What Types Of Alternative Health Insurance Plans Are Available In Massachusetts

An increasingly popular alternative health insurance plan is what is known as a health care cost-sharing plan or a faith-based health plan. These plans can be sold in Massachusetts because Massachusetts doesnt consider them to be health insurance plans, and therefore, theyre not regulated by the state and dont count as mandated insurance. Before you sign up for a cost-sharing health plan, understand the plan may not cover all conditions and typically does not cover pre-existing conditions.

Student Health Plans: Private Insurance Plans That Are Good For Students

Student health plans represent another way for college students to access health insurance. Some insurance companies offer these plans for students between the ages of 17 and 29, allowing students to pay premiums annually, or semiannually in some instances. Unlike a school-based plan, these plans travel with you wherever you study in the United States.

If you start at one university and then transfer to another university, the coverage transfers with you.

You May Like: What Do You Need To Get Health Insurance

Does Masshealth Check Bank Accounts

The MassHealth agency considers funds in a bank account available only to the extent that the applicant or member has both ownership of and access to such funds. The MassHealth agency determines the ownership of and access to the funds in accordance with 130 CMR 520.005 and 520.006. Verification of Account Balances.

Recommended Reading: How Much Is Individual Health Insurance

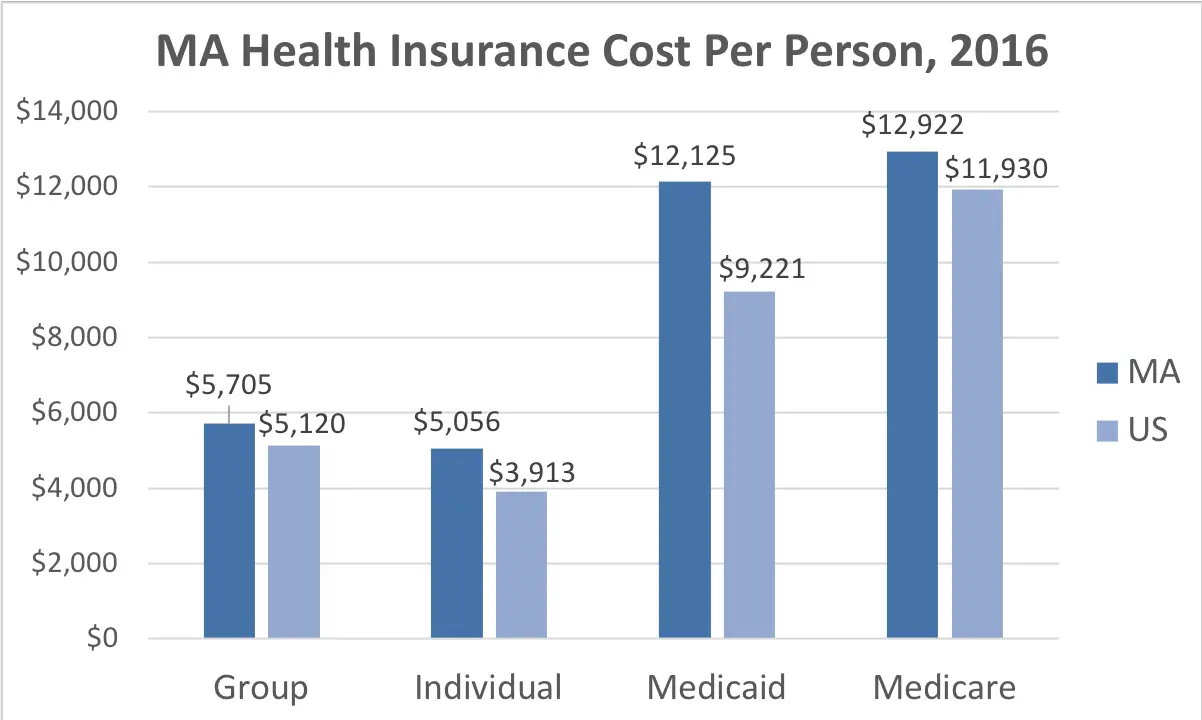

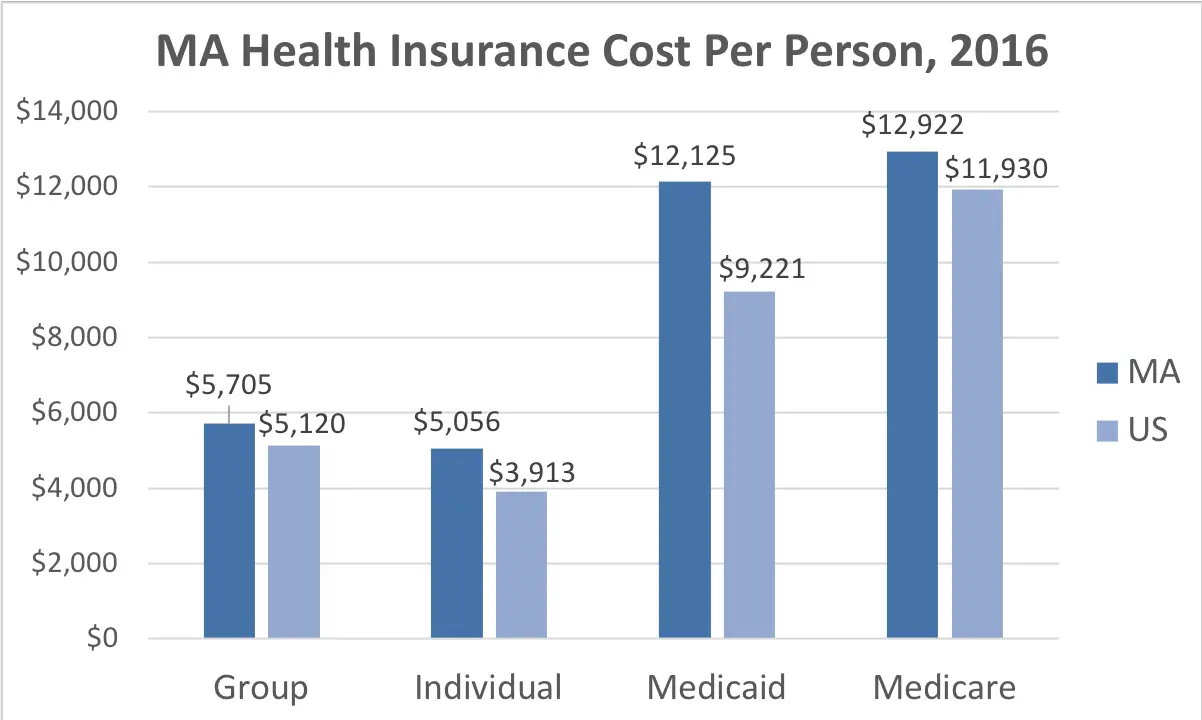

Ma Doctor Visits Per Person Per Year By Insurance Type

This type of care includes visits to doctors in which the patient was not in an institution such as a hospital.

The frequency of doctor visits among all user categories are reasonably close to the national average, with the exception of Medicaid managed care patients. Medicaid managed care patients run about two-thirds higher than the national average, other patient types are about 10% below the national average. Other than Medicaid, we don’t see the frequency of doctor visits among Massachusetts residents as a contributor to the high health care and health insurance costs.

How Do I Enroll In Massachusetts Individual And Family Insurance

You can enroll in individual or family insurance through the Massachusetts Health Connector. Since the Health Connector is an active adjuster exchange, all plans carry comprehensive benefits. You can still use any health insurance company you wish, but they may not provide the same comprehensive benefits that youll find through the Health Connector. Use the tools provided to compare the benefits of the plans and how it will serve your needs.

Read Also: How To Be A Health Insurance Agent

Massachusetts Health Insurance: Find Affordable Plans

See how you can get cheap health insurance in MA, including marketplace plans, Medicare, and Medicaid.

- IX.

Massachusetts residents have many health care options to choose from. The number of options is one of the reasons Massachusetts has the lowest number of uninsured residents in the United States.

This guide provides a detailed overview of your health insurance options in Massachusetts.

How To Get The Best Health Insurance

If youre looking to purchase health insurance on your own, you can just go to the websites of major health insurance companies in your area and see what plans they provide. You can compare plans on your own, although quotes will vary pretty widely.

But lets face it. This is a ton of work. Choosing the right health insurance plan for you or your family is a daunting task. And you probably have better things to do with your time than sifting through endless health insurance quotes.

Thats why I recommend using our trusted and independent insurance agents for your health insurance needs. Theyll look at your situation and compare the best rates so you can get the coverage you need. Theyll help you understand the marketplace or even what your employer is offering. And the best thing? Theyre free!

Connect with one of our insurance agents today.

About the author

George Kamel

Also Check: Is Health Insurance Mandatory In New York

Average Monthly Obamacare Premiums Per State

While $612 was the national average monthly premium for ACA plans, its important to understand that the majority of people enrolled get subsidies in the form of advance premium tax credits .

The table below shows the state-by-state average premium for Obamacare plans in 2019, the most recent year for which data is available. It also gives the average monthly premium after the average advance premium tax credit is applied, as well as the average monthly premium after APTC for consumers who received an APTC.

| Obamacare Average Premiums for 2019 |

|---|

| Location |

| $62 |

Cheapest Silver Plan By County

The availability of health insurance, as well as the cost, will be affected by the county that you live in. For instance, for a 40-year-old, the BMC HealthNet Plan Silver A II is the cheapest Silver plan in Essex County with a monthly premium of $368. However, in Middlesex County, the same Silver plan costs $411 a difference of $43 per month.

| County |

|---|

Sample rates are based on monthly premiums from counties in Massachusetts.

Read Also: How To Get Health Insurance For My Small Business

Overview Of Massachusetts Health Reform

Massachusetts launched its health reform initiative in 2006 based on the principle of shared responsibility among individuals, government, and business. Building on the existing system, the state expanded its Medicaid program, created a new subsidized program through a health insurance exchange, instituted insurance market reforms to make insurance more available and affordable, and required employers not offering insurance to contribute a modest amount of money to help finance government subsidies. The state was also the first to require individuals who could afford it to purchase health insurance. Early projections from the Urban Institute, which was contracted by local stakeholders to provide research informing the reform debate, indicated that coverage expansion reforms would not reach anything close to universal coverage without an individual mandate . Because it interacts with the coverage expansion tools, the mandate must be understood in reference to the broader reforms, subsidies, and insurance regulations.

Tips For Finding Healthcare Coverage

With the rising costs of healthcare, how can Americans save on healthcare and the cost of insurance? Be diligent, and do your research to compare plans. That way, you can get the most comprehensive health coverage you can afford.

If your employer offers health insurance and pays for a large portion of the premium, it is a great option to think about. If not, shop the health insurance exchange for affordable coverage. Check to see whether you qualify for any subsidies to help offset the cost of health insurance. Health savings accounts can also help you pay for out-of-pocket expenses such as co-pays and deductibles.

Finally, if you have a catastrophic accident or illness, ask the hospital for help with a payment plan. Many hospitals will reduce their charges for those who are unable to obtain insurance.

Dont Miss: Can I Cancel My Health Insurance

Recommended Reading: When Does Health Insurance End After Leaving Job

Q How Do I Submit My Medical Bills

If you have purchased supplementary insurance, check with your insurance carrier about how you should submit your bills. Otherwise, it is required that you send your itemized bill to your nearest OHIP Claims office within 12 months of receiving treatment. With your bill, send :

- an original, detailed statement, itemized on a fee-for-service basis

- your original receipt for payment

- your name and current Ontario address

- your health number

- a completed Out of Province/Out of Country Claims Submission

To avoid delays, do not hold your bills and receipts until you return to Ontario. Mail them to your insurance carrier or the ministry as soon as you receive them.

For more information : Travelling Outside Canada

Average Health Insurance Cost By Age

Age plays a big role in the cost of a premium for health insurance generally, younger people have lower premiums, as they are seen as less risky and less likely to require more medical care.

Often, the starting point for an insurance rate is based on that of an individual who is 21 years old. According to ValuePenguin, the average health insurance premium for a 21-year-old was $200 per month. This is also an average for a Silver insurance plan — below Gold and Platinum plans, but above Bronze plans.

How does the breakdown of premiums by age look? Slowly in small increments, the average premium will increase. Ages 21-24 were all consistent at $200, but at 25 the premium goes up to $201 — about 1.004 x $200.

Slowly the amount it goes up increases. At 26 the average premium is 1.024 times the base premium, up to $205. By the age of 30, though, it has gone up for an average premium to $227, or 1.135 x $200.

Going through the list of ages, this pattern is pretty consistent. The average premium for a policyholder at 35 years is $244, 1.222 times the base rate at 40, it’s 1.278 times that rate to bring the average premium up to $256.

From here, though, the premiums start going up at higher rates. The average health insurance premium for a policyholder at 45 is $289, up to 1.444 times the base rate, and by 50, it’s up to $357, which comes out to 1.786 x $200.

Read Also: How To Get State Health Insurance In Ct

Average Cost Of Health Insurance In Massachusetts

Massachusetts residents pay an average of $385 per month, per person for health insurance. There are certain things that you can do to help lower this cost. When evaluating how much youll pay, insurance companies look at a variety of factors:

- Body mass index : A high BMI can be a precursor to several preventable chronic conditions like high blood pressure, diabetes or heart disease. Take steps to lower your BMI by exercising regularly and eating healthy foods.

- Tobacco use: Smokers pay more for health insurance than their non-smoking counterparts. A little over 13% of people in Massachusetts are smokers. If you smoke, there are plenty of free and low-cost programs to help you quit. And if you do not smoke, dont start. Youll help protect your health as well as save money on health insurance.

- Age: Older people tend to have more health conditions, so you may pay more for health insurance when youre 50 versus when youre 20 or 30.

How Much Does Life Insurance Cost

Individual life insurance quotes depend on many factors, which influence your risk. A healthy 35-year-old male getting a term life insurance policy can expect to pay about $30.42 in monthly premiums for a 20-year, $500,000 policy as of April 2022, while a 35-year-old female with the same term length and policy amount may pay $25.60. Generally, term life insurance is more affordable than whole life insurance because whole life lasts longer and has an additional savings feature.

More than 50% of Americans overestimate the cost of insurance and put off buying a life insurance policy as a result. In a study by LIMRA, a research, consulting, and professional development organization for financial services, and Life Happens, a nonprofit focused on providing unbiased education around insurance options, 44% of millennials estimated that a 20-year term policy would cost $1,000 or more per year. By contrast, the actual cost of the policy was approximately $165/year.

The following are sample rates of a 20-year policy for a 35-year-old male non-smoker with a Preferred health rating in other words, somebody with a very good health or minor health conditions.

To see up-to-date life insurance pricing trends month over month, check out our price index.

Also Check: Can I Add A Friend To My Health Insurance

How Much Is Health Insurance A Month For A Single Person

It depends on a variety of factors, ranging from your resident state to your age to the type of plan . Employer-sponsored plans average $622.50 a month, with individual employees paying $105 of that, for example. Individual plans on the healthcare exchanges range from an average of $648 to $273 monthly.

Different Types Of Plans

Shopping for a health insurance plan can sometimes feel like being in a grocery store and staring at rows of the same product for what seems like hoursonly its less exciting and way more expensive! But comparing plans could save you money. This is because the type of plan you choose also affects your health insurance costs.

Here are the plans and networks you can shop for in the health insurance marketplace:

Don’t Miss: How Much Does Private Health Insurance Cost Per Month

How Much Money Can You Have In The Bank And Still Get Masshealth

Under MassHealth, a resident over 65 may have no more than $2,000 in countable assets in his or her name. The countable part is important! MassHealth doesnt necessarily require that you give up your home or sell your belongings to get under that $2,000 mark only certain types of assets are considered countable.

Catastrophic Health Insurance Plans

For qualifying Americans under the age of 30, catastrophic plans are available to provide what can be considered last-resort health insurance. Catastrophic plan premiums are lower than even Bronze tier plans. However, you pay more for visits and prescriptions due to high deductibles, which are $8,550 for the year in 2021.

Recommended Reading: Do You Pay Monthly For Health Insurance

Average Health Insurance Costs

With so many different variables impacting how much health insurance will cost a person on a monthly or yearly basis, we’re better off breaking things down instead of giving one general number.

So what are some of the biggest factors in determining how health insurance costs can vary? Certainly, the type of plan someone has and the tier of the plan she has to go a long way. Medical history — not to mention whether the person is a smoker — can play a role in whether insurers give a higher rate. Someone in need of insurance for a family is going to have a higher premium than someone seeking an individual plan.

Two factors that can also play a large role in healthcare rates and premiums is how old someone is and where he lives.

The Government Health Insurance Marketplace

The Health Insurance Marketplace was established by the Affordable Care Act in 2010 to provide insurance plans to individuals, families and small businesses. Through this online resource, you can learn more about health insurance, compare plans, enroll in a plan and more. Finding and purchasing a health insurance plan through the marketplace may qualify you for subsidieshealth insurance at a low or no costdepending on your income. You can also purchase a policy through the marketplace even if youre offered insurance by your employer however, you may not qualify for subsidies if you have access to employer-sponsored coverage.

To buy a policy through the marketplace, you must apply during open enrollment or special enrollment. Open enrollment for 2022 coverage begins Nov. 1, 2021 for the federal marketplace and runs until Jan. 15, 2022. To have your coverage start by Jan. 1, 2022, enroll in your plan by Dec. 15, 2021.

Some state exchanges may have slightly different open enrollment periods. If you miss open enrollment, you may qualify for a special enrollment period due to a major life change like moving, getting married, having a child or losing your existing health coverage.

To begin your search for insurance through the marketplace, head to Healthcare.gov during open enrollment and enter your ZIP code. It will direct you to either your states exchange or to the federal marketplace where you can begin shopping.

Read Also: How Much Does Health Insurance Cost Per Month In Texas

Private Health Insurance On The Massachusetts Marketplace

Plans from the Massachusetts Insurance Exchange are categorized in four tiers, each named after precious metals. You receive the same quality of care, regardless of which tier your plan is, but those named after more valuable metals cover a higher percentage of your medical costs.

Heres an overview of each metal tier in Massachusetts to help you understand them better:

Apart from the plans shown in MoneyGeeks study, you can get cheaper health insurance plans in Massachusetts based on your income. If your annual earnings fall between 100% and 400% of the federal poverty level, you are eligible for premium tax credits. For example, a two-person household in Massachusetts with an annual income ranging from $17,420 to $69,680 can take advantage of these plans. You can use HealthCare.govs calculator to see how much you can save.

Every year, typically between November and December, open enrollment happens. This is when you can choose to purchase a new plan or renew the one you currently have. Presently, enrollment dates have been expanded due to COVID-19.

Types Of Health Plans

Because there are many different types of health plans, you should be sure to look for the one that fits your needs. Comprehensive health insurance provides benefits for a broad range of health care services. These health plans offer a detailed list of health benefits, may limit your costs if you get services from one of the providers in the plans network, and typically require co-payments and deductibles.

Here are some of the types of plans offered in Massachusetts

Health Maintenance Organization

HMO plans cover hospital, medical and preventive care. You are only covered if you get your care from HMO’s network of providers . With most HMO plans you pay a copayment for each covered service. For example, you pay $30 for an office visit and the HMO pays the rest of the cost.

Preferred Provider Plans

Preferred provider plans usually cover hospital, medical and preventive care. These plans have a network of preferred providers that you can use, but they also cover services for out-of-network providers. PPP’s will pay more of the cost if you use a provider that is in the network. Example: After copays and deductibles, the plan pays 100% of a service for a network provider but 80% for an out-of-network provider. Note that if you choose to go OON when you are in a PPP, your provider may balance bill you directly for the entire cost of the procedure.

Major Medical Plans/ Indemnity Plans

You May Like: How To Get Health Insurance In France