What Is Health Insurance For Self

Health insurance for the self-employed is any insurance plan purchased as an independent contractor or self-employed individual where you are required to cover the cost of your own employee benefits, including health insurance. You may have a couple of options for buying coverage, such as purchasing health insurance directly from a provider or through your states exchange or Heathcare.gov. You may apply during open enrollment which happens once per year every fall or after a qualifying life event.

Depending on your income, you may qualify for a discount through cost-sharing reductions, which may lower the cost of your deductible, co-payments, or co-insurance. To qualify, you must sign up for one of the Marketplace plans.

If your income is low, you may also see if you qualify for Medicaid, which could offer free or inexpensive health insurance. You may apply for Medicaid through the Marketplace or through your states Medicaid agency.

Beware Of Unlicensed Health Plans

When choosing a health plan, it is important to consider the differences between your options. Some plans provide more generous coverage, while others could leave you responsible for high medical bills. Shopping for health insurance can be overwhelming, but remember, if the plan sounds too good to be true, it probably is.

Discount Plans

Do not buy a discount plan as an alternative to health plan coverage. Discount plans charge a monthly fee in exchange for access to health care services at a reduced fee. These plans are not insurance and do not make any payments when you need health care services. Instead, they allow you to get a discount off of some of your medical charges. Discount plans may look like a cheap health plan, but they are not health insurance and they do not meet your Massachusetts “individual mandate” requirement for health coverage. You should check with your doctor or local pharmacist to ask whether you will receive any real savings before you give your money or your personal information to anyone offering health care discounts.

Health care sharing ministry plans.

| Limited Time Offer | Pay First, Read Later |

| Beware of high pressure sales tactics that tell you a low monthly price is a limited time offer and will expire in a day or two.There is no such thing as a limited time offer or “special” in health insurance. | Beware of companies that will not provide any written information about the health plan unless you pay first. |

Remember: Stop. Call. Confirm.

Despite Health Insurance Premiums That Are Nearly The Highest In The Nation Free Coverage Is Available To Some Wyoming Enrollees

Wyomings individual health insurance market experienced substantial rate increases in 2017 and 2018, although the rates have stabilized since then and are dropping quite a bit for 2021. Since 2018, the cost of cost-sharing reductions has been added to silver plan rates. And since premium subsidies are based on the cost of the benchmark silver plan, the premium subsidies grew substantially in 2018 and have remained disproportionately large. So although average rates decreased slightly in 2019, increasing only slightly for 2020, and are dropping by about 10 percent for 2021, average premium subsidies are still much larger than they were in 2017.

The subsidies keep the cost of the benchmark plan fairly consistent from one year to the next. But the subsidies can also be applied to plans at other metal levels, which have had less premium growth since 2017. That makes those plans particularly affordable for people who qualify for premium subsidies but who dont get CSR benefits and thus dont need to select a silver plan .

As an example, consider a family in Sweetwater County: parents are 45, kids are 15 and 13, and their household income is $97,000 .

You May Like: How Much Do Health Insurance Agents Make

How Do You Choose A Plan That Meets Your Budget And Needs

To settle on the right plan, think about how you typically use healthcare services. For example, ask yourself:

- How often do you usually visit the doctor? Once a year for a checkup, or monthly to monitor a health condition? Was last year typical, or unusual?

- Are you expecting larger-than-average health expenses next year or do you only expect to use preventive care services? For example, are you having a baby? Were you recently diagnosed with a condition that will require regular treatment?

- What prescriptions do you take regularly?

- How many healthcare providers do you typically see? Just a primary care doctor, several specialists over the year, or just the provider at your local retail or urgent care clinic?

- Do you and your family have one or more chronic health conditions?

- Have you or any of your family members been diagnosed with COVID-19 in the past year?

- Have you postponed healthcare services because of COVID-19?

It may be helpful to add up what you spent last year, just as a general guideline.

Make sure you look at all costs, not just the premiums. For example, a high-deductible plan can work out to your advantage if you are relatively healthy and only expect only to use preventive care services, since those services are at 100%. These types of plans typically have lower premiums. However, if you have a chronic condition that requires a lot of care, you might consider a plan that has a higher premium but lower out-of-pocket costs.

Dont Forget to Shop Around

Is Health Insurance Worth It

Its very rare to find a scenario where health insurance isnt worth the cost. You never know when youll become sick or get injured, and its significantly cheaper to pay for health insurance than to incur large medical bills. Doctors visits, hospital stays, and ambulance rides can add up to hundreds of thousands of dollars. Its better to pay for health insurance than risk getting stuck with those bills.

Read Also: Will My Health Insurance Pay For An Auto Accident

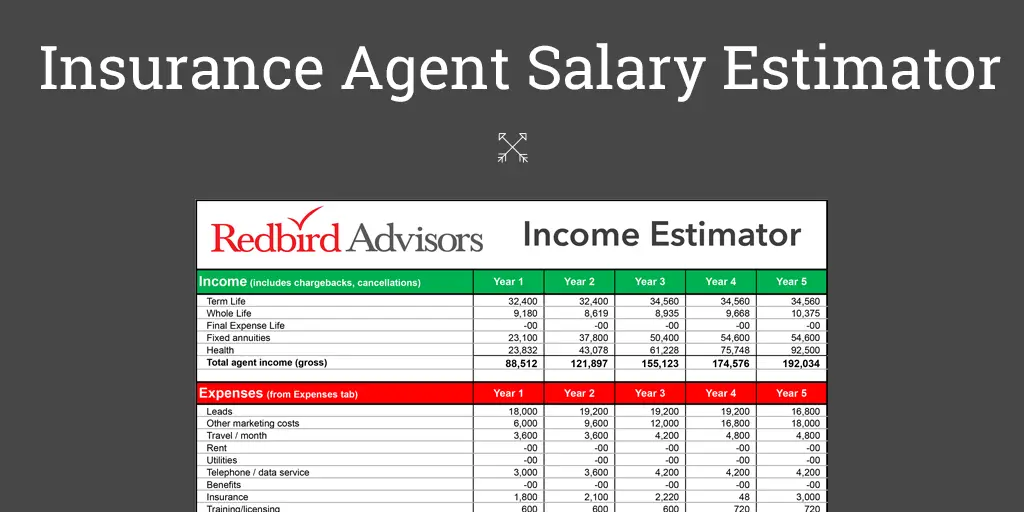

How To Be A Successful Insurance Agent

There are several tips that will help you to be a successful Insurance Agent.

First of all, be patient and commit to the career path. Your success shouldnt be measured overnight, allow yourself sufficient time to meet your goals. Setting realistic and attainable goals will be crucial to your success.

As an insurance salesperson, you need to always think of new ways to attract, engage, and retain customers. Building relationships and staying top of mind will be crucial to your success as an insurance agent.

Consistency will be key to your career. As a salesperson, you will need to be very consistent in the actions you take to manage your relationships and run your business. Consistency will lead to more sales and higher earnings over time.

Understand And Compare How Health Plans Are Structured

Know the differences between a health maintenance organization , preferred provider organization , exclusive provider organization , point of service plan and high-deductible health plan with a health savings account.

Dig into the details of what the health plans cover. For instance, how will the plan cover the prescription drugs you take? Make sure the healthcare providers you want to use are in the plan’s network. Otherwise you will pay more out of pocket or may not have coverage to see them.

In addition to reviewing the premium you’ll pay for the plan, estimate how much you’ll pay out of pocket for the amount of healthcare you expect to use in the next year.

If you rarely need medical care, it probably makes more sense to choose a plan with a higher deductible and lower premium than to pay a high premium for a plan with a low deductible. However, if you have a family and expect will need at least some health care services, a lower deductible could be the best choice.

Recommended Reading: Can A Significant Other Be Added To Health Insurance

What Are The Disadvantages Of Private Health Insurance

Disadvantages of Private Health Care.

- Inequality. It will be a bigger burden for those on low incomes to take out health care insurance.

- Health Care is a Merit Good. People may forget, be unwilling or be unable to take out private health care insurance.

- Positive Externalities.

- Difficult to get money back.

How Buying Private Health Insurance Works

Some Americans get insurance by enrolling in a group health insurance plan through their employers.

Medicare provides health care coverage to seniors and the disabled, and Medicaid has coverage for low-income Americans.

Medicare is a federal health insurance program for people who are 65 or older. Certain young people with disabilities and people with end-stage renal disease may also qualify for Medicare. Medicaid is a public assistance healthcare program for low-income Americans regardless of their age.

If your company does not offer an employer-sponsored plan, and if you are not eligible for Medicare or Medicaid, individuals and families have the option of purchasing insurance policies directly from private insurance companies or through the Health Insurance Marketplace.

Recommended Reading: Can Aflac Replace Health Insurance

Are Your Providers In Network

Check the health plan’s network to make sure it has a good selection of hospitals, doctors and specialists. Look for your providers in the plans network.

This is especially true if you get an HMO. HMOs have a restricted network and wont pay for the care you receive outside of the network.

If you get a PPO, youll likely be able to get out-of-network care, but it can come at a higher price tag.

Modest Gains In Gross Revenue

When I compiled my final 2020 revenue and expense figures, my taxable revenue increased over 2019. The 2020 net revenue was $57,745 compared to $47,028 in 2019. Part of the increase was attributable to decline of expenses from $13,456 in 2019, down to $10,954 in 2020. Like most people, I just did not travel for business in 2020 because of the Covid-19 restrictions and I also cut back on advertising.

The decline of advertising nationwide showed up in my revenue. My Google Adsense revenue dropped by 35 percent as advertisers either stopped advertising or reduced what they were willing to spend per ad click. My book sales were cut in half as there were no speaking engagements that are the primary driver for book sales.

Insurance commissions increased by approximately $9,000 in 2020, about 17 percent. The increase of insurance revenue was tempered by losing one of my small group clients and several individual and family clients moving into Medi-Cal. The loss of business was counter balanced by enrolling several families who lost employer group health insurance from Covid-19 lay-offs and Medicare.

Also Check: Can I Buy Dental Insurance Without Health Insurance

Hot Tubs Swimming Pools Or Outdoor Spas

These water features can make your yard into a private oasis to help you get away from the worldbut they are outdoors, which increases the possibility of damage during storms or acts of vandalism. As a result, your coverage costs may increase. Also, because theyre water features, there is an increased possibility of injury to you and your guests, so some insurers may require that you increase your liability limit if you have a hot tub, pool, or spa.

Best Large Provider Network: Blue Cross Blue Shield

Blue Cross Blue Shield

BCBS members have access to plans through health maintenance organizations , exclusive provider organizations , and preferred provider organizations .

BCBS health care organizations offer nationwide coverage, and six of its companies were included in the top 15 best health insurers by Insure.com. Of those six, the ones that have AM Best ratings for financial strength received an A or better.

-

No matter where you live, there is a health care facility provider who accepts BCBS in your state.

-

There are many policy options and there is a plan available no matter how much coverage you may want.

-

Customers have rated various BCBS companies less than 3.5 stars on Consumer Affairs. The complaints include difficulty in getting medical procedures approved, coverage denials, and limited PPO choices.

The Blue Cross Blue Shield Association offers private health insurance coverage in the United States and over 170 countries. Over 110 million Americans have their health insurance through a BCBS organization. There are 35 BCBS independent health insurance companies in the U.S., and most have an AM Best financial strength rating of A .

The HMO plans offer the most comprehensive plans at the greatest savings but limit doctor choices to those inside the HMO. The EPO plan uses select provider networks and incorporates policies that promote and manage member health care. On the other hand, the PPO plans offer more flexibility with a great number of participating doctors.

Also Check: How To Get Health Insurance For My Parents

What Is The Cheapest Health Insurance

As you can see from the factors listed above, theres a lot that goes into determining the price of insurance. There isnt a single healthcare plan thats the most affordable for everyone. But finding the right plan for your needs is easy with HealthMarkets. Our free FitScore® technology helps you shop, compare and apply for a healthcare plan in minutes. We can even check to see if you may qualify for a tax credit. To get a better look at what plans could cost you and your family, get started now.

46698-HM-1120* Subsidy amounts are based on a 40-year-old nonsmoker making $30,000 per year.

References:

How To Get Individual Health Insurance

How can you buy an individual health plan? The health insurance marketplace, run by the U.S. Department of Health and Human Services, is the ACA exchanges website that offers you a menu of your coverage options. The site lets you compare individual health insurance plans and find the best health insurance to buy for individual.

You simply enter your information, including your income, and the site provides your coverage options, including estimated costs. Thats the place to start when looking for your insurance options.

Not all insurers sell plans through the government-run health insurance marketplace. You can find more individual and family options by shopping directly through health insurance companies that offer plans outside the exchanges. That will take more work to compare the insurers, but you may also find a plan that better fits your needs outside of the exchanges.

Now, lets take a look at when you can buy individual health insurance and the types of plans and other options.

Recommended Reading: Do Real Estate Brokers Offer Health Insurance

Where Can I Buy Private Health Insurance

A good place to start looking for coverage is the Health Insurance Marketplace created in 2014 by the Affordable Care Act . On the marketplace for your state, you can look through the details of private health insurance plans, and compare the cost and benefits of each. If your state does not have its own marketplace, use Healthcare.gov.

More Answers: Health Coverage If You’re Self

- How do I know if Im self-employed or a small employer?

-

If you run a business that produces income and has no employees, youre considered self-employed. You can buy health coverage through the individual Health Insurance Marketplace®.

- Youre not considered an employer only because you hire independent contractors to do some work.

- “Employees” are generally workers whose income you report on a W-2 form at the end of the year.

Don’t Miss: What Is A Health Insurance Plan

Ways To Cut The Cost Of Private Health Insurance

Approximately 4 million people in the UK currently pay for private health insurance and this number is rising despite the financial uncertainty in the wake of the Coronavirus pandemic. It goes to prove the importance people place on their health, however, many are finding out that not only is private health insurance relatively complex, it can be expensive too. While many people are purchasing private health insurance for the first time in their lives, many more are looking for ways to cut down the cost of their cover. The reality is that cutting the cost of your health insurance is going to require some form of compromise. There are, however, some clever ways that you can cut down on the amount you pay each month and so in this article we look at 10 ways you can cut the cost of your health insurance.

Hmo Vs Ppo Vs Epo Vs Pos

Another factor to consider when it comes to how to get health insurance is the plan type. Here are the 4 most common types of plans:

- HMO: An HMO is a health maintenance organization. With an HMO, you choose a primary care doctor. If you need to see a specialist, you typically need to get a referral from your primary care provider. HMOs have a provider network. You may not be able to see providers outside of your network. If your plan allows you to see out-of-network providers, you will have to pay more.

- PPO: A PPO is a preferred provider organization. It allows you more flexibility than an HMO. You typically dont need a referral to see a specialist. You can see providers outside of the provider network, but you will pay a bit more.

- EPO: An EPO is an exclusive provider organization. It combines aspects of an HMO and a PPO. You have the more restrictive network associated with an HMO. If you see an out-of-network provider, you pay significantly more. You also have the freedom to see specialists without a referral.

- POS: A POS is a point-of-service plan. You can see any provider in your network without getting a referral. If you want to see an out-of-network provider, you do need a referral.

Don’t Miss: How Much Does A Family Health Insurance Plan Cost

Age And Construction Of The Home

Its a fact you should consider when choosing a home: Older homes simply cost more to repair and may be in need of it more often. Replacing vintage floorboards and tiles, rebuilding plaster walls, and patching canvas ceilings require specialists and costly materials, which your insurer will see as increased costs in the event of a repair. As a result, your older home will cost more to insure than a newer one. In addition, the construction of an older home likely does not meet current code. By law, a home being repaired by a licensed contractor must be brought up to current code, which can add thousands of dollars in material and labor to the repair cost. Standard homeowners policies do not cover that cost, but most companies will offer you the opportunity to purchase a separate endorsement to your policy to cover the costs of code updatesfor additional cost, of course.