What Are Health Insurance Deductibles

A health insurance deductible is a specified amount or capped limit you must pay first before your insurance will begin paying your medical costs.

For example, if you have a $1000 deductible, you must first pay $1000 out of pocket before your insurance will cover any of the expenses from a medical visit. It may take you several months or just one visit to reach that deductible amount.

Youll pay your deductible payment directly to the medical professional, clinic, or hospital. If you incur a $700 charge at the emergency room and a $300 charge at the dermatologist, youll pay $700 directly to the hospital and $300 directly to the dermatologist. You dont pay your deductible to your insurance company.

Now that youve paid $1000, you have met your deductible. Your insurance company will then start paying for your insurance-covered medical expenses.

Your deductible automatically resets to $0 at the beginning of your policy period. Most policy periods are 1 year long. After the new policy period starts, youll be responsible for paying your deductible until its fulfilled.

You may still be responsible for a copayment or coinsurance even after the deductible is met, but the insurance company is paying at least some amount of the charge.

Short Term Health Insurance

Another option that you have is to buy short term health insurance.

Short term health insurance is an option that you have in most states. It is a cheaper alternative to buying your own individual or family health insurance policy that may help bridge the gap between retiring and enrolling in Medicare.

Short term health insurance is cheap but these plans offer significantly less comprehensive coverage when compared to a marketplace health insurance plan. Its also important to keep in mind that you can be denied or charged more for short term health insurance depending on your pre-existing conditions.

While this option offers less comprehensive coverage it may help you avoid steep health care bills in worst case scenario situations before youre eligible for Medicare.

eHealth is here to help you find short term health insurance available in your area. Our team of experienced agents can find the perfect plan for your situation, and can even help you make the transition from short term health insurance into Medicare once youre eligible!

Qualifying To Use The 12

To use the 12-month rule, you must apply it when you first start your business or first file taxes as an individual. You must get IRS approval if you havent been using the rule and want to start doing so. IRS approval is granted automatically. You must file IRS Form 3115, Application for Change in Accounting Method, with your tax return for the year you want to make the change. When you do this, you apply the 12-month rule to your prior years taxes, which may result in additional deductions and tax refunds for prior years. Filing Form 3115 is a complex process best done by a tax professional.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

Take Advantage Of Switching Periods

Every year there are two peak periods when Aussies are looking for health cover: March and June.

March is a peak period as April 1 is the time each year that premiums go up, meaning lots of people with insurance are looking for a better deal.

The other peak comes in June, as July 1 is the cut-off for people needing to take out cover before those nearly 31 get stung with Lifetime Health Cover loading.

Shopping in one of these two peak periods can really work in your favour as health funds are trying to win the most business by offering a whole range of sign-up bonuses and incentives.

These incentives run the gamut from waived extras waiting periods and free months of cover to gift cards and Fitbits. All of these mean money in your hip pocket.

What Do I Pay

- Monthly premiums. You pay a monthly medical premium for yourself and any enrolled dependents on your account. Your premiums pay for an entire calendar month of coverage. Your medical and life insurance premiums cannot be prorated for any reason, including when a member dies before the end of the month. LTD premiums may only be prorated the month an employee enrolls if they are required to submit evidence of insurability.

- Premium surcharges. In addition to your monthly medical premium, you may be charged a $25 tobacco use premium surcharge and a $50 spouse or state-registered domestic partner coverage premium surcharge.

- Out-of-pocket costs. You are responsible for paying any out-of-pocket costs for deductibles, coinsurance, or copayments for services under the medical, dental, and vision plans you choose. See the Medical benefit comparison for a side-by-side comparison of common benefits and costs for services for each plan.

- Supplemental and employee-paid insurance. You can buy supplemental life and supplemental AD& D insurance for yourself and your dependents. You will be automatically enrolled in employee-paid LTD insurance. You can reduce to a lower cost coverage level. You can also decline the coverage.

Also Check: Starbucks Health Insurance

More Hospitals Are Pushing Patients To Pay In Advance In Some Cases It May Make Sense

Two days before Katherine Lynch was due to give birth to her daughter, she got a call from the billing department at the hospital where she planned to have the baby. Lynch was asked if she wanted to pay in advance the $1,044 she would owe after insurance picked up the rest.I was surprised and annoyed, says Lynch, 33, a psychologist who lives in Novato, Calif. I was in grad school at the time. Money was tight. But she paid because she thought she had to.Later, when she got an explanation of benefits statement from her insurance company, she realized that shed overpaid by several hundred dollars. It took multiple phone calls to the hospital for Lynch to get her money refunded.It wasnt easy to find the time to do that with a new baby at home, says Lynch.

Lynchs experience isnt unusual these days. Hospitals are becoming more aggressive about asking patients with health insurance to pay their share of the tab up front.

In most cases, consumers can’t be required to pay up front. And as the above example shows, it’s usually better to wait to see how much of the bill is covered by your insurance plan. But there are times when prepaying can actually save you money, especially if you use it to negotiate a discount with the hospital .

Questions For Your Attorney

If you’re thinking about prepaying some of your expenses, make sure you know the tax consequences. Don’t assume you’ll be able to get the full tax benefits of the payment in the year it’s made. If you have any questions, talk to a professional tax preparer or a tax lawyer before you file.

- Is it a good idea to prepay expenses?

- Can a prepaid salary be deducted in the year it was paid?

- Are there any prepaid multi-year expenses that are fully deductible in the year of payment?

- Do I need to file Form 3115 to use the 12-month rule?

Also Check: Starbucks Dental Coverage

Why They’re Billing Upfront

Depending on the service you’re receiving and how much it costs relative to your deductible, many hospitals still use the traditional method of waiting to send you a bill until after your procedure is complete and your insurance company has processed your bill.

It’s becoming increasingly common, though, for hospitals to ask for payment of your deductiblepartial or in fullbefore scheduled medical services are provided. This is due to a variety of factors, including increasing medical costs, and rising deductibles and total out-of-pocket costs.

Hospitals don’t want to be stuck with unpaid bills, and they know after the procedure is completed, people may not pay what they owe. The hospital can send them to collections, but obtaining payment upfront is a more effective method of ensuring that the bill gets paid.

What Should I Look For When Im Buying Travel Insurance

When searching for a policy, make sure you look for the following things:

- Coronavirus medical and repatriation cover To cover you if youre infected when youre away.

- Coronavirus cancellation cover Youll need this if you want to be able to claim on insurance for refunds if Covid stops you travelling for any reason. Our ratings will tell you how much Covid cover an insurer has.

- Scheduled airline failure insurance To cover you if your airline goes bust.

- Excesses This is what youll pay towards what your insurer pays out. Youll need to be able to afford them if youre claiming.

Which? recommends getting the following levels of cover:

- Emergency medical cover £5m worldwide

- Cancellation, curtailment and missed departure £2,000 or the value of your holiday

- Personal belongings and money £1,500

- Personal liability £1m

Find out more:flight cancellations and compensation

Also Check: Is Starbucks Health Insurance Good

Would It Benefit Me Not To Have A Pretax Deduction

Deducting your premiums pretax may affect the following benefits:

- Social Security. If your base salary is less than the annual federal taxable maximum, paying your premiums pretax reduces your Social Security taxes now. However, your lifetime Social Security earnings would be calculated using the lower salary, which lowers your Social Security benefit when you retire.

- Unemployment compensation. Paying your premiums pretax also reduces the base salary used to calculate unemployment compensation. To learn more about IRC Section 125 and its impact on other benefits, talk to a qualified financial planner, tax specialist, or visit your local Social Security office.

How Can I Pre

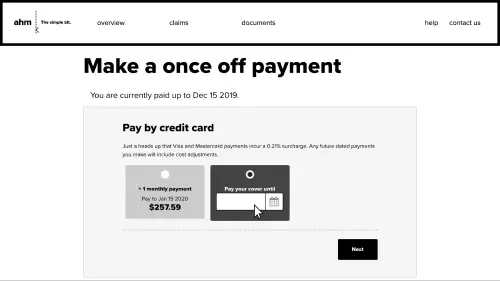

Your advance payment options are credit card or BPAY. Here’s how:

Online

Log in to online member services and go to Payments to make an instant credit card payment. Unsure how much to pay? Use the online member services Premium Calculator to check your pre-pay amount.

BPAY

Enter the Biller Code and your Customer Reference Number. You can find these details at online member services under Payments > Pay by BPAY.

Phone

Call us on . Have your credit card and Customer Reference Number ready to go.

Also Check: Does Starbucks Provide Health Insurance

Big Funds Return Covid

All five of the big funds have announced payments to their members to return extra profits they made during COVID-19 in 2020.

- BUPA will return $120 million via cashback by the end of 2021. Between $15 and $110, on average $71 per policy.

- HBF returned $42 million via cashback in July/August 2021. Between $20 and $140, on average $89 per policy.

- HCF will return $66 million by freezing premiums until 1 November 2022.

- Medibank will return $105 million by deducting the amount from the next premium paid from October 2021. The payment is usually similar to five days’ premium it’s up to $52 for extras only and up to $175 for hospital and extras combined. On average that’s $25 for extras only per policy and $60 for hospital and extras combined per policy.

- NIB will return $15 million by deducting the amount from the next premium paid from September 2021, up to $64 for combined, up to $48 for hospital only and $13 for extras only, which is on average $22 per policy.

All of the biggest health funds released support packets for their members in 2020 when COVID-19 struck, and allowed affected members to suspend their policies or get cover for free for a period of time.

HBF was the only fund to fully cancel its 2020 premium increase. Medibank, Bupa, HCF and NIB, along with almost all other health funds, delayed their premium increase by six months until 1 October 2020.

Do I Need Private Health Care Coverage When Travelling Outside Canada

While travelling within Canada, the portability criterion of the Canada Health Act requires that insured hospital and physician services are covered at host-province/territory rates. When outside the country, coverage is required to be at home-province/territory rates. As a result, health care services received abroad may not be fully covered by a provincial or territorial health insurance plan. For that reason, it is highly recommended that you purchase private insurance before departing Canada, to ensure adequate coverage.

Also Check: Do Starbucks Employees Get Health Insurance

Who Is Eligible For Health Care In Canada

Our national health insurance program is designed to ensure that all insured persons have access to medically necessary hospital and physician services on a prepaid basis. The Canada Health Act defines insured persons as residents of a province. The Act further defines a resident as:

“a person lawfully entitled to be or to remain in Canada who makes his home and is ordinarily present in the province, but does not include a tourist, a transient or a visitor to the province.”

Therefore, residence in a province or territory is the basic requirement for provincial/territorial health insurance coverage. Each province and territory is responsible for determining its own minimum residence requirements with regard to an individual’s eligibility for benefits under its health insurance plan. The Canada Health Act gives no guidance on such residence requirements beyond limiting waiting periods to establish eligibility for and entitlement to insured health services to three months. Most provinces and territories also require residents to be physically present 183 days annually, and provide evidence of their intent to return to the province.

What Other Health Care Services Do Provinces And Territories Provide

Provinces and territories may also offer “additional benefits” under their respective health insurance plans, funded and delivered on their own terms and conditions. These benefits are often targeted to specific population groups , and may be partially or fully covered. While these services vary across different provinces and territories, examples include prescription drugs, dental care, optometric, chiropractic, and ambulance services.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

What Should I Do If I Am Moving To Another Province Or Territory

Residents moving from one province/territory to another continue to be covered by their “home” province/territory during any minimum waiting period, not to exceed three months, imposed by the new province/territory of residence. After the waiting period, the new province/territory of residence assumes your health care coverage.

It is your responsibility to inform your provincial/territorial plan that you are leaving and where you are moving, and to register with the health insurance plan of your new province or territory.

Am I Covered For Health Services That I Leave The Country To Obtain

Prior approval by your provincial/territorial health insurance plan may be required before coverage is extended for elective health services obtained outside Canada. Individuals who seek elective treatment out-of-country without obtaining approval from their provincial or territorial health insurance plans may be required to bear the cost of the services received.

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

The Threshold Doesn’t Apply To All Your Income

The good news here is that this percentage doesn’t apply to your total income, but only to your AGI. This is the number that’s arrived at after you’ve taken certain above-the-line deductions on Schedule 1 of your Form 1040 tax return, reducing your total, gross income to your taxable income.

Above-the-line deductions include things like certain retirement plan contributions, tuition, and student loan interest. Your AGI will typically be less than your overall income if you can claim any of these deductions. For example, you might have earned $60,000, but your AGI is just $54,000 if you contributed $6,000 to your IRA in that year. Your 7.5% threshold drops from $4,500 to $4,050.

Your AGI appears on line 11 of your Form 1040 before you claim itemized deductions or the standard deduction for your filing status on line 12.

Will My Holiday Firm Refund Me

Before you claim on your travel insurance, youll first need to check if you can get a refund from your travel provider. Or, if youve booked the flights and accommodation yourself, youll need to seek refunds from them before contacting your insurer.

Sadly, the pandemic has shown that not all holiday firms play by the rules when it comes to refunds.

Many firms have rapidly refunded customers for cancelled trips, but others have hung onto cash for months, and in some cases broken the law.

Nearly half of firms made our Green category for having rapid refunds and no-quibble cancellation policies. Among these were Which? Recommended Providers Jet2 Holidays, Kuoni and Hays.

Only a handful of companies made the Green+ list, including WRPs Explore and Exodus. To make this category, Green-rated firms also need to refund those unable to travel because NHS Test and Trace has told them to isolate.

As for the other firms we looked at, one in five were classed as Amber for following legal obligations but nothing more and three in ten were Red. Firms with this rating might stall or pass the buck on refunds, while others werent transparent about their terms and conditions a major problem for would-be travellers.

Also Check: Starbucks Medical Insurance

Whats The Right Deductible For Me

The answer to this question depends largely on how many people youre insuring, how active you are, and how many doctor visits you anticipate in a year.

A high-deductible plan is great for people who rarely visit the doctor and would like to limit their monthly expenses. If you choose a high-deductible plan, you should begin saving money so that youre prepared to pay any medical expenses up front.

A low-deductible plan may be best for a larger family who knows theyll be frequently visiting doctors offices. These plans are also a good option for a person with a chronic medical condition.

Planned visits, such as wellness visits, checkups on chronic conditions, or anticipated emergency needs, can quickly add up if youre on a high-deductible plan. A low-deductible plan lets you better manage your out-of-pocket expenses.