The Importance Of Visiting A Therapist

Around 450 million people, one in four individuals, suffer from mental health disorders that impact their daily lives. However, only about 40% of individuals with a mental health disorder seek treatment. In todayâs world, especially given the social isolation that the pandemic has posed on us and the age of social media, these mental health problems have begun to impact more and more individuals of younger ages.

Therapy serves as an outlet to taking steps in bettering oneâs mental health. In therapy, individuals are taught skills to address symptoms on their own. Because of this, research has shown that the benefits of therapy outlast the benefits of medication alone.

Factors Affecting The Cost Of Uk Private Medical Insurance

- Your age

The cost of private health care depends on two main factors: your personal circumstances and the policy options and cover levels that you choose.

We go into more detail on cover options in Best Health Insurance, but in brief your circumstances can mean how old you are, where you live, whether youre insuring just yourself or a whole family and so on.

It also includes things like your lifestyle choices whether or not you smoke, for instance. However, even if youve quit smoking but use a vaporiser, your premium can still be higher than somebody who doesnt smoke at all. This is because insurance companies usually ask about nicotine consumption rather than smoking cigarettes specifically.

Considering Public Health England found that e-cigarettes are 95% less harmful than smoking, we think this hike in premiums is unfair. For this reason, weve teamed up with ActiveQuote to get vapers a 10% cashback deal on their health insurance. Join our group to get a quote.

Cover levels mean the options and limits you select to cover treatments or amounts that the basic cover would not. We explore the cost of these below.

Insurance For Families In California

If youre shopping for coverage for multiple household members, you must apply the same considerations to each person who needs health insurance. In some cases, it makes sense to purchase a low-cost plan and use it only if one of your family members has a serious illness or injury. In other cases, paying a higher monthly premium can help you save money on doctor visits, emergency care, lab tests, and other medical services. For example, if your child has a chronic heart condition, a plan with a high deductible and high out-of-pocket maximum may cost you more than a plan with a higher premium and lower out-of-pocket costs. You may also want to choose a plan based on the size of the network to ensure your family members can continue seeing their preferred providers.

You May Like: Starbucks Partner Health Insurance

Cost Sharing And Your Premium: A Balancing Act

The higher your cost sharing , the lower your monthly premium will be. The monthly premium for a plan where you pay a larger percentage of the costs will be lower than a plan where you pay less out-of-pocket. For example, a plan where you have a 30% co-insurance will have a lower premium than a plan in which you pay only 20% co-insurance. Your cost-sharing has an annual maximum , and the higher that maximum is, the lower your monthly premium.

You will want to think about the costs of premiums and annual out-of-pocket costs. They are related. For example, young, healthy people often like plans with higher cost-sharing but lower monthly premiums. This is because they do not expect to got to the doctor very much. Older people or people with health problems who choose this same lower monthly premium plan would end up paying a lot more. That is because these groups need more care and visit the doctor a lot. This is why some older people or people with health problems choose insurance with higher premiums. They know their out-of-pocket costs when they visit the doctor or hospital will be less.

Basic Health Insurance Terms

If youre just learning the ins and outs of health insurance, I feel your pain. Health insurance is complicated stufflike rocket-science complicated. You might not even know where to start.

Before we look at how much health insurance costs, lets break down some terms into plain English.

First, there are only two main kinds of health insuranceprivate and public.

Private coverage is health insurance through your employer, union or even the armed forces. You can also get it on your own through the governments marketplaceHealthcare.gov.

Public insurance is provided by the government. It includes Medicare , Medicaid or care from the Department of Veterans Affairs.

Your premium is the amount you pay monthly for your coverage.

The deductible is the amount you have to fork over before your insurance company starts chipping in.

Your maximum out-of-pocket costs are the limit to what you will pay in a year. For example, if your plans maximum out-of-pocket costs are $8,000, once you pay that amount, your insurance company will cover everything above that through the rest of the year. It acts as a financial safety net so you dont totally break the bank from medical costs.

Also Check: Does Insurance Cover Chiropractic

Cobra Insurance In California

In California, COBRA insurance is available and required to be offered by employers. COBRA insurance allows for the continuation of group insurance benefits for a specified time if you were fired or quit your job. This insurance only allows for the extension of coverage if the employee and their dependents have experienced a qualifying life event.

Group Coverage Also Known As Employer

Companies that provide health insurance to employees as a benefit provide an insurance type known as group insurance. The cost of this type of health plan is based on total premiums paid to the insurance company. Premiums include payments from both employers and employees. Premiums do not include payments for services such as deductibles, co-pays or other out-of-pocket costs. Group coverage includes: Health Maintenance Organizations , Preferred Provider Organizations , Point-of-Service Plans and High-Deductible Health Plans.

Read Also: Does Costco Offer Health Insurance For Members

What To Know About Insurance In California

- California has a state-sponsored health insurance exchange, but youre not required to use it if you dont qualify for a subsidy or dont want to utilize your If this applies to your situation, you can purchase health coverage through an agent or broker or directly from an insurance company.

- Open Enrollment: California has an expanded open enrollment period compared to most states. For insurance coverage starting in 2022, you can enroll between November 1, 2021 through January 31, 2022.

- Special Enrollment: Once the COVID-19 enrollment period ends, you may be able to enroll in a new health plan if you have a qualifying life event. Qualifying events usually result in a loss of coverage or a change in eligibility for your previous plan. For example, you may qualify for a special enrollment period if you give birth, lose your job, or move to California from another state.

- Covered California: State and federal officials closely regulate insurance prices. If you decide not to use Covered California, you wont pay any more for your insurance plan than you would if you purchased a plan from the exchange.

- Coverage types: In California, 48% of insured residents have group health coverage. Another 25.3% have Medicaid, 11.4% are enrolled in Medicare, 6.6% have non-group coverage, and military insurance plans cover 0.9%. Just under 8% of Californias population is uninsured.

What Are California’s Medicare Options For Seniors And People With Disabilities

Medicare is another option if youre looking for affordable health insurance in California. When its time to enroll in Medicare, you have two options:

- Original Medicare is a basic plan that doesnt include prescription coverage and doesnt cover vision exams for glasses, routine dental care, or other services. Because Original Medicare is considered a no-frills plan with only hospital and medical insurance, you have the option of signing up for Medicare Part D and Medicare Supplement Insurance to make your Medicare costs more manageable. Medicare Part D covers your prescription medications, while Medicare Supplement Insurance fills some of the gaps in Original Medicare. For example, you can use Medicare Supplement Insurance to pay your Medicare deductible.

- Medicare Advantage Plans are all-in-one plans that give you more coverage. Offered by private insurance companies, these plans typically include prescription coverage and may even cover hearing aids and other extras that arent included in Original Medicare. Another benefit of Medicare Advantage is that multiple plan types are available, including HMO plans and PPO plans, giving you more flexibility when choosing doctors and medical facilities.

Eligibility

Enrollment

Medicare Resources

Recommended Reading: Evolve Health Insurance

Why Is Life Expectancy In The Us Lower Than In Other Rich Countries

The graph below shows the relationship between what USA as a country spends on health per person and life expectancy in that country between 1970 and 2015 for a number of rich countries.

The US clearly stands out as the chart shows: Americans spend far more on health than any other country in the world, yet the life expectancy of the American population is shorter than in other rich countries that spend far less.

What are the best places for healthcare globally?

What Is The Average Cost Of Health Insurance Per Month In California

California residents can expect to pay an average of $487 per person* for a major medical individual health insurance plan. Prices will vary and premiums can be lower if you are in good health.How much does health insurance cost in California? Metal Level Average Monthly Premium* Silver $557 Gold $715 Platinum $942.

Also Check: Starbucks Health Insurance Eligibility

Keep Track Of Your Bills

- Keeping track of your bills helps you protect yourself from fraud.

- You may get something in the mail that says, “This is not a bill.” It may be called an Explanation of Benefits . You should not pay it.

- If you do not understand a bill, call the people who sent it to you. You have a right to get an explanation.

- If you think the bill is wrong, call your health insurance company. You can file a complaint or appeal if you disagree with the bill. Use this form to do so.

- If you have two insurance policies, usually one policy pays first. Talk to your insurance companies to make sure you understand what to do with your bills.

Cheapest Health Insurance By Age

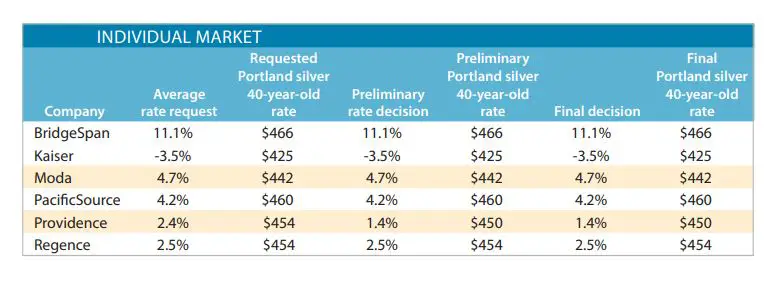

A key factor for the price of health insurance is your age.

For example, for a Silver health plan, a 40-year-old in California will pay 28% more on average for the same coverage when compared to a 21-year-old. The jump in monthly cost grows even larger as you get older, with a 60-year-old paying, on average, 51% more than a 40-year-old for Silver tier coverage.

Also Check: What Insurance Does Starbucks Offer

How Do I Enroll In California’s Health Insurance Marketplace

If you want to check your eligibility for a tax subsidy that helps reduce the cost of health insurance, youll need to use Covered California to shop for coverage. To start the process, visit CoveredCalifornia.com. If youre ready to fill out an application, click the Apply button otherwise, click Get My Estimate for a health insurance quote. The Get My Estimate option allows you to enter the number of people in your household, your total household income, age, and ZIP code to determine how much you can expect to pay each month for a health plan. It also uses your income to determine if you might be eligible for a tax subsidy to defray your out-of-pocket costs. If you click Apply, youll be prompted to create an account or log in to your existing Covered California account. To create a new account, enter your name, date of birth, Social Security number, and desired username and password as prompted. Youll also need to create a four-digit PIN to help keep your account secure. Make sure you have the following documents available before you start the application:

- Recent pay stubs

- Individual vs. family deductibles

How Do I Get Cheap Health Insurance In California

The best way to find the cheapest health insurance in California is to compare policies from multiple health care providers. By getting quotes from several companies, you’ll be able to understand which company has the most expensive rates and why. Finally, by evaluating what you need in a health plan, you will be able to select a policy that fits your needs at an affordable rate.

You May Like: Does Kroger Offer Health Insurance To Part Time Employees

Medicare And Medicare Advantage

The charts showing the cost the the number of enrollees includes people covered by all types of Medicare and Medicare Advantage. The cost of this type of health coverage includes participation from employers, individuals, federal, state and local government. Excluded from the costs are any form of co-pay or a deductible the individual must pay to receive care.

How enrollees use their health care services is based on enrollees in Medicare Advantage plans only. Medicare Advantage plans are Medicare health plans offered by private companies that contract with Medicare. Medicare Advantage plans include Health Maintenance Organizations , Preferred Provider Organizations , Private Fee for Service Plans, Special Needs Plans and Medicare Medical Savings Account Plans .

The Average Cost Of Health Insurance By Plan Types

There are four types of health plans you can choose on the Marketplace, with varying degrees of flexibility and cost:

- Health Maintenance Organization : HMOs tend to have lower premiums but require you to use a specific set of providers and get referrals to specialists for covered services, except in emergencies. Silver HMOs average $473 per month.

- Exclusive Provider Organization : Somewhere between an HMO and a PPO, EPOs typically require that you use the health plans in-network providers, but you dont always need referrals to see specialists. EPO Silver plans average $508 per month.

- Preferred Provider Organization : PPOs tend to be more expensive than HMOs but typically offer a broader range of providers. You usually dont need to get a referral to see specialists for covered services. On the Marketplace, Silver PPO plans have an average premium of $517.

- Point of Service : POS plans tend to be the most flexible at an increased financial cost. You can usually get care outside of the health plans provider network, though youll likely pay more for those services. POS Silver plans have an average monthly premium of $534.

Average Health Insurance Premiums by Plan Type – Silver Plans

Scroll for more

- $534

Recommended Reading: Starbucks Health Insurance Part Time

Cheapest Health Insurance Coverage By Metal Tier

The average cost of health insurance in California is $537 per month for a 40-year-old purchasing a Silver plan.

We researched and compared health plans offered on the Covered California marketplace to identify the most affordable health insurance option at each level of coverage.

| Metal Tier | ||

|---|---|---|

| L.A. Care Bronze 60 HMO | $250 | |

| L.A. Care Silver 70 HMO | $311 | |

| L.A. Care Gold 80 HMO | $326 | |

| L.A. Care Platinum 90 HMO | $369 | $4,500 |

Monthly cost for a 40-year-old

For example, if you are self-employed and need health insurance, you may be able to purchase an individual plan through the health insurance marketplace. Keep in mind that an HMO plan is typically a great way to get a more affordable rate on coverage.

The higher tiers have the most expensive premiums along with the smallest deductibles, while lower tiers like Bronze and Silver or even Catastrophic health insurance have high deductibles but cheap monthly premiums. For example, the monthly rate for the Gold plan is 30% more expensive than the price of the Bronze plan.

How Can I Get Dental Insurance In California

You can get dental insurance in California through your employer’s health insurance plan. Alternatively, you can purchase health insurance and add dental coverage to your plan, or you can simply purchase a stand alone dental insurance plan.

Before purchasing dental insurance, you should compare carriers and coverage levels, and check whether or not your preferred dentist is within the carrier’s network to keep costs at a minimum. You can get a quote and submit your application to purchase a plan.

Don’t Miss: Kroger Health Insurance Benefits

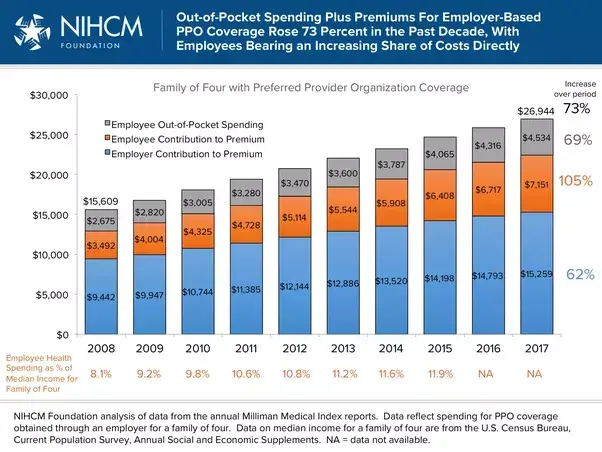

How Much Is Family Health Insurance Per Month

The average premium for a family of 4 in 2020 is was $1,437, according to customer data gathered by one health insurance agency. This does not include families who received government subsides. Like individual insurance, your family cost will depend on ages, location, plan category, tobacco use, and number of plan members.

What Is The Average Cost Of Health Insurance

Maybe youre wondering, How much does individual health insurance cost? Heres what you can expect. The average individual in America pays $452 per month for marketplace health insurance in 2021.2 The average family pays $1,779 per month.3

But the cost of health insurance varies widely based on a bunch of factors. Some things are in your control, some arent. Things like your age, how many people are on your plan, how much coverage you need, where you live and who your employer is all play a role in the price of your coverage.

Heres a breakdown showing the average costs depending on your state:

Kaiser Family Foundation, 2021.

Don’t Miss: Starbucks Health Insurance Plan

How Do I Find Affordable Health Insurance

Group plans are generally cheaper than individual plans. So if you are eligible for onethrough your employer, your union, or some other associationthat’s your best bet, in terms of coverage for the money. If that’s not an option, the public health marketplaces established by the Affordable Care Act offer affordable health insurance for individuals. In most of the U.S., you can sign up for a plan offered through the federal government via the HealthCare.gov site. However, 12 states run their own marketplaces, and residents sign up via their sites.