible for subsidies for your Marketplace insurance. This means you will get additional savings that reduce your monthly premium amounts for your Obamacare plan. There are two types of health insurance subsidies: premium tax credits and cost-sharing reductions.

Premium tax credits help make Marketplace insurance more affordable. You can have this credit applied monthly to reduce your monthly premium costs. Or, you can opt to have this amount credited back to you at the end of the year in full when you complete your annual tax return. The amount a person receives in premium tax credits depends on their annual income and household size. You can use a premium tax credit for any metal-tier Marketplace plan.

Cost-sharing reductions are extra savings that apply only to those who enroll in a Silver-tier plan. These extra savings lower the amount a person has to pay for deductibles, copayments, and coinsurance. If you qualify for cost-sharing reductions, youll also have a lower out-of-pocket maximum.

In 2019, those who used HealthSherpa to shop the Marketplace paid an average gross premium of $818 per month. However, they also received an average subsidy of $724 per month. This means that those who used HealthSherpa paid only $30 per month for their monthly health plan premium. This is significantly less than the national average cost of $477 per month.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

How To Use The Health Insurance Premium And Tax Credit Calculator

First, to get to the calculator. Once youre there, youll enter your basic personal information and click submit when youre finished.

The information you’ll enter includes:

- State

- Whether or not you have job-based coverage

- Total number of people in your family

- Number and ages of adults in your family

- Number and ages of children in your family

- Whether or not you use tobacco

Tip: Be sure to enter all of the information as accurately as possible for the best results, including your household income .

How The American Recovery Plan Act Makes Health Insurance Cheaper

Signed into law on March 11, 2021, the new $1.9 trillion COVD-19 stimulus package will have a major impact on the healthcare premiums of millions of Americans.

Officially known as the American Rescue Plan Act, this stimulus is expected to reduce healthcare premiums on some plans by as much as 20%. This will ultimately save millions of Americans hundreds of dollars on healthcare.

The stimulus plan reduces healthcare costs by expanding tax credits on many healthcare plans. Healthcare costs vary based upon an individualâs age, income and chosen plan but consider the following examples.

Stimulus impact for

You May Like: What Insurance Does Starbucks Offer

Example For A Family Of Three In Utah Earning $70000/year

Here’s a look at a health insurance premium and tax credit estimate for a family of three living in Utah earning $70,000/year.

In this example, the family would pay about $383/month for a silver plan, receiving a premium tax credit of $1,064/month . Without financial help, the silver plan would be $1,447/month .

How Do I Access The Premium Tax Credits

To receive your premium tax credit, you must purchase health insurance through the federal marketplace, healthcare.gov, or your state’s marketplace.

Most states have a website where you can view and compare policies, enroll in a plan, and receive the premium tax credit. A licensed health insurance broker is a great resource for help selecting a health plan. Look up your state marketplace here.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

Best Cheap Health Insurance In Texas 2020

Persons looking for the best health insurance options in Texas can find cheap, subsidized Texas health insurance exchange policies. Presently, eight companies provide plans on the exchanges, even though not all companies provide plans in every county.

For the 2020 plan year, the average monthly cost of a private health plan for a 40-year-old in Texas is down to $508. This is a drop of 14% or $85 from 2018.

The average consumer will perhaps want to begin shopping by looking at the Blue Advantage Silver HMO 205. The coverage is the cheapest Silver option sold by Blue Cross Blue Shield , which operates in each Texas county, and the Silver plan qualifies for additional subsidies for low-income families. Nevertheless, if you have access to the Ambetter Balanced Care 5, then that would be a cheaper Silver plan option.

Medicare And Medicare Advantage

The charts showing the cost the the number of enrollees includes people covered by all types of Medicare and Medicare Advantage. The cost of this type of health coverage includes participation from employers, individuals, federal, state and local government. Excluded from the costs are any form of co-pay or a deductible the individual must pay to receive care.

How enrollees use their health care services is based on enrollees in Medicare Advantage plans only. Medicare Advantage plans are Medicare health plans offered by private companies that contract with Medicare. Medicare Advantage plans include Health Maintenance Organizations , Preferred Provider Organizations , Private Fee for Service Plans, Special Needs Plans and Medicare Medical Savings Account Plans .

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees