Health Coverage For People With Disabilities

If you have a disability, you have three options for health coverage through the government.

-

Medicaid provides free or low-cost medical benefits to people with disabilities. Learn about eligibility and how to apply.

-

Medicare provides medical health insurance to people under 65 with certain disabilities and any age with end-stage renal disease . Learn about eligibility, how to apply and coverage.

-

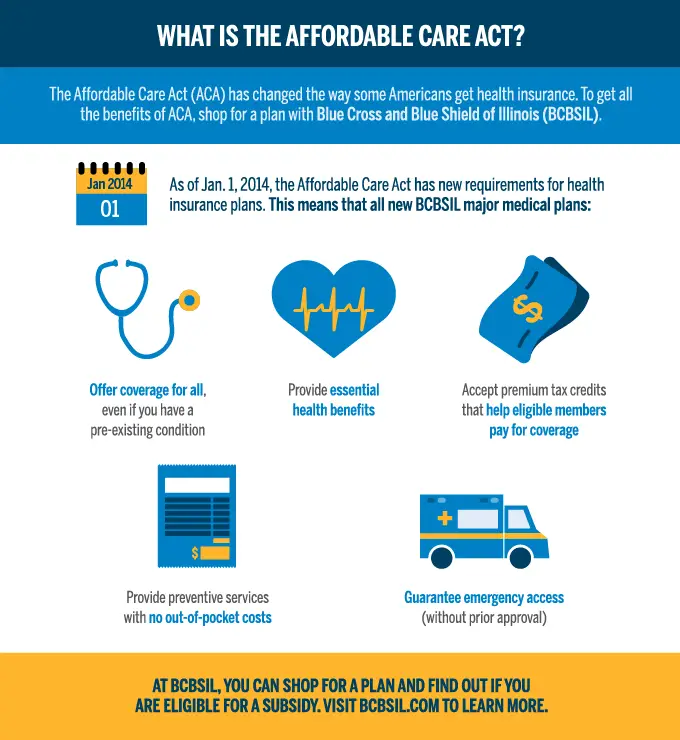

Affordable Care Act Marketplace offers options to people who have a disability, dont qualify for disability benefits, and need health coverage. Learn about the .

How To Get Health Coverage

You can get health care coverage through:

- A group coverage plan at your job or your spouse or partner’s job

- Your parents’ insurance plan, if you are under age 26

- A plan you purchase on your own directly from a health insurance company or through the Health Insurance Marketplace

- Government programs such as

What Does Access Health Insurance Ct Cover

“The overall care I received was excellent! I also appreciate your affiliation with Yale New Haven Hospital.”

“Throughout the visit I felt like the staff really cared. The Doctor took his time talking with me about my symptoms, and I felt like he listened to all my concerns and took that into consideration when recommending the right treatment. Thank you!”

“I had to take my son in for an ear infection following a sudden change in temperament at daycare. He was inconsolable the entire car ride but when we got there and by the time we left this care facility he was back to his normal happy go lucky little two year old boy. I highly recommend PhysicianOne Urgent Care.”

“I wanted to take a moment to thank you for the attention you gave me last week. My son was started on antibiotics and ear drops. Within 24 hours he began to feel better. The poor kid had been going to school in tears because he was afraid of missing any more days, but feeling just awful! He’s not been able to even think about lacrosse practice, but thanks to starting him on antibiotics, he was thrilled to return to practice today.”

Read Also: How Much Are Employers Required To Pay For Health Insurance

Medicaid Covers 1 In 5 Americans And Serves Diverse Populations

Medicaid provides health and long-term care for millions of Americas poorest and most vulnerable people, acting as a high risk pool for the private insurance market. In FY 2017, Medicaid covered over 75 million low-income Americans. As of February 2019, 37 states have adopted the Medicaid expansion. Data as of FY 2017 show that 12.6 million were newly eligible in the expansion group. Children account for more than four in ten of all Medicaid enrollees, and the elderly and people with disabilities account for about one in four enrollees.

Medicaid plays an especially critical role for certain populations covering: nearly half of all births in the typical state 83% of poor children 48% of children with special health care needs and 45% of nonelderly adults with disabilities and more than six in ten nursing home residents. States can opt to provide Medicaid for children with significant disabilities in higher-income families to fill gaps in private health insurance and limit out-of-pocket financial burden. Medicaid also assists nearly 1 in 5 Medicare beneficiaries with their Medicare premiums and cost-sharing and provides many of them with benefits not covered by Medicare, especially long-term care .

Figure 4: Medicaid plays a key role for selected populations.

Why Choose Access Health Louisiana

Access Health Louisiana is the leader in high quality and convenient healthcare at affordable prices. With 32 clinics and school-based health centers located throughout Southeast Louisiana, there is always a location near you.

We are the leader in providing quality healthcare to patients of all ages. Our friendly team of board-certified providers are all accepting new patients. Same-day appointments are available at most clinics. Telemedicine appointments and teletherapy appointments are also available.

All of AHLs community health centers operate in high-need areas where access to care is difficult. No patient is ever turned away for treatment at any of our clinics due to their ability to pay. Access Health Louisiana accepts most commercial insurances, Medicaid, Medicare and for those who are uninsured, we offer an income-based sliding-fee scale.

No insurance? No problem. AHL is committed to making sure that everyone in Southeast Louisiana has access to quality, affordable and convenient care. We accept all commercial insurances, Medicaid and Medicare. For patients without insurance coverage, we offer a sliding-fee scale. This means you only pay for what you can afford. Our patient care coordinators will only charge you based off your current income and household size. Many cash-paying patients pay as little as $15 for an exam.

These are just some of the many reasons why entrusting your familys healthcare to Access Health Louisiana is a smart choice.

Read Also: What Is The Best Supplemental Health Insurance For Medicare

Closing The Coverage Gap Can Reduce Medical Debt Expand Economic Opportunity

Closing the Medicaid coverage gap also has economic benefits both to individuals who receive coverage and to the broader community. Extending health coverage to people in the gap can protect more people from medical debt and provide more flexibility for people to pursue opportunities for economic mobility, such as participating in training programs and starting or building businesses.

Medical debt is the top cause of bankruptcy in the United States and people of color are more likely to report trouble paying medical bills. In 2018, about 28 percent of households with a Black family member and 22 percent with a Latino family member had medical debt, compared to 17 percent of households with a white family member and 10 percent with an Asian family member.

Further reducing disparities in medical debt by closing the coverage gap will help address the racial wealth gap and keep more money in the pockets of people of color to pay for other needs and boost their financial security. Furthermore, closing the coverage gap can reduce the geographic differences in medical debt. Among regions in the United States, the average amount of medical debt in collections was highest in the South where many of the states havent adopted the Medicaid expansion. Also, the drop in new medical debt from 2013 to 2020 was 34 percentage points greater in expansion than in non-expansion states, indicating the gains that closing the coverage gap may have.

Closing The Coverage Gap Will Strengthen Health Care Systems That Serve People Of Color

Expanding health coverage also plays a role in reducing disparities in the availability of health care providers that serve larger numbers of people of color. Most of the funds for closing the coverage gap go to payments for health care services, allowing more rural hospitals, safety net hospitals, and community health centers many of which disproportionately serve people with low incomes and people of color to stay open and even to provide more services in their communities.

Of the ten states with the most rural hospital closures since 2010, all but two are non-expansion states and the two that have expanded Medicaid, Oklahoma and Missouri, only began the expansion in 2021. In some of the non-expansion states, closed rural hospitals were more likely to be in counties with a higher share of Black residents. For example, six out of the nine rural hospitals that closed in Georgia since 2005 were in counties with higher shares of people of color compared to the statewide average: five had a higher share of Black residents and one a higher share of Latino residents. Five out of eight shuttered rural hospitals in Florida were in counties with shares of Black residents above the state average, as were all four shuttered rural hospitals in South Carolina . While not all non-expansion states saw this kind of disparity, these examples show the importance of greater inclusion of communities of color in conversations about peoples access to health care in rural areas.

You May Like: What Does Deductible Mean In Health Insurance

When Can You Apply For Health Insurance 2021

For most Americans, November 1, 2021 is the next opportunity to enroll in an ACA-compliant health plan without needing a qualifying life event. But in states that use HealthCare.gov, enrollment in 2021 coverage is still available for people who are receiving or have received unemployment compensation in 2021.

Hospital And Doctor Visits

Health insurance covers the cost of visits to see your primary physician, specialists and other medical providers. It also covers when you get health care services at a hospital, whether for emergency care or surgeries, outpatient care, procedures or overnight stays.

You might be responsible for the plans deductible, copayment and coinsurance costs. But as long as you remain in-network and your care is deemed medically necessary, the health insurance plan should pick up the lions share of the cost once you reach your plans deductible.

You May Like: Does Health Insurance Cover Helicopter Transport

Large Bills Are Possible Even With Insurance

Patients with health insurance can also be shocked by the out-of-pocket costs for serious illnesses.

According to statistics on annual per-patient costs of chronic diseases in the U.S., the minimum and maximum costs for:

- Heart failure is between $29,300 and $52,000

- Cancer is between $29,400 and $46,200

- Diabetes is between $17,500 and $28,000

Alcohol-related illnesses, smoking-related illnesses, obesity, strokes, and asthma are also among the most expensive chronic diseases to treat.

If your health insurance covers 80 percent of this cost, you would be responsible for the other 20 percent. Therefore, your share of heart failure treatment could run from $5,860 to $10,400. It would be roughly that much for cancer treatment and less for diabetes care.

If you have not met your annual deductible at the time treatment is needed, that will add to your out-of-pocket cost.

For many, this highlights the value of supplemental insurance. For example, a critical illness insurance policy will pay a lump sum benefit if you are diagnosed with cancer, heart attack, stroke, or another serious condition. It’s money to use for out-of-pocket expenses your health insurance won’t cover â plus, anything else you need during a difficult time.

Medicaid Is Jointly Financed By States And The Federal Government

Medicaid is financed jointly by the federal government and states. The federal government matches state Medicaid spending. The federal match rate varies by state based on a federal formula and ranges from a minimum of 50% to nearly 75% in the poorest state. Under the ACA, the federal match rate for adults newly eligible was 100% for 2014-2016, phasing down gradually to 90% in 2020 and thereafter . The federal matching structure provides states with resources for coverage of their low-income residents and also permits state Medicaid programs to respond to demographic and economic shifts, changing coverage needs, technological innovations, public health emergencies such as the opioid addiction crisis, and disasters and other events beyond states control. The guaranteed availability of federal Medicaid matching funds eases budgetary pressures on states during recessionary periods when enrollment rises. Federal matching rates do not automatically adjust to economic shifts but Congress has twice raised them temporarily during downturns to strengthen support for states.

Total federal and state Medicaid spending was $577 billion in FY 2017. Medicaid is the third-largest domestic program in the federal budget, after Social Security and Medicare, accounting for 9.5% of federal spending in FY 2017. In 2017, Medicaid was the second-largest item in state budgets, after elementary and secondary education .

Figure 8: Medicaid is a budget item and a revenue item in state budgets.

Recommended Reading: Can I Change My Health Insurance Outside Of Open Enrollment

Whats The Worst That Can Happen If I Dont Have Health Insurance

Without health insurance, you will likely be responsible for all your health care expenses. In some situations, this could be financially ruinous.

The federal government notes that simply treating a broken leg can cost $7,500. Three days in the hospital might run you $30,000.

And those are relatively minor costs compared to the hundreds of thousands of dollars it might cost to treat an especially serious or chronic condition if you dont have health insurance.

New Official State Rock

Dolostone has been officially designated as Illinois official state rock after Gov. J.B. Pritzker signed a bill into law in June.

Students from Pleasantdale Middle School in suburban Burr Ridge and Maplebrook Elementary School in Naperville helped to push for the designation.

Dolostone is a sedimentary rock made of the mineral dolomite. It makes up the majority of bedrock in the state of Illinois, and helps provide nutrients to soil, according to geologists.

You May Like: Do You Have To Have Health Insurance In Tennessee

Continuous Glucose Monitor Update

At the October 2021 AHCCCS Pharmacy and Therapeutics Committee meeting, the continuous glucose monitor class was reviewed for potential addition by AHCCCS as a supplemental rebate class. After further review, AHCCCS has determined not to add the CGM class for supplemental rebate. AHCCCS is in the process of standardizing medical necessity criteria for the AHCCCS Fee-for-Service program and MCO contractors.

Americas Surprise Medical Bill Problem

The difference between in-network and out-of-network providers is a leading cause of surprise medical bills.

Many health care procedures are ones you plan for and make appointments for ahead of time. Therefore, you can ensure the provider is part of your insurance planâs network.

But even if you think youâve chosen the right providers, you may still inadvertently be under the care of a non-network provider.

For example, most patients donât get to choose the anesthesiologist for their C-section or back surgery. In another example, you may see an in-network provider who sends you to the in-house lab for blood work or a radiologist for X-rays, who are not in the insurance carrierâs network.

Any provider who bills your insurance carrier and who isnât in-network will leave you paying a larger percentage of the overall bill. In some cases, insurance companies will not pay any out-of-network costs.

Surprise medical bills often arise during emergencies, when a patient isnât able to choose a provider. For example, the ambulance that picks you up after youâve had a heart attack may take you to a non-network hospital that was closer to your home.

According to the Kaiser Family Foundation, an estimated 1 in 5 emergency claims and 1 in 6 in-network hospitalizations include at least one out-of-network bill.

Read Also: Can I Get Health Insurance In Another State

Choosing A Health Insurance Plan

Reading the fine print is important when choosing health care plans. These questions may help:

- Can I go to any doctor, hospital, clinic, or pharmacy I choose?

- Are specialists, such as eye doctors and dentists covered?

- Does the plan cover special conditions or treatments such as pregnancy, psychiatric care, and physical therapy?

- Does the plan cover home care or nursing home care?

- Will the plan cover all medications my physician may prescribe?

- What are the deductibles? This is the amount you must pay each year before your insurance company will begin paying claims.

- Are there any co-payments? This is the amount of money you pay each time you receive medical services or a prescription.

- If there is a dispute about a bill or service, how is it handled?

Visit With Your Doctor

1 Prior Authorization not required in certain circumstances, such as emergency or urgent situations.

2 The 24/7 Bilingual Nurseline may not be available with all plans. Check your benefits booklet for details.

3 Internet/Wi-Fi connection is needed for computer access. Data charges may apply. Check your cellular data or internet service providers plan for details. Non-emergency medical service in Idaho, Montana and New Mexico is limited to interactive audio/video , along with the ability to prescribe. Non-emergency medical service in Arkansas is limited to interactive audio/video for initial consultation, along with the ability to prescribe. Behavioral Health service is limited to interactive audio/video , along with the ability to prescribe in all states. Service availability depends on location at the time of consultation.

4 Visiting a Retail Clinic may not be covered with all plans. Check your benefits booklet for details.

5 Blue365 is only available to Blue Cross and Blue Shield of Illinois members with active health plan coverage. Members who do not have an active health plan with BCBSIL will not be able to register on the Blue365 website.

You May Like: Do Substitutes Get Health Insurance

Closing The Coverage Gap A Critical Step For Advancing Health And Economic Justice

One of the most important steps Congress can take to advance health equity in recovery legislation under consideration is to close the Medicaid coverage gap. More than 2 million adults, majorities of whom live in the South and are people of color, are uninsured and in the coverage gap, meaning they have incomes below the federal poverty line but no pathway to affordable coverage because their state is one of 12 that has refused to adopt the Affordable Care Acts Medicaid expansion. Budget reconciliation legislation passed by the House Energy and Commerce Committee would permanently close the Medicaid coverage gap, and Congress should ensure this solution remains permanent and comprehensive in the final recovery package.

Closing the coverage gap is an important step in undoing the effects of structural racism that continue to affect peoples health and well-being. A large body of evidence suggests that closing the gap would:

Coverage For Individuals Eligible For Arizona Long Term Care

AHCCCS contracts with several program contractors to provide long term care services. An ALTCS program contractor works like a Health Maintenance Organization . The program contractor works with doctors, nursing homes, assisted living facilities, hospitals, pharmacies, specialists, etc. to provide care. You will also be assigned a case manager who will coordinate your care.

In addition to the services listed above, people who qualify for long term care can receive services such as:

- Nursing Facility

- Adult Day Care Health Services

- Home Health Services, such as nursing services, home health aide, and therapy

- Home Delivered Meals

- Dental Services

Note: This is a partial list of covered services

Read Also: How Much Do Businesses Pay For Health Insurance