Not All Employers Are Required To Provide Health Insurance

Employers arenât necessarily required to provide health insurance in the United States if they classify as a smaller business. The requirements fall in line with the number of employees a business has, and some state laws might change the requirements, depending on where you live.

Dr. Kate Tulenko, a health workforce expert at Corvus Health, explains why employers are not required to provide health insurance for their employees

âThe Affordable Care Act does require large employers to provide health insurance to 95% of their workers or pay a fine. The health insurance provided must meet certain affordability requirements and must cover a minimum set of essential services. Whether individuals have to pay a penalty if they do not have health insurance depends on their state of residence and is in flux due to lawsuits challenging the ACAâ.

Do Salaried Employees Receive Overtime

Yes. Employees who are paid by salary are entitled to overtime. An hourly wage can be calculated to determine the overtime pay per hour.

For example: an employee who earns a salary of $450 per week and is expected to work a 40-hour week is paid $11.25 per hour. Overtime is paid at 1 ½ times the regular wage rate. Using this example, the employee would earn $16.87 per hour for overtime.

| To calculate an employees hourly wage: | |

| Salary earned per week ÷ Total Hours = Hourly Wage | |

| $11.25 × 1.5 = $16.87 Hour of overtime |

What Is A Good Compensation Package

Although businesses compensate salespeople in a wide variety of ways, most use a combination of salary and incentive components, along with common benefits such as health insurance, a retirement savings plan, and paid time off. Providing a base salary that assures salespeople a steady income is a good idea.

Don’t Miss: What Is On Exchange Health Insurance

How Much Does Health Insurance Cost A Company Per Employee

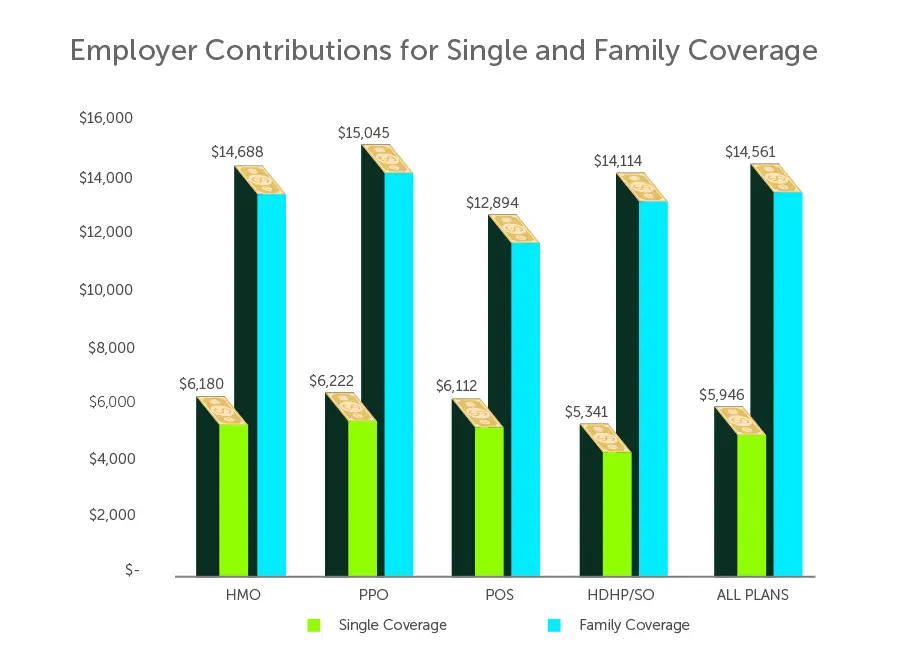

Health insurance costs vary widely but the average annual premiums for employer-sponsored coverage in 2020 were $7,470 for single coverage and $21,342 for family coverage. When you take into account the average contributions by workers, that brings the employer costs to $6,227 and $15,754 respectively.

The actual amount youll pay is based on a number of different factors, which well cover next.

Special Or Extra Duty Pay For Police Officers

Police forces regularly allow their police officers to provide security and other special or extra duty services to third parties for events.

We consider a third party that pays special or extra duty pay to police officers to be their employer. The third party has to do all of the following:

- withhold CPP contributions, EI premiums, and income tax from SEDPwhen the payment is made to a police officer

- remit these deductions to us

- report the SEDP and deductions on a T4 slip

However, we administratively allow the individual police forces, who are the regular employers of the police officers in question, the option to assume these responsibilities instead.

Note

If the police force does not assume the responsibility for withholding remitting, and reporting, it is the third partys responsibility to do this. In such a situation, the third party may have to put the police officer on payroll as a part-time employee.

Under the administrative option, the police force can take into account the CPP contributions and EI premiums previously deducted from the police officers regular salary and SEDP when determining the maximum CPP pensionable and EI insurable earnings for the year.

To determine how much income tax to deduct, the police force should use the method described under Bonuses, retroactive pay increases, or irregular amounts.

For more information, go to Police forces and extra duty.

Read Also: Is Ivf Covered By Health Insurance

What Records Are Employers Required To Maintain

Employers must keep records for all employees that show:

- Name, address, date of birth, and occupation

- The date the employment started

- The regular wage and overtime wage at the start of employment and whenever the wage rate changes

- The regular and overtime hours of work, recorded separately and daily

- Date wages are paid and the amount paid on each date

- Deductions from wages, and the reason for each deduction

- If applicable, overtime that is banked with the written agreement of the employee and employer and the dates the employee takes the banked time off with pay

- The dates on which general holidays are taken

- The employees hours of work on a general holiday and the wages paid

- Start and end dates of annual vacations, the period of employment in which the vacation is earned, and the date and amount of vacation wages paid

- The amount of any outstanding vacation wages when the employment ends and the date this is paid to the employee

- Copies of documents on maternity leave, parental leave, compassionate care leave or other leaves, including dates and number of days taken as leave

- Dates of termination of the employment

- Copies of work schedules

If an employee is paid a monthly or annual salary, it can be divided into an hourly wage for record keeping purposes. Regular hours of work are not required to be recorded if they do not vary on a daily basis, but any overtime or other changes should be recorded.

Employment Benefits And Payments From Which You Do Not Deduct Cpp Contributions

Employment

Do not deduct CPP contributions from payments for the following types of employment:

- Employment in agriculture, or an agricultural enterprise, horticulture, fishing, hunting, trapping, forestry, logging, or lumbering, when you meet one of the following conditions:

- pay your employee less than $250 in cash remuneration in a calendar year

- employ your employee for a period of less than 25 working days in the same year on terms providing for cash remunerationthe working days do not have to be consecutive.

NotesIn a calendar year, if your employee reaches both minimums$250 or more in cash remuneration and works 25 days or morethe employment is pensionable starting from the first day of work. Deduct CPP contributions if your employees pensionable earnings are more than the CPP basic exemption for the same period.

For more information on when these types of employment are pensionable, go to Agriculture and horticulture.

NotesIf your employee works seven days or more, the employment is pensionable from the first day of work. Deduct CPP contributions if your employees pensionable earnings are more than the CPP basic exemption for the same period.

For more information on when these types of employment are pensionable, go to Circus and fair.

- Employment by a government body as an election worker if the worker meets both of the following conditions:

- is not a regular employee of the government body

- works for less than 35 hours in a calendar year

Benefits and payments

You May Like: Is It Required For Employers To Offer Health Insurance

Starting And Stopping Cpp Deductions

There might be special situations where you may have to start or stop deducting CPP in the year for a particular employee. In these situations, you also have to prorate the maximum CPP contribution for the year to make sure you have deducted the correct amount.

Note

In some cases, the requirements are different for the Quebec Pension Plan. For information, see Guide TP-1015.G-V, Guide for Employers: Source Deductions and Contributions, which you can get from Revenu Québec .

Special situations

Your employee turns 18 in the year

Start deducting CPP contributions in the first pay dated in the month after the employee turns 18. When you prorate, use the number of months after the month the employee turns 18 .

Your employee turns 70 in the year

Deduct CPP contributions up to and including the last pay dated in the month in which the employee turns 70. When you prorate, use the number of months up to and including the month the employee turns 70 .

Your employee gives you a completed Form CPT30

Stopping CPP contributions

In certain situations, an employee can elect to stop contributing to the CPP. In order to be eligible for this election, the employee must meet all the following conditions:

- the employee is at least 65 years of age, but under 70

- the employee receives a CPP or QPP retirement pension

- the employee is receiving, or will receive, pensionable employment earnings that require CPP contributions

Note

Restarting CPP contributions

Note

Note

Your employee dies in the year

Healthcare You Can Afford

Group Insurance Explained

Generally, there are three types of health plans your employer may offer: HMO , EPO , POS , and PPO .Depending on the level of cost-sharing, most employers pay anywhere between 50-70% of your health plan.

Many group insurance plans can cover immediate family members, or dependents, such as a spouse and children. Additionally, the premium rates for all employees are determined by the insurer, and part of the employeesâ premiums are paid for by the employer.

The Cost of Group Insurance

The average costs of a health plan are $500 per individual and $1,000 per family. This means you can expect to pay $150 – $300 a month out of your salary. In some cases, your employers can opt to pay for 100% of your health plan, but if there is a deductible , you still have to pay a certain amount out-of-pocket.

While it may be convenient to accept the health insurance plan your employer is offering, it’s important to evaluate if it’s actually worth accepting based on your healthcare needs.

Dr. Tulenko explains how to determine if the plan is right for you:

You should start by comparing the health insurance plan that your employer is offering with ones that you can purchase in your state health insurance market or the national health insurance market. Some factors to consider include:

Read Also: How Does Health Insurance Work Through Employer

Are There Situations When Employers Or Employees Do Not Need To Give Notice Of Termination

The following are some cases where notice of termination is not required:

- When employees are placed on a temporary layoff period of no more than 8 weeks in a 16 week period. There are additional considerations for determining the layoff period for temporary help employees. SeeTemporary Help Agency fact sheet.

- When the employee works in the construction industry

- When the employer can prove just cause, see Just Cause fact sheet

- When employment is for a specific length of time or a specific task or job

- When the employee has substantial control over whether or not to accept work and is not penalized by the employer for choosing not to work, except for temporary help employees who are entitled to notice if they regularly work more than 12 hours per week

- If the employer acts in a manner that is improper or violent toward the employee

- Under The Elections Act, election workers can be terminated for specific reasons by the person who appointed them. The worker can appeal to the Legislative Assembly

Employers must consider each situation on a case by case basis if deciding not to provide a notice period to an employee.

How We Got To Now

Interested in learning more about healthcare in America and how we got to where we are today? Download our eBook, The History of Employer-Sponsored Healthcare. Here, we discuss the on-going debate regarding the impact of the ACA’s employer mandate. It also takes you through a quick look at the historical timeline of employer-sponsored healthcare, providing context for the state of American healthcare as it exists today.

Do you offer family health insurance to your workforce? How do you handle premium differentials and/or surcharges? Leave us a comment below or contact us. Wed love to help you find solutions that work for everyone!

Also Check: What Does No Cost Share Mean In Health Insurance

Employer Health Insurance: What Is It & Is My Employer Required To Offer

Employer health insurance is a benefit offered by your employer to cover a portion of your health care costs. Many times, health insurance within a company or organization is less expensive than buying a plan individually because the employer pays for a large portion of your monthly premium. In this article, we evaluate what employer health insurance is and who is required to offer it.

Mira is a great option for employees who donât get health benefits through their employer or as a supplement to a high deductible plan from your employer. For just $45/mo, you get low copays and no deductible. to get covered.

Hawaii Health Plan Requirements For Employers

- May 26, 2018

Question: What are the main health plan-related issues for employers to be aware of when they hire employees in Hawaii?

Compliance Team Response:

Hawaii has a unique law called the Prepaid Health Care Act . It imposes a number of strict requirements on employer-sponsored health plans for employees in Hawaii.

Heres a summary of the main Hawaii PHCA rules to be aware of:

- Employer Must Pay At Least Half of the Premium

The first restriction is that the employer must in all cases pay at least half of the premium for employee-only coverage. This means that in no case would an employer be able to set the employee-share of the premium at an amount greater than 50% of the full premium.

- Employee Cannot Be Required to Pay More than 1.5% of Monthly Gross Income

The employer also cannot charge an employee more than 1.5% of the employees monthly gross wages for the cost of employee-only coverage. This creates a number of practical/administrative difficulties that often results in employers in Hawaii simply offering employee-only coverage for free or some nominal amount that will clearly be within the 1.5% limit .

- Employee-Share of Premium for Dependent Coverage Depends on Plan Option Offered

- Coverage Must be Offered at 20+ Hours Per Week

Unlike the ACA employer mandate pay or play standard of 30 hours per week, the PHCA requires that employers offer coverage to employees who work 20 hours or more per week.

- Employee Generally Must Enroll in Coverage

FAQs and Cites:

Don’t Miss: How Much Does Usps Health Insurance Cost

Who Pays For Damages To Company Vehicles Valuable Equipment Or Other Losses

Employers may not deduct wages to cover any costs for faulty work, poor quality work, loss of customers, cash shortages, or damages to their property. This includes: the cost of car accidents and parking tickets involving company vehicles, dishes broken by employees, customers leaving without paying. See the Deductions fact sheet for more information. Employers have the right to take action against an employee who caused the damages in civil court. If a court issues an order of repayment, the employer can then garnish the wages of the employee.

The Employer Mandate For Large Employers

The ACA employer mandate requires “large employers” to provide a specified percentage of their full-time equivalent employees and those employees’ families with minimum essential healthcare insurance. This insurance must pay for at least 60% of covered services. Employers can require that employees contribute toward their insurance coverage, but they can’t require them to pay more than 9.83% of their household income toward it. Large employers who fail to comply with the coverage mandate must pay a no-coverage penalty to the IRS.

Also Check: Does Colonial Life Offer Health Insurance

Employers Pay 83% Of Health Insurance For Single Coverage

In 2020, the standard company-provided health insurance policy totaled $7,470 a year for single coverage. On average, employers paid 83% of the premium, or $6,200 a year. Employees paid the remaining 17%, or $1,270 a year.

For family coverage, the standard insurance policy totaled $21,342 a year with employers contributing, on average, 73%, or $15,579. Employees paid the remaining 27% or $5,763 a year.

Do Retail Employees Get A Day Off Per Week

Most employees are entitled to a rest period of no less than 24 consecutive hours each week, including retail workers.

|

Eight weeks |

Employers can either allow the employee to work out this notice period, or pay wages in lieu of notice for the same number of weeks, or a combination of both.

Read Also: How To Get Health Insurance Fast

Changes To Your Business Entity

If your business stops operating or the partner or proprietor dies

If your business stops operating or the partner or proprietor dies, you should do the following:

To find out how to fill out and file the T4 or T4A slips and Summary, you can do one of the following:

- see Guide RC4157, Deducting Income Tax on Pension and Other Income, and Filing the T4A Slip and Summary

If you change your legal status, restructure, or reorganize

If you change your legal status, restructure, or reorganize, we consider you to be a new employer. You may need a new business number and a new payroll program account. Call 1-800-959-5525to let us know if your business status has changed or will change in the near future.

Note

Amalgamations have different rules. For more information, see the next section, If your business amalgamates.

The following are examples of changes to a business status:

- You are the sole proprietor of a business and you decide to incorporate.

- You and a partner own a business. Your partner leaves the business and sells their half interest to you, making you a sole proprietor.

- A corporation sells its property division to another corporation.

- One corporation transfers all of its employees to another corporation.

If the situation just described does not apply, you must continue to deduct CPP/QPP, EI, and PPIP. You cannot take into consideration any deductions taken by the previous employer.

If your business amalgamates

Employment Benefits And Payments From Which You Do Not Deduct Ei Premiums

Note

Enter an X or a check mark in the EI box only if you did not have to withhold EI premiums from the earnings for the entire reporting period.

Employment

Even if there is a contract of service, payments for the following types of employment are not insurable and EI premiums do not have to be deducted:

- Casual employment if it is for a purpose other than your usual trade or business. For more information about casual employment, go to Casual employment.

- Employment when you and your employee do not deal with each other at arms length. There are two main categories of employees who could be affected:

- Related persons: individuals connected by a blood relationship, marriage, common-law relationship, or adoption. In cases where the employer is a corporation, the employee is considered related to the corporation when they are related to a person who either controls the corporation or is a member of a related group that controls the corporation. However, these individuals can be in insurable employment if you would have negotiated a similar contract with a person with whom you deal at arms length.

- Non-related persons: an employment contract between you and a non-related employee can be non-insurable if it is apparent from the circumstances of employment that you were not dealing with each other in the way arms length parties normally would.

For more information, go to Not dealing at arms length for purposes of the Employment Insurance Act .

Benefits and payments

Also Check: How To Get Health Insurance As A Business Owner