No Mandatory Health Insurance: Disadvantages

It takes a very savvy healthcare consumer to score discounts from providers, not all of whom will necessarily go along with such requests. Normally, insurance companies, not individuals, are the ones negotiating with hospitals and doctors to lower prices for large member groups.

The main drawback when health insurance isn’t mandatory, however, is the risk you assume when choosing the self-pay route. The downside of going health insurance-free could be substantial if you end up needing expensive medical care and you don’t have the money to pay for it from savings or your monthly income.

“You’re one major accident or illness away from falling into long-term debt, as medical bills can be quite excessive out of pocket,” Steiner says.

Legislation To End Surprise Balance Bills

On March 11, 2016, lawmakers in Florida passed House Bill 221, and Governor Scott signed it into law in April. HB221 bans the practice of balance billing in situations where the patient uses an in-network hospital or urgent care facility and does not have the ability or opportunity to choose a participating provider at the facility. The new rules took effect July 1, 2016, and HB221 is being called a model for other states that want to implement similar consumer protections.

Florida already prohibited balance billing for HMO members who receive emergency care or treatment at an in-network facility, but HB221 provides similar protections for insureds who have PPO and EPO plans. HB221 was sponsored by six Republicans and two Democrats. Rep. Carlos Trujillo, a Miami Republican and one of the bills sponsors, said that their goal was to remove the consumer from the middle of the billing process when hospitals contract with providers who arent in the same networks as the hospital.

Not surprisingly, radiologists and anesthesiologists were among those fighting against HB221 in Florida, claiming that it would force them to accept whatever payment the insurance companies wanted to offer them, despite the fact that they dont have a contract with the carrier in question. But the legislation passed with support from both the Florida Association of Health Plans and the Florida Medical Association.

Option #5 Lower Your Risks For High Premiums

If you are without insurance because of the high cost of premiums, there are some things that you can do to lower your risks thus lower your premium. Most of these choices are lifestyle related. For example, those who are at a healthy weight will have a lower premium than those who are overweight. Some companies even give cash back and reimbursement incentives for healthy choices such as joining a gym.

Another lifestyle choice that raises premiums is smoking. Insurance companies know that smokers are at higher risk for lung cancer, heart disease, and high blood pressure. So in return, they charge higher premium rates to those who smoke. Quitting not only brings many health benefits, but also will lower you premium by $1,000 or more a year.

Also Check: Do Real Estate Brokers Offer Health Insurance

Why Does Uf Require Proof Of Health Insurance

The age range of college students accounts for the largest group of uninsured and under-insured individuals in the nation. Here at the University of Florida, preserving our students health and wellness is paramount. There are times when students health or well-being, access to health services, or payment for healthcare can hinder them from achieving their academic goals.This change was founded on removing as many obstacles as possible for our students to reach graduation.

How Insurer Participation In Floridas Exchange Has Changed Over Time

As is the case in most states, insurer participation in Floridas exchange has changed considerably over time. Heres a summary:

Cigna exited at the end of 2015

Two weeks before the start of the third open enrollment period, Cigna announced that they would not offer plans in the exchange in Florida in 2016. At that point, they had about 30,000 enrollees in the Florida exchange, all of whom had to select coverage from a different carrier if they wanted to continue to be insured in the exchange in 2016. Cigna continued to offer plans outside the exchange , but no subsidies are available outside the exchange.

In the weeks leading up to the start of open enrollment, there were carriers in several states that announced they would not participate in the exchanges for 2016. In most cases, the risk corridor payment shortfall was cited as a reason, but Cignas justification for leaving the exchange was somewhat unique: the carrier cited fraudulent billing by substance abuse clinics and labs in Florida. Cigna has said they didnt realize how significant the fraudulent claims were until after the deadline to submit plans for 2016. Once they determined the scope of the problem, they made their decision to pull out of the exchange market for a year.

Time/Assurant exited at the end of 2015

Time/Assurant announced in June 2015 that they would exit the health insurance market nationwide and did not offer plans for 2016 or any subsequent years.

UnitedHealthcare exited at the end of 2016

Read Also: Is Health Insurance Really Worth It

Florida Dental And Vision Plans

Dental and vision insurance plans, underwritten by Golden Rule Insurance Company, have no age limit restrictions.4 They offer coverage for the dental and vision services many medical insurance plans dont include.

From Miami to Orlando, Tampa to Jacksonville, explore these Florida health insurance options and more that may be available now.

Rates And Plans For 202: Approved Average Rate Increase Of 66% Plus Four Insurers Joining The Market

Two insurers that offered plans in Floridas marketplace as of 2016 are rejoining for 2022. UnitedHealthcare and Aetna CVS Health will enter the Florida marketplace for 2022 .

Two other insurers Capital Health Plan and Sunshine State Health Plan will also join the states marketplace for 2022.

The states existing marketplace insurers will implement the following average rate changes for 2022, which amount to an average rate increase of 6.6% :

- AvMed: 2.9%

- Blue Cross Blue Shield of Florida : 9.8% increase .

- Bright Health Insurance Company: 8.6% increase .

- Cigna: 5.8% increase .

- Florida Health Care Plan Inc: 3.3% increase

- Health First Health Plans: 2.2% increase

- Molina: 6.5% increase

- Oscar Health: 1.4% increase .

- Florida Blue HMO : 4.3% increase .

- Ambetter : 9.9% increase .

- Sunshine State Health Plan: New for 2022, so no applicable rate change

- United Healthcare: New for 2022, so no applicable rate change

- Coventry/Aetna-CVS: New for 2022, so no applicable rate change

- Capital Health Plan: New for 2022, so no applicable rate change

For perspective, heres a summary of how average premiums have changed in Floridas individual market since ACA-compliant policies debuted in 2014:

The basic details of the rate filings are available on the federal rate review site and on FLOIRs rate filing search system. But essentially all of the pertinent documents for each rate filing are marked trade secret in Florida, and not available to view.

Also Check: What Does Health Insurance Cost For An Individual

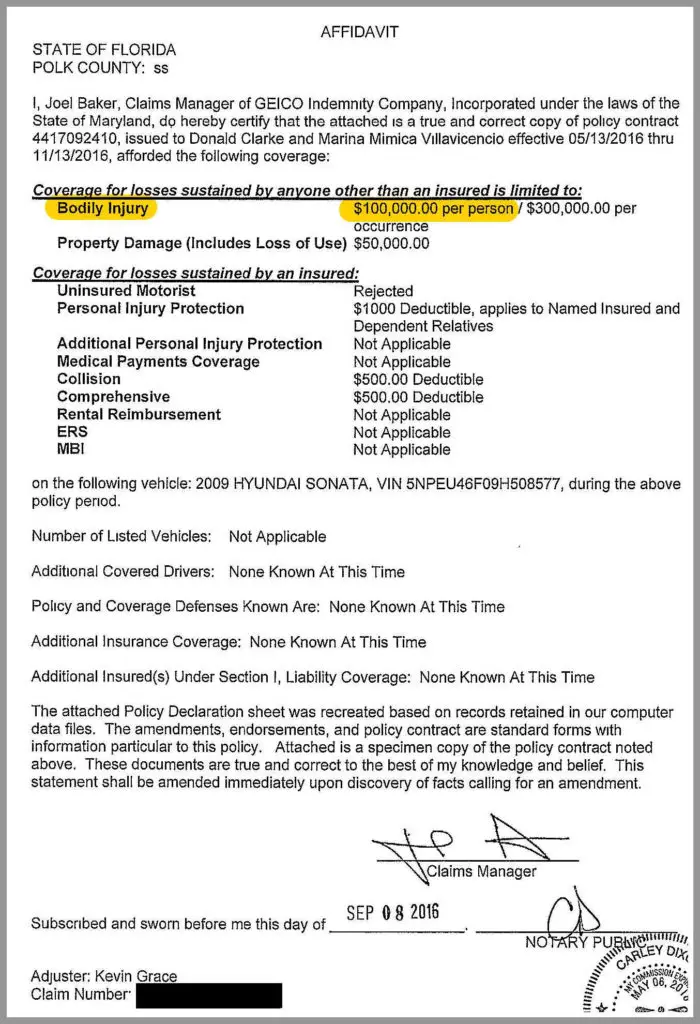

What Happens If You Reject Uninsured Motorist Coverage

If you reject uninsured motorist coverage, you will need to use another type of coverage or pay out of pocket in the event that you are hit by an uninsured driver. If you already have collision insurance and medical coverage of some sort, rejecting uninsured motorist coverage might be a good way to lower your premium. Otherwise, paying for uninsured motorist coverage is generally an inexpensive way to add extra protection.

Children’s Health Insurance Program

If an individual is under 18 years of age, they may qualify for coverage under their state’s Children’s Health Insurance Program . CHIP provides health coverage to nearly 8 million children in families with incomes too high to qualify for Medicaid, but can’t afford private coverage.

Eligibility is determined by each state and is income and disability based. Each state’s CHIP or SCHIP program may have a different name. It is important to note that your child may qualify for SCHIP coverage even if denied Medicaid.

Children may also be eligible for some disability benefits from Supplemental Security Income.

Additionally, under the Affordable Care Act, many young adults are now able to remain on their parents’ health insurance plan until age 26.

Read Also: Where To Go If You Have No Health Insurance

Health Insurance Coverage For Multiple Years

TriTerm Medical Insurance,2 underwritten by Golden Rule Insurance Company, is short term health insurance that offers coverage for preventive care, doctor office visits, and prescriptions.

- Apply once for insurance coverage terms that equal one day less than 3 years.

- $2 million lifetime maximum benefit per covered person on most plans.

- Eligible expenses for preexisting conditions are covered after 12 months on the plan.

Option #2 Cover Florida

Cover Florida is a unique health insurance program that has pros and cons. It was developed by legislation through the state government, but does not use tax dollars. It is for individuals who do not qualify for Medicaid, but still cannot afford health insurance. It is also for those who may not have insurance offered to them through an employer. Since it is not state funded, those who are covered have access to a wide variety of providers.

Cover Florida is a contract based health insurance program. This means that companies within Florida have contracted with the state to offer affordable, quality health insurance. Different counties have different options available. Premiums start at $83 per month and cover many typical medical situations. For those who dont think they can afford coverage, Cover Florida is a good option. You must be without insurance for six months, or have lost a job that provided your insurance to qualify. While this coverage is certainly helpful, it is not guaranteed to meet all of your needs.

Recommended Reading: How To Retire Early And Afford Health Insurance

Health Insurance Rate Changes In Florida

Health insurance rates, deductibles and out-of-pocket maximums are set yearly by health insurance companies. The plans are then sent to the federal exchange to be approved for the following plan year.

In Florida, the cost of Catastrophic health insurance plans increased by 13% from 2020 to 2021 the largest rate increase by metal tier in the state.

Conversely, the price of the other metal tiers didn’t change much over the past year. The cost of Bronze plans rose by 3%, but the cost of Expanded Bronze and Platinum plans remained flat, while the cost of Silver and Gold plans decreased by 2% and 1%, respectively.

| Metal tier |

|---|

Premiums are for a 40-year-old adult.

Register For Electronic Fingerprinting

Florida requires electronic fingerprints be taken in order to run a criminal background check.

To make a reservation with MorphoTrust, click the Online Fingerprint Reservation button or call 800-528-1358. Insurance license fingerprint records are good for 1 year. Cost of fingerprinting is $48.55. The results of your criminal history check will be submitted electronically to the Florida Department of Financial Services.

Southwest Florida has two Insurance License fingerprinting locations:

- Fort Myers: Fingerprint Services – 8192 College Pkwy, Suite A-27

- Naples: Asares Advanced Fingerprint Solutions – 11725 Collier Blvd, Suite E-2

If you are asked for the “ORI” number at any time during the fingerprint process, use FL921060Z. This is how the fingerprinting company knows your fingerprints are for Florida Insurance Agent licensing.

Recommended Reading: Does Health Insurance Have To Cover Birth Control

Do You Have To Have Health Insurance To Go To A Detox Center In Florida

The reason a lot of individuals affected by addiction dont seek treatment is that they are worried they will be denied access or wont be able to afford it. Although insurance is helpful when paying for treatment, it is not necessary to be admitted into most facilities like ours at Coastal Detox.

Before an addiction spirals out of control, its important to get help from professionals who understand how to properly treat it. The first step towards recovery is always recognizing that addiction has occurred. It sounds easy, but this is often one of the most difficult things to do because its hard to walk away from substance abuse.

Also Check: Can Aflac Replace Health Insurance

How Do I Get Health Insurance In Florida

If you do not have Florida health insurance benefits through an employer, you have options for where you can purchase health coverage:

You May Like: Does Golden Rule Insurance Cover Mental Health

Floridas Other Exchange: 712 Customers By 2016 No Longer State

Florida Health Choices is the states own version of an online marketplace, but it does not offer any premium subsidies. While Florida Health Choices was established by 2008 legislation sponsored by Marco Rubio, who was the Florida House Speaker at that point, it faced many delays and did not go live until March 2014. The states pseudo-exchange was engaged in a legal battle with HHS over efforts to trademark Healthchoices, The Health Insurance Marketplace.

Florida Health Choices initially offered discount-only plans for some health services, such as dental services and prescription drugs. These plans were not true health insurance, and consumers largely ignored the state-sponsored exchange. Just 49 people purchased plans through Florida Health Choice during 2014 .

In early January 2015, Florida Health Choices began offering health plans that were compliant with the ACA and covered the ACA s ten essential health benefits. Policies from four insurers were available in 2015: Assurant, Cigna, Humana, and UnitedHealthCare.

For 2016, Assurant exited the health insurance market nationwide, but Cigna, Humana, and UnitedHeathcare continued to offer plans through Florida Health Choices .

The Florida Health Choices board of directors approved an $852,000 budget for 2015. Heading into the year, Naff was quoted in the Miami Herald saying, Id be tickled pink if we got 1,000 people.

Best For Preventative Care: Kaiser Permanente

Kaiser Permanente

-

Only available in 8 states

-

History of skimping on behavioral healthcare

Kaiser Permanente is another health insurance company with a strong reputation. The company was founded in 1945 and it doesnt have a rating with AM Best. Kaiser Permanente earned high scores of at least 4.0 and up to 5.0 with NCQA along with standout rankings from the J.D. Power 2021 U.S. Commercial Member Health Plan Study.

Kaiser Permanente has faced some scrutiny from the state of California, though. The company has been subject to several state sanctions and fines for skimping on behavioral healthcare. Some members were still struggling to get care at the end of 2019, according to the Los Angeles Times.

Kaiser Permanente offers health insurance in Washington, D.C., and eight statesCalifornia, Colorado, Georgia, Hawaii, Maryland, Oregon, Virginia, and Washingtonfor 12.5 million members. The companys network includes 39 hospitals, 727 medical officers, 23,597 physicians, and 63,847 nurses.

You may have access to a variety of health plans that include Medicare, Medicaid, high-deductible health plans, health savings account-eligible plans, and catastrophic plans. Plan availability depends on where you live.

The claims process may depend on your health plan and must be within 12 months of the date of your service. There are some additional steps to submit a claim for an emergency or urgent care visit away from home.

Recommended Reading: Does Short Term Health Insurance Cover Pregnancy

Comprehensive Long Term Care

Sunshine Health is the largest Comprehensive Long Term Care managed care organization in Florida. We offer comprehensive physical and behavioral health services and programs to support our members ability to age in place and remain independent for as long as possible. Long Term Care is for Medicaid enrollees 18 years and older who require a Nursing Facility level of care. This doesnt mean members must reside in nursing homes. We help members stay in the community whenever possible with long-term services and supports. We help can help members transition from nursing facilities into a home setting of their choice.

Does Florida Have A Penalty For Not Having Health Insurance

Looking for does florida have a penalty for not having health insurance? Get direct access to does florida have a penalty for not having health insurance through official links provided below.

Follow these easy steps:

- Step 1. Go to does florida have a penalty for not having health insurance page via official link below.

- Step 2. Find the official insurance at the bottom of the website.

- Step 3. If you still cant access does florida have a penalty for not having health insurance please leave a message below .

Florida does not have an individual mandate, so you are able to go uninsured without paying a penalty. We recommend you get a plan, however, to avoid huge medical bills if something happens to you. Go to healthsherpa.com to see plans and prices and to see if youre eligible for a subsidy to lower the cost.

As of 2019 the Obamacare Individual mandate which requires you to have health insurance no longer applies at the federal level. However, 5 states and the District of Columbia have an individual mandate at the state level. You may have to pay a penalty for not having health insurance if you live in one of the following:

Read Also: How To Cancel Cobra Health Insurance