Can I Buy Short

Yes, you can buy short-term health insurance in Kentucky with plan durations up to 12 months, and the ability to reapply for your policy for up to three years .1

Before you purchase a short-term plan, its important to understand what makes this type of temporary health insurance different from Affordable Care Act plans.

- Policies can be sold year-round with no designated enrollment period.

- The ACAs 10 essential coverage benefits are not required.

- People with pre-existing conditions can be denied coverage.

Each state is responsible for setting its own regulations for short-term health insurance, so limitations can change.2

Kentucky Health Insurance Companies

- Ambetter from WellCare of Kentucky

- Anthem Blue Cross Blue Shield

- CareSource Kentucky Co.

- Molina Healthcare

Ambetter plans are being offered through WellCare of Kentucky for the first time in 2022. Their plans will be available in 63 counties, including Boone and Jefferson Counties.

Anthem Blue Cross Blue Shield offers the most affordable rates for Expanded Bronze plans, while Ambetter offers the cheapest rates for Gold, Silver and Bronze plans.

You Have More Insurance Options For Your Health Than You Think Kentucky

If youre self-employed or without insurance from your employer in other words, youre looking for individual or family health insurance in Kentucky you might be looking for Affordable Care Act insurance, what’s often called Obamacare. However, we want to make you aware of the whole range of individual and family insurance products we have available in your state.

Don’t Miss: Does My Health Insurance Cover Eye Exam

Health Care Market Competitive Dynamics

Most states have laws requiring new health care facilities to be approved by special boards. These boards are known as certificate of need boards. The purpose of these boards is to certify there is need for new facilities. CON boards have the effect of reducing the level of competition, which results in higher prices for the services provided.

To better quantify the effect of legislation that minimizes competition, ValChoice has calculated the difference in health care cost between states with and without CON boards. Using a simple average calculation, states with CON requirements have an average cost for health care that is $664 more per person insured than states without CON requirements.

States included in the calculations as having CON requirements include the following: Alabama, Alaska, Arkansas, Connecticut, Delaware, District of Columbia, Florida, Georgia, Hawaii, Illinois, Iowa, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire*, New Jersey, New York, North Carolina, Oklahoma, Ohio, Oregon, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, Washington, West Virginia and Wisconsin*. Other states do not have CON board certification requirements.

*New Hampshire and Wisconsin are included as having CON requirements for the reason the recent modifications in CON laws have not yet had a material impact on the cost of health care in the state.

Kentucky Health Insurance Cost Per Person

Average cost calculations for comprehensive group and individual insurance is based on data reported to the state department of insurance. Group insurance is based on 388,939 enrollees and individual insurance is based on 172,757 enrollees. Supplementary vision and dental insurance contracts sold as riders to comprehensive insurance are not included. Medicaid costs are based on data from Macpac.gov divided by the number of people covered based on Kaiser Family Foundation data. Medicaid data includes both state and federal spending. Medicare costs are based on data from CMS.gov divided by the number of people covered based on Kaiser Family Foundation data. CMS data are from 2014, adjusted for health insurance cost inflation rates.

Recommended Reading: How Much Is Catastrophic Health Insurance

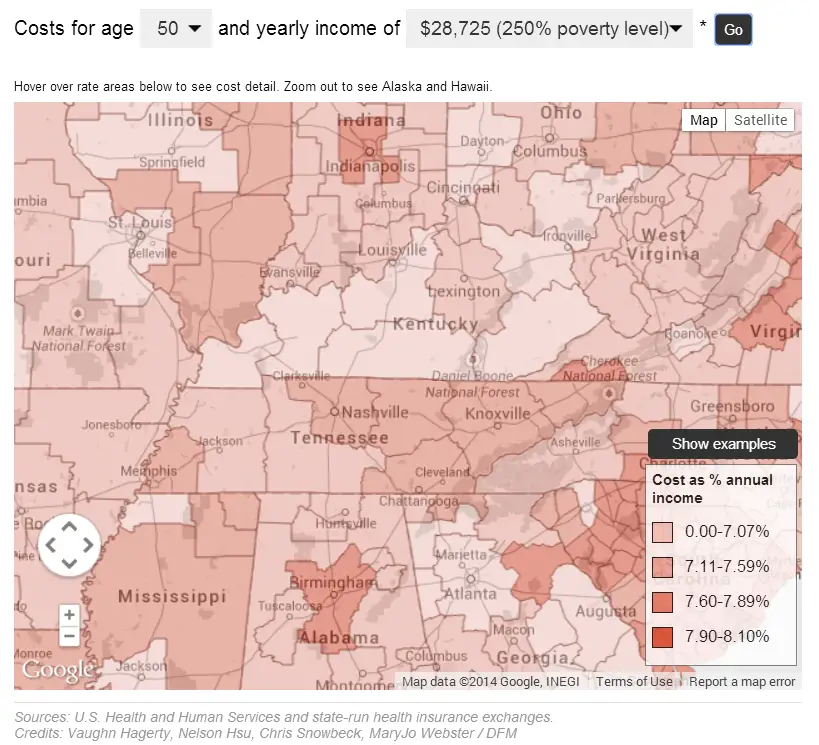

Regional Differences In Healthcare Affordability Burdens

The survey also explored five regions in Kentucky and revealed differences in how Kentuckians experience healthcare affordability burdens.The eastern Kentucky region reported the greatest number of healthcare affordability burdens with the Louisville metro area showing fewest affordability burdens .

Perhaps reflecting these high rates of healthcare affordability burdens, residents of eastern Kentucky also report starkly higher levels of worry:

- Worry about affording prescription drugs spiked at 71% for eastern Kentucky, compared to 55% for remaining regions.

- Worry about affording the costs of serious illness or accident spiked at 78% for eastern Kentucky, compared to 66% for remaining regions.

- Overall worry about healthcare affordability burdens was highest in eastern Kentucky , compared to the northern , Louisville , Lexington and western regions.

Additional detail and regional reports are available at www.HealthcareValueHub.org/KY-2018-Healthcare-Poll.

If You Are In Between Jobs

If youre starting a new job and need coverage until your new health insurance plan goes into effect, consider these options:

COBRA

The Consolidated Omnibus Budget Reconciliation Act allows you to retain your insurance coverage for up to 18 months when you lose or quit your job. You typically have to pay the entire premium which can be quite expensive but it can bridge the gap until your new employers insurance policy is active. When you leave your job, your previous employer will send you information about how to elect COBRA coverage.28

Read Also: How To Cancel My Health Insurance

Health Insurance Rate Changes In Kentucky

In Kentucky, health insurance providers are required by law to get any premium, deductible or out-of-pocket maximum changes approved by federal regulators.

In 2022, Gold plans had the biggest drop in average price â with premiums decreasing by 10% compared to 2021.

| Metal tier |

|---|

Premiums are for a 40-year-old adult.

Apply For A Kentucky Short

HealthMarkets can help you find short-term health insurance plans in Kentucky online. If you apply today, you could have health coverage as soon as the next day. Get started by finding a short-term plan that meets your needs.

47191-HM-0321

1.KY.gov Retrieved from https://insurance.ky.gov/ppc/Documents/stld_faqbuyersguidefinal.pdf Accessed February 24, 2021. | 2.CBO. September 2020. Retrieved from https://www.cbo.gov/publication/56622

Disclaimer:*Average based on premiums for all 2021 short-term health plans sold by HealthMarkets for a 40-year-old non-smoking male making $30,000 per year living in Louisville, KY.

Don’t Miss: Does Cigna Health Insurance Cover Therapy

How Do I Enroll In Kentuckys Health Insurance Marketplace

Because Kentucky doesnt have its own exchange, you can visit HealthCare.gov to enroll through the federal Health Insurance Marketplace. You need to create an account before you can browse available health plans, which is a simple and straightforward process. Provide your name and contact information, select a password and then choose your security questions. Make sure to remember your password and security information.

Youll need to provide the following information for everyone youre including on your policy:

- Each household members Social Security number

- How many people are claimed as dependents on your federal income taxes

Wellhop For Mom & Baby

Connect with other expectant moms. Get support and information during your pregnancy and after you deliver. This program is part of your health plan and there is no extra cost to you.Heres how it works:

- Join video conversations every other week with women who have similar due dates and a group leader.

- Chat and share experiences with moms from your group on the Wellhop app or website.

- Visit the Wellhop library. Youll find articles, videos and more.

Kentucky Medicaid

Have you received information asking you to take action so that you can keep getting benefits?Your Medicaid coverage needs to be renewed every 12 months. Dont let your health care coverage end. Its too important.

You can renew by going online to kynect, contacting a local kynector or through Department for Community Based Services .

-

PDF 1.08MB Last Updated: 10/13/2021

Summer

-

PDF 1.58MB Last Updated: 07/06/2021

Spring

-

PDF 1.23MB Last Updated: 03/18/2021

Winter

UnitedHealthcare Community Plan has practice guidelines that help providers make healthcare decisions. These guidelines come from nationally recognized sources. UnitedHealthcare Community Plan has practice guidelines for conditions including:

View our Clinical Practice Guidelines or call our Member Services at to request a printed copy.

Also Check: Can Substitute Teachers Get Health Insurance

The Cheapest Health Insurance In Kentucky By Age And Metal Tier

Age is one of the factors affecting the cost of health insurance in Kentucky. A Silver plan for a 26-year-old costs an average of $414 per month, while a similar policy typically costs roughly $1,098 monthly for a 60-year-old.

Health Insurance Costs in Kentucky by Age and Metal Tier

Your health insurance premium increases as you age, so it can be tempting to choose a plan with low deductibles, such as an Expanded Bronze plan, while youre young. However, you will end up paying more out of pocket if your medical expenses suddenly increase due to illness or a medical emergency even though your monthly cost is low.

All rates are averages based on sample ages only and do not consider income. Older people can get cheaper health insurance in the Kentucky Marketplace because of tax premiums and other regulations. However, you can only find out the exact calculation when you apply for a plan.

The table below shows the comparison of costs between metal tiers and the buyers age. Learn more about how to choose the best metal tier for you through MoneyGeeks guide on health insurance in Kentucky.

Cheapest Health Insurance in Kentucky by Age And Metal Tier

Sort by Metal Tier:

Medicaid/chip Dental Coverage In Kentucky

Adults and children enrolled in Medicaid in Kentucky are eligible to receive limited dental services such as exams, x-rays, emergency visits, extractions and fillings.

KCHIP, which is Kentuckys CHIP, provides dental coverage to children up to age 19 living with families who have income above the eligibility limits for Medicaid.

Also Check: Who Accepts Bright Health Insurance

Kentucky Uninsured Medical Care Programs And Free Health Insurance Plans

If you do not have health insurance then Kentucky has several options available for you, including free health insurance plans. Several government programs, non-profits, and other resources offer low income and uninsured patients with free or low cost medical care, medications, and other support.

The exact type and amount of health care provided in the state will vary based on many factors, including the families income, number of household members and their current medical condition. Some assistance may be provided to those residents in Kentucky who have so called limited health insurance as well. There may also be free dental or health insurance policies for the very low income or children. If your current plan doesnt pay for a certain bill or service, then the state may be able to assist.

Pediatric Dental Benefits In Kentucky

The exchange-certified pediatric dental plans available in Kentucky will comply with the ACAs pediatric dental coverage rules. This means out-of-pocket costs for pediatric dental care will not exceed $375 per child in 2022 , and there is no cap on medically-necessary pediatric dental benefits

Pediatric dental coverage is not automatically included with the medical plans from insurers who offer coverage through Kentuckys health insurance marketplace.

As is the case for all essential health benefits, the specific coverage requirements for pediatric dental care are guided by the states essential health benefits benchmark plan.

You can see details here for Kentuckys benchmark plan, which does include coverage for both basic and major dental services for children.

Recommended Reading: Does Health Insurance Cover Everything

Affordable Health Insurance Plans In Kentucky

Home » Health » 2023 Affordable Health Insurance Plans in Kentucky

Kentucky offers two health insurance carriers on its exchange CareSource and Anthem. Their plans are competitive, although premiums have increased slightly over the past years. The state makes it easy for everyone to find affordable coverage, with various coverage tiers, catastrophic, and short-term plans available for purchase to its residents.

Medicare and Medicaid are available options through the federal government if their qualifications are met. The states Medicaid program is administered through Kynect. Kentucky offers the Kentucky Dental Health Program to promote healthy teeth in children, complete with a fluoride program.

Frequency Of Using Medical Services Other Than A Doctor Or Hospital

Non-doctor health care visits is a measure of how often people receive medical care without seeing a doctor. This type of care excludes patients that have been admitted to hospitals or other institutions. Examples of non-physician health care includes appointments or walk-in clinics to see a nurse, physical therapist, counselor for mental health appointments or other non-physician medical personnel.

Residents insured with all types of insurance received this type of medical care with a frequency higher than the national average.

Non-physician care tends to be an expensive form of treatment. The reason non-physician visits are expensive is that many times these are visits to outpatient facilities. Many outpatient facilities are owned and operated by hospitals. While hospital owned and operated medical facilities are less expensive than a hospital, oftentimes they are more expensive than a doctor visit.

You May Like: Where Can I Buy Health Insurance

Health Insurance Coverage For Multiple Years

TriTerm Medical Insurance,2 underwritten by Golden Rule Insurance Company, is short term health insurance that offers coverage for preventive care, doctor office visits, and prescriptions.

- Apply once for insurance coverage terms that equal one day less than 3 years.

- $2 million lifetime maximum benefit per covered person on most plans.

- Eligible expenses for preexisting conditions are covered after 12 months on the plan.

How Much Does Dental Insurance Cost In Kentucky

For adults who purchase their own stand-alone or family dental coverage through the exchange, premiums range from $22 to $115 per month.

IHC Specialty Benefits reports that the average monthly premium for a stand-alone family dental plan sold in Kentucky over a two-year period was $47.39.

If a family is purchasing coverage through the health insurance exchange, the premiums associated with pediatric dental coverage may or may not be offset by premium tax credits . Heres more about how that works, depending on whether the health plan has integrated pediatric dental benefits.

Don’t Miss: How Much Is Health Insurance For A Child

Kentucky Health Insurance Costs Overview

As 2023 data is not yet available, we have used statistics from 2022 to reflect costs so you can have an idea of what to expect. Current data shows that 2023 premiums will rise by 4 percent for a 27-year-old for a silver benchmark marketplace plan sold through HealthCare.gov.

Kentucky has three tiers of health insurance coverage Gold, Silver, and Expanded Bronze.

What To Know About Health Insurance In Kentucky

MoneyGeeks analysis includes sample rates based on private plan data from Kentuckys insurance marketplace. As a result, you may find more affordable prices when you apply for a plan. In addition, the government has programs like Medicaid and Medicare that are typically cheaper than plans found in the marketplace for lower-income and older residents.

Don’t Miss: Does State Farm Provide Health Insurance

The Cheapest Health Insurance In Kentucky By Metal Tier

The metal tier system for health insurance has a significant impact in determining the cost of your coverage. If you choose a plan with lower insurance premiums, you will pay higher deductibles and out-of-pocket maximums. However, it also covers less if you need to get medical care. This means that to get lower out-of-pocket expenses, youll most likely have to pay higher monthly premiums.

Four metal tiers are available in Kentucky, including Catastrophic, Expanded Bronze, Silver and Gold. The average rates for each tier are:

- Catastrophic: $303 per month

- Expanded Bronze: $392 per month

- Silver: $517 per month

- Gold: $620 per month

Individuals who have high medical costs may find a Gold Plan cheaper as it results in less out-of-pocket expenses. However, for a relatively healthy person who seldom goes to the doctor, an Expanded Bronze plan may be the most affordable.

The table below lists the cheapest plan by the monthly premium for every metal tier. In the Kentucky marketplace, premiums, deductibles and out-of-pocket maxes may vary significantly within a metal tier.

Kentucky residents with low incomes may qualify for cost-sharing reductions , lowering the cost of deductibles for Silver plans. Because of this, you can get access to more coverage.

The rates in the table are based on available plans for a sample 40-year-old male. The most common plan type in Kentucky is HMO.

Cheapest Health Insurance in Kentucky by Metal Tier

Scroll for more

Finding Your Best Health Insurance Coverage In Kentucky

The best health insurance policy for you is one that fits your medical needs and financial situation. Typically, policies in the higher metal tiers, like Silver and Gold, have costlier monthly premiums, but they also provide lower out-of-pocket expenses, like deductibles, copays and coinsurance.

These plans are best if you think you may become sick or already have high recurring medical costs that arise from chronic conditions. On the other hand, those who are young and healthy or don’t expect to have many medical costs may wish to choose a plan in a lower metal tier, such as Bronze or Expanded Bronze, to save money.

If your household income is below 138% of the federal poverty level, you can enroll in Medicaid to receive federally funded coverage.

Gold plans: best for high expected medical costs

Gold plans are the highest metal tier available in Kentucky and typically cover the greatest share of out-of-pocket costs, which means you’ll pay lower deductibles, copays and coinsurance. These benefits come at the expense of a higher monthly premium.

The average cost of a Gold plan for a 40-year-old in Kentucky is 15% greater than the average cost of a Silver health plan. Generally, Gold health insurance policies are the best in terms of cost-effectiveness if you expect to incur high medical expenses, such as from chronic conditions, or you have costly prescriptions. You can expect these plans to cover about 80% of your medical costs, while you pay for the remaining 20%.

Don’t Miss: How Much Is Low Cost Health Insurance