If My Employer Does Not Provide Health Insurance Benefits Or If I Am Working Only Part

Yes. Several programs are available for people without insurance in California.

Medi-Cal is Californias joint federal-state Medicaid program that provides free or low-cost health coverage. In general non-elderly adults with household income up to 138 percent of Federal Poverty Level , pregnant women with household income up to 213 percent of FPL, and children from birth through age 18 with household income up to 266 percent of FPL qualify for Medi-Cal. You can also get Medi-Cal if you fall within certain categories. To see if you are eligible for Medi-Cal, contact the Department of Health Care Services.

Childrens Health Insurance Program may provide health coverage to children in families that do not qualify for Medicaid. Similarly, Medi-Cal Access Program may provide health coverage to pregnant women with household income more than 213 percent of FPL.

Covered California Health Exchange is the California agency offering subsidized health insurance plans in accordance with the Affordable Care Act . Covered California helps individuals and families obtain health coverage that includes the minimum essential benefits required by Obamacare. If your household income is at or below 400 percent of FPL, Covered California may qualify you for subsidized plans with reduced premiums. If your household income is between 138 percent and 250 percent of FPL, Covered California may qualify you for extra discounts that reduce their cost for medical services .

New Regulations Allow Employers Of Any Size To Reimburse Individual Market Premiums Starting In 2020

Prior to 2020, large employers were not allowed to reimburse employees’ individual market premiums. Employers with 50 or more full-time employees are required to offer group health insurance in order to avoid the ACA’s employer mandate penalty, and they faced even steeper penalties, as described above, if they reimbursed employees for individual market premiums.

But in October 2017, President Trump signed an executive order aimed at relaxing the rules on this issue. The executive order didn’t change any rules on its own it simply directed federal agencies to “consider proposing regulations” that would accomplish various goals.

One of those goals was to expand the use of health reimbursement arrangements and provide more flexibility in their use, including “allow HRAs to be used in conjunction with nongroup coverage.”

A year later, in October 2018, the Departments of Labor, Treasury, and Health & Human Services published proposed regulations to allow the use of HRAs in conjunction with individual market coverage, regardless of the size of the employer.

The regulations were finalized in June 2019, mostly as proposed but with some changes. The new rule took effect as of January 2020, allowing large employers to fulfill the ACA’s employer mandate by offering an individual coverage HRA used to reimburse employees for the cost of individual market health insurance.

Employer And Employee Contributions To Monthly Premiums

As a small business with less than 50 full-time equivalent employees, you are not required to offer group health insurance. If your company does decide to offer health coverage to your employees, then you are typically required to pay for at least 50 percent of employee premiums as a small employer. Keep in mind that your business can also decide to contribute a larger amount to your workers premiums.

If you are a small business with less than 50 full-time equivalent employees, youre not required to offer group health insurance. If you do choose to offer health coverage to your employees, then youre typically required to pay for at least 50 percent of employee premiums as a small employer. Keep in mind that your business can also decide to contribute a larger amount to your workers premiums.

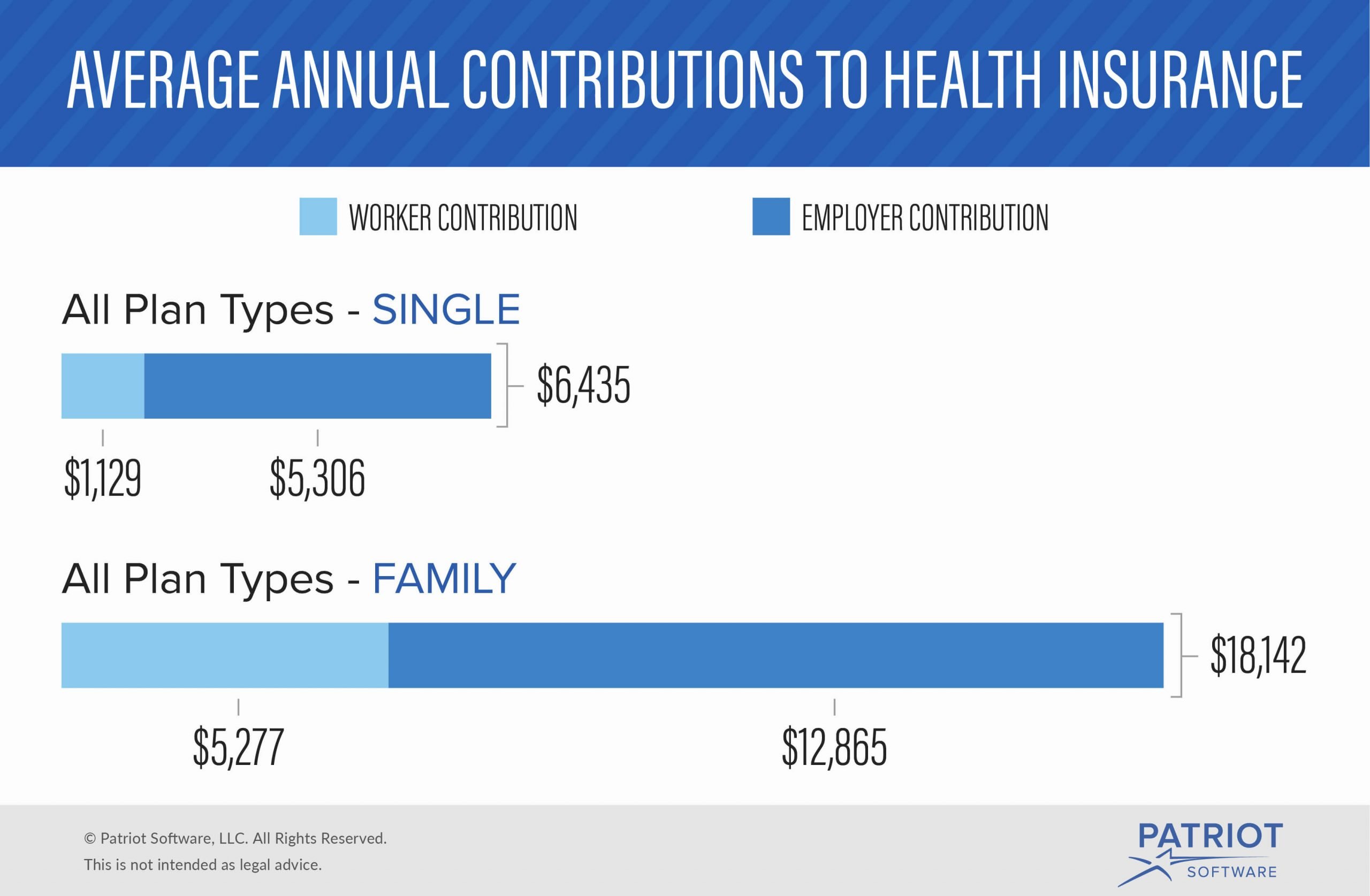

The Employer Health Benefits 2019 Summary of Findings noted that the level of employer contributions to worker premiums tends to vary:

- 31 percent of covered small firm employees had their employer pay the entire premium for their single coverage.

- 35 percent of covered small firm employees were enrolled in a plan where they contribute more than one-half of the premium for family coverage.

- In 2019, the average amount covered employees contributed was $1,242 for single coverage and $6,015 for family coverage.

Source: Kaiser Family Foundation 2019 Employer Health Benefits Survey

You May Like: Can You Get Health Insurance Immediately

On The Contrary Why Do Employers Pay For Health Insurance Anyway

- Read in app

NOBODY expects employers to provide groceries, housing or clothing, but for odd historical reasons American employers have evolved into providers of health insurance. Nearly two-thirds of Americans under 65 rely on health coverage from an employer.

Some of America’s largest companies, maybe eager to level the playing field, favor requiring employers to provide insurance. But they have it backward. They should be advocating an end to employer-financed health coverage altogether.

Why should we hate the employer-financed system? Let us count the ways:

It makes it difficult or sometimes even impossible for people to change jobs, not only damping economic efficiency but reducing the competition for labor and, therefore, reducing wages. Without alternative health coverage, there is ”strong evidence for job lock,” wrote two economists, Jonathan Gruber and Brigitte C. Madrian, in a National Bureau of Economic Research study released this year.

It suppresses the creation of new businesses because, for many potential entrepreneurs, quitting a job means forgoing health insurance, a risk too big to take.

It unfairly excludes the unemployed, the self-employed and low-skilled workers. And it can shortchange single people, whose employers effectively pay higher wages to workers with families when providing dependent coverage.

What If The Health Insurance Through My Employer Is Too Expensive

Many people run up against the problem of their employer-provided health insurance seeming way too expensive. Especially when it includes covering their entire family. Unfortunately, if the costs are still underneath approximately 9.5% of your annual household income, it is still affordable by legal standards, and you still arent eligible for subsidies through the Marketplace.

If you find it cost-prohibitive to ensure your children through your job-based health plan, you may have other options. Depending on your income level, you might be able to get them coverage separate from yours through the Childrens Health Insurance Program . CHIP is the federal program that matches federal dollars with state dollars to provide healthcare for low-income families who earn too much to qualify for Medicaid. Children who live in a household where the household income meets the qualifications can enroll in CHIP. And this is true even when parents get or accept an insurance benefits offer from their employer.

You can see if you or your family qualifies for Medicaid or CHIP by entering your zip code and income information here.

Read Also: Where Can You Get Affordable Health Insurance

Do I Have A Formal Reimbursement Plan In Place

The first question to consider is, Do you have a formal reimbursement plan in place? A formal reimbursement plan is a type of group health plan. When you have a formal reimbursement plan, your organization has official plan documents outlining how the reimbursement plan works.

In many cases, reimbursements are tax-deductible to the organization and received tax-free by employees.

Common types of formal reimbursement plans include:

- Health reimbursement arrangements

- Employer payment plans

How Much Do Health Benefits Cost Employers

Health insurance costs vary widely but the average annual premiums for employer-sponsored coverage in 2020 were $7,470 for single coverage and $21,342 for family coverage. When you take into account the average contributions by workers, that brings the employer costs to $6,227 and $15,754 respectively.

You May Like: Is It Required By Law To Have Health Insurance

I Was Already Enrolled In A Marketplace Plan When I Got A New Job Do I Need To Cancel It

If youre currently enrolled in a Marketplace-based health insurance plan and then get hired and your employer offers insurance, there are a few things to know. First is that now youre probably no longer eligible for any savings or subsidies on your Marketplace plan. And this is true even if you dont accept the employer-sponsored insurance and opt to continue on your Marketplace plan. If youre offered job-based insurance that meets the federal minimum standards, then you lose your eligibility for cost savings on the Marketplace. So, some people may want to cancel their Marketplace plans to enroll in job-based insurance. For many, this will best allow you to stay covered and keep your costs down.

If you want to cancel your Marketplace plan, you can log into your Marketplace account to do so.

What Happens If You Do Not Have Health Insurance Through Your Job

If you do not currently receive health insurance benefits through your job, then you have many options available for you to choose from. First of all, if you lose your job and find yourself without health insurance coverage because you only had it through your work, then you could keep your job-based health plan thanks to the Consolidated Omnibus Budget Reconciliation Act . Although you will still need to pay the premium for your coverage, you will be able to extend your current health care coverage for a certain period of time.

Shopping for health insurance as an individual in the marketplace requires you to look into multiple options so that you find the right plan for you and your family. The best way to find the right health insurance coverage is to get multiple quotes and explore as many coverage options as possible.

One thing to consider in the overall cost of getting insurance through the marketplace as an individual is that you may be able to take a tax deduction for the health insurance premium that you pay.

The type of insurance plan that you choose will also depend on your age, health history and how many dependents you will need to have covered by your health insurance plan. If you have more dependents, the prices that you pay for health insurance will be higher.

You May Like: Is Health Insurance Mandatory In New York

How Do I Ask My Employer For Health Insurance

To understand your choices here are some of the main questions you should ask:

Accommodation Or Utilities Provided By The Employer

If you provide accommodation or utilities free of charge, it is a taxable benefit to your employee. The method you use to determine the value of the benefit depends on whether or not the place in a prescribed zone has a developed rental market.

Places with developed rental markets

Some cities and towns in prescribed zones have developed rental markets. When that is the case, you base the value of the benefit for any rent or utility you provide on its fair market value.

The cities and towns in prescribed zones that have developed rental markets are:

| Dawson Creek |

| Yellowknife |

Places without developed rental markets

In places in prescribed zones without developed rental markets, you have to use other methods to set a value on the housing benefit. The method you use depends on whether you own the residence or rent it from a third party.

If you provide both rent and utilities and can calculate their cost as separate items, you have to determine their value separately. Add both items to get the value of the housing benefit.

If your employee reimburses you for all or part of their rent or utilities, determine the benefit as explained below. Subtract any amount reimbursed by your employee and include the amount that remains in their income.

Accommodations you own

If you own a residence that you provide rent-free to your employee, report as a benefit whichever of the following amounts is less:

Note

Recommended Reading: Where To Find Health Insurance

Moving Expenses And Relocation Benefits

When you transfer an employee from one of your places of business to another, the amount you pay or reimburse the employee for certain moving expenses is usually not a taxable benefit. This includes any amounts you incurred to move the employee, the employee’s family, and their household effects. This also applies when the employee accepts employment at a different location from the location of their former residence. The move does not have to be within Canada.

Also, if you pay certain expenses to move an employee, their family, and their household effects out of a remote work location when their employment duties are finished, the amount you pay is not a taxable benefit.

If you paid allowances to your employee for incidental moving expenses that they do not have to account for, see Non-accountable moving allowances.

Moving expenses paid by employer that are not a taxable benefit

The following expenses are not a taxable benefit to your employees if you paid or reimbursed them:

Moving expenses paid by employer that are a taxable benefit

If you pay or reimburse moving costs that we do not list above, the amounts are generally considered a taxable benefit to the employee.

If you do not reimburse, or only partly reimburse, an employee for moving expenses, the employee may be able to claim some of the moving expenses when filing their income tax and benefit return.

Housing loss

Why Choose A Group Health Plan

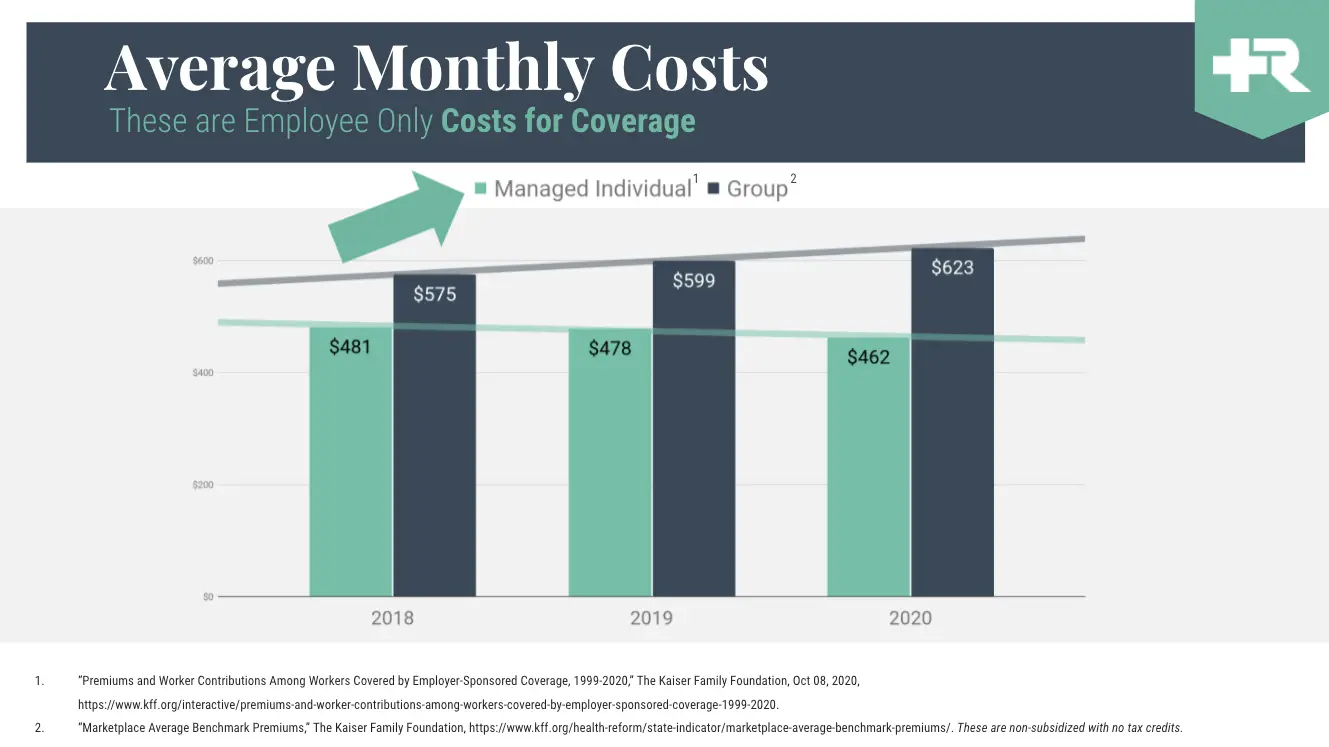

Group health insurance plans are designed to be more cost-effective for businesses. Employee premiums are typically less expensive than those for an individual health plan. Premiums are paid with pretax dollars, which help employees pay less in annual taxes. Employers pay lower payroll taxes and can deduct their annual contributions when calculating income taxes.

You May Like: How To Apply For Low Cost Health Insurance

What Rules Must Health Insurance Reimbursements Follow

Whichever health insurance reimbursement program you use, you need to follow certain rules. Confirmation of a standard and legal HRA program entails more than just supplying receipts for expenses:

- Plan documents: Plan documents outline the reimbursement program, its do’s and don’ts, and what the IRS requires via the Employee Retirement Income Security Act .

- Proof of reimbursement: All HRA programs must offer reimbursement and cannot pay for employees’ health insurance costs directly.

- Health plan rules: All of the most common HRA program options must comply with ERISA, HIPAA, COBRA and the ACA.

Key takeaway: Even though HRAs and QSEHRAs are not directly governed under the ACA, you must follow ERISA, IRS and other regulations to remain compliant. For example, you must submit proof that employees’ costs were reimbursed rather than paid for directly.

Is An Employer Required To Pay For Health Insurance

If you decide to offer health insurance to your team, in many cases, your responsibility doesnt end there. In the majority of states, carriers will require you to cover 50% of the premium cost for employees. This requirement, however, only applies to premiums for the employee, not their covered dependents. For other tiers of coverage, such as employee and spouse, employee and children, or family, the insurers want employers to pay 33%.

For 2020, the affordability threshold is 9.78% of an employees income.

Many employers even choose to contribute more than this amount. In fact, last year, on average, covered workers contributed only 17% of their premium for single coverage and 27% for family coverage. One reason for this, especially in companies with lower-wage workers, is that large employers covered by the ACA must offer affordable coverage or be penalized. For 2020, the affordability threshold is 9.78% of an employees income.

Recommended Reading: What Does Health Insurance Cost In Retirement

What Happens If I Decline My Health Insurance Through My Employer

If you decline individual health insurance through your employer, you can enroll in an Obamacare plan through the Marketplace. Although you most likely will not qualify for any subsidies or other financial assistance. You will only be able to qualify for cost savings if the following applies:

1. Your employer-sponsored health plan doesnt meet the minimum value standard.

If your employer-provided plan does not include substantial coverage , it doesnt meet the standards. And if it doesnt pay for at least 60% of covered medical costs, it wont either.

2. The cheapest plan through your employer costs more than a certain percentage of your household income.

And again, that plan must meet the minimum value standard. This number is 9.83% and each year the IRS issues an update on this percentage. This calculation is made using your portion of the monthly premium that covers you, the employee. This does not include premiums for others in your family.

Most job-based health insurance plans are deemed to be affordable and found to meet the minimum value standard. But if your employer-sponsored plan isnt, you may qualify for a Marketplace subsidy depending on your income level.

A reminder: You can only enroll in a Marketplace plan during the annual Open Enrollment period, unless you qualify for a Special Enrollment Period. Grab our free guide to enrolling in Marketplace insurance for more information.

Can My Employer Cancel My Health Insurance Or Require Me To Pay It While Im Off For A Work Comp Injury

There is a common concern among many Missouri workers who are off work due to a work injury. It has to do with their employers canceling their health insurance while they are off from work. Many ask, Can my employer cancel my health insurance, or require me to pay it, while Im off recovering from a work comp injury?

Answer: a company must continue your health insurance while you are on leave, but they are able to require you to pay your premium.

While most states prevent employers from retaliating against an employee that has filed a workers compensation claim, most do not address the continuation of benefits in the event of an extended absence due to a work-related disability or injury. As a result, some employers will choose to stop paying for health coverage.

However, there are two federal programs that mandate the continuation of health coverage. One is the Family and Medical Leave Act and the second is COBRA. Both of these programs can help workers who have been injured and cannot work, keep their health coverage if they are able to pay the cost themselves.

You May Like: How Much Does Health Insurance Cost In Ct