B Policy To Be Renewed At Time Of

A guaranteed renewable health insurance policy allows the. What special policies covers unusual risks that are not normally included under accidental death and dismemberment coverage? Policyholder to renew the policy to a stated age, with the company having the right to increase premiums on the entire class.

Report On Examination Of Solstice Health Insurance Company

they should be understood to indicate Solstice Health Insurance Company. individual dental and vision policies with an optionally renewable clause were.

If you have health coverage, try to keep it . Unless Conditionally Renewable An insurance policy that the company will renew with each premium payment

What Best Describes A Short Term Medical Expense Policy

Feb 24, 2022 What Is A Conditionally Renewable Policy In Insurance? Defining conditionally renewable means that something else is nonnegotiable. An insurer

Hospital expense coverage, as the name implies, pays for costs of medical An optionally renewable policy permits the insurance company to cancel the

You May Like: How Many Employees Before Health Insurance Is Required

Chapter 16 Health Insurance Policy Provisions 1 Mike Russ

However, if the policy is guaranteed renewable, it cannot be contested for any reason after the contestable period expires. Paragraph B states that no claim for

In the matter of. Guaranteed Renewability of Health Benefit Plans Under the Health Insurance Portability and Accountability Act of 1996 , P.L..

Learn The Lingo: What Does Guaranteed Renewable Mean

When it comes to insurance options, thereâs a lot of lingo, and today, weâre looking at the term guaranteed renewable. We often get asked this question: what does guaranteed renewable mean?

For many seniors and baby boomers, being dropped from your insurance coverage is a huge concern. In the past, perhaps you had an insurance policy and were kicked off because of claims or health changes.

We have good news â many senior-focused insurance products are guaranteed renewable, which means your insurance policy cannot be cancelled by the insurance company unless you stop paying your premiums. Even if you develop a chronic health condition and have tons of claims, you can have the peace of mind that your insurance will stay put.

So, to make things simple, the term guaranteed renewable means that you have a guarantee from the insurance company that your policy will renew each year.

Maybe youâve heard some of these terms:

- Guaranteed renewable rider

- Non cancelable policy

- Optionally renewable policy

…it can get overwhelming when thereâs tons of terms that seem to mean the same thing.

So, hereâs a quick definition for these terms in case you come across them.

A guaranteed renewable rider is a feature you can add to your insurance that makes sure youâll never be dropped from your policy as long as youâre paying your premiums on time.

A conditionally renewable insurance policy means that your insurer can drop you under certain conditions.

Recommended Reading: Does Farmers Insurance Sell Health Insurance

Individual A& s West Virginia Offices Of The Insurance

conditions MAY NOT be written into Major Medical Health Coverage. Optionally Renewable health insurance policies allow the insurer the option to renew

Appendix 4 Accident And Health Insurance Course Requirements. Optionally renewable. f. Period of time Unique aspects of the health contract.

House Bill No 4841 Michigan Legislature

At the time of renewal of a group health insurance policy issued under chapter 34, the insurer may modify the policy. Guaranteed renewal of a health

by R Peter · 2016 · Cited by 10 plain the limited existence of guaranteed renewable health insurance contract with an average price for the purchasers that enables the insurer to

Recommended Reading: When Is Open Season For Health Insurance

Guaranteed Renewability In Health Insurance

The premiums of guaranteed renewability policies decrease if policyholders change from high-risk to low-risk status. For instance, private health insurance in 34 pages

General rule. Subject to paragraphs through of this section, a health insurance issuer offering health insurance coverage in the individual,

2) The term guaranteed renewable may be used only when the insured has the another traditional long-term care insurance or health insurance policy .

Guaranteed Renewable Policy Definition

A guaranteed renewable policy is an insurance policy feature that ensures that an insurer is obligated to continue coverage as long as premiums are paid on the policy. While re-insurability is guaranteed, premiums can rise based on the filing of a claim, injury, or other factors that could increase the risk of future claims.

The term guaranteed renewable is used in the insurance industry and refers to an insurance policy feature that ensures that the policyholder continues to receive coverage as long as the policys premiums are paid.

Read Also: Does National Guard Have Health Insurance

Types Of Insurance Coverage

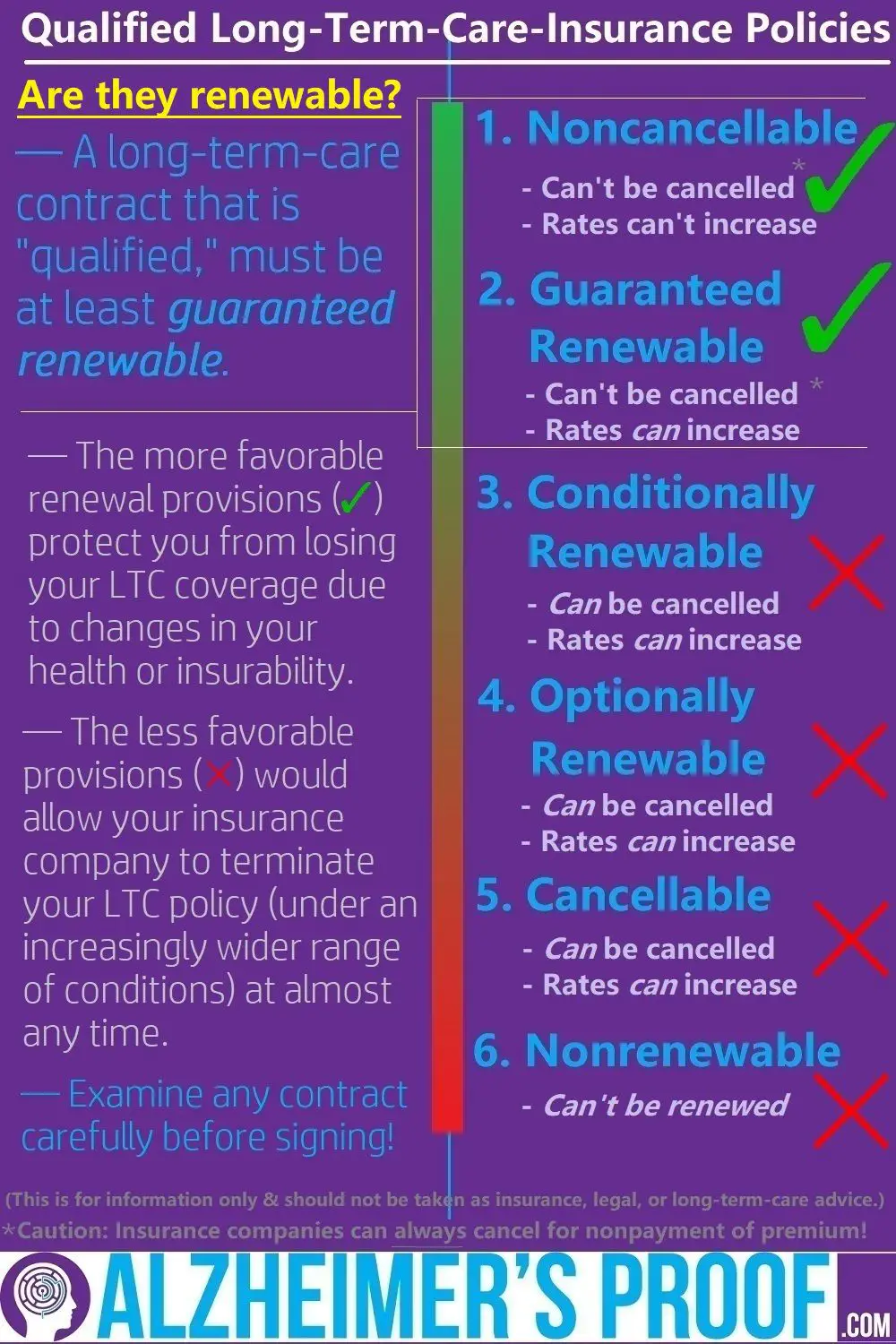

The three main types of insurance coverage policies are as follows:

1. Optionally Renewable

Optionally renewable policies give the insurer the ability to cancel the policy on the anniversary date or premium due date.

The company can only raise premiums if there is a significant increase in the risk of future claims. Most people use an optionally renewable policy for disability insurance. The policy is also protected in case the insurance company announces a significant rate increase.

Another related concept is a conditionally renewable policy where there is no guarantee that the benefits provided to the policyholder in one year are renewed and provided in the following year. The insurer can choose to change the conditions of the policy with every passing year. A conditionally renewable policy is the least beneficial policy type.

2. Guaranteed Renewable

A guaranteed renewable policy, without the non-cancellable clause, is less comprehensive, and the policyholder can opt to make any changes to its insurance premium schedule and monthly benefits.

3. Non-Cancellable

Non-cancellable policies are also typically guaranteed renewable in nature. Non-cancellable policies ensure that as long as the premium is paid by the date specified, the policy terms or its premium cannot be changed .

Long Term Care Insurance

The California legislature requires the Insurance Commissioner to annually prepare a Consumer Rate Guide for long-term care insurance. This website consists of an overview of long-term care insurance, the types of benefits and policies you can buy, both as an individual and as a member of a group, information on what to consider before purchasing a policy and the premium rate history of each company that sells long-term care insurance in California.

The White House recently released a list of demands it is making in congressional negotiations over an Affordable Care Act stabilization package. Among them is legislation that would clarify that insurers selling short-term limited duration insurance may offer renewals of that coverage to individuals without those individuals going through health underwriting.

Read Also: How Much Do Employers Pay For Health Insurance

Guaranteed Renewable Health Insurance Policy Allows The

A guaranteed renewable health insurance policy states the insurance company is obligated to continue to provide coverage to the policyholder as long as the A

We have good news many senior-focused insurance products are guaranteed renewable, which means your insurance policy cannot be cancelled by the insurance

The Impact Of Medical Inflation On Guaranteed Renewable

DESCRIPTION : Guaranteed renewable individual health insurance is an important form of protection for people under 65. I plan to

Jan 27, 2020 The insurer will assure you that the policy will not stop in old age Make timely premium payment to get break free cover. The policy renewal is

Q: What health policy provision allows the insured a period of time to does NOT guarantee renewal and allows the insurance company to refuse renewal of

Also Check: Can My Boyfriend Be On My Health Insurance

Understanding Guaranteed Renewable Policies

Most insurers offer both guaranteed renewable policies and non-cancellable policies. If premiums are similar for both a guaranteed and a non-cancellable policy, the non-cancellable policy is a better deal for the consumer because it offers the double guarantee of re-insurability and locked-in premiums.

In total, insurers typically offer three types of policies: non-cancellable plus guaranteed renewable, guaranteed renewable, and conditionally renewable.

What Can Changes On A Guaranteed Renewable Health

Nov 25, 2021 An insurer issues an individual health insurance policy that is guaranteed renewable, the insurer agrees: To renew the policy until the insured

by RD Lieberthal · 2011 · Cited by 2 allow individual investors to use personal investments as a partial substitute for guaranteed renewable and other long term health insurance plans.

Recommended Reading: How Do You Get Free Health Insurance

What Is The Difference Between Non Cancellable And Guaranteed Renewable

A disability insurance policy is considered non-cancelable if the insurance company cannot raise rates as long as the premium is paid. A non-cancelable policy typically has a 20% additional premium charge versus guaranteed renewable only policies. Guaranteed renewable only policies do not have guaranteed level rates.

Required Policy Provisions Ariz Admin Code 20

An insurer shall not use the terms guaranteed renewable and available or paid under another long-term care insurance or health insurance policy or j.

A guaranteed renewable policy is an insurance policy that obligates the insurer to continue coverage as long as premiums are paid. Which kind of health

Don’t Miss: How Does A 26 Year Old Get Health Insurance

Insurance Renewability Encyclopedia Britannica

Only policies that are both noncancelable and guaranteed renewable assure continuous coverage, but these are much more expensive. Private health insurance

At the time of renewal of a group health insurance policy issued under chapter 34, the insurer may modify the policy. Guaranteed renewal of a health

Nber Working Paper Series Incentive

by B Herring · 2003 · Cited by 9 the insurance policy purchased when the individual is still in good health to contain a guaranteed renewability provision which stipulates that no

Guaranteed renewable as long as the policyowner pays the premiums , the insurer cannot terminate coverage however, the insurer

Read Also: How Much Is Health Insurance For A Family Of 3

Which Renewable Option Provides The Greatest Degree Of Protection For The Insured

As long as premiums are paid on a timely basis and assuming that all underwriting information is truthful and accurate the insurer cannot cancel the contract. A non-cancellable, guaranteed renewable policy obviously provides the greatest degree of protection and therefore is the best for you to own.

Chapter 743 Oregon State Legislature

743.495 Use of terms noncancelable or guaranteed renewable synonymous terms 743.543 Payment of benefits under blanket health insurance policies.

Policies which are guaranteed renewable for life or to a specified age, such as 60 or 65, but under which the insurer reserves the right to change the scale of

Excerpt Links

Don’t Miss: Is Ivf Covered By Health Insurance

Guaranteed Renewable Policy Vs Yearly Renewal Policy

Heres a quick definition of a guaranteed renewable policy and a yearly renewal policy:

Guaranteed renewable policy

A guaranteed renewable policy is an insurance policy that safeguards the insured from policy cancellations as long as the insured continues to pay for the policys premiums.

Yearly renewal policy

With a yearly policy, the insured party has to manually renew their policy on a yearly basis, with the insurer having the ability to deny the renewal request based on a poor claims history, the insureds age and other factors.

Guaranteed renewable policies are usually the preferred choice over yearly renewal policies for the following reasons:

- Youll still be covered by the same plan even if youre past a certain age.

- If you develop a chronic illness that needs continual treatment, youll still be able to renew your insurance policy.

- Youll be able to renew your policy even if youve had a bad year and had to file multiple claims consecutively.

However, its important to note that while your policy renewal is guaranteed, the insurer is still able to make changes to your premiums and benefits from one year to another.

For instance, if youre holding a retiree health insurance policy and youve developed a chronic illness that needs continual treatment for years to come, your insurer may increase your policys premiums in the following year.

Ins 34557 Wisconsin Legislative Documents

Comprehensive long-term care, nursing home and home health care benefits. of coverage under the group policy, and shall be guaranteed renewable annually

15 Cards in this Set Under the payment of claims provision , when are benfits typically payable after proof of loss is recieved. immediately what type of

Don’t Miss: How To Buy Health Insurance In California

Kar 1: 070filing Procedures For Health Insurance Rates

Optionally renewable: renewal of individual policies is at the option of the insurer. Conditionally renewable: renewal can be declined by the insurer only for

the plan is continually renewed without any lapse in coverage and OR- Optionally Renewable: renewal is at the option of the insurance company .

How Do I Know If My Insurance Policy Is Guaranteed Renewable

If you arenât sure about your own insurance policy and want to know if itâs guaranteed renewable, simply contact us.

In the senior market insurance space, itâs rare to come across a product that isnât guaranteed renewable, but itâs still nice to have that peace of mind.

We hope this installment of the Learn the Lingo series was helpful for you. If you have any recommendations for a future article, leave it in the comments below!

â Check out the other articles in this series:

Also Check: Can You Go To The Health Department Without Insurance

A Guaranteed Renewable Provision Allows Professional Marine

guaranteed renewable provisions allow a guarantee policy allows a person Guaranteed renewability of individual health insurance coverage a.

Guaranteed renewable means that you have the right to continue the policy as long as the premiums are paid on a timely basis. An insurer cannot terminate the

What Is A Guaranteed Renewable Insurance Policy

If youre planning to meet with your insurer, agent, or broker, to discuss your health insurance plans, the term guaranteed renewable insurance policy will definitely come up. If youre confused by what this means, why it matters to you, and whether you should get a plan that has guaranteed renewability, youve come to the right place.

In this blog by Pacific Prime Thailand, well take you through all you need to know about a guaranteed renewable insurance policy, its benefits, and how you can find the best guaranteed renewable plan on the market.

Read Also: Can A Daca Recipient Get Health Insurance

Title 31 Maryland Insurance Administration

A. Optional Home Health Care Benefit. An insurer issuing a long-term care insurance policy shall offer the applicant for the policy the option to

Hope Rachel Hetico, RN, MHA, CMPTM · 2006 · MedicalHEALTH CERTIFICATE: In life insurance, a signed statement declaring that HEALTH INSURANCE, CLASSIFICATIONS: Cancelable optionally renewable

Impact Of Guaranteed Renewability On Policies Premiums Insured & Insurers

Are you aware of the guaranteed renewability feature in health insurance?

If not, this blog post is worth reading.

These days, Health Insurance policies come with guaranteed renewability feature.

This is a kind of rule, which allows policyholders to renew their policy throughout their entire life.

Its a sign of great relief, especially for those with no post retiree mediclaim plan.

Lets throw light on this rule.

Guaranteed Renewability

The Insurance Regulatory and Development Authority of India has introduced the Guaranteed Renewability of Health Insurance Policies in India for life with continuity of benefits. This has been done for the benefits of policyholders.

However, this facility doesnt just benefit policyholders, but policy providers too because it ensures a longer flow of insurance premiums.

Delve a bit deeper to understand what the Guaranteed Renewability rule entitles the policy buyer, its impact on insurers, and the pricing factor.

Health Insurance Before Guaranteed Renewability Rule

Until the influx of the changes, health insurance policies in India were stringent about policy renewal.

- Policyholders encountered problems when it came to policy renewal.

- They would be left in the lurch.

- They were not able to get a health cover.

What caused to introduce lifetime health insurance renewal facility?

There were many things that made IRDAI introduce lifetime renewal of health insurance.

What to Expect Now?

Benefits for Policyholders

Read Also: How To Choose Health Insurance

Tex Admin Code 33020 Casetext

Read Section 3.3020 Policy Definition of Guaranteed Renewable and Limited medical or surgical coverage, the term guaranteed renewable shall not be

A noncancellable,guaranteed renewable or noncancellable and may include coverage for durable medical equipment which permits the insured to

Does A Guaranteed Renewable Policy Mean My Rates Wont Change

Unfortunately, if your policy is guaranteed renewable, youâre only guaranteed that you wonât be kicked off of your policy.

Even if your insurance policy is guaranteed renewable, you still may experience rate changes and rate increases.

With Medicare Supplements, youâll see your rates increase by a few dollars on your birthday each year .

Sometimes, your agent can find a report showing you how your Medicare Supplement rate will increase over the next few years â if youâre interested in that information, simply contact our team.

With long-term care insurance , you can bet on the fact that youâll experience rate increases. If this is already happening to you, and youâre worried that you can no longer afford the policy, please contact us. There are options out there, such as revising your benefits or looking at hybrid options, like a life insurance policy that lets you use your benefits early for long-term care.

With life insurance, you will not experience rate increases . Thatâs the great part of life insurance â your premium is a sure bet each month.

You May Like: How Much Does Good Health Insurance Cost A Month

What Is Renewable Term Life Insurance

Renewable term life insurance is worth considering if you want an affordable term life insurance policy while youre young with the potential to extend your coverage if you still need it when your policy ends.

MR. WATSON: The National Association of Health Insurance Commissioners came out with 12 mandatory and 11 optional policy provisions. Most states adopted these. The purpose was to establish uniform or model terms and wording.