How Much Does Travel Health Insurance Cost

Plans vary, but if youre just looking for medical travel insurance for travel outside the U.S., you can usually get coverage for less than $50 per person for a single seven-day trip. Older travelers may pay a bit more, and prices can climb a bit if you decide to add on riders for extreme activities, increase your coverage or lower the deductible.

Generally speaking, however, travel health insurance is an affordable way to have peace of mind that your medical expenses will be covered should something unexpected happen when you go abroad.

If you decide that you want to also cover the cost of the trip itself, comprehensive travel insurance is a better option for you, but expect to pay a higher premium based on your total trip cost.

Accidental Death And Dismemberment Insurance

This coverage pays a lump sum to your beneficiary, such as a family member, if you die in an accident while on the trip. Accidental death and dismemberment insurance policies also pay a portion of the sum to you if you lose a hand, foot, limb, eyesight, speech or hearing. Some plans apply only to accidental death in a plane.

» Learn more: NerdWallet’s guide to life insurance

Are You Prepared For Travel Plan Trip

Help protect yourself with Trip Cancellation and Trip Interruption Insurance4 when travelling outside of your home province within Canada or internationally, which includes:

- Coverage for eligible non-refundable travel expenses, like trip deposits and flight change fees.

- Reimbursement for meals, accommodations, transportation and other expenses if your trip is delayed or interrupted due to a covered cause.

For Trip Cancellation and Trip Interruption please call

Read Also: Does Farmers Insurance Sell Health Insurance

Compare And Buy Online

Enter your trip details to quote, compare and buy travel insurance from trusted insurers. Purchase securely with instant confirmation of coverage and travel worry-free.

- Plans from top rated companies

- Easily compare prices and benefits

- Over 75,000 verified customer reviews

- 100% safe and secure checkout

- Instant confirmation of coverage via email

All Medical Care Comes At A Cost

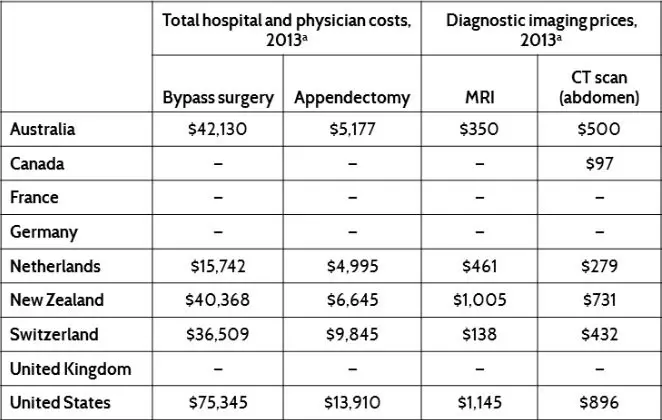

Whether you need to see a doctor, require prescription medications, need to undergo medical testing, stay in a hospital, or require emergency care, it all comes at a cost. Simple blood work testing is expensive on its own, not to mention ultrasounds, x rays, CT Scans or MRIs.

God forbid you are pregnant and going into labour while visiting Canada and experience a difficult childbirth resulting in a C-Section and your newborn needs NICU care. This can amount to thousands of dollars. Canadian healthcare is not quite as expensive as it is in the United States, but bills can add up if you require multiple measures of medical care.

Read Also: How Does Health Insurance Work Through Employer

Should I Purchase My Insurance In My Home Country Or Directly From Canada

Technically, you can purchase visitors to Canada Emergency Medical Travel Insurance either way. However, it is important to remember that many medical facilities in Canada have a great working relationship with insurance companies and that your claim could be processed much faster.

Many medical facilities in Canada offer direct billing to various Canadian insurance companies. This makes it much easier to validate the services you received and the fees that were charged. It is very easy to purchase Travel medical insurance online, and if you have any questions they always provide a phone number so that you can speak with them directly.

When you purchase visitors to Canada Emergency Medical Travel Insurance in your home country, the claims process could be much longer.

Average Cost Of Basic Vs Comprehensive Travel Insurance Policies

We took a closer look at some relatively basic travel insurance policies and some of the least expensive ones offered by carriers. Not surprisingly, the average cost of the basic policies was lower than the average cost of the more comprehensive plans. The more a travel insurance policy covers, or the higher claim limits it has, the higher the mean premium.

You May Like: How To Get Cheap Health Insurance In Texas

What Does Travel Health Insurance Cover

Travel health insurance typically covers medical emergencies, dental emergencies, medical evacuation , accidental death and dismemberment and sometimes trip delay and baggage loss.

Heres a sample quote from the GeoBlue Voyager Choice plan for a weeklong trip for a 53 year old and a 44 year old:

- Insurance cost: $57.44

- Dental care: Up to $500 for injury up to $250 for pain relief

- Accidental death and dismemberment: Up to $50,000

- Emergency evacuation: Up to $500,000

- Post-departure trip interruption: Up to $500

- Lost baggage: Maximum benefit of $500 per trip, limited to $100 per bag

Medical Only Travel Insurance Comparison

This medical-only travel insurance comparison will help you compare the prices of various travel medical insurance. To obtain the quotes, I used the example of a 30-year-old American who lives in Pennsylvania and is traveling to Mexico for two weeks, with a trip cost of $2,500.

Additionally, I chose a $0 deductible for all plans that offered deductible options . SafetyWing has a $250 deductible included as part of its plan. For the plans that allow you to choose the maximum coverage limit , I chose $250,000 .

Don’t Miss: When Does New Health Insurance Start

What Activities Are Covered By Travel Insurance

Every travel company has its own policy rules regarding what they will offer coverage for. However, in most cases, travel insurers will offer coverage if you get into an accident doing one of the following activities:

- Swimming

Even the following activities may be covered by some insurers under certain circumstances:

- Skiing

- Scuba diving

- Abseiling and rock climbing

- Sailing

- White water rafting

- Bungee jumping

Here Are Some Examples Of Emergency Medical Coverage You Might Need

- While on a business trip, you get food poisoning.

- A cobblestone road can cause you to trip and fracture a tooth.

- You travel ahead of your church missionary team to arrange housing and in a traffic accident.

- When you travel with your children in another country, you get hurt in a fall.

- Travel medical assistance services are available to assist you in an emergency.

Don’t Miss: Does Short Term Health Insurance Cover Pre Existing Conditions

Factors That Impact The Cost Of Travel Insurance

The factors that determine the cost of travel insurance vary depending on the insurer and policy you choose. For instance, some travel insurance companies don’t take your destination into consideration when setting rates, while others do. The following are some of the most commonly used inputs in determining travel insurance rates:

Does Travel Insurance Have Disability Coverage

Yes, some travel insurance companies do have coverage for disabilities and pre-existing conditions, but not all. Disability travel insurance is not included in policies by default and in the majority of cases, disabled people will have to pay more to get the additional coverage they need.

You can find coverage for the following instances :

- Medical treatment related to your disability/pre-existing condition.

- Loss or damage of disability and mobility equipment.

- Replacement of essential medication.

- Replacement of an essential carer.

In the end, it really comes down on a case-by-case basis and you have to contact a travel insurance company to discuss how your disability fits into their policies.

The coverage for physical disability changes depending on the type of disability it is and whether it is stable.

Recommended Reading: What Does Health Insurance Cost For An Individual

It Might Be Bought By Travelers

These travelers should consider purchasing travel insurance for medical reasons.

- US Citizens going abroad. The typical U.S. health insurance plan does not cover international travel. Therefore, if you are traveling abroad, you will need to have travel medical coverage in case of accidental injuries or illnesses that occur outside of your coverage area.

- Visitors to the US. Family members visiting the US from abroad should have insurance coverage.

- International business travelers. You will need to have some evacuation and medical coverage in case your U.S. health insurance doesnt cover you if you work overseas.

- Long-term and expat travelers. You should ensure that your health insurance, even Medicare, covers you if you travel outside the United States.

- Foreign aid workers and missionaries. You are not meant to cause harm by traveling because you want to make a difference in the lives of others. You should ensure you are covered in the event of a medical emergency and evacuation to safety.

Immigrants Coming To Canada

One thing many people are not aware of is there is a waiting period for provincial healthcare coverage. Therefore it is very important to purchase private emergency health insurance BEFORE arriving in Canada.

The waiting period varies from province to province, so to ensure you have proper coverage, emergency travel insurance is highly recommended. During the waiting period, anything can happen that may cause you to require medical attention.

Purchasing emergency travel medical insurance protects you from high expenses that would otherwise have to pay out of your pocket. It is important to know that Canada does not provide or cover free healthcare for visitors, tourists or new immigrants that have not attained the proper waiting period.

Also Check: How To Get State Health Insurance In Ct

How To Choose Travel Medical Insurance

The medical risks you face when traveling outside the U.S. are hard to quantify. Basically, the chances of facing a major medical problem are small very small, for medevac but the financial consequences of a serious event are potentially quite large.

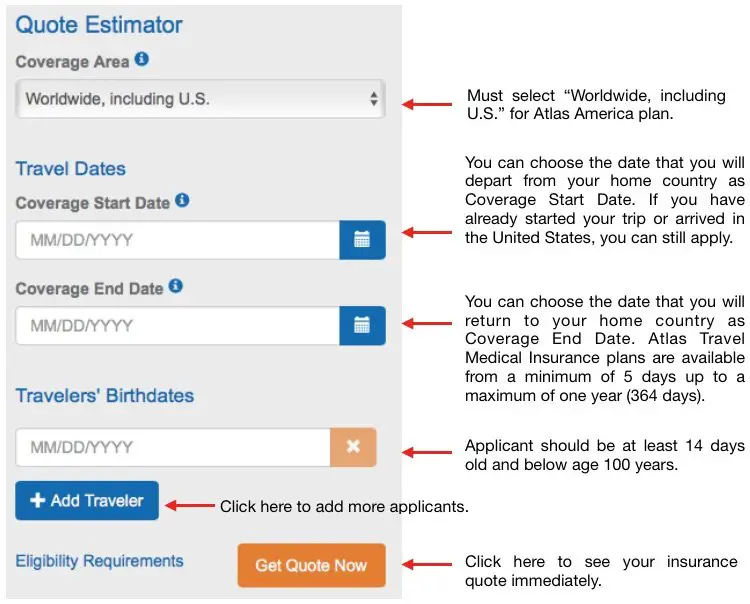

Fortunately, travel health insurance prices are not bad. As with all travel insurance, my suggestion is that you check with one or two of the online travel insurance agencies, enter your personal details, trip details, and the coverages you want, and select the least expensive policy that meets your needs. Some of the major agencies include InsureMyTrip.com, Squaremouth, and QuoteWright.

Medevac: The Fine Print

Most medevac policies Ive seen call for transport to either the nearest appropriate medical facility or back to the U.S., depending on the circumstances. Typically, that means you start at a local or regional hospital. The insurance pays for transport back to the U.S. only when, in the opinion of the attending physician, local/regional facilities are inadequate.

When you need medevac, the insurance company calls all the shots. That means you must, from the beginning, make all arrangements through the insurance company or its local agents. If you jump the gun and make your own arrangements, chances are the insurance company wont cover them.

Don’t Miss: Can I Go To The Er Without Health Insurance

Travel Health Insurance Cost To Usa

If you know anything about the U.S. healthcare industry, you may be aware of the rising costs of medical care. Without adequate travel insurance coverage, medical issues can lead to serious financial problems. Theres no need to put yourself and your family at risk. In most instances, travel health insurance will take care of basic healthcare costs. When you sign up for travel insurance, you are securing coverage for countless health benefits, including hospitalization, doctor visits, prescription drugs, tests, x-rays, and even the acute onset of pre-existing conditions .

So How Much Does Visitor Insurance Cost? It depends on several factors. In this article, we will break down the cost of coverage, from premiums and deductibles to policy maximums and treatment payments.

In general, visitor health insurance will cost less if you:

The premium depends on your age, the coverage duration, medical maximum, deductible amount, and plan type. When you choose low maximum coverage, your monthly or weekly premium will be much less than it would be if you wanted a limit of $100,000 or more. In the case of a serious medical emergency, $25,000 may only get you so far. You could end up owing tens of thousands of dollars should you fall ill or suffer a major injury that requires surgery.

Heres a look at how deductibles and premiums may vary according to your selections.

Long And Short Trip Insurance Policies

Another aspect that will impact how much does travel insurance cost is your trip length. If you are planning a short trip, such as a vacation, there is little need for you to purchase a policy. However, if you are planning a longer trip like a business trip, it is important to consider the possible risks associated with a longer trip, such as possible late night airport security delays, increased traffic congestion, and other possible inconveniences that may arise. If you are planning a trip that will take you through some dangerous locations, like high security prison or military bases, your trip will likely cost more in terms of premiums because you will be more at risk for loss or damage from these circumstances.

Also Check: Where To Find Health Insurance

Prices For Snowbird Travel Insurance Premiums

The following chart compares snowbird travel medical insurance premium ranges from 12 travel insurance providers using a variety of scenarios for age, health, trip length and policy type. Your rates may vary depending on your specific medical conditions, situation and needs.

Important Note: The rates below are based on specific medical conditions, ages and policy durations and are subject to change without prior notice. Some policy exclusions and limitations may apply. Rate estimates were provided by Securiglobe in March, 2016.

Primary Vs Secondary Medical Coverage

Travel medical insurance can be primary or secondary coverage, depending on the plan. If its primary, it will pay out before any other health insurance you have. If you have health insurance and buy travel medical insurance as secondary coverage, your own health plan must pay first.

If youre traveling overseas where your U.S. health plan doesnt provide coverage, a travel medical plan thats secondary will essentially become primary coverage due to lack of other insurance.

Read Also: Does Cigna Health Insurance Cover International Travel

Primary Vs Secondary Coverage

- Primary coverage means that if you should fall ill or get injured, this policy will kick in as your main insurance. Your regular everyday health insurance would be the backup.

- Secondary coverage is supplementary insurance that covers gaps that your primary plan doesn’t cover.

The wise move is to call your current health insurance carrier to ask about your coverage abroad so you can figure out what youll need. In some cases, the travel health insurance provider might require you to buy primary insurance.

So What Will My Travel Insurance Cost

In short, there are many inputs that go into a travel insurance plans cost. Furthermore, these factors can often compound, such as when an older traveler books a 21-day family trip to an international destination. Understanding how these elements affect your plan is critical to weigh the upfront cost of your policy against the benefits that you may need. You can quote, compare and buy travel insurance on TravelInsurance.com in under five minutes.

Read Also: How Much Is Health Insurance For Seniors

What Does Travel Insurance Cover

Most travel insurance plans cover the following, although the coverage changes from one company to the other, as well as from one specific plan to the other:

- Medical treatment. If you get into an accident or get sick during your trip, your travel insurance will cover for doctor consultations, emergency treatment, hospitalization, surgery, prescription drugs and medicine, etc.

- Trip cancellation, interruption, or curtailment. If your trip is cut short or cancelled for some reason, you will be covered for any lost travel and or accommodation costs. The reasons deemed acceptable for reimbursement change based on the policy. You can also choose to purchase a Cancel For Any Reason add-on to your existing policy.

- Repatriation of remains. In the case of death. It can also include overseas funeral expenses.

- Lost, stolen, or damaged possessions, but not is it is due to recklessness.

- Missed flight. If the flight you missed was through no fault of your own the insurance company will cover any expenses related to it.

- Return of a minor.

- Hijacking.

Where Are You Going

Did you know the cost of travel insurance isnt affected by your choice of destination? It doesnt matter if youre heading to Iceland or Cambodia the quotes you receive are determined solely by your trip cost and your age.

However, your destination is an important factor when youre thinking about how much travel insurance to buy. Thats because if youre heading overseas, youll need the additional protection of emergency medical benefits and emergency medical transportation benefits. And if youre visiting more remote areas, theres a greater chance youll require expensive emergency medical assistance.

For instance, lets say a traveler falls and breaks his ankle while on a walking tour in Paris. Fortunately, several high-quality hospitals are just a short ambulance ride away. Travel insurance can pay for emergency medical care and emergency medical transportation required by his covered serious injury but the total bill is unlikely to be astronomical. A plan like OneTripSM Basic, with up to $10,000 in emergency medical/dental and up to $50,000 in emergency medical transportation, may be enough.

You May Like: What Is The Health Insurance For Low Income

Simply Arrange Your Cover By Telephone

- Do you have any questions about your travel insurance?

- Not sure which travel cover is right for you?

- Do you need help arranging your travel insurance?

- Want to arrange your cover over the telephone?

We’re here for you: +49 89 244 414 178

Monday to Friday 8.30 am to 6.30 pm, Saturday 9.00 am to 2.00 pm

Sample Quotes From Top Insurance Travel Health Insurance Providers

| Company | ||

|---|---|---|

| IMG | $45.85 | Limited COVID coverage, $1 million for emergency evacuation, accidental death and dismemberment, acute onset of preexisting conditions, trip delay, trip interruption, lost luggage |

| Seven Corners | $82.18 | COVID medical coverage, $500,000 for emergency evacuation, accidental death and dismemberment, acute onset of preexisting conditions, trip delay, trip interruption, lost baggage |

| Atlas Travel Insurance | $56.24 | COVID medical coverage, $1 million for emergency evacuation, accidental death and dismemberment, crisis response, political evacuation, acute onset of preexisting conditions, trip delay, trip interruption |

You May Like: What Is The Best Health Insurance Coverage