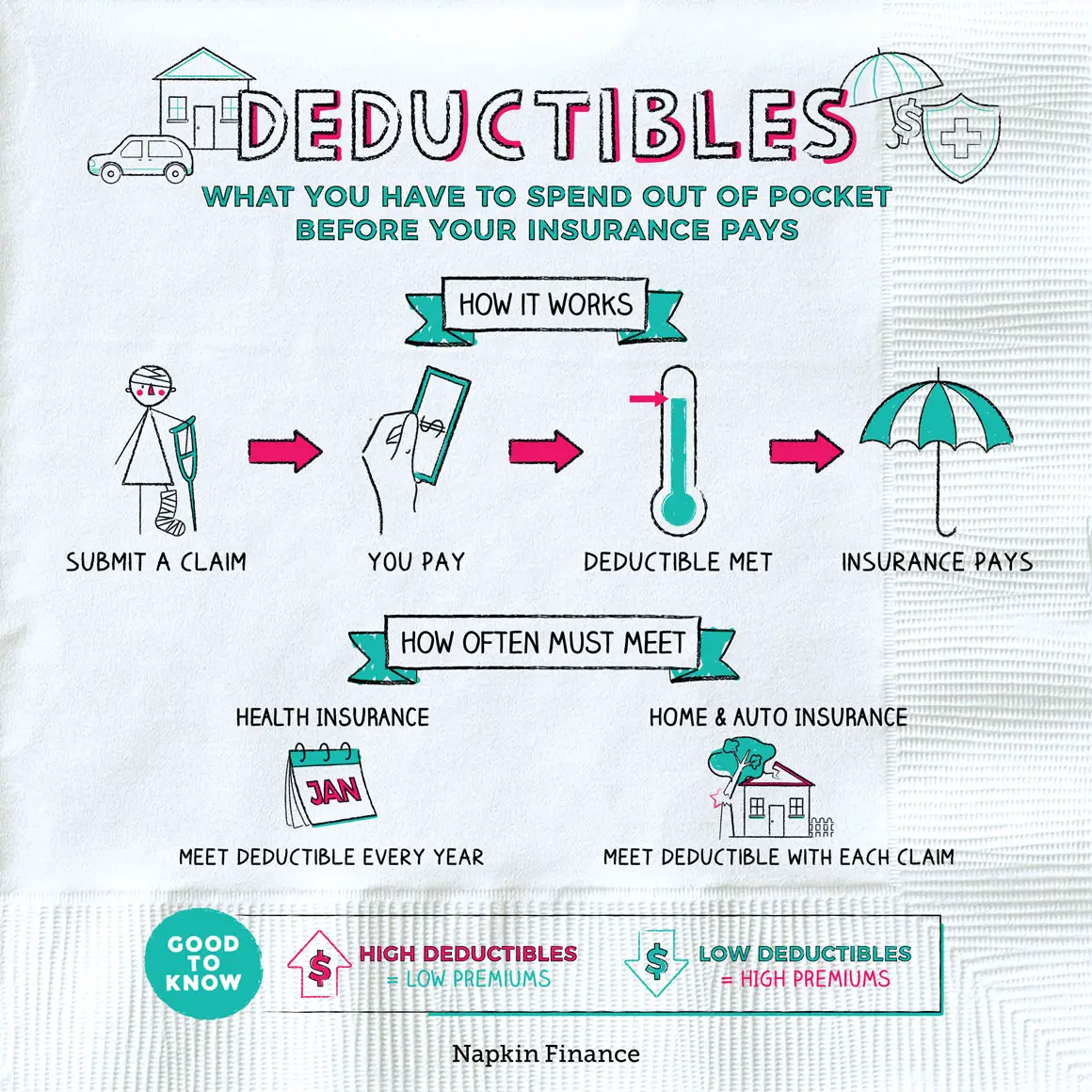

How Health Insurance Deductibles Work

When you buy health insurance, you pay a set monthly premium for one year of coverage. At the end of the year, you may continue your coverage, although the insurer may revise the premium amount at that time.

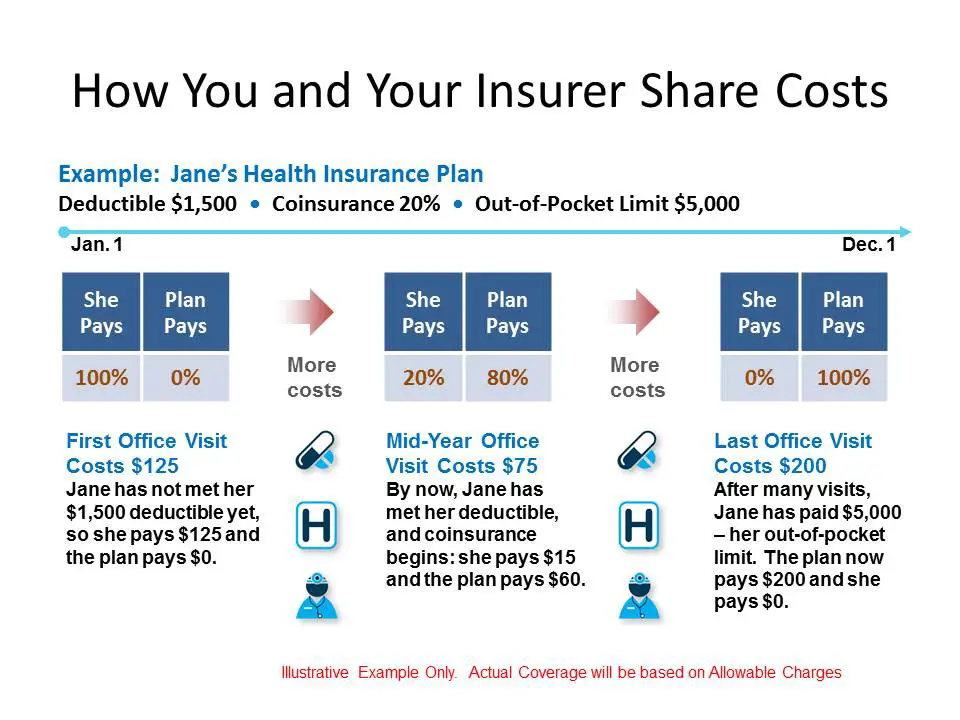

The annual deductible is separate from the monthly premium and must be used up before any services are covered by the insurance company. For example, if a plan has a $1,000 annual deductible and a patient needs a procedure that costs $3,000, the patient would need to pay the $1,000 deductible, while the insurance company would pay the remaining $2,000, assuming the procedure was covered under that health plan.

After the deductible is paid, your medical costs are covered, minus the monthly premiums and any copayment owed for those expenses. However, when a new year begins, the deductible clock is reset.

Why Would A Person Choose A Ppo Over An Hmo

Advantages of PPO plans A PPO plan can be a better choice compared with an HMO if you need flexibility in which health care providers you see. More flexibility to use providers both in-network and out-of-network. You can usually visit specialists without a referral, including out-of-network specialists.

Advantages Of Deductible In Health Insurance

Deductibles in health insurance offer the following benefits to the insured:

- They help in reducing the health insurance premium. Also, if the insured opts for voluntary deductibles, then the insurance company may also offer discounts.

- It discourages the insured from raising claims of small amounts, which helps the insured earn No Claim Bonus that can be used to increase the coverage of the primary health insurance policy.

- Despite the applicable deductibles, the insured can get access to health insurance coverage during medical emergencies or unforeseen hospitalisation.

Recommended Reading: What Is A Health Insurance License

What Expenses Count Towards The Deductible

When youre trying to meet your deductible, certain health care costs will be excluded. Premiums and copays generally dont count, but you should check the details of your plan.

As mentioned, usually the cost of certain preventive services and benefits do not count towards the deductible either, because they and are covered in full by health insurance.

Prescription drugs are also typically covered even if you havent met the deductible. However, certain plans may require a deductible for prescription drugs, before insurance helps to shoulder the costs.

How Do I Decide What Deductible Amount To Choose

If you’re mostly healthy and don’t expect to need costly medical services during the year, a plan that has a higher deductible and lower premium may be a good choice for you.

On the other hand, let’s say you know you have a medical condition that will need care. Or you have an active family with children who play sports. A plan with a lower deductible and higher premium that pays for a greater percent of your medical costs may be better for you.

Also Check: Do You Need A Ssn To Get Health Insurance

Low Or High Annual Deductible: Which One Is Better

As stated earlier, health insurance deductibles vary from one policy to another. This is why it is pertinent to compare policies carefully. Higher annual deductibles are generally evened out by lower premiums or cost-sharing.

The inverse is true for lower annual deductibles as they have high premiums and out of pocket expenses. Some health insurance policies, such as HMOs, don’t have any sort of deductibles. These policies are called zero-deductible policies.

Zero-deductible policies generally have comparably higher premiums, with the inverse being true for high deductible policies.

A zero-deductible policy is best suited to those that have multiple prescriptions or frequently see doctors. This is because such a policy can suit their coverage and budget requirements.

Conversely, for people that are healthy and don’t frequently use medical services, a higher deductible plan would make more financial sense. The higher deductible would be offset by low premiums, which could mean you pay much less in the long run.

Examples Of Copayments And Coinsurance

Here are two examples:

- A copayment of $30 may be due when you have an office visit with a doctor.

- A coinsurance share of 10% may be due if you are treated in an emergency room.

The amount you pay for your deductible, copayments, and coinsurance all count toward your annual out-of-pocket maximum, which is the total you must pay before your insurance plan begins paying 100%.

The maximum out-of-pocket annual cost, as of 2021, is $8,550 for an individual plan and $17,100 for a family plan. For 2022, those limits increase to $8,700 and $17,400, respectively.

Read Also: What Is An Average Health Insurance Deductible

What Does It Mean When You Have A $1000 Deductible

A deductible is the amount you pay out of pocket when you make a claim. Deductibles are usually a specific dollar amount, but they can also be a percentage of the total amount of insurance on the policy. For example, if you have a deductible of $1,000 and you have an auto accident that costs $4,000 to repair your car.

How Does A Health Insurance Deductible Work

Lets pretend you have a health insurance plan with a $1,000 deductible. If you have an accident or develop an illness and need medical treatment, youll have to pay for the first $1,000 in medical costs.

And after youve met that $1,000 deductible? For any further medical treatment, the cost would be less to you because your coinsurance kicks in to help cover some of the remaining bills.

Its good to remember that with most insurance plans, youre usually able to receive certain routine and preventative health care services for freeregardless of whether youve met your deductible.

Also Check: Can I Add My Boyfriend To My Health Insurance

Whats The Right Deductible For Me

The answer to this question depends largely on how many people youre insuring, how active you are, and how many doctor visits you anticipate in a year.

A high-deductible plan is great for people who rarely visit the doctor and would like to limit their monthly expenses. If you choose a high-deductible plan, you should begin saving money so that youre prepared to pay any medical expenses up front.

A low-deductible plan may be best for a larger family who knows theyll be frequently visiting doctors offices. These plans are also a good option for a person with a chronic medical condition.

Planned visits, such as wellness visits, checkups on chronic conditions, or anticipated emergency needs, can quickly add up if youre on a high-deductible plan. A low-deductible plan lets you better manage your out-of-pocket expenses.

How Do You Reach Your Out

Your deductible is part of your out-of-pocket maximum . This is the most youll pay during a policy period for allowed amounts for covered health care services.

Other cost-sharing factors that count toward hitting your out-of-pocket maximum:

- Copayments: Fixed dollar amounts of covered health careusually when you receive the service. .) Your plan determines the price of your copay and whether its owed before or after you meet your deductible.

- Coinsurance: You likely wont pay coinsurance, calculated as a percentage of shared costs between you and your health plan, until your deductible is met. Typical coinsurance ranges from 20 to 40% for the member, with your health plan paying the rest.

Your premium and any out-of-network costs dont count toward your out-of-pocket maximum.

Once your deductible and coinsurance payments reach the amount of your out-of-pocket limit, your plan will pay 100% of allowed amounts for covered services the remainder of the plan year.

Don’t Miss: Do Any Real Estate Companies Offer Health Insurance

Can You Get Short

While you can find short-term health insurance plans with low deductibles, but it’s rare that you would find zero-deductible policies because of how this type of insurance coverage is structured.

The deductible amounts for short-term health insurance are generally higher than those of traditional health insurance plans because the focus of short-term plans is filling any gaps in coverage, such as when changing jobs or before open enrollment. Because they’re not designed for long-term coverage, some short-term health insurance plans can have deductibles as high as $10,000.

Our pick for the best low-deductible short-term health insurance company is Pivot Health. This insurer offers one of the lowest deductibles on the market, starting at $1,000.

What Types Of Deductibles Are There In Private Health Insurance

Private health insurance companies offer different types of deductibles. For example:

- the fixed deductible

- the percentage deductible

- the deductible for individual modules

With a fixed deductible, you pay your medical bills yourself up to a fixed amount in EUR per year. For example, if a deductible of 500 EUR has been agreed to, your health insurance only pays if your treatment costs exceed 500 EUR.

With a percentage deductible, you contribute a fixed percentage to the costs. For example, if you go to the doctor and get an invoice, you pay 20 percent of it yourself but only up to a maximum amount.Private health insurance sometimes consists of individual components. There are tariff modules for doctors, dentists, and hospitals. For example, if you have a component deductible, you only have to take part in dental treatment.

Recommended Reading: How To Get Health Insurance For My Employees

What Is A No

A policy with no insurance deductible means that you get the full cost-sharing benefits of your plan immediately. You won’t need to pay a certain amount out of pocket before the insurance company starts paying for covered medical services.

For example, if you had a covered medical procedure that cost $2,500, a no-deductible plan would mean the insurance company would pay their full rate for the procedure starting from day one of your policy. If you had the same medical procedure and your insurance plan had a $1,000 deductible, you would pay the first $1,000 of the cost before the insurer would contribute to the cost.

Can Adjusting Your Health Insurance Deductibles Save You Money

The answer is yes! Adjusting health insurance deductibles can have benefits when it comes to how much youre paying in monthly premiums and how much youre paying out of pocket.

First, you should track how many times youve needed to see a doctor or buy prescription drugs in the past few years. If youre in a family plan, this also goes for each member of your family.

How much health care do you need on average each year? Could you cover the cost of a higher deductible if you were faced with a large medical bill at any time?

You May Like: How Much Is Health Insurance In Nj

Will You Always Have A Copay

No. It will depend on your plan, and the service youre using. Some plans use them to cover shared costs, but others dont. And sometimes the service youre using will be paid for with a mix of a copay and/or your deductible and coinsurance obligation. Plus, as well discuss more below, some plans offer certain services at no cost to you, such as annual exams or other preventive care.

Do You Pay A Deductible With A Medicare Advantage Plan

Yes. The Medicare Advantage Plan is one of two alternatives for Medicare recipients who want to supplement the coverage they receive. Both are available through private insurers.

Medicare Advantage Plan

A Medicare Advantage Plan replaces your Medicare card with a private insurer’s Medicare Advantage Plan card. That insurer manages your Part A, Part B, and Part D services and costs.

Its coverage has its own premiums , copayments, and coinsurance costs.

It will offer additional coverage and additional services at an additional cost. The costs vary widely, as do the options for coverage.

Medigap Plan

Medicare Supplement Insurance, known as Medigap, covers some of the deductibles, coinsurance, and copayments due for Medicare services.

For example, you can choose a Medigap plan that has a low monthly premium but requires you to pick up the deductible every year. But if you’re hospitalized for more than 60 days, it will pick up your share of the costs.

HealthCare.gov. “Subsidized Coverage.” Accessed Nov. 29, 2021.

Health Resources & Services Administration. “Women’s Preventive Guidelines.” Accessed Nov. 29, 2021.

Don’t Miss: Can You Put Your Girlfriend On Your Health Insurance

Why Should You Consider A Health Savings Account

There are advantages to using a health savings account paired with a high-deductible health plan, especially if you have a large emergency fund and don’t often use health insurance. Money can be deposited into an HSA tax-free and then withdrawn tax-free to pay for eligible health care expenses. Plus, funds in an HSA can be invested and can grow tax-free year after year as long as the money is ultimately spent on health care, it can be withdrawn tax-free.

Simple Products Huge Benefits

We provide great health insurance products based on hundreds of clients feedback to make sure you always get reassurance from us that we insure you the best way possible.Get a quote, with actionable options perfectly matching your needs.

Please be advised that our data privacy policy can be found on our website:and that the information you provide us will be stored on our internal servers. We also kindly suggest that you take note of Telegrams Terms of Service and avoid using it to send medical or sensitive data.

Please be advised that our data privacy policy can be found on our website:and that the information you provide us will be stored on our internal servers. We also kindly suggest that you take note of WhatsApps Terms of Service and avoid using it to send medical or sensitive data.

Please be advised that our data privacy policy can be found on our website:and that the information you provide us will be stored on our internal servers. We also kindly suggest that you take note of Signals Terms of Service and avoid using it to send medical or sensitive data.

You May Like: Does My Health Insurance Cover Gym Membership

How Can You Reduce Your Premiums Through An Insurance Deductible

There are several ways to reduce your premiums with an insurance deductible:

- The most common way is to choose a high deductible. This will allow the health insurer to offer you a lower premium rate.

- Another way to save money on premiums is to take out a family policy instead of an individual policy. This is because family policies usually have a higher deductible than individual policies.

- You should always shop around and compare different health insurance policies before buying. This will help you find the policy that offers the best value for money.

What Doesnt Count Toward The Deductible

Healthcare expenses that arent a covered benefit of your health plan dont count toward your deductible even though youve paid for them. For example, if your health insurance doesnt cover orthotic shoe inserts, then the $400 you paid for a pair of orthotics prescribed by your podiatrist doesnt count toward your deductible.

Similarly, if your health plan doesn’t cover out-of-network care, any amount that you pay for out-of-network care will not be counted towards your deductible.

If your health insurance requires a per-episode deductible, or a deductible each time you get a particular type of service, as well as an annual deductible, money you pay toward the per-episode deductible might not count toward your annual deductible.

If you have separate deductibles for in-network and out-of-network care, the amount youve already paid toward your in-network deductible doesnt count toward your out-of-network deductible. Depending on your health plans rules, the amount youve paid toward your out-of-network deductible likely won’t count toward your in-network deductible, either.

In most health plans, copayments don’t count toward your annual deductible, although they do count toward your total out-of-pocket costs for the year.

Also Check: Can You Change Your Health Insurance Plan After Open Enrollment

What Is 5000 Deductible In Health Insurance

Asked by: Lenna Schmitt

The $5,000 deductible option means your health plan benefits kick in after you pay $5,000 out of your own pocket. You can: choose your coinsurance, choose your office visit copay, and choose your prescription drug benefits to create a plan just for you or for your whole family.

When Does A Deductible Make Sense

If you rarely or never see a doctor, a deductible may be worthwhile for you. This is how you save on your insurance premium. Make sure, however, that the deductible is not too high. You never know if you might suddenly get sick. Then you may have to pay a lot yourself and deplete any savings you have!

Also Check: How Much Does Student Health Insurance Cost

What Is A Deductible And What Does It Mean In Insurance

Fact-checked with HomeInsurance.com

Before you purchase an insurance policy, youll be asked to set a deductible. If youre a first-time insurance buyer, the word deductible is an important term to know. In this article, well explore what a deductible is, how they work and key aspects to keep in mind. Youll also learn about how deductibles affect your premium.

Policies Without A Deductible

Some insurance companies offer policies without a deductible, but theres usually a catchyou might end up paying a huge premium, or get charged for other hidden costs. Insurance companies that offer zero deductible policies often charge a no-deductible fee, and you might also have to sign a deductible waiver. Before you choose a zero deductible policy, make sure you read and understand the fine print.

Read Also: Does Health Insurance Cover Labor And Delivery

What Does It Mean If I Have Met My Deductible

If you have already paid your deductible this year, it means that your healthcare is going to cost you less for the rest of the calendar year. You will pay a fraction of what you would pay before you met your deductible, or you may have no out of pocket costs at all. This means that at the end of the year it can be much less expensive for you to access healthcare services before the clock strikes midnight on December 31.