Why Do Workers Want Employment

Workers want health insurance for themselves and their families in order to protect against the catastrophic costs of serious illnesses and to ensure access to medical care. For those without the time or income to save for it, insurance may be the only way to obtain medical care that would otherwise be unaffordable . Although it is possible for individuals to purchase insurance on their own, the high cost of private individual coverage, barriers to access to that coverage, and steep transactions costs help account for the value of group coverage to workers and thus explain why, in the absence of any viable alternative, workers demand coverage through their employers.

Employment-based coverage is far less expensive than individually purchased coverage, for several reasons. First, through pooling, employers can reduce adverse selection and administrative expenses. These cost advantages are significant, especially for large firms. Moreover, employers are able to offer relatively inexpensive health insurance because most people covered by employment-based plans are in good health. Those people who are most expensive to insurethe elderly and people with serious disabilities and chronic conditionsare typically covered by public programs such as Medicare and Medicaid, thereby reducing the cost of employment-based insurance .

Also Check: Will Health Insurance Cover A Breast Reduction

Small Businesses And The Affordable Care Act

If you are a small business owner considering whether to purchase health insurance for your employees, here is a summary of considerations as they pertain to the Affordable Care Act:

- The ACA established the SHOP marketplace, allowing small employers a way to cost-effectively offer coverage to their employees.

- If you offer health insurance to employees, it must be offered to all employees similarly situated when they become eligible.

- You must provide a summary of benefits and coverage form describing the health plan, what it covers, and what it costs.

- You may choose to offer flexible spending accounts , but employees cannot contribute more than a limited amount.

- The ACA offers additional incentives for workplace wellness programs, which can reduce costs by up to 30%.

- Once you have more than 50 FTE employees, you will be subject to employer shared responsibility payments if you dont offer health insurance.

- If you provide self-insured health coverage, you must file an annual return with the IRS, reporting information for each covered employee. If you offer coverage through an insurance policy, the policy issuer will file the return.

- You may qualify for the small business health care tax credit if you cover at least 50% of premium costs for your employees, have fewer than 25 FTE employees, meet certain wage payment requirements, and purchase the coverage through the SHOP marketplace.

How To Compensate Employees Who Opt

Due to the employer mandate under the Affordable Care Act , large employers with more than 50 full-time employees or full-time equivalent employees are required to offer medical coverage. However, its not necessarily a requirement for employees to purchase what the employer offers. In fact, employers are even allowed to provide incentives to employees with the goal of enticing them to purchase their health insurance plan elsewhere and forgo the group health coverage policy entirely. This type of special compensation is referred to as an opt-out arrangement or cash in lieu of benefits waiver.

With opt-out arrangements, the goal is to reduce insurance costs for the employer while simultaneously offering more options to the employee. When done correctly, its a win/win for both parties. This page provides an overview of how opt-out arrangements work along with important things for employers to keep in mind.

- Group Health Plan Opt-Out Arrangements

- Determining ACA Affordability

- Action Steps

Don’t Miss: What Is The Best Supplemental Health Insurance

Update: The New Qsehra May Allowemployers To Pay Up To $5k Annually Towards Employee’s Individual/family Plans Ask Us How It Works

Many California employers still contribute to employee’s individual planswithout the QSEHRA andthey’re running a risk by doing so.

It’s highly valued by employees

Even if a company is only paying 50% toward the Bronze level plan, theemployee feel taken care of.

The cost to vet, hire, and train employees is a significant cost.

More sothan the health insurance premium paid.

And here’s what I heard from one of our clients about offering insurance:

Group Health Insurance Vs Employer Health Insurance

Group health insurance is an insurance plan that covers a group of people who are employees of a company or part of an organization. The employer purchases the plan and employees are often given a small discount. Although it is not required to be on your employer’s group plan, many people choose to be covered by group insurance for several reasons.

Group Insurance Explained

Generally, there are three types of health plans your employer may offer: HMO , EPO , POS , and PPO .Depending on the level of cost-sharing, most employers pay anywhere between 50-70% of your health plan.

Many group insurance plans can cover immediate family members, or dependents, such as a spouse and children. Additionally, the premium rates for all employees are determined by the insurer, and part of the employeesâ premiums are paid for by the employer.

Don’t Miss: Does Health Insurance Cover Abortion

Are Employers Required To Provide Healthcare

As a business owner, offering health benefits for the first time is an important milestone that will inevitably help you recruit and retain top talent. After all, health benefits consistently rank as the top most requested benefit by employees in the U.S.

While health benefits are important for organizations of all sizes, the Affordable Care Act only legally requires a select few to offer itor suffer potential consequences if they choose not to. So how do you know if the ACA regulation applies to your organization, and what happens if you dont follow it?

In this article, well cover:

Are There Exemptions Or Complications Associated With This Waiting Period

There may be extenuating circumstances that affect this waiting period. For example, if your job does not offer health insurance until you have met certain other requirements, such as completing an actual orientation program, the 90-day waiting period may not necessarily apply under these conditions.

Another circumstance that may affect this waiting period is if you are considered a variable hour employee.

If you are hired as a part-time employee, but there is the potential or likelihood that you will become a full-time employee, your employer can wait up to a year before determining if you are a full-time employee and then proceed to offer you health insurance.

However, after the year of you being a variable hour employee has concluded, your employer cannot add the 90 days on to your waiting period after becoming a full-time employee.

Under these circumstances, your employer must offer you health insurance within 13 months after your start date.

Employers also have the option of setting hour of service requirements before even beginning the 90-day waiting period.

These service requirements cannot exceed 1,200 hours, are prohibited from being reapplied to an employee, and are only allowable for new hires.

Recommended Reading: How To Cancel Aetna Health Insurance

Who Is Helped By The New Qsehra Reimbursement Rules

For employees who work for small businesses that dont offer health insurance, the availability of premium subsidies in the exchanges depends on income, along with family size and the cost of coverage in the applicants area. In general, subsidies are available in most cases if the applicants household income doesnt exceed 400% of the poverty level.

If youre currently receiving a premium subsidy in the exchange and your employer begins reimbursing premiums under a QSEHRA, the exchange subsidy would be reduced by the amount of the employer reimbursement.

But if youre not eligible for a premium subsidy in the exchange , a QSEHRA could directly benefit you if your employer decides to take advantage of that option.

This article outlines various situations in which a QSEHRA benefit can be helpful, harmful, or neutral to an employees financial situation.

How Will I Know If I Have Been Assessed A Penalty

The Internal Revenue Service sends Letter 226J to employers and plan sponsors relating to compliance for any given year. You have 30 days to respond if you are found out of compliance. When a penalty is assessed, you are informed via IRS Notice 220J. This notice will inform you of the penalty, if any. The Notice will advise you of your rights of appeal.

Also Check: Who Pays First Auto Insurance Or Health Insurance

Recommended Reading: How Much Is Health Insurance For Kids

Determining How Many Full

The regulations allow various calculation methods for determining full-time equivalent status. Because these calculations can be complex, employers should consult with their legal counsel.

- Full-timeemployees work an average of 30 hours per week or 130 hours per calendar month, including vacation and paid leaves of absence.

- Part-timeemployees’ hours are used to determine the number of full-time equivalent employees for purposes of determining whether the employer mandate applies.

- FTEemployees are determined by taking the number of hours worked in a month by part-time employees, or those working fewer than 30 hours per week, and dividing by 120.

Advantages Of Group Health Insurance

Group health insurance plans have several advantages over individual insurance.

- Lower premiums The cost to the policyholder is lower because the employer pays part of the premium cost.

- Supplemental coverage Companies often provide supplemental health plans, such as vision, dental, and pharmacy coverage as a bundle or separately.

- Tax benefits Employees pay premiums with pre-tax dollars. This lowers their taxable income. For employers, the money paid toward employees premiums is usually tax-deductible. Small businesses with fewer than 25 employees may be eligible for a Small Business Health Care Tax Credit.

- Family benefits When an employee enrolls in group health insurance, their spouse and dependents are also eligible for coverage at an additional cost.

Recommended Reading: How Much Is Health Insurance For A Family Of 3

How Does Group Health Insurance Work

A company purchases the group health insurance plans and then offers them to their employees. The premium cost is often shared between the employer and the employee. Many insurers require at least 70% participation, although that may vary from state to state.

This requirement may leave you wondering if small business can even get a group insurance policy. The ACA does require insurers to offer group health insurance to small businesses that have between 1 to 50 employees.

The employer has to have at least one qualified employee that isn’t an owner or a spouse.

Can Business Owners Buy A Plan On The Marketplace

As a small business owner, you have two health insurance options through Healthcare.gov, a.k.a. The Marketplace. If you are a sole proprietor, you may purchase an individual health insurance plan. Your options may include bronze, silver, or gold plans with a range of monthly premiums, deductibles, and coverage.

You may also qualify for the Small Business Health Options Program if you have one to 50 full-time equivalent employees. If your company has fewer than 25 full-time employees who meet the maximum income threshold , you may be eligible for the Small Business Health Care Tax Credit. In this situation, you must offer SHOP to all of your full-time employees and pay at least 50% of their premium cost.

This tax benefit credits 50% of all premiums paid on company tax returns. Since these are IRS guidelines with amounts changing annually, based on inflation and other factors, it is best to check with your tax advisor on eligibility.

Read Also: What Is The Average Monthly Cost Of Health Insurance

Recommended Reading: Is Health Alliance Good Insurance

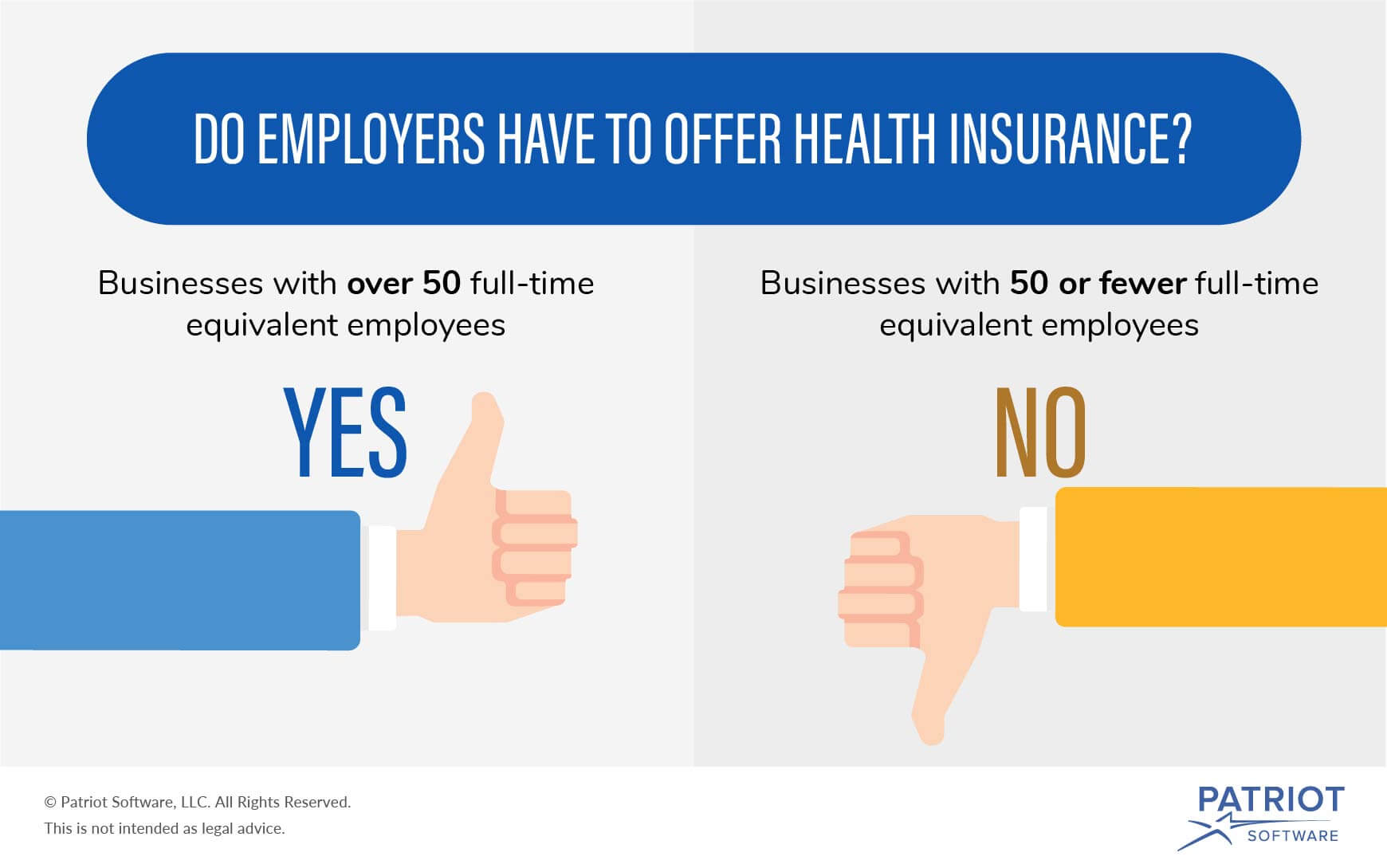

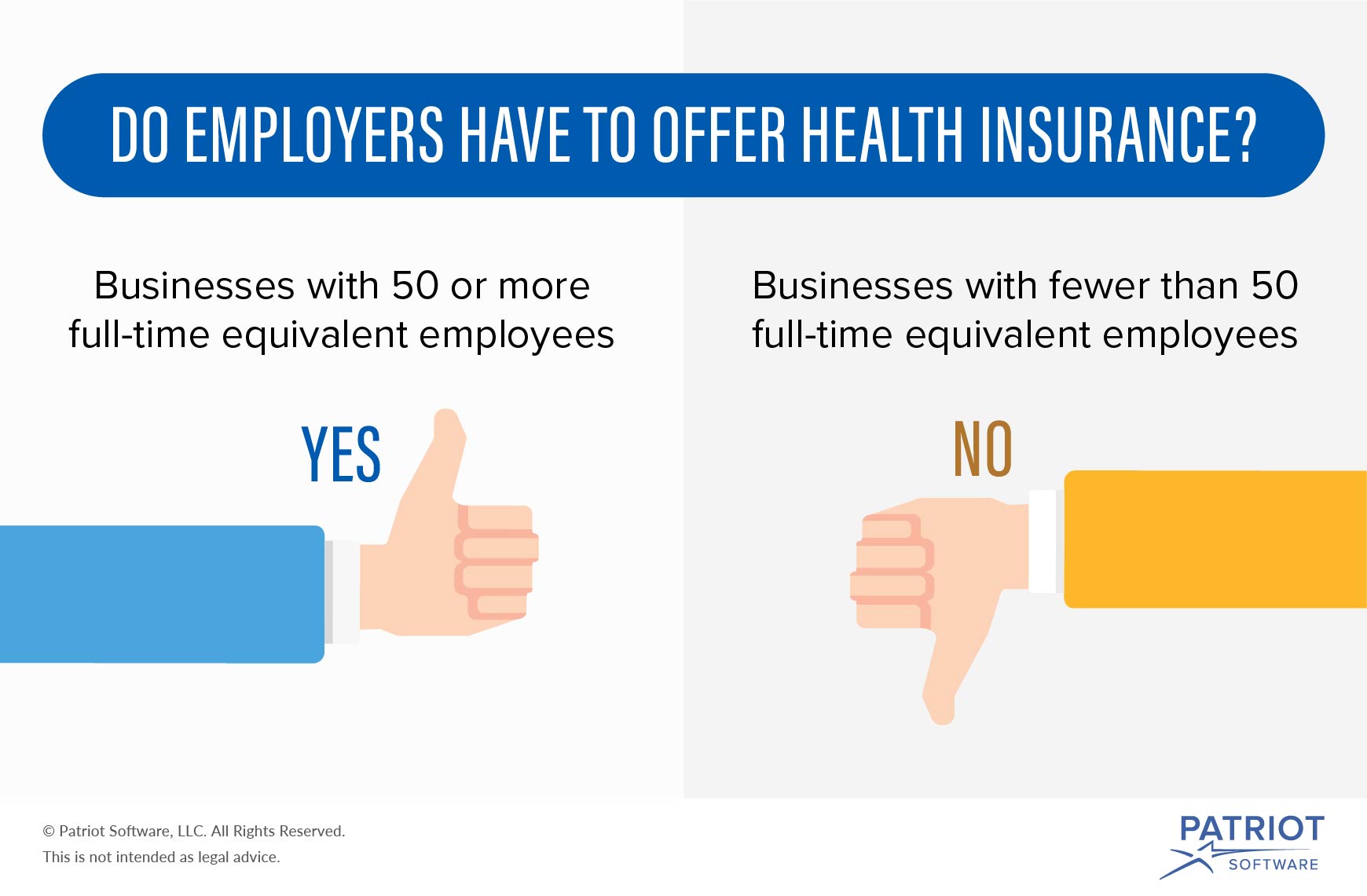

Are Employers Required To Offer Health Insurance

The provisions of the Affordable Care Act determine whether an employer is required to offer health insurance or not. In most states, small businesses with fewer than 50 full-time or full-time equivalent employees have no legal requirement to offer health insurance. But many small business owners do to attract and retain good workers. As a small business owner if you decide to offer medical coverage, youll have to meet the following health insurance requirements.

- The health insurance coverage must be offered to all full-time employees. Typically, full-time employees are defined as those who work 30 or more hours per week on average.

- A small business has no obligation to offer health insurance to part-time employees .

- However, if an employer offers insurance to at least one part-time employee, then the small business must offer group coverage to all part-time employees.

How Does Group Insurance Differ From Individual Health Insurance

Individual health insurance is when people purchase a single policy for themselves and/or their families. People may enlist an insurance agent or broker to help them guide them through the different policies.

Traditionally, group health insurance has been offered at a lower cost because the risk to the insurer is distributed across multiple members. However, as the individual health insurance market strengthens, the cost of individual health insurance is lowering in many markets. The ACA also offers premium tax credits for those who qualify to combat costs.

Also Check: Do We Need Health Insurance

What Small Businesses Need To Know About The Employer Mandate

Under the Affordable Care Act , businesses with 50 or more full-time equivalent employees that do not offer health coverage, or that offer health coverage that does not meet certain minimum standards, may be subject to a financial penalty, referred to as the Employer Shared Responsibility payment. The Employer Shared Responsibility provisions, often referred to as the âemployer mandate,â have been in effect since 2015 for businesses with 100 or more FTE employees. But, starting in 2016, the employer mandate will become effective for businesses with 50 or more FTE employees. The purpose of this summary is to provide a brief overview of the employer mandate provisions, and to inform your business about how you may be impacted by changes to the provisions made in 2016.

Also Check: What Insurance Does Starbucks Offer

Organizational Performance And Profitability

Perhaps the most important impact of health insurance is its effect on firms productivity and profitability, although these effects were not directly tested. Similarly, no studies compared the quality or ability of workers employed by firms providing health insurance with workers at firms that did not offer insurance. However, the evidence that firms offering health insurance paid their workers higher wages than did those not offering health benefits suggests that insured workers may be more productive than uninsured workers. A complementary explanation is that workers with health insurance also received a wage premium, or an efficiency wage.

Some analysts make a similar argument with regard to pensions and productivity: The strength and durability of the wage/pension relationship across different data sets and empirical procedures support the view that pensions enhance productivity . More remains to be learned about how health insurance fits into a compensation structure that enhances work effort. However, the fact that firms making a wide range of investments in workers typically start with health insurance suggests that health coverage comes to mind first when employers consider making human capital investments in their workforce.

You May Like: A Good Health Insurance Plan Should

Can You Offer Health Insurance To Certain Employees Only

Written by: Josh MinerSeptember 23, 2020 at 8:05 AM

One way small employers rein in health insurance costs is to only offer the benefit to full-time employees. Many employers have asked us whether they can take this approach a step further, and offer different levels of benefits to different employees.

The short answer is yes, as long as the employer does not make these decisions on a discriminatory basis.

In this post, well explore what the law requires, how employers can legally restrict eligibility or offer different benefits to different employees, and some suggested options.

Virtual Care For Only $25 Per Visit

Virtual primary care, urgent care, and behavioral health visits are only $25 with a Mira membership.

The Cost of Group Insurance

The average costs of a health plan are $500 per individual and $1,000 per family. This means you can expect to pay $150 – $300 a month out of your salary. In some cases, your employers can opt to pay for 100% of your health plan, but if there is a deductible , you still have to pay a certain amount out-of-pocket.

While it may be convenient to accept the health insurance plan your employer is offering, it’s important to evaluate if it’s actually worth accepting based on your healthcare needs.

Dr. Tulenko explains how to determine if the plan is right for you:

You should start by comparing the health insurance plan that your employer is offering with ones that you can purchase in your state health insurance market or the national health insurance market. Some factors to consider include:

You can also consider speaking with someone who has the health insurance plan you are considering to find out what they like and don’t like about the plan.

You May Like: How Long Do You Have Health Insurance After Being Fired

As A Small Business Owner These Are The Requirements You Should Be Aware Of When Offering Health Insurance To Your Employees

- Businesses with 50 or more full-time employees are required to provide group health insurance coverage to their employees. If they dont, that business is liable for penalties and fines at the end of the tax year.

- Knowing whether or not your organization is required to offer health insurance is one thing, understanding how to go about setting your program benefit up is another.

- If you are required to offer health insurance benefits to your employees, your next steps involve ascertaining whether your small business qualifies for the ACAs small business healthcare tax credit.

- This article is for small business owners who want to learn more about health insurance requirements, how the ACA affects eligibility and what is forthcoming in 2021.

Since the post-World War II era, when employer-sponsored healthcare benefits were conceived, healthcare, including the regulations surrounding employer-offered health insurance, have evolved, in some cases, drastically changing from year to year. The Affordable Care Act plays a huge role in an employers responsibilities, so small business owners need to have a clear understanding of it so they can prepare their businesses for the end of the year and 2021.