What Kind Of Coverage Is Included In Employer Health Insurance

Large Employer-sponsored health insurance do not have to cover the 10 essential health benefits that the Affordable Care Act requires of all individual insurance plans, but it probably will. Individual plans are designed to mimic employer-based plans, so you can expect that common medical issues will be covered.

Dependents

Your employer is required to offer you a plan that will cover your children , however, the can opt out of covering spouses. Additionally, if your child becomes pregnant, then they may lose coverage under your plan.

Your employer can choose to offer you access to one of several health insurance models. You can tell what type of plan network is being offered by the three or four-letter abbreviation thats typically part of the plan name.

HMO

In a health maintenance organization, one large company acts as both your insurer and healthcare provider. Youll have to choose a doctor to be your primary care provider who can refer you to specialists. EPO and POS organizations work similarly but have a few additional options to let you access out-of-network care.

PPO

In a preferred provider organization, youll have access to in-network and out-of-network care. In-network care is covered, whereas out-of-network doctors who havent signed an agreement with your insurer will incur higher costs to you.

HDHP

HRA

Individual Coverage Health Reimbursement Arrangement

Applying For Cobra Coverage

In order to begin COBRA coverage, an individual must confirm that they are eligible for assistance according to the requirements listed above. Typically, an eligible individual will receive a letter from either an employer or a health insurer outlining COBRA benefits. Some individuals find this notification difficult to understand because it includes a large amount of required legal information and language. If you have any difficulty determining whether you are eligible for COBRA or how to begin coverage through this program, contact either the insurer or your former employer’s HR department.

For individuals either not eligible for COBRA or those searching for alternatives, there are other options, such as a spouse’s health insurance plan.

For individuals either not eligible for COBRA or those searching for alternatives, there are other options. In some cases, a spouse’s health insurance plan may be a possibility. Or you might explore your options on the federal health insurance marketplace or a state insurance marketplace. Loss of a job will open up a special enrollment period.

How Does This Influence Your Company

Employers encouraging employee health benefits because of their numerous positive rewards should consider using an opt-out method for higher retention of group health insurance.

Opting out policies to consider are:

- Opt-out arrangements should be offered under a Section 125 cafeteria plan to avoid unfavorable employee taxation.

- The Affordable Care Act will consider certain opt-out payments as part of the employees premium for determining affordability under the act.

- Unconditional opt-out

You May Like: What Is Comprehensive Health Insurance

What To Do When Employees Opt Out Of Your Health Plan

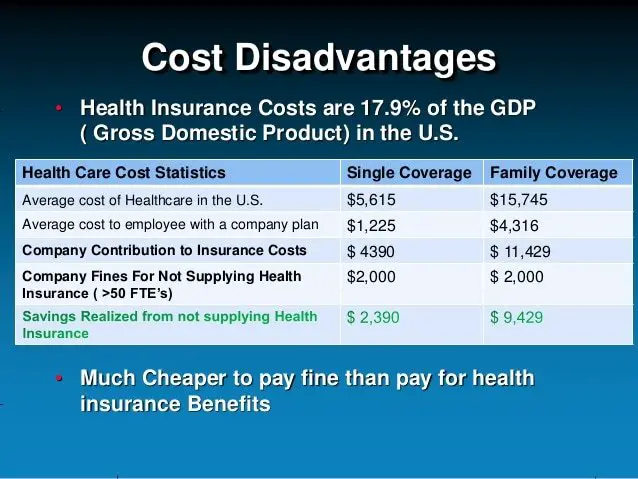

Group health plan premiums have been climbing faster than wages for years, and this trend is likely to continue in 2017.

According to the Society for Human Resource Management, the costs that employers pay to provide health benefits are likely to rise 6 percent next year, while employees can expect their monthly premiums to rise by about 5 percent. With the average inflation rate hovering around 1.5 percent, the rise in health care costs is taking a heavier toll with each passing year.

Opt-out payments are a way for you to save money as group health coverage premiums continue to increase, by offering employees cash benefits in exchange for not enrolling. An opt-out plan sounds like a good idea in theory, but you need to be careful, since new rules implemented by the IRS have turned opt-out payments into a potentially costly choice.

Open Enrollment: When Employees Opt Out from The Benefits Guide on Vimeo.

TheOpt-Out Option

The Affordable Care Act requires applicable large employers with 50 or more full-time employees to provide affordable health insurance coverage to their employees. The definition of affordability depends on whether the employees required contribution exceeds an indexed percentage of household income or wages .

Avoiding Penalties

RemainingCompliant

The documentation mandated by the IRS in order to remain compliant with the ACA includes forms 1094C and 1095C. Extra forms require extra help and, unfortunately, extra dollars.

Can I Use A Health Savings Account To Pay For A Marketplace Plan

When you shop on the Marketplace for a plan, you may be able to pay your premiums with pre-tax dollars through a Health Savings Account . A Health Savings Account is a special type of savings account. It lets you set aside pre-tax dollars for certain kinds of qualified health expenses. Using an HSA can help you lower your healthcare costs overall through the use of pre-tax dollars. However, when it comes to the Marketplace, only certain plans let you use your HSA to pay for premiums. That means you would need to decide that enrolling through the Marketplace is the best option for you and then look specifically for an HSA plan.

And unless you get a High-Deductible Health Plan , you wont be able to use pre-tax dollars for your premiums. On average, plans with deductibles of at least $1,350 for an individual qualify as being HDHP. Likewise, plans with deductibles of $2,700 for a family generally qualify as being a HDHP. When you shop on the Marketplace, you can see which plans are HSA-eligible. Should you be able to use your HSA for your premiums, keep in mind that in 2018, the maximum amount you could contribute from an HSA for a HDHP was $3,450 for an individual and $6,900 for a family.

Don’t Miss: Can I Pay For My Employees Individual Health Insurance

When Employees Opt Out Of Employer Health Insurance: Ehealthinsurance Describes Alternative Open Enrollment Scenarios

Mountain View, CA November 16, 2011eHealthInsurancehealth insuranceSeven Cases When Employees May Choose to Opt-out of Employer Health InsuranceWhen the share of premium paid by employees gets unaffordableWhen employer plans no longer meet workers coverage needsWhen employer contributions toward dependent premiums get slashedsurveyWhen covered adult children live out of stateWhen they want a better plan than their employer offersJ.D. Power surveyWhen their preferred doctors are no longer coveredWhen employees want health insurance portabilityAdditional Resources for Consumers:

- Download or request a FREE printed copy of our book, Individual Health Insurance For Dummies, Health Care Reform Special Edition,produced in cooperation with For Dummies, a branded imprint of Wiley, and co-authored by eHealthInsurance

About eHealth

Compare Payout Vs Coverage

Other factors also come into play, such as an affordability calculation.

The good news:

These complicated things dont matter to you.

All you should care about is if you receive cash in lieu of taking health insurance, which is essentially an opt-out payment.

You must then decide if the payment is a better deal than taking the coverage.

Ask your employers payroll, human resources or benefits department to see if they offer an opt-out.

If your employer is a small business, they may not have these departments. Instead, talk to your manager or the owner.

Find out how the program works. Ask how much money you could receive for opting out.

Most employers dont offer an opt-out arrangement. If yours doesnt, it may still make sense to decline coverage.

Find out what other health insurance options you have. Then, run the numbers to see if it makes sense.

Don’t Miss: What Is The Best Affordable Health Insurance

Whats Wrong With Employer Sponsored Health Insurance

The high proportion of people who get their health insurance through their jobs is one of the most distinctive features of the U.S. health care system. According to the Census Bureau, 56 percent of the population had employer-sponsored health insurance as of 2017. ESHI accounts for 83 percent of all of those with private insurance of any kind. People whose health insurance is tied to their jobs far outnumber the 38 percent of the population served by government insurance of all kinds.

What is more, most people on ESHI appear to be satisfied with the coverage they get. A survey by Americas Health Insurance Plans , an insurance industry group, found that 71 percent of respondents were satisfied with their ESHI plans, compared with just 19 percent who were not satisfied. An independent survey by Gallup came up with similar results, finding 69 percent of people on employer-sponsored plans to be satisfied. A study by the Employee Benefit Research Institute found that 50 percent of workers were extremely or very satisfied with their own ESHI plans, with another 39 percent somewhat satisfied.

How should would-be reformers interpret these numbers? Clearly, one possible reaction is, If it aint broke, dont fix it. The Affordable Care Act took that approach. Rather than trying to replace ESHI, it made it mandatory for employers with 50 or more workers.

Enrollment Options And Procedures

Once you have your health plan in place, youll need to manage all the details of signing up and dropping employees. Below, we explain how to do this and the rules you need to understand.

Adding and Dropping Employees

You can add employees to the medical plan when they are hired, usually on the first of the month following date of hire, or the first of the month after completing a waiting/probationary period. Once the employee chooses a plan, it stays in effect until one of two things happens:

- Open enrollment. See below for more information.

- Qualifying status change. Go to Making Enrollment Changes below for more information.

You can drop employees from the plan at any time during the year due to:

- Termination. Layoff, firing, retirement or quitting.

- Change in hours or classification. Employees who reduce their hours so that they are no longer eligible for insurance, or who move into a classification that is not offered insurance . Employees who lose coverage must be offered the opportunity to continue their medical coverage at their own expense.

Laws such as COBRA govern how employers may extend medical benefits to employees after termination in the tool box see Laws Related to Health Insurance for more information.

Open Enrollment

Making Enrollment Changes

Employees generally can make changes to their benefit elections during the year only if they have a qualifying status change. Events that qualify as a status change include:

Waiver of Coverage

Read Also: Does Health Insurance Pay For Abortions

Is It Better To Get Employer Sponsored Health Insurance Or On Your Own

Employer based health insurance is often more affordable than an individual plan, but not always — and you may find an ACA plan with a better provider network.

Brian Colburn, senior vice president of corporate development & strategy at Waltham, Massachusetts-headquartered Alegeus, says that, despite the advantages of employer group insurance plans, many still choose to purchase individual health insurance.

“Oftentimes, this happens when the employee’s needs don’t match up with what the employer sponsored coverage offers. If you have unique health care needs, desire doctors and specialists out of network or want a more bare-bones plan, the individual marketplace can be a good alternative,” says Colburn.

Neat explains that it may be best to shop for coverage at Healthcare.gov if you qualify for an income-based subsidy. The ACA marketplace provides subsidies and tax credits to help people pay for ACA plans. The subsidies can save members hundreds of dollars each month, but they arent available for plans outside of the ACA marketplace.

“If you are self-employed or you do not have affordable options at work, an individual ACA or private marketplace plan may be the only option in your area. The good news is that ACA plans have no penalties for pre-existing conditions, so if you are struggling with a health condition, this may be your best choice,” she says.

Do Employers Have To Offer Health Insurance If So What Kind

Depending on company size, employers may or may not have to offer coverage to their workers. But if they do, the health plan must meet certain minimum requirements.

Companies with 50+ Employees

Companies with 50 or more full-time employees are required to offer healthcare to their full-time employees. Smaller companies have the option to do so, but theyre also able to pass the responsibility of finding healthcare on to you.

Affordable Coverage Under an Employer

The insurance that large companies offer must, at a minimum, pay for 60 percent of your covered healthcare expenses and require you to pay less than 9.78 percent of your household income for monthly premiums. The Affordable Care Act defines this as affordable coverage. But because the affordability percentage of 9.78 percent does not apply to your spouse, children, or other dependents, coverage for your dependents may be unaffordable.

Also Check: What Is The Cost Of Health Insurance In Usa

When You Can Opt Out Of Your Employers Health Insurance Plan

That said, here are three scenarios in which you may want to opt out of group insurance at work and take out health insurance yourself.

Your employer offers health insurance, but it does not contribute to contributions.

Most, but not all, employers help pay contributions. The amount they subsidize may vary for different employers. If your employer does not help you pay contributions, you can find a better deal by buying an individual healthcare plan.

Your employer offers insurance, but you think its a bad plan.

Under the Affordable Care Act, employer-sponsored plans must cover at least 60 percent of medical expenses for a standard population the employee covers 40 percent of healthcare costs through deductions and co-payments. Your plan determines whether it meets this requirement.

What Percentage Of Health Insurance Do Employers Typically Pay

Most employees who are covered through employer-sponsored plan make some kind of contribution to the cost of their monthly premiums. Employees contributed an average of $104 per month to their employer-sponsored insurance in 2019, according to the Kaiser Family Foundation.

Employees at small businesses typically contribute a higher percentage of the premium for family coverage than employees at larger companies. And on average, employees who work for companies with a larger amount of lower-wage workers contribute more towards their monthly premiums for both single coverage and family coverage than employees do at companies with fewer low-wage workers.

Don’t Miss: How Much Is Health Insurance In Costa Rica

Qualifying Events For Employer

Qualifying life events may change your coverage requirements and therefore affect the group health insurance and flexible spending accounts offered through your job. FSAs are arrangements with your employer that let you pay for out-of-pocket medical expenses, dental care or vision care with tax-free dollars. You can decide how much money you put into an FSA up to a limit set by your employer.

If you encounter a qualifying life event, you will be provided the opportunity to change any of the selections previously made on your FSA plan. For example, if you had a child and wanted to increase your contribution to your flexible spending account, you would be allowed to do so because adding a dependent is a qualifying life event.

Group health insurance is affected by qualifying life events in that the event may alter the amount of insurance you need or the number of people covered under the policy. The Health Insurance Portability and Accountability Act allows employees who have experienced a qualifying life event to enter a special enrollment period in which they can select a new group health plan. This can be very helpful if you were recently married, for instance, as you may want to add your spouse to the health insurance policy.

Consequences Of Opting Out

If you choose to opt out, you do so with the knowledge that:

- During the 12 month period for which you opt out, the Ministry of Health will not pay for any medical, hospital or other health care services, or for any items such as prescription drugs that might otherwise have been a benefit. This will be true regardless of whether the services/items are required on a routine or an emergency basis, due to illness or accident, and regardless of the cost involved

- You will be responsible for paying the entire cost of health care services and items you receive during the opted out period. You will not be able to opt back in, in the event of an unforeseen medical problem. Note: Hospital costs alone can exceed $1,000 per day

- You may find you are unable to obtain extended health care benefits or coverage for travel outside B.C.

- You will be given a Notice of Exemption to show that you have opted out and must present that notice when medical, hospital and other health care services are accessed, and when purchasing items such as prescription drugs, that might otherwise have been a benefit

- An Election to Opt Out form must be completed each year if you choose to remain outside B.C.’s provincial health care programs

Don’t Miss: Can A Child Have 2 Health Insurance Plans

Changing To A Marketplace Plan

If you have job-based coverage, you might be able to change to a Marketplace plan. But you probably wont qualify for a premium tax credit or other savings. As long as the job-based plan is considered affordable and meets minimum standards, you wont qualify for savings. Most job-based plans meet these standards.

Learn about changing to a Marketplace plan.

Considerations When Opting Out

To make an informed decision regarding whether to opt-out and what type of option to choose, it is important to consider the following:

Coordination of Benefits

In every benefits plan, there is a coordination of benefits provision which outlines what will occur in instances of double coverage. Through this process, a person is covered under two health insurance plans and may receive claims payouts and payment under both plans.

Typically, one health insurance plan becomes identified as the primary health insurance plan. Then the second plan is the secondary. In the event of a health insurance claim, the primary health insurance plan will pay out first, then the second one will kick in to pay towards the remaining cost that the first plan didnt cover completely.

An individual can only claim as much as a combined maximum of 100 percent of eligible expenses, meaning that they would not receive compensation for the combined coverage amount rather, the first insurer would pay the percentage as outline by their plan , and the second insurer would pay the remaining 20%.

Read Also: Is Health Insurance Mandatory In New York