The Question Is Thisdo Those Benefit Enhancements Justify $4k In Guaranteed Spending

Probably not unless we know we’ll have lots of those services during the year.

Even then…it would have to bigger stuff since $4K buys a lot of office visits, labs, and medications.

Also, we can fund that $4K in an HSA and get an average 20-30% boost from not having to pay tax.

It’s like $5K in that case.

Variety Of Family Health Insurance

However, the problem of family health insurance costs presents too many answers because insurance rates plans are based on too many factors. First, the location. The level of health insurance may vary by location. In general, the average monthly insurance rate for a family living in an urban area differs from that for a family living in a rural area. The same thing comes from those living in the suburbs. Second, it depends on the type of work the family head is responsible for. Management jobs have high premium rates and those factory jobs have very low prices. So the prices are also based largely on the income of the person who will be paying for their family insurance.

Third, prices may also vary depending on staff support. This means that there are companies that automatically reassure their employees and pay half the price of their family insurance plans. Fourth, the rate may also depend on your age. Think about that if you are already among middle-aged people who want to get insurance, the insurance company will look at your age and the age of your family members and may offer you a different coverage plan. Finally, location and function depending on the quality of life of the insurer plays their important roles that influence the level of insurance strategies.

Coverage For Florida Children

Florida children from birth through the end of age 18 are eligible for coverage. It is free to apply and with year-round enrollment, the time to apply is always now. Begin your familys application by clicking the pink Apply Now button. Then Florida KidCare does the rest. Based on the age of the child, household size, and family income, we automatically match each child with their best fit of the four Florida KidCare programs Medicaid, MediKids, Florida Healthy Kids, or the Childrens Medical Services Health Plan. Its that easy!

Don’t Miss: What Type Of Health Insurance Do I Need

Individual Health Insurance Cost And Hras

Group-based and individual health insurance plans are popular choices, but there is a third option that can benefit employees and employers alike: a health reimbursement arrangement .

There is a small handful of HRAs available to business, but the most popular are the Qualified Small Employer HRA

Download our comparison chart: Group health insurance vs HRAs

Is Employer Coverage Cheaper

Many people assume that employer coverage is the best or cheapest option. In 2020 an estimated 157 million people opted for their employer-based health care plan.4

But is it? Should you always choose your employers health coverage or should you opt for individual health insurance?

Employer plans can sometimes be less expensive since the company chips in part of the costs. Your employer can also sometimes get a better rate because theyre buying a large block of insurance packages. But not always. It can sometimes be cheaper to get health insurance on your own. While it might take a little more work on your end, if youre looking to save money on your health insurance costs, you might want to pass on the employer coverage and shop for an individual plan.

Also Check: What Causes Health Insurance Premiums To Increase

Changing From Family Plan To Single Plan

A single plan is simple enough to figure out with COBRA. It gets a bit more complicated if you need to switch from a family plan to a single plan. This can happen if you get divorced or turn 26 and are no longer eligible for coverage on your parents plan.

In instances like these, the HR officer will look up the rate for single coverage on the same health plan you are currently enrolled in. To calculate the COBRA cost, the HR officer will have to determine:

- What you would have been contributing to an individual plan. If you are a family member , your contribution would typically be higher than the employee . In some cases, dependents may be responsible for the entire amount if the employer does not contribute to family coverage.

- What the company would have been contributing toward that premium. If you are the employee , the amount should be clear-cut. If you are the dependent, the contribution can vary depending on the employer.

After adding these two figures together, you would add another 2% to calculate your total COBRA premium costs.

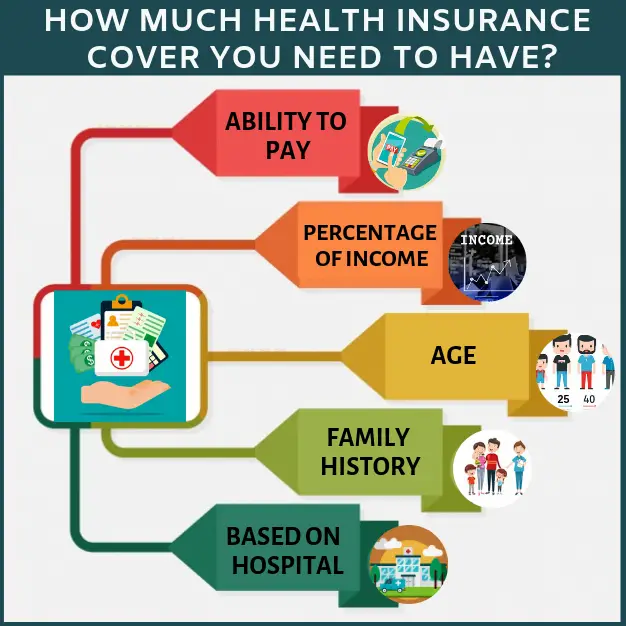

Is There Ever A Right Amount Or Coverage That One Needs To Look At

The right amount of coverage depends on several factors like the type of hospital you prefer, current age and health conditions of yourself and your family members, your affordability etc. Healthcare costs vary significantly by hospital and the facilities opted. For example, the cost of a knee replacement surgery nearly doubles if you opt for an imported implant instead of an indigenous one. This way, the size of your Health Insurance should be linked to your income and lifestyle.

While there is no ideal sum assured for Health Insurance policy for an individual, there are two market-broadly-accepted rules on its quantum. First, your health cover should be at least 50% of your annual income. And second, the insurance cover should at least cover the cost of a coronary artery bypass graft in a hospital of your choice. Most personal finance experts recommend a minimum health cover of Rs 5 lakh. You can have similar sum assured as a family floater to include your family members.

The rising costs of medicines and treatments may render your individual Health Insurance cover inadequate to cover all expenses. The basic Health Insurance policy may not cover expenses related to recovery phase such as extensive nursing care, counseling sessions, rehabilitation. But you can substantially enhance your health cover over and above your basic policy with tools like Riders and Top-Ups without corresponding increase in the premium.

You May Like: What Is The Best Supplemental Health Insurance For Medicare

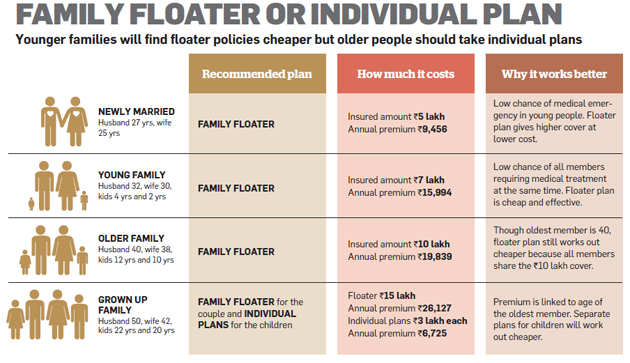

Individual Versus Family Plans

An individual plan has one member, or just one person covered by the plan. Family plans cover two or more members.

Your plan’s deductible and out-of-pocket maximum are based on whether you have an individual or family plan.

The deductible and out-of-pocket maximum for a family plan is usually double of an individual plan. So if the deductible for a plan is $2,000 for a family, it’s $1,000 for an individual. If the out-of-pocket maximum for an individual plan is $6,000, it will be $12,000 for a family, no matter how many people the plan covers.

How Much Does A Family Health Insurance Plan Cost

BY Anna Porretta Updated on May 04, 2021

Protecting your familys health is important, but so isprotecting your wallet from unexpected healthcare costs. Family healthinsurance keeps both your family and your finances healthy.

If a member of your family has a medical emergency and they are uncovered, you could end up paying the hospital bills and various related costs all out of pocket, which could have the potential to break anyones bank.

Read Also: How To Enroll In Health Insurance

Health Care Programs Eligibility

Health care coverage is available to individuals and families who meet certain eligibility requirements. The goal of these health care programs is to ensure that essential health care services are made available to those who otherwise do not have the financial resources to purchase them.

It is very important that individuals and families obtain health care coverage. In Michigan, there are many health care programs available to children, adults, and families. Specific coverages may vary depending on the program and the applicant’s citizenship status . The Michigan Department of Health and Human Services determines eligibility for most of the health care programs that are administered by the State of Michigan).

All of the health care programs in Michigan have an income test, except Children’s Special Health Care Services, and some of the programs also have an asset test. These income and asset tests may vary with each program. For some of the programs, the applicant may have income that is over the income limit and still be able to obtain health care benefits when their medical expenses equal or exceed their deductible amount.

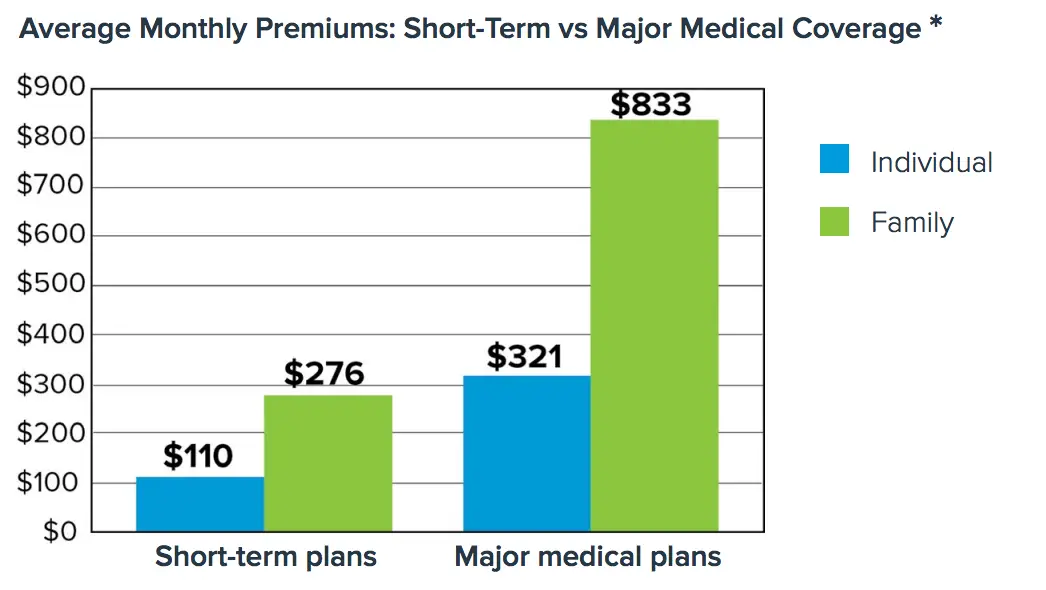

How Much Does Individual Health Insurance Cost

Many people assume that individual health insurance is more expensive than group health insurance.

Note: Individual health insurance is purchased by an individual for themselves or their family, and group health insurance is purchased by an employer for employees.

So how much does individual health insurance cost? And how does it stack up against company-based group health insurance?

Data shows that individual health insurance is, on average, more affordable than group coverage. In addition, a third health insurance option exists for small businesses to offer their employees that can help businesses better control their health benefits budget.

Read Also: Does Colonial Life Offer Health Insurance

Additional Family Health Insurance Costs

In addition to your premium and deductible, you can expect other costs with family health insurance, including the following:

- Copayment: A copayment is a fixed amount thatyou pay for a covered service. A copayment may come into effect before or afteryou have reached your deductible.

- Coinsurance: Coinsurance is a percentage you payfor covered service after reaching your deductible. You can expect to paycoinsurance until you have reached your out-of-pocket maximum.

- Out-of-Pocket Maximums: Out-of-pocket maximumsare limits on how much money you are required to pay for coverage. Once youhave reached your out-of-pocket limit, your insurance will pay for 100% of thecost of your covered benefits for the rest of the coverage year.

Tips For Finding Cheap Health Insurance

Generally, the best way to find more affordable health insurance in Australia is to:

- Do your research and know the benefits you want your health plan tocover. If you only wish to avoid the LHC loading and MLS, then a BasicHospital plan might suffice.

- Shop around and compare costs from some of the major health funds available in your state.

- Consider a higher Excess to reduce your monthly premiums. However,make sure you have that amount of money saved and ready when needed.

- Consider combining plans into one policy purchased from the same insurer this may result in a discount.

- Pay your annual premium as a lump sum before the 1ste of April to avoid the yearly price increase.

- Check to see if you can join one of the restricted healthfunds suited to your industry, for example, the Teachers Health andDefence Health Limited.

- Pick the plan most suited to your stage of life and budget.

Also Check: How Much Is Health Insurance For Seniors

Basic Health Insurance Terms

If youre just learning the ins and outs of health insurance, I feel your pain. Health insurance is complicated stufflike rocket-science complicated. You might not even know where to start.

Before we look at how much health insurance costs, lets break down some terms into plain English.

First, there are only two main kinds of health insuranceprivate and public.

Private coverage is health insurance through your employer, union or even the armed forces. You can also get it on your own through the governments marketplaceHealthcare.gov.

Public insurance is provided by the government. It includes Medicare , Medicaid or care from the Department of Veterans Affairs.

Your premium is the amount you pay monthly for your coverage.

The deductible is the amount you have to fork over before your insurance company starts chipping in.

Your maximum out-of-pocket costs are the limit to what you will pay in a year. For example, if your plans maximum out-of-pocket costs are $8,000, once you pay that amount, your insurance company will cover everything above that through the rest of the year. It acts as a financial safety net so you dont totally break the bank from medical costs.

South Dakota Medicaid For Youth Formerly In Foster Care

The Former Foster Care Medical Program provides extended medical coverage for youth age 18 to 26 that are leaving State foster care after their 18th birthday. Referrals for this program are normally generated by the Division of Child Protection Services staff. You may also call 877.999.5612 for further information.

Eligibility Requirements

- The youth must have been in foster care under the responsibility of the State of South Dakota on his/her 18th birthday.

- The youth must be a resident of South Dakota.

- There is no resource or income limit.

- Eligibility continues from the month the youth is no longer under the responsibility of the State until the end of the month in which the youth attains age 26 if s/he meets all other eligibility requirements.

Also Check: How To Get Health Insurance For My Family

Find Cheap Health Insurance Quotes In Your Area

Health insurance premiums have risen dramatically over the past decade. In the past, insurers would price your health insurance based on any number of factors, but after the Affordable Care Act, the number of variables that impact your health insurance costs decreased significantly.

In 2021, the average cost of individual health insurance for a 40-year-old across all metal tiers of coverage is $495. This represents a decrease of close to 2% from the 2020 plan year.

Children’s Health Insurance Program

Do you know a child who doesn’t have health insurance coverage? The state’s Children’s Health Insurance Program can provide a healthier future for many of these children.

CHIP is for children who:

- are North Dakota residents

- are U.S. citizens or qualified aliens

- do not have health insurance coverage

- are 18 years of age or younger

- live in families with qualifying incomes

Don’t Miss: How Much Does Usps Health Insurance Cost

You Can Run Your Family Of 4 Health Quote To View Rates And Plans Side By Side From The Major Carriersfree

Again, there is absolutely no cost to you for our services.

20 years of experience in the California health insurance market has taught usonething… Competent and experienced guidance is INVALUABLE

We are licensed Covered Ca agents with in-depth knowledge of their plans,process, andtax credits.

LINKS

Employee Health Insurance Premiums

If you work for a large employer, health insurance might cost as much as a new car, according to the 2019 Employer Health Benefits Survey from the Kaiser Family Foundation. Kaiser found that average annual premiums for family coverage were $20,576 in 2019, which was nearly identical to the base price of a Honda Civic.

Families contributed an average of $6,015 toward the cost, which means employers picked up 71% of the premium bill. For a single worker in 2019, the average premium was $7,188. Of that, workers paid $1,242 or 17.2%.

Kaiser included health maintenance organizations , Preferred Provider Organizations , point-of-service plans , and high deductible health plans with a savings option in arriving at the average premium figures. It found that PPOs were the most common plan type, insuring 44% of covered workers. While high deductible health plans with a savings option covered 30% of insured workers.

| Average Employee Premiums in 2019 |

|---|

| Employee Share |

| $103.50 |

Of course, whatever employers spend on their workers’ health insurance leaves less money for wages and salaries. So workers are actually shouldering more of their premiums than these numbers show. In fact, one reason wages may not have risen much over the last two decades is because health costs have risen so much.

Which type of plan employees choose affects their premiums, deductibles, choice of healthcare providers and hospitals, and whether they can have a health savings account , among many choices.

Recommended Reading: When Does New Health Insurance Start

Types Of Health Insurance Plans And Its Benefits

Are you availing a health insurance policy for yourself or are you taking one that covers your familys health as well? Is it a policy that you are taking because of an underlying critical illness? Based on your current need or your future planning, you need to carefully select your health insurance keeping in mind the different benefits of health insurance. There are various types of individual health insurance plans and family health insurance plans. So compare health insurance plans and choose a policy that covers all your needs or if you are taking a family health insurance, make sure it covers them all adequately.

You should also look for options such as, hospital rent capping, and co-payment. Yes, some plans say that the policyholder must bear a certain percentage of the total expenses or the bill. This can sometimes put you at a disadvantage so you need to make sure that your health insurance policy doesnt have one, and even if it does, then it shouldnt be more than 10%.

Health Insurance For Families Of 4 5 And More Review

Hopefully, you’ve gleaned some tips on how to insure a family.

There are specific plans that work best for that situation.

What to consider when picking coverage :

- Different health care needs for different family members

- Making sure all the doctors are in-network

- All the preventative visits getting coverage

- What if multiple family members get big bills

- The HSA plan option for families

- Monthly premium versus benefit difference

Of course, we’re happy to walk through any questions you have on family health coverage.

More family members just means more questions!

How can we help!

Read Also: Can A Child Have 2 Health Insurance Plans

Digging Deeper For Pricing Information

For more details, we consulted the 2020 Health Insurance Exchange Premium Landscape Issue Brief linked to the bottom of the press release. It reveals that 27-year-olds buying silver plans will see their premiums increase by 10% or more in Indiana, Louisiana, and New Jersey.

More importantly, it reveals that the percentage changes don’t tell us much about what people are actually paying: “Some of the states with the largest decreases still have relatively high premiums and vice versa,” the brief states. “For example, while Nebraskas benchmark plan premium decreased 15% from PY19 to PY20, the average 27-year-old PY20 benchmark plan premium is $583. On the other hand, while Indianas average PY20 benchmark plan premium increased 13% from PY19, the average 27-year-old PY20 benchmark plan premium is $314.”

In fact, the benchmark plan premium for a 27-year-old in 2020 is a whopping $723 in Wyoming. How many 27-year-olds can afford that kind of monthly premium? By contrast, New Mexicos 2020 benchmark plan premium for a 27-year-old is the lowest in the nation at $282.

All of these numbers only apply to the 38 states whose residents buy plans through the federal exchange at Healthcare.gov. Residents of California, Colorado, Connecticut, Idaho, Maryland, Massachusetts, Minnesota, Nevada, New York, Rhode Island, Vermont, Washington, and Washington, D.C. buy insurance through their state’s exchange.