Is There A Penalty For Not Having Health Insurance

Too often, people learn that the personal penalty for not having health insurance is the exorbitant healthcare bills. If you fall and break your leg, hospital and doctor bills can quickly reach $7,500for more complicated breaks that require surgery, you could owe tens of thousands of dollars. A three-day stay in the hospital might cost $30,000. More serious illnesses, such as cancer, can cost hundreds of thousands of dollars. Without health insurance, you are financially responsible for these bills. Two-thirds of people who file for bankruptcy indicate that medical bills contributed to their financial situation, according to a 2019 study.

The Affordable Care Act increased the number of people with insurance and lowered those who couldnt afford to pay their health bills. While the federal health insurance coverage mandate and shared responsibility payment was in effect, from 2014 through 2018, the number of people in the United States who got health insurance increased by around 20 million.

Since 2019, there is no federal penalty for not having health insurance, says Brad Cummins, the founder and CEO of Insurance Geek. However, certain states and jurisdictions have enacted their health insurance mandates. The states with mandates and penalties in effect are:

- California

- Preventive and wellness services

- Pediatric services

There are a variety of health plans that meet these requirements, including catastrophic and high deductible plans.

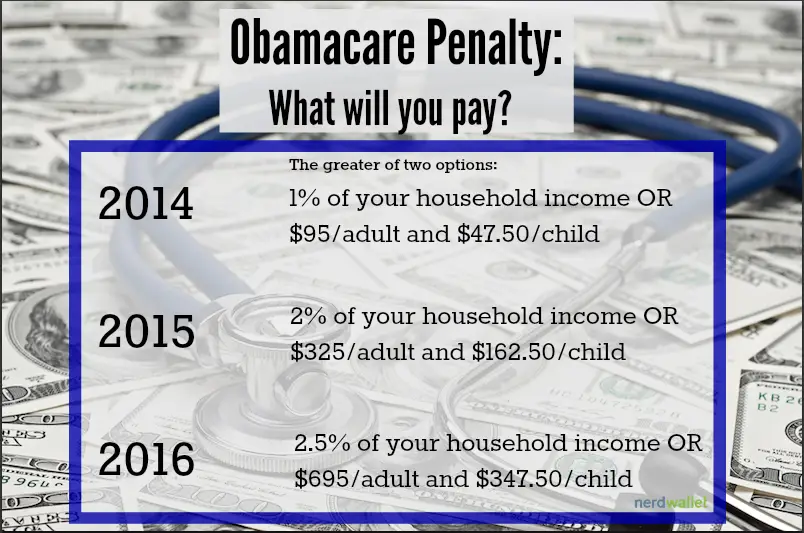

How Big Were The Penalties

The IRS reported that for tax filers subject to the penalty in 2014, the average penalty amount was around $210. That increased substantially for 2015, when the average penalty was around $470. The IRS published preliminary data showing penalty amounts on 2016 tax returns filed by March 2, 2017. At that point, 1.8 million returns had been filed that included a penalty, and the total penalty amount was $1.2 billion an average of about $667 per filer who owed a penalty.

Although the average penalties are in the hundreds of dollars, the ACAs individual mandate penalty is a progressive tax: if a family earning $500,000 decided not to join the rest of us in the insurance pool, they would have owed a penalty of more than $16,000 for 2018. But to be clear, the vast majority of very high-income families do have health insurance.

Today, the median net family income in the United States is roughly $56,500 For 2018, the penalty for a middle-income family of four earning $60,000 was $2,085 . This is far less than the penalty a more affluent family would have paid based on a percentage of their income.

The penalty could never exceed the national average cost for a bronze plan, though. The penalty caps are readjusted annually to reflect changes in the average cost of a bronze plan:

The maximum penalties rarely applied to very many people, since most wealthy households were already insured.

Individual Mandate Penalty Repeal

Former President Trump campaigned on a promise to repeal the ACA and replace it with something else. Republicans in the House passed the American Health Care Act in 2017 but the legislation failed in the Senate, despite repeated attempts by GOP Senators to pass it.

Ultimately, Republican lawmakers passed the Tax Cuts and Jobs Act and President Trump signed it into law in December 2017. Although the tax bill left the rest of the ACA intact, it repealed the individual mandate penalty, as of 2019 .

Although Congress did not repeal anything other than the mandate penalty , a lawsuit was soon filed by a group of GOP-led states, arguing that without the penalty, the mandate itself was unconstitutional.

They also argued that the mandate was not severable from the rest of the ACA, and so the entire ACA should be declared unconstitutional. A federal judge agreed with them in late 2018.

An appeals court panel agreed in late 2019 that the individual mandate is not constitutional, but sent the case back to the lower court for them to decide which provisions of the ACA should be overturned.

The case ultimately ended up at the Supreme Court, where the justices ruled in favor of the ACA. So although there is still no federal penalty for being uninsured, the rest of the ACA has been upheld by the Supreme Court .

Also Check: Is Student Health Insurance Cheaper

Washington Dc Individual Mandate

- Effective date: January 1, 2019

- Requires individuals and their dependents have ACA-compliant health insurance

- Imposes a penalty on residents who go without health insurance but can afford it

- Provides exemptions to the tax penalty for circumstances such as financial hardship, pregnancy, or eviction

Individuals who go without qualifying health coverage for a full year and dont file for an exemption may owe a tax penalty. The penalty amount is either 2.5% of the gross family household income or $695 per individual and $347.50 per child youll pay whichever amount is greater.

According to dchealthlink.com, the maximum penalty for not having coverage in DC is based on the average premiums for bronze level health plans available on DC Health Link. In 2020 this amount is $3,448/year per person and, for households with more than one person without coverage, it is multiplied by the number of people in the household without coverage up to a maximum of five household members. So, potentially, a household of five or more that went the entire year without health coverage would have a penalty cap of $17,240 in 2020.

The Fee For 2018 Plans And Earlier

- You may owe the fee for any month you, your spouse, or your tax dependents don’t have qualifying health coverage . See all insurance types that qualify.

- You pay the fee when you file your federal tax return for the year you dont have coverage.

- In some cases, you may qualify for a health coverage exemption from the requirement to have insurance. If you qualify, you won’t have to pay the fee. Learn about health coverage exemptions.

Read Also: Can A Significant Other Be Added To Health Insurance

Similarities & Differences Between Traditional Ira Roth Ira &

In 2006, the Massachusetts legislature passed the Health Care Reform Act, requiring almost all of its citizens to obtain minimum levels of health insurance or face penalties. The law requires the majority of state residents over age 18 who meet minimum income standards to purchase health care coverage or pay penalties when filing state tax returns. The state requires enrollment in plans meeting its minimum creditable coverage levels. If you don’t enroll, you’ll face monthly penalties.

A $10000 Obamacare Penalty Doubtful

By Victoria KnightOctober 29, 2020

We encourage organizations to republish our content, free of charge. Heres what we ask:

You must credit us as the original publisher, with a hyperlink to our khn.org site. If possible, please include the original author and Kaiser Health News in the byline. Please preserve the hyperlinks in the story.

Have questions? Let us know at

You May Like: What To Do When You Lose Your Health Insurance

Why Do I Have An Insurance Penalty In 2021

Posted: October 23, 2020

If you are a Californian with no health insurance in 2020, you may face a tax penalty in 2021. Though in 2019 the Trump administration rescinded the tax penalty established by the Affordable Care Act, you may still need to pay a tax penalty in 2021 if you live in California and do not have health insurance.

Your options are either to not carry health insurance and pay a penalty at tax time or to enroll in a qualified insurance plan and avoid paying the penalty, though some exceptions may apply depending on your circumstances.

What Is The Tax Penalty For Not Having Health Insurance

As of January 1, 2020, the state of California will require California residents to maintain minimum essential coverage or pay a penalty. The annual penalty is 2.5% of household income or a per person charge, whichever is higher. The per person penalty will be $695 per adult and $347.50 per child . The per person penalty amounts will be adjusted annually for inflation. The penalty cannot exceed the cost of the state average premium for the bronze level coverage offered through Covered Calfornia for the applicable household size or 300% of the per person charge, whichever is lower. For more details, please reference pages 6 & 7 of the FTB bill analysis.

You May Like: How To Get Medication Without Health Insurance

How Are Health Insurance Rates Calculated

Health insurance rates can vary widely among what initially appears to be an endless amount of insurance companies. And there are many risk factors that are utilized in calculating your rates. But it still boils down to the fact of, the riskier that you appear, the more you will be charged for coverage.Insurance companies utilize a range of data to determine what rates to charge each individual and/or family. And some of those factors include:

- Geographic Location Where you live has a large effect on your premiums. And market competition and local regulations may account for some of it.

- Your Age The older that you are, the more you will most likely pay in premiums. And depending on your age, you could pay 3 times more than someone younger.

- Tobacco Use Insurers may charge tobacco users up to 50% more than those that dont use tobacco.

- Individual or family Enrollment Insurers may charge more for plans that include coverage for a spouse and/or dependents.

- Plan Category

And because of the Affordable Care Act, no additional factors can affect the cost of your health insurance plan, besides any savings that you may receive from subsidies and/or tax credits.

State Individual Mandate Penalties

With the elimination of the federal individual mandate penalty, some states have implemented their own mandates and penalties:

- Massachusetts already had a mandate and penalty, which has been in place since 2006. The state had not been assessing the penalty on people for whom the federal penalty applied, but started assessing the penalty again as of 2019.

- New Jersey implemented an individual mandate and an associated penalty starting in 2019.

- The District of Columbia also implemented an individual mandate and associated penalty as of 2019.

- Rhode Island created an individual mandate and associated penalty as of 2020.

- California created an individual mandate and associated penalty as of 2020.

Most of the states with individual mandates have modeled their penalties on the federal penalty that was used in 2018, which is $695 per uninsured adult , up to $2,085 per family, or 2.5% of household income above the tax filing threshold, although there are some state-to-state variations.

Vermont has an individual mandate as of 2020, but the state has not yet created any sort of penalty for non-compliance.

Maryland has created a program under which the state tax return asks about health insurance coverage, but instead of penalizing uninsured residents, the state is using the data in an effort to get these individuals enrolled in health coverage. Other states have since followed Maryland’s lead in creating an “easy enrollment” program.

You May Like: What To Do When You Lose Health Insurance

What Are The Effects Of Repealing The Individual Mandate

Since its implementation, the individual mandate was controversial amongst the public and its repeal was equally debated. Much of the debate surrounding the individual mandate repeal was based on its effects on healthcare premiums. With less people obtaining health insurance, the premiums were expected to become higher for those who needed healthcare and had preexisting conditions. Not only was this controversial financially, but this brought up concerns over the state of health for the U.S. population. The worries about the inflation of premiums were brought to light when premiums for bronze plans increased from 3 percent to 13 percent once the tax penalty was removed. Additionally, enrollment fell from 2.8 million uninsured individuals to 13 million. For these reasons, certain states have chosen to enact their own mandates on health insurance requirements.

Ri Health Insurance Mandate

Health insurance is a requirement in the state of Rhode Island.If you go without continuous health coverage, you might pay a penalty when you file your taxes in 2021. See below for more information about the health insurance mandate and how it might affect you.

Better yet, sign up for coverage through HealthSource RI today to avoid a tax penalty later.

COVID-19 Hardship ExemptionIf you are looking for more information about exemptions from the penalty fee, please see the exemptions section below. Additionally, the State of Rhode Island recognizes that the COVID-19 pandemic has brought about unusual and unanticipated circumstances for many individuals. As a result, HealthSource RI filed a regulation expanding its criteria for qualification for the Hardship Exemption to include a COVID HARDSHIP, which can be claimed on an individuals RI Personal Income Tax return by using code 19. Filers who may claim this exemption DO NOT need to file an exemption application with HealthSource RI.

This exemption is valid for use ONLY for the months of April 2020 through December 2020 and may be claimed directly if the taxpayer attests that, due to a direct impact of the COVID-19 pandemic, the following statements are true:

1) The individual lost minimum essential coverage during the 2020 calendar year, and

2) The individual suffered a hardship with respect to the capability to obtain minimum essential coverage during the subsequent months in the 2020 year.

Recommended Reading: Are Health Insurance Companies Open On Weekends

No Longer A Federal Penalty But Some States Impose A Penalty On Residents Who Are Uninsured

Although there is no longer an individual mandate penalty or Obamacare penalty at the federal level, some states have implemented their own individual mandates and associated penalties:

Vermont enacted legislation to create an individual mandate as of 2020, but lawmakers failed to agree on a penalty for non-compliance, so although the mandate took effect in 2020, it has thus far been essentially toothless . Vermont could impose a penalty during a future legislative session, but the most recent legislation the state has enacted calls for the state to use the individual mandate information that tax filers report on their tax returns to identify uninsured residents and provide targeted outreach to help them obtain affordable health coverage.

What Are Possible Exemptions From The Fee

There are several ways to get exempted from state individual mandate penalties, just as there were possible exemptions for the federal individual mandate. A few common cases that you can be granted an exception for are cases of circumstantial reasoning, including financial status, life events, or hardships. Additionally, most states do not require you to pay a fee for any month you are covered. So if you are only uninsured for a few months of the year, you will only be penalized for those months, in most cases. Make sure to check with your specific state to find out if you qualify for exemption.

Read Also: What Is Temporary Health Insurance

Why Have An Individual Mandate

These states have an individual mandate for the same reason the ACA originally did. Without an individual mandate, people would only buy insurance if they knew they were going to need it. Most often, this means the elderly and people with pre-existing conditions.

But those who use their health insurance the most are also the most expensive to insure. Before the Affordable Care Act, insurance companies would evaluate all applicants before enrolling them. Based on peoples age and medical history, the insurance companies would then deny them health care coverage, or charge them more for it. But the ACA made that kind of discrimination illegal. And then it took things one step further. An individual mandate is an incentive for everyone to get health insurance, even healthy people. That meant there was now a larger pool of people applying for health insurance. And with more healthy people getting health insurance, health insurance companies could lower premiums for everyone.

In other words, the individual mandate was meant to be one of the of cost-savings and consumer protections we associate with the ACA. It allows more people to be insured at a lesser rate per person. Even though there is no national individual mandate anymore, some states have passed their own mandates to help keep more people insured at lower costs per person. If the mandates help more people get insured, taxpayers in these states will have lower monthly premiums on average.

What Is The Individual Mandate

The health insurance marketplacesestablished by the AffordableCare Act provide coverage to 11.41 million consumers, according to anApril 2020 report from the Centers for Medicare & Medicaid Services .

Prior to 2020, if you went without Affordable Care Act compliant health insurance for more than two consecutive months, you would pay a penalty. This requirement was commonly known as the Obamacare individual mandate. The purpose of the penalty was to encourage everyone to purchase health insurance if they werent covered through their employment or a government-sponsored program. According to Kaiser Health News, the federal ACA penalty for going without health insurance in 2018 was $695 per uninsured adult or 2.5% of your income, whichever amount was higher.

In response to concerns about the affordability of marketplace ACA plans, congress passed the Tax Cuts and Jobs Act at the end of 2017. The law reduced the individual penalty of the Obamacare individual mandate to zero dollars, starting in 2019. Now that the individual mandate tax penalty has been removed, there is not a tax penalty at the federal level.

Recommended Reading: How Much Do Health Insurance Agents Make

Vermont Enacted A Mandate But Opted Not To Impose Any Penalty For Non

Vermont enacted legislation in 2018 to create a state-based individual mandate, but they scheduled it to take effect in 2020, instead of 2019, as the penalty details werent included in the 2018 legislation and were left instead for lawmakers to work out during the 2019 session. But the penalty language was ultimately stripped out of the 2019 legislation and the version that passed did not include any penalty. So although Vermont does technically have an individual mandate as of 2020, there will not be a penalty associated with non-compliance .