Question: Can You Change Health Insurance At Any Time

With very few exceptions, you can cancel your health insurance plan at any time for any reason.

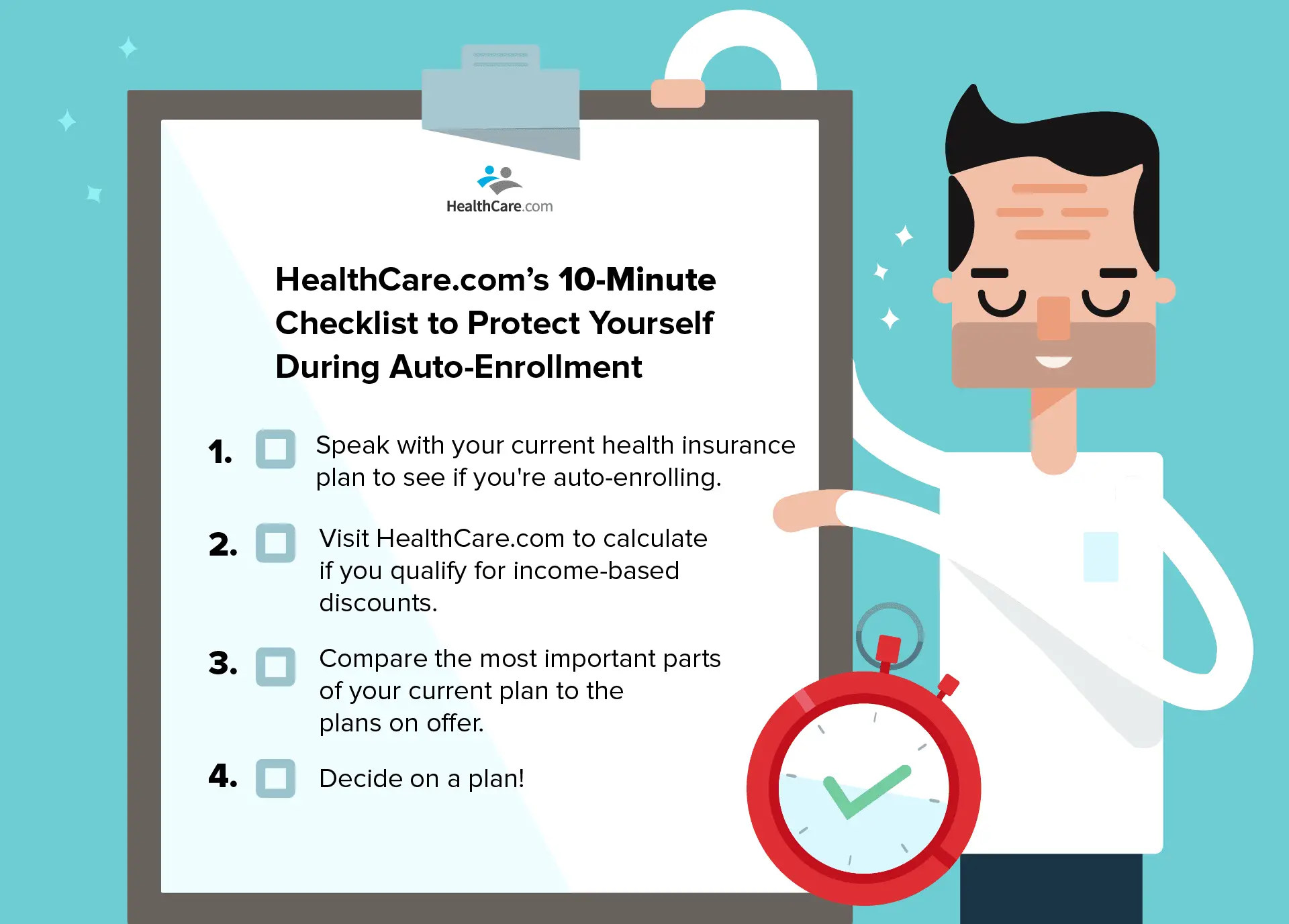

Understanding Open Enrollment, what you need in a health care plan and how to qualify for a Special Event Period can make the process of switching your health insurance plan much simpler.

What Happens If I Missed Open Enrollment

If you miss your employers open enrollment deadline, you could lose coverage for you and your loved ones, and you could be subject to a fine imposed by the Affordable Care Act . Missing this deadline also means that you could be unable to make changes or enroll in benefits until the next open enrollment period.

Can I Buy Or Change Private Health Plan Coverage Outside Of Open Enrollment

In general, you can have a special enrollment opportunity to sign up for private, non-group coverage during the year, other than during Open Enrollment period, if you have a qualifying life event. During the COVID-19 emergency period, you can also have an extended amount of time to sign up. Events that trigger a special enrollment period are:

- Loss of eligibility for other coverage Note that loss of eligibility for other coverage because you didnt pay premiums does not trigger a special enrollment opportunity

- Gaining a dependent . Note that pregnancy does NOT trigger a special enrollment opportunity in most states

- Loss of coverage due to loss of dependent status

- A permanent move to another state or within a state if you move outside of your health plan service area

- Exhaustion of COBRA coverage

- Cessation of employer contributions to COBRA premiums

- Losing eligibility for Medicaid or the Childrens Health Insurance Program

- Income increases or decreases enough to change your eligibility for Marketplace subsidies

- Change in immigration status

- Enrollment or eligibility error made by the Marketplace or another government agency or somebody, such as an assister, acting on their behalf.

Note that some triggering events will only qualify you for a SEP in the health insurance Marketplace they do not apply in the outside market. For example, if you gain citizenship or lawfully present status, the Marketplace must provide you with a special enrollment opportunity.

Recommended Reading: Do Colleges Offer Health Insurance

How Can I Tell If The Care I Need Is Preventive Or Diagnostic

Since coverage can change depending on whether care is considered preventive or diagnostic, it’s important to understand the difference. Here are a few examples to help explain how it works.

| Type of visit | |

|---|---|

| If you have a routine colonoscopy but do not have symptoms. | If your doctor orders a colonoscopy based on symptoms you’re having. |

How To Switch To Your Spouse’s Health Insurance Policy

Written by: Elizabeth WalkerOctober 18, 2021 at 9:22 AM

If you and your spouse are both eligible for employee health benefits, you may want to explore each company’s health insurance options to see which is best for you and your wallet.

If you want to switch to a spouses policy, or your spouse wants to enroll in yours, its usually a simple task to accomplish. However, its important to get the timing right and to know when youre eligible for special enrollment periods .

Also Check: Can I Put My Wife On My Health Insurance

Know Where To Get Reliable Help

Assessing your coverage options and finding the best plan can be confusing. It can be daunting to sort through the advertising and sales pitches, but there are resources available for unbiased advice and information, says Jane Sung, a senior strategic policy adviser at the AARP Public Policy Institute.

Again, a good starting point is the Medicare Plan Finder tool. Medicare also offers enrollees an online-chat feature for some beneficiaries where you can connect with Medicare experts to ask questions about your coverage options.

The Medicare Rights Center has an interactive tool that provides easy-to-use information about enrollment and plan options. And if you want state-specific details, the State Health Insurance Assistance Program can tell you more about offerings in your area. To find your states SHIP program, go to Shiptacenter.org or call 877-839-2675 to talk to a trained counselor.

People who are struggling to pay bills may be able to get help through the Medicare Savings Program. To find out whether youre eligible, go to benefitscheckup.org or contact your local Medicare Savings Program office.

Changing Your Health Insurance: Why You Might Want To

People choose to change their health insurance plans for all kinds of reasons. A few of the most common include:

- Changes in your plans network If your preferred doctors or specialists stop accepting your insurance, you could pay significantly more. Other health insurance options may help lower your overall medical bills.

- Needing more or less coverage If, for example, you visit the doctor frequently and copays are eating into your budget, a different plan may help you keep medical expenses under control. On the other hand, if youre paying for top-tier coverage but dont often use it, a more modest plan could be a better fit.

- Moving, changes to your employment or changes to your family These events are often times when its important to review your entire financial situation. Along the same lines, theyre also times when youll be able to switch your health insurance coverage.

No matter why you want to switch health insurance plans, there are two windows of opportunity when you can: annual open enrollment and special enrollment periods.

You May Like: Why Should I Have Health Insurance

Review Plan Documents To Understand Coverage Details

You can find more coverage details by reviewing these health plan documents before you enroll in a plan:

- Summary of benefits: Read this document to get an overview of coverage for each plan, including benefits, cost-sharing requirements and coverage limitations and exceptions.

- Plan coverage document: Ask your employer for this document that will offer a deeper dive into the coverage details for each plan.

Remember, it’s good to ask questions so you understand the coverage details of each plan before you enroll.

Its Not Too Late To Contribute To An Hsa

If you are a High Deductible Health Plan participant and meet eligibility requirements, its not too late to contribute to a Health Savings Account .

You may not be eligible if:

- You have additional non-HDHP medical plan coverage

- You or your spouse has a Healthcare Flexible Spending Account

- You are listed as ‘dependent’ on another persons tax return

- You are enrolled in Medicare

Advantages of an HSA

- Tax-free withdrawals for qualified medical expenses

- Account balance rolls over, year over year

- Money remains available for qualified expenses even if you change health insurance plans, change employers or retire

To enroll in the HSA

- Log in via CUBES, confirming access through multi-factor authentication

- Select +Add next to the Health Savings Account benefit

- You must confirm eligibility every year

- Complete the eligibility questions and Health Savings Account Affirmation and Set Up Your HSA Contribution. .

As always, if you have any questions, please contact the Columbia Benefits Service Center, Monday to Friday from 9:00 a.m. to 4:00 p.m. at 212-851-7000 or via email at .

Recommended Reading: How Do I Know If My Health Insurance Is Good

Special Enrollment Period If Youre In An Area Affected By Certain Natural Disasters

The federal government allows a special enrollment period, after the end of the general enrollment period, Medicare Advantage open enrollment period, or other individual special enrollment period , for people who live in an area thats experienced a FEMA-declared major disaster or emergency.

In general, if, because of the disaster, you were unable to complete your enrollment during the window that was originally available to you , youll have additional time to complete your enrollment. Your disaster-related enrollment window will continue for four months after the start of the FEMA-declared emergency period.

For 2021 coverage, there were several states and several partial states where this special enrollment period was available after the fall enrollment window ended in December 2020.

Hurricane season overlaps with the Medicare general enrollment window in the fall, which often leads to some areas having additional time to enroll after December 7. There are also FEMA-declared disaster areas due to other situations each year, such as wildfires, tornadoes, and floods.

Option : Join A Health

Faith-based healthcare is offered through 501 nonprofit charities with a religiously-oriented purpose, and serve as alternatives to health insurance. These plans are often referred to as health sharing ministries or healthcare sharing ministries.

Unlike traditional health insurance, these faith-based are not health insurance plans and do not insure people rather, they distribute healthcare costs among a large pool of people. Members pay into the system and upon receiving a bill from their physician, other members of the plan will contribute to help pay the bill.

Because members may buy in to them at any time of year, faith-based plans offer an alternative source of coverage for those who miss the open enrollment deadline.

Note that health-sharing plans will help you pay for medical care, but only if that care is consistent with biblical teachings . Although these plans are not required to cover essential health benefits mandated by the Affordable Care Act, theyre grandfathered into the ACA, thus faith-based plan members were exempt from paying the individual mandate penalty when it was applicable.

Read Also: Do Dermatologist Take Health Insurance

With A Special Enrollment Period

-

If you experience certain types of life changes like losing health coverage, getting married, moving, or having a baby you may qualify for a Special Enrollment Period to enroll in a Marketplace plan. If eligible, you may qualify for help paying for coverage, even if you werent eligible in the past. Learn more about lower costs.

How To Compare Advantage Plans

If you decide to stay with Medicare Advantage and just switch plans, use the Medicare Plan Finder tool or call Medicare to find out what other plans are available in your area and compare them. Here again, dont just focus on low monthly premiums. Some plans advertise $0 premium policies. But focusing on low monthly costs alone is a mistake.

There might be trade-offs that could result in higher out-of-pocket costs,” says Mary Johnson, a Medicare policy analyst with The Senior Citizens League, a nonpartisan senior advocacy organization.

A better strategy is to estimate your total out-of-pocket costs under the plan. Take a look at your past medical needs and consider what care you might need in the year ahead. Then add up the copays, deductibles, and coinsurance payments you are likely to pay. Your insurer may have an online cost estimator tool that may help, and you can find more resources here. Don’t forget to do a separate calculation for your prescription drug costs.

Dig into the details of plans that look promisingyou want to make sure your medical treatment will actually be covered. Call the insurance companies or check their websites to learn what doctors and hospitals are in the plans network. Then double-check this information by calling your healthcare providers directly to make sure they take that insurance plan.

Don’t Miss: How To Get Health Insurance In California

Is Supplemental Insurance Right For You Learn More And Get A Complimentary Quote

I would like coverage for:

MYSELF

Accident – In Idaho, Policy A37000ID. In Oklahoma, Policy A37000OK. In Virginia, Policies A371AAVA & A371BAVA.

Cancer – In Idaho, Policies B70100ID, B70200ID, B70300ID, B7010EPID, B7020EPID. In Oklahoma, Policies B70100OK, B70200OK, B70300OK, B7010EPOK, B7020EPOK. In Virginia, Policies A75100VA – A75300VA. Critical Illness – In Idaho, Policies A73100ID & A7310HID. In Oklahoma, Policies B71100OK & B7110HOK. In Virginia, Policy A73100VA. Life – In Idaho, Oklahoma, & Virginia, Policies: ICC18B60C10, ICC18B60100, ICC18B60200, ICC18B60300, & ICC18B60400. Short-Term Disability – In Idaho, Policy A57600IDR. In Oklahoma, Policies A57600OK & A57600LBOK. In Virginia, Policies A57600VA & A57600LBVA. Dental – In Idaho, Policies A82100RIDA82400RID. In Oklahoma, Policies A82100ROKA82400ROK. In Virginia, Policies A82100RVAA82400RVA.

Accident – In Idaho, Policy A37000ID. In Oklahoma, Policy A37000OK. In Virginia, Policies A371AAVA & A371BAVA.

Cancer – In Idaho, Policies B70100ID, B70200ID, B70300ID, B7010EPID, B7020EPID. In Oklahoma, Policies B70100OK, B70200OK, B70300OK, B7010EPOK, B7020EPOK. In Virginia, Policies A75100VA – A75300VA.\

Critical Illness – In Idaho, Policies A73100ID & A7310HID. In Oklahoma, Policies B71100OK & B7110HOK. In Virginia, Policy A73100VA.

Life – In Idaho, Oklahoma, & Virginia, Policies: ICC18B60C10, ICC18B60100, ICC18B60200, ICC18B60300, & ICC18B60400.

What Happens If You Dont Enroll During Open Enrollment

If you dont enroll during open enrollment, you might end up covered anyway. For example, Fronstin says that if you already have health insurance through an employer but dont choose coverage the next time open enrollment comes around, typically youre automatically re-enrolled in the same plan if you dont do anything.

You may also qualify to purchase coverage if you take on a new job that offers health care benefits. Another way to get insurance outside of the open enrollment period is to qualify for a special enrollment period or to qualify for a program such as Medicaid.

However, in other situations, you may not be able to find health insurance coverage until the next open enrollment period.

Also Check: How To Get Temporary Health Insurance

Switching To A Spouses Policy During Open Enrollment

If you want to switch to a spouses health insurance policy during the annual open enrollment period, changing your coverage is easy. You simply need to cancel your current coverage and enroll in your spouses policy. If youre making the change to cut back on group health insurance costs, timing the change during open enrollment means you start saving right away.

Most organizations run their coverage with the calendar year. Open enrollment generally begins in November for coverage beginning January 1. Be sure to check that you and your spouses plans follow the same plan year with the same start date for changes made during open enrollment to avoid a gap in coverage.

If youre switching from group health insurance to a qualified small employer health reimbursement arrangement or an individual coverage HRA , your spouse must be enrolled in an individual or family policy before they can participate in the HRA on a tax-free basis.

What If You Cant Afford Your Aca Plan Anymore

What happens if you simply cant afford your health insurance premium at some point in the coming year? If an ACA special enrollment period and other minimum essential coverage are not available options, you may want to consider non-ACA-compliant , but only if it fits both your financial situation and healthcare needs.

If you find yourself in a position where your current health insurance is unaffordable you dont have to make these decisions alone and guess the best course of action.

Call to speak with a licensed agent to help you understand your health insurance options both on and away from the state-based and federally facilitated health insurance exchanges.

Don’t Miss: Do I Need Pet Health Insurance

What Is An Open Enrollment Period

Open enrollment when you can make changes to your health insurance plan. You can also sign up for a new plan during open enrollment.

Youre able to enroll in a plan through:

- Your employer

- An individual health plan through your state’s or the federal government-run insurance marketplace or directly through an insurance company

- Medicare

During the annual open enrollment period, you can change your current plan or obtain new coverage. Its important to make these choices carefully, says Gretchen Jacobson, vice president, Medicare, for The Commonwealth Fund.

The best plan for your friend may not be the best plan for you, she says. Each plan has different benefits, different drug coverage and different health care providers in their networks.

Selecting the right health insurance plan can be challenging. Each year, millions of Americans have the opportunity to choose a new plan, or to tweak their existing coverage. But with so many options available, how can you know if you are making the right choice?

Get educated, says Paul Fronstin, director of the health research and education program at the Employee Benefit Research Institute. There are potentially options out there for you.

Fronstin adds that such alternatives may or may not be better than the plan you already have. But that is something you have to figure out, he says.

Can You Just Cancel Your Aca Plan

Lets say you want to switch health insurance plans halfway through the year and dont qualify for special enrollment, but youd still like to cancel your current major medical coverage. Is that an option?

Yes, its possible. However, its important to remember that going without comprehensive major medical coverage could leave you vulnerable to unexpected medical bills should you become sick or injured.

Instead of and going without coverage, you may want to consider either keeping your comprehensive plan and adding or enrolling in a non-ACA-qualifying as an alternative to going uninsured if you qualify.

Lets look more closely at these options, both of which are available year-round in most states.

Also Check: Can You Put Boyfriend On Health Insurance

Changing Health Coverage Outside An Open Enrollment Period

It can be tricky to change your coverage to a spouses policy outside of the open enrollment period. Your current policys coverage period may not match up with your spouses policy coverage period and you could be refused coverage until open enrollment rolls around again.

If you are enrolled in a cafeteria plan and have had your hours reduced to 30 hours per week or less, or if youve purchased an individual health insurance plan through the federal Marketplace or state ACA exchange, among other specific instances, youre able to drop your group health insurance midyear.

Additionally, if your employer offers you a QSEHRA or an ICHRA, this triggers a special enrollment period , giving you 60 days from the time you are offered the HRA to change to your spouse’s individual insurance family plan.