International Health Insurance For Us Citizens Living Abroad Whats Covered

How much youll pay for health insurance isnt a number you can guess. Its affected by many factors, few of which you control.

With William Russell, international health insurance can cover US citizens for:

- Doctor visits, consultations, hospital care and mental health treatment in multiple overseas territories .

- Up to $100,000 for unexpected elective medical care and $250,000 in emergency treatment costs during short visits back to US soil, for reassurance when you visit family or head home for the holidays .

What Is The Cost Of An Emergency Room Visit

If you become ill and in need of emergency care, American healthcare prices will start adding up right away. An ambulance to take you to the hospital will start at $400. If you need tests, typical additional costs are $100 – $500. Should you need to spend the night, an additional charge of $5,000 might be added to your bill. With medications to treat your illness, the total cost of an emergency room or ER visit could be $6,000 or more!

Beyond Your Monthly Premium: Deductible And Out

- Deductible: How much you have to spend for covered health services before your insurance company pays anything

- Copayments and coinsurance: Payments you make each time you get a medical service after reaching your deductible

- Out-of-pocket maximum: The most you have to spend for covered services in a year. After you reach this amount, the insurance company pays 100% for covered services.

Also Check: Starbucks Open Enrollment

What Is The Cost Of Healthcare In The Us Without Medical Insurance

Below are average American healthcare prices for common procedures and services. These are estimates. The actual costs will vary depending on the healthcare facility providing the services. The infographics below will give you a good overview of the costs you may incur when visiting a doctor or hospital without insurance. These are the prices a visitor to the USA may face if they do not have a travel insurance plan or international health insurance plan.

These infographics list some of the typical, routine or unforeseen medical services that people require, along with their average costs. Much of this data comes directly from U.S. hospitals, which are required to list the cost of 300 of the most common medical procedures. As you will see, the cost of a doctor’s visit or the average cost of a hospital stay in the U.S. varies widely depending on the services you need.

How Much Does Health Insurance Cost

In 2022, the average cost of health insurance is $541 a month for a silver plan. However, costs will vary by location. Insurance is expensive in West Virginia and South Dakota, averaging more than $800 a month. States with cheaper health insurance include Georgia, New Hampshire and Maryland, averaging less than $375 a month.

Don’t Miss: Shoprite Employee Benefits

What Is The Cost Of Cancer Treatement Without Insurance

Having cancer is enough to make anyone feel anxious about the uncertain road ahead. So any unwelcome medical costs will only add to those stress levels if you are uninsured. And, unfortunately, the costs for treatments in the U.S. \come with a high price tag. Nearly breaking the million-dollar mark is a bone marrow transplant. It could cost more than an eye-watering $900,000+. Prices start at a still pretty extortionate $638,000.

Brain cancer treatment costs anything from $50,000 to a lofty $700,000+, while breast cancer costs range from $48,500 through to $300,000+. The price it takes to tackle pancreatic cancer starts from $31,000 through to $200,000+. And melanoma treatment can be anywhere from $1,700 to $152,000+.

What Is The Affordable Care Act

The Affordable Care Act provides individuals and families greater access to affordable health insurance options including medical, dental, vision, and other types of health insurance that may not otherwise be available. Under the ACA:

-

You may be able to purchase health care coverage through a state or federal marketplace that offers a choice of plans.

-

Insurers can’t refuse coverage based on gender or a pre-existing condition.

-

There are no lifetime or annual limits on coverage.

-

Young adults can stay on their familys insurance plan until age 26.

-

Seniors who hit the Medicare Prescription Drug Plan coverage gap or “donut hole” can get a discount on medications.

Read the full text of the ACA and learn more about its provisions and relationship to patients, insurers, businesses, and families.

Recommended Reading: Starbucks Benefits For Part Time

Digging Deeper For Pricing Information

However, it’s not universally good news. For more details, we consulted the CMS’ 2020 Health Insurance Exchange Premium Landscape Issue Brief. It indicates that 27-year-olds buying silver plans saw their premiums increase by 10% or more in Indiana, Louisiana, and New Jersey.

More importantly, it reveals that the percentage changes don’t tell us much about what people are actually paying: “Some of the states with the largest decreases still have relatively high premiums and vice versa,” the brief states. “For example, while Nebraskas benchmark plan premium decreased 15% from PY19 to PY20, the average 27-year-old PY20 benchmark plan premium is $583. On the other hand, while Indianas average PY20 benchmark plan premium increased 13% from PY19, the average 27-year-old PY20 benchmark plan premium is $314.”

In 2021, that trend continues. The 2021 edition of the CMS Brief notes that, for example, while Wyomings average benchmark plan premium decreased 10% from PY20 to PY21, the average 27-year-old PY21 benchmark plan premium is $648the highest in the U.S. How many 27-year-olds can afford that kind of monthly premium? By contrast, New Hampshire’s benchmark plan premium for a 27-year-old is the lowest in the nation at $273.

Drug Costs Are Rising

On average, Americans shell out almost twice as much for pharmaceutical drugs as citizens of other industrialized countries pay. High drug prices are the single biggest area of overspending in the U.S. compared to Europe, where drug prices are government regulated, often based on the clinical benefit of the medication.

With little regulation of drug prices, the U.S. spends an average of $1,443 per person, compared to $749, on average, spent by the other prosperous countries studied. Drug prices in the U.S. are 256% of those in comparison countries. In the U.S. private insurers can negotiate drug prices with manufacturers, often through the services of pharmacy benefit managers. However, Medicare, which pays for a hefty percentage of the national drug costs, is not permitted to negotiate prices with manufacturers.

Recommended Reading: Health Insurance Starbucks

Catastrophic Health Insurance Plans

For qualifying Americans under the age of 30, catastrophic plans are available to provide what can be considered last-resort health insurance. Catastrophic plan premiums are lower than even Bronze tier plans. However, you pay more for visits and prescriptions due to high deductibles, which are $8,550 for the year in 2021.

How Much Is Health Insurance By State

Wondering how much private health insurance costs? The answer is that monthly premiums can vary significantly depending on where you live.

Variation in rates stems from factors like how much competition there is in a given state, forcing insurers to offer attractive rates. Expenses may also vary because of the expected health costs of a population. For example, in states where people tend to be less healthy or where doctors and hospitals charge more, insurance companies set higher rates to cover those costs.

Average Health Insurance Premiums by State for 40-Year-Olds

Scroll for more

- $7,646

Average health insurance rates are only part of the story. Your actual plan may cost you much more or less than the typical person pays.

Thanks to federal subsidies, many people find their premiums are much more affordable. More than 50% of people can find a Silver plan for less than $10 per month with federal cost-sharing adjustments.

Another way to save money on premiums is to opt for higher-deductible plans. You may pay less each month, but you are on the hook for more of the bill if you use health care services until you reach your deductible. If you dont use many services, this kind of trade-off may save you money in the long run.

Don’t Miss: Kroger Health Insurance Part-time

The Average Cost Of Health Insurance By Company

What you can expect to pay for health insurance differs by the insurance company. Some insurers want to grow, so they offer more attractive rates. Others are more cautious and will charge more to be sure they can cover their members health care costs.

Among national carriers, rates can vary widely. For example, the average Silver plan premium for Kaiser Permanente plans is $427 per month. Anthem charges an average of $481, while UnitedHealthcares average rate is $641. Newer plans, such as Bright Health and Oscar, fall somewhere in the middle, with average monthly premiums of $488 and $492, respectively.

Premiums are not the only factor when choosing a health plan. Some of the most affordable plans can have coverage that falls short of your needs. The best health insurance companies can cost a bit more, but are surprisingly affordable and give you the best value for your money.

Consider the plan’s total cost by looking at things like deductibles, coinsurance and out-of-pocket maximums. Check that your preferred doctors and facilities are in-network to save money and hassle. Be sure to also review quality and customer satisfaction ratings available on the Marketplace to make sure youre not going to encounter more annoyances than a plan’s potential premium savings are worth.

Average Health Insurance Premiums by Company

Scroll for more

- $641

Here’s How That Breaks Down

According to eHealthInsurance, for unsubsidized customers in 2016, “premiums for individual coverage averaged $321 per month while premiums for family plans averaged $833 per month. The average annual deductible for individual plans was $4,358 and the average deductible for family plans was $7,983.”

That means that, last year, the average family paid $9,996 for coverage alone, and, if they met their deductible, a total of just under $18,000.Meanwhile, an average individual spent $3,852 on coverage and, if she spent another $4,358 to meet her deductible, a total of $8,210.

These figures do not take into account any additional co-insurance responsibility she might have. In addition to co-pays and deductibles, an increasing number of plans now require co-insurance payments, which require that, even once you meet your deductible, you continue paying some percentage of all costs until you hit your out-of-pocket maximum.

Read Also: How Much Does Starbucks Health Insurance Cost

How To Estimate Your Yearly Total Costs Of Care

In order to pick a plan based on your total costs of care, youll need to estimate the medical services youll use for the year ahead. Of course its impossible to predict the exact amount. So think about how much care you usually use, or are likely to use.

- Before you compare plans when youre logged in to HealthCare.gov or preview plans and prices before you log in, you can choose each family members expected medical use as low, medium, or high.

- When you view plans, youll see an estimate of your total costs including monthly premiums and all out-of-pocket costs based on your households expected use of care.

- Your actual expenses will vary, but the estimate is useful for comparing plans total impact on your household budget.

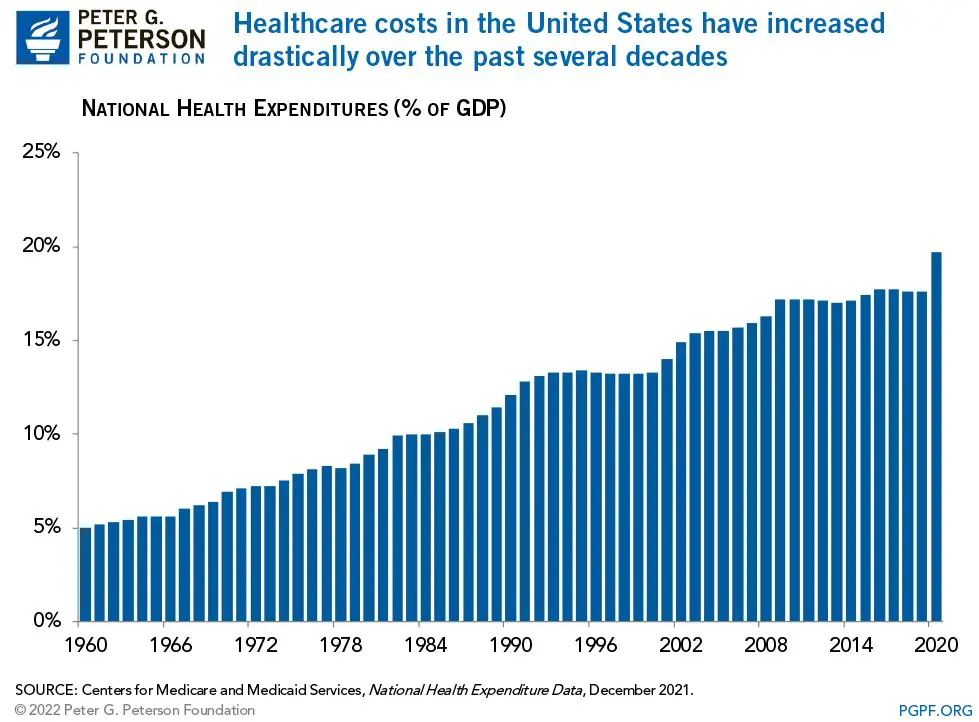

Why Do Us Health Insurance Costs Keep Going Up

The cost of US health insurance has almost doubled in a decade, as the table shows:

| 2010 | ||

|---|---|---|

| Average employer health insurance costs for family coverage | $9,773 | |

| Average employee health insurance costs for worker coverage | $3,997 | $5,588 |

Whats behind this trend is the subject of debate some argue government programmes, such as Medicare and Medicaid , have relieved providers of pressure to keep insurance affordable.

However, its likely that some factors driving up the cost of healthcare in the USA may be similar to those in other countries, including population ageing and an increase in chronic illness. Check out eight main reasons healthcare costs are rising globally.

At the same time, a shift towards high-deductible health plans is increasing the out-of-pocket costs for Americans. Under such plans, families can be asked to pay for their first $14,000 of medical costs, so the impact may be greater even if their insurance package costs the same overall.

Irene Papanicolas

Visiting assistant professor in the Department of Health Policy and Management at Harvard Chan School

You May Like: How To Cancel Evolve Health Insurance

The Average Cost Of Health Insurance By Metal Tier

Plans offered on the Health Insurance Marketplace are categorized into metallic tiers: Bronze, Silver, Gold and Platinum.

The tier corresponds to the value of the coverage, or how health plans and members split the costs. For example, in Bronze plans, the health insurer pays approximately 60% of the costs of care, and the individual typically pays 40%. The provider typically pays 90% in Platinum plans, and the individual pays 10%. These ratios are set by tier and based on expected spending for a typical health plan member.

In MoneyGeeks analysis, the lowest average premiums were $383 per month for Bronze plans. The average Platinum plan, by contrast, costs $782 per month.

Average Health Insurance Premiums by Metal Tier

Scroll for more

- $170$3,501

Tips For Reducing Health Insurance Costs

Shopping and doing the research to find the best health insurance are important, because your situation and medical expenses play large roles in what you get out of your health insurance plan.

- A health savings account may help you save money on your medical spending if you have a qualifying high-deductible plan to go with it.

- Compare the out-of-pocket costs for different plans. Out-of-pocket costs may include deductibles, copays, and coinsurance.

- Create a checklist of what is important for you or your family, and compare how each plan fits with what you are looking for.

- Make sure your plan allows you access to the providers you want. If you choose a plan with a limited provider network, you may find it harder not to rack up additional costs for using out-of-network providers.

- If both you and your spouse have access to health insurance, consider using coordination of benefits to leverage your coverage and potentially reduce costs.

- If you foresee costs, such as those related to mental health needs or pregnancy in the near future, review your health insurance options with your family’s needs and plans in mind. Some health insurance plans may have better coverage for pregnancy and childbirth than others.

Don’t Miss: Starbucks Pet Insurance

Types Of Health Insurance Plans

When purchasing health insurance, your choices typically fall into one of three categories:

- Traditional fee-for-service health insurance plans are usually the most expensive choice. They offer the most flexibility in choosing health care providers.

- Health maintenance organizations offer lower co-payments and cover the costs of more preventive care. Your choice of health care providers is limited to those who are part of the plan.

- Preferred provider organizations offer lower co-payments like HMOs but give you more options when selecting a provider.

How Do I Find Affordable Health Insurance

Group plans are generally cheaper than individual plans. So if you are eligible for onethrough your employer, your union, or some other associationthat’s your best bet, in terms of coverage for the money. If that’s not an option, the public health marketplaces established by the Affordable Care Act offer affordable health insurance for individuals. In most of the U.S., you can sign up for a plan offered through the federal government via the HealthCare.gov site. However, 12 states run their own marketplaces, and residents sign up via their sites.

You May Like: Starbucks Insurance Cost

What Is The Cheapest Health Insurance

As you can see from the factors listed above, theres a lot that goes into determining the price of insurance. There isnt a single healthcare plan thats the most affordable for everyone. But finding the right plan for your needs is easy with HealthMarkets. Our free FitScore® technology helps you shop, compare and apply for a healthcare plan in minutes. We can even check to see if you may qualify for a tax credit. To get a better look at what plans could cost you and your family, get started now.

46698-HM-1120* Subsidy amounts are based on a 40-year-old nonsmoker making $30,000 per year.

References:

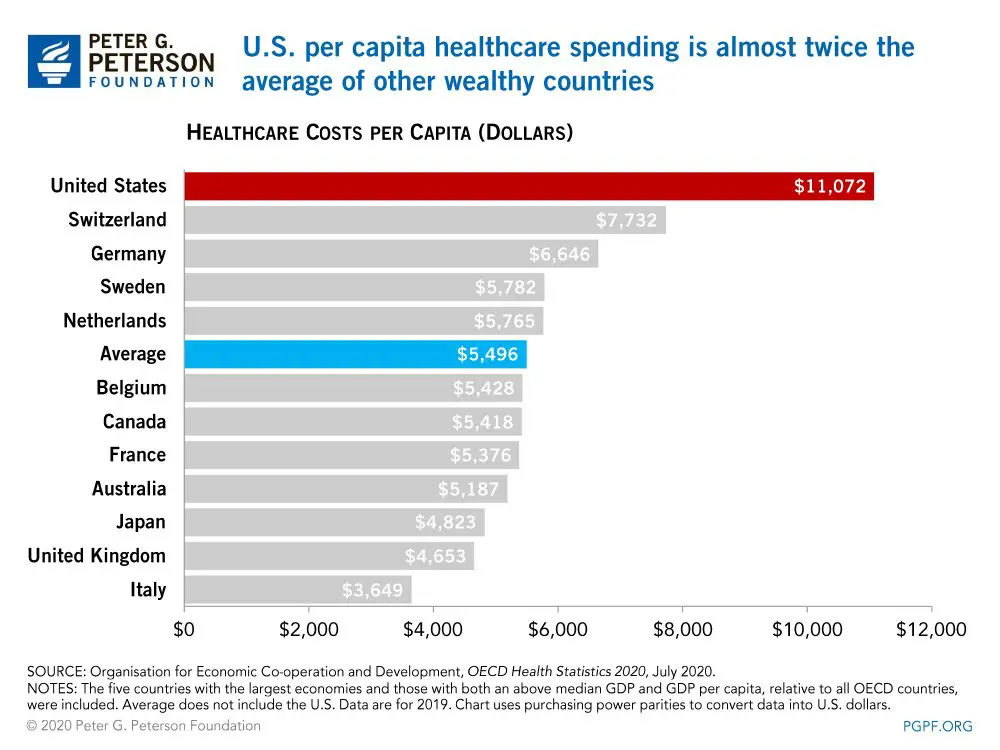

How Do Us Health Insurance Costs Stack Up Globally

Voluntary healthcare payments including for private health insurance totalled more than $1,685 per capita in the USA in 2019.

This is lower than the figure in Switzerland, where voluntary payments were worth $2,745 per capita. Check out how much medical treatment can cost abroad.

However, the USAs private spending continues to soar far above that in many other nations. American private health spending is five times higher than Canadas, for instance.

Don’t Miss: Does Kroger Offer Health Insurance To Part Time Employees

Does My Us Health Insurance Cover Me Abroad

Most of the time, your domestic health insurance plan doesnt provide cover abroad, but there are some cases it will for instance, for emergencies, medical evacuations or during short trips. Contacting your provider is usually the best way to find out. Sometimes, even if your insurer will cover care in such cases, you may need to pay out-of-pocket and apply for reimbursement.

What Does The Plan Cover

One of the things health care reform has done in the U.S. is to introduce more standardization to insurance plan benefits. Before such standardization, the benefits offered varied drastically from plan to plan. For example, some plans covered prescriptions, others did not. Now, plans in the U.S. are required to offer a number of “essential health benefits” which include

Emergency servicesPreventive services and management of chronic diseasesRehabilitation services

For our international population of students who might be considering coverage through a non U.S. based plan, asking the question, “what does the plan cover” is extremely important.

Recommended Reading: Do Substitute Teachers Get Health Insurance