Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents youâll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Donât Miss: Does Starbucks Provide Health Insurance For Part Time Employees

How To Apply For An Exemption For 2018 And Earlier

Depending on the type of exemption you qualify for, you will need to submit an application to Healthcare.gov or request the exemption from the Internal Revenue Service when you file your taxes. .

- Federal Health Insurance Marketplace : Go to HealthCare.gov to determine which exemption to request. Print out, complete and mail the federal Application for Exemption. The completed form and any supporting documents should be mailed to:Health Insurance Marketplace Exemption Processing465 Industrial Blvd.London, KY 40741

- IRS: Information for claiming an exemption through the IRS when you file your taxes can be found at www.irs.gov.

MNsure uses the federal Health Insurance Marketplace to process exemption applications. The federal government will notify you if you qualify for an exemption. If you apply to HealthCare.gov and qualify, you will receive an exemption certificate number that youll need for your federal income tax return you file for the year of the exemption. For questions about the status of your application or your eligibility for an exemption, visit HealthCare.gov, or call the Health Insurance Marketplace Help Center at 800-318-2596. TTY users should call 855-889-4325. If you have questions about how to get a copy of and where to submit the application form, call the MNsure Contact Center at 855-366-7873 or 651-539-2099.

Read Also: How To Sign Up For Free Health Insurance

What To Do If You Dont Have Health Insurance

If you live in a state that requires you to have health coverage and you dont have coverage , youll be charged a fee when you file your 2019 state taxes. Check with your state or tax preparer. You will NOT get Form 1095-A unless you or someone in your household had Marketplace coverage for all or part of 2019.

Also Check: How To Apply For State Health Insurance

Supplemental Job Displacement Benefit

The Supplemental Job Displacement Benefit is a nontransferable voucher for education-related retraining and/or skill enhancement that is payable to a state-approved or accredited school if the date of injury is on or after 01/01/04 and before 01/01/13. The voucher can be used to pay for tuition, fees books, or other expenses required by the school for retraining or skill enhancement. Up to 10 percent of the voucher may be used to pay for a vocational or return-to-work counselor. In order for the injured worker to qualify for this benefit, the injured employee must have sustained permanent disability, the injured employee must not have been able to return to work within 60 days, and the employer must have failed to timely offer modified or alternative work. There is a maximum voucher amount set by law and the amount varies based upon the extent of permanent disability.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

Will You Be Penalized For Not Having Health Insurance This Tax Season

The U.S. Internal Revenue Service said last week that it would process tax returns even if taxpayers fail to check the box indicating whether they have health insurance coverage. Maintaining health insurance coverage the so-called individual mandate is a key requirement of the controversial health reform law. Beginning this tax season, the IRS had planned to automatically reject returns that omitted taxpayers health insurance status. After considering President Donald Trumps Jan. 20 executive order to ease the financial burden of the mandate, the agency said it decided to reverse course.

This is probably a fairly minor, incremental undercutting of the individual mandate or the insurance market more broadly, said Jason Lacey, a tax and health care attorney in Wichita, Kansas.

Chris Sloan, a senior manager at the consulting firm Avalere Health, offered a similar perspective.

For the market as a whole, I think theres a question of how much impact this is going to have, Sloan said.

The IRS announcement coincided with the release of a Trump administration proposal aimed at keeping health insurers in the ACA insurance exchanges for 2018. The proposed rules would shorten the open-enrollment period and make it harder for people to sign up outside of that enrollment window, among other changes.

But, a day earlier, the health insurance giant Humana Inc. said it would exit from all Affordable Care Act markets in 2018.

You May Like: What Insurance Does Health First Accept

Is There A Penalty For Being Uninsured

No, there is no longer a federal mandate but some states and jurisdictions have enacted their health insurance mandates.

However too often than not, people learn that the personal penalty for not having health insurance is the exorbitant healthcare bills.

For instance, if you get a broken leg from a trip and fall, hospital and doctor bills can quickly reach $7,500 and for more complicated breaks that require surgery, you could owe tens of thousands of dollars.

A three-day stay in the hospital might cost you about $30,000.

If you take a look at more critical illnesses including cancers and strokes, your bill might be running into the hundreds of thousands of dollars. So without a health insurance, you are financially responsible for these bills. Two-thirds of people who file for bankruptcy indicate that medical bills contributed to their financial situation, according to a 2019 study.

So essentially, the Affordable Care Act increased the number of people with insurance and lowered those who couldnt afford to pay their health bills.

Below are the states that have mandates and penalties in effect for persons without a health insurance cover

- California

How Do I Enroll In A Health Insurance Plan During Open Enrollment

You can enroll in a health insurance plan online, over the phone, or in person. To enroll, you will need the following information:

- Name, address, email address, social security number, birthday, and proof of citizenship status

- Household size and income if you want to apply for subsidies

- Coverage details and premium for an employer-sponsored plan thatââ¬â¢s available to anyone in your household

- Payment information for your premiums

- Your doctorsââ¬â¢ names and zip codes so that you can check to make sure theyââ¬â¢re in-network

- A list of medications taken by anyone who will be covered under the policy

- If you want to enroll in a catastrophic plan and are 30 or older, youââ¬â¢ll need a hardship exemption.

Recommended Reading: Is Colonial Health Insurance Good

How Are Health Insurance Rates Calculated

Health insurance rates can vary widely among what initially appears to be an endless amount of insurance companies. And there are many risk factors that are utilized in calculating your rates. But it still boils down to the fact of, the riskier that you appear, the more you will be charged for coverage.Insurance companies utilize a range of data to determine what rates to charge each individual and/or family. And some of those factors include:

- Geographic Location Where you live has a large effect on your premiums. And market competition and local regulations may account for some of it.

- Your Age The older that you are, the more you will most likely pay in premiums. And depending on your age, you could pay 3 times more than someone younger.

- Tobacco Use Insurers may charge tobacco users up to 50% more than those that dont use tobacco.

- Individual or family Enrollment Insurers may charge more for plans that include coverage for a spouse and/or dependents.

- Plan Category

And because of the Affordable Care Act, no additional factors can affect the cost of your health insurance plan, besides any savings that you may receive from subsidies and/or tax credits.

Frequently Asked Workers Compensation Questions

Q: What is a loss reserve?

A: Insurance companies use loss reserves to evaluate the monetary worth of each claim. A loss reserve is an estimated amount of money that the insurance company sets aside, or earmarks, to pay for a claim. It is usually up to a claims adjuster to set the loss reserve, utilizing judgment and experience from prior claims that are similar. Adequate loss reserves help determine how much money an insurance company must have in surplus to meet current, emerging, and future claims obligations. Insurance companies must report workers compensation loss reserves, along with other claim reporting information, to the WCIRB, as this information is used by the WCIRB to calculate experience modifications. Poor loss reserve practices can put an insurance company in financial jeopardy, as both overestimating and underestimating loss reserves can lead to a misallocation of funds required to pay out claims, and creates an inaccurate picture of an insurers financial obligations. When there are not enough funds reserved to meet future obligations, an insurers solvency will be negatively impacted.

Conversely, if too many funds are reserved, the experience modification may become inflated, leading to the need to unfairly raise the insureds premiums. Since maintaining insurer solvency is of high importance, loss reserves must be as accurate as possible and revised regularly based on the most current claims information available.

Q: What is a minimum premium?

Recommended Reading: How Do Small Business Owners Get Health Insurance

Creation Of The Affordable Care Act

The Affordable Care Act was enacted in 2010 under the Obama administration with the main purpose to make healthcare insurance available to everyone regardless of their financial circumstances. The act made healthcare available to nearly 95% of U.S. citizens, increased the availability of healthcare by making insurance mandatory, and assessed financial tax penalties to those without healthcare . Most importantly, it protected individuals with pre-existing conditions by forbidding health insurance companies from discriminating against them in the form of either massive premium hikes or denial of coverage. The Affordable Care Act also worked to aid young adults, one of the least financially stable populations in America, by allowing children to stay under their parents healthcare plan until the age of 26.

Penalty For No Health Insurance 2020 In California

There are lots of reasons to consider investing in health insurance. Health insurance can:

- help pay for expenses from unexpected accidents and injuries

- make regular and long-term care more affordable

- promote well-being as trips to the doctor are often covered

But this year Californians have a new reason to add to that list the upcoming health insurance penalty. 2020 marks a change in Californias laws that could impact you if you dont have health coverage. Know your options to avoid facing a penalty for not having insurance.

- Effective date: January 1, 2019

- Requires individuals and their dependents have ACA-compliant health insurance

- Imposes a penalty on residents who go without health insurance but can afford it

- Provides exemptions to the tax penalty for circumstances such as financial hardship, pregnancy, or eviction

Individuals who go without qualifying health coverage for a full year and dont file for an exemption may owe a tax penalty. The penalty amount is either 2.5% of the gross family household income or $695 per individual and $347.50 per child youll pay whichever amount is greater.

Recommended Reading: What Is Private Health Insurance

Exceptions To The Rule

As with most things in life, there are some exceptions to the no legal obligation rule when it comes to employer-sponsored health insurance. Here are a few examples:

- If your employment contract specifically gave you the right to health insurance, your employer must uphold this promise.

- Union employees, who are guaranteed health care in a collective bargaining agreement, must receive these benefits.

- When all other employees in your employment classification are offered health insurance, you must receive the same offer.

- If health insurance is being offered on a discriminatory basis , you may have a workplace discrimination claim based on protections within Title VII of the Civil Rights Act.

Generally speaking, the ACA holds that if an employer offers health insurance to employees, it must offer coverage to all eligible employees as soon as they become eligible. Employers who choose to go this route are subjected to a 90-day maximum waiting period, after which insurance must be provided to all eligible employees.

How The Penalty Worked

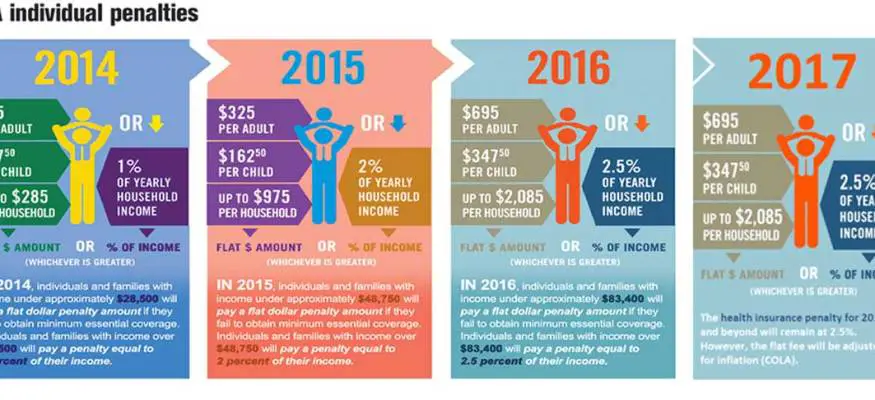

Your individual mandate tax is the greater of either 1) a flat-dollar amount based on the number of uninsured people in your household or 2) a percentage of your income .

This means wealthier households will wind up using the second formula, and may be impacted by the upper cap on the penalty. For example: for 2017, an individual earning less than $37,000 would pay just $695 while an individual earning $200,000 would pay a penalty equal to the national average cost of a bronze plan . This is because 2.5% of his income above the tax filing threshold would work out to about $4,740, which is higher than the national average cost of a bronze plan. The IRS publishes the national average cost of a bronze plan in August each year that amount is used to calculate penalty amounts when returns are filed the following year.

Recommended Reading: How Can You Buy Health Insurance

Individual Mandate Penalty Repeal

Former President Trump campaigned on a promise to repeal the ACA and replace it with something else. Republicans in the House passed the American Health Care Act in 2017 but the legislation failed in the Senate, despite repeated attempts by GOP Senators to pass it.

Ultimately, Republican lawmakers passed the Tax Cuts and Jobs Act and President Trump signed it into law in December 2017. Although the tax bill left the rest of the ACA intact, it repealed the individual mandate penalty, as of 2019 .

Although Congress did not repeal anything other than the mandate penalty , a lawsuit was soon filed by a group of GOP-led states, arguing that without the penalty, the mandate itself was unconstitutional.

They also argued that the mandate was not severable from the rest of the ACA, and so the entire ACA should be declared unconstitutional. A federal judge agreed with them in late 2018.

An appeals court panel agreed in late 2019 that the individual mandate is not constitutional, but sent the case back to the lower court for them to decide which provisions of the ACA should be overturned.

The case ultimately ended up at the Supreme Court, where the justices ruled in favor of the ACA. So although there is still no federal penalty for being uninsured, the rest of the ACA has been upheld by the Supreme Court .

How Much Will I Owe If I Didnt Have Health Insurance

Up through December 31, 2018, lets say you could afford health insurance by chose not to buy it. If thats the case, you may pay a penalty fee on your federal taxes. This might come up in three different scenarios:

Starting with the 2019 plan year, the Shared Responsibility Payment no longer applies. This is important to note when you file your taxes. However, this does not apply to the states that have their own individual health insurance mandate.

Its best to check with your state to find out whether you might be subject to any penalty fees. Another option can be to check with your accountant. California, the District of Columbia, Massachusetts, New Jersey, Rhode Island, and Vermont have their own individual mandates.

Also Check: Does Amazon Have Health Insurance

What Is The Penalty For No Health Insurance

Question: What is the penalty for not having any health insurance?

Answer: In 2016, the penalty is $695 per adult and $347 per child up to a family cap of $2,500 or 2.5% of household income, whichever is greater. In 2015, it was $325 for adults, with a $975 maximum or 2% of household income. Kaiser Family Foundation predicts that in 2016, average penalties will increase, on average, from $1,177 to $1,450 per household. According to Peter Lee of Covered California, The bigger penalty could be showing up in the emergency room and walking out with a bill in the tens of thousands of dollars,.

Categories:

Read Also: Can I Go To The Er Without Health Insurance

Exemptions From Health Insurance Requirement

There are a number of exemption provisions under which you may avoid the requirement to have health insurance. These provisions include:

- Unaffordable careif minimum coverage would cost more than 8 percent of your household income, you may qualify for an exemption.

- No tax filing requirementhaving an income below the Internal Revenue Services filing threshold exempts you from the coverage requirement.

- Hardshipif you experience a hardship that prevents you from getting coverage, the Health Insurance Marketplace may certify your exemption. Situations include those whose pre-existing health coverage was canceled due to the ACA.

- Short coverage gapsif your coverage lapses for less than three consecutive months, you will not be charged a fee for the uninsured time.

- Membership in an exempt groupNative American tribes, prisoners, undocumented immigrants, members of health care sharing ministries and those whose religious beliefs prevent them from having insurance are exempt from the requirement to be insured.

Not sure if you are exempt from the tax penalty or from the requirement to purchase health insurance? See Are You Exempt From Health Care Coverage? to help determine whether you might be eligible to waive the tax penalty entirely and apply for a health care exemption.

Also Check: What Is The Cheapest Health Insurance Plan