The Cost Of Cancellation

If youre booking an expensive holiday in advance, you may want the security of knowing you will be able to recover the costs if youre unable to travel. Read through the circumstances where cancellation cover is provided, check that it meets the full cost of your holiday and look for any excesses.

Insurance can allow you to claim unused travel and accommodation costs that you are unable to recover elsewhere. When travelling at short notice, on a low cost holiday or with a flexible ticket, you may decide that you do not need cancellation cover at all.

If your trip is cancelled or significantly delayed, you may be entitled to compensation from the airline or a refund from the travel provider.

Its still important to have emergency medical cover. If your trip is dependent upon the health of a non-travelling relative, you may need to answer questions about their medical history and pay to top up the cover.

Im Mainly Concerned About Getting Sick While Traveling What Insurance Should I Look For

Travel medical insurance is available as a stand-alone plan or as part of a larger travel insurance package. It can pay expenses if you get an injury or illness while on your trip, as long as itâs a condition thatâs covered by the policy.

If youâre concerned about COVID-19, check out Forbes Advisorâs ratings of the best pandemic travel insurance.

This Could Be Interesting

|

AWP P& C International S.A.Branch Office Germany D-85609 Aschheim |

Although your household contents policy covers damage and loss caused by robbery and burglary, a Luggage Insurance policy also covers simple theft. If your handbag or suitcase, for example, is stolen from your hotel room while you are on holiday, the luggage policy will cover you. Household insurance does not deem this to be an insured event. In addition, the luggage policy also covers theft of luggage from your car subject to certain conditions.

Tip:

Make a list of all the items you take on your trip, and make a realistic calculation of current value of all your luggage to determine the amount of cover you require. So, you’ll be well prepared if you suffer a loss event.

Also Check: Is Colonial Health Insurance Good

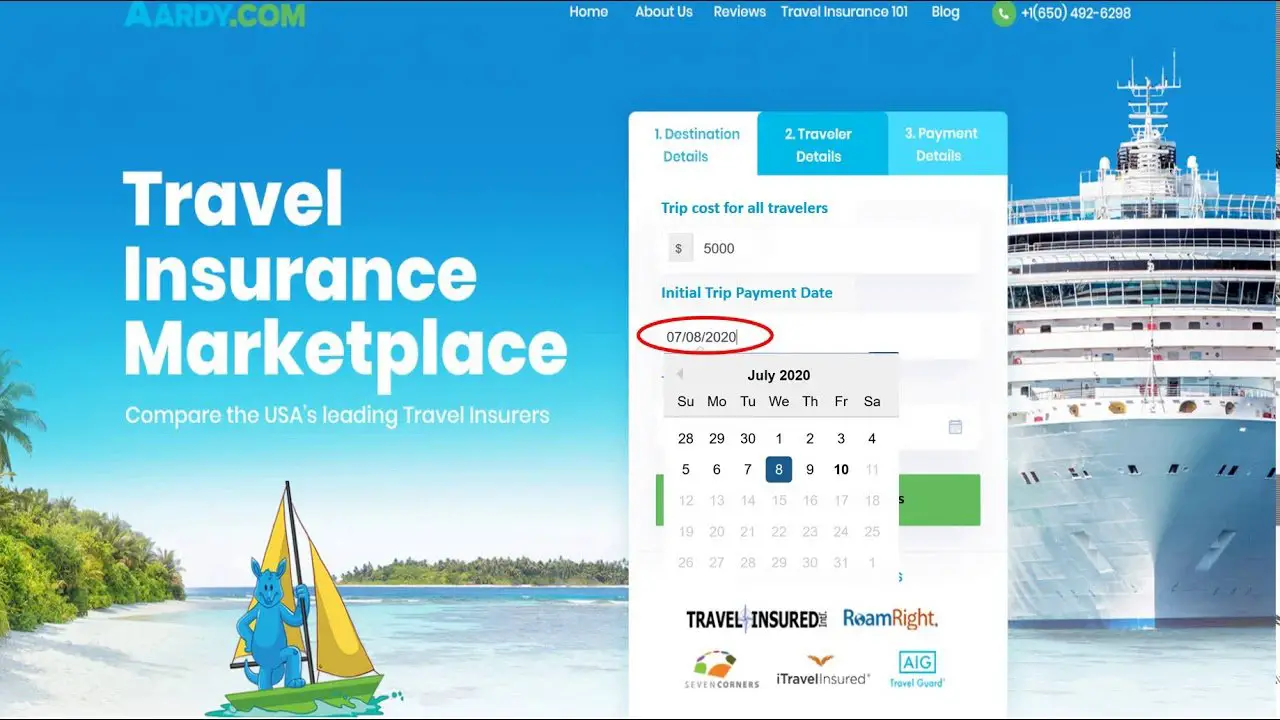

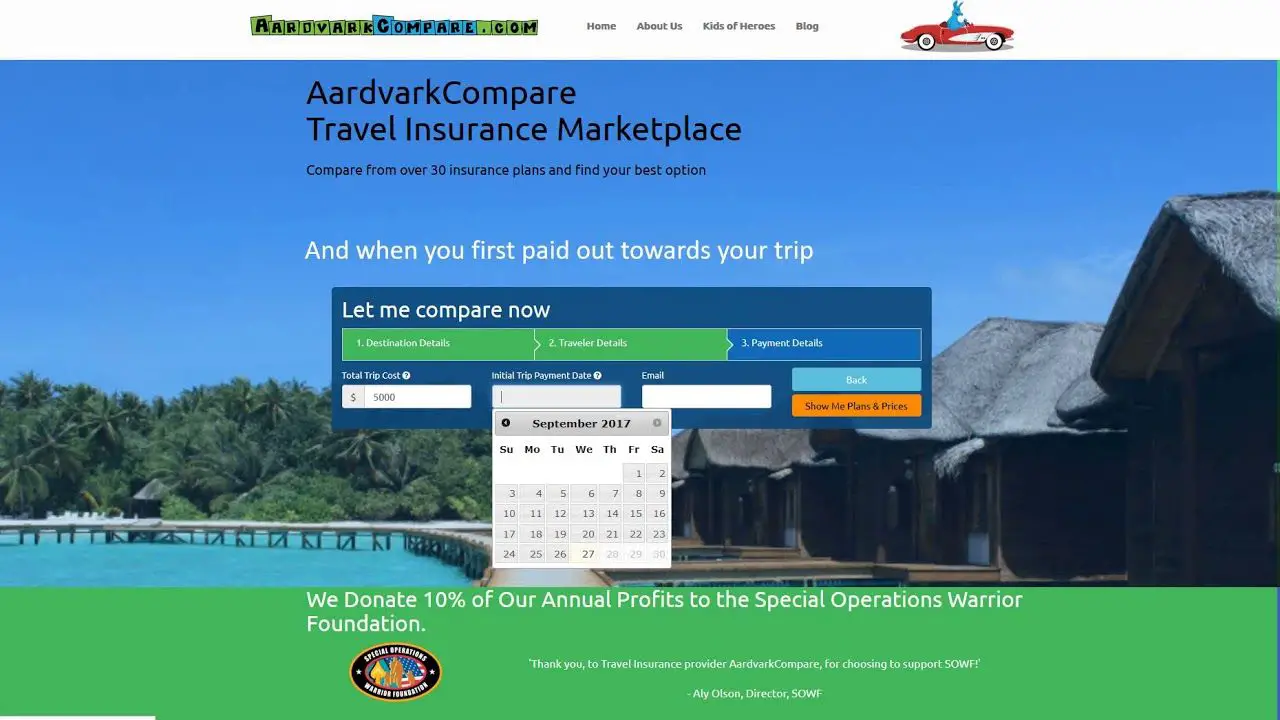

How To Get Travel Insurance

When youre considering travel insurance for an upcoming trip, youll be happy to know that some components of your trip may already be covered. For example, when you book a trip with your credit card, depending on the card you use, you may already receive trip cancellation and interruption coverage.

So when deciding on what level of coverage you need, check to see what you already get with your credit card. Then, decide what additional coverage you would like. Commonly, travel medical protection is not included with your credit card, so if youre looking for more comprehensive coverage, it makes sense to purchase a general trip insurance policy.

Below, we include four ways to obtain travel insurance, along with the pros and cons of each option.

Checklist: What To Look For When Reading Your Policy

When reading your policy, pay attention to the following:

- Does your insurance cover medical care related to COVID-19? What are the restrictions or limitations in this regard?

- Is your destination excluded from your coverage? Does your insurance cover destinations with a level 3 or level 4 advisory from the Canadian government

- Are emergency medical repatriations covered?

- What is the maximum length of your stay?

- Do you have the option to extend your contract in an emergency?

- What is the maximum amount covered by your insurance?

Don’t Miss: Does Colonial Life Offer Health Insurance

Travel Insurance Is A Must When Applying For A Schengen Visa

Extract from Regulation No 810/2009 of the European Parliament and of the Council of 13 July 2009, which entered into force on April 5 of 2010:

Applicants for a uniform visa for one or two entries shall prove that they are in possession of adequate and valid travel medical insurance to cover any expenses which might arise in connection with repatriation for medical reasons, urgent medical attention and/or emergency hospital treatment or death, during their stay on the territory of the Member States. The insurance shall be valid throughout the territory of the Schengen Area Member States and cover the entire period of the persons intended stay or transit. The minimum coverage shall be EUR 30,000

Provincial Health Insurance Does Not Cover Everything

Health insurance in each province or territory has limitations. So, wherever you are in Canada, you may have to pay for costs that are not included in your provincial coverage. Ambulance trips and prescription drugs and other drugs given outside a hospital are some examples of services that are not reimbursed by OHIP.

Similarly, health services provided by doctors could be reimbursed up to the rates that are effective in your province or territory of residence.

For example, if you see a doctor during your trip, they may require you to pay the difference out of pocket between the fees billed in your province of residence and the ones in the province you are visiting. Depending on the services received, these amounts could represent several hundred dollars, and they will not be reimbursed by OHIP.

Don’t Miss: How Do I Know Which Health Insurance I Have

How You Can Get Atol Protection

When you make a package holiday booking that includes a flight, make sure the travel firm has a licence. Firms have to display their ATOL number on websites and in brochures.

When you book, the ATOL holder or their agent must provide an ATOL Certificate confirming you are ATOL protected immediately when you pay any money . This should include the name of the licensed firm youve booked with, their ATOL number and details of whats protected. Take these documents with you when you travel.

You will not be protected by ATOL if you:

- are not buying a package holiday from an ATOL holder or its appointed travel agent

- buy a Linked Travel Arrangement . This is where a business facilitates the sale of two or more travel services but does so in a way that it is not classed as a package. If a travel business sells an LTA, it must inform you that this is the case and what protection you may have

- buy your flight and accommodation separately from different suppliers, such as an airline and a hotel company

You can check whether a business holds an ATOL on the CAA website.

Here Are Just A Few Reasons To Protect Yourself With Rbc Travel Insurance:

24-hour worldwide emergency medical and travel assistance

Caring, multi-lingual professionals, registered nurses and physicians are available around the clock to make sure you receive the proper help and care you need in case of a medical or other emergency.

Unlimited coverage for eligible medical expensesDisclaimer1

If you become injured or ill during your trip, your policy will pay for any eligible medical expenses that arenât covered by your government health insurance.

Coverage for stable pre-existing conditionsDisclaimer2

You can travel knowing youâre financially protected if you need emergency medical treatment during your trip.

Safe transportation to the closest medical facility

If you need urgent treatment, weâll provide transportation to the most appropriate facility, even if itâs in another country. Weâll also pay to have a friend or family member travel to your bedside.

Direct payment of medical bills, whenever possibleDisclaimer3

We will also coordinate payments with your government health insurance so you arenât out-of-pocket for any costs.

You May Like: How To Get Health Insurance For My Parents

Why Is International Health Insurance Cover For One Year Worthwhile

- Foreign health travel insurance cover is an absolute must for all trips. No matter how long or how far the journey, sudden illness or an accident can occur anywhere and at any time. Annual travel insurance saves you having to remember to arrange an international insurance policy before every trip. A doctor’s appointment abroad often costs much more. An annual policy can also be more cost-effective than separate policies for each trip.

- An annual travel insurance policy gives you worldwide protection for 12 months no matter whether you are taking a business trip, a family holiday or a mini break for just a few da.

- If you have arranged an international insurance package for the whole family, everyone named on the policy is protected even if you travel separately. An annual international health insurance package, therefore, affords you maximum travel cover throughout the year for a low premium.

For Visitors To Canada

If you are an international traveler visiting Canada for a short trip or a stay of less than one year, a less comprehensive and more affordable travel insurance plan may be the best option. These travel medical insurance plans cover the costs of medical treatment for emergencies and illnesses that occur while traveling. They also offer additional benefits such as coverage for adventure sports, trip interruption, medical evacuation and transportation, and more.

If you also want to cover the cost of your trip, consider a trip cancellation plan.

Also Check: Does Farmers Insurance Sell Health Insurance

What Are The Travel Health Plan Limits

The proper amount of medical coverage for your trip can be difficult to judge. When reviewing the different policies, you’ll see that every plan will offer varying levels of coverage typically ranging from $50,000 all the way up to $2,000,000. However, coverage may be lower for certain age bands. When determining how much protection you are going to need, there are a few things you’ll want to keep in mind:

Does your own health insurance plan cover you while traveling outside of the country? Some companies will, some companies will not, but if you purchase a travel insurance plan that provides secondary coverage and need to file a claim, you will still be required to file with your own insurance regardless. Therefore, it is always important to know how much you can expect from them, if anything. If you will be traveling for an extended period and your own insurance won’t cover you, you may want a higher medical limit. Also, it’s important to note, Medicare typically will not provide benefits outside of the U.S. Therefore, if Medicare is your primary insurance, you will most likely want a higher medical benefit.

How long is your trip? If you’re going to be away for more than a month or two, odds are you’ll want to have a higher benefit to account for the greater exposure to risk. Of course, whether or not your own health insurance will cover you is still an important factor to bear in mind.

What Is International Travel Medical Insurance

International travel insurance or worldwide medical insurance are two other synonyms for travel health policies. There is no technical separation for these policies from regular trip insurance plans. Many of the carriers have policies that are structured to have a greater focus on the medical and evacuation aspects of the plans, causing them to be marketed or commonly called travel medical plans.

Recommended Reading: What Does Health Insurance Cost An Employer

How Family Physicians Are Set

The majority of Canadian citizens and permanent residents have a family physician. They consult their physicians for annual physical exams and ongoing healthcare management. Family physicians order tests, like blood work and X-rays, and refer patients to specialists.

Family physicians may operate out of a small office as solo practitioners. They may also form small collectives where they take turns covering after-hours drop-in services. They might also have a nurse or phlebotomist on staff.

In some areas, the family physician is also a nurse practitioner. They are specially trained nurses who take on many of the duties of a primary care physician. Nurse practitioners based in rural areas may have a rotating schedule where they cover care in communities separated by hundreds of miles. Meanwhile, those in urban areas may be part of a larger clinic that does more than just primary care by including community services like breastfeeding support groups and nutrition services.

Are You A Travelling Senior Seeking Fun In The Sun

Don’t get burned! Make sure that the senior travel insurance you buy offers reliable coverage!

We’ve got Canada’s #1 selection of travel insurance companies offering plans specifically for snowbirds, retirees, tour groups or senior travellers, AND we provide personalized guidance and advice to ensure you obtain reliable coverage at the right price.

Whether you have a more complicated medical history and need help to navigate through the various medical questionnaires or whether it’s better to avoid the questionnaires altogether. Whether you need to find a policy with a short stability period or get a discount for perfect health we’ve got Canada’s best policies and the best prices.

Travel insurance prices have been increasing due to the lower Canadian dollar, and recently due to COVID19 related claims especially for senior travellers trying to cover pre-existing conditions.

Recent rate increases make our quick online comparisons and advice even more relevant than before. Keep in mind that the policy that worked well last year may not be the wisest choice this year depending on the size of the recent rate adjustment, the age bracket the company uses, or changes to your health. Over the last year, we’ve also added new policies that use different age brackets so you may remain in the lower-priced age bracket with one company while the others have bumped you into the next higher-priced group even if you are in perfect health.

We have policies that:

Read Also: Does Health Insurance Have To Cover Birth Control

Get Help Covering Unexpected Medical Expenses When You Travel

Whether youre travelling for business or pleasure, unexpected trip and health problems can occur. Help protect your trip and keep disruptions to a minimum with CoverMe travel insurance for travelling Canadians simple, affordable coverage for emergency medical expenses, baggage loss, trip cancellations and more.

Can I Use This Covid

- Its specifically designed to offer coverage for COVID-19 while the Government of Canadas avoid all non-essential travel advisory , which is still in place at time of publication.

- However, if the Government of Canada changes to an avoid all travel advisory , your coverage may cover you for trip interruption. Certain exclusions, limitations and conditions may apply. Please review the Certificate of Insurance to learn more about what is/isnt covered.

- WestJet reserves the right to terminate this offer at anytime.

- While we continue to closely monitor this evolving situation, travelling comes with risks to your personal health and safety its up to you to give each one proper consideration before going through with your trip. Bookmark travel.gc.ca/travelling/advisories to stay informed.

Read Also: Can You Add Your Mom To Your Health Insurance

Other Plan Benefits To Look For

The plans listed above include benefits beyond trip cancellation and medical coverage. Check out the details to make sure youre getting other benefits you want, too. For example, the Cat 70 plan that scored among the highest in our rankings also provides reimbursement for:

- Trip cancellation due to injuries, weather, hurricanes and terrorism

- Travel delay

The Benefits Of Travel Insurance

Travel insurance that covers you in the event of an accident or sudden illness will allow you to receive reimbursement for various expenses that are not generally covered by your public health insurance plan, such as:

- Emergency dental care

- Accessories and medical devices prescribed by the attending physician

- Prescription drugs prescribed in a medical emergency

- Ambulance transportation costs

- Emergency medical repatriations to your province or territory of residence, if this service is considered necessary and safe

- Urgent dermatological care

- The services of different types of health professionals

- Accommodation costs in a private or semi-private room

- The part of the costs that would normally be charged to you for consultations outside a hospital

Recommended Reading: How Do I Find My Health Insurance

Why Buy A Travel Medical Plan

Every type of travel insurance has its benefits, but finding the right plan is imperative while planning a trip. A travel medical plan is a great option if youre traveling abroad and are not worried about covering trip cost due to a cancellation or added expenses due to a travel delay.

Anyone looking for robust coverage for baggage or interruption should consider a comprehensive plan. Travel medical plans are excellent in assisting travelers to find adequate medical care while traveling abroad. Always think safety first. Please review and compare the different plans offered on our site before you buy. Use the form on the upper right hand side of this page to compare, and read reviews of plans that are available for your specific trip abroad or domestic.

Decide How Long You’re Going For

Travel insurers usually quote based on how many days you’ll be away.

- If youre just planning a quick trip, you may want a one-off travel insurance policy. These are for a set number of days.

- If you travel often, or for extended periods, consider an annual multi-trip policy. It may end up being more convenient and better value.

- If you’re going overseas long-term to live or work, you may not be covered by some policies. You may need to get domestic health and property insurance in your destination. Ask your insurer.

Annual multi-trip policies and credit card travel insurance policies can restrict the length of each trip you take. This could be anywhere from 15 to 365 days, depending on fine print in your policy. Some allow you to pay for extra days.

Compare CHOICE reviews of single trip and annual multi-trip travel insurance policies.

Also Check: How Much Is Independent Health Insurance