Covered California Plans: Metallic Plan Benefits

Find Bronze, Silver, Gold and Platinum Obama Care Plans and Prices

When the Affordable Care Act became law, health insurance plans were repackaged, and categorized into 4 metal tiers: Bronze, Silver, Gold and Platinum. Covered California took this a step further and streamlined all the plans they offered on-exchange, so they became a real apples to apples comparison.

The silver tier is the most popular, so using it as an example, if you were looking at all the Silver 70 plans on the Covered California marketplace, there would be no plans benefit differences. You would only have to decide which carrier you want, and whether you want an HMO, EPO, PPO or HSP. These acronyms represent the type of network you would have access to and essentially which doctors, and hospitals accept your insurance.

Price: $

Bronze 60 Plan

Best For: A healthy individual/family that does not have medical conditions, but wants insurance just in case something major happens

Features:

- First 3 office visits are a fixed copay before deductible is reached

- High deductible

- Out-of-pocket maximum limit which is the most you would pay in a calendar year if the worst happened.

Bronze HDHP 60 Plan:

Best For:A healthy individual/family that wants to take advantage of tax savings, and plans on putting money into a special bank account called a Health Savings Account. This money can be used for medical expenses and the money roles over from year to year.

Features:

Minimum Coverage Plan

Features:

Average Proposed Rate Increase Of 18% For 2022 Bright Health Joining Marketplace And Three Insurers Are Expanding Coverage Areas

Covered California announced in July 2021 that the preliminary individual market rate changes for 2022 amount to a 1.8% increase. These rates are still subject to final review by state regulators.

The preliminary rate changes for 2022 are higher than the rate changes have been for the past two years , but the average rate increase across the three-year window amounts to just 1.1%, indicating significant stability in the states individual insurance market.

The following preliminary rate changes apply in Californias individual market:

- Anthem Blue Cross of California : 2.5% .

- Blue Shield of California : 1.3% increase.

- Bright HealthCare: New for 2022, offering plans in Contra Costa County.

- Chinese Community Health Plan: 1.7% increase.

- Health Net: 4.5% increase.

- Oscar Health Plan of California: 8.6% increase.

- Sharp Health Plan: 0.7% .

- Valley Health Plan: : 5.5% increase.

- Western Health Advantage: 3% increase.

California Withdrew Proposal To Allow Undocumented Immigrants To Buy Coverage Through Covered California

SB10 was signed into law in California in June 2016. The law allows undocumented immigrants to purchase unsubsidized coverage in the exchange, but a waiver from HHS was necessary in order to move forward, since the ACA forbids undocumented immigrants from purchasing coverage in the exchanges.

Californias waiver proposal was complete as of January 17, 2017, which was the start of a 30-day public comment period. But on January 18, the state withdrew the waiver at the request of California State Senator Ricardo Lara , the senator who had introduced and championed SB10 . Governor Jerry Brown agreed with Laras decision to withdraw the waiver proposal.

The state withdrew the proposal because they were concerned that the Trump administration might use information from the exchange to deport undocumented immigrants. Lara said that he didnt trust the Trump administration to do whats best for California and to implement the waiver in a way that protects peoples privacy and health. He called the withdrawal of the waiver the first California casualty of the Trump presidency.

Undocumented immigrants can already purchase full-price coverage outside the exchange. Its not clear how much SB10 would have decreased the uninsured rate among undocumented immigrants if it had been implemented, since they would still have been required to pay full price for their coverage in the exchange.

You May Like: What Is The Self Employed Health Insurance Deduction

Due To Covid And The American Rescue Plans New Subsidies Covered California Enrollment Is Open Through The End Of 2021 For Uninsured Or Unsubsidized Californians

Open enrollment for 2021 health plans in California ended January 31, 2021. But in response to the ongoing COVID pandemic and the Biden administrations decision to open a special enrollment period on HealthCare.gov, Covered California announced a COVID-related special enrollment period for uninsured residents, running from February 1, 2021 through May 15, 2021. The state estimated that 1.2 million uninsured residents are eligible for premium subsidies through Covered California or Medi-Cal.

Soon thereafter, the federal government enacted the American Rescue Plan, which provides additional premium subsidies to marketplace enrollees, making health coverage much more affordable in 2021 and 2022. To give California residents ample opportunity to take advantage of these new subsidies, Covered California announced another special enrollment period, running from April 12 through December 31, 2021, for uninsured residents as well as residents who were enrolled off-exchange . This window gives these individuals an opportunity to switch to an on-exchange plan in order to take advantage of the new premium subsidies, since there is no longer a subsidy cliff in 2021 or 2022.

The state also announced a special enrollment period, starting in mid-August, for people in areas where a state of emergency has been declared due to the wildfires in California. These residents have 60 days to enroll in coverage, starting with the date the state of emergency was declared.

Cancel Your Existing Covered California Plan If You Reapply

If you currently have an active health plan through Covered California but find yourself submitting a new application to Covered CA for a different plan for one or more of these reasons:

- You didnt like your original plan or its rate increase, and didnt know how to switch plans.

- Thought you needed to reapply each year during Open Enrollment

- You couldnt remember your username or password to access your existing Covered CA account

- You sought help from a health insurance agent and they reapplied for you

Take action to cancel your old plan to avoid potential problems of the old plan auto-renewing and the payment liability for two plans, by following the directions below.

If you have active existing coverage through Covered CA, follow these steps to cancel your original plan:

Request a cancellation date based on when your new plan starts so that you have no gap in coverage.

Additional Steps to Follow

Double check with your old carrier and/or your bank to make sure any automatic payments you have set up for your old plan have been cancelled. Auto-pay will generally continue through the new year with most insurance companies unless you cancel it.

Why is it important to cancel your old plan?

Read Also: How Much Does Usps Health Insurance Cost

How To Cancel Your Insurance Plan Without Replacing It

You can cancel your Marketplace plan any time, but there are important things to consider:

- No one plans to get sick or hurt, but bad things happen even to healthy people. Having medical debt can really limit your options. If you’re paying for every medical service yourself, you may make some health care decisions based on money instead of what’s best for your health.

Choose Health Plan Button May Be Dead

Choose a Health Plan button may not always work.

In addition, the Choose Health Plan button and link may be active but clicking it results in a system error or displays a page of your current plan with no option to cancel. Choosing a new health plan can only be accomplished when you have successfully terminated participation in you existing health plan. You may also want to terminate the current plan if you are moving to a new region in California or youve gained access to an employer sponsored group plan.

Also Check: Is Health Insurance Paid In Advance

Does Covered California Verify Income

Covered California will check the income you reported on your application and compare it to what the IRS has on file for you. They will just tell Covered California if the income you reported does or does not match what they have on file for you. The IRS information comes from your latest income tax return.

What Is Individual And Family Health Insurance

Unlike traditional insurance through your employer, with Individual insurance, you can shop for a plan that suits your family’s own needs, purchase the plan and make monthly premium payments directly with the carrier of your choice.

Any of the individual health plans you choose will cover the same 10 essential health benefits, but the copays, deductibles, provider networks, benefits, and rates will vary.

There are a number of scenarios where someone would purchase an individual policy including self-employed individuals, and those who are in-between jobs for more than 3 months, not offered affordable coverage through their employer, or no longer being covered by their parent’s health plan.

Health insurance coverage is now required for almost everyone by the Affordable Care Act . You might have to pay a penalty if you go without coverage.

Read Also: How Do I Find Out My Health Insurance Deductible

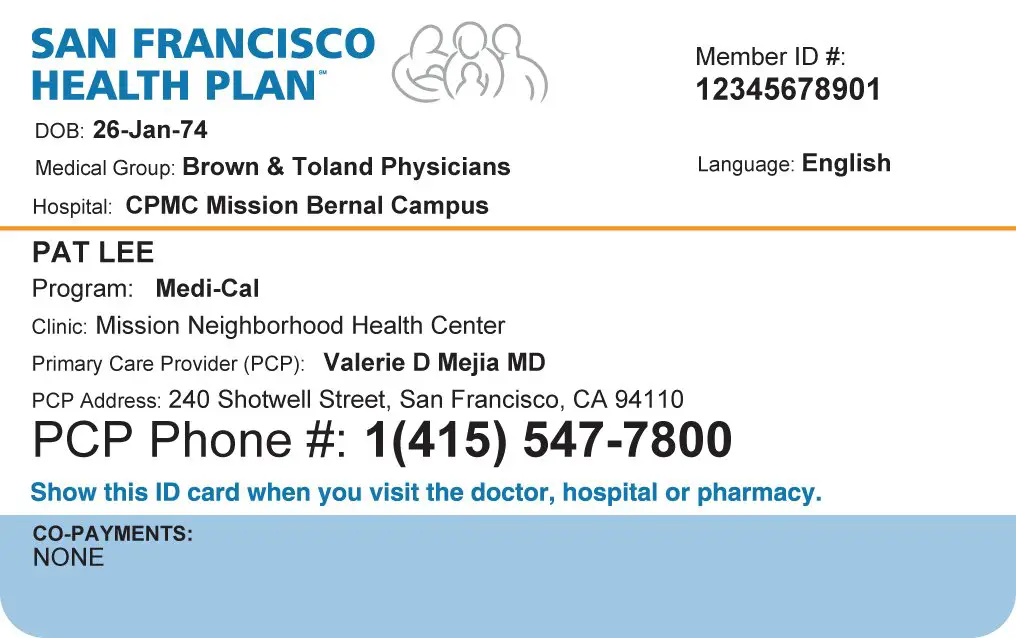

How To Renew With Medi

Medi-Cal renewal happens throughout the year, occurring on the anniversary of your enrollment in Medi-Cal.

If members of your household have Medi-Cal, they will receive a Medi-Cal renewal form from their local county human services agency. Complete this form and mail or fax it, along with any information the county requests, to your local county human services agency. You can also renew by visiting your county human services agency in person or by calling the phone number on the renewal notice.

If you lose Medi-Cal coverage, you may enroll in health insurance coverage through Covered California in the special-enrollment period due to a loss of coverage.

arrow_back

Individual Health Insurance Through The Affordable Care Act

The place where Californians can get brand-name health insurance under the Patient Protection and Affordable Care Act. Its the only place to get federal premium assistance to help you buy private insurance from companies. That means you may qualify for a discount on private insurance, or get health insurance through the states Medi-Cal program.

You can still use an agentwhen you enroll through Covered California and we can help you understand the various plans, benefits, and premiums. All you have to do is create an account at www.CoveredCA.com and they allow you to search for Certified Insurance Agents and designateyour selection to help you pick a plan and enroll. There is no extra cost for this service.

Recommended Reading: How Much Is High Deductible Health Insurance

Who Is Not Eligible For Covered California

Who is Not Eligible for Covered California? If you are not lawfully present in California, you are not eligible for a Covered California plan. However, you can still apply through Covered California to find out if you are eligible for Medi-Cal or to find coverage for family members who are lawfully present.

California Health Insurance Exchange Links

About our health insurance quote forms and phone lines

We do not sell insurance products, but this form will connect you with partners of healthinsurance.org who do sell insurance products. You may submit your information through this form, or call to speak directly with licensed enrollers who will provide advice specific to your situation. Read about your data and privacy.

The mission of healthinsurance.org and its editorial team is to provide information and resources that help American consumers make informed choices about buying and keeping health coverage. We are nationally recognized experts on the Affordable Care Act and state health insurance exchanges/marketplaces. Learn more about us.

If you have questions or comments on this service, please contact us.

Also Check: How To Sign Up For Aarp Health Insurance

Which Insurers Offer Coverage In The California Marketplace

As of 2021, there are eleven insurers that offer exchange plans in California. Covered California announced in July 2021 that an additional insurer, Bright HealthCare, will be joining the marketplace, bringing the total number of participating insurers to 12.

The following insurers will offer plans in the California exchange as of 2022, with plan availability varying from one location to another:

- Anthem Blue Cross of California

- Blue Shield of California

- Valley Health Plan

- Western Health Advantage

Three existing insurers plan to expand their coverage areas as well: Anthem Blue Cross of California, Blue Shield of California, and Valley Health Plan. As a result, all residents will be able to select from at least two insurers, and most Californians will be able to select from among four insurers.

Which Health Insurance Plan Is The Right One For Me

Health Insurance plans come in many different shapes and sizes. But deciding which plan is best for you depends on a few factors. Primarily what are your medical needs, who is your doctor, and what is your budget. Additionally when it comes to choosing a plan through a health exchange like Covered California, other factors like income, household size and location will play into your decision.

Regardless if you are getting your health insurance through your work or as an individual , you should always compare your plan options. Below is a guide of things that you can use to help you compare your health insurance plans.

Premium: This is the monthly cost of your plan. It is important because you have to pay it every month or you wont have coverage. It is not the only thing you should look at but is often one of the biggest factors in somebodys decision process. If you purchase a health plan outside of a health exchange like Covered California , you will be responsible for 100% of your monthly premium. If you purchase a plan inside of a health exchange like Covered California they may help you pay for a portion of your premium every month. In general the monthly price is connected with how much you pay when you go see a doctor. If your premium is high you will usually pay less when you use the service. If your monthly premium is low you will normally pay more when you use your healthcare services.

Managed Care Plans

Health Maintenance Organization :

Read Also: Where Can I Buy Travel Health Insurance

Preventive Care For Adults

The Endless Loop Of No Action

In order to activate the health plan change link in the Actions box, the household must either enroll in family dental or decline coverage. If you select Decline, you get hit with a pop up window that gives you the option to decide Later. If you click on the Decide Later, you are looped back to the same screen and you still cant change the health plan.

Blue Shield plan termination

Some individuals that switched from a Blue Shield plan to another carrier AND did not either decline the family dental or enroll in a dental plan have not had their Blue Shield plans terminated for 2016. Covered California states that the enrollment is not complete until the primary applicant makes a decision on the family dental, to either enroll or decline. It seems as if Covered California does not send a termination notice to the carrier that the family is switching from until a family dental plan option is made. This was only determined from the experience of two former Blue Shield members who switched to a different carrier in 2016. One of the Covered California members had declined the family dental, completing the application, and Blue Shield had terminated the plan as of December 31. The other Covered California member had not declined dental and their Blue Shield plan was still active. We could only conclude that Blue Shield, and possibly other carriers, are not receiving a termination notice until the dental plan option is declined.

You May Like: Can I Buy Health Insurance Outside Of Open Enrollment

Can I Drop My Employer Health Insurance

An employee can voluntarily cancel coverage at any time only if the company is not having employee premium contributions deducted pre-tax. If they are, they are de facto enrolled in a Section 125 Plan and cannot change that election until Open Enrollment or a Qualifying Life Event.

Thank You For Choosing Covered California

After enrolling, new members will receive a welcome letter and a brochure from Covered California. You will also get an enrollment package and membership ID card from your health insurance company.

Your health insurance through Covered California can help you cover medical costs for the following services:

Doctor visits.

Pediatric care, including dental and vision.

Laboratory services.

Mental health and substance abuse services.

Also Check: Do You Pay Health Insurance Monthly Or Yearly

Covered California Says Health Insurance Just Got Too Cheap To Ignore

By Bernard J. WolfsonMay 3, 2021

We encourage organizations to republish our content, free of charge. Heres what we ask:

You must credit us as the original publisher, with a hyperlink to our californiahealthline.org site. If possible, please include the original author and California Healthline in the byline. Please preserve the hyperlinks in the story.

Covered California Caps Monthly Prescription Costs

The cost of high-end prescription drugs is a growing problem for healthcare cost sustainability, and the rising cost of prescriptions is cited repeatedly in justifications provided by insurers requesting double-digit rate increases. But the cost of specialty medications can also be an insurmountable burden for patients, even when they have health insurance. For high-end specialty medications, like Sovaldi, its not uncommon for patients to reach their maximum out-of-pocket exposure very quickly, paying thousands of dollars per month in coinsurance for their medications.

In May 2015, Covered California rolled out a cap on prescription costs that went into effect in 2016, along with various other benefit enhancements that allow consumers access to more care without having to meet steep deductibles. Because Covered California requires plan standardization on and off-exchange, the prescription copay cap is also available to many consumers purchasing plans outside the exchange. The cap is linked to the metal level of the plan purchased for the majority of consumers, the cap is $250 per specialty medication per month, but it ranges from $150 to $500, with bronze plan enrollees having the highest specialty drug copay cap.

You May Like: How To Apply For Health Insurance In Arizona