What Is An Out

There is a limit for how much you will have to spend on your health care costs in a year. This is called the out-of-pocket maximum, or OOPM. Your coinsurance, copay, deductible and other in-network essential health benefits apply to the OOPM. Your premium does not count toward the OOPM.

Time To Show You Our Research On Private Medical Insurance

Let the research begin. When still living in the US, we researched many options and found it to be overwhelming. Many US insurance companies wouldnt insure us outside of the United States for an extended period of time. Others wanted a thorough head-to-toe examination and proof that we were over the top healthy.

We received many online quotes from your standard US Insurance companies and many quoted $5000 $12,000 per year for our family of 4. What?! I thought that was crazy and continued to do research. They will tell you that you are covered in Spain, but beware!

Many of these companies are not accepted or known in Spain.

After living in Spain for 1 year, it was time for us to apply for our Spanish resident card renewal. As part of this process, we needed to again show proof of finances as well as Medical Coverage.

You Both Have Employer

If youre both employed by a company or companies that contribute to your health insurance premiums, maintaining your individual coverage with your respective employers is almost always the cheapest way to go.

Thats because employers typically require very low contributions from their employees to the plan cost even if it feels like a lot coming out of your paycheck. According to the Kaiser Family Foundation , employees pay only 17% of the premiums on individual plans on average, which you can do if you both have that option, and 27% on family plans.

In 2020, that breaks down the average health insurance costs you can expect to pay for an individual or family plan:

Again, the cost of a family plan may vary depending on how many people youre adding to the plan. Also, its important to note that the cost of your premium will also depend on where youre located and the amount to which your employer is able and willing to contribute to your health insurance costs.

In some cases, an employer may pay the full amount, but most employees can pay at least some of the cost.

Speak with your human resources representative about how much it would cost to combine health insurance coverage with your partner into a single plan, and have your spouse do the same. Note that you can add your spouse to your plan within 60 days of getting married. Otherwise, youd need to wait until open enrollment.

Also Check: Can A Married Dependent Be On Health Insurance

Group Coverage Vs Individual Health Insurance Cost

Written by: Elizabeth WalkerOctober 25, 2021 at 9:23 AM

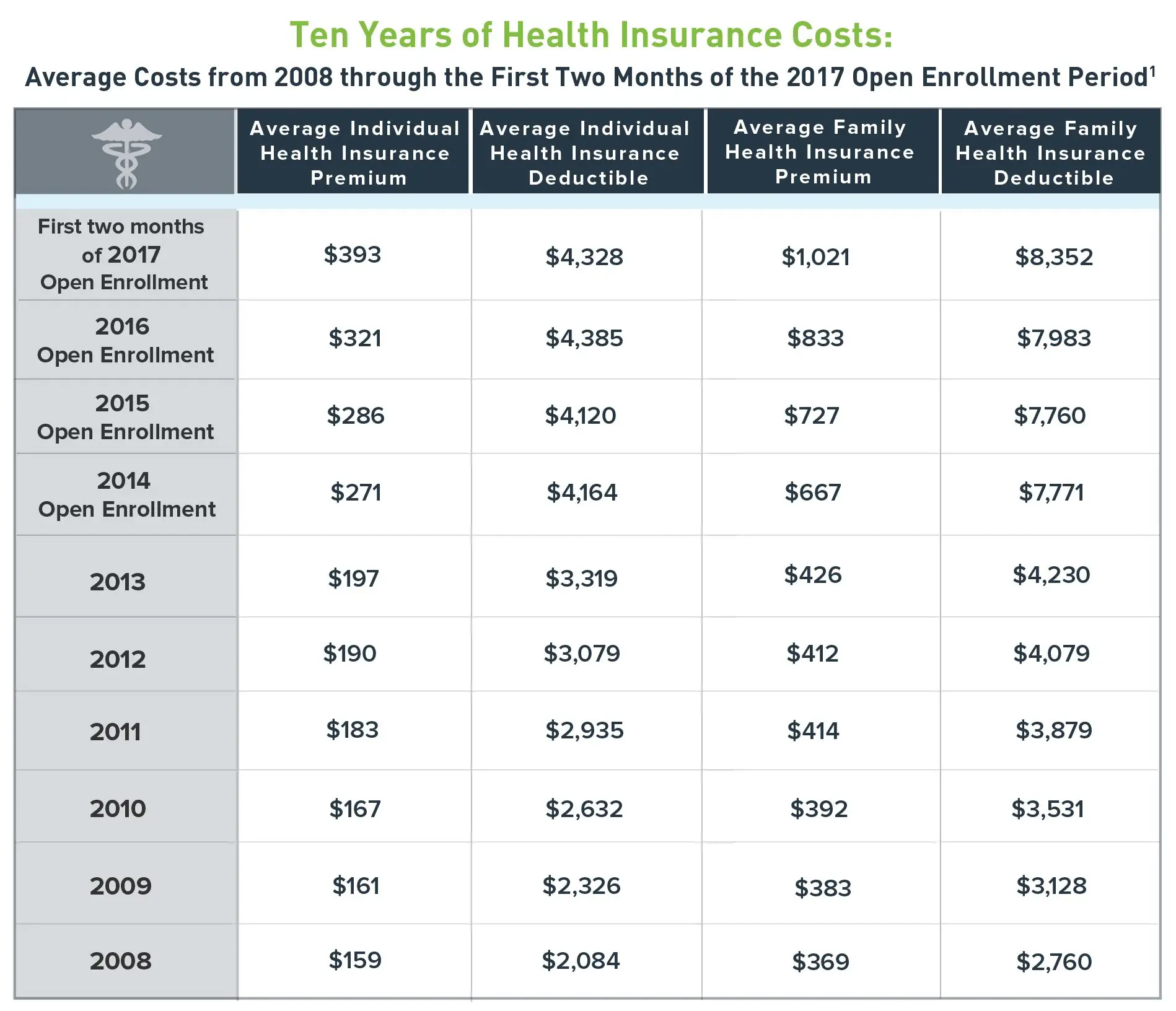

Many people assume that individual health insurance is more expensive than group health insurance, but is that really true? How exactly do individual health insurance premiums compare to group health insurance premiums?

In this article, well compare the cost of group health insurance and individual health insurance, as well as discuss another budget-friendly health insurance option to make your insurance even more affordable.

How Much Is Health Insurance Per Month For One Person

Monthly premiums for ACA Marketplace plans vary by state and can be reduced by subsidies. The average national monthly health insurance cost for one person on an Affordable Care Act plan in 2019 was $612 before tax subsidies and $143 after tax subsidies are applied.

Wondering how insurance premiums are decided? The Affordable Care Act ensures that insurance companies cannot discriminate based on gender, current health status, or medical history. Here are factors that determine health insurance premiums.

You May Like: How To Become A Health Insurance Broker In California

How Do Different Hospitals Influence The Cost Of Private Health Care

Different private hospitals in the UK charge you varying fees for treatment. The cost would depend on the equipment used, facilities available, and accommodation provided. Hospitals in major UK cities are often more expensive than hospitals in rural areas, as with many other services. Insurers strive to maintain a level playing field for all involved parties.

To begin, they work with hospitals to guarantee that costs do not spiral out of control by making agreements with hospitals to obtain preferred rates, resulting in cheaper premiums.

Next, the hospitals are divided into groups. For instance, the cheapest hospitals, the costliest, and a middle group. You then pick which of the three sets of hospitals you wish to be treated in, paying extra if you want to be covered at the more expensive ones. This guarantees that those who live near the cheap hospitals pay less for their health insurance.

On the other hand, if you reside in a major city, your nearest hospital could be in your insurers most expensive group. This would have an impact on how much you pay.

The decision of which hospitals to obtain coverage from is a personal choice. The primary factors considered for this decision include the location of the nearest covered hospital, the premium connected with acquiring cover for it, and the facilities at that hospital for any specific medical issues you may have.

One example is Vitality health care insurance, where the three hospital levels are:

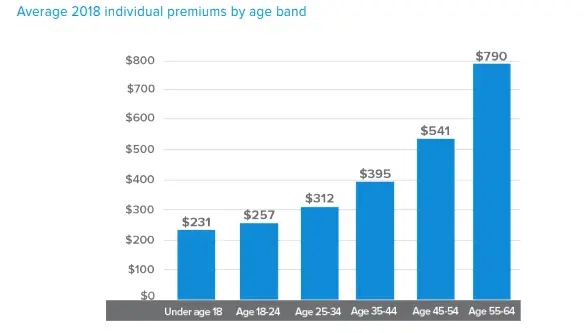

Average Health Insurance Cost By Age

Age plays a big role in the cost of a premium for health insurance generally, younger people have lower premiums, as they are seen as less risky and less likely to require more medical care.

Often, the starting point for an insurance rate is based on that of an individual who is 21 years old. According to ValuePenguin, the average health insurance premium for a 21-year-old was $200 per month. This is also an average for a Silver insurance plan — below Gold and Platinum plans, but above Bronze plans.

How does the breakdown of premiums by age look? Slowly in small increments, the average premium will increase. Ages 21-24 were all consistent at $200, but at 25 the premium goes up to $201 — about 1.004 x $200.

Slowly the amount it goes up increases. At 26 the average premium is 1.024 times the base premium, up to $205. By the age of 30, though, it has gone up for an average premium to $227, or 1.135 x $200.

Going through the list of ages, this pattern is pretty consistent. The average premium for a policyholder at 35 years is $244, 1.222 times the base rate at 40, it’s 1.278 times that rate to bring the average premium up to $256.

From here, though, the premiums start going up at higher rates. The average health insurance premium for a policyholder at 45 is $289, up to 1.444 times the base rate, and by 50, it’s up to $357, which comes out to 1.786 x $200.

Recommended Reading: What Are The Different Types Of Health Insurance Plans

Employee Health Insurance Premiums

If you work for a large employer, health insurance might cost as much as a new car, according to the 2019 Employer Health Benefits Survey from the Kaiser Family Foundation. Kaiser found that average annual premiums for family coverage were $20,576 in 2019, which was nearly identical to the base price of a Honda Civic.

Families contributed an average of $6,015 toward the cost, which means employers picked up 71% of the premium bill. For a single worker in 2019, the average premium was $7,188. Of that, workers paid $1,242 or 17.2%.

Kaiser included health maintenance organizations , Preferred Provider Organizations , point-of-service plans , and high deductible health plans with a savings option in arriving at the average premium figures. It found that PPOs were the most common plan type, insuring 44% of covered workers. While high deductible health plans with a savings option covered 30% of insured workers.

| Average Employee Premiums in 2019 |

|---|

| Employee Share |

| $103.50 |

Of course, whatever employers spend on their workers’ health insurance leaves less money for wages and salaries. So workers are actually shouldering more of their premiums than these numbers show. In fact, one reason wages may not have risen much over the last two decades is because health costs have risen so much.

Which type of plan employees choose affects their premiums, deductibles, choice of healthcare providers and hospitals, and whether they can have a health savings account , among many choices.

The Cost Increases With Age

Although it cant be helped, the older you are the more your premiums will be, this is because the health risks we face as we age are greater. Using the same basic policy from above, the cost of the 43 year old, non-smoker goes from £49.06 a month to £69.77 a month for a 53 year old.

|

33 Years Old |

|

~10% Increase |

If I Give Up Smoking Could I Get Reduced Premiums?

Absolutely. If you can prove you have given up and havent consumed nicotine in the last 12 months, most insurers will then class you as a non-smoker therefore lowering your premiums.

Does Vaping Increase The Cost Of Private Health Insurance?

It is important to note that insurers dont just class those using cigarettes as smokers. A smoker refers to anyone using any nicotine based products including things such as vapes and patches. If you consume nicotine in any way your premiums will increase, even if it is through vaping.

Recommended Reading: Does Insurance Pay For Home Health Care

Do Your Research About Health Insurance In Spain

Again we reached out to several and received quotes for our family of 4. To receive a quote for coverage, all they needed was our birth dates and passport numbers . Of course, you still have the varieties of coverage from your basic coverage to the mac daddy full hospitalization as well as various deductibles, in a network, out of network, etc.

It seems some of the Spanish Consulates now have a requirement regarding health insurance with state you can not have a co-pay or deductible. This is new and will raise the price of your insurance, compared to the rates we currently have.

We received price quotes for our family of 4 ranging from 45 220 per month . If you opt for a quarterly, bi-annual, or yearly contract, you may also receive discounts.

I think the Annual contract for full coverage with dental, travel, and hospitalization was about 2200 per year . This is a far cry from the prices quoted to us by many of the US companies, and we didnt need to go to the ends of the earth to prove we were in good health.

Tech Stocks Roundup: Cramer Says Google Is The ‘cheapest Of Faang’

- 2 hours ago

After age 50, premiums rise tremendously. At age 53 the average premium is more than double the base rate, and by 55 the average premium is $446. At age 60, the average premium is $543. If a person is 64 years old, the average health insurance premium is $600 – 3 full times what it is at 21.

It is also important to note that while this is a general guideline, prices vary dramatically from state to state. Some states, like New York, don’t factor age into premiums at all.

Don’t Miss: How To Enroll In Cigna Health Insurance

How Do You Choose A Plan That Meets Your Budget And Needs

To settle on the right plan, think about how you typically use healthcare services. For example, ask yourself:

- How often do you usually visit the doctor? Once a year for a checkup, or monthly to monitor a health condition? Was last year typical, or unusual?

- Are you expecting larger-than-average health expenses next year or do you only expect to use preventive care services? For example, are you having a baby? Were you recently diagnosed with a condition that will require regular treatment?

- What prescriptions do you take regularly?

- How many healthcare providers do you typically see? Just a primary care doctor, several specialists over the year, or just the provider at your local retail or urgent care clinic?

- Do you and your family have one or more chronic health conditions?

- Have you or any of your family members been diagnosed with COVID-19 in the past year?

- Have you postponed healthcare services because of COVID-19?

It may be helpful to add up what you spent last year, just as a general guideline.

Make sure you look at all costs, not just the premiums. For example, a high-deductible plan can work out to your advantage if you are relatively healthy and only expect only to use preventive care services, since those services are at 100%. These types of plans typically have lower premiums. However, if you have a chronic condition that requires a lot of care, you might consider a plan that has a higher premium but lower out-of-pocket costs.

Dont Forget to Shop Around

How Much Is Health Insurance Per Month For Individuals

Is health insurance expensive? Does it cost much? You may be pleasantly surprised to know that some of the best and most comprehensive plans will easily fit within your budget. Legislative changes and Marketplace coverage allow you to apply for affordable private policies. Comprehensive, catastrophic, and high-deductible options are offered. The average cost of coverage is less than $100 per month in many areas, thanks to increased instant tax credit subsidies.

We help you find low-cost budget-friendly plans so you pay less for your benefits. We will also answer all of your questions so you know the cost of your medical plan, what it covers, and what you need to do to buy it. And we explain how you can use our website to get free online quotes, compare the plans that cost the least, and enroll for a policy. The process often takes less than 20 minutes, and ancillary policies are also available, including dental and vision options.

How Much Does My Health Insurance Cost?

If you purchase benefits through an employer, typically you will be charged less, since they are paying some of the premium. HSAs are typically available along with PPO or HMO plans including copays for office visits and prescriptions. Depending upon the size of the employer, contributions may be deposited by the employer into your account. Annual contributions typically range from $0 to $3,000.

You Can Find Cheap Private Medical Insurance Online

Healthcare Benefits You Plan To Keep

Dependents

Pages

Don’t Miss: How To Buy Pet Health Insurance

What Does Uk Health Insurance With Outpatient Cover Cost

We found our quote increased between £12 and £31 per month for our 33-year-old.

Most health insurance policies have a ‘basic’ or ‘core’ level of cover that insures you for treatments when you are admitted to hospital – clearly these would tend to include more serious and life-threatening conditions. However, these basic levels of cover often do not include any cover for outpatient treatment – i.e. being treated by a hospital, doctor or specialist without admission to or an overnight stay in a hospital.

This outpatient cover can be added on, and as for other covers, the details of it vary from insurer to insurer.

Our 33-year-old example buyer was quoted an extra £13 per month by AXA for their Standard Outpatient option. Their core cover includes cover for out-patient surgery, CT, MRI and PET scans already so this extra out-patient option is for consultations, diagnostic tests or if you need to see a practitioner . Their Standard option covers 3 specialist consultations with no limit on diagnostics or practitioner charges.

Vitality‘s core cover also covers MRI, CT and PET scans. Their outpatient option covers other out-patient costs, such as specialist consultations, physiotherapy, and diagnostic tests like blood tests and x-rays. £1,000 of cover per year was quoted for us at an extra £7 per month in July 2017.

How To Shop For Private Insurance

If youre not covered through your employer, or not eligible for financial assistance through a state-funded program, you will likely have to buy private insurance for individual or family through a private health insurance provider, such as Independence Blue Cross.

You may be able to purchase a plan on the Pennsylvania Insurance Exchange , which has replaced healthcare.gov.

Start by finding out which private health insurance carriers are available in your area. Independence Blue Cross serves the Philadelphia and southeastern Pennsylvania regions . See if private health insurance plans from Independence are available in your ZIP code.

Shopping for private health insurance is much easier when you know what questions to ask. When it comes to health coverage, everyone has different needs and preferences. We can help you figure out what type of plan you want, how to find a balance of cost and coverage, and what other benefits you should consider.

Read Also: Do You Have To Have Health Insurance In Florida

Does Changing Your Underwriting Affect The Cost Of Private Health Insurance

You can read more about the different underwriting methods in our article health insurance for people with pre-existing medical conditions.

The implication on cost is quite small – for example, switching from Full Medical Underwriting to a 2-year Moratorium cost our 33-year-old under £5 per month. As a result, many people choose the type of underwriting based on their personal circumstances and the resulting terms and conditions they are comfortable with, rather than the price.

You can use Activequote.com to investigate the costs and cover levels for different policies with different underwriting methods.