What If I Forgot To Pay My Health Insurance Premiums

You should pay your health insurance premium before your policy expires, so that there is a continuity of the coverages provided by your health insurance policy. However, if you are unable to pay your health insurance premium before policy expiry, then you can use the grace period given by your insurer to renew your medical insurance policy. But, if you do not renew your policy in the grace period as well, then your health insurance policy will lapse and you will not be covered for any medical emergency.

What Is The Difference Between Medical Aid And Medical Insurance

These days, medical aid seems to be a luxury that is only affordable to the rich. Since medical insurance entered the scene, the number one question asked by the public is, what is the difference between medical aid and medical insurance?

Well, this article is here to explain that as simply as possible.

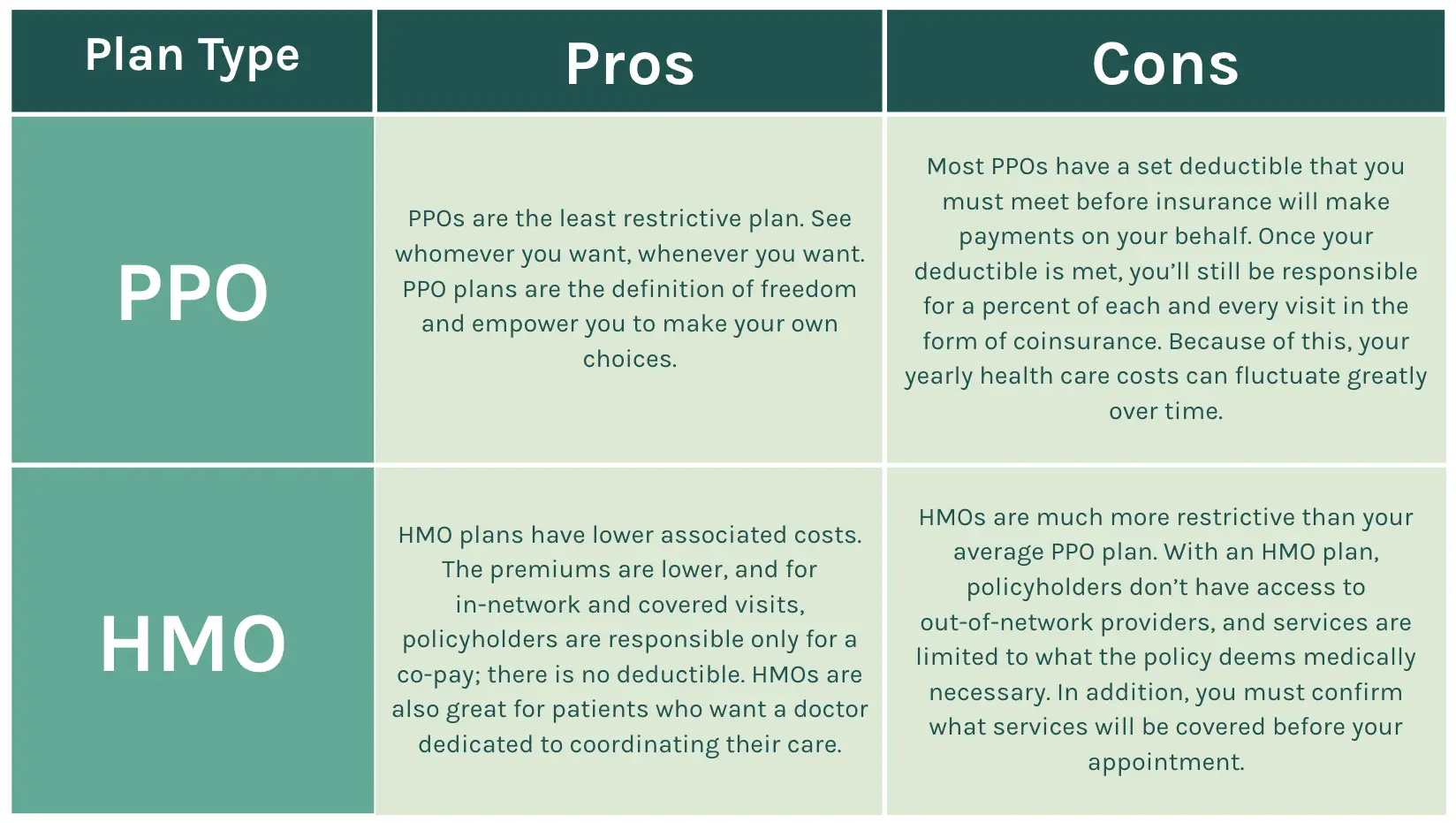

When searching for an affordable medical aid, one plan might seem better than the other in some aspects, and then lack in the other. For example, one plan might cover doctors visits and every day procedures, but doesnt cover hospital bills. Other plans may fully cover in hospital procedures, but then you have to pay out of pocket for essential meds and doctor visits.

Most people want the cheapest medical aid rates, with most extensive cover. However, medical aid plans that cover the client fully are usually very costly. Then, there is the issue of gap cover, which is there for the parts that all medical aids dont see to.

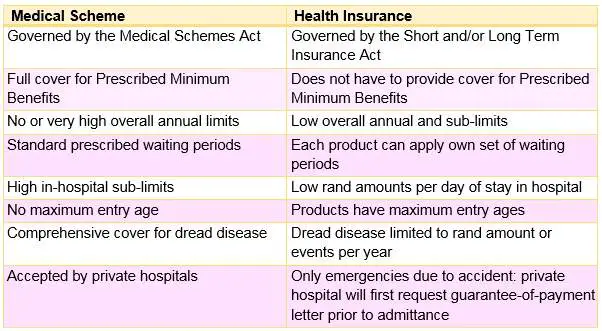

Medical aid, which is regulated by the Medical Schemes Act is essentially:

Also, then what is medical insurance, and how does it differ?

Medical insurance focuses more on major life events. It may not cover pre-existing conditions, but is helpful in case of accidental injuries, paralysis or illnesses that may occur after you have taken out the insurance.

With medical insurance you are covered for a certain amount, and everything more than that you will need to pay for.

Medical Insurance is regulated by the long-term Insurance Act. It:

How Much Should A Health Insurance Plan Cost

Thanks to the Affordable Care Act, there are only five factors that go into setting your premium:

-

Your age

-

Whether or not you use tobacco

-

Individual v.s. a family plan

-

Your plan category

Health insurance companies are not allowed to take your gender or your current or past health history into account when setting your premium.

Health insurance premiums on the Affordable Care Act’s marketplaces haveincreased steadily due to many different circumstances, including political uncertainty as well as the cost of doing business. Additionally, while average premiums for the benchmarksecond-lowest-cost Silver plan have fallen slightly since 2018, costs vary widely by state and insurance market.

Over 9 million people â or 84% â who got health care through marketplaces received tax credit subsidies in 2020, further reducing the actual cost of health insurance.

When it comes to figuring the cost of health insurance, however, you need to look at more than just the monthly premium. As we mentioned in the sections above, health insurance is only one part of your total spending on health care services. In fact, if you frequently visit a doctor and you buy a plan with a high deductible and low monthly premium, it’s likely that you’ll spend more money overall than if you bought a plan with higher premiums, a lower deductible, and lower copayments and coinsurance payments.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

What Is The Need For Health Insurance

An effective medical insurance policy is essential because the prices of medicines and hospital treatments are rising day by day. If an accident or critical illness befalls you, it will cause a huge financial burden on you and your family. A hard-hitting truth is that whether your trip to hospital is planned or it comes as an unpleasant surprise, it is sure to cost you heavily. So, its better to have a protection of health insurance plans, that besides helping you manage your finances, also offer you a several other benefits at very affordable premium rates. You can also check out various health insurance quotes online to figure out which one is most suited to your budget.

Here are 5 reasons that will make you understand the importance of having the best health insurance plan:

With so many health insurance plans in India offered by health insurance companies in India to choose from, you can certainly choose the best health insurance plan from among them.

Indemnity Based Health Insurance Plans In India

The indemnity based health insurance plans give you the reimbursement for the expenses incurred by you for hospitalization or cashless claim settlement up to the Sum Insured opted by you. These plans are also known as traditional health insurance plans. These health insurance plans cover you for the expenses related to doctors fees, hospital room rent, OT charges, medicines and more.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

Travel Insurance With Emergency Medical Benefits Covers Just That Emergencies

Emergency medical and dental benefits, included in many travel insurance plans, can cover losses due to covered medical and dental emergencies that occur during your trip up to the maximum amounts outlined in your policy. A covered medical emergency means a sudden, unexpected illness, injury or medical condition that could cause serious harm if it not treated. For emergency dental benefits, a covered emergency refers to an injury or infection, a lost filling or a broken tooth during your trip that requires treatment.

Put simply, emergency medical and dental benefits exist to protect you when you experience a serious covered medical crisis requiring medically necessary treatment not a minor health issue. These benefits do not cover things such as routine preventative care, normal childbirth, elective cosmetic surgery, palliative care, experimental treatments or allergy treatments . Additionally, such treatment must be performed by an authorized provider, such as a doctor, dentist or hospital.

What Is A Free Look Period

Health insurance companies in India grant you a free look period of 15 days, during which you can analyze the health insurance policy that you have purchased. You can cancel your health insurance policy in these 15 days if you think that this medical insurance plan is not suitable for you without paying any cancellation fee.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

If I Want To Claim For Cashless Treatment How Will I Approach

To avail the benefit of cashless claims, all you need to do is approach a network hospital and show your health card, which has your policy number, name of the insurance company and type of health insurance policy. You will also have to fill up a pre-authorization form that will be sent by the network hospital to your insurance company. On verification of these documents, your claim will be directly settled by your insurer to the hospital.

What About Terminating The Policythe Legal Document Issued To The Policyholder That Outlines The Conditions And Terms Of The Insurance Also Called The Policy More

Exit criteria in a health insurance policyThe legal document issued to the policyholder that outlines the conditions and terms of the insurance also called the policy More mean the tenure of plan coverage. It is the period till which the insurance company will bear the cost for your medical expenses in return for the premium payment. On the other hand, terminating a health plan means where the policyholderA person who pays a premium to an insurance company in exchange for the insurance protection provided by a policy More surrenders the policyThe legal document issued to the policyholder that outlines the conditions and terms of the insurance also called the policy More and stops paying the premium. The regulations of surrendering the policyThe legal document issued to the policyholder that outlines the conditions and terms of the insurance also called the policy More and exit procedure are different in the two health insurance plans.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

Difference Between Health Insurance And Medical Insurance:

Before purchasing health insurance or medical insurance plans, analyze the thin line between the two.

1- Medical insurance will provide you coverage only for hospitalization, pre-specified ailments and accidents that too for a pre-specified amount while health insurance will provide you with comprehensive coverage against hospitalization expenses, pre-hospitalization and post-hospitalization expenses and ambulance charges.

2- Medical insurance will not provide you with any add-on coverage while health insurance, on the other hand, offers add-on coverage such as critical illness, accidental disability, etc.

3- Medical insurance doesnt offer any flexibility in terms of coverage whereas health insurance policyholders can reduce their policy duration, health insurance premium amount after a certain period, etc.

4- Medical insurance doesnt provide the insured with the critical illness cover while health insurance provides the insured with critical illness cover for diseases like cancer, heart attack, etc.

5- In medical insurance, the pre-assured sum cannot exceed INR 5 Lakhs while in health insurance the limit is INR 6 Crores.

Why Is Medical Insurance Important

A medical insurance will help you to pay for various hospitalization and medical expenses that you will incur if you become ill or injured. These expenses will include a hospital room, professional and surgery fees and medical supplies and services. A medical insurance policy will also help you if can no longer work and earn an income because of illness or injury.

No matter what type of insurance you take on, make sure you understand what is covered and in the insurance policy. Ask for explanations on anything that you find is ambiguous from the insurance company.

You May Like: Does Starbucks Offer Benefits

What Health Insurance Covers

Health insurance is a kind of insurance coverage option designed to help pay for medical, surgical, and sometimes dental expenses incurred by the insured during a designated period of time. Health insurance can help minimize the costs of an illness or injury listed in the policys definition of coverage.1

What Do You Mean By Domiciliary Hospitalization What Does It Cover

Domiciliary Hospitalization refers to a situation where you are undergoing a treatment or are under medical care at home instead of hospital and still you are considered as hospitalized. You might be taking the treatment as home because of non-availability of hospital beds/room in the hospital or you are not in a condition to be shifted to a hospital for the treatment.

The domiciliary hospitalization covers you for the expenses related to the treatment you receive for an Illness/disease/injury at home instead of a hospital.

You May Like: Does Starbucks Provide Health Insurance For Part Time Employees

Is There A No

A no-claim bonus in health policies refers to a sum that gets added to the insured sum at the year-end if you do not apply for plan coverage expenses. The no-claim bonus is not applicable in employer health insurance, and you can only enjoy the coverage benefits. While in personal health plans, there are provisions for availing the bonus sum at the end of the year. However, depending on the policyThe legal document issued to the policyholder that outlines the conditions and terms of the insurance also called the policy More you pick for individual insurance, the regulations may differ about the no claim bonus.

Private Health Insurance Vs Public Health Insurance

Find out if public or private health insurance plans are the best fit for you.

Find Affordable Health Insurance In Your Area!

Health insurance is a subject that we’ve all heard so much about, but one that can also be very confusing. One of the most common questions people have is, “What plan is right for me?” Two of the terms you may have heard regarding health insurance is private health insurance and public health insurance. We’ll take a look at what exactly these two types of health insurance plans are, the differences between the two, and how to determine which plan is right for you.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

What Is A Health Insurance Policy

Health insurance is like a financial security that you have for handling your medical expenses. Health insurance plans are like an investment that you make so that you can safeguard your hard-earned funds from being spent on expenses related to hospitalization, medicines, ambulance, doctors consultation and more. A health insurance policy can also be viewed as an agreement between you and your health insurance company that binds them to cover you financially in case of any medical emergency.

There are several types of health insurance plans in India. And, you should choose the best health insurance policy for yourself and your family so that you can relax when it comes to paying hefty medical bills. You not only get covered for the medical expenses with your health insurance plans, but also get facilities such as cashless treatment and quality health care at a reputed network hospital. Health insurance plans are like your friends that take away your financial burden in case of hospital related exigencies.

Key Features Of Health Insurance Policy

A comprehensive health insurance policy comes with packed features. Check its features in detail.

Cashless Treatment

It is common that every health insurance company has few hospitals under its network. The benefit of theses hospital is that if you get admitted in these hospitals then you do not have to pay out from your pocket. The insurer will be there to take care of it. You just need to tell your policy number and the rest of the things will be handled by the insurer and hospital.

Pre and Post Hospitalization

You will surely love this feature as it provides coverage on both pre and post-hospitalization charges for a period of 30 to 60 days depending on the plan purchased.

Ambulance Charges

No Claim Bonus

One more add-on benefit, you will surely get this benefit for every claimless year. It can be in any form, either an increment in the sum assured or a discount in premium.

Medical Check-Up

Free check-up is provided by a few insurance companies.

Tax Benefits

According to Indias tax system if you are paying a premium amount then you are liable to get a tax refund under section 80D of Income Tax Act for a maximum value of Rs.25000 for Indians in the age group of 18 to 50 years and Rs.30000 for senior citizens.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

What Is Mediclaim Insurance

The key feature of mediclaim is the coverage for hospitalization and treatment towards accident and pre-specified illnesses for a specific sum assured limit. The mediclaim premium is based on the sum assured. It reimburses your actual medical expenses. It is really a helpful insurance policy as it offers coverage on hospitalization and treatment costs. The policy is taken to settle the hospitalization expenses incurred at the time of hospitalization

Term Insurance Vs Health Insurance

We know your family is everything to you, you want to see them happy and independent even when you are gone and also when you are around.

Term insurance is often argued by most to be an overly emotional persons panic resolution. This is incorrect, if you can spare the annual premium amount and buy yourself some peace of mind that there will be someone to take care of your family even after you are gone, then why not? And the same holds true for a Health insurance.

If you are mindful of your familys medical wellbeing and if you are aware that you are not superhuman and that diseases do not ask for permission you will probably get a health insurance for you and your family, to keep those heaping medical bills at bay, by paying a very small cost for it.

Be smart and plan things before its too late. We are here to explain both of these policies to you, so that you can decide which one to opt for.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

What Are The Different Types Of Health Insurance

There are several different types of health insurance in the U.S., including public coverage and private coverage.

Private healthcare coverage can be provided by an employer or purchased in the individual/family market. Members of the armed services and their families are covered under Tricare, and people employed by the federal government are covered under FEHB.

Both public and private plans tend to use a managed care model , in which a private insurer will manage and oversee the provision of services, the quality of the care provided, the reimbursement system, the provider network, and rules such as prior authorization or step therapy.

In the individual/family market, all major medical healthcare plans with effective dates of January 2014 or later are governed by the Affordable Care Act and required to be compliant with its provisions, regardless of whether theyre sold in the exchange or outside the exchange. These plans all offer coverage on a guaranteed-issue basis, regardless of an applicants medical history. But coverage is only available during open enrollment or a special enrollment period triggered by a qualifying event.

There are still grandmothered and grandfathered plans in effect in the individual and small-group markets in many states , but these plans have not been able to enroll new members except for new family members or new employees on existing employer-sponsored plans since 2013 or 2010, respectively.

Types Of Health Insurance Policies

- Individual Health Insurance – Covers a single person, as the name suggests. Know more about Individual health insurance.

- Family Floater Policy – The entire family along with the insured is covered under a single plan, the premium is paid annually. Know more about Health insurance plans for family.

- Unit-linked Health plan – The insurance companies offer coverage and investment under the same roof of unit-linked insurance.

- Senior Citizens Health Insurance – This Policy is for your ageing parents, we provide all the possible benefits to our customers when they choose to buy this policy. With the best hospital and service tie-ups to covering the common treatments required in old age, we give the best to our customers. Know more about Senior citizen health insurance plans.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees