Determining How Much You Should Spend On Health Insurance

The amount you should spend on health insurance depends on a few different characteristics of health insurance plans: the deductible, premium, and cost-sharing mechanisms. Generally, plans with higher monthly premiums have lower deductibles and less cost-sharing. There are four tiers of health insurance plans available on the Marketplace:

Average Cost Of Health Insurance

The average monthly cost of health insurance in the United States is $541.

Find Cheap Health Insurance Quotes in Your Area

Health insurance premiums have risen dramatically over the past decade. In previous years, insurers would price your health insurance based on a multitude of factors. However, the number of variables have decreased significantly with the Affordable Care Act.

In 2022, the average cost of individual health insurance for a 40-year-old on a silver plan is $541. This represents an increase of nearly 1% from the 2021 plan year.

Average Obamacare Costs Per Month By Plan Type

| Health insurance plan member |

|---|

| $129,880 |

The ACA marketplace makes it easy to figure out if you qualify. You enter your household income information into the ACA marketplace website, which uses that information to provide estimates on how much youll pay for health insurance by plan available in your area.

The website will also let you know if you qualify for your states Medicaid program. Medicaid is a federal/state health insurance program for lower-income people. The comprehensive insurance plan costs little to nothing for those who qualify, depending on household income and family size.

If you dont qualify for advanced premium tax credits or a Medicaid plan, here are four ways to save on a plan through the Obamacare marketplace.

Recommended Reading: Can I Transfer My Health Insurance To Another Company

How To Estimate Your Annual Total Cost

Because theres no way to be sure what medical expenses youll have in a year, its impossible to predict the exact annual cost of care. However, you can get an idea of your estimated total cost of care.

First, youll need to determine the expected care for you and each family member on your plan. For instance, if you expect to have few visits to the doctor with occasional prescription drugs and no expected hospital visits, you might expect a low level of care. But if you think youll have more frequent doctor visits with lots of prescription drugs and at least one expected hospital visit, you might expect a high level of care.

Once you have an idea of the level of care youll need, youll be better suited to find the annual total cost for each of your plan options. If youre searching for plans on the Health Insurance Marketplace, you can enter your level of expected care and the Marketplace will show you estimated total yearly costs for each plan. If youre working with a licensed insurance agent, they can also help you estimate your total cost.

With a better idea of which plan is suited to your expected level of care, you can feel more comfortable in determining which is best for your needs and budget.

How Does Health Insurance Work

If you need to shop for insurance, chances are youâll use an online exchange hosted by the federal government or your state . These exchanges are shopping portals where you can easily check multiple insurance companies to find a plan with the lowest premium. Companies that sell through the federal exchange must provide multiple plan options covering 10 essential healthcare benefits. This means you can be confident the coverage youâre buying meets your needs.

In return for paying the premium, the insurer will pay for part of the cost of your healthcare services according to the terms of the insurance planâs contract. The insurer must also comply with laws specifying what health services must be covered.

Your insurance plan will likely also require you to pay for a portion of your health care costs. This payment may be in the form of coinsurance, copays, and your policyâs deductible. But with insurance, your total cost of health care should be much lower than if you pay for your medical services completely out of pocket.

Also Check: Can I Get Health Insurance If I Lose My Job

Are You Ready To Find The Right Individual Health Insurance For You

eHealth is here to help you. We have licensed insurance brokers who understand the various coverage options and can guide you through your individual insurance health insurance choices. Our service is quick and convenient and free of charge. Call us at 396-2521 , MonFri, 9am7:30pm ET, or email us at [email protected].

This article is for general information and may not be updated after publication. Consult your own tax, accounting or legal advisor instead of relying on this article as tax, accounting, or legal advice.

How Does Insurance Work In The Us

Private health insurance is either offered through your employer or school, or you have to buy it on your own. You can select a plan that suits you best from the ACAâs Health Insurance Marketplace. The ACA, which stands for the Affordable Care Actâitâs nicknamed âObamacareââprovides subsidies to those who canât afford high premiums of insurance plans. The size of the subsidy depends on the individualâs income. Some states like California, Colorado, New York, and Massachusetts run their own healthcare exchanges.

The world of health insurance also has its own language and an extended glossary. It helps to learn a few of the essential terms in order to understand the plan youâre buying:

- Premium: The monthly cost of your plan.

- Deductible: The amount you pay out of pocket before your insurance kicks in.

- Co-Insurance: The percentage of costs you still need to pay after your insurance kicks in.

- Co-pay: What you pay the doctor at every visit.

Cost of health insurance varies widely, and it depends on the types of benefits you choose. Usually plans with higher premiums cover more of your medical expenses. In 2018, premiums averaged $440 per month for individuals, and $1,168 per month for families.

Read Also: What Is Old Age And Survivors Health Insurance

Pick A Health Plan Category That Works For You

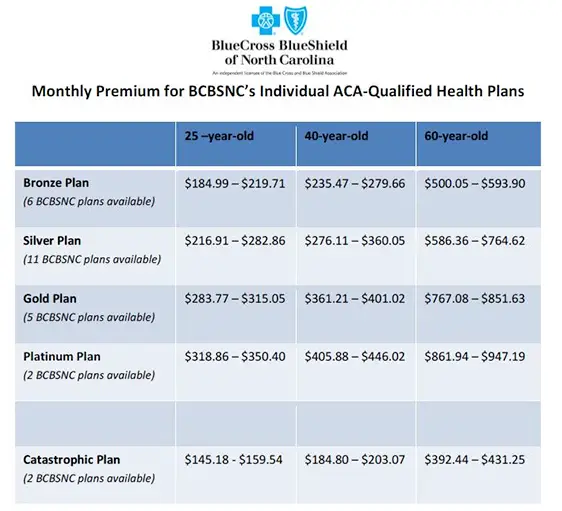

The Marketplace has 4 health plan categories to help you compare plans: Bronze, Silver, Gold, and Platinum. Theyre based on how you and the plan share the costs for care you get.

Generally, categories with higher premiums pay more of your total costs of health care. Categories with lower premiums pay less of your total costs.

So how do you find a category that works for you?

- If you dont expect to use regular medical services and dont take regular prescriptions: You may want a Bronze plan. These plans can have very low monthly premiums, but have high deductibles and pay less of your costs when you need care.

- If you qualify for extra savings : Silver plans may offer good value. If you qualify, your deductible will be lower and youll pay less each time you get care. But you get these extra savings only if you enroll in Silver. If you dont qualify for extra savings, compare premiums and out-of-pocket costs of Silver and Gold plans. Check if you qualify for extra savings.

- If you expect a lot of doctor visits or need regular prescriptions: You may want a Gold plan or Platinum plan. These plans generally have higher monthly premiums but pay more of your costs when you need care.

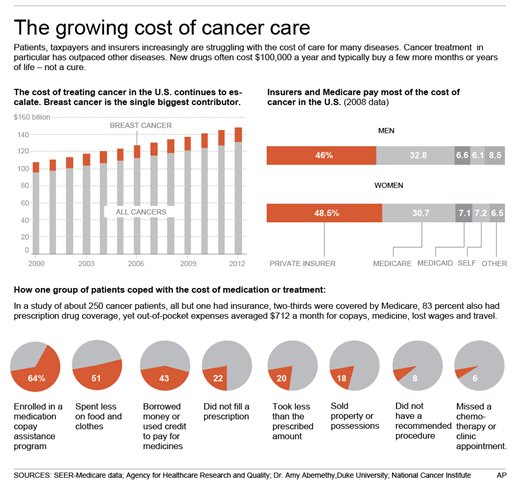

Why Health Insurance Is So Expensive

The expense of medical treatment, which accounts for 90% of expenditure, is the single greatest driver of U.S. healthcare costs. These costs are a result of the rising price of new medications, treatments, and technology as well as the rising expense of caring for people with long-term or chronic medical illnesses.

Also Check: How Much Does Health Insurance Cost By Age

The American Treatment Cost Gap And Health Insurance Cost

The raw cost of treatment is higher in the USA than in many countries, so this influences the cost of insurance. There are several reasons for this cost gap:

Due to the sizeable treatment cost differences, many international insurers including William Russell do not cover treatments that take place on American soil as part of our standard policies.

However, if youre an American citizen working overseas, then its good to know some of our international health insurance policies provide short-term cover for visits of up to 45 or 90 days. Find out more about our USA-45 and USA-90 international health policies.

Medicare Advantage Plan :

- Monthly premiums vary based on which plan you join. The amount can change each year.

- You must keep paying your Part B premium to stay in your plan.

- Deductibles, coinsurance, and copayments vary based on which plan you join.

- Plans also have a yearly limit on what you pay out-of-pocket. Once you pay the plans limit, the plan pays 100% for covered health services for the rest of the year.

Recommended Reading: How Much Is The Cheapest Health Insurance

The Average Cost Of Health Insurance By Metal Tier

Plans offered on the Health Insurance Marketplace are categorized into metallic tiers: Bronze, Silver, Gold and Platinum.

The tier corresponds to the value of the coverage, or how health plans and members split the costs. For example, in Bronze plans, the health insurer pays approximately 60% of the costs of care, and the individual typically pays 40%. The provider typically pays 90% in Platinum plans, and the individual pays 10%. These ratios are set by tier and based on expected spending for a typical health plan member.

In MoneyGeeks analysis, the lowest average premiums were $383 per month for Bronze plans. The average Platinum plan, by contrast, costs $782 per month.

Average Health Insurance Premiums by Metal Tier

Scroll for more

How Can I Lower My Life Insurance Rates

Your overall medical history may be out of your hands, but you can take steps to potentially lower your premium.

- Quit smoking. Kicking the habit could cut your premium in half and improve your health.

- Cut down on drinking. If you enjoy more than a drink a day, you could cut back on alcohol for lower rates.

- Get in shape. Insurers consider weight and exercise habits an important part of your risk. A lower BMI typically leads to cheaper rates.

- Consider major life changes. Look at your coverage after changes like becoming a new parent. You can also ladder policies based on debt, like a 30-year term policy for your mortgage and a 15-year policy to get to retirement.

- Look for discounts. Talk with your insurer about lowering premiums with a joint policy or other savings opportunities.

How long will I have to pay premiums?

If you have a term life policy, youll need to pay premiums for the length of the term to maintain coverage. This could be 1, 5, 10, 15, 20, 25 or 30 years.

With permanent policies like whole life, youll have to pay premiums for your entire life otherwise, youll lose coverage. But once youve accumulated enough cash value, you can use it to pay your premiums.

Recommended Reading: Can Illegal Aliens Get Health Insurance

Healthcare Spending And Health Insurance In The Us

While expensive, health insurance can help people mitigate even bigger expenses. The Centers for Medicare & Medicaid Services states that U.S. healthcare spending in 2020 was $4.1 trillion. That breaks down to $12,530 per person. Health insurance covered about 68% of those costs.

Most of us are fortunate enough to have some form of health insurance. KFF notes that approximately 50% of Americans have group insurance coverage through an employer. The employer often pays for at least part of that premium. Another 35% receive health insurance from government programs such as Medicare and Medicaid, or through the U.S. military.

Finally, approximately 6% of Americans are individually insured. They purchase health insurance directly from an insurer, through an agent or broker, or through a healthcare exchange.

How Do Premiums Deductibles Cost

Generally,the more benefits your plan pays, the more you pay in premium. But your medicalexpenses for care are lower.

Toillustrate how these costs may influence your choice of plans, consider the ACAplans.

Inaddition to the metallic plan categories, some people are eligible to purchasea plan with catastrophic coverage. Catastrophic plans have very low premiums andvery high annual deductibles . However, they pay for preventivecare regardless of the deductible. These plans may be a suitable insuranceoption for young, healthy people. To qualify for a Catastrophic plan, you mustbe under age 30 or be of any age with a hardship exemption or affordabilityexemption . Learnmore about Catastrophic coverage.

Don’t Miss: How To Sell Health Insurance From Home

You Both Have Employer

If youre both employed by a company or companies that contribute to your health insurance premiums, maintaining your individual coverage with your respective employers is almost always the cheapest way to go.

Thats because employers typically require very low contributions from their employees to the plan cost even if it feels like a lot coming out of your paycheck. According to the Kaiser Family Foundation , employees pay only 17% of the premiums on individual plans on average, which you can do if you both have that option, and 27% on family plans.

In 2020, that breaks down the average health insurance costs you can expect to pay for an individual or family plan:

Again, the cost of a family plan may vary depending on how many people youre adding to the plan. Also, its important to note that the cost of your premium will also depend on where youre located and the amount to which your employer is able and willing to contribute to your health insurance costs.

In some cases, an employer may pay the full amount, but most employees can pay at least some of the cost.

Speak with your human resources representative about how much it would cost to combine health insurance coverage with your partner into a single plan, and have your spouse do the same. Note that you can add your spouse to your plan within 60 days of getting married. Otherwise, youd need to wait until open enrollment.

Ask Almost Anyone Who Has Lived In The United States And They Will Have A Health Insurance Story To Tell You Even If They Dont They Most Certainly Know Someone Who Does

Health insurance is notoriously expensive and complicated in the U.S. Unlike Canada, most of Europe, and many other countries where universal health care provides a basic level of coverage to all citizens, the U.S. has a mixture of private and two kinds of government-run programs. Basic coverage in California and Florida can cost $450 per month, while similar plans in New York can cost upwards of $600 per month.

Recommended Reading: What Is Gap Health Insurance And What Does It Cover

Private Health Insurance Companies

You can visit the websites of major health insurance companies in your geographic region and browse available options based on the type of coverage that you prefer and the deductible that you can afford to pay.

The types of plans available and the premiums will vary based on the region where you live and your age. Its important to note that the plan price quoted on the website is the lowest available price for that plan and assumes that you are in excellent health. You wont know what youll really pay per month until you apply and provide the insurance company with your medical history.

Pricing and the type of coverage can vary significantly based on the health insurance company. Because of this, it can be difficult to truly compare the plans to determine which company has the best combination of rates and coverage. It can be a good idea to identify which plans offer the most of the features that you require and are within your price range, then to read consumer reviews of those plans.

If you are choosing a family plan or are an employer who is choosing a plan that youll provide to your employees, then youll also want to consider the needs of others who will be covered under the plan.

What Affects Obamacare Costs

Obamacare costs are based on multiple factors, including age, whether you smoke, how many people are covered on your plan, the health insurance company, your location, the plans metal tier, the benefit design and your household income. A health insurance company cant use your overall health or gender when setting your rates.

Lets look at how the different metrics affect health insurance costs.

Recommended Reading: How Much Do Employees Pay For Health Insurance

How To Get The Best Health Insurance

If youre looking to purchase health insurance on your own, you can just go to the websites of major health insurance companies in your area and see what plans they provide. You can compare plans on your own, although quotes will vary pretty widely.

But lets face it. This is a ton of work. Choosing the right health insurance plan for you or your family is a daunting task. And you probably have better things to do with your time than sifting through endless health insurance quotes.

Thats why I recommend using our trusted and independent insurance agents for your health insurance needs. Theyll look at your situation and compare the best rates so you can get the coverage you need. Theyll help you understand the marketplace or even what your employer is offering. And the best thing? Theyre free!

Connect with one of our insurance agents today.

About the author

George Kamel