Minimum And Maximum Deductibles

Participation in a qualifying HDHP is a requirement for health savings accounts and other tax-advantaged programs. A qualifying plan must have a minimum deductible and out-of-pocket maximum which the Internal Revenue Service may modify each year to reflect change in cost of living. According to the instructions for IRS form 8889, “this limit does not apply to deductibles and expenses for out-of-network services if the plan uses a network of providers. Instead, only deductibles and out-of-pocket expenses for services within the network should be used to figure whether the limit is reached.”

| Year |

|---|

| $13,300 |

Minimum Deductibles And Maximum Out

HDHPs have specific guidelines in terms of allowable deductibles and out-of-pocket costs. These are adjusted annually by the IRS, although there have been some years when there were no changes.

For 2020 coverage, HDHPs must have deductibles of at least $1,400 and out-of-pocket caps that dont exceed $6,900 . Note that this is lower than the total out-of-pocket allowed on non-HDHPs under the ACA the gap between the maximum allowable out-of-pocket limit for HDHPs versus other health plans has been steadily widening since the ACA was implemented.

For 2021, the minimum deductibles for HDHPs are unchanged , but the maximum allowable out-of-pocket caps will increase to $7,000 for an individual and $14,000 for a family.

But not all plans that fall within these dollar limit guidelines are HDHPs, since HDHPs are also required to only cover non-preventive services after the enrollee has met the deductible.

The Pros Of High Deductible Health Plans

For most people, the most appealing aspect of an HDHP is the low monthly premium. Because the deductibles are high, monthly premiums are lower than plans with low deductibles and low out-of-pocket maximum. An out-of-pocket maximum is the most youll pay out of pocket during your coverage year.

HDHPs provide 100% coverage for preventive, in-network services before you satisfy your deductible. If youre relatively healthy and generally dont have medical expenses beyond annual physicals and screenings, theres a good chance youll save money by opting for an HDHP.

A full list of qualifying preventative services and screenings is available at Healthcare.gov. Here are some examples of the medical care that is 100% covered before you meet your deductible.

Adults

-

Developmental screening for children under age 3

-

Hearing screening for all newborns

-

Vaccines for illnesses such as whooping cough, influenza, and chickenpox

The biggest pro: If you are healthy and dont have any large medical events on the horizon, an HDHP can keep your monthly payments low.

Also Check: What Is The Best Health Insurance In Alabama

Are Hdhps Leading To Lower Health Costs

A key tenet of an HDHP is that it can reduce health care costs — both for employers and employees in lower premiums.

However, our Insure survey found that the vast majority of people with a high deductible plan havent seen lower health care costs. Forty-six percent of people surveyed said their costs increased and 41% said they stayed the same. A mere 13% said their costs decreased. These findings were nearly identical to 2019’s results when 46% said costs increased, 32% said they remained the same and 11% said they decreased.

One drawback with an HDHP is that paying more for doctor appointments and tests may make people delay care.

The Insure.com survey found that concern is a reality. Nearly half of people with an HDHP said theyve delayed care because of cost:

- 40% said they put off care. This was down from 56% in 2019.

- 55% said they havent delayed care.

- 5% weren’t sure.

Thats a problem not just for the plan members, but the employer and health insurer, too. Delaying necessary care could lead to more health problems and higher health bills later.

Another concern is that people with high-deductible plans often say their plans arent educating them to improve health care decisions. High-deductible health plans were once commonly called consumer-directed health plans. A vital piece of those plans is educating patients to help them become better health care consumers.

Impact On Preventive Services And Utilization

When a consumer purchases a health insurance policy, there is a moral hazard risk because the consumer may utilize too much medical care because the full cost of care is defrayed . Advocates of Consumer-driven healthcare such as HDHPs operate on the premise that imprudent choices made by patients may be avoided if they are held financially responsible through high copayments and deductibles. However, in practice, studies show that HDHP may actually promote behavior such as avoiding preventive care visits and reducing much needed ambulatory care, especially for those with chronic conditions or low socioeconomic status.

Recommended Reading: How Much Does Health Insurance Cost In Ct

Comparing The Two Plans

The low-deductible plan is better if you spend more than $2,650/year at the doctor and the HDHP is better if you spend less than that. Many people see the higher deductible and out-of-pocket maximums on HDHPs and panic which, is why low-deductible plans are so popular, but the thing to keep in mind here is that the total cost of this HDHP will never be more than $1,880 above the total cost of this low-deductible plan.

Another thing to remember is that even if you do have a major injury or prolonged illness for a year or two, the cost of that will be easily balanced out by all the years where you don’t have any major problems. Let’s say you average $500/year in medical expenses, but once in your first five years, you get in a major accident and it costs $10,000 in hospital bills. Do you know how much money you would save with the higher deductible plan over that time frame? $4,100. That’s a whole lot of money. Obviously, the savings are even higher if you don’t get in the accident.

Ppo Preferred Provider Organization

If you are willing to pay more money for flexibility, consider a PPO. They tend to come with a larger network of doctors and also provide benefits for out-of-network care. Referrals to specialists are not required, so this can save time and hassle if you have the financial means to pay a higher monthly premium.

Further reading: What Is POS vs PPO Health Insurance? The Costs And Benefits

Recommended Reading: Can You Get Health Insurance After Open Enrollment Ends

Where Cr Stands On High

Theres no argument that high healthcare costs need to be reined in. But Consumer Reports doesnt think consumers should bear the brunt of that responsibility through insurance plans with enormous out-of-pocket costs. Instead, we believe that employers, the government, and medical-service providersas well asconsumersmust work together to lowerthe underlying costs of healthcare.

The idea behind high-deductible plans is that if consumers face the consequences of their health spending, they will spend their dollars more wisely.

Instead, those cost-sharing plans are causing considerable consumer harm, says Lynn Quincy, director of CRs Healthcare Value Hub. Almost all of the savings that they generate are due to people cutting back on healthcare services. They postpone going to a doctor, dont fill prescriptions, or cut back on preventive care. Most troubling is that the sickest workers may cut back on care. Whats more, several studies have found that consumers in HDHPs do no more price shopping for medical services than the average person. They also fail to use free preventive services.

To control spending and bring better value to our healthcare system, CR believes we need a different vision of what the consumers role in healthcare should be. These are some strategies we suggest:

Go to ConsumersUnion.org/highhealthcosts for more information.

What Happens If You Dont Meet Your Deductible

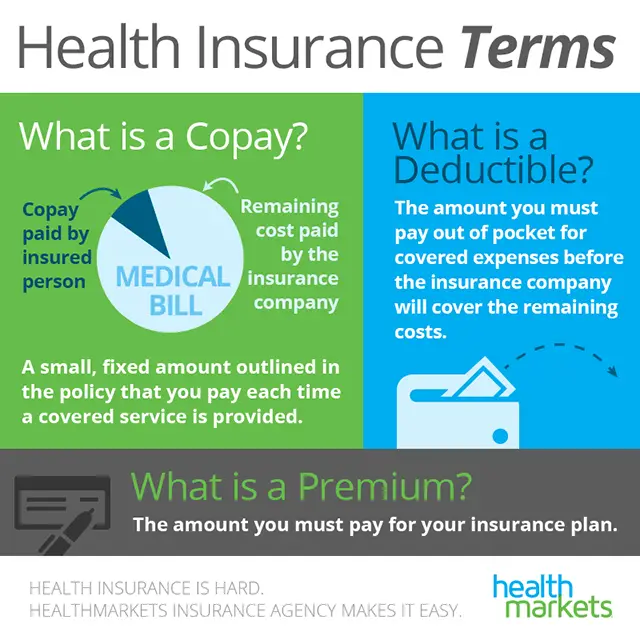

Your insurance coverage doesnt begin paying for your health care until you meet the minimum deductible on your account. If your deductible is $1,000 for the year, youre typically responsible for paying for the first $1,000 of your healthcare costs before your insurance carrier will begin to pay.

If you dont meet your deductible, the health insurance plan doesnt need to pay its share of health care services and you dont have to pay coinsurance.

You May Like: How Do I Know If My Health Insurance Is Good

High Deductible Health Plans

An Its Your Choice High Deductible Health Plan is a health plan offering that combines a Health Savings Account with the uniform benefits offered by the State of Wisconsin Group Health Insurance Program. An HDHP paired with an HSA gives you greater flexibility and discretion over how you use your health care dollars.

HDHPs have higher annual deductibles and out-of-pocket maximum limits than other traditional health plan offerings. With an HDHP, the annual deductible must be met before plan benefits are paid for services other than in-network preventive care services . Preventive services are covered 100%, before the deductible is met. In exchange for the increased cost sharing, this plan offers a lower monthly premium cost.

Analysis Of High Deductible Health Plans

A insurance plan with a deductible that is larger than the deductible for more standard indemnity plans . Many such plans are accompanied by a savings option that allows people to set aside pretax dollars to be used to meet out-of-pocket health care expenses up to their deductible.

These are the nine performance dimensions against which we measured High Deductible Health Plans:

Also Check: Can I Put My Wife On My Health Insurance

Whats The Difference Between High And Low Deductible Health Plans

A high deductible health plan is also referred to as HDHP. A low deductible health plan may be referred to as an LDHP. Depending on the type of plan you have, there could be separate deductibles for prescriptions and/or separate deductibles per family member. It could take as little as one visit or over the course of many months to meet your deductible. For some plans, you may not meet your deductible within your plan year.

How Much Does A Medical Office Visit Cost

Medical visit payment rates are different between different insurance companies

A rough guide is:

-

New Patient Office Visit: $200 – $450 depending on how much time is spent on evaluation and/or how many medical conditions are addressed.

-

Subsequent Office Visits: $75 – $300 depending on how much time is spent on evaluation and/or the number of medical conditions being addressed.

-

Any tests performed during the visit are ADDITIONAL cost according to your insurance plan.

-

Most insurances will cover Preventative Visit without deductible or copay – e.g. Annual Physical or Medicare Annual Wellness Visit .

-

To understand the difference between a Annual Preventative/Physical visit vs a medical visit please click on the button below.

If you are interested in paying out of pocket , you can view our self pay rates on our dedicated webpage.

Don’t Miss: Can Health Insurance Deny Pre Existing Conditions

What Is An Hdhp

As you can probably guess from its name, a high-deductible health plan has a higher deductible than other plans. But theres a significant payofflower monthly premiums. HDHPs are a relatively new approach to health coverage, but theyre becoming more popular every year both as an employee benefit and for the self-employed.

The two purposes of HDHPs are:

- To contain spiraling health care costs across the board

- To encourage consumers to make better informed choices about their health care

How do they achieve those purposes? Well, theres something about a flat fee that tends to encourage people to sometimes overuse a benefit. You know, like your Aunt Betsy and your Uncle Mike? Yeah, the ones who are usually in great health, but go to the doctor for blood work and an MRI absolutely anytime they sneeze? That outlook can lead to runaway spending, as well as ballooning costs over timecausing health care costs to keep rising.

But when you have to shoulder some of the cost associated with your health care, youre probably going to try to find ways to save on insurance. Nobody wants to spend more, obviously.

So, to help make an HDHP more worth your while, the IRS has built in a few features that make this kind of plan very budget friendly. But is it the right plan for you?

What Are The Types Of Deductible

Per incident deductible Per incident deductible is the type of deductible where you pay the chosen deductible amount for every illness or injury after which the policy will start paying based on the coverage of that plan. You need to pay a deductible for every new incident you claim for.

Annual deductible It is a deductible you meet only once per year or for the time you are on the plan if its less than a year. This is a fixed dollar amount that you need to pay for the covered services for a calendar year.

How to choose the right deductible?

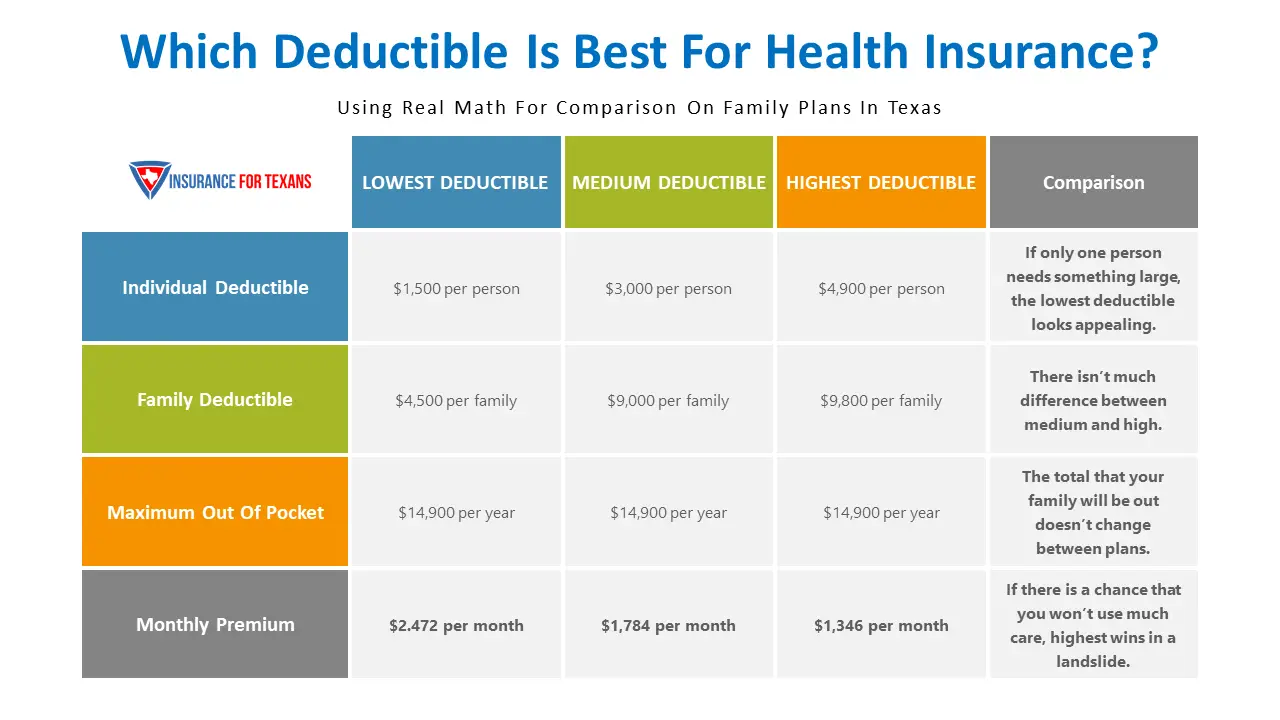

The answer to this question depends largely on the number of people you are insuring, and how many doctors visits you may have in a year. While a high-deductible plan is great for people who rarely visit the doctors, a low-deductible plan may be best for a larger family who frequently visits doctors offices.

Selecting a high-deductible plan saves a lot of money because you are prepared to pay medical bills upfront. Low-deductible plans are suitable for people or families with frequent medical illnesses. Doctor visits or emergency needs can quickly add up if you are on a high-deductible plan, but the latter plan lets you better manage your out-of-pocket expenses.

Can Visitor Guard® help?

Absolutely!

Do give us a call if you wish to purchase a health insurance policy.

Read Also: How Much Is Travel Health Insurance

You Dont Want To Hit Your Deductible

With most plans, hitting your deductible means that more services are covered and you save money. But the deductibles for HDHPs are higher than other plans, so planning to hit your deductible probably wont save you money, nor is it a good way to manage your health.

If your plan costs $4,800 annually and you manage to reach your $2,500 deductible, then youve already spent $7,300. In all likelihood, you could have used that money to get a plan that offers far more coverage.

If you crunch the numbers before you choose a plan and you think you might hit the deductible in an HDHP, then a traditional plan with higher premiums and more coverage might be better for you.

What Is A High Deductible Health Plan

10 Minute Read | September 27, 2021

Health care is expensive. And the price never seems to stop rising! Thats why some people avoid it altogether. But skipping health insurance is like whitewater rafting without a life jacket. The sun and the spray might feel nice for a while, but when you go overboard, youll wish youd put one on.

So, whats a budget-minded guy or gal to do in these choppy waters? For many, the answer is to accept the possibility of higher out-of-pocket costs while reaping the benefit of lower premiums. Its called a high-deductible health plan .

Also Check: How Do I Know If I Have Private Health Insurance

% Of Us Workforce Enrolled In High

High-deductible health plans were created for consumers to have a health insurance option with lower premiums and high deductibles. These plans can be linked to health savings accounts to pay for qualified medical expenses in a tax-advantaged way.

Many Americans have chosen to enroll in HDHPs as health insurance premiums have increased throughout the 21st century. With this in mind, ValuePenguin analyzed which states have the highest percentages of employees enrolled in HDHPs.

However, these plans generally arent ideal for families or individuals with modest to high medical expenses, meaning there may be better options for consumers.

How Should I Choose A Health Insurance Plan Deductible

A health insurance deductible is a highly personal decision based on your household budget and your healthcare needs.

Just as insurance companies calculate premiums based on risk, you should choose your insurance company based on the risk that your plan presents to you, considering how copays and other costs may affect your total medical care costs each year.

Read Also: How To Stop Health Insurance

Limits Of A High Deductible Health Insurance Plan

A high-deductible health insurance plan is defined as one with a deductible of at least $1,400 for individuals and at least $2,800 for a family plan.

A high-deductible health insurance plan is defined as one with a deductible of at least $1,400 for individuals and at least $2,800 for a family plan. This annual deductible is the amount youll pay out of pocket before your insurance pays for anything.

On top of that, the IRS sets limits on the maximum amount youll have to pay for in a year with an HDHP. For an individual, that amount is $6,900, and for you and your family members, it is $13,800 annually. However, its crucial to note that these numbers are only the legal limits and that each particular plan may be set up differently.

How Much Does Health Insurance With No Deductible Cost

The average monthly cost of health insurance in the U.S. was $456 for an individual and $1,152 for a family, according to eHealth.

When you opt for zero-deductible plan, youre likely to pay much higher premiums. That is because your insurance coverage costs the insurer more than if you were contributing toward costs with a higher deductible. With that higher risk and, in turn, higher costs, the insurance company charges more.

Millen explains the difference between a low and high deductible.

A low deductible means you are willing to incur the medical cost risk and pay from your own checking account, he says. A high deductible means you are willing to trade a lower cost from the health insurance company in return for taking on more out-of-pocket costs .

Finding a health insurance plan with no deductible may be difficult depending on where you live. The marketplace plans use a tiered system of four different metal tiers to fit your personal needs.

Here are the typical insurance tiers from the health insurance marketplace:

| Coverage tier |

|---|

| $1,027 | $703 |

So, as you can see, you may pay more than $1,000 in premiums over the course of a year by going with a low deductible health plan rather than a high-deductible plan. However, a health plan with a low deductible can more than make up for those higher monthly premiums if you rack up hefty medical bills with a high-deductible plan.

You May Like: Are Daca Recipients Eligible For Health Insurance