How Much Is Aetna Health Insurance

Among eHealth shoppers, the average premium for an ACA-compliant health insurance in 2018 was $465.86 for an individual plan, although insurance costs can vary significantly depending on the kind of plan you choose, the benefits included and your location.In 2017, the last year Aetna sold ACA-compliant individual health insurance plans, premiums for plans not eligible for a subsidy averaged $525.07. Premiums plans that were eligible for a subsidy averaged $374.55, and the average cost of a dental insurance policy from Aetna averaged $64.40

| Year | |

| Obamacare/ACA Coverage without a subsidy | $525.07 |

| Obamacare/ACA Coverage with a subsidy | $374.55 |

Which Insurance Is Best For Health

Best Health Insurance Plans in India Health Insurance Companies Health Insurance Plans Maximum Sum Insured Amount HDFC Ergo General Insurance My Health Suraksha Rs. 75 Lakh Care Health Insurance Care Policy Rs. 6 Crore Care Health Insurance Care Freedom Policy Rs. 5 Lakh Bajaj Allianz General Insurance Health Guard Policy Rs. 50 Lakh.

Carrier Participation In The Texas Marketplace Since 2014

The exchange in Texas had 15 carriers offering plans in Texas for 2015, up from 12 in 2014. Only Michigan and Ohio had more carriers in their exchanges, with 16 each.

But by 2017, only ten insurers were offering plans in the Texas exchange, and most of them only offered coverage in a fraction of the states 254 counties. In the majority of the counties, there were one, two, or three carriers offering plans. And there were no PPO plans available in the exchange by 2017 insurers had opted to switch to more economical HMOs and EPOs as a cost-saving measure.

Several insurers exited at the end of 2016

UnitedHealthcare exited the individual market in Texas at the end of 2016, as was the case in most of the states where United offered exchange plans in 2016.

According to a Kaiser Family Foundation analysis, United only offered plans in 30 of the 254 counties in Texas in 2016. But they were the counties with the most enrollees: 80 percent of Texas exchange enrollees had UnitedHealthcare as an option in 2016. But the total number of enrollees in Uniteds plans was under 157,000, including on- and off-exchange members.

In August 2016, Aetna announced that they would exit the exchanges in 11 of the 15 states where they had been offering exchange plans. Texas was one of the states where Aetnas exchange enrollees had to secure new coverage for 2017.

Oscar reduced coverage area in 2017, but expanded it in 2018 and again in 2019

Sendero remained in the exchange

Recommended Reading: Starbucks Insurance Plan

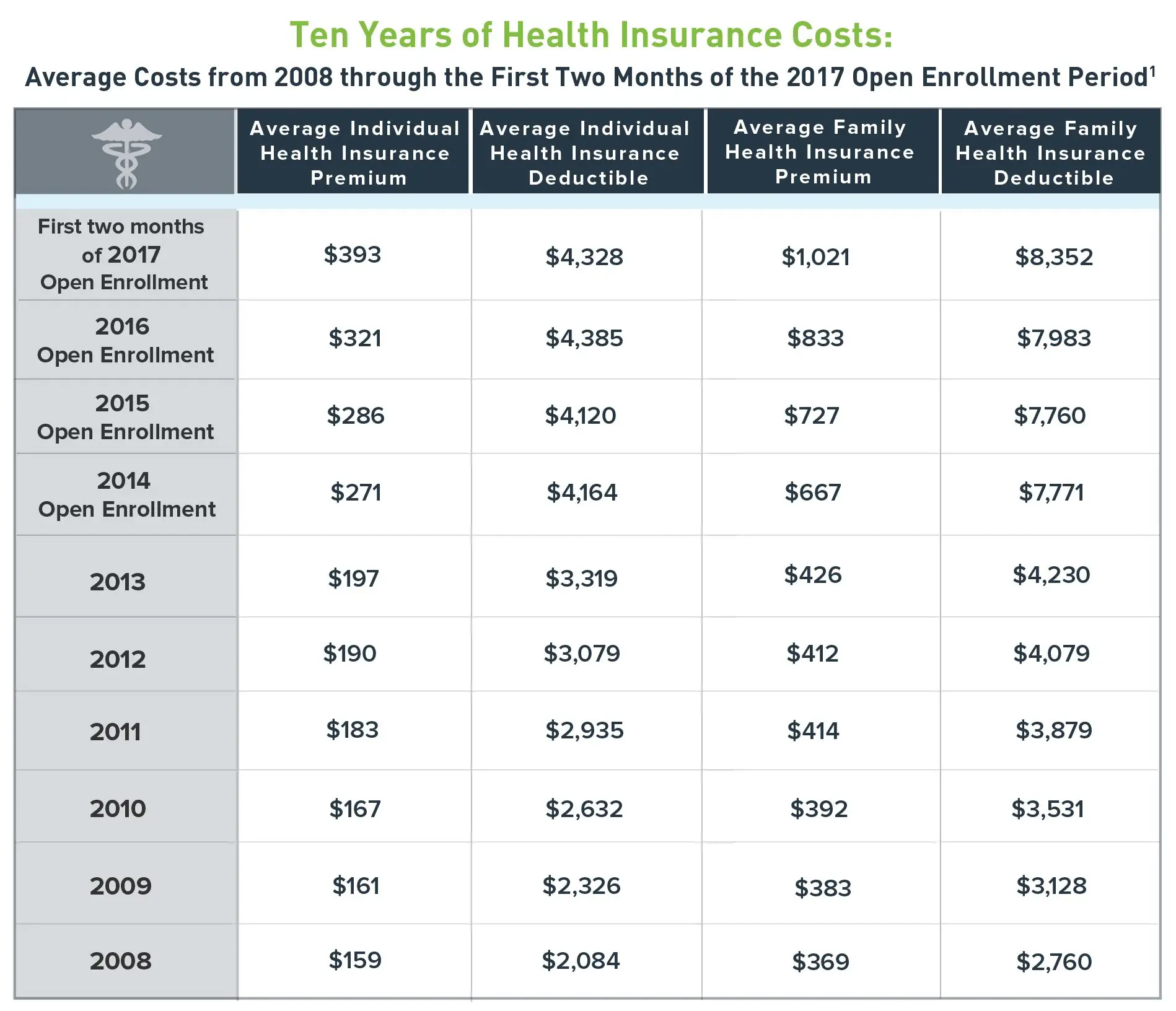

Average Health Insurance Costs

With so many different variables impacting how much health insurance will cost a person on a monthly or yearly basis, we’re better off breaking things down instead of giving one general number.

So what are some of the biggest factors in determining how health insurance costs can vary? Certainly, the type of plan someone has and the tier of the plan she has to go a long way. Medical history — not to mention whether the person is a smoker — can play a role in whether insurers give a higher rate. Someone in need of insurance for a family is going to have a higher premium than someone seeking an individual plan.

Two factors that can also play a large role in healthcare rates and premiums is how old someone is and where he lives.

Average Number Of Days Tx Residents Spent In The Hospital

The number of days in the hospital are counted starting with the day the patient is admitted. The last day is not counted, unless the first and last day are the same day.

Texas residents with group and individual insurance spend slightly more than the average number of days in the hospital. However, Medicaid managed care patients spend double the national average of days in the hospital. Medicare Advantage patients spend approximately 35% more days in Texas hospitals than residents of other states spend in the hospital.

You May Like: Does Starbucks Provide Health Insurance For Part Time Employees

Different Types Of Plans

Shopping for a health insurance plan can sometimes feel like being in a grocery store and staring at rows of the same product for what seems like hoursonly its less exciting and way more expensive! But comparing plans could save you money. This is because the type of plan you choose also affects your health insurance costs.

Here are the plans and networks you can shop for in the health insurance marketplace:

How Much Is Health Insurance Per Month For One Person

Monthly premiums for ACA Marketplace plans vary by state and can be reduced by subsidies. The average national monthly health insurance cost for one person on an Affordable Care Act plan in 2019 was $612 before tax subsidies and $143 after tax subsidies are applied.

Wondering how insurance premiums are decided? The Affordable Care Act ensures that insurance companies cannot discriminate based on gender, current health status, or medical history. Here are factors that determine health insurance premiums.

Recommended Reading: Starbucks Dental Insurance

Average Health Insurance Rates By Plan Type

Another distinction between plans that can change the rates you pay is the type of network the plan uses.

Depending on whether the plan is a preferred provider organization , health maintenance organization , exclusive provider organization or point of service , access to health care providers will be managed in different ways.

HMOs tend to be the most restrictive about which doctors you can see and what you must do to see them. This usually means that the insurers save on your cost of care and thereby provide lower premiums.

| Type |

|---|

Policy premiums are for a 40-year-old applicant.

Affordable Health Insurance Plans In Texas

There are a number of ways to purchase comprehensive, affordable insurance in Texas. There are eight health insurance companies available in Texas on the state exchange. BlueCross and BlueShield of Texas are the only one to offer plans in every county. However, several other insurance companies offer health insurance in various jurisdictions across the state.

Highlights and updates

- Texas uses the federally run marketplace at Healthcare.gov.

- Open enrollment for 2022 health plans in Texas will begin November 1, 2021, for coverage that begins on January 1, 2022.

- Texas residents with qualifying events can still enroll or make changes to their 2020 coverage.

- More than 1.1 million Texas residents enrolled during 2020 open enrollment.

- Eight health insurance companies offer plans through the Texas marketplace.

- The average monthly premiums slightly decreased in 2020.

- Short-term health plans are available in Texas for up to 364 days.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

Average Health Insurance Cost By Age

Age plays a big role in the cost of a premium for health insurance generally, younger people have lower premiums, as they are seen as less risky and less likely to require more medical care.

Often, the starting point for an insurance rate is based on that of an individual who is 21 years old. According to ValuePenguin, the average health insurance premium for a 21-year-old was $200 per month. This is also an average for a Silver insurance plan — below Gold and Platinum plans, but above Bronze plans.

How does the breakdown of premiums by age look? Slowly in small increments, the average premium will increase. Ages 21-24 were all consistent at $200, but at 25 the premium goes up to $201 — about 1.004 x $200.

Slowly the amount it goes up increases. At 26 the average premium is 1.024 times the base premium, up to $205. By the age of 30, though, it has gone up for an average premium to $227, or 1.135 x $200.

Going through the list of ages, this pattern is pretty consistent. The average premium for a policyholder at 35 years is $244, 1.222 times the base rate at 40, it’s 1.278 times that rate to bring the average premium up to $256.

From here, though, the premiums start going up at higher rates. The average health insurance premium for a policyholder at 45 is $289, up to 1.444 times the base rate, and by 50, it’s up to $357, which comes out to 1.786 x $200.

Grandmothered Plans May Renew

In November 2013, the federal government announced that states could allow non-grandfathered, pre-2014 health plans to renew again and remain in force in 2014. In March 2014, they issued another extension for these transitional policies, allowing states to let them continue to renew as late as September 2016. The majority of the states have accepted that proposition, but in 2014, Texas regulators simply didnt issue any guidance whatsoever on the matter .

Because Texas didnt issue any guidelines for renewal of grandmothered plans, regulators initially said that grandmothered plans would not be allowed to renew in Texas in 2014. But they eventually reversed course on this, with the Department of Insurance simply noting that they do not object to carriers renewing grandmothered plans in accordance with federal guidelines. HHS has since issued additional extensions for transitional plans, allowing them to renew as late as October 2021, and remain in force until the end of December 2021. Texas has confirmed that they will allow insurers to go along with the latest federal extension, with grandmothered plans allowed to remain in force until the end of 2021.

You May Like: Starbucks Insurance Part Time

Different Levels Of Coverage

Okay, stay with me here. I’m almost done with this marathon investigation into all things health insurance. I looked at the different types of plans, but theres a little more to it before we put a bow on all this.

When it comes to marketplace health care plans, there are four different levelsbronze, silver, gold and platinum. Think of them like medals at the Olympics. These tiers give you different options on how much your plan will actually pay out versus how much youll pay. Also keep in mind they dont reflect quality of care.14

Generally speaking, plans with a lower monthly premium will mean a higher deductible, and vice versa.

Bronze is one step up from a catastrophic plan. They give you lower monthly costs, but more out-of-pocket expenses.

Silver offers lower deductibles and out-of-pocket costs than Bronze, but youll pay more in monthly premiums. And depending on your income, silver plans also come with discounts called cost-sharing reductions where the provider could cover costs up to the 90% mark.

Gold plans have high monthly premiums but low deductibles, coinsurance and out-of-pocket costs.

Platinum is the highest monthly premium out there, with the lowest out-of-pocket costs. This type of coverage means youre really putting all your eggs in that big monthly premium basket! But having a lower deductible means your insurance company will start covering those crazy health care expenses a lot sooner.

Why Is Life Expectancy In The Us Lower Than In Other Rich Countries

The graph below shows the relationship between what USA as a country spends on health per person and life expectancy in that country between 1970 and 2015 for a number of rich countries.

The US clearly stands out as the chart shows: Americans spend far more on health than any other country in the world, yet the life expectancy of the American population is shorter than in other rich countries that spend far less.

What are the best places for healthcare globally?

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

What Is The Average Cost Of Non

What do you pay if your income exceeds the 400% FPL ? The average national monthly non-subsidized health insurance premium for one person on a benchmark plan is $462 per month, or $199 with a subsidy. Monthly premiums for ACA Marketplace plans vary by state and can be reduced by subsidies. Actual cost varies based on your age, location, and health plan selection,

Take a closer look. In a recent eHealth ACA Index report, we tracked costs and shopping trends among ACA plan enrollees who bought non-subsidized health insurance at ehealth.com during the nationwide open enrollment period for 2020 coverage.

How Do I Get Cheap Health Insurance In Texas

When browsing for a new health insurance policy in Texas, the best way to ensure you get a cheap policy is to compare plans from several different companies. By comparing policies, you will be able to understand which companies place more emphasis on your location and age. Then, using your own criteria and needs, you can choose a policy that works best for you.

You May Like: Does Starbucks Provide Health Insurance

The Effect Of Insurance Deductibles On The Cost Of Health Care

TX residents insured through group, individual and medicare health plans generally have a deductible. Deductibles define the amount of the medical expenses the insured person must pay before the insurers coverage begins to pay the medical bills. The deductible amount depends on the insurance plan. Generally speaking, individual insurance has larger deductibles than other plans. Deductibles have the effect of increasing the cost of the insurance for people that file insurance claims. For example, a person on an individual plan paying the average price of $3,538 with a relatively common $6,000 deductible has an effective price of more than $10,000, if they use their insurance.

How Much Does Average Health Insurance Cost Per Month

Looking for how much does average health insurance cost per month? Get direct access to how much does average health insurance cost per month through official links provided below.

Follow these easy steps:

- Step 1. Go to how much does average health insurance cost per month page via official link below.

- Step 2. Find the official insurance at the bottom of the website.

- Step 3. If you still cant access how much does average health insurance cost per month please leave a message below .

How Much Does Health Insurance Cost per Month in Each State With a Subsidy? The estimated national average cost in 2021 for a silver plan after a premium subsidy* is applied is $195. This chart, unlike the previous one, takes into account subsidies.

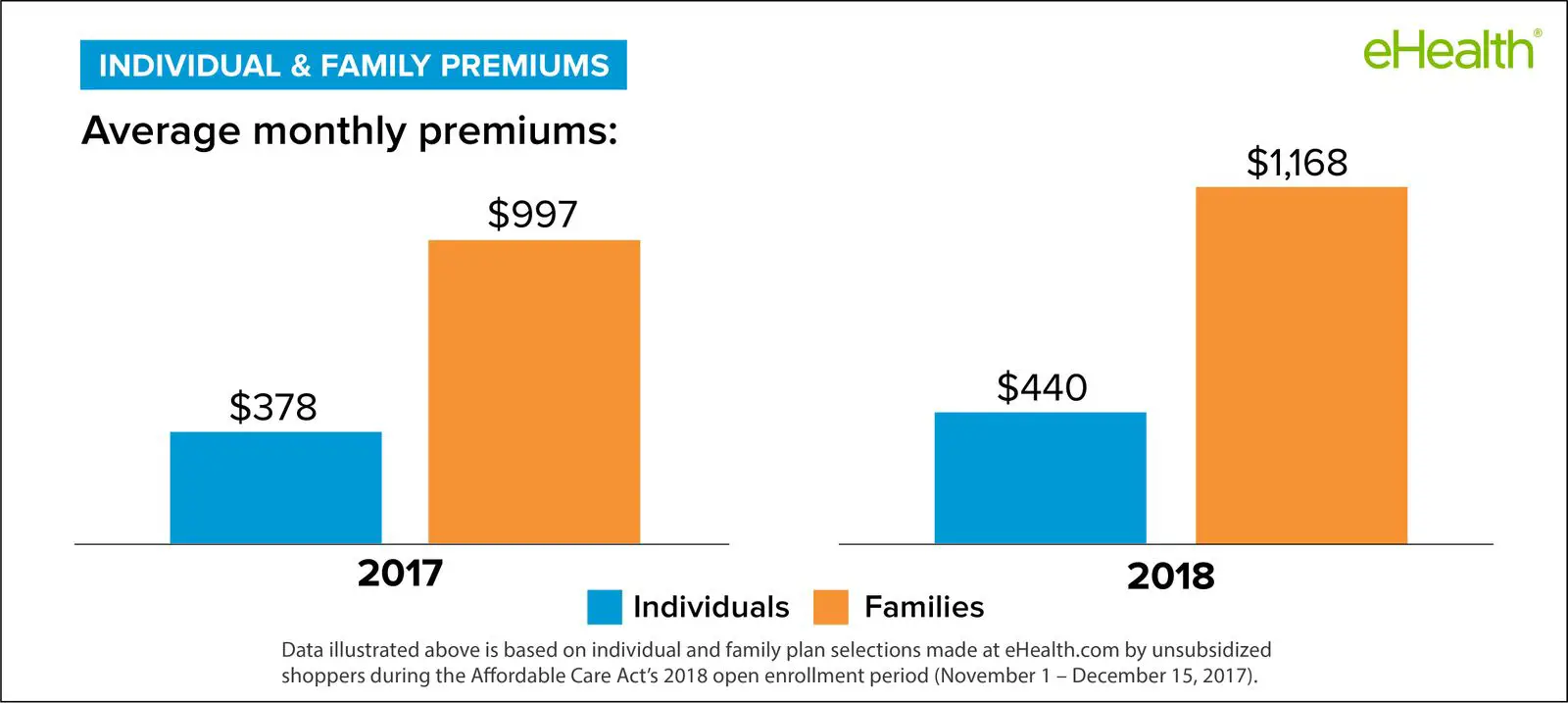

In 2020, the average national cost for health insurance is $456 for an individual and $1,152 for a family per month. However, costs vary among the wide selection of health plans. Understanding the relationship between health coverage and cost can help you choose the right health insurance for you.

Recommended Reading: Do Starbucks Employees Get Health Insurance

How Much Is Family Health Insurance Per Month

The average premium for a family of 4 in 2020 is was $1,437, according to customer data gathered by one health insurance agency. This does not include families who received government subsides. Like individual insurance, your family cost will depend on ages, location, plan category, tobacco use, and number of plan members.

How Much Does Blue Cross Health Insurance Cost

How much is health insurance a month for a single person? For a single adult, without dependents, living in NSW, you can expect to pay between $110.50 and $142.30 a month for a Basic combined Hospital and Extras policy .

People ask , is Blue cross a fee for service health insurance? Under fee-for-service, you choose the doctor or the hospital or the clinic, and the insurance pays for part or all of the cost according to a schedule laid out in the policy. The Bluesblue Cross and Blue Shield are the best-known providers of this kind of healthinsurance, although not the only ones.

Also, how much will my health insurance cost? In 2020, the average national cost for healthinsurance is $456 for an individual and $1,152 for a family per month. However, costs vary among the wide selection of health plans.24 nov. 2020

, how much is health insurance a month for a single person in Canada? How much does health insurance cost in Canada? On average, healthcare premiums for a family in Canada are around C$157 per month . For an individual male its C$47 per month, and for an individual female its C$80 per month.25 mai 2021

, how do I find affordable health insurance? Visit HealthCare.gov to apply for benefits through the ACA Health Insurance Marketplace or youll be directed to your states healthinsurance marketplace website. Marketplaces, prices, subsidies, programs, and plans vary by state. Contact the Marketplace Call Center.11 mai 2021

Contents

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

Health Insurance Rate Changes In Texas

Health insurance premiums changes are set by the health insurance companies on a yearly basis. Before these premiums are set, they are first approved by the federal health insurance exchange.

In Texas, the prices of every metal plan increased from 2020 to 2021. The highest increase affected Gold plans, which rose by 11%. Catastrophic plans increased by 2%, the lowest increase among the metal tiers.

| Metal tier |

|---|

What Happens If You Get Hit By Someone Without Insurance In Texas

If you are in a car accident with no insurance in Texas, the police will likely give you a ticket. They may have your car towed or ask you to arrange for someone with proof of insurance to drive it away from the scene. Some municipalities also have ordinances that allow police to impound your vehicle.

You May Like: Does Starbucks Provide Health Insurance For Part Time Employees