Rates And Plans For 202: Approved Average Rate Increase Of 66% Plus Four Insurers Joining The Market

Two insurers that offered plans in Floridas marketplace as of 2016 are rejoining for 2022. UnitedHealthcare and Aetna CVS Health will enter the Florida marketplace for 2022 .

Two other insurers Capital Health Plan and Sunshine State Health Plan will also join the states marketplace for 2022.

The states existing marketplace insurers will implement the following average rate changes for 2022, which amount to an average rate increase of 6.6% :

- AvMed: 2.9%

- Blue Cross Blue Shield of Florida : 9.8% increase .

- Bright Health Insurance Company: 8.6% increase .

- Cigna: 5.8% increase .

- Florida Health Care Plan Inc: 3.3% increase

- Health First Health Plans: 2.2% increase

- Molina: 6.5% increase

- Oscar Health: 1.4% increase .

- Florida Blue HMO : 4.3% increase .

- Ambetter : 9.9% increase .

- Sunshine State Health Plan: New for 2022, so no applicable rate change

- United Healthcare: New for 2022, so no applicable rate change

- Coventry/Aetna-CVS: New for 2022, so no applicable rate change

- Capital Health Plan: New for 2022, so no applicable rate change

For perspective, heres a summary of how average premiums have changed in Floridas individual market since ACA-compliant policies debuted in 2014:

The basic details of the rate filings are available on the federal rate review site and on FLOIRs rate filing search system. But essentially all of the pertinent documents for each rate filing are marked trade secret in Florida, and not available to view.

How Do You Get Health Insurance In Florida

Florida residents can purchase plans from private providers or the federal exchange during open enrollment. Outside of open enrollment, you may qualify for a special enrollment period due to a qualifying life event, like getting married or losing coverage. Floridians can also enroll in short term plans without a qualifying life event for quick coverage outside of open enrollment.

Why Is Health Insurance So Expensive

The driving factor for why health insurance is so expensive is that health care is so expensive, says Louise Norris, a licensed health insurance agent based in Colorado and author of The Insiders Guide to Obamacares Open Enrollment. The price of health care in this country is really high.

According to a 2020 report from the Kaiser Family Foundation, insurers said the reasons they had to increase premium costs included the continued cost of COVID-19 testing, the rebounding of medical services that had been delayed during the pandemic and morbidities related to foregone care.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

Cost: Hospitals And Related

New York and Florida showed greater parity in terms of costs related to hospitalization and medication.

A New Yorker moving to Florida can expect to pay substantially more for prescription drugs.

According to CMS, the per capita actual cost paid by Medicare Part B in Florida averaged $862 in 2019.

That compares to $540 in New York.

But at $2,366 per day, Floridians pay substantially less than the $3,070 New Yorkers pay for a day in a hospital.

New Yorkers relocating to Florida will also save on insurance premiums.

The total premium for employer-sponsored health insurance plans came to $18,134 in 2019.

That compares to $16,785 in Florida.

But headline figures can be deceiving.

Healthcare costs can bite Floridians harder, given the lower median household income of $55,660 in Florida almost $13,000 less than the $68,486 median household income in New York.3

How Much Is Medigap In Maine

Plan G in Maine would cost about $205 a month. But, even when youre 90, youll have a premium equal to a person thats 65. While it may seem like a lot at first, long term, its the most comprehensive option.

Those with Medigap in Maine can switch to a different policy with the same or fewer benefits throughout the year. Maine follows community rating method laws. Premiums dont go off age, those under age 65 still qualify for the same costs as those over 65. Because of these rules, its no shock that premiums are much higher in this state.

Don’t Miss: Starbucks Dental Benefits

Is It Cheaper To Get Health Insurance Through Employer

Workplace health insurance is usually cheaper than an individual health plan. Employer-sponsored plan premiums have increased 3% annually for single coverage plans and about 5% for family plans. Those increases are much more modest than what youll find for individual health plans most years.15 oct. 2020

Why Is Auto Insurance For A Teen In Florida So Expensive

Lets unpack the reason why Florida car insurance is so expensive.

First off, Florida requires its drivers to carry Personal Injury Protection insurance. PIP is an extension of coverage existing in no-fault states. PIP coverage helps pay for your and your passengers medical bills after an auto accident, regardless of who is at fault.

Auto insurance rates are also higher because drivers in Florida are only required to carry very low minimums on their insurance. In turn, accidents resulting in higher loss ratios drive up the market prices, leading to increased rates. Its against the law to drive without insurance in Florida. The required minimums for insurance in Florida are listed below.

| Zip Code |

|---|

The required minimums for Property Damage Liability and Personal Injury Protection are $10,000 each, respectively.

If you wish to acquire the minimum bodily injury requirements, youre looking at $10,000 per person/$20,000 per accident.

If the required minimum coverages were higher, the individual cost of insurance would, perhaps, be lower in Florida.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

Why Does Healthcare Cost So Much

Healthcare spending in the United States is $3 trillion a year, straining the budgets of families, businesses and taxpayers alike. Learn what makes healthcare so expensive, why costs continue to rise and what we can do about it.

The price of medical care is the single biggest factor behind U.S. healthcare costs, accounting for 90% of spending. These expenditures reflect the cost of caring for those with chronic or long-term medical conditions, an aging population and the increased cost of new medicines, procedures and technologies.

Also, healthcare reform law has expanded access to insurance to millions of Americans. Weve transitioned to a healthcare system in which everyone can obtain health insurance regardless of age or health status, and many individuals who are newly insured need ongoing medical attention.

We can all play a part in helping to make America healthierand curbing healthcare costs. Our healthcare system must focus more on quality care for patients that helps them get healthy faster and stay healthy longer. Meanwhile, everyone can lower their risk of developing many costly chronic diseases by adopting healthier lifestyles.

Where Does Your Healthcare Dollar Go?

Finding Your Best Health Insurance Plans In Florida

Remember, premiums are not the only cost component when it comes to your health care. Out-of-pocket costs in the form of deductibles, copays and coinsurance are just as important to compare when you shop.

The best cheap health insurance plan for you and your family will depend on your income level and expected health care needs.

Households with higher expected medical costs should opt for plans with higher cost-sharing benefits, while those who expect to be relatively healthy or to need little to no routine care should look toward cheaper plans.

Average consumers should start by browsing Silver plans

Unless youre extremely healthy or know youll have significant medical expenses, we advise that you begin your shopping process by looking at the Silver metal tier health insurance plans. These are the plans that the exchange offerings are generally benchmarked off of, and they occupy a good middle ground between premiums you are guaranteed to pay and cost-sharing responsibilities that you will incur if you have any medical expenses.

The Silver plans are also the only plans on the Florida exchange that make you eligible for cost-sharing reductions that further reduce your copays, coinsurance and deductibles if you have a household income under 250% of the federal poverty level.

In such a case, these plans can actually offer more benefits than higher-priced Gold and Platinum plans but at a much lower premium.

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

Average Monthly Aca Premiums By Metal Tier

In most states, Silver plans are the most popular. These arenât the cheapest plans but someone can only receive premium subsidies by purchasing a Silver plan, and most ACA enrollees do receive a subsidy. The second most popular plan in most states is a Bronze plan. For anyone who doesnât qualify for a subsidy, a Bronze plan will usually offer the lowest premium. Gold plans are usually the most expensive of these three tiers, and they are also the last popular of the three in most states.

The table below includes data for the 38 states that used the federal ACA exchange in 2020. The 13 states that used state-based exchanges have different reporting requirements and have not yet reported complete data. Platinum plans and catastrophic plans were omitted because they arenât available in all counties or states.

If I Decide To Enroll In A Marketplace Plan Will I Be Eligible For Subsidies/savings

First, your employer may contribute to your health insurance costs when you enroll in an employer-sponsored plan. Sometimes they even contribute 100%. But if you opt-out of your employer-sponsored plan for an Obamacare plan, they wont. Want to opt-out of an employers plan? Youll be handling the costs of your monthly premiums on your own and paying full price.

Second, if you turn down an employer plan and enroll in an Obamacare plan, you probably wont get any subsidies/savings. The only ways you can qualify for a subsidies are:

More on these minimum standards here.

To make this process a little easier, weve created a free guide you can save and refer back to later.

Recommended Reading: Is Starbucks Health Insurance Good

Why Is Healthcare So Expensive

A new study by Yale professor Zack Cooper lifts the lid on the Byzantine pricing system in U.S. healthcare by examining how much privately insured patients really pay for procedures. Cooper spoke with Yale Insights about why costs are so high and how he thinks policy responses can fix the broken healthcare market.

- Assistant Professor of Health Policy, Yale School of Public Health

Q: You co-authored a working paper, The Price Aint Right? Hospital Prices and Health Spending on the Privately Insured, that analyzed an enormous set of data that had never been publically available. What was the data and how did you get it?

The negotiated transaction prices paid by private insurance companies to healthcare providers have been treated as commercially sensitive data and therefore have been largely unavailable to researchers. But three of the five largest insurers in the nation, Aetna, United, and Humana, made a database of health insurance claims data available for research through a nonprofit called the Healthcare Cost Institute.

The data covers 2007 to 2011 and more than 88 million unique individuals, or nearly one in three individuals in the U.S. with private health insurance. While it is anonymized, the data are incredibly granular. Basically, we have claims-level data for 1% of GDP each year.

Q: What do we know about why healthcare in the U.S. is so expensive? Where has the data for that come from in the past?

Q: Where does the additional money paid to providers go?

How To Get The Cheapest Car Insurance In Florida

Despite Florida’s high insurance premiums, there are ways to save on auto insurance. Keep these in mind when shopping for car insurance so you can take advantage of the discounts different companies offer. Standard discounts include anti-theft devices on a vehicle, having multiple cars on your policy, taking a defensive driving course, and establishing yourself as a good driver with a clean record.

Per Autolist, you may also notice a rates if you’re a senior citizen, member of the military, veteran, or qualify as a good student as determined by the insurance company. A good credit score will also make a difference in your insurance premiums. In fact, credit score can hold a stronger weight than some driving record blemishes, like a DUI or at-fault crash, according to Nerd Wallet. For their study, Nerd Wallet averaged rates for 40-year-olds who earned a good driver discount because of their clean driving record, yet had poor credit.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

Florida Health Insurance Exchange Links

Assists consumers who have purchased insurance on the individual market or who have insurance through an employer who only does business in Florida. / Out of State: 413-3089

Serves residents enrolled in managed care helps resolve grievance between managed care entities and their subscribers. 1-888-419-3456

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health exchange updates are regularly cited by media who cover health reform and by other health insurance experts.

About our health insurance quote forms and phone lines

We do not sell insurance products, but this form will connect you with partners of healthinsurance.org who do sell insurance products. You may submit your information through this form, or call to speak directly with licensed enrollers who will provide advice specific to your situation. Read about your data and privacy.

The mission of healthinsurance.org and its editorial team is to provide information and resources that help American consumers make informed choices about buying and keeping health coverage. We are nationally recognized experts on the Affordable Care Act and state health insurance exchanges/marketplaces. Learn more about us.

If you have questions or comments on this service, please contact us.

How To Get The Best Health Insurance

If youre looking to purchase health insurance on your own, you can just go to the websites of major health insurance companies in your area and see what plans they provide. You can compare plans on your own, although quotes will vary pretty widely.

But lets face it. This is a ton of work. Choosing the right health insurance plan for you or your family is a daunting task. And you probably have better things to do with your time than sifting through endless health insurance quotes.

Thats why I recommend using our trusted and independent insurance agents for your health insurance needs. Theyll look at your situation and compare the best rates so you can get the coverage you need. Theyll help you understand the marketplace or even what your employer is offering. And the best thing? Theyre free!

Connect with one of our insurance agents today.

About the author

George Kamel

George Kamel is a personal finance expert and host of The Fine Print Podcast. Since 2013, George has served at Ramsey Solutions where he teaches on how to spend less money, save more, and avoid consumer traps. He is also the host of The EntreLeadership Podcast.

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

What Does Health Insurance Cover

Every health insurance plan could essentially include or exclude any type of coverage they wanted before the introduction of the Affordable Care Acts . This made it incredibly tedious to compare plans because there was little standard of coverage between dozens of options. Now the ACA dictates that every permanent health insurance plan must include at least the following ten essential benefits:

Your plan must also include the following benefits for women:

- Breastfeeding support: This includes counseling and equipment for nursing mothers.

- Birth control: ACA-compliant plans must include prescribed FDA-approved contraceptive methods. This includes emergency contraceptives but does not include drugs intended to terminate an already viable pregnancy.

Your employer may be exempt from covering certain contraceptives if you work for a house of worship or a religious non-profit.

Can I Refuse Health Insurance From My Employer And Get Obamacare

Yes, the Affordable Care Act ensures that almost all Americans can buy individual and family health insurance from its online Marketplace, aka Obamacareeither the federal exchange or a state-run one. However, you most likely will not qualify for any subsidies, tax credits, or other financial assistance. The only way you might be eligible is if a) your employer-sponsored health plan doesnt meet the minimum value standard of coverage required by the ACA, or b) the cheapest plan through your employer costs more than a certain percentage of your household income. Even without the subsidy, though, a Marketplace plan may offer a more economical deal than your employer-based insurance, so comparison-shopping never hurts.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

Why Is Insurance So Expensive For Teenage Drivers

Can you remember getting into an accident as a teen? Keep your eyes on the road! is a common gibe from adults to younger drivers, but data shows that statistics hold up.

Teens are new to driving and thus more likely to have an accident.

Younger drivers are more prone to distraction. Studies from the National Highway and Traffic Safety Association indicate that teens risk for an accident goes up along with the number of passengers riding in the vehicle.

Key Reasons Why Health Insurance Is So Expensive

- The Americans pay almost four times the population of other developing countries for pharmaceuticals.

- COVID-19 has raised the demand to reduce costs on our increasingly complicated and costly healthcare system . Thats why health insurance is so expensive in the USA.

- Also, the prices of hospitals are rising even higher than specialist wages in the US. Moreover, hospitals, doctors, and infants are charged more than elsewhere.

- In other nations, the government is at least partly responsible for pricing medicines and healthcare. Prices in the United States rely on the strength of the demand. Thats why health insurance is so expensive in the USA.

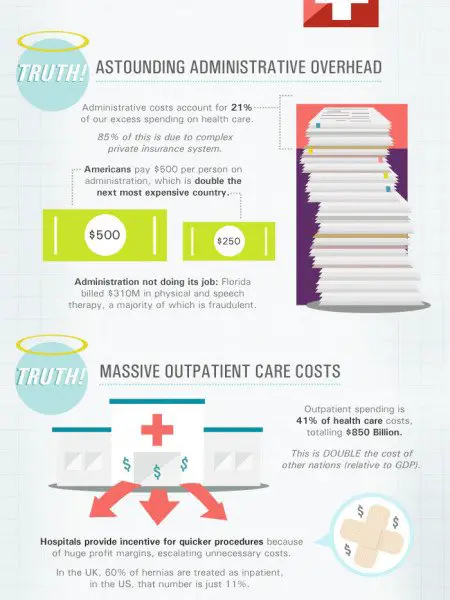

- Administrative duplication is one explanation for high prices. Providers face a wide range of usage and multi-payor billing needs. Such that expensive administrative support is essential to charge and refund.

Here are some fundamental reasons why health insurance is so expensive?

Lack of accountability by the government

- This may be the most difficult cause for disengagement, but the key point is this: organizations that offer health services like healthcare facilities and medicines manufacturers, like many private insurance companies, have more leverage to keep premiums up by dealing with several payers.

- However, there is more incentive to satisfy the need to market their services as they have to bargain with a single-payer.

Insurance and Healthcare Services Consolidation

Creating Waste on Multiple Systems

The cost of drugs is rising

Read Also: Starbucks Benefits For Part Time Employees