Top Prescription Plans For 2019

There are many prescription plans for seniors to consider, but among the top choicesare:

A no-deductible, monthly subscription payment plan with a 4-star national rating.

The Humana Walmart PlanProviding you are willing to fill your prescriptions at Walmart, this low-cost plan has a minimal annual prescription fee, with a small deductible, and low-cost co-pays.They also feature a top-notch mail order feature.

Aetna Medicare Select PlanHas the lowest premium of all part D plans, with minimal co-pays for tier 1 and 2 drugs. It does have a deductible and recommended pharmacies.

UnitedHealthcare MedicareRx Walgreens 1

Top 5 Health Insurance Companies In The Us

by JC Lewis Insurance Services | Jun 24, 2020 | Health Insurance |

You probably already know that health insurance companies make up a massive segment of the U.S. economy, but you may not realize just how big a segment.

In fact, the health and medical insurance industry in the United States is a $1.1 trillion dollar enterprise currently, and one that has grown 2.9 percent each year on average between 2015 and 2020.

And if you were pressed, you could probably name a half dozen or so health insurance companies. But there are likely far more health insurance providers than most of us realized.

In fact, according to data at ValuePenguin.com,

In the United States, there are currently more than 900 health insurance companies that offer medical coverage. However, the health insurance industry is dominated by five companies: Anthem, UnitedHealthcare, Humana, Health Care Service Corporation and CVS Health Corp., who control more than 38% of the market.

Best For New England: Harvard Pilgrim

Harvard Pilgrim Health Care

This New England not-for-profit company has 4.5-rated plans in two states , one of which also scored an impressive 4.5 on prevention, and a 4.0-rated plan in New Hampshire. The Harvard Pilgrim Passport and Access America plans are offered jointly by Harvard Pilgrim and UnitedHealthcare, allowing members access to a gigantic network of doctors nationwide, thousands of hospitals, and flexible health benefits.

Don’t Miss: Is Colonial Health Insurance Good

How To Compare The Best Health Insurance Companies And Plans

Even plans of the best health insurance companies can vary greatly. But the general rule of thumb is that the less you pay per month, the higher your deductible is. Higher premiums are usually associated with lower deductibles. Generally it is beneficial for those with existing health issues to opt to pay more per month and less out-of-pocket for services.

Those in good health often opt for a high deductible option in hopes that they never have to actually pay the deductible but would mostly be covered if something major happened.

A prescription plan is another important consideration when looking for the best health insurance. If you need to take medications regularly you’ll want to choose a plan with a good prescription plan. If you need to insure your entire family, you’ll want to look at family deductibles and maximums. Only full-coverage options will satisfy the minimal essential health care insurance required to get around paying the fine.

Monthly PremiumThis is your monthly payment for health insurance. It may be worth asking if you can get discounts for paying in advance or if you set up direct payments from your bank account.

DeductibleThe amount you are required to pay, not counting preventive care, before the insurance company starts paying out. Low-deductible plans offer deductibles of about $500, whereas high-deductible plans might be as much as $6600.

How Do You Enroll In Coverage With Aetna

If you decide Aetna is the insurance carrier for you, there are a number of ways to sign up for coverage.

You can start by clicking on Shop for a Plan from the upper left-hand corner of the companys website, Aetna.com.22 You can also contact the company by calling 1-800-872-3862 to speak with someone who can help you. If you prefer interacting via social media, Aetna offers two Twitter handles: @Aetna and @AetnaHelp.23 Aetna also works with agents and brokers so you can sign up for coverage by having a professional walk you through the options.24 As you explore what is available to you, make sure you check to see if you qualify for a current-year subsidy under the Affordable Care Act.

Don’t Miss: Can I Change My Health Insurance Outside Of Open Enrollment

A Plus International Healthcare

A Plus International is an Asian company partnered with AXA to provide international medical coverage.

A Plus offers four different worldwide insurance plans, Hospitalisation, Global 80, Global 100, Global 100 Plus, as well as the option to include add-ons. Its Southeast Asia Plans are exclusively for residents of Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Thailand and Vietnam.

Best For Hmos: Kaiser Foundation Health Plan

Kaiser Foundation Health Plans

The nonprofit insurer Kaiser Foundation Health Plan Incpart of Kaiser Permanentewon stellar ratings for private insurance, with one plan getting a top overall NCQA score of 5.0 and 7 other plans, ranging from Georgia to California, winning 4.0 to 4.5 ratings. In the Medicare Advantage arena, Kaiser was also a winner with 8 plans in the very top echelons. The company operates in 8 states and Washington, D.C.

All of Kaiser’s highly rated private and Medicare Advantage plans are HMOs. This is good news for those needing budget health insurance because HMOs have lower premiums, no deductibles, and lower copays and prescription drug costs. The downside to an HMO is the stipulation thatexcept in emergenciesyou must use only doctors, hospitals, and other services that are in the network. The plans do, however, deliver the same essential goods as a PPO plan. Kaiser’s policies have relatively low premiums.

Also Check: How Much Will Health Insurance Cost Me In Retirement

Best For Medicare Advantage: Aetna

Aetna

An impressive 43 Aetna Medicare Advantage plans sold in 37 states, plus the District of Columbia, received top NCQA ratings in 2019, with Connecticut and Maine being standouts. In 2020, Aetna Medicare Advantage Prescription Drug plans were made available in 264 new counties across the country, providing millions more Medicare beneficiaries access to an Aetna plan. The insurer also sells Medicare supplement plans in 49 states. In addition to these, they also offer a combination dental, vision, and hearing supplemental Medicare product in many states.

In the private arena, Aetna is a large provider of employer-based health insurance. A total of 4 Aetna plans serving Iowa, Pennsylvania, and Utah made the top NCQA ranks in 2019, and the 2021 J.D. Power U.S. Commercial Health Plan Study ranked Aetna plans second highest in Ohio, Maryland, and Virginia. In addition, Aetna’s pricing seems to be at a lower level than many competitors’ pricing.

In November 2018, Aetna became part of CVS Health Company, and synergies between the two are beginning to emerge. For example, Aetna medical plan subscribers with high blood pressure can get a free home monitor at CVS. Chronic disease monitoring may also be available at CVS stores.

Humana: Best Health Insurance Company For Seniors

Humana is ranked the fifth largest health insurance provider in the United States, which means that it has a reassuring amount of financial capital behind it. The policies are relatively affordable, though this one only really applies to their HMO plans. But if you’re happy with that and dont mind a specific range of pharmacy options, Humana health insurance is well worth considering.

Humana’s policies for more elderly customers are especially attractive, as many of their competitors hike up their prices substantially for older customers. The fact that Humana doesn’t makes it our top pick for seniors.

Don’t Miss: Can Substitute Teachers Get Health Insurance

Your Local Health Insurance Company Experts

JC Lewis Insurance, a family-owned firm of expert brokers based in Sonoma County, offers California health insurance plans only from the leading health insurance carriers licensed to do business in California.

Not only are we expert brokers, we are licensed and certified by each of these insurance carriers to offer coverage to individuals, families, and small group employers in addition to Medicare supplemental and prescription drug plans for seniors.

If you are self-employed, or your employer doesnt provide health benefits, an individual or family plan may be the best option for you or you and your family.

And if youre looking to purchase medical insurance for you and your family, you will likely have many questions and concerns. Bring your questions about health coverage insurance and you can be confident that JC Lewis Insurance Services will help you find the right solution.

The Best Landlord Insurance Will Offer Competitive Pricing Strong Financial Ratings And Easy To Reach Customer Service Agents

Get an online quote today. There are widely available insurance options out there that protect the property you’re renting. See more of milton insurance inc on facebook. Who writes homeowners insurance in florida?

Get the best insurance advice from a company that has been in business for over 100 years. We suggest you familiarize yourself with the search engine for companies and organizations in milton. Australia raises astrazeneca safety age to 60. Expert recommended top 3 insurance services in milton keynes, uk.

Don’t Miss: Do You Need Health Insurance To See A Doctor

What Health Insurance Plan Is Best For International Students

International students attending a university in Canada are not always eligible for the countrys public health care. They are instead required to get a private health care insurer. Each province is different. In provinces where students are not eligible for public health care insurance, the universities themselves often provide a health insurance plan for their international students. It may even be mandatory and included in the tuition fees.

If you can not continue your semester due to illness, many insurance plans for international students will reimburse your tuition fees!

Manulife Health Insurance Plans

We are also pleased to offer insurance options from Manulife in Saskatchewan, including the Flexcare®, FollowMe and Association programs. With this suite of products, you can select options to add to your insurance plan to ensure youre getting exactly the coverage you want for your specific needs.

Recommended Reading: How To Get Health Insurance Without Social Security Number

What Does Health Insurance Cover

You will find that health insurance coverage ranges pretty widely from one insurance provider to the next, and even between the individual plans offered by a provider. But while your exact options vary, there are some mandatory coverage standards that every health insurance policy must provide.

Thanks to the Affordable Care Act, there are 10 categories of health services that all healtcare.gov insurance plans are required to cover, called Essential Health Benefits. These include pregnancy and childbirth services, prescription drug coverage, mental health services, outpatient hospital care, preventative care, emergency services, and more. Plans must also provide dental coverage to minors .

The exact details and limits of this coverage may differ from one state to the next. Also, large companies that self-insure employees are not required to follow these same standards, though many still do. Youll want to check with your employers plan to see exactly what is covered if you are offered health insurance through your job.

How Do I Cancel My Personal Health Insurance Plan In Canada

In Canada, cancelling your private health insurance plan is not difficult. Generally, you will do it in writing. Check your specific contract and contact your service provider for details.

Be aware that you may owe a penalty if your policy has not yet expired. Policies often run for a one-year term, even if payments are monthly.

Avoid bad surprises. To avoid gaps in coverage, make sure that your new insurance plan begins before your previous one lapses.

Also Check: How Much Does Marketplace Health Insurance Cost

Gms Group Advantage For Small Business

Group Advantage health and dental plans are specifically designed and attractively priced for small businesses with 3 to 10 employees. We know you want to look after your employees health and offer attractive benefits, but price stability is vital too. GMS understands this, so you wont see big premium hikes when your plan renews.

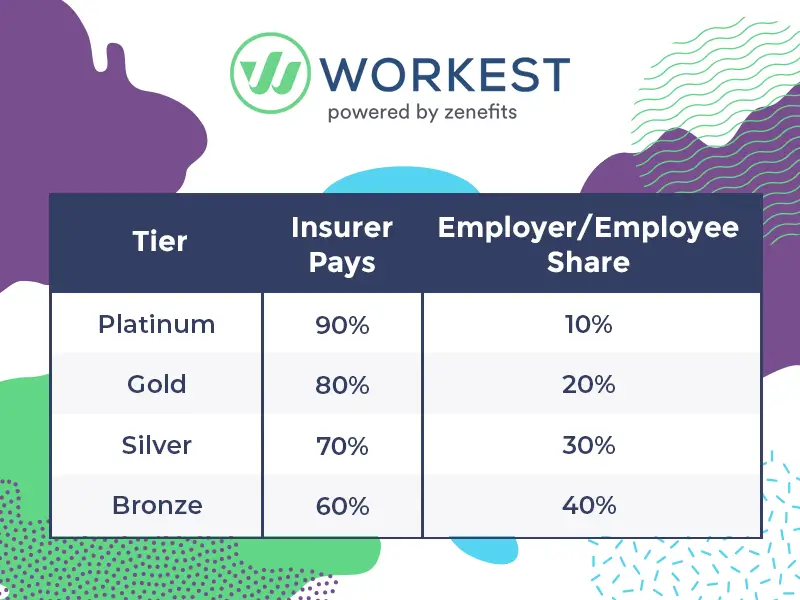

Want a quote? You dont have to wait for one just click below! You can choose from Silver, Gold or Platinum health coverage plans to cover prescription drugs, health and vision care, and you can add on dental care, too.

The added advantage for your employees is that every plan includes the Employee and Family Assistance Program . You will support your employees and their family members with online access to interactive tools, care locators and personalized content plus confidential counselling when they face difficulties and lifestyle coaching to help them with day-to-day challenges.

Best For Nationwide Coverage: Blue Cross Blue Shield

Blue Cross/Blue Shield

One out of three Americans has health coverage from Blue Cross Blue Shield. The names on various state plans include Anthem, CareFirst, Highmark, Independence, and Wellmark, but the 35 independent and locally operated Blue Cross Blue Shield companies open doors in all 50 states, Washington D.C., and Puerto Rico. Nationwide, more than 80% of doctors and 90% of hospitals contract with Blue Cross Blue Shield companiesmore than any other insurer, according to the company.

In 2019, more than 40 Blue Cross Blue Shield company plans earned moderate to high ratings from NCQA based on clinical quality and member satisfaction, while 10 Anthem plansincluding some with lower overall ratingsscored impressively in the customer satisfaction area. Blue Cross Blue Shield offers employer insurance, individual policies on healthcare.gov, and a variety of Medicare plans .

Read Also: Does Any Health Insurance Cover Cosmetic Surgery

Key Health Insurance Numbers To Consider

Average bronze-level health insurance plan: $2,570 per year for individual insurance.

$325 per adult and $162.50 per child , or 2 percent of your household income, above the tax return filing threshold for your filing status whichever is greater.

Cost of non-subsidized, individual health insurance: $300 – $600 per month, or $3,600 – $7,200 per year.

Is Paying For Cancer Insurance Worth It

The National Coalition for Cancer Survivorship states that among the U.S. population, medical expenditures for cancer in 2020 were projected to reach at least $158 billion. With this in mind, if your health insurance policy has a high deductible and you are looking at a lot of out-of-pocket costs, or if there is a history of cancer in your family, a cancer insurance policy could help ease the blow financially if you were to receive a diagnosis.

You May Like: Do You Need Health Insurance To See A Dermatologist

Availability Of Health Insurance Plans

One of the primary factors of comparison of different health insurance companies is the types of health plans offered by insurance companies. While some insurance companies offer only generic health insurance plans like the individual health insurance plan and the family health insurance plan, some insurance companies offer plans specifically designed for certain categories like for women, children, senior citizens. Choose the insurance company which offers the plan matching your requirements.

Understanding Health Insurance In Saskatchewan

Every year, the government cuts services covered by the Saskatchewan Provincial Health Insurance plan, making residents responsible for paying more of the bill. A supplemental health insurance plan from Special Benefits Insurance Services can help fill the gaps left by the government plan. Additional coverage from our Saskatchewan Health Insurance Plans will limit your out-of-pocket expenses and protect your bottom line.

A single injury or illness can have a devastating impact on your bottom line. Gain peace of mind and the financial protection you need with a health insurance plan from SBIS. With suitable coverage, you can rest assured that you and your family will have access to the care you need without breaking the bank.

Looking for health insurance in Saskatchewan can be overwhelming. There are a variety of factors to think about. You must review the plans to learn what is covered and not covered, decide what amount of coverage is right for you and your family, and determine how much you can afford to pay.

SBIS has been helping Saskatchewan residents find the health insurance plan thats right for them for more than 25 years. We will save you time and reduce your anxiety by helping you navigate the insurance application process.

When you work with SBIS, you get

To speak with a representative, call Monday through Friday, 8:45 a.m. 4:45 p.m. ET. A representative is available to answer your questions and guide you through the buying process.

Read Also: How Long Can My Dependent Stay On My Health Insurance

Insurance Companies In Milton Florida 2021

2 days agoInsurance CompaniesComments Off on Insurance Companies In Milton Florida 20211 Views

Insurance Companies In Milton Florida 2021. Get an online quote today. Compare local agents and online companies to get the best, least expensive auto insurance.

Internet access in milton, florida. We are licensed with all of the top health insurance providers in florida. The addition of avmed brings the total to 8 insurance companies offering obamacare/aca coverage in florida for 2021.

How Does Health Insurance Work

Health insurance works by allowing you to budget for medical expenses so you dont have to pay the entire cost out of your own pocket if a medical emergency occurs. You have a set amount to pay either monthly or when you access services through health insurance, and the health insurer pays the rest for covered services. By knowing how much you would be responsible for when accessing health services, you can be more financially prepared when you need care.

Recommended Reading: Can I Have Two Health Insurance

Kaiser Permanente: Best Health Insurance Company For Customer Service

Kaiser Permanente stacks up well against its peers, with relatively low premiums easy quotation process, straightforward websites and a well-liked mobile app. The lack of nationwide coverage could be a drawback for some people, even if they live within the coverage area and Kaiser Permanente is definitely one of the more localized health insurance providers.

However, it performs well and has a consistently high level of customer satisfaction, and it is well worth considering for potential customers in those regions and states where it is operational. Kaiser Permanente scored the highest ratings possible in customer satisfaction during the 2017 Health Insurance Plan Study run by JD Power and Associates. Kaiser ranked the highest in six regions, Maryland, South Atlantic, California, Virginia, Northwest and Colorado.

To find out more, why not read our how to choose a health insurance plan guide or take a look at our guide to the best life insurance options.