What Does Catastrophic Health Insurance Not Cover

A catastrophic plan wont cover anything other than the requirements listed above until your deductible is met.

In addition, exclusions on catastrophic plans are similar to any other health insurance plan. Plans may vary by provider, but most dont cover elective procedures, such as cosmetic surgery. Experimental treatments are also commonly excluded.

What Dont Catastrophic Health Plans Cover

Your catastrophic health plan doesnt cover emergency care until youve met your deductible. And there may be certain limits on preventive care and number of covered visits to a Primary Care Provider , depending on the plan.

Its important that you understand what is and is not covered by your particular plan.

Catastrophic Health Insurance And High

Itâs easy to make the mistake of thinking that a catastrophic health insurance plan is the same thing as a high deductible health plan . After all, a catastrophic plan has a high deductible, so it must be a high deductible health plan, right?

Wrong.

A qualified HDHP is a very specific type of health insurance designed to be used with a health savings account. Learn the difference between an HDHP and a catastrophic plan, and what might happen if you buy a catastrophic plan when you thought you were buying an HDHP.

Recommended Reading: How Much Does Individual Health Insurance Cost In Massachusetts

How Do Hsas Fit In

If you are employed and covered by only a high-deductible health plan, you can combine a catastrophic health care plan with a health savings account , which allows you to set aside tax-free money to apply toward medical costs. An HSA can help you pay for any of your out-of-pocket health expenses under a catastrophic health insurance plan.

How Can I Get Catastrophic Health Insurance

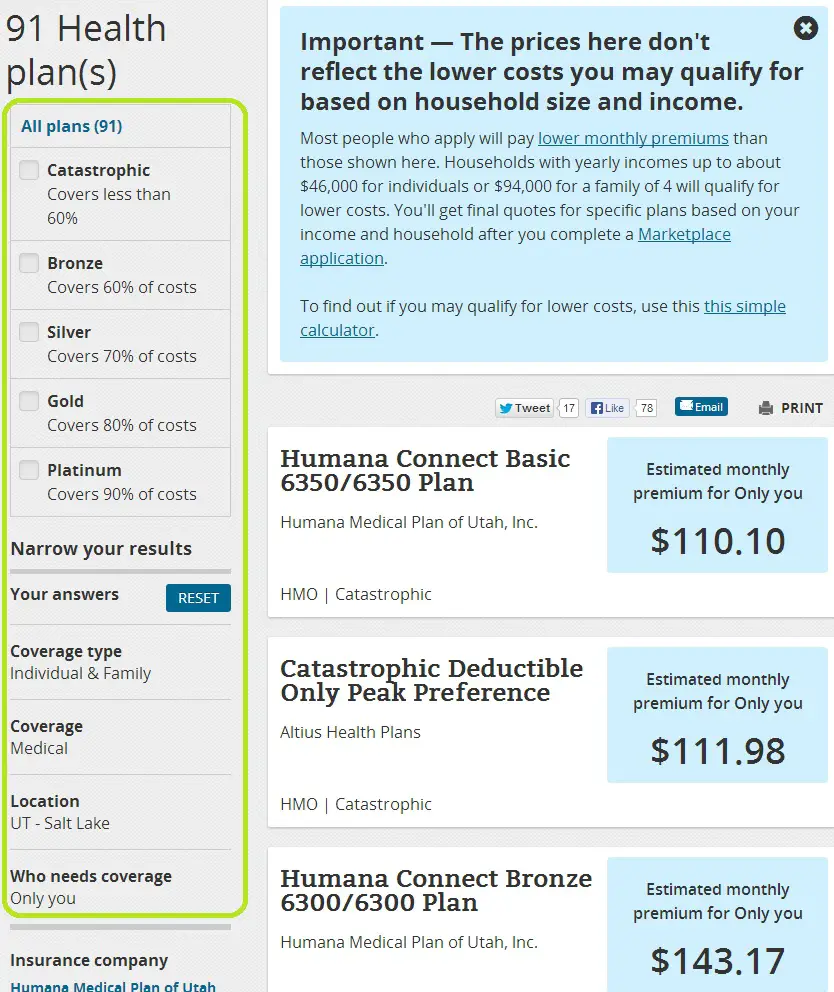

You can purchase catastrophic health insurance plans through the Health Insurance Marketplace at Healthcare.gov, or you can purchase directly from a private insurance company.

To purchase a plan through Healthcare.gov, you need to be under 30. If you are over 30 and think you qualify for a catastrophic plan due to a hardship, you must apply for an exemption before selecting a plan. Applying through Healthcare.gov allows you to compare plans from multiple insurers so you can pick the best plan for your needs.

If you purchase directly through a company, you may purchase short-term insurancetemporary coverage against major accidents or illnesseswithout having to meet certain criteria or qualifying for an exemption. However, short-term plans dont cover pre-existing conditions.

You May Like: How To Transition From Private Health Insurance To Medicare

Cons Of Catastrophic Coverage

- If there ever is a medical emergency, you will end up paying more than you would with other health insurance options.

- May leave out important health benefits like coverage for prescription medication.

- You dont have the ability to apply for federal subsidies through the health insurance marketplace.

Catastrophic Plans: High Deductibles Plus Primary Care And Preventive Care

- Catastrophic plans cover all of the essential benefits defined by the ACA, but with very high deductibles, equal to the annual limit on out-of-pocket costs under the ACA .

- They must still limit members out-of-pocket costs for in-network services to no more than the annual out-of-pocket maximum that applies to all plans .

- Catastrophic plans cover up to three primary care visits per year before the deductible is met .

- And like all ACA-compliant plans, catastrophic plans cover certain preventive care with no cost-sharing.

- Other services beyond preventive care and some primary care will be paid by the insured until the deductible is met.

Also Check: When Can I Apply For Health Insurance

The Importance Of Health Insurance For Young Adults

Despite its importance, many young adults do not have health insurance. If you are young and healthy, it can be tempting to avoid it altogether in favor of not spending money on a monthly premium. In addition, fear about costs and confusion about available plans can prevent young adults from seeking insurance plans.

It is crucial to remember health insurance plays an important role in financial and physical health. Young adults should explore available plans to protect themselves against potential health-related incidents. These are some additional reasons behind health insurances importance:

Enroll In An Employers Plan

Another option for young adult health insurance is to join an employers plan. This choice can simplify many of your decisions. For example, your employer often splits premium costs with you, lowering your monthly costs. In addition, you avoid the necessity of researching and finding a plan on your own.

However, there are a few exceptions for employer insurance, including:

- Missing the enrollment period: After your initial hiring, your employer should explain your health benefits and provide an enrollment period length. If you miss this enrollment period, you might be unable to join the plan until the next Open Enrollment Period.

- Contracted employees: If you were hired as an independent contractor, you might not have the choice of employer health insurance. It is best to check with your HR department to understand available insurance plans.

- Small business employees: Small business owners might not be required to provide health insurance for employees. If a company has 50 employees or fewer, they typically do not have to offer insurance. You might encounter this issue if you work for a small business.

Also Check: What Insurance Does Aurora Health Care Accept

Private Health Insurance In Canada

Private health insurance is health coverage that covers expenses not paid by the public system. It is either purchased by an individual or offered as a benefit by an employer. It typically reimburses a percentage of prescription drugs, dental care, supplemental health care, medical equipment and nursing, and vision care. There are basic, inexpensive plans that can help pay a portion of medical expenses. More complete, more expensive options offer greater reimbursement on a wider range of treatments. These plans may include services like access to therapists and chiropractors, semi-private hospital rooms, catastrophic drug, emergency travel, and orthodontic services.

We highly recommend getting a private insurance plan. It can help you access better care when you need it while saving you from large, unexpected expenses.

Balance your expected needs and your budget to find a plan that makes sense for you.

Popular private health insurance companies in Canada include:

- Physician services, surgery/anaesthesia, x-ray and laboratory services

- Accessories and medical devices bought in pharmacies

- Orthopedic shoes or podiatric orthotics

Health care costs are split between you, the provincial insurer and the private insurer. Your provincial and private plans each pay a percentage. You covering the remainder.

Private health insurance can be a literal lifesaver

Start saving today!

Can You Get Catastrophic Coverage Over 30

Yes, you can get health insurance over the age of 30.

The purpose of the Affordable Care Act was to provide affordable health insurance to everyone. If you cant afford health insurance, rather than foregoing coverage, you may qualify for a hardship exemption. The following are some examples of what would qualify you for a hardship exemption, but for a full list, you can read more here.

- You are currently homeless or have recently been homeless.

- You have been evicted from your home, or have recently been evicted.

- You were are or have been a victim of domestic violence. If you are currently a victim of domestic violence you can seek help here.

- You have recently experienced the death of a family member.

- You have current outstanding medical bills you have not been able to pay.

If you do qualify for a hardship exemption, it would be worth exploring federally funded health insurance programs like Medicaid and Medicare. You may be eligible for subsidized health coverage that will cost you little to no money. You also may be exempt from any health insurance penalty should you choose to go without coverage for the year.

You May Like: Do I Need Health Insurance Between Jobs

Benefits And Costs Of Catastrophic Health Insurance

Find Cheap Health Insurance Quotes in Your Area

Catastrophic health insurance or high deductible health plans are low-premium and high-deductible policies that you can buy for health insurance coverage. Catastrophic insurance is a qualified health insurance plan that follows the guidelines of Obamacare. A catastrophic plan is a form of emergency health insurance designed to provide coverage in the event of a significant medical emergency while you pay for most day-to-day health expenses yourself. You are eligible for catastrophic health insurance if you are under 30 years old or currently approved to receive the hardship exemption.

What Does Catastrophic Health Insurance Cover

Catastrophic health insurance plans must cover all the services required by the ACA. In general, these services include preventative services, pregnancy care, prescription drugs, and laboratory services. The ACA designates three separate lists of preventative services that must be coveredone for all adults, one for women, and one for children.

Read Also: Can I Use My Health Insurance In A Different State

Whats A Catastrophic Plan

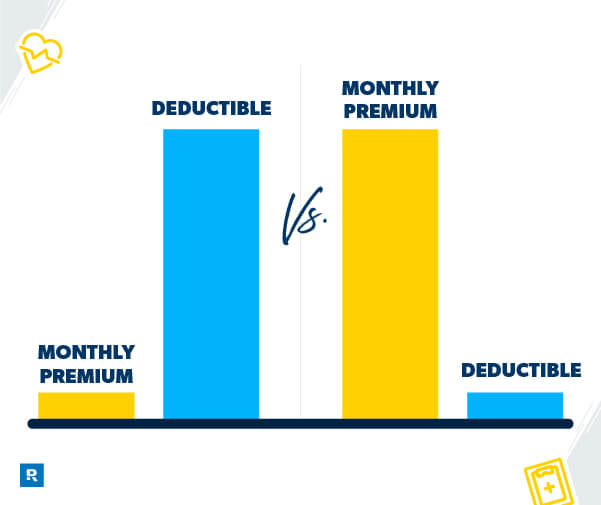

Catastrophic plans have low monthly payments but a high deductible. A deductible is the amount you pay for health care services before your insurance starts to pay. Once you meet your deductible, our Blue Cross® Value plans pay 100 percent for most services. Medical treatment for a serious illness or accident can cost thousands of dollars. So you can see how these plans protect you from catastrophic expensesand how theyre better than no insurance.

Heres a few other things you should know about catastrophic plans:

- They cover the same essential health benefits as other plans, including preventive care.

- You cant apply a subsidy to catastrophic plans.

- They dont pair with a health savings account.

How Catastrophic Health Plans Work

Catastrophic coverage works exactly like any other health insurance plan purchased through the marketplace. The first step is finding a plan and enrolling, once you do that, youre officially covered.

With catastrophic plans you will pay a monthly premium in order to remain covered, your premium will also be lower than Bronze, Silver, Gold, and Platinum plans purchased through the marketplace. When its time to seek out medical attention, whether it be for a routine checkup or something a little more serious, thats when your coverage will kick in, but only after you reach your deductible or out-of-pocket maximum.

Once you reach your deductible or out-of-pocket maximum, your catastrophic health plan will typically cover 100% of your medical costs for the rest of the year, or whenever your deductible or out-of-pocket maximum reset. Its important to note that your deductible may be a significant chunk of change.

Also Check: How To Get Gap Health Insurance

How To Get Health Insurance As A Freelancer

If you’re a freelance worker who’s married, your most cost-effective option for health insurance may be to get onto your spouse’s workplace health plan, if they have access to one. Otherwise, you can purchase a plan from the health insurance marketplace, which was established by the Affordable Care Act.

Now, you have to follow the rules for obtaining coverage through a marketplace plan. You can sign up during open enrollment, which runs from Nov. 1 through Dec. 15 every year. The process of signing up for coverage can vary by state, and you may be eligible for a health insurance subsidy, depending on your income .

That said, if you had health insurance through a job but lost your coverage , you may qualify for a special enrollment period to sign up for a marketplace plan. This means you won’t have to wait until the annual open enrollment period.

Whether you’re new to freelancing or have been doing it for years, it’s important to factor the cost of health insurance into your budget and make room for it. Going without insurance has the potential to be a very costly mistake. And the last thing you want to do is regret your decision to go freelance due to a pile of medical bills.

What Is Catastrophic Insurance And How Much Does It Cost

Catastrophic health insurance is an option for young adults who want to protect themselves in the event of a serious medical emergency but don’t expect to need regular medical care.

Let Jerry find your price in only 45 seconds

Also Check: Can You Put A Boyfriend On Your Health Insurance

What Is Catastrophic Limit

Catastrophic limit refers to the maximum amount of certain covered charges set by the insurance policy to be paid out of pocket of a beneficiary during a year. It is the amount of money that a person must pay out-of-pocket for health care expenses incurred by a catastrophic illness before the insurer pays bills.

How Much Does Catastrophic Health Plans Cost

The average cost of a catastrophic health plan in 2020 is $195. Thats signficantly less than the usual monthly costs in an employer-sponsored plan or an individual health plan.

One downside to catastrophic health plans is the deductible. Catastrophic health plans deductibles, which you have to pay for health care services before the plan chips in money, are much higher than other health plans. Catastrophic health plans deductible is $8,150. Thats significantly higher than other plans. For instance, high-deductible health plans average deductible is about $2,500 for single coverage. The deductibles in health maintenance organization and preferred provider plans are even lower.

However, once you reach your deductible in a catastrophic plan, the plan covers the rest of your health care costs for the year.

Don’t Miss: How Can I Get Low Income Health Insurance

Who Qualifies For Catastrophic Health Insurance

There are limitations as to who can qualify for catastrophic health insurance and some factors you should consider before making this purchase. Anyone under the age of 30 can qualify for catastrophic health insurance without any financial limitations. If youre over 30, youll need to meet specific income requirements, also called hardship exemption, which can vary by location and provider.

You can also qualify if youre facing one of these common exemptions:

If you live in one of these states, you should instead opt for the lowest level health care plan as alternative coverage.

Simple Saver Epo Catastrophic Plan

AmeriHealth New Jersey offers the Simple Saver EPO Catastrophic plan to individuals and families who qualify. Like all AmeriHealth New Jersey health plans, Simple Saver EPO covers the 10 Essential Health Benefits.

| Type |

|---|

What are the pros and cons of catastrophic health insurance?

- Pro: Catastrophic plans have lower monthly premiums than plans in the metallic categories.

- Con: Catastrophic plans have much higher deductibles and out-of-pocket costs than plans in the metallic categories. This could mean high costs if you get sick or hurt.

- Con: The Simple Saver EPO catastrophic plan does not have out-of-network coverage, except for emergency care services.

What do catastrophic health insurance plans cost?

Catastrophic plan monthly premiums are based on age and household size. Refer to the Monthly Premium Rate Card to view and compare monthly premiums.

What are my other health plan options?

AmeriHealth New Jersey offers a variety of EPO health plans for individuals and families. No matter which of our EPO plans you choose:

- You are not required to select a primary care physician.

- You do not need a referral to see a specialist.

- Some plans have an option to open a tax-advantaged health savings account .

Don’t Miss: What Is The Deadline For Health Insurance Open Enrollment

How Do I Qualify For An Exemption So That I Can Get Catastrophic Health Coverage

There are two main types of exemptions that would help you qualify for catastrophic insurancepersonal hardship and affordability exemptions. You could qualify for either exemption depending on the details of your specific situation.

Some common hardship qualifications include:

- Death of a close relative

- Utility services being shut off

- Home foreclosure

- A fire, or a natural- or human-caused disaster that results in substantial property damage

There are also affordability exemptions. This means that your income is not enough to be able to afford regular health care coverage. If you qualify for an exemption, you would claim it on your annual tax return and get money back.

Catastrophic Plans Are Not Hsa

A health savings account is a type of tax-advantaged account to which people can contribute pre-tax money as long as theyre covered by an HSA-qualified high deductible health plan . In laymans terms, catastrophic and high-deductible are often used interchangeably. But in health policy, they each have strict definitions:

- HDHPs that allow a member to contribute to an HSA are not allowed to cover any care before the deductible, with the exception of preventive care , and the maximum out-of-pocket amount for an HDHP in 2022 is $7,050 for an individual .

- Catastrophic plans are required to cover at least three primary care visits before the deductible, and they have deductibles that are higher than the allowable limits for HDHPs .

So by definition, catastrophic plans cannot be HSA-qualified, and catastrophic plan enrollees cannot contribute to HSAs. If you want to be able to contribute to an HSA, youll need an HSA-qualified plan. These plans can be found at the Bronze, Silver, and Gold levels, depending on the area and the insurer offering the plans, but they cannot be catastrophic plans.

Don’t Miss: How Long Can My Son Stay On My Health Insurance

What Is Catastrophe Cover

Catastrophe insurance protects businesses and residences against natural disasters such as earthquakes, floods, and hurricanes, and against human-made disasters such as a riot or terrorist attack. These low-probability, high-cost events are generally excluded from standard homeowners insurance policies.

How To Compare Insurance Options

Choosing the best insurance option for your needs takes significant time and research. It is best to research plans as thoroughly as possible before enrolling in one. You should understand the eligibility requirements and financial obligations of plans, and make sure you can meet them.

These are a few other tips for comparing insurance options:

Recommended Reading: How Much Is The Fine For Not Having Health Insurance