How Much Does A Dental Insurance Cost

As they say, you can captivate the world when you flash that perfect smile with those pearly white teeth. But beyond the aesthetics, having clean and healthy teeth is an important part of our oral health which affects our overall well-being.

Having good oral health improves our senses, confidence in ourselves, and how we relate to other people. That is why it is important to take care of our mouth and teeth. We do this by brushing and flossing our teeth regularly. But aside from this, we also need to consult our dentist on a regular basis.

Not everyone gets to see a professional for preventive dental interventions and treatments. The common reason is that they cannot afford the rising cost of dental services. Because of this, experts are saying that it would be wise to invest in a dental insurance. But then again, how much does dental insurance cost? Is it worth it? Or will it be a contributing factor for dental services to continue to be inaccessible to other people?

What Are The Specific Costs Involved

There are a number of costs associated with individual health insurance that you may have to pay, depending on the type of policy you have.

- A premium is the amount you pay your insurance carrier each month.18

- A deductible is the amount of money you must pay out of your pocket before your insurance begins to pay a benefit.19

- A copayment is a flat dollar amount you may have to pay for certain services

- Coinsurance is a percentage of covered health services that you are responsible for paying for once youve met your deductible.20

- An out-of-pocket maximum is the total amount of money you may have to pay for healthcare services in a particular plan year. 21

In some cases, a person may have to pay each of these costs. For example, a consumer may have a healthcare plan with a $1,000 deductible that costs $300 in monthly premiums. After hes met his deductible, he may have to pay $50 for a doctors office visit and 30% of the cost for any laboratory services. The good news is this consumer knows his total out-of-pocket costs will be capped by his out-of-pocket maximum in case he becomes seriously ill or injured.

How Much Youll Pay

Many variables affect how much youll pay for health care coverage, some of which are under your control.

Canadian Costs Versus The World

So where does this leave our average family of four? In their 2015 report, the Canadian Institute of Health Information noted that Canadians were among the highest health care spenders in the world. They estimated the average spend at $5,782 per person.

That put the personal spending above the average but nowhere near the biggest spenders. As it has for years, the average American spent twice as much as $11,916. An average family in Sweden spent slightly more at $6,601 and the same family in the UK spent $5,170.

Don’t Miss: How To Cancel Cobra Health Insurance

How Much Is Health Insurance For Retirees In Canada

For many baby boomers in Canada, health care is a major concern. As we age, many of us have to cope with a wide range of health issues, from poor eyesight to heart disease and everything in-between.

Fortunately, each province and territory has its own health plan, which provides many health care services for free. The problem is, however, that not everything is covered.

How much can we expect to have to pay for health care costs in retirement? How much does health insurance cost for retirees? And is it worth it? Well cover some of these topics through this blog so that you have all the information you need.

Key Question #: Where Can I Receive Care

One way that health insurance plans control their costs is to influence access to providers. Providers include physicians, hospitals, laboratories, pharmacies, and other entities. Many insurance companies contract with a specified network of providers that has agreed to supply services to plan enrollees at more favorable pricing.

If a provider is not in a plans network, the insurance company may not pay for the service provided or may pay a smaller portion than it would for in-network care. This means the enrollee who goes outside of the network for care may be required to pay a much higher share of the cost. This is an important concept to understand, especially if you are not originally from the local Stanford area.

If you have a plan through a parent, for example, and that plans network is in your hometown, you may not be able to get the care you need in the Stanford area, or you may incur much higher costs to get that care.

Dont Miss: What Is The Health Insurance For Low Income

Read Also: What’s Open Enrollment For Health Insurance

What Is Individual Health Insurance

While many people get their health insurance through a group plan sponsored by their employer or union, others buy it themselves. If you are buying your own health insurance, you are purchasing an individual plan, even if you include family members on the plan. If this sounds like what you need, let eHealth show you all of your individual and family health insurance options, and use our free quote comparison tool to find an affordable plan that meets your needs.

Asa result of the Affordable Care Act , people can purchase individualhealth insurance through a government exchange or marketplace , or they can buy health insurance from privateinsurers. You may be restricted to purchasing health insurance through agovernment exchange to certain times of the year. Usually you can purchasehealth coverage from a private insurance company anytime.

ACAplans are a good starting place to understanding individual health insuranceoptions. ACA health plans are categorized by metals. You can learn more aboutthe metallic plans: Bronze, Silver, Gold, and Platinum.

How To Get The Best Health Insurance

If youre looking to purchase health insurance on your own, you can just go to the websites of major health insurance companies in your area and see what plans they provide. You can compare plans on your own, although quotes will vary pretty widely.

But lets face it. This is a ton of work. Choosing the right health insurance plan for you or your family is a daunting task. And you probably have better things to do with your time than sifting through endless health insurance quotes.

Thats why I recommend using our trusted and independent insurance agents for your health insurance needs. Theyll look at your situation and compare the best rates so you can get the coverage you need. Theyll help you understand the marketplace or even what your employer is offering. And the best thing? Theyre free!

Connect with one of our insurance agents today.

About the author

George Kamel

George Kamel is a personal finance expert and host of The Fine Print Podcast. Since 2013, George has served at Ramsey Solutions where he teaches on how to spend less money, save more, and avoid consumer traps. He is also the host of The EntreLeadership Podcast.

You May Like: What To Do If You Lose Your Health Insurance Card

How Much Do Individual Private Health Care Treatments Cost

Weve listed some of the average costs for private care treatments in the UK if you do not have health insurance, according to Privatehealth.co.uk.

| Private health care treatment | |

| Coronary angiogram | £2,066 |

You can access private health care treatment without insurance by paying for individual procedures or operations.

However, the cost of private care can be high. Privatehealth.co.uk found the highest price of a private knee replacement in the UK is £15,410 and the highest price of a CT scan is £960.

Why Supplemental Insurance Is Important

Although we have detailed the different types of plans available to all sectors of the Canadian society, you might be wondering why having a supplemental health insurance policy is so important. This is especially true if you are relatively young and are still under the impression that nothing bad will ever happen to you. After all, you might think, you can go to a doctor if you get sick, he will figure out what is wrong with you, and you will recover. However, this is not always the case. For one thing, there are no guarantees in life just because you are healthy today does not mean you will always be so. For another, the cost of medical services and prescription drugs continues to rise at a rapid rate, and if you are diagnosed with a serious illness, it is likely that you will become bankrupt in a short amount of time. If you make your health a priority, not only will you be sure you have access to whatever services you might need, but you can rest well knowing they will be covered by your insurance plan.

You May Like: Where Do You Go If You Have No Health Insurance

Also Check: How To Get Health Insurance For My Family

How Do Premiums Deductibles Cost

Generally,the more benefits your plan pays, the more you pay in premium. But your medicalexpenses for care are lower.

Toillustrate how these costs may influence your choice of plans, consider the ACAplans.

Inaddition to the metallic plan categories, some people are eligible to purchasea plan with catastrophic coverage. Catastrophic plans have very low premiums andvery high annual deductibles . However, they pay for preventivecare regardless of the deductible. These plans may be a suitable insuranceoption for young, healthy people. To qualify for a Catastrophic plan, you mustbe under age 30 or be of any age with a hardship exemption or affordabilityexemption . Learnmore about Catastrophic coverage.

What Are Hsa Hra And Fsa Accounts

During open enrollment, you may be able to choose plans that offer tools to help you save money to pay for eligible health care expenses. Lets break down the basics of these common health accounts.

A health savings account is a place to put money away pretax in order to save for standard medical expenses to self-care treatments to first aid items and medical equipment. An HSA is owned by the employee and remains with them even after leaving a company.

Also Check: Where Can I Purchase Affordable Health Insurance

Basic Health Insurance Terms

If youre just learning the ins and outs of health insurance, I feel your pain. Health insurance is complicated stufflike rocket-science complicated. You might not even know where to start.

Before we look at how much health insurance costs, lets break down some terms into plain English.

First, there are only two main kinds of health insuranceprivate and public.

Private coverage is health insurance through your employer, union or even the armed forces. You can also get it on your own through the governments marketplaceHealthcare.gov.

Public insurance is provided by the government. It includes Medicare , Medicaid or care from the Department of Veterans Affairs.

Your premium is the amount you pay monthly for your coverage.

The deductible is the amount you have to fork over before your insurance company starts chipping in.

Your maximum out-of-pocket costs are the limit to what you will pay in a year. For example, if your plans maximum out-of-pocket costs are $8,000, once you pay that amount, your insurance company will cover everything above that through the rest of the year. It acts as a financial safety net so you dont totally break the bank from medical costs.

How Can You Save Money On Health Insurance Costs

If the cost of health insurance seems too steep for you, there are ways you can minimize the costs.

Under Obamacare, you may qualify for a subsidy, or premium tax credit that lowers the amount of money you must pay each month if your income falls below a certain level.22 If you are eligible for a subsidy, the amount you qualify for is based on how your income compares to the federal poverty level.

You can also purchase supplemental health insurance, which can cover some of your out-of-pocket costs such as deductibles and coinsurance.23

If you are self-employed and have a high deductible health plan , you can open a health savings account or a medical savings account 24 that lets you save pre-tax dollars to pay for qualified medical expenses.25

Factor in ALL Costs Before Deciding

When choosing a plan, factor in ALL costsnot just your monthly premiums, but also your out-of-pocket costs both before and after you meet your deductible.

Recommended Reading: Is Dental Insurance Included In Health Insurance

What Is Private Health Insurance

Put simply, private health insurance or private medical insurance is a policy that covers the cost of private medical care should you become unwell. It works alongside the NHS, and often gives you access to shorter wait times, a choice of location or treatments only offered privately.

You pay a monthly sum to the insurer, then it pays for certain private treatment you may need during the policy, such as consultations or surgery.

What The Average American Spends A Year

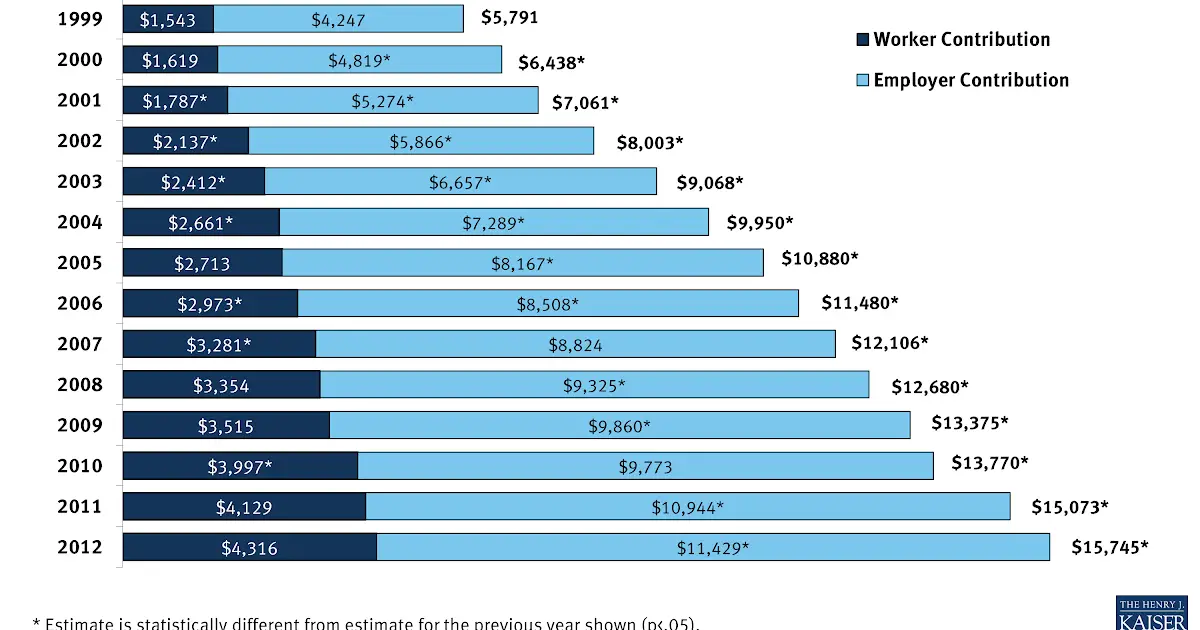

According to the most recent data available from the Centers for Medicare and Medicaid Services , “the average American spent $9,596 on healthcare” in 2012, which was “up significantly from $7,700 in 2007.”

It was also more than twice the per capita average of other developed nations, but still, in 2015, experts predicted continued sharp increases: “Health care spending per person is expected to surpass $10,000 in 2016 and then march steadily higher to $14,944 in 2023.”

Indeed, average annual costs per person hit $10,345 in 2016. In 1960, the average cost per person was only $146 and, adjusting for inflation, that means costs are nine times higher now than they were then.

Also Check: Can You Buy One Month Of Health Insurance

What Is The Maximum Income For Marketplace Insurance

So, there is technically no cap on how much you can earn to qualify for help paying your insurance premium. Its only a percentage of your income. It also increased the amount of subsidies you can receive. Prior to 2021, you were expected to spend from 2% to 9.83% of your household income toward health insurance.

Change In Average Health Insurance Cost For 2021

From 2020 to 2021 health insurance rates decreased across the nation by over 2%. Additionally, year over year, Indiana saw the largest jump in health insurance costs across all metal tiers increasing nearly 10%. Including Indiana, 21 states had their rates increase on average from 2020 to 2021.

Both Pennsylvania and New Jersey switched their health insurance exchanges from being government-based to state-based. Interestingly, New Jersey had an increase in rates of close to 9% due to the change, while Pennsylvania’s rates went down decreasing by 8%.

On the other hand, rates in Iowa and Maryland decreased the most year over year, falling 20% and 17%, respectively. Overall, 27 states experienced a decrease in health insurance premiums.

| State |

|---|

Policy premiums are for a 40-year-old applicant.

You May Like: Do You Need Health Insurance To Go To Planned Parenthood

How Much Does It Cost For Health Insurance In Canada

Despite the rumors, health insurance in Canada isn’t really free. The actual cost of health care in Canada is thousands of dollars and can reach tens of thousands of dollars.

Universal health coverage covers everyone who is a citizen or deemed a permanent resident. It doesn’t cover everything they need.

In fact, it isn’t even really universal. There is no one plan. There are actually 15 different provincial and territory plans that makeup “health insurance, Canada.”

How Much Does Blue Cross Health Insurance Cost

How much is health insurance a month for a single person? For a single adult, without dependents, living in NSW, you can expect to pay between $110.50 and $142.30 a month for a Basic combined Hospital and Extras policy .

People ask , is Blue cross a fee for service health insurance? Under fee-for-service, you choose the doctor or the hospital or the clinic, and the insurance pays for part or all of the cost according to a schedule laid out in the policy. The Bluesblue Cross and Blue Shield are the best-known providers of this kind of healthinsurance, although not the only ones.

Also, how much will my health insurance cost? In 2020, the average national cost for healthinsurance is $456 for an individual and $1,152 for a family per month. However, costs vary among the wide selection of health plans.24 nov. 2020

, how much is health insurance a month for a single person in Canada? How much does health insurance cost in Canada? On average, healthcare premiums for a family in Canada are around C$157 per month . For an individual male its C$47 per month, and for an individual female its C$80 per month.25 mai 2021

, how do I find affordable health insurance? Visit HealthCare.gov to apply for benefits through the ACA Health Insurance Marketplace or youll be directed to your states healthinsurance marketplace website. Marketplaces, prices, subsidies, programs, and plans vary by state. Contact the Marketplace Call Center.11 mai 2021

Contents

Recommended Reading: What Is Temporary Health Insurance

Individual Versus Family Plans

An individual plan has one member, or just one person covered by the plan. Family plans cover two or more members.

Your plan’s deductible and out-of-pocket maximum are based on whether you have an individual or family plan.

The deductible and out-of-pocket maximum for a family plan is usually double of an individual plan. So if the deductible for a plan is $2,000 for a family, it’s $1,000 for an individual. If the out-of-pocket maximum for an individual plan is $6,000, it will be $12,000 for a family, no matter how many people the plan covers.