Coverage Under Manipal Cigna Personal Accident Insurance

Personal accident insurance plans usually cover the following instances

- Death due to an accident

- Permanent partial disability due to an accident

- Permanent total disability due to an accident

- Temporary total disability due to an accident

- Coverage for fractures or burns suffered in an accident

- Loss of employment for which a lump sum benefit is paid

- Education fund for dependent children in case of accidental death or permanent total disability

- Participating in adventure sports or dangerous activities

- Substance abuse

Besides these coverage benefits, personal accident plans also have some exclusions which include the following

Are Health Insurance Premiums Tax

Health insurance premiums may only be deducted if total medical expenses exceed 7.5% of your adjusted gross income in a year.

Taxpayers must also itemize their deductions if they want to deduct their health-related expenses. The Tax Cuts and Jobs Act of 2017 increased the standard deduction significantly, so itemizing makes less sense for most taxpayers.

Self-employed individuals who do not qualify for employer-sponsored health insurance may deduct premiums on their taxes without itemizing.

Does The Company Offer Individual Health Plans

For the purpose of this review, we chose to examine the plans offered in Illinois as a sample again, these plans may differ from state to state. Plans are available at the Bronze, Silver, and Gold levels, with cost-sharing reduction options for those who qualify through the marketplace.

These plans all utilize the Connect network and none of them offer out-of-network coverage. Cigna does offer PPO plans elsewhere.

Don’t Miss: How Can A College Student Get Health Insurance

What Insurance Products Are Offered By Cigna

Cigna offers a variety of individual and group health insurance plans that differ from state to state. The website lists nine states in which individual plans are offered but provides employer-sponsored group plans across a larger region. Currently, Cigna offers individual plans in Arizona, Colorado, Florida, Illinois, Missouri, New Jersey, North Carolina, Tennessee, and Virginia.

Beyond major medical, they also have an array of supplemental health plans available.

Benefits Of Health Insurance

The main purpose of health insurance is to receive timely and effective medical care without putting any strain on your savings. Health insurance plans offer financial protection owing to increasing medical costs. Health insurance policies cover most medical expenses some include hospitalization expenses, day-care procedures, domiciliary expenses and ambulance charges.

Here are a few other benefits of having a health insurance plan:

1. Financial cover against medical expenses

2. Financial cover against critical illnesses

3. Cashless claim benefits

4. Additional financial cover in addition to the cover given by employers

5. Tax exemption benefits

You May Like: How To Apply For Low Cost Health Insurance

Members Benefits And Resources

Cigna policyholders can take advantage of some additional benefits, including the online portal and mobile app. Policyholders can use these tools to monitor their claims, view their Cigna health ID cards and find in-network doctors. Cigna enrollees can also sign up for recurring medication delivery. Pharmacists are on-call to answer questions and fill prescriptions 24/7.

How To File A Claim With Cigna And Aetna Insurance

Cigna

To file a claim with Cigna Health Insurance, use this form. Follow instructions on page 2 of the form. Mail your completed claim form with original itemized bills, to the Cigna HealthCare Claims Office, which is printed on your Cigna HealthCare ID card. For questions, you may call 1 997-1654.

Aetna

If you use a network doctor or hospital, your claims will be submitted by that provider. If you see an out-of-network provider, you need to submit the claim yourself. You must submit a completed claim form or alternative documentation via fax or mailing address. As an alternative to sending a claim form, supply a description of services, a bill of charges from the provider and any medical documents you received from your provider.

Don’t Miss: How Do I Find My Health Insurance

The Absolute Worst Ever

The absolute worst ever. I enrolled with Cigna Preferred Medicare HMO at the end of April 2020 effective date May 1, 2021. As of today I have been unable to register on their website and I constantly encounter issues with doctors’ offices having difficulty confirming my account. After having spent hours on the phone with customer service I have given up and now await open enrollment. I wouldn’t recommend Cigna to ANYONE.

Reply from Cigna

Awful pointless insurance, how can three fillings end up costing me nearly £1000!! Lack of transparency, misleading documentation and limits that make the insurance pointless.

Reply from Cigna

How Much Does Health Insurance Cost

Health insurance plans can vary greatly in cost based on factors such as your health, your geographic region, the amount of your deductible, and copay requirements. Its a good idea to compare the total costs and benefits of the plan and not just look at the premium.

Policies with lower deductibles generally allow you to pay less upfront, but youll pay a higher monthly premium in exchange for that. Youre effectively paying more on a monthly basis rather than all at once through a deductible when you need care. You might also be responsible for a co-pay, a fixed percentage of the balance remaining after youve paid your deductible. You and the insurance company are sharing the costs.

Health insurance you might receive through your employer is typically cheaper than purchasing a policy on your own.

Read Also: How To Get Health Insurance For My Parents

How To Make A Health Insurance Claim

Here is how you can make an health insurance claim to ensure that you are either reimbursed for your expenses or the health insurance provider can make a cashless payment on your behalf.

- Step1: Your pre-authorization form and medical records will be submitted by the hospital TPA to insurer TPA as specified in your policy card

- Step 2: After assessing your claim request, an initial approval will be given.

- Step 3: In case during hospitalization, there is a need to increase the approved cashless amount, the relevant documents need to be submitted by the hospital TPA desk to the insurer for enhancement.

- Step 4: At the time of discharge, the hospital TPA will submit your final bill and discharge summary to insurer TPA.

- Step 5: After final enhancement of your claim request, the insurer TPA gives final approval for the final billed amount.

- Step 6: Once the final approval comes, there are some non-payable items and expenses depending on your policy terms, which are not covered by your insurance as per regulations. Please settle them with the hospital to complete the discharge formalities

Read More: Steps to Make Cashless Claims towards Health Insurance

How Much Are Cigna Insurance Rates

Is Cigna good health insurance? This review was written outside of open enrollment, and as a result, Cigna was not offering rate quotes on its website. The site instead directs visitors to the marketplace website to compare quotes here those who qualify for special enrollment can compare rates from multiple companies and not just Cigna.

That website required a series of qualification steps, and as a result, we were unable to obtain quotes.

It is unusual for a company as big as Cigna to make it difficult for visitors to get a quote, even outside of open enrollment. Since any number of reasons may qualify a person for special enrollment, quoting should be readily available at all times. This is the first major health insurer we have encountered this issue with Cigna insurance quotes are simply not available all year unless you qualify for enrollment.

Read Also: Where Do You Go If You Have No Health Insurance

Things To Know About Manipal Cigna

Important highlights about the company, which are worth a mention include the following

- The company is present across 15 leading cities of India

- The company received the award of Economic Times Best Promising Brand in the year 2015

- Manipal Cigna is the official health insurance partner of two leading marathons Standard Chartered Mumbai Marathon and Airtel Delhi Half Marathon .

Cigna Medicare Advantage 2021 Review

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Cigna is the seventh-largest provider of Medicare Advantage , offering plans in almost half of U.S. states. The insurer also offers stand-alone Medicare drug plans nationwide.

Although most of Cignas Medicare Advantage members are in highly rated plans, the companys offerings dont always get top marks from third-party rating agencies.

Heres what you should know about Cigna Medicare Advantage.

Read Also: Can You Get Health Insurance After Open Enrollment Ends

What Is The Gold Plan

There is only one plan at the Gold level, and it also has a few cost-sharing reduction options. This plan is the Cigna Connect 1400, which has a $1,400 individual deductible and a $2,800 family deductible.

While both primary care visits and specialist visits are covered before the deductible is met at $15 and $50 copays respectively many other services are still subject to the deductible and covered with a 20 percent coinsurance thereafter.

The deductible on this plan is relatively low, but a Cigna Gold plan typically has better types of coverage than what we see here. Prescriptions on the Gold plan have the same copay amounts as the Silver plans again, surprising.

Cigna Medicare Advantage Service Area

Cigna offers Medicare Advantage Prescription Drug plans in 23 states and Washington, D.C., and Medicare prescription drug plans in all 50 states and Washington, D.C. Altogether, Cigna offers Medicare Advantage plans in 369 counties .

Overall, Cigna is the eighth-largest health insurer in the country , and it is the sixth-largest in terms of for-profit health plans . More than half a million Medicare beneficiaries are enrolled in Cigna Medicare Advantage plans .

Don’t Miss: Does Health Insurance Pay For Abortions

How We Reviewed Medicare Providers

Even Medicare health plans with a national presence can vary locally in their cost, quality, and customer satisfaction. To evaluate Medicare plans, we looked at health insurance industry ratings from the primary accrediting agency for health plans, NCQA, and the Medicare Star Ratings from CMS, the regulatory agency that oversees Medicare. We included the National Association of Insurance Commissioners complaint index, and AM Bests financial stability ratings. We also considered information from the companies on their programs and strategies.

Cigna Medicare Supplement Insurance Plan Options

Cigna has five Medicare Supplement Plans. Plans G, N, and A are available if youre on Original Medicare. Plans F and High Deductible Plan F are only available if you were first eligible for Medicare before 2020.

Most plans cover all Medicare Part A deductibles and provide coinsurance and coverage for hospitalization, skilled nursing, and hospice. Only plans F and High Deductible Plan F cover Medicare Part B deductibles. All provide coinsurance or copays for Medicare Part B. Benefits covered by these plans are the same across all insurers the only difference is premiums may vary depending on health, age, gender, and where you live.

Cigna offers several additional programs, including Healthy Rewards and a Health Information Line. The Healthy Rewards program offers discounts and savings for a variety of health and wellness programs. Compare your Cigna Medicare Supplement Plan options.

| Plan name |

*Based on pricing in Miami, FL

Don’t Miss: How Much Do You Pay For Health Insurance

What Does Health Insurance Cover

Health insurance typically covers the costs of medical, prescription, and surgical services. It pays for your care if you get sick or injured, as well as preventative care such as vaccines and wellness checkups with your doctor. It pays for most prescription drugs and medical devices.

Health insurance doesnt cover elective surgical procedures or beauty treatments, however, and its not the same as accident insurance. Health insurance will most likely cover your medical expenses if youre involved in an accident, but accident insurance is a supplemental policy that gives you a lump sum to help pay for your out-of-pocket accident-related costs.

Comparing Health Insurance Terms

1. Beneficiary vs Nominee: A beneficiary is a person or entity that gets the insurance proceeds when the insured dies. And a nominee is the person that receives the insurance proceeds when the insured dies. Here, the nominee receives the proceeds but may not be able to use it.

2. Sum assured vs Sum insured: Sum assured is a pre-defined amount that is to be paid in case of an eventuality. Life insurance works on the sum assured. While sum insured is the upper limit of the pay-out an insurer is liable to pay in case of any eventuality to the insured. Health insurance works on the sum insured.

3. Agent vs Aggregator: An insurance agent is nothing but a sales representative of an insurance company. An aggregator is a platform where a buyer can see and compare several plans to suit his/her needs.

4. Co-pay vs Co-insurance: Both co-pay and co-insurance are out-of-pocket expenses that are needed to be borne by the insured. The difference, however, is that while co-pay is a fixed sum that needs to be paid, co-insurance is a fixed percentage of the entire claim amount.

Read Also: What Health Insurance Is Available In Nc

Pros And Cons Of Cigna Medicare Supplement Insurance Plans

| What we like about Cigna Medicare Supplement Plans: | The drawbacks of Cigna Medicare Supplement plans: |

|

|

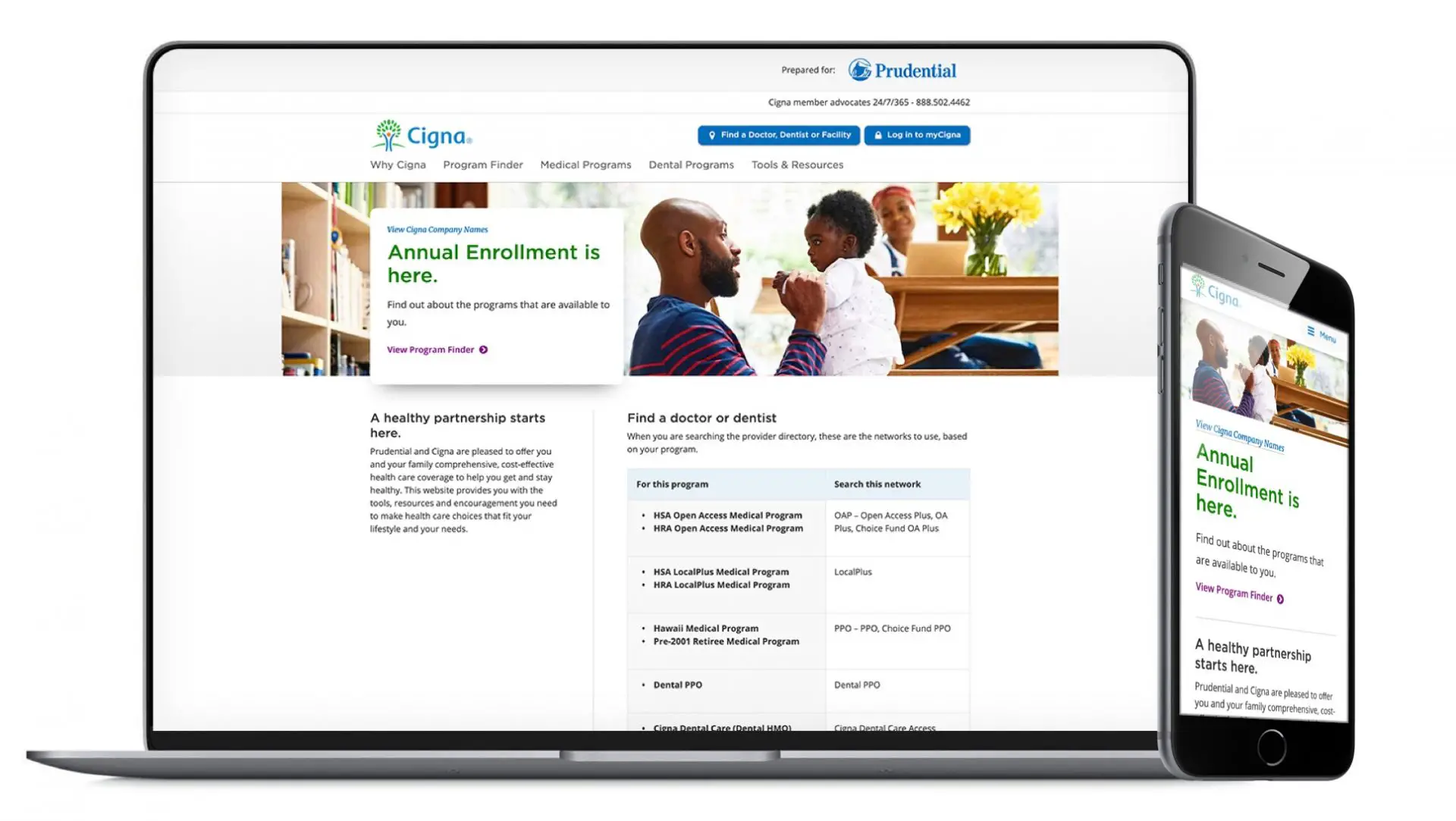

Online Access To Your Plan

myCigna.com gives you 1-stop access to your coverage, claims, ID cards, providers, and more. Log in to manage your plan or sign up for online access today.

Accidental injury, critical illness, and hospital care.

Controlling costs, improving employee health, and personalized service are just a few of the ways we can help your organization thrive.

Use Cigna for Brokers to access everything you need to manage your business and complete enrollments.

Getting ready to enroll with Cigna through your employer?

Recommended Reading: Can I Stop My Health Insurance Anytime

What Is The Process For Manipal Cigna Cashless Health Insurance Claim

- If you are getting hospitalised in a networked hospital, it would be a cashless claim. You should inform the insurance company immediately of your claim

- Fill up a pre-authorization form stating the claim details and submit the form to the insurance company.

- If it is a planned hospitalisation, the form should be filled in and submitted at least 3 to 5 days before being hospitalised. If, on the other hand if the hospitalisation is due to an emergency, fill up the form and submit it within 24 hours of hospitalisation

- The insurance company would verify the pre-authorization form and approve the claim

- Once the claim is approved you can avail cashless treatments. The medical bills would be settled by the insurance company directly with the hospital

- A Manipal Cigna Health Insurance claim form should be filled and submitted with the insurance company along with all the medical documents to complete the claim process.

Most Common Exclusions Of Health Insurance Plans

- Pre-existing health conditions

Any sort of pre-existing health conditions, illness or medical conditions that the insured may or may not be suffering at the time of buying the health insurance plan are not covered. The insurance plan he/she opts for covers unforeseen medical situations. However, do note that pre-existing health conditions are covered, but with a clause of a waiting period. The waiting period for such pre-existing health conditions are defined in the policy kit.

- Cosmetic Surgery

Any form of cosmetic procedures and dental procedures that are done to enhance the physical look and appearance is excluded from health insurance. However, it is essential to note that when it is recommended by a doctor, medical practitioner, specialist or a general physician due to an accident and /or injury, then it is covered under your health insurance plan. In addition to these, joint replacement surgeries are also excluded from common health insurance plans.

- Injuries caused but intentional self-harm and suicide attempts

It is important to note that intentional suffering and injury caused to oneself or a harmful attempt to end ones life is not covered under any health insurance plan. Do keep in mind that such physical injuries are under, all circumstances , never covered by any health insurance policy.

- Alternative Treatment and Special Therapies

You May Like: What Is The Health Insurance For Low Income

What Are Cigna Insurances Financial Strength Ratings And Consumer Reviews

Is Cigna insurance any good? Cigna has an A+ rating with the Better Business Bureau which rates a variety of providers, with 426 total complaints on file in the past three years. While you may have heard people call Cigna HealthCare the worst insurance ever, its worth noting that 165 of those complaints were closed in the past 12 months. For such a huge company, thats not a particularly high complaint volume.

Since Cigna HealthCare serves a number of states under a variety of company names, there is more than one report on this company from the National Committee for Quality Assurance.

An overview of most of the states Cigna Corporation serves shows an average rating of 2.5-3.5, with an even three in most states. Only in Maryland did the company earn a four rating.

Consumer Affairs has 644 reviews of Cigna HealthCare, most of which are negative. Most of the complaints against Cigna healthcare insurance cite denied claims and poor customer service. Again, the complaint volume is not high for a huge company, and although the comments are similar in nature, they are generally the same complaints we see with most health insurance companies.

Cigna has been at the center of a few controversies, most notably a 2007 case where the company denied a liver transplant to a patient who died while the case was being appealed.