What Does Catastrophic Health Insurance Cover

Catastrophic health insurance plans must cover all the services required by the ACA. In general, these services include preventative services, pregnancy care, prescription drugs, and laboratory services. The ACA designates three separate lists of preventative services that must be coveredone for all adults, one for women, and one for children.

How Do Hsas Fit In

If you are employed and covered by only a high-deductible health plan, you can combine a catastrophic health care plan with a health savings account , which allows you to set aside tax-free money to apply toward medical costs. An HSA can help you pay for any of your out-of-pocket health expenses under a catastrophic health insurance plan.

Illness Behavior And Utilization In Ias

Non-admission rate is defined as the percentage of patients needing treatment who are not treated in the two weeks before the survey. In IAs, households for which the household head is enrolled in the UEBMI have the highest prevalence rate and non-admission rate in the two weeks before the survey .

Fig. 1

Illness behavior and utilization in integrated areas. This figure explains the two-week prevalence, two-week visiting rate, and non-admission rate among different medical insurance enrollees in integrated areas. Non-admission rate refers to the percentage of patients needing treatment who are not treated in the two weeks before the survey

Don’t Miss: Should I Cancel My Health Insurance

Catastrophic Health Insurance Plans

Catastrophic health insurance is not available to everyone, but if you qualify, its one of the cheapest plans you can buy. Although premiums are low, out-of-pocket costs for care are high.

Catastrophic health insurance plans are low-cost health plans aimed at people under 30 and those who qualify for a hardship or affordability exemption.

While catastrophic health plan premiums are low, these plans have very high deductibles.

Catastrophic plans offer the same coverage as all Affordable Care Act plans, including no-cost preventative care, but most other care is subject to the deductible. Read on to find out how a catastrophic health plan works and who qualifies.

- The maximum age to qualify for a catastrophic plan is 30 unless you qualify for a hardship or affordability exemption.

- Premiums for catastrophic plans are low, but there is a high deductible.

- Like all ACA plans, catastrophic health insurance provides preventative care at no cost, and three office visits a year are also exempt from the deductible.

- Catastrophic plans are best for people who dont need a lot of regular medical care.

Hidden Benefit Of Catastrophic Health Insurance

Even if you donât spend enough on health care to meet your catastrophic health planâs deductible, youâll still pay less on out-of-pocket medical expenses with a catastrophic plan than if you had no health insurance coverage at all.

A catastrophic plan can be an HMO, PPO, EPO, or POS plan. These plans all negotiate discounted rates with the doctors, hospitals, labs, and pharmacies that are in their network of providers. As a subscriber to the catastrophic health plan, you get the benefit of these discounted rates even before youâve paid your deductible.

Hereâs an example. Letâs say you havenât met your catastrophic planâs $8,700 deductible yet. You injure your ankle and need an ankle X-ray. The rack rate for your X-ray is $200. Without your catastrophic health insurance, youâd have to pay $200 out-of-pocket. Now let’s say that the in-network discount rate for health plan members is $98. Since youâre a member of the health plan using an in-network X-ray facility, youâll only have to pay the $98 discounted rate. Youâll pay $102 less than youâd pay if you were uninsured.

Don’t Miss: Does Health Insurance Cover Helicopter Transport

Are Catastrophic Plans Worth It

A catastrophic plan may be a good option for young and healthy people, but is generally not recommended if youre older, need ongoing medical care and dont have the financial reserves to pay a high deductible.

Consider the following factors:

- Your age: Availability applies only to people under the age of 30 or those who meet certain exemptions.

- Your health: If you have a pre-existing medical condition or expect to need frequent or ongoing medical care, a catastrophic health insurance plan may not be a good choice.

- Your budget: These plans generally lower premiums than other types of health insurance.

Who Qualifies For A Catastrophic Plan

Unlike other health plans, the ACA limits catastrophic health insurance to only two groups of people:

- People under 30

- People over 30 who qualify for hardship and affordability exemptions

Possible reasons for hardship exemptions are:

- Damages to your home in a disaster

- A sudden need for you to care for a disabled or aging family member

Go to your states health insurance exchange to see if you qualify for a hardship exemption. Catastrophic health plan quotes should appear when you search for plans if youre eligible. If you dont see the option, you can request a hardship exemption.

Also Check: Can I Opt Out Of Employer Health Insurance

Interested In Extra Protection Against The Unexpected

Catastrophic coverage is an affordable way to protect you and your loved ones from high prescription drug costs resulting from an illness or accident. Let us help you decide. Think about what your probable healthcare needs are and how much financial risk you can tolerate before making any health insurance decision. When you start looking for a health insurance plan, simply give us a call. Our experts can answer your questions and help you decide.

How Do I Qualify For An Exemption So That I Can Get Catastrophic Health Coverage

There are two main types of exemptions that would help you qualify for catastrophic insurancepersonal hardship and affordability exemptions. You could qualify for either exemption depending on the details of your specific situation.

Some common hardship qualifications include:

- Death of a close relative

- Utility services being shut off

- Home foreclosure

- A fire, or a natural- or human-caused disaster that results in substantial property damage

There are also affordability exemptions. This means that your income is not enough to be able to afford regular health care coverage. If you qualify for an exemption, you would claim it on your annual tax return and get money back.

You May Like: Can I Go To The Er Without Health Insurance

Alternatives To Catastrophic Health Plans

Catastrophic health plans have low premiums, but those might still be too much for some people. Plus, the deductible means huge out-of-pocket costs when you need care, which isnt ideal for everyone.

There are other options to catastrophic health plans:

Catastrophic health plans are an option for young people and those who are facing hardships. However, make sure to compare the pros and cons of each of your options to find a plan that best meets your needs.

Best Overall: Blue Cross Blue Shield

-

Member discounts through the Blue365 program

-

Extensive provider network

-

BlueCard Program for nationwide care

-

High average NCQA rating

-

Catastrophic plans arent available nationwide

-

Premiums relatively high in some states

Like all catastrophic plans, BCBS catastrophic plans cover 100% of most medical services, including doctors visits, prescriptions, and hospitalizations, once the deductible is met. Unlike all other providers, though, BCBS has an extensive nationwide provider network with more than 1.7 million doctors and hospitals providing nationwide coverage. If you need medical care while traveling domestically or internationally, you can use your BlueCard to submit claims outside of your local BCBS coverage area.

The company also has good third-party ratings. In the J.D. Power 2022 U.S. Commercial Health Plan Study, BCBS was rated the top health insurance company for overall customer satisfaction in 12 of 22 regions. Its average NCQA rating is 3.73 out of 5, which is the second-highest score of the companies we reviewed.

Another perk of BCBS is its Blue365 program, which gives you access to discounts on things like healthy food, fitness classes, medical devices, personal care items, and travel. Because BCBS plans are sold and administered by 34 independent and local organizations, the plan options and plan costs will vary based on your location.

Also Check: Can A Self Employed Person Deduct Health Insurance Premiums

Catastrophic Plan Enrollment Is Low Partially Because People Dont Know Theyre Eligible For Catastrophic Plans

Obtaining a hardship exemption is not typically a quick process, and catastrophic plans dont automatically show up on the list of available plan options for people who are 30 or older. So its possible that many applicants are unaware that they could seek a hardship exemption and obtain a catastrophic plan.

A knowledgeable broker can inform applicants about catastrophic plans and guide them through the process of obtaining an exemption, but as described in this letter from a broker in Colorado, the process isnt necessarily easy or seamless even with assistance.

During the open enrollment period for 2021 coverage, only 98,135 people enrolled in catastrophic plans, out of 12 million exchange enrollees nationwide. And nationwide enrollment in catastrophic plans dropped to under 82,000 for 2022, despite the fact that total exchange enrollment climbed to 14.5 million people.

The fact that premium subsidies cant be used with catastrophic plans is a primary reason for the low uptake of catastrophic plans. And the American Rescue Plans subsidy enhancements were available during the open enrollment period for 2022 coverage, making catastrophic plans even less popular .

But for the population that isnt eligible for premium subsidies, catastrophic plans would likely be much more popular than they currently are if the plans were displayed among the available options in the browsing tools used by the exchanges.

How Can I Purchase Travel Medical Insurance

You may be able to purchase travel coverage through your existing private insurer, a travel agent, or your credit card. If not, there are specialist companies.

If you are travelling, even for a short period, travel insurance is important. Outside of your province, your provincial medical plan may not cover your expenses. Outside of the country, it will not. Health care in other countries, like the neighbouring United States, can be extremely expensive. In some countries, you may even be denied critical care if you are unable to pay upfront.

Recommended Reading: Starbucks Benefits For Part Time Employees

Read Also: How Long Can Your Kid Stay On Your Health Insurance

Best Catastrophic Health Insurance Of 2023

Blue Cross Blue Shield has the best catastrophic health plans

We recommend the best products through an independent review process, and advertisers do not influence our picks. We may receive compensation if you visit partners we recommend. Read our advertiser disclosure for more info.

Catastrophic health plans are sold through the Health Insurance Marketplace or your states exchange. A few companies offer them if youre under 30 or if you have a qualifying exemption that makes a Marketplace or job-based health plan unaffordable. Catastrophic plans arent a replacement for regular medical insurance. They have low premiums but high deductibles, so you pay for most routine medical expenses out-of-pocket.

But before you purchase a catastrophic plan, see if you qualify for the premium tax creditit can help you get a low-cost or free Marketplace plan with better benefits.

Whats Covered On A Catastrophic Health Insurance Plan

Catastrophic plan coverage is limited to essential health benefits, which include preventive care, hospital and emergency services, maternity, mental health, prescription drugs, and labs:

- Catastrophic plans have a fixed deductible of $8,550 for individuals and $17,100 for families

- Coverage includes three primary care visits and a limited number of preventive health screenings

- All other services are paid for out-of-pocket and count toward your deductible

Although catastrophic health plans must comply with the ACA, the plans arent eligible for tax credits. Youll have to pay the full cost and may spend more than you would with a bronze or silver plan with a tax credit.

Recommended Reading: Will Health Insurance Pay For A Service Dog

Basic Features Of Sample Families

Table reports the summary statistics of the households and the household heads characteristics. Both in IAs and NIAs, household heads are predominantly men, married, with junior high school education, and employed. The primary insurance scheme for the heads of household is NRCMS in NIAs and URRBMI in IAs. Households in IAs are mainly concentrated in the eastern urban areas. Compared with NIAs, households in IAs are more likely to attend non-primary medical institutions .

Table 1 Characteristics of households and household heads

Read Also: Shoprite Employee Benefits

What Is Catastrophe Cover

Catastrophe insurance protects businesses and residences against natural disasters such as earthquakes, floods, and hurricanes, and against human-made disasters such as a riot or terrorist attack. These low-probability, high-cost events are generally excluded from standard homeowners insurance policies.

Also Check: Can I Buy One Month Of Health Insurance

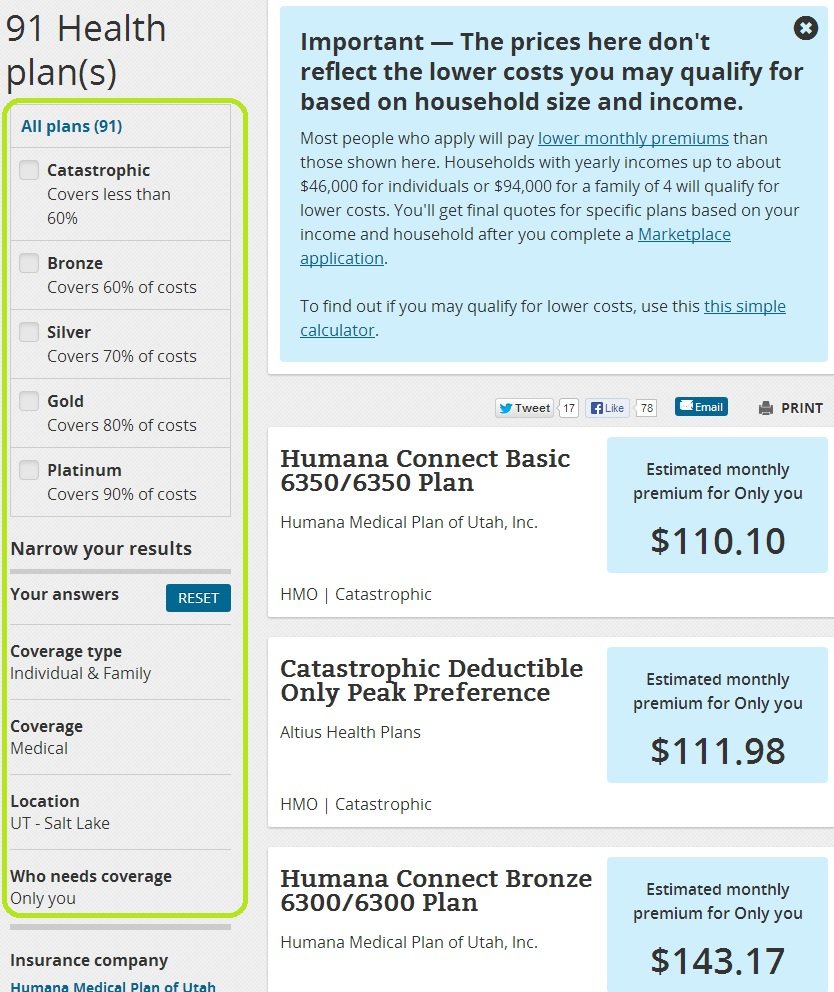

Find Affordable Healthcare That’s Right For You

Answer a few questions to get multiple personalized quotes in minutes.

Affordable Care Act Open Enrollment Period Snapshot Survey Key Findings 44% of…

Updated: February 2nd, 2022ByDan Grunebaum×

We do not sell insurance products, but there may be forms that will connect you with partners of healthcare.com who do sell insurance products. You may submit your information through this form, or call 855-617-1871 to speak directly with licensed enrollers who will provide advice specific to your situation. Read about your data and privacy.

Our mission is to provide information that will help everyday people make better decisions about buying and keeping their health coverage. Our editorial staff is comprised of industry professionals and experts on the ACA, private health insurance markets, and government policy. Learn more about our content.

Top Three Best Catastrophicinsurance Plans In 2022

There are several health insurance companies with catastrophic plans. These Catastrophic insurance companies all have varying policies and monthly premiums. Although there is always a common similarity every insurance company has its criteria. Below are three insurance companies with one of the best catastrophic health insurance plans.

Cigna

Cigna is a very popular insurance company and is often regarded as one of the big boys. This company has a wide variety of health insurance plans and policies. With high regard for customer satisfaction, Cigna is rated as one of the very best. Catastrophic health plans are one of the many available plans offered by Cigna.

An advantage of this insurance company is its online hub and awareness centers. This helps to enlighten individuals and their effective customer service helps to answer all your questions. To get a catastrophic plan Via Cigna, all you need to do is sign up, check if youre eligible and apply for a catastrophic plan.

Cigna is however only available in 10 US states. Hence, you can enjoy Cigna Catastrophic services if you reside in Colorado, Arizona, Missouri, Florida, Illinois, Kentucky, Virginia, Tennessee, North Carolina and Utah.

Blue Cross Blue Shield

Kaiser Permanente

Kaiser Permanente is highly recommended for individuals that find it difficult to afford monthly premiums. You would no doubt find one of the lowest catastrophic health insurance premiums in this insurance company.

Also Check: Do I Need Health Insurance In California

How Much Is Health Insurance

The cost of health insurance depends on many factors, including your age, plan category , tobacco use, and whether you qualify for the Advance Premium Tax Credit, which can reduce monthly premiums to $0.

For example, a single 25-year-old in Miami, Florida might pay $198.81 for a catastrophic plan from Bright Health or $262.29 for a Bronze plan. However, if that person qualifies for the tax credit, they may pay as little as $0 for the Bronze plan, but the same price for the catastrophic plan. Catastrophic coverage does not qualify for premium tax credits.

Which One Should You Choose

If you qualify and you have the money available for your deductible, then Catastrophic Health Insurance may be right for you.

If you do not qualify for Catastrophic Health Insurance or do not want a high deductible plan, a Health Share Plan can certainly be an affordable alternative.

In just a few minutes, you can get a Health Share quote online .

You May Like: Does Humana Insurance Cover Home Health Care

What Does Catastrophic Medical Insurance Not Cover

There are a few potential downsides to catastrophic medical insurance policies.

- They may not be an excellent fit for those who have chronic conditions.

- The plans may not fit the needs of people who must visit their primary care provider regularly.

- These plans tend to come with lower costs but higher deductibles.

- They dont align with health savings accounts.

- They can be more expensive without proper due diligence on cost-effective care facilities near you.

One of the more frustrating aspects of a catastrophic medical insurance plan is that it will not cover emergency care until you reach your deductible threshold. While this is something you account for as you enroll in this plan, a high deductible means that in emergency situations, you can still have a large bill.

These plans may also come with other restrictions depending on the provider of their catastrophic medical insurance option. For instance, plans may have varied visits to the PCP doctor, varying forms of the amount of preventative care, and other aspects.

It is in your best interest to have a clear understanding of the coverage present in your specific plan so that you do not have any surprises regarding the cost of care.

Be sure to thoroughly look through the pros and cons of each catastrophic insurance plan before you buy. Then, ensure your purchase meets your specific coverage needs and is worth your money.

Best For Health Management Programs: Oscar

-

Offers a wide range of health management programs

-

$0 virtual urgent and primary care

-

Mobile app that rewards you for healthy habits

-

Low NCQA rating

Oscar offers health management programs for a variety of different conditions, including asthma, heart disease, depression, diabetes, pregnancy, weight loss, high blood pressure and cholesterol, pain management, and low back pain. It also offers low premiums on catastrophic plans, but offers the most affordable health insurance coverage for other metal level plans.

Oscars catastrophic plan members also get access to a variety of customer perks, like $0 virtual primary care and urgent care through Oscar Care, plus a dedicated team to answer your medical questions. You can also use the Oscar Health app to refill prescriptions, message your care team, and make appointments. You can even earn up to $75 per year for tracking your steps on the app.

However, Oscars average NCQA rating is 2.75 out of 5, which is the lowest of the providers we reviewed.

Also Check: Is It Too Late To Change Health Insurance