Getting The Cheapest Business Insurance

Finding the cheapest business insurance policy is a priority for the cost-conscious business owner, but always weigh the price against the coverage. You dont want to pay for coverages you dont need, but you also dont want to be underinsured if something happens. Seek balance.

To help maximize your savings, analyze your business first to understand your specific needs. Be sure to include any contractual requirements and rule out any inapplicable coverages. Be informed.

You can save money by adjusting your deductibles. A deductible is the amount you pay out of pocket toward a covered loss at the time of a claim. Generally, the higher your deductible, the lower the cost of your annual premium. Just be sure youre comfortable paying the deductible you select.

Of course, you have questions. Help take the guesswork out of finding your best small business insurance cost and coverage combination by speaking with a licensed professional. They can walk you through the process and customize a quote specifically for your business. Call us today, or start a quote online. Its that simple.

Are Businesses Required To Offer Health Insurance

You must provide health insurance if you have 50 or more full-time employees. If you have fewer than 50 employees, you may be exempt from this federal rule. But some stateslike Hawaii, for examplemay have stricter requirements where you must offer health insurance regardless of business size. You need to be familiar with both the state and federal guidelines for small business health insurance.

What Percent Of Health Insurance Is Paid By Employers

Written by: Elizabeth WalkerSeptember 24, 2021 at 9:37 AM

When youre considering a new health insurance program, your organization’s contribution strategy is an important decision. In simple terms, how much will employees pitch in for coverage, and what percentage will be paid by the employer?

With traditional group health insurance plans, the organization must contribute a minimum percentage, leaving the employees to pay the remaining amount, usually through a payroll deduction. So just what percent do employers typically pay in the United States?

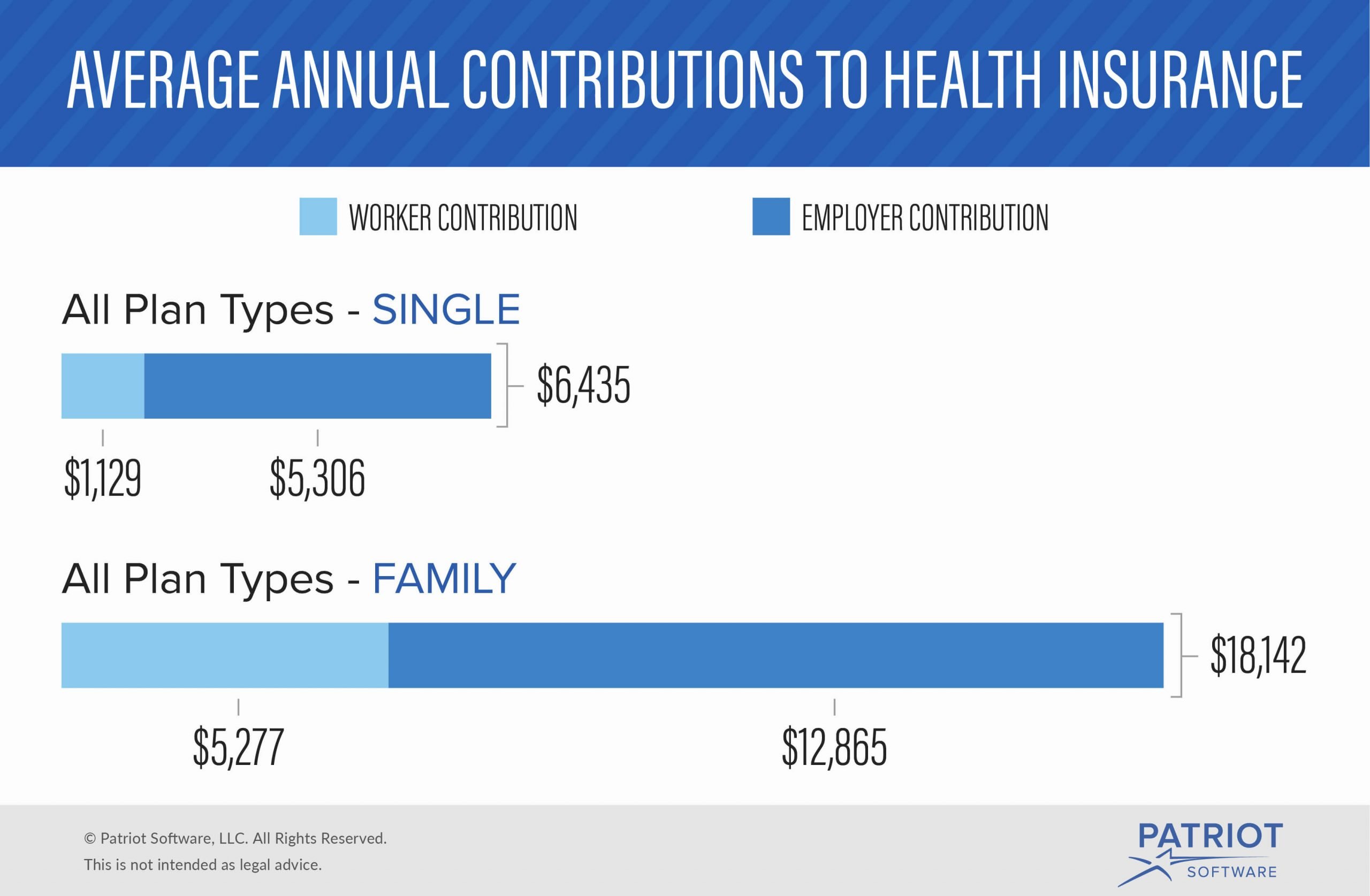

Across the country, a Kaiser Family Foundation survey found that the average percent of health insurance paid by employers is 83% for single coverage and 73% for family coverage. Lets dive into these stats a little deeper.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

What Is A Small Business Health Insurance Copayment

Acopayment is a specific cost you may be required to pay for medical supplies orservices through your group health plan .

Otherexamples of health services that usually require copays may include:

- Different types of therapy

- ER or ambulance services

- Remember that it is employees who cover the costs of copayments, not their employers

Typically,most HMO plans have copayments due to contractual agreements with health careproviders. Other types of small business health insurance plans, such as PPOplans, POS plans, and EPO plans, also may have copayments among theirassociated costs.

Usually,the copay is for in-network medical services only. Going to an out-of-networkprovider could mean that the copayment may not apply, and that the full amountor coinsurance percentage of the bill may need to be paid.

Where To Find The Right Coverage

For finding the right coverage, some can use SHOP to source and sign up for employee health insurance plans. But, for others, its not as straightforward. While anyone can use SHOP, there are a few other options open to employers with 50 or more FTEs. Here are those options:

If reaching out to insurance companies on your own seems daunting, dont worry you can ask someone else to do it. Licensed insurance brokers are a great resource for small business owners and will greatly help you circumnavigate all of the paperwork and popular pitfalls of finding an employee health insurance plan. Intuit has recently added this service as an add-on to its Payroll offerings. By partnering with SimplyInsured, Intuit Payroll customers can choose to purchase this surface and work with licensed and knowledgeable insurance brokers. Its all part of Intuits full-service small business solutions.

If youve had some experience with purchasing health insurance before, this might be your best option. Not all health insurance companies will work directly with businesses, but some do. Make sure to conduct due diligence and check out ratings on sites like Consumer Affairs and the National Committee for Quality Assurance . JD Power also publishes an annual ranking of the best health insurance options by state.

You May Like: Does Starbucks Provide Health Insurance For Part Time Employees

How Much Do Health Benefits Cost Employers

Health insurance costs vary widely but the average annual premiums for employer-sponsored coverage in 2020 were $7,470 for single coverage and $21,342 for family coverage. When you take into account the average contributions by workers, that brings the employer costs to $6,227 and $15,754 respectively.

Health Insurance Changes In 2020

Though many changes in the costs of health insurance will depend on the types of plans you choose and make available to your employees, some trends and legal changes are more systematic. These will affect employees and employers everywhere, regardless of what insurer you use.

“Deductibles are continuing to increase, and there are more cost-sharing options between employers and employees,” said Berzins.

This increase in options means that business owners can make more plans available to their employees than in prior years, and, in many cases, it has lowered the costs for employers.

“Some employers saw rebate checks last year for the first time from fully insured plans,” Berzins added.

The largest increases in costs in 2020 will be in out-of-pocket payments. Employees can reduce their expenses by choosing different tiers of insurance within their group health plan, said Berzins.

And there is a definite benefit for employees who don’t have many medical expenses: “These changes will help stabilize premiums,” Berzins said.

Additional changes employees can expect in 2020 include fewer choices among covered healthcare providers, and increases in the use of accountable care organizations and telemedicine. Employers can expect to experience the continued effects of the ACA’s individual mandate penalties being zeroed out, a change that took effect in 2019. This change has impacted how many employees, and their dependents, participate in insurance plans.

You May Like: Does Starbucks Offer Health Insurance

Selecting A Health Insurance Policy That Works For You

Once you have a good idea of what type of coverage to purchase and from whom, the next step is to apply for a policy. Work closely with the insurance company to gather data on the next steps. This generally will include providing all employee names and personal information.

Most often, the insurance provider will set up a time to come to the place of employment to enroll employees and educate them on their options. Others handle this through a set of forms each employee must complete.

Most of the time, a benefits package is issued, which contains all of the terms and features of the policy and instructs employees on their next steps. It’s common to see a booklet outlining information. There may be resources for setting up online accounts and how to start using the policy within this. Some companies have mobile apps, too.

The insurance company will then mail health insurance cards to the covered employees once the policy is active. They will also provide insight into available features, including preventative care services. Employees can then start using their policies as they want and need to do so.

How Does Small Business Health Insurance Work

The Affordable Care Act defines a small business as a group of no more than 50 full-time employees , though some states define it differently. California, for instance, categorizes small businesses as employers of no more than 100 FTE. Small business owners arent legally required to provide health insurance to their workers, but there are rules for those who do.

A small business owner enrolls in a group health insurance plan offered by a private insurance company and then offers their employees the opportunity to enroll in that plan. The employer pays part of their employees monthly premiums, and the employees are typically responsible for their deductibles, copays and services not covered by the plan.

Also Check: Is Starbucks Health Insurance Good

Health Insurance Costs Are A Major Factor In Choosing An Employee Benefits Package Here’s What To Expect In 2020

Health insurance is a crucial benefit that can cost companies just as much as employees.

Nearly 60% of Americans have health insurance through an employer. While the passage of the Affordable Care Act , also known as Obamacare, made direct-purchase health insurance more accessible for those without employer-sponsored options, for many workers, health insurance is seen as a draw of regular employment.

This means that the insurance benefits an employer offers, and how the costs of that insurance are shared, directly impacts a business’s ability to hire the right people.

“Employer health benefits are such a crucial part of attracting and retaining talent,” said Michael Stahl, executive vice president and chief marketing officer at HealthMarkets. “It is essential to get it right.”

Healthcare is going to cost you, whether you own a business or you’re just an average employee. Stahl and two other health insurance experts helped us break it down.

Where To Shop For Small Business Health Insurance Plans

Business owners can quickly search on eHealth to find local plans that may help them qualify for tax credits. The quick health plan quote box on eHealth also provides direct access to information about all kinds of health plans for businesses, families, and individuals. These resources can help businesses and consumers find plans to fit a variety of budgets and get the right information to make an informed decision.

This article is for general information and may not be updated after publication. Consult your own tax, accounting, or legal advisor instead of relying on this article as tax, accounting, or legal advice.

Read Also: Starbucks Benefits For Part Time Employees

It Saves You Money At Tax Time

Employer health-care premiums are tax exempt, which can greatly reduce or even erase your tax obligations. Your contributions are also tax deductible, meaning you can write off the cost of employer-sponsored contributions during tax season. By offering employee health insurance, you may also qualify for the Small Business Health Care Tax Credit.

Do Employers Have To Offer Insurance

The Affordable Care Act sets the rules for employer-sponsored health insurance. Whether you have to provide coverage depends on your business size.

If your business is above the ACA size requirement, you must offer insurance. If you are considered a small business, you do not have to comply. You can still offer coverage to your employees.

You are a small employer if you have 50 employees or fewer. The workers can be full-time employees or full-time equivalent. Full-time equivalent employees work an average of 30 hours per week.

You need to calculate full-time equivalents if you have part-time employees. Add up the number of hours that part-time employees work. Divide the sum by the number of part-time workers.

Add this number to the total full-time workers employed. If the number is 50 or fewer, you are a small business and are not required to offer health insurance. If the number is more than 50, you must provide insurance.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

How Much Does Small

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

For small businesses, providing health insurance to employees can be a significant expense. The average annual health insurance premium for small firms, according to a 2020 Kaiser Family Foundation report, was:

-

$7,483 for single coverage, of which employers contributed $6,297, or 84%.

-

$20,438 for family coverage, of which employers contributed $13,618, or 67%.

The report defined small firms as those having from three to 199 employees.

Of businesses with fewer than 50 employees, which are not legally required to offer health insurance, 53% offered health insurance in 2020. Among businesses with three to nine employees, 48% did.

While costly, offering health insurance to your employees can help you stay competitive as a business, retain workers and take advantage of tax benefits. Heres what to know.

Small Business Tax Benefits For Health Insurance

Once you sign up for a plan, your small business could qualify for a sliding-scale tax credit of up to 50% of the cost of premiums you pay on behalf of your employees. Youd have to have fewer than 25 full-time employees to qualify and pay an average wage of less than $50,000 a year and cover at least half the cost of health insurance premiums for your employees . You also have to have bought your group plan on a federal or state marketplace. If you qualify, you can take the credit in two consecutive tax years.

Even if you qualify for this new tax credit, you may still be able to take a traditional business expense deduction for the cost of premiums you paid that the credit didnt cover.

Investing in health benefits for your team can give your small business a competitive advantage in attracting and retaining great employees and that is good for the health of your bottom line.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

What Does It Mean To Be Fully

A fully-insured policy is one in which the benefits are purchased from an insurance company. In exchange for the premium it receives, the insurance company assumes the financial risk and responsibility of paying for covered services. Conversely, a self-insured plan is one in which an employer, not an insurance company, provides benefits. The employer established a plan document outlining the covered expenses, exclusions, and other important terms pays claims using its own funds along with any enrollee contributions and may hire a third party to administer benefits on its behalf. Oftentimes, an employer will utilize an insurance carrier as their third-party administrator. Generally, federal law governs both fully-insured and self-insured plans however, self-insured plans are not subject to state insurance regulation.

What Costs Affect A Small Group Health Plan

A small group health insurance plan, like most individual policies, usually has a number of separate payments, such as deductibles and premiums:

- A premium is a recurring payment that policyholders must make on a monthly basis to remain enrolled in health insurance.

- A deductible is a set amount of money that a policyholder must pay out of pocket before their insurance kicks in and begins to cover medical expenses.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

Employer And Employee Contributions To Monthly Premiums

As a small business with less than 50 full-time equivalent employees, you are not required to offer group health insurance. If your company does decide to offer health coverage to your employees, then you are typically required to pay for at least 50 percent of employee premiums as a small employer. Keep in mind that your business can also decide to contribute a larger amount to your workers premiums.

If you are a small business with less than 50 full-time equivalent employees, youre not required to offer group health insurance. If you do choose to offer health coverage to your employees, then youre typically required to pay for at least 50 percent of employee premiums as a small employer. Keep in mind that your business can also decide to contribute a larger amount to your workers premiums.

The Employer Health Benefits 2019 Summary of Findings noted that the level of employer contributions to worker premiums tends to vary:

- 31 percent of covered small firm employees had their employer pay the entire premium for their single coverage.

- 35 percent of covered small firm employees were enrolled in a plan where they contribute more than one-half of the premium for family coverage.

- In 2019, the average amount covered employees contributed was $1,242 for single coverage and $6,015 for family coverage.

Read Also: Does Colonial Life Offer Health Insurance

Blind Decisions Are Bad Decisions

This is why Remodel Health has developed our proprietary Health Benefits Analysis for your team. This secure and compliant evaluation of your organization will provide you with the exact outlook for what getting started with managed individual health benefits can look like. Before you dont click on the link, dont worryits only $35 per employee. Yeah, thats it! While it would normally cost about $9,500 to accomplish this, you can get it done cheaper and more easily than ever.

Head on over to remodelhealth.com/analysis to get started today in the future of health benefits!

Important Notice: Remodel Health does not intend to provide specific insurance, legal, or tax advice. Remodel Health always recommends consulting with your own professional representation to properly evaluate the information presented and its appropriate application to your particular situation.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

Health Insurance Deductibles: What Can You Expect

On top of premiums, everyone who carries health insurance also pays a deductible. This means you pay 100% of your health expenses out of pocket until you have paid a predetermined amount. At that point, insurance coverage kicks in and you pay a percentage of your bills, with the insurer picking up the rest. Most workers are covered by a general annual deductible, which means it applies to most or all healthcare services. Here’s how general deductibles varied in 2019:

- $1,655: Average general annual deductible for a single worker, employer plan

- $2,271: Average annual deductible if that single worker was employed by a small firm

- $1,412: Average annual deductible if that single worker was employed by a large firm

| Median Individual Deductible, Qualifying Health Plan Without Subsidies from Healthcare.gov., Plan Year 2020 |

|---|

| Bronze |

| $1,430 |

Individuals who are eligible for cost-sharing reductions are responsible for deductibles as low as $115 for those with household incomes closest to the federal poverty level.