When Should I Consider Short

Short-term health insurance provides temporary coverage that can be used as a bridge while you wait for a full coverage policy. You should consider short-term coverage in the case of an emergency if you are without coverage for a certain period. For example, if you leave a job and don’t qualify for COBRA insurance coverage, you might consider short-term coverage. Anyone can purchase short-term health insurance. However, most of the time you will be required to undergo a medical exam.

Can’t Find Answers To Your Questions

Ask our specialists – Licensed and experienced insurance professionals in the U.S.

DISCLAIMER: The information within this article is intended as a broad summary of benefits and services and is meant for informational purposes only. The information does not describe all scenarios, coverages or exclusions of any insurance plan. The benefits and services of an insurance plan are subject to change. This is not your policy/certificate of insurance. If there is any discrepancy between the information in this article and the language of your policy/certificate wording, the language of the policy/certificate wording will prevail.

How Do I Get Temporary Health Insurance Between Jobs

While theres no specific lost job health insurance, two main coverage options are available for you if youre unemployed: A COBRA plan allows you to extend the health care plan from your previous employer for up to 18 months after you leave a job. You can buy a plan yourself through the Health Insurance Marketplace.

Read Also: Starbucks Dental Insurance

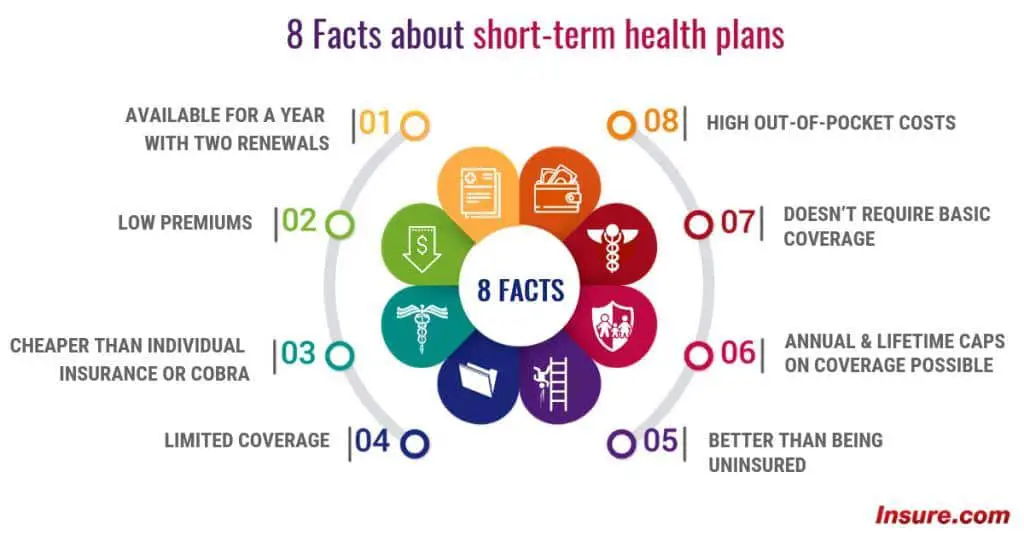

What Are Short Term Health Plans

A short term health insurance policy provides complete financial coverage for medical treatments undertaken during a shorter time span. The duration usually ranges between 3 to 6 months but can also extend up to a maximum of 12 months. After that, you can renew the policy plan or opt for NCB .

Typically, short term medical insurances come with a lower premium amount.

Also Read

How Do I Enroll In Washington Dc’s Health Insurance Marketplace

To enroll in a health plan, visit DCHealthLink.com and click the Get Started button under Individual & Family. Then, click Shop & Enroll to start the application process. If you want to check your eligibility for lower monthly premiums, youll need to answer questions about your household size, availability of employer coverage, and household income. When you click Get Your Estimated Savings, the site will tell you if you qualify for reduced premiums or Medicaid coverage based on your income.

Once you answer the initial questions, youll need to create a DC Health Link account to finish your application. After you enter the required information, youll be able to see the plans available to you. DC Health Link has several standardized plans to make it easier to compare costs and coverage options. These standard plans cover many services, such as primary care visits and generic drugs, before youve met your deductible. As a result, your out-of-pocket costs may be lower than they would be with a nonstandard plan. You can click on each plans Summary of Benefits and Coverage to determine how much you can expect to pay for each type of covered service.

Once you pick a plan, youll be able to complete the enrollment process.

Read Also: Starbucks Dental Coverage

How Many People Will Switch To Short

HHS projected that 500,000 people would shift from individual market plans to short-term plans in 2019 as a result of the new federal rules for short-term plans. They estimated that 200,000 of those people had on-exchange plans in 2018, and 300,000 had off-exchange plans. They estimated that another 100,000 people who were uninsured in 2018 would enroll in short-term plans in 2019 as a result of the new regulations. So for 2019, HHS projected a total increase of 600,000 people covered under short-term health plans.

And by 2028, they expect the total increase in the short-term insurance population to reach 1.4 million, while the individual insurance market population is expected to decline by 1.3 million over that time.

But its difficult to know how all of the moving parts will affect the eventual outcome. Short-term plans existed before the ACA, but the individual market plans sold in most states were subject to medical underwriting that was similar to short-term plans.

And the ACAs individual mandate penalty was in place from 2014 through 2018, likely suppressing enrollment in short-term plans. People who relied on short-term plans during those years were subject to a penalty under the ACAs individual mandate if they were not otherwise exempt from it, because short-term plans are not considered minimum essential coverage. But the individual mandate penalty no longer exists, as it was repealed starting in 2019 under the GOP tax bill that was enacted in late 2017.

How Does Short Term Disability Insurance Work

To get a better idea of how short term disability works, let’s start by answering some FAQs:

- How much does short term disability pay? If you qualify for short term disability benefits, you will typically be reimbursed for about 60 percent of your lost wages. Depending on the policy, the benefit may be as low as 40 percent or as high as 70 percent. Most policies have a benefit cap as well.

- When does short term disability start? Before short term disability benefits kick in, there is typically an elimination period of 14 days. However, this waiting period may be as short as one week or as long as one month.

- How long is short term disability? Short term disability benefits generally last around three to six months. However, some plans may pay as long as one or even two years.

But that’s just the tip of the iceberg. Let’s take a closer look by comparing short term disability insurance side-by-side to other similar types of coverage.

You May Like: Starbucks Dental Benefits

Easy And Instant Approval

If you are currently uninsured for any reason, you need to be approved for a new insurance plan as quickly as possible. After all, there are steep consequences for those who are injured or become ill without coverage. Considering the financial costs of medical procedures and medication, just one serious health issue could put you and your family under serious financial strain, particularly if youre already short on money due to unemployment or the loss of a loved one. Unfortunately, accidents and illnesses can strike at any time. Thats why its imperative to choose an insurance provider that allows you access to coverage quickly and efficiently.

Signing up for one of our short term medical plans takes just minutes. When you begin the enrollment process you receive immediate notification if you are approved. With Pivot Health, your coverage can start within 24 hours! If you are healthy and do not have a pre-existing condition, its quite likely that you will be accepted without any complications. Dont put your familys financial future at risk when unexpected medical issues occur. Apply for a short term insurance plan today to help protect yourself from crippling medical debt.

Repealing The Individual Mandate And Short

What does the repeal of the Affordable Care Act’s “individual mandate” penalty have to do with short-term health insurance, you ask?

For starters, that mandate, also known as the “individual shared responsibility provision,” requires all Americans to have qualifying–or “minimum essential”–health coverage or pay a fine.

Short-term plans don’t count as qualifying health coverage, so if that’s all you have, and if you don’t qualify for an exemption, the federal government will penalize you come tax time. Or at least it will until 2019.

The new tax law didn’t actually get rid of the mandate, by the way. It’s still in place. Rather, the new law “zeros out” or eliminates the fine that used to be tied to not having qualifying coverage.

So, even though the Affordable Care Act–also known as the ACA or Obamacare–continues to require you to have a certain amount of health insurance, the government won’t fine you if your coverage isn’t of the “minimum essential” variety.

In other words, you’ll soon be free to buy short-term health insurance without worrying about the IRS breathing down your neck the next time you file your taxes.

How soon? Well, the penalty won’t go away until 2019, which means you’ll pay a fine if you enroll in a short-term health plan this year and don’t earn an exemption from the mandate.

You May Like: Starbucks Employee Insurance

Keep These Short Term Insurance Reminders In Your Long

With short term health insurance you are not buying an ACA health plan. That means you need to keep a few things in mind as you plan your coverage needs:

- ACA health plans are guaranteed issue, meaning you cannot be denied coverage based on preexisting conditions

- Short term insurance plans are not guaranteed issue, do not cover preexisting conditions, and you must answer a series of medical questions to apply for coverage

- ACA health plans are required to cover 10 essential health benefits, including maternity and newborn care, mental health and substance abuse disorder services

- Short term insurance plans do not have coverage requirements, so plans vary in what they cover. Check your plan details carefully

So, its true that you may save money by choosing short term health insurance. Just be sure you know what you are buying, and that its a good choice for you. For the right situation, short term insurance plans can definitely provide fast, flexible, temporary health insurance coverage that fits your needs.

Find Your Base Period

Your benefit amount is based on the quarter with your highest wages earned within the base period.

A base period covers 12 months and is divided into four consecutive quarters. The base period includes wages subject to SDI tax that were paid about 5 to 18 months before your disability claim began. The base period does not include wages paid at the time your disability begins. For a DI claim to be valid, you must have at least $300 in wages in the base period. The following information may be used to determine the base period for your claim.

If a claim begins on or after January 1, 2021:

The base period is the 12 months ending last September 30. Example: A claim beginning February 14, 2021, uses a base period of October 1, 2019, through September 30, 2020.

The base period is the 12 months ending last December 31. Example: A claim beginning June 20, 2021, uses a base period of January 1, 2020, through December 31, 2020.

The base period is the 12 months ending last March 31. Example: A claim beginning September 27, 2021, uses a base period of April 1, 2020, through March 31, 2021.

The base period is the 12 months ending last June 30. Example: A claim beginning November 2, 2021, uses a base period of July 1, 2020, through June 30, 2021.

You can get a general estimate by using our online calculator.

Note: The calculator is intended to provide an estimate only. Your actual WBA will be confirmed once your claim has been approved.

Recommended Reading: Can I Go To The Er Without Health Insurance

Disability Insurance Benefits And Taxes

Generally, if you pay the entire amount of the disability premium yourself, your disability benefits will be tax-free. This may bring your income while on disability closer to your current take-home pay.

If your employer pays all or part of the disability premium, your disability benefits will be subject to income taxes.

What Evidence Do You Have To Provide To Collect Short

Your physician will need to sign off on your claim form before you even submit your application, to vouch for the fact that your injury or illness prevents you from working.

After you submit your claim, your employer or the insurance company who administers your short-term disability plan will request that you submit your medical records so that they can review them and verify that theyre consistent with your disability claim. Contact your healthcare providers office to find out the best way to send those records over.

It can feel a little invasive to hand over these types of private documents, but know that its a standard part of the benefits process.

You May Like: Starbucks Insurance Benefits

Whats The Difference Short Term Health Insurance Vs Aca Health Plans

Short Term health insurance, whats also referred to as Temporary health insurance or Term health insurance, provides flexible and fast health coverage for those times when you face a gap in your health insurance coverage. If youre between jobs, leaving school or your parents health insurance plan, or losing your current coverage and weighing your options, Short Term insurance can be a good solution, offering affordable health insurance right when you need it.

However, and this is important: A Short Term health insurance plan is not the same as an Affordable Care Act health insurance plan.

You Need To Fill A Gap Between Employer Coverage And Your Next Job

As the saying goes, hope for the best and prepare for the worst. Even if you think youll land a job with benefits right away, it is wise to secure temporary health insurance coverage.

When you are unemployed and in between job-based health insurance plans, its often tempting to wait it out and remain uninsured. After all, the strain of household budgets and health insurance premiums can break the bank. But so can unexpected medical bills.

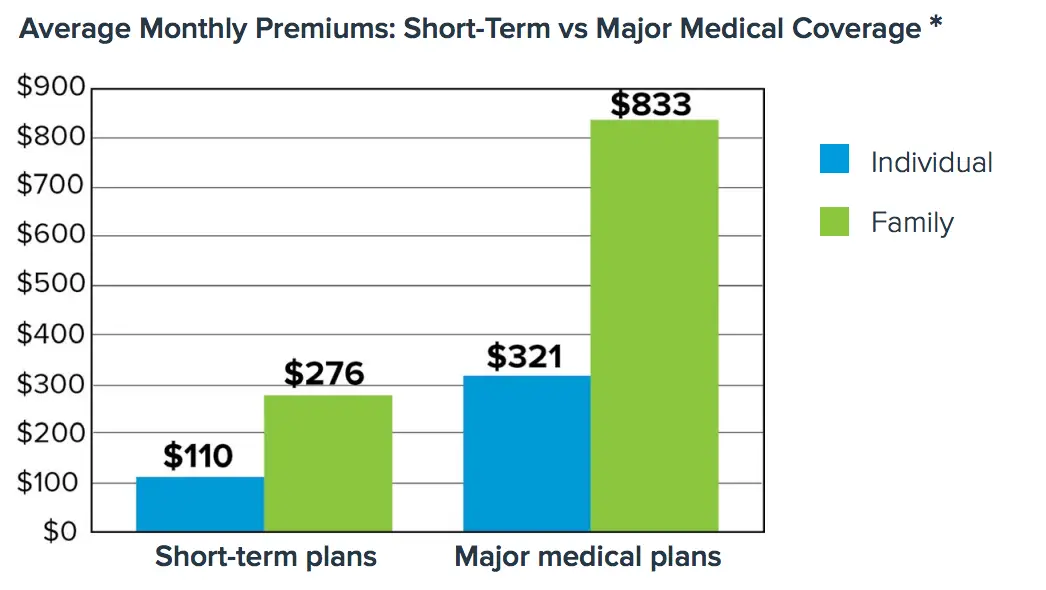

Short-term health insurance premiums are often a fraction of major medical insurance premiums. Plans usually include benefits related to inpatient and outpatient hospital care, emergency room visits, surgical services, ambulatory services, and intensive care, among other things. Keep in mind, you will still have to pay your medical bills until you reach your deductible and cover out-of-pocket costs for copays on covered services. If you reach the end of your policy and still need coverage, depending on your states laws, you can typically apply for and enroll in a new policy.

Don’t Miss: How Much Does Starbucks Health Insurance Cost

Is Mental Health Covered With Short

What if its not something physical that takes you away from the demands of your job? What if youre struggling with depression or some other mental health issue that makes it nearly impossible to fulfill your work responsibilities?

Mental health can be covered by many short-term disability plans . However, youre going to need to have proof that this is an issue youve been struggling with for some time.

You should be talking with a psychiatrist before your leave, says McDonald. There should be a really solid foundation of what the problems are.

How Often Will You Receive Payments

This is another area that can vary. Fortunately, your payment questions should be answered clearly within your plan documents.

Be aware that if your employer works with an insurer to offer short-term disability benefits, then payments will usually be administered through the insurance company. That means they might arrive on a schedule different from the payroll timing youre used to .

Meaghan Tiernan, a senior copywriter for a marketing agency in San Francisco, used her short-term disability for maternity leave. She was given a debit card that her short-term disability payments were added to.

I think it was one lump sum every two weeks on an regular basis, she explains. They even include weekends, so it was typically every 14 days that I was paid. Then youd have to transfer the funds from that debit card to your bank account if that was your preference.

Don’t Miss: Is Starbucks Health Insurance Good

Get Legal Advice And Help

Filing a claim for LTD can be a difficult, confusing and lengthy process. Each policy is different. A personal injury or disability insurance lawyer can help you understand your policy, notify you of any deadlines, guide you through the claim process, and deal with the insurance company. This will help ensure that you will get the benefits you deserve in a timely manner.

Even when an individual has a legitimate cause for claiming their long-term disability benefits, often insurance companies will initially deny the claim, or offer an amount much lower than asked for.

If you or someone you care about suffers from a long-term disability and has disability insurance, contact our preferred experts. They can help you get the LTD benefits you are entitled to, even if your claim was denied. They offer a free consultation and do not charge up-front fees:

What Qualifies For Short

To qualify for short-term disability benefits, an employee must be unable to do their job, as deemed by a medical professional. Medical conditions that prevent an employee from working for several weeks to months, such as pregnancy, surgery rehabilitation, or severe illness, can qualify to receive benefits. Since employers in most states must legally provide workers compensation insurance to all employees, any injuries incurred on the job are typically covered under a workers comp policy and are therefore not eligible for short-term disability.

While most non-work-related temporary medical conditions are covered by a short-term disability policy, there can be exclusions for preexisting conditions or intentional and foreseeable injuries . While employees can qualify for time off under the Family and Medical Leave Act to care for a sick relative, most short-term disability policies would not provide benefits if the covered employee is not the one with the illness.

Recommended Reading: Starbucks Perks For Employees

You Retire Early And Dont Yet Qualify For Medicare

Why risk your retirement savings on paying for major healthcare expenses 100 percent out-of-pocket? If theres a little time between your early retirement and your Medicare eligibility, consider buying a short-term health insurance plan. This happens most frequently when one spouse qualifies for Medicare but the other, younger spouse needs a plan until Medicare is available. Once you meet your deductible, your plan will help pay for additional covered expenses. It is important to note that temporary coverage may not be an option if you have preexisting conditions.