How Much Does An Emergency Visit Cost Without Health Insurance

A trip to the emergency room will also cost $50 to $150 just to check-in without insurance. But this is where the big numbers come in: the tests and the doctors fees.

Your $50 to $150 goes to the hospital. The doctor you see may charge you another $100 to upwards of $1,000 for the level of service. And an ER visit may require CT scans, MRIs, or more, all with a price. Those X-rays at $140 and CT scans up to $1,146 are fully your responsibility. If you are admitted for an overnight stay, the hospital room and service will be additional, as well.

Healthcare Blue Book found an ER visit for a minor problem ranges from $431 to $1,343. The prices climb by the severity of the health issue with a very severe problem, pricing between $1,056 to $3,295.

What Is An Employee Benefits Package Worth

Your hourly rate or salary and job description are important but taking time to look at the entire employee benefits package and comparing them when you have more than one job offer matters too.

Consider the job responsibilities andtotal compensation youve been offered and look at the value of each benefit and how it will impact your budget, your day-to-day life, and your future.

Sometimes a potential employer with a lower-paying job may actually offer better benefits to employees than the company with the high-paying job, so review the entire compensation program direct comp + benefits.

The Costs Of Health Insurance

Kaiser Family Foundation reviews all healthcare providers and in 2020 reported the average health insurance premium is $462 per month.

Of course, when you add a family to the mix, the insurance premiums are even greater and it continues to rise.

While employers will cover most of the premiums for single employees, they do not take on those costs when it comes to a spouse or children. The National Conference of State Legislators reported single employees paid 18% of the costs of insurance premium but for family coverage, the employees paid 29%.

Also Check: Is There Still A Penalty For Not Having Health Insurance

What Is The Average Cost Of Health Insurance

Updated on Thursday, March 11 2021 | 0 min. read| by Aaron Besson

While the average cost of health insurance is $452 a month, many factors can change that. How do your rates compare?

The average cost for individual health insurance in 2021 is $452 a month. This cost may vary depending on where you live and how much coverage you want. This article will cover:

Medical Emergencies Can Bankrupt You

Medical emergencies are very expensive. If you have the misfortune of undergoing a medical emergency without insurance, it is easy to find yourself with a crippling amount of medical debt, and seemingly no way out of the mess.

If you take good, preventive care of your health, it’s hard to see why you’d really need insurance. However, being hit by a car and becoming seriously injured, or even just missing that last stair at home and dislocating an ankle could cause an injury that costs you thousands of dollars in medical bills, and it can quickly climb higher if you need surgery or any kind of ongoing rehabilitation. Emergency surgeries such as appendectomies can be very expensive as well.

You may not be able to work while you’re laid up, and that means that you could lose out on pay as well. Even with insurance, you may find it difficult to pay for health care costs in these instances. It is very hard to pay for medical costs without health insurance, especially if you are checked into a hospital even just overnight.

You May Like: Does Progressive Do Health Insurance

Beyond Your Monthly Premium: Deductible And Out

- Deductible: How much you have to spend for covered health services before your insurance company pays anything

- Copayments and coinsurance: Payments you make each time you get a medical service after reaching your deductible

- Out-of-pocket maximum: The most you have to spend for covered services in a year. After you reach this amount, the insurance company pays 100% for covered services.

How Much Does Group Health Insurance Cost

When an employer provides health insurance coverage to employees, the business purchases a plan to cover all eligible employees and dependents. This type of coverage is commonly called a group health insurance plan or a fully-insured plan.

According to the Kaiser Family Foundation , in 2021, the average cost of employee health insurance premiums for family coverage increased by 4% from the previous year to $22,221. The average annual premiums for an individuals plan also increased 4% to $7,739.

Many employers also changed their offerings on telemedicine, mental health coverage, and wellness programs following the COVID-19 pandemic. Although these numbers vary by company and provider, the average insurance costs continue to rise year over year.

Don’t Miss: Can A Significant Other Be Added To Health Insurance

Individual Health Insurance Premiums On The Exchanges

The federal insurance plan marketplace at HealthCare.gov, aka Obamacare, is alive and well in 2021, despite years of its political foes’ efforts to kill it. It offers plans from about 175 companies. Some 12 states and the District of Columbia operate their own health exchanges, which basically mirror the federal site but focus on plans available to their residents. People in these areas sign up through their state, rather than the federal exchange.

Each available plan offers four levels of coverage, each with its own price. In order of price from highest to lowest, they are labeled platinum, gold, silver, and bronze. The benchmark plan is the second-lowest-cost silver plan available through the health insurance exchange in a given area, and it can vary even within the state where you live. It’s called the benchmark plan because it’s the plan the government usesalong with your incometo determine your premium subsidy, if any.

The good news is prices are going down a bit. According to the Centers for Medicare & Medicaid Services , the average premium for the second-lowest-cost silver plan decreased by 4% on HealthCare.gov from 2019 to 2020 for a 27-year-old. Six states experienced double-digit percentage declines in average second-lowest-cost silver plan premiums for 27-year-olds, including Delaware , Nebraska , North Dakota , Montana , Oklahoma , and Utah .

Flexible Spending And Health Savings Accounts

Some employers choose to offer Flexible Spending Accounts and Health Savings Accounts .

These plans are like personal savings accounts. But you can only use funds in the accounts for qualifying medical expenses.

You can use a medical FSA to pay for eligible medical, dental, or vision care expenses not covered by insurance.

HSAs can only be used with High Deductible Health Plans and are similar to a 401.

According to HealthCare.gov, an HSA can be used to pay deductibles, copayments, coinsurance, and some other expenses.

This includes the ability to save money for future healthcare expenses too.

As an employee, you can determine the amount you want to contribute. And the contribution of funds to the account is on a pre-tax basis, reducing your tax liability.

Employers have no requirement to contribute to FSA or HSA plans, but they may as an additional employee benefit.

One other employer-sponsored benefit is an HRA. This Health Reimbursement Account can be used to reimburse an employee for out-of-pocket medical expenses.

Your employer funds these types of accounts. You may even be allowed to roll the money over from year to year if funds are not depleted.

Recommended Reading: Which Health Insurance Company Is The Best In Texas

Total Compensation Is Much More Than Just Your Salary

Your salary is the most obvious measure of how much your employer values your work, and it’s typically what prospective employees look at first in deciding whether to seek a particular job. Yet benefits now make up an increasingly large proportion of the total compensation that workers receive, and businesses have to look carefully at the cost and value of benefits in order to make sure they attract the best job candidates. By understanding how much your benefits are worth, you can make a true apples-to-apples comparison between jobs and make more informed decisions in your career path. In particular, the following benefits are common and can add considerable value to your compensation package.

How Much Is Needed For Health Care Costs In Retirement

According to the Fidelity Retiree Health Care Cost Estimate, an average retired couple age 65 in 2022 may need approximately $315,000 saved to cover health care expenses in retirement.

Of course, the amount youll need will depend on when and where you retire, how healthy you are, and how long you live. The amount you need will also depend on which accounts you use to pay for health caree.g., 401, HSA, IRA, or taxable accounts your tax rates in retirement and potentially even your gross income.2

Tip: If you’re still working and your employer offers an HSA-eligible health plan, consider enrolling and contributing to a health savings account . An HSA can help you save tax-efficiently for health care costs in retirement. You can save pretax dollars , which have the potential to grow and be withdrawn tax-free for federal and state tax purposes if used for qualified medical expenses.3

Read Viewpoints on Fidelity.com: 5 ways HSAs can fortify your retirement

You May Like: How Much Does Short Term Health Insurance Cost

Where Can You Buy Small

- Directly from an insurance provider in your state.

- Using an insurance broker. The broker will shop for policies tailored to your business. Theyll charge a commission , and may also charge a brokers fee. Some payroll products, such as Gusto and QuickBooks Payroll, allow you to buy health insurance from brokers on their platforms.

- Using the Small Business Health Options Program: SHOP is the federal government’s insurance option for businesses with fewer than 50 full-time equivalent employees . Most states require at least 70% of your eligible employees to participate in the SHOP health plan you offer.Businesses with fewer than 25 employees may qualify for a small-business health care tax credit worth up to 50% of premium costs.

- Using a Professional Employer Organization. A PEO is a company you can hire to administer benefits on your behalf. PEOs can legally become the co-employer of your employees. By serving as co-employer for multiple small companies, PEOs have a combined employee pool equivalent to that of a larger company. This gives them access to more competitive insurance rates than small businesses can typically get on their own.

- Qualify for QSEHRA. This is an arrangement for small businesses that offers employee reimbursement for qualified health expenses. Employees are not allowed to contribute through their paychecks and employer contribution terms to each employees QSEHRA must be the same.

Why Health Reimbursement Arrangements Are An Effective Way To Control Costs

Instead of purchasing a group health insurance policy and paying premiums set by the insurance company, an alternative strategy is to use an HRA to reimburse employees for premiums and out-of-pocket medical expenses.

Options such as a qualified small employer HRA or individual coverage HRA are simple and inexpensive solutions that work for any small business. Employers can choose whether they want to reimburse for health insurance premium costs or premiums and out-of-pocket expenses.

The Affordable Care Act created the QSEHRA specifically for small businesses with fewer than 50 full-time equivalent employees .

There is also the option of providing a group coverage HRA , also known as an integrated HRA, to help bridge the gap between offering a traditional group plan while minimizing premium costs.

With an HRA:

- The employer sets an annual or monthly allowance they will agree to reimburse employees for medical costs

- Employees purchase their own health insurance plan on a private exchange or the health insurance marketplace

- Employees are able to choose a plan from a provider of their choice that has the features they need most

- As employees pay premiums and associated medical costs, the employer reimburses the employee for eligible expenses up to their allowance balance

The cost savings from providing an HRA are significant. The employer controls the allowance they decide to offer, making the actual cost of the reimbursement amount affordable and customizable.

Recommended Reading: Does Health Insurance Cover Braces

The Costs Of Healthcare Coverage

No matter which type of coverage you choose, you’ll still be responsible for all premiums, deductibles, copayments, and coinsurance. For the lowest monthly payment, you can choose to go with Original Medicare — but you’ll face higher out-of-pocket expenses. With an Advantage plan, you’ll likely have higher premiums, but greater coverage and fewer out-of-pocket costs.

Most people won’t pay a premium for Part A coverage as long as you’ve paid Medicare taxes for at least 10 years, but you will have a deductible of $1,364 per benefit period — which begins when you’re admitted to a hospital and ends 60 days after you leave the hospital. Then with Part B coverage, the standard premium is $135.50 per month, but it may be higher depending on your income. Part B also has a deductible, though it’s just $185 per year.

If you also enroll in Part D coverage, that will be an additional cost. This type of insurance is offered through private, Medicare-approved providers, so prices will vary based on your individual plan, but the maximum deductible for 2019 is $415 per year.

Medicare Advantage plans are also offered through third-party insurance companies, so rates can vary widely based on your location, the provider, and the amount of coverage you’re receiving. But you’ll typically still have to pay a premium, usually along with the standard Part B premium as well.

The Motley Fool has a disclosure policy.

How Health Stipends Can Be A Cost

While HRAs are an excellent option for organizations looking to lower their health benefit costs, they arent always the best choice for some employers.

If youre looking to add an HRA as your first health benefit or cancel your group health insurance policy, youll need to consider premium tax credits eligibility. Some of your employees might become eligible for premium tax credits without an employer-sponsored group health insurance plan.

With a QSEHRA, your employees must reduce their advance premium tax credit by the amount of their QSEHRA allowance. Meanwhile, employees who are offered an ICHRA must choose whether to waive their APTC and take the ICHRA or keep their tax credits and opt-out of the health benefit. This is based on affordability.

These employees cant take advantage of their employer-sponsored health benefits and receive premium tax credits simultaneously.

Health stipends can help to alleviate these concerns. Employee health stipends are like an HRA, except theyre taxable, more flexible, and have fewer regulations. This allows stipends to be a flexible option for all types of organizations.

If your employees receive tax credits, they can keep those credits and take advantage of your employee health stipend.

Whats more, health stipends are also a great option for organizations with employees in other countries.

Don’t Miss: How Can You Buy Health Insurance

Healthcare Is One Of The Biggest Expenses You’ll Face In Retirement So It Pays To Pick The Right Insurance

When you’re preparing for retirement, healthcare expenses are probably one of the last things on your mind. But retirees can end up spending tens of thousands of dollars on healthcare alone during their golden years, making it one of the most crucial costs to prepare for.

The average retiree spends around $4,300 per year on out-of-pocket healthcare costs, according to a study from the Center for Retirement Research at Boston College, and that doesn’t include long-term care. Medicare will help cover some costs, but coverage is far from free, and you’ll still face some out-of-pocket expenses.

Health insurance in retirement is widely misunderstood, which can be an expensive problem. Seventy-two percent of adults over the age of 50 admit they don’t fully understand how Medicare works, a survey from the Nationwide Retirement Institute found, and more than half believe that coverage is free. In order to avoid any pricey surprises, it’s important to understand which costs you’re responsible for, what your insurance will cover, and how much coverage will cost.

How Much Does A Primary Care Visit Cost Without Health Insurance

If you choose to forgo health insurance, you will have to pay the full fees for doctor visits. Perhaps you are healthy and only need an annual checkup?

The average cost of visiting a doctor for a checkup without health insurance can cost between $200 and $300. A new patient office visit up to 30 minutes can cost upwards of $578, according to the Healthcare Blue Book.

Recommended Reading: How To Get Health Insurance In France

Types Of Dental Plans

As we mentioned earlier, different types of dental plans can affect your out-of-pocket costs. Depending on the type of plan you choose, youâll also have different levels of flexibility when it comes to choosing a provider. Consider whether cost or choice is more important when you decide which plan might be the best fit for you.

Dental plans generally fall into three categories:

- Indemnity or fee-for-service plans

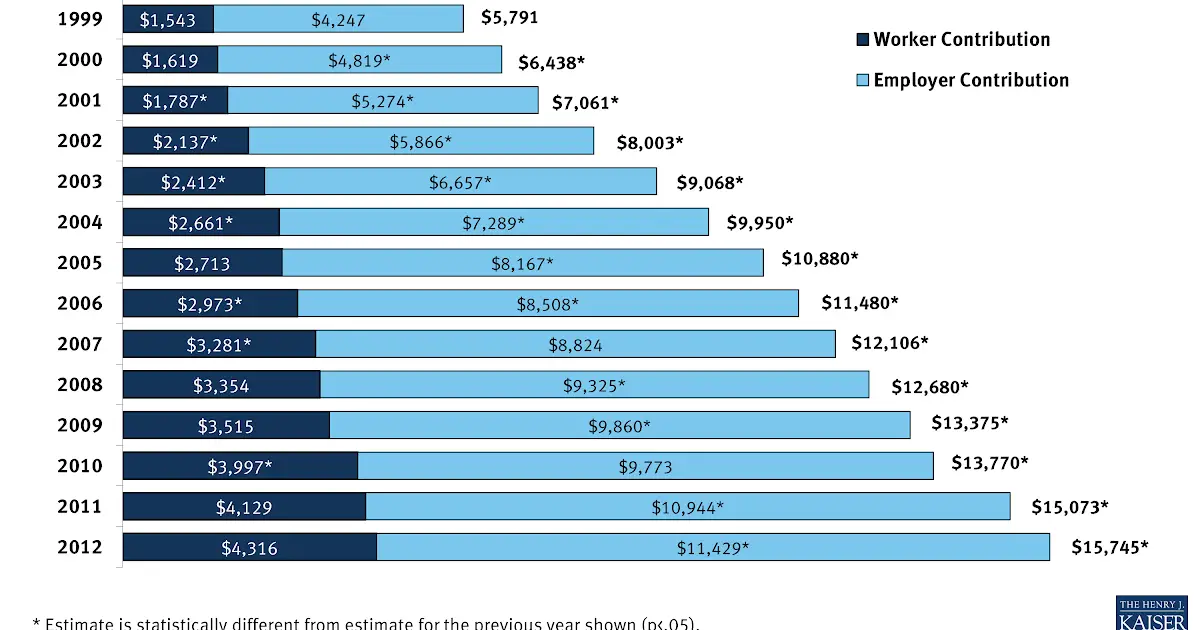

How Has The Average Cost Of Employer

Average employer-provided health insurance costs have increased modestly in recent periods. The KFF 2019 survey found that the average single premium increased by 4 percent, and the average family premium increased by 5 percent over the previous year.

However, a long-term view of employer-sponsored healthinsurance costs reveals a larger change in the costs over time. According tothe KFF report, the average premium for employer-sponsored family healthcoverage increased 22 percent over the last five yearsand 54 percent over the last ten years.

Although average premium costs have risen over the pastseveral years, employer-provided health insurance may often be a more affordable option than individual healthinsurance coverage.

Source:Kaiser Family Foundation 2019 Employer Health Benefits Survey

Don’t Miss: Where To Get Health Insurance When Unemployed