Avoid Contacting Insurance Companies First

Instead of searching through your options on the health care marketplace, you could call up a private health insurance company like Cigna or UnitedHealthcare to order a plan directlyâbut that’s an approach Nechrebecki doesn’t recommend.

Not all plans offered will be ACA-compliant, and it can be hard for consumers to know the difference, says Nechrebecki. You’re better off looking at the health care marketplace first, especially if you are subsidy-eligible. If you can’t find what you need there, then search for an ACA-compliant plan elsewhere.

How Mandatory Health Insurance Worked In The Past

When the Affordable Care Act â also known as Obamacare â passed in 2010, it became mandatory for most people to have health insurance.

Tax penalty for not having insurance

Back in the day, youâd end up with a tax penalty if you didnât have health insurance.

Tax subsidies to make insurance cheaper

The tax penalty sounds harsh. But the ACA also introduced tax subsidies to make insurance more affordable. It also opened up Medicaid eligibility to include more low-income people and families.

While the rules of the ACA have changed, it still exists. And it still plays a role in helping people get insurance. More on that shortly!

Protect Your Health And Your Wallet

Now you can feel more confident about buying the right self employed health insurance for you.

Take your time, do your research, and compare plans before deciding. Find cost-saving measures in other areas of your life to prioritize a budget for health insurance.

For more helpful healthcare information and news, browse our other blogs.

Read Also: How To Get My Health Insurance Card

Your Spouse Or Domestic Partner’s Plan

If your spouse works and has coverage through their job, you may be able to join their plan. Because it’s an employer-based plan, it may also save you money. It may charge a lower premium since the employer will usually pay into the plan.

Even if you are not married, you may qualify as a domestic partner if you share the same home and live a domestic life together. But you cannot be legally married to anyone else.

Think Outside The Box

Depending on your particular circumstances, there are additional affordable health insurance options available to you. For instance, if you’re a student, your college or university may offer a student health insurance plan. If you’re active in or retired from the military, you may qualify for TRICARE. Those who are senior citizens or have certain disabilities may be eligible for government-issued Medicare.

Another option for young adults: You can stay on your parents’ family plan until you turn 26. That could become tricky if you move to a different state, warns Nechrebecki, because then you may be forced to see more expensive out-of-network doctors.

Aikman notes that there are also faith-based plans that are not ACA-compliant. These are usually called health care sharing ministries . Since they are religious in nature, some don’t cover health care costs like birth control or elective abortions, so they tend to be more restrictive in terms of coverage. But on the flip side, they also tend to be less expensive than other health insurance for freelancers.

You May Like: Why Is Private Health Insurance So Expensive

Looking For Health Insurance Marketplace Coverage From Unitedhealthcare

UnitedHealthcare Exchange plans offer a variety of affordable, reliable coverage options. You can find plans available in your area at UnitedHealthcare Exchange plans or you can call TTY 711.

If youre looking for ACA plans in New York or Massachusetts, visit Healthcare.gov or call to learn about plans available near you.

Other Avenues For Finding Coverage

Membership Organizations

Professional or trade organizations like unions and guilds often provide group plans for members, which can be an effective low-cost option for independent workers. Membership organizations like AARP also offer access to specific plans, as do many colleges and universities for students. Group plan access through an organization tends to function very similarly to many ESI plans.

Talking to an Agent or Broker

Agents and brokers can be helpful resources and can direct individuals to the best-fitting option from a particular provider. Insurance companies hire or rely on independent agents to sell plans while brokers assist clients with navigating the market. Both tend to operate on commissions from the insurance companies whose product they sell. This Find Local Help tool from healthcare.gov can help you locate agents, brokers and navigators in your area.

Direct Enrollment and Private Exchanges

COBRA

The Consolidated Omnibus Budget Reconciliation Act, or COBRA, allows workers and their families to stay on an employer-sponsored group plan for up to 18 months after it would have otherwise lapsed. Its expensive but can help in certain situationsincluding transitioning from a job with ESI to self-employment. To qualify, the lapsing plan must already be covered by COBRA and the insured party must experience a change in eligibility that meets certain criteria, such as the death, divorce or job loss of the covered employee.

Health Care Sharing Ministries

Also Check: How Long Can A Dependent Stay On Health Insurance

Can You Write Off Health Insurance If Self Employed

As a self-employed individual, you may be able to deduce your premiums paid for medical, dental, and long-term care coverage for yourself, your spouse, and your dependents. The policy can also cover your kids who are under the age of 27, even if they arent your dependent. You cannot take the self-employed health insurance deduction if youre eligible for coverage under a plan from your employer or your spouses employer.

Learn more about the self-employed health insurance deduction on the IRS site.

How We Choose The Best Health Insurance Companies For The Self

We evaluated 25 insurance companies offering self-employment health insurance and assessed a range of factors before narrowing the selection to the top four categories. Monthly premiums and overall pricing were primary factors for consideration because being self-employed could mean periods of economic uncertainty.

We also looked at online availability, ease of obtaining a quote, range of policies, coverage, network, options, and added benefits.

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE 24 hours a day/7 days a week to get information on all of your options.

MULTIPLAN_HCIDOTDASH01_2023

Thomas Barwick / Getty Images

Don’t Miss: How To Apply For Health Insurance In Ct

Get Expert Advice From An Independent Insurance Agent

When youre in charge of finding health insurance thats worth more than the paper its written on, dont leave it to chance or the internet to find the best one for you!

An independent insurance agentlike the ones youll find in our Endorsed Local Providers programare the experts to turn to.

You can find local agents who are ready to walk you through your health care options and track down the best health insurance quotes in the exciting world of being your own boss! And theyre RamseyTrusted, so you know youll be working with top insurance agents who really know their stuff.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners. Learn More.

Enroll In Cobra Through Your Previous Job

The Consolidated Omnibus Budget Reconciliation Act is a government program that allows employees to keep their group health insurance plan when they leave their job for whatever reason. Through COBRA, your employers insurance provider will convert the group plan to an individual plan for you. This makes it possible to keep your existing coverage for 18 or 36 months.

However, group insurance plans cost less because the premiums are pooled. With an individual plan and without a subsidy from your employer, youll have to pay full price for the plan plus a 2% administrative fee. If you want to explore this alternative, contact your employers insurer and get information on COBRA coverage and the monthly premium.

Read Also: What Does No Cost Share Mean In Health Insurance

How Much Does Health Insurance Cost For A Freelancer

The current average cost for self-employed health insurance in the United States is $495 a month $5,940 annually. The price can be much lower about $200/month on average if you qualify for a tax subsidy. Your location also plays a major role in determining your health insurance costs as it can be far more expensive to get insured in some states, like New York & West Virginia for example where month premiums are over $700/month on average, than others, like Colorado and New Hampshire as two examples where average monthly insurance rates are in the $300-$400 range.

Obamacare Individual Health Insurance Premiums

Premiums can also vary between an Obamacare or a non-Obamacare individual health plan. Obamacare, known as the Affordable Care Act, created marketplaces that allow individuals and families to shop for health insurance plans. A recent study by eHealth found that for the first half of the 2021 Open Enrollment Period, these were the average national monthly costs for ACA-compliant plans:

- Average monthly premiums for individual coverage: $484

- Average monthly premiums for families: $1,230

- Average annual deductibles for individuals: $4,394

- Average annual deductibles for families: $7,800

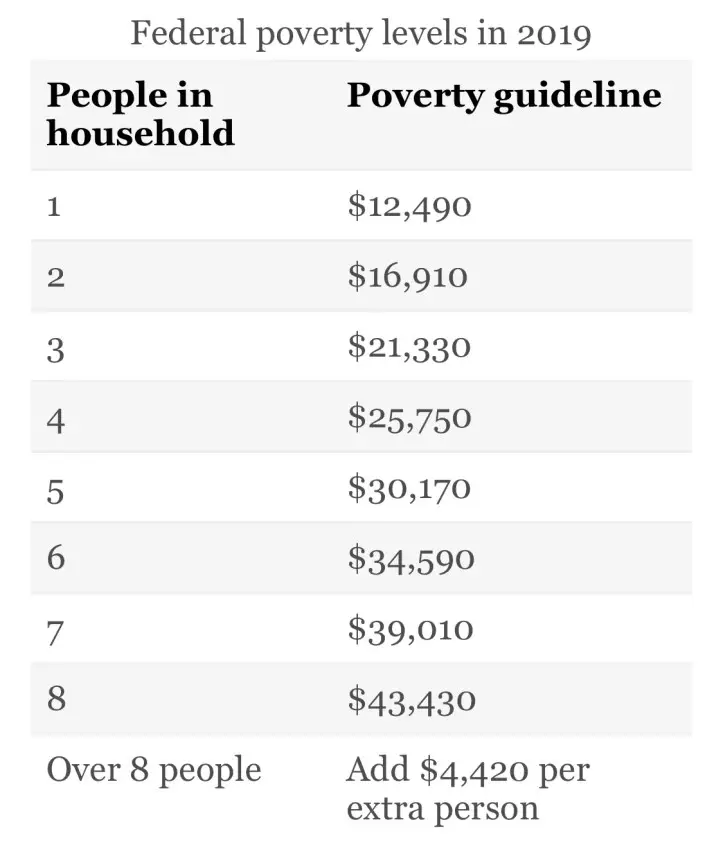

Its important to note that individuals and families may qualify for Obamacare subsidies that can decrease the premium they must pay dramatically. People with modest incomes might also qualify for cost-sharing subsidies that will further reduce out-of-pocket health costs. Typically, your family income needs to fall within 100%-400% of the federal poverty level, and you must lack access to other major medical insurance, to qualify for a subsidy.

The American Rescue Plan, which was signed into law by President Joe Biden this year, includes provisions to make health insurance coverage more affordable as well. The plan will increase the amount of subsidies, expand the number of people who qualify for subsidies, and forgive amounts some taxpayers would typically pay if they received too much in subsidies in 2020.

Don’t Miss: Do You Have To Have Health Insurance To File Taxes

Top Options To Get Self

Disclosure: Some of the links below are affiliate links, which means at no extra cost to you, we may earn a commission if you click through and make a purchase.

Ready to start shopping for health insurance for self-employed individuals now? eHealthInsurance.com makes it easy to explore coverage options in your area so you can find the right health insurance plan to fit your individual needs. You can also read on to learn more about some of your different options for getting covered.

Heres a rundown of the best self-employed health insurance options in 2021:

Coverage Options For Self

The best way to shop for health insurance in New Jersey is to get a better understanding of the individual and family plans that are available. The Affordable Care Act requires all health plans to be organized into Bronze, Silver, and Gold categories according to the level of coverage they offer. Theres also a Catastrophic coverage plan available for people under 30 or those who qualify for a special exemption.

All plans cover the same essential health benefits the difference is what you pay in monthly premiums and out-of-pocket costs when you need care. The following chart may help you decide what type of health plan is best for you based on how much you are willing to pay towards your premium each month and the amount youll pay when you receive care.

For example, a Bronze health plan may be best for you if you don’t use a lot of health care services and want to pay less in monthly premiums. On the other hand, Gold might make more sense if you use a lot of health care and are able to pay more in monthly premiums.

| Meet the requirements and need just-in-case coverage |

Read Also: Can Permanent Residents Get Health Insurance

Group Coverage Vs Individual Health Insurance Cost

Originally published on December 2, 2022. Last updated December 6, 2022.

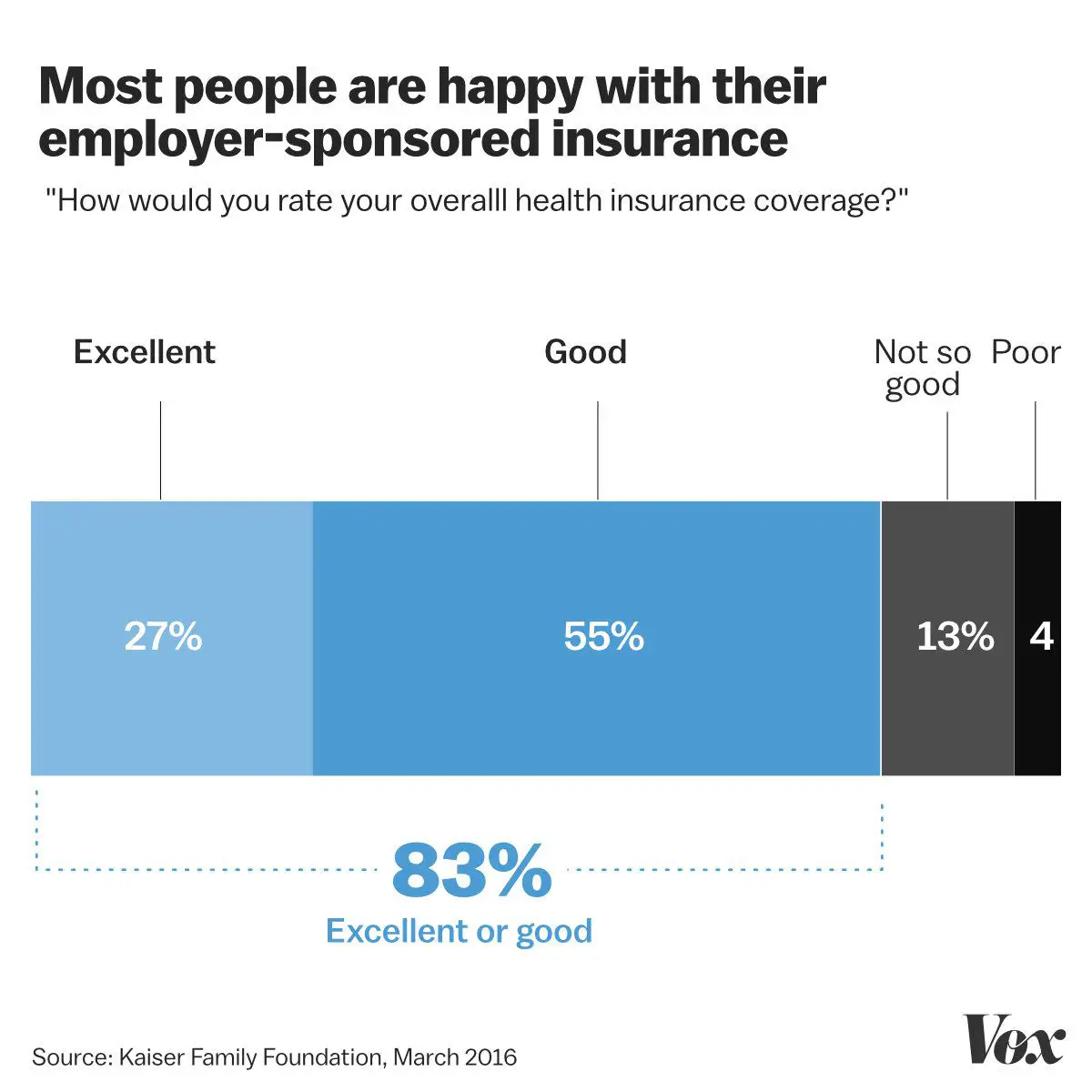

According to the Kaiser Family Foundation, nearly 50% of Americans1 rely on an employer-selected group health plan for insurance coverage. However, many Americans do purchase their own, individual health policy, either because they arent eligible for an employer-sponsored group plan or a myriad of other reasons.

If you aren’t able to participate in a group health plan or have the option to choose between group and individual coverage, you need to know you’re making the right call for you and your family.

In this article, well go over the average cost of both group and individual health insurance and cover additional benefit options that can make your insurance more affordable.

How To Get Health Insurance When Youre Self

8 Min Read | Mar 2, 2022

Being your own boss is exciting! Youre in control and doing work youre really passionate about. But what about health insurance? Most folks rely on their employer for coverage. But if youre the employer, what are your options?

Dont worry! Youve still got plenty. Whether you own your own business, have a steady freelance gig or are a consultant, well walk you through the best ways to set up your own health insurance.

Also Check: Are Health Insurance Premiums Tax Deductible

When To Shop For Health Insurance

The Open Enrollment Period is the time when individuals and families can buy a new health plan or make changes to their current health plan on the ACA Marketplace. Open Enrollment begins on November 1 each year and has a December 15 deadline for purchasing plans that take effect January 1, and a January 15 deadline for plans that go into effect on February 1.

Special Enrollment Periods are available to get coverage or change plans at other times of year. To qualify, you must have experienced a life change within the last 60 days such as losing your health coverage, getting married, or having a baby. Additionally, individuals whose income falls at or below 150% of the Federal Poverty Line , which is approximately $19,000 for an individual and $40,000 for a family of four, may be able to enroll or change their plans throughout the year.

How To Compare Individual Health Insurance For Self

At eHealth, weve helped millions of Americans find individual health insurance that they can afford and truly benefit from. If you enter your ZIP code in the form and answer a few, short questions, we will help you find the perfect individual health insurance for you and your family too. In addition to different kinds of individual health insurance plans, we can also help you find group health insurance and dental plans for yourself and your growing business.

You May Like: What Is Household Income For Health Insurance

How Can You Cut Health Insurance Costs

If you find the plan prices too costly, you could look into a high deductible health plan . Or, you may want to choose a lower tier in the marketplace. You can also talk to a health insurance broker who represents several companies and can search health plans for you. The more you shop for your health insurance, the more likely you are to save money.

How Much Is Health Insurance For Self Employed

Self-employed people have to cover all expenses that many people take for granted. The biggest of which is health insurance. So how much is self-employed health insurance?

Health insurance depends on many different things and the cost can be different from person to person. But the biggest factors on self-employed health insurance costs are who you buy it from and what level of coverage youâre looking for. In this article, weâll walk through everything that makes up the total price you pay for insurance before getting into some of the most popular plans out there for self-employed workers.

Health insurance is one of the biggest expenses that you will face as a self-employed worker. The prices will vary drastically from person to person, but an average self-employed person can expect to pay anywhere from $335/month up to $1,618/month depending on the company and the level of coverage.

All the information in this article comes directly from myself searching for self-employed health insurance. During my search, I learned about everything that goes into the cost for insurance, which is more than just the monthly premium! The plan details and costs that you find here come directly from the companies themselves.

Read Also: How Much Is Health Insurance Under Obamacare

Should I Take Public Or Private Health Insurance

As a freelancer in Germany, you have the possibility to choose between the two, public and private health insurance. However, when it comes to which one you should purchase, the decision is entirely up to you.

In addition, you should keep in mind a few things before making your choice. If you plan on moving to Germany permanently, it would probably be best for you if you joined the public healthcare system. As you get older, the monthly premiums are likely to change in the private healthcare sector. Moreover, adding additional cover would also have its own challenges since the risk status increases with age.

Freelancers registered with private health insurance providers, on the other hand, have a few more advantages. This means, if your income is relatively low, you may choose to begin with a basic private health insurance tariff and later on switch to a more comprehensive one. You may combine the tariffs of different services according to your needs and create a health insurance package that is perfect for you.

It is not easy to suggest a health insurance plan that fits perfectly to everyone. However, DR-WALTER has numerous affordable health insurance plans you might want to check out, like DR-WALTER.

PROVISIT by DR-WALTER is suitable for foreign citizens who plan to stay in Germany for up to two years. It provides you with comprehensive coverage, consisting of:

- travel health insurance