Why Offer Employee Group Benefits

There are many good reasons to offer business employee health benefits. Employee group benefits:

- Help attract new talent and retain existing talent.

- Ensure your employees are healthy and happy so they can do their best possible work.

- Help protect the health and wellbeing of your biggest asset and investment

- Are a tax-deductible business expense.

Exceptions To The Rule

As with most things in life, there are some exceptions to the no legal obligation rule when it comes to employer-sponsored health insurance. Here are a few examples:

- If your employment contract specifically gave you the right to health insurance, your employer must uphold this promise.

- Union employees, who are guaranteed health care in a collective bargaining agreement, must receive these benefits.

- When all other employees in your employment classification are offered health insurance, you must receive the same offer.

- If health insurance is being offered on a discriminatory basis , you may have a workplace discrimination claim based on protections within Title VII of the Civil Rights Act.

Generally speaking, the ACA holds that if an employer offers health insurance to employees, it must offer coverage to all eligible employees as soon as they become eligible. Employers who choose to go this route are subjected to a 90-day maximum waiting period, after which insurance must be provided to all eligible employees.

If My Employer Voluntarily Provides Health Insurance Benefits Is It Obligated To Provide Benefits To All Employees

Maybe, depending on the employer. Employers covered by Obamacare must provide health insurance to at least 95% of their full-time employees and dependents up to age 26. Otherwise, an employer is free to cover some, as opposed to all, of its employees. For example, salespersons can be excluded from an insurance plan while administrators are covered.

Exception: If an employee is entitled to participate in an employer-provided health benefits plan under ERISA, an employer may not wrongfully deny participation. To qualify, an individual must be classified as an employee, not a temporary worker or independent contractor and must be eligible to receive benefits according to the terms of the plan.

You May Like: Starbucks Open Enrollment

What Do Employers Need To Communicate To Their Employees If They Offer Small Business Group Health Insurance

If you decide to offer small group health insurance, you will need to provide your employees with specific information about the Marketplace health insurance offering:

- Who qualifies to participate in the companys group health plan. Small business employers are required to offer full-time employees the health coverage. Full-time means the employee works on average at least 30 hours per week. You are not obligated to offer coverage to employees family members but should disclose whether or not dependents may be covered by your companys plan.

- If you have new hires and you are uncertain whether they will work full-time, you are permitted to have a wait period, usually no more than 90 days from date of hire, to determine if the new hire is eligible to participate in the plan. Your employee communications should include a description of this wait period, if applicable.

- Benefits covered by your group health insurance plan. You must provide employees with a standard Summary of Benefits and Coverage form explaining what their health plan covers and what it costs. The purpose of the SBC is to help employees understand their health insurance options.

Other Helpful Facts About Applying For Small Business Group Health Insurance

Youcan offer group health insurance to part-time and seasonal workers if you wish.But it is important to understand, usually you must enroll at least 70 percentof your uninsured, full-time employees. If some of your employees have otherindividual or group health insurance coverage, they dont count toward the 70percent rule.

Andthere is a caveat to the 70 percent rule. If you enroll in small business group health insurance from November 15 to December 15 of the year,the 70 percent participation rule does not apply. You can be approved for smallbusiness group health insurance with fewer than 70 percent of your eligiblefull-time at this time. Applying forsmall business group health insurance during this period may be advantageous ifyou are concerned that one or more eligible employees will refuse healthinsurance coverage and disqualify the company from getting small business grouphealth insurance.

Read Also: What Is Evolve Health Insurance

Labor Department Regulations Are Expected

The health law stipulates that employers with more than 200 full-time workers are required to enroll newly hired full-time employees in a plan unless the employee specifically opts out of the coverage. However, the provision wont take effect until the U.S. Department of Labor issues regulations.

Employees who are unhappy about being required to buy into a company plan could complain to the Department of Labor, some experts say. Its unclear whether such efforts would succeed.

Employment law experts point to a 2008 decision by the Labor Department dealing with state laws that restrict employers from making deductions from workers paychecks without their consent. The department issued an advisory opinion saying that federal ERISA law pre-empted a Kentucky law that required an employer to get an employees written consent before withholding wages to contribute to a group health plan.

Although that decision doesnt have the force of law, it suggests how the Labor Department views such issues, says Cheryl Hughes, a principal at Mercers Washington Resource Group.

This article was reprinted from kaiserhealthnews.org with permission from the Henry J. Kaiser Family Foundation. Kaiser Health News, an editorially independent news service, is a program of the Kaiser Family Foundation, a nonpartisan health care policy research organization unaffiliated with Kaiser Permanente. It was produced with support from The SCAN Foundation.

Health Insurance Coverage As A Voluntary Benefit

Many smaller companies offer health insurance as a benefit, even if they aren’t required to by law. In fact, the majority of Americans have health insurance coverage through an employer. A study by the Urban Institute reported that 83.1% of all workers were offered health insurance through an employer in the first quarter of 2016.

In other words, you are likely to receive health insurance through your company, but it’s perfectly legal for employers of any size to refuse to provide it.

Don’t Miss: Kroger Employee Discount Card

Whats The Group Health Insurance Definition Of An Employee

Your employees must be working full time or do the equivalent of full-time work. A full-time employee would be working at least 30 hours per week. The interesting definition of an equivalent would be a combination of employees who all dont necessarily work full time individually but amount to full-time hours. Think 3 employees who are working 10 hours per week.

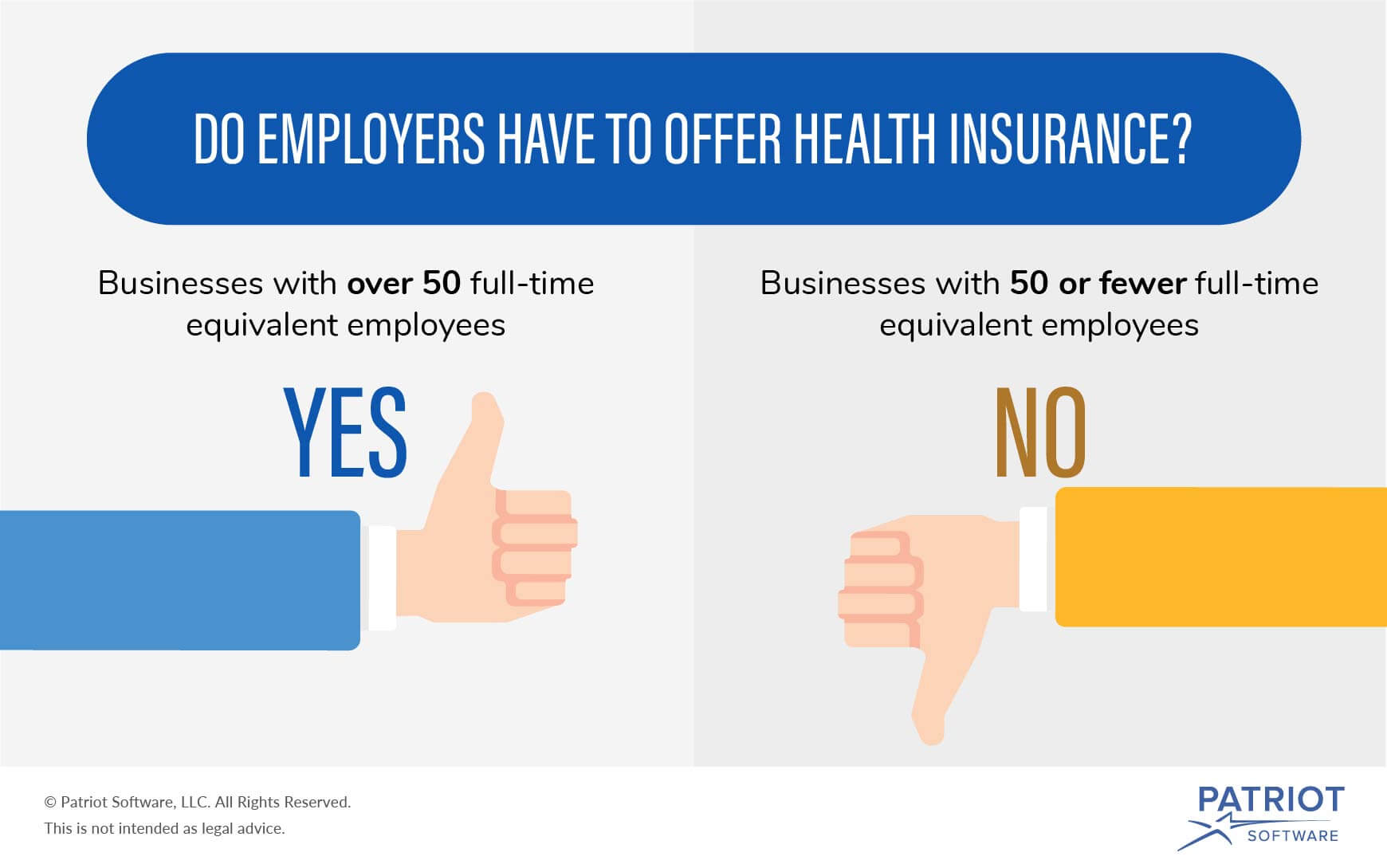

What Is Considered A Small Group For Health Insurance

As noted above, groups with up to 50 employees are considered small groups in most states. The ACAs employer mandate requires employers with 50 or more employees to offer health coverage to full-time employees. Businesses with 49 or fewer full-time equivalent employees are not required to offer health coverage.

Don’t Miss: Starbucks Insurance Cost

How Many Employees Do You Need To Get Group Health Insurance

Group health insurance can often be less expensive than individual plans that offer the same benefits and coverage options. However, not everyone qualifies for group coverage plans. If you have a small business, youll want to determine whether you qualify for group health insurance before you apply for coverage. The following information about group health insurance for small businesses will help you make informed decisions about health insurance for you and your employees.

Can Employers Refuse To Cover Spouses

When stating above that group health plans apply to immediate family members of your employees, this does not necessarily include the spouse.

While the spouse may be automatically added to a group health plan, the employer may choose to issue a spousal exclusion, by which the insurance plan applies only to the children of your employee.

If you are an employer and are considering spousal exclusion for your business group health benefits plan, be very cautious. The spousal exclusion must not be discriminatory, meaning that in the example if you are issuing a spousal exclusion for all your full-time employees, and these are mostly male, this could be seen as a gender exclusion, and exclusions cannot be based on criteria such as gender, race, nationality or religion.

If you are still confused about employee-related group coverage, then perhaps you can check out this FAQ section with a list of short answers to complicated group benefits-related questions.

Also Check: Does Uber Have Health Insurance

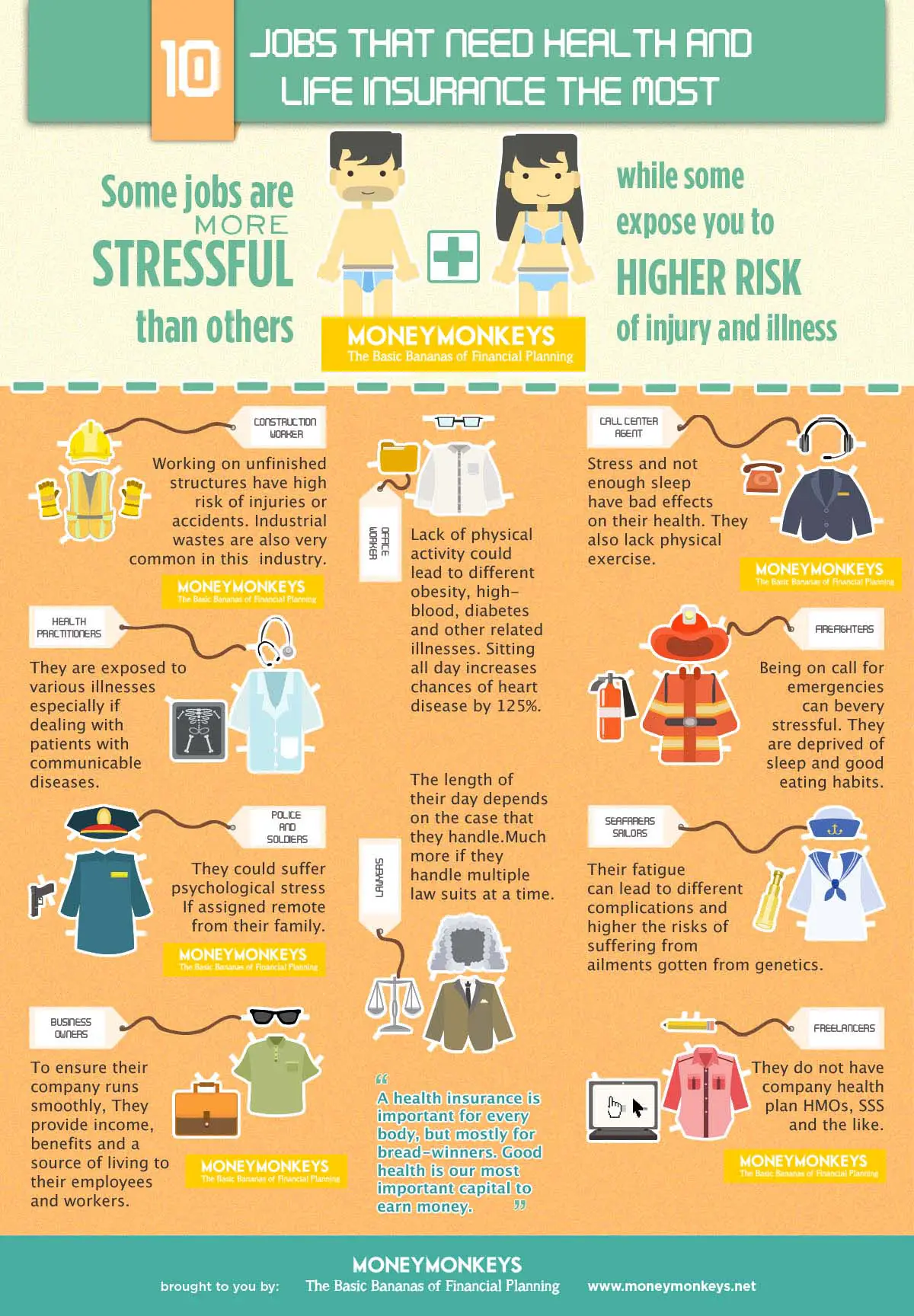

Do Employers Have To Offer Health Insurance

Eden Health Team

Lets face it: Employer-provided health insurance is the gold standard of workplace benefits. However, its not always clear whether an employer provides healthcare and employees might ask: Do employers have to offer health insurance?

From a legal standpoint, there is no federal law that says companies must offer health insurance to their employees. However, employers health insurance requirements do apply for some businesses depending on their size. The Affordable Care Act , passed under President Barack Obama, stipulates that certain companies must provide health insurance or pay a fine.

How Does Group Insurance Differ From Individual Insurance

You can purchase an individual insurance plan for yourself or one of your family members. All costs of this chosen plan are being paid by you directly. When it comes to group health benefits, your employer/company provides a plan that you and your immediate family members can partake in and pay only a small percentage as agreed on beforehand.

The pros can be considered cons, depending on your viewpoint:

- Your employer can pay some of your monthly premiums

- Your employer can help you choose an appropriate plan

- Your employer can provide plan documents

Some people want to be personally involved in all aspects of the health insurance plan they rely on, which is why all of these points might pose problems.

Note that you can always purchase an individual plan alongside your group plan.

RELATED ARTICLE

Don’t Miss: What Health Insurance Does Starbucks Offer

Affordable Care Acts Coverage Mandate

Under the ACA, also called Obamacare, Americans who were not otherwise eligible for an exemption were required to have health insurance coverage for themselves and their families. Failure to have minimum health insurance triggered a tax penalty at the same time, the ACA allowed for the creation of a premium tax credit to help Americans offset some of the cost of getting health insurance through the Health Insurance Marketplace.

This rule changed in January 2019, when the tax penalty mandate for health insurance was eliminated. While the ACA technically still exists, Americans who choose not to maintain health insurance for themselves or their family members in 2019 and beyond wont be penalized at tax time. Its estimated that as many as four million Americans will choose not to have health insurance coverage this year as a result of the penalty being eliminated.

As a result of the American Rescue Plan Act of 2021, all taxpayers with insurance bought on the ACA Marketplace are now eligible for the ACA premium tax credit previously, filers were ineligible if their income exceeded 400% of the federal poverty line.

Type Of Employees Matters

One of the employees on the group health insurance plan can be the employer or owner. However, at least one other employee who is not an owner must exist and enroll in the group health plan. That other employee must be someone who is:

- Not an owner or employer

- Not the spouse of an owner or employer

- Not a family member of the owner or employer

- Not a partner of the owner or employer

- Not a seasonal worker hired on an impermanent basis, even if the person works full-time during that period

- Usually not a contractor of the owner or employer

Recommended Reading: Uber Driver Health Insurance

Summary Of Benefits And Coverage Disclosure Rules

Employers must provide employees with a standard “Summary of Benefits and Coverage” form explaining what their health plan covers and what it costs. The purpose of the SBC is to help employees understand their health insurance options. You could face a penalty for non-compliance. Learn more about SBCs and see a sample completed form.

Contact An Experienced Employment Law Attorney Today

If you believe that your employer has failed to provide required health coverage due to discrimination, your employment classification, or because an employment contract guaranteed you this right, an experienced employment law attorney can help. Legal issues surrounding employee benefits constitute an extremely complex, and constantly evolving area of law, and it is in your best interest to obtain legal counsel if you believe your rights have been violated in any way.

Read Also: Can You Add A Boyfriend To Your Health Insurance

How Many Employees Do You Need To Qualify For Group Health Insurance

Group health insurance is a cost-effective way for small businesses to offer health insurance, as its cheaper than buying individual plans.

A company has to have fewer than 50 employees to qualify for group health insurance. You also have to have an office of some sort in the state where youre applying for coverage, and you need to enroll at least 70% of your uninsured employees.

If youre a family-run business, you need to check your eligibility for group health insurance, as you need to have workers who are not related to or the spouse of the owner of the company. If you only employ family members, youll need to apply for a family health insurance plan instead. Sole proprietors also cannot apply for group health insurance.

Part-time employees and seasonal workers do not count as part of the group, but you can still choose to offer them group health insurance. You can also provide individual health insurance to specific workers alongside your group plan.

Select A Health And Safety Representative Or Create A Joint Health And Safety Committee

Under the Occupational Health and Safety Act, workers and employers must work together to keep the workplace healthy and safe.

One way to do this is by working with your workplace health and safety representative, or with your joint health and safety committee. They are responsible for identifying potential health and safety problems and bringing them to your attention. They can also make recommendations on improving health and safety in workplace.

Also Check: Starbucks Health Plan

Eligibility For The Premium Tax Credit

You are eligible for the premium tax credit if:

- Your household income is at least 100% but no more than 400% of the federal poverty line for your family size

- You do not file a Married Filing Separately tax form

- You are not claimed as a dependent by any other person on their tax return

- You cannot get minimum health coverage under an employer-sponsored health insurance plan

- You are not eligible for government-sponsored health coverage under Medicare or another program

- You enroll in Marketplace health coverage within the month you apply for the tax credit

- You pay the share of your health insurance premiums that is not covered by the tax credit

Myth : Employers Must Cover The Same Percentage For Single And Family Coverage

Busted. An employer’s contribution does not have to be the same for single employee coverage and family coverage, and often is not. When it comes to national averages, employers typically cover about 82 percent of single employee premiums and 70 percent of family premiums.3

Among small firms , about one-third of workers contributed more than 50 percent of the total family premium.

Also Check: Health Insurance Starbucks

Q What If My Baby Wasnt Born In Hospital Or Attended At Home By A Registered Midwife

You will need to visit a ServiceOntario centre to register your child for Ontario health coverage.

If you visit a ServiceOntario centre within 90 days of the birth of your child you need to bring :

- confirmation of the babys birth, through either a letter from the hospital or attending physician, or a Certified Statement of Live Birth from a provincial office of the Registrar-General

- your residency document

- your identity document

If you visit a ServiceOntario centre more than 90 days after the birth of your child you need to bring :

- your childs citizenship document

Read Also: Starbucks Healthcare Benefits

Medical Loss Ratio Rebates

Insurance companies must generally spend at least 80% of premium dollars on medical care. Insurance companies that don’t meet this requirement must provide rebates to policyholders usually an employer who provides a group health plan. Employers who get these premium rebates must allocate the rebate properly. Learn more about federal tax treatment of Medical Loss Ratio rebates from the IRS.

Read Also: Starbucks Health Insurance Options

Evidence Of The Effects Of Health Insurance

Are employers perceptions of the value of health and health coverage consistent with the evidence from empirical studies? Is health coverage associated with measurable gains in health and productivity? Is absenteeism reduced? Do the benefits of health coverage justify its costs? The existing empirical research can shed some light on these questions, but it is hardly conclusive. Substantial gaps in research remain.

Plusthe Equivalent # Of Part

For example, if we have two parttime employees who work an average of 15 hours, thats the equivalent of 1 full time employee.

What does this mean?

For one, you cant drop all your full time employees down to part time andavoid requirements.

Also, you could have a lot of part-time employees and still trigger therequirements for coverage . Well discuss thislater.

Read Also: What Benefits Does Starbucks Offer