Remote Customer Retention Specialist Christian Care

Posted: Aug 15, 2021 · A program of Christian Care Ministry, Medi-Share is a healthcare sharing ministry where members share each others eligible medical bills. Its pillars are: GOD-HONORING healthcare AFFORDABLE choice ACCEPTABLE under the law In 1993, a formalized approach to sharing healthcare burdens began with the Medi-Share program.

Celebrating 40 Years Of Service To You

and many more to come!

Christian Healthcare Ministries serves Christians in all 50 states and around the world, having shared nearly $6 billion in our members medical bills. Read about our 40 years of service by

Christian Healthcare Ministries’ members and staff have exercised their faith by ministering to one another through spiritual and financial support at any age or stage in life. We encourage you to read any of the hundreds of medical bill sharing stories members have shared with us or learn more about why we’re celebrating our strong 40-year history and looking forward to a continuing vibrant future.

The Genetic Basis For Reducing Disease Risk

Many diseases have a genetic basis. That is, certain parts of your genome may put you at greater risk for developing a disease. When you know your genetic makeup, you can discuss your risk with a medical provider and take preventative measures to reduce your chances of developing diseases.

Programs like Medishare do not covergenetic counseling. Genetic testing sites like Nebula Genomics allow you to explore your genome and learn about your disease risk with their online platform. Nebula Genomics is not a diagnostic company and changes to your lifestyle should be discussed with a licensed medical provider. Knowing your disease risk allows you to make healthy decisions that can lower your medical bills and make a program like that even more cost-effective.

Don’t Miss: Does Amazon Have Health Insurance

Medical Providers May Not Want To Bill Medi

There have been a few anecdotal cases of doctors and hospitals refusing to bill Medi-Share, and instead, asking the patient to pay out-of-pocket. In some cases, this may stem from the fact the PHCS network Medi-Share uses is not the universal PHCS provider network.

Its incumbent on Medi-Share Members to .

That said, the anecdotes of providers being unwilling to bill Medi-Share have still had happy endings. In particular, this mothers cancer treatment was prepaid by Medi-Share at self-pay rates after the provider initially refused to accept the plan.

The health share ministry made sure to come through for her.

However, receiving a huge out-of-pocket bill from a provider can come as a shock to a family who has already paid their full portion.

Since you want to be focused on getting well rather than on finances, this bears keeping in mind.

Can Sharing Plans Be Reimbursed Through Qsehra

Coming Soon!

The IRS is proposing that membership in a Health Care Sharing Ministry will be considered an official medical expense under section 213. This change will allow members to be reimbursed tax-free for the monthly share they pay to belong to the sharing plans.

What’s the Catch?In order to participate in QSEHRA for 2021 participants will need to have insurance that meets Minimum Essential Coverage .

This means a separate MEC plan will need to be purchased to qualify.

You May Like: How Much Is Health Insurance For Seniors

Get Christian Healthcare For Less

Posted: Is this site affiliated with christian care ministry or the product medishare? We are not affiliated with any medical health sharing ministry, including Christian care ministry nor any plan including medishare. Our mission at the Healthcare Enrollment Center is to help you find the best health care by comparing all available options.

Hcsms Are Still Not Minimum Essential Coverage

Now that the ACA’s individual mandate penalty has been reduced to $0, there is no longer a need for HCSM members to obtain an exemption from the individual mandate penalty. So there’s no longer a need, for example, for HCSMs to have been in operation since 1999. A newer HCSM can enroll members and function just like any other HCSMtheir members would not be eligible for a penalty exemption under the ACA, but that’s no longer an issue since there is no longer a federal penalty for being without minimum essential coverage.

It’s important to understand, however, that the concept of minimum essential coverage continues to be relevant in terms of qualifying for a special enrollment period to purchase ACA-compliant coverage.

Special enrollment periods are granted when a person experiences a qualifying event that allows them to enroll in an ACA-compliant plan outside of the normal annual enrollment window. But in most cases, the applicant must have had minimum essential coverage prior to the qualifying event in order to trigger a special enrollment period. In other words, most qualifying events allow for plan changes but don’t necessarily allow a person to go from being uninsured to being insured .

For example, if they lose coverage under the healthcare sharing ministry for some reason, it would not trigger a loss-of-coverage special enrollment period, because the coverage that’s endingthe healthcare sharing ministry planis not considered minimum essential coverage.

Don’t Miss: How To Get Health Insurance In France

I Was Shocked I Couldnt Believe It I Had Never Entertained The Possibility That The Company Would Not Cover The Expenses Of The Operation

Timothy Corridon

I wanted something affordable. I didnt think I would need it that long, Corridon said. I thought Id be able to get another job quicker than I did.

More than a million people nationwide have turned to health sharing ministries as the cost of medical care continues to increase. Many of the plans market themselves as lower-priced alternatives to policies that must meet tougher mandates, such as coverage for pre-existing conditions, set by the Affordable Care Act.

Most of the groups were allowed to continue operating under the federal health law because of a religious exemption, and they offer cheaper rates because they are not considered to be insurance and are not required to pay claims. Members pay monthly premiums, with the expectation that the funds will be shared when medical expenses come up.

This past due bill is one of many Corridon has received since a health care sharing ministry refused to pay expenses associated with his surgery.

In Connecticut, more than 5,000 people have joined the ministries, industry officials have estimated. But while some are happy with the coverage, others have complained to state agencies that they were misled into purchasing the plans, or surprised when medical bills werent paid.

Plans like those offered by health sharing ministries have flourished in recent years as the Trump administration loosened rules to allow alternatives to the Affordable Care Act that dont provide such broad coverage.

What Is Christian Healthcare Ministries

Christian Healthcare Ministries is a budget-friendly, biblical, and compassionate healthcare cost solution for Christians in all 50 states and around the world. Were not health insurance rather, we’re the first and longest-serving health cost sharing ministry, having shared over $6 billion in our members medical bills.

Don’t Miss: Can I Use My Health Insurance In A Different State

Free & Unlimited Extras With Medi

| Faith-Based Community |

“The best part of Medi-Share is that they’re caring.”

– Pastor Ariel, Husband and Father

“Medi-Share’s an ally and you don’t feel like that with traditional insurance.”

– Catherine M., Business Owner

“Medi-Share is supportive, and wonderful, and amazing.”

– Ocieanna F., Mother of 4

“Bills have been over a million dollars. And the members at Medi-Share have faithfully shared.”

– Sandra E., Wife and Mother

“I was able to enjoy our new baby and never have to even worry about the bills.

– The Sokic Family, new parents

“Working with Medi-Share was a joy, right from the beginning.”

– Steve S., Missionary

What Are Pros And Cons Of Health Care Sharing Ministries

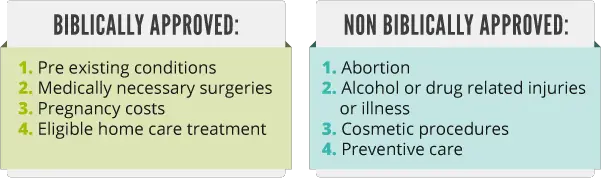

HCSMs may provide an affordable way to receive assistance paying your medical bills. Typically, the monthly share amount as well as the annual unshared amount are less than the premiums and deductibles of traditional health insurance coverage. Because HCSMs arent providing insurance, they dont have to comply with ACA mandates. For instance, they dont have to cover pre-existing conditions, preventative care, reproductive care such as birth control, or services for substance use disorders.

Don’t Miss: Can I Get Health Insurance Outside Of The Marketplace

Hcsms Dont Have Individual And/or Family Deductibles

Traditional health insurance plans include a deductible that must be paid out-of-pocket before medical benefits are paid out. With a HCSM, you pay whats called an annual unshared amount. This is the out-of-pocket amount you agree to pay for eligible medical expenses before your medical bills are shared for payment. The annual unshared amount, which resets each year, is typically lower than a traditional health plan deductible. For instance, with Solidarity Healthshare, the annual unshared amount is $750 for an individual, $1,500 for a couple and $2,500 for a family.

How Does Primary Care Work With Medi

Unlike regular insurance, primary care insurance is not usually covered by Medi-Share. However, there are exceptions such as a physical examination for children under 6 years of age and an annual physical examination for each member.

Because members must pay for most preventive services themselves, Medi-Share recommends that members use doctors in their PPO network to find Get the best deal possible. Medi-Share also offers free telehealth to its members.

Don’t Miss: What Is The Best Travel Health Insurance

What To Know About Health Sharing Ministries And Tax Exemptions

Amy

Filing taxes is notably one of the least enjoyable things adults must do each year. To get ahead of the many questions we receive each year about health sharing ministries and tax exemptions, weve provided you with a quick guide to filing income taxes for Medi-Share members.

Take Command is a big fan of sharing ministries as affordable alternatives to health insurance. In fact, you can read about our CEO’s review of Medi-Share on the blog. The important thing to remember is that sharing ministries are different than traditional health insurance in more ways than one .

Unlike traditional health insurance, members of healthcare sharing ministries, such as Medi-Share, are exempt from the individual mandate penalty that has been imposed on those who can afford to purchase health insurance but opt out. You can view the Christian Care Ministry’s Certificate of Exemption here.

Here’s what to know about sharing ministries and tax exemptions.

Monthly Payments To An Hcsm May Be Lower Than Traditional Medical Insurance Premiums

Because youre not paying for traditional medical insurancewhich requires coverage for things like preventative care, pre-existing conditions and reproductive carea monthly HCSM payment is usually less than a monthly insurance premium. Still, under the Affordable Care Act, many families qualify for healthcare subsidies.

Also Check: How To Apply For Health Insurance In Colorado

Christian Healthcare Ministries Vs Medi

Posted: Oct 10, 2021 · CHM. Christian Healthcare Ministries has 3 healthcare plans that you are able to choose from. CHM offers the Bronze plan, Silver plan, and a Gold plan for their members. These plans range from $90-$450/mo. CHM differs from Medi-Share and other sharing ministries. Unlike other health share programs, CHM works differently.

Is My Share Amount Tax

Your share payment is not deductible for federal income tax purposes as a charitable donation or medical expense. Since there is a strong possibility that your medical expenses will get shared by another Member, you cannot deduct your share as a charitable donation, even though Christian Care Ministry is a 5013 not-for-profit ministry. Your share payment is not tax-deductible as an insurance expense because Medi-Share is not insurance.

Also Check: Where Can I Buy Travel Health Insurance

Health Care Sharing Ministry

Health care sharing ministries are organizations in the United States in which health care costs are shared among members with common ethical or religious beliefs in a risk-pooling framework in some ways analogous to, but distinct from, health insurance.

Members of health care sharing ministries are exempt from the individual mandate requirement of the U.S. Patient Protection and Affordable Care Act of 2010 . This means members of health care sharing ministries were not required to have insurance as outlined in the individual mandate, which was later repealed.

Approximately 31 states have safe harbor laws distinguishing healthcare ministries from health insurance organizations. Some of the larger health care sharing ministries are Christian Healthcare Ministries , Medi-Share, a program of Christian Care Ministry , Samaritan Ministries , Liberty HealthShare , United Refuah HealthShare, MCS Medical Cost Sharing Altrua HealthShare, Freedom HealthShare, Unite Health Share Ministries, and Trinity HealthShare .

What Is A Health Care Sharing Ministry

First, let’s jump in to a little background information.

A health care sharing ministry is an affordable alternative to health insurance that brings together a group of like-minded individuals that help each other share the burden of unexpected medical costs. They often have a PPO network along with a more affordable price tag.

With health care costs as high as they are, healthcare sharing ministries are exploding in popularity due to their lower costs and shared values they promote. Some examples are Medi-Share, Liberty HealthShare, Christian Healthcare Ministries, Altrua Health Share, Shared Health Alliance and Samaritan Ministries.

Recommended Reading: How To Find The Best Private Health Insurance

Escape The Market Altogether

Before Obamacare came along, I used to pay $300 a month for a $10,000 deductible health insurance policy.

I am self-employed and make a solid income. However, once the law was passed, my monthly premiums shot up to $1,100 a month!

With the future of American health insurance still being unclear, you may feel uncomfortable with a system that is being tinkered with in real-time and Medi-Share allows you to leave it all behind.

Review Of Medishare Privacy

According to their privacy policy, Medishare typically does not share member information with anyone outside of Christian Care Ministry, Inc. without permission. Christian Care Medi-share may disclose information to partners who provide services on the members behalf.

Medishare uses typical security measures to protect personal and financial information online, such as a Secured Socket Layer .

Also Check: How Much Do Health Insurance Agents Make

Is Healthcare Sharing Tax Deductible

As the deadline to file your taxes this year rapidly approaches, many members and non-members alike have questions on how Medi-Share works and whether monthly shares or annual household portions in our healthcare sharing ministry are tax-deductible. This blog will help answer any questions you may have.

Its The Cost These Things Are Cheaper The Same Way A Flimsy Car Is Cheaper Its Not As Good Of A Car Thats Why Its Cheaper

State Health Care Advocate Ted Doolittle

David White, a spokesman for Aliera Companies, reiterated in an email that the plans are not insurance and said all policies have language clearly explaining the distinction. Members are asked to sign a form of acknowledgment when they finalize their enrollment.

Health care sharing ministries offer an affordable alternative to traditional insurance plans, he wrote. Member contributions are received by the health care sharing ministry and are then used to pay eligible share requests to the ministrys members.

While Connecticuts insurance department has received complaints against several health sharing ministries, the largest portion target Aliera and another group it markets, Trinity HealthShare, records show.

In December, the department issued a cease and desist order against the two groups, saying they illegally advertise their plans as health insurance in Connecticut. Commissioner Andrew Mais accused the organizations of misleading consumers and trying to avoid insurance regulation.

The action does not affect current ministry members, but bars the groups from marketing their plans to new customers.

Aliera and Trinity have appealed the order.

Complaints arise

While health care sharing ministries have been around for years, complaints against some of them have increased recently.

Complaints have rolled in to several Connecticut agencies against Aliera Healthcare, a group that markets religious health sharing ministries.

Don’t Miss: Where To Go For Health Insurance

Lifestyle And Reasons For Medi

Medi-Share guidelines need to be followed by members to be eligible for Medi-Share insurance. The members are required to follow the Statement of Faith. Members who are above the age of 18 years and do not follow the Christian lifestyle might even get their membership canceled. Below are some of the actions that can lead to the cancellation of membership:

- Tobacco used in any way

- Illegal drugs

- Drug abuse in the form of alcohol, over-the-counter medicines, or even prescription drugs

- Sexual relations outside Christian marriage

- Participation or involvement in activities against personal safety

If a member gains weight abnormally, the member needs to participate as a health partner.

John Oliver On Healthcare Ministries: They Are Not Health Insurance

The Last Week Tonight host exposes the lack of regulations around healthcare sharing ministries by forming one of his own

On Last Week Tonight, John Oliver dove deep into American health insurance more specifically, healthcare sharing ministries, organizations in which members share healthcare costs that are often misleadingly billed as health insurance, centered on a common religious faith, and ripe for misuse.

The most important thing to know about healthcare sharing ministries isnt just that they can be cheaper than health insurance, which they can, Oliver explained. Its that they are also not health insurance. Generally they are nonprofits where people who share religious beliefs, usually Christianity, agree to help cover each others medical bills.

Healthcare sharing ministries have existed for decades, usually for insular communities such as Mennonites or the Amish. But their popularity exploded after 2010, when the Affordable Care Act, popularly known as Obamacare, included ministries as an exemption from the laws insurance mandate. Some healthcare sharing ministries, such as Liberty Healthshare, advertise specifically to conservative audiences who loathe the law, with ads on right-wing fringe networks and at the Conservative Political Action Conference.

But there are significant drawbacks to healthcare sharing ministries, Oliver continued, ranging from the disquieting to the disqualifying.

Read Also: How To Enroll In Health Insurance