Should You Chose The Standard Deduction Or Itemized Deduction For Personal Medical Expenses

Employees will need to consider their income and medical expenses when deciding whether to take the standard deduction or to itemize their deduction.

To determine which deduction to take, you must calculate the deductible amount. Remember, you can only deduct medical expenses greater than 7.5% of your adjusted gross income.

For example, if your AGI is $56,000, you can only deduct medical expenses greater than $4,200 on your tax return. If your out-of-pocket medical expenses and other expenses exceed the standard deduction, then choosing the itemized deduction will allow you to get more money back on your tax return.

Its a good idea to consult with your tax advisor to determine which filing method is best for you.

Health Insurance Premiums And Total Household Resources

Some qualified paid health insurance premiums may be deducted from income when calculating the homestead property tax and other credits allowed on the Michigan income tax return.

Definitions:

Pre-Tax Deduction An amount excluded from income tax. Pre-tax deductions reduce your taxable income. They are deducted from your income before taxes, so you are not taxed on that money.

Post-Tax Deduction An amount deducted after the tax is deducted. Post-tax deductions do not reduce your federal, State and Medicare tax liability. They are deducted from your income after taxes, so you are taxed on that money.

Total Household Resources Total household resources includes all income received by all household members during the year, including income that might be exempt from adjusted gross income. Net losses from business activity may not be used to reduce total household resources. For a listing of income sources to include in total household resources, view Income and Deductible Items .

POST TAX HEALTH INSURANCE PLANS

Post-tax premiums paid for any of the following types of health insurance plans may be deducted to compute applicable credits:

Post-tax Medicare premiums that are paid out of your pocket may be deducted to compute applicable credits. This applies to the following types of coverage:

Health Insurance And Coronavirus

If you were impacted by Coronavirus and cant pay your premiums, check with your insurance company about extending the payment deadline or ask if they will delay terminating your coverage.

If you lost your job and have Marketplace insurance, you can update your income and possibly qualify for a bigger savings on your health insurance through the Health Insurance Marketplace.

Dont worry about knowing these tax laws.TurboTax will ask you simple questions about you and give you the tax deductions and credits youre eligible for based on your entries. If you have questions, you can connect live via one-way video to aTurboTax Live tax expert with an average 12 years experience to get your tax questions answered. TurboTax Live tax experts are available in English and Spanish, year round and can even review, sign, and file your return or you can even just fully hand your taxes over to them all from the comfort of your home.

Read Also: Does My Health Insurance Cover Abortion

The Threshold Doesn’t Apply To All Of Your Income

The good news here is that this percentage doesn’t apply to your total income but only to your AGI. This is the number that’s arrived at after you’ve taken certain above-the-line deductions on Schedule 1 of your Form 1040 tax return, reducing your gross income to your taxable income.

Above-the-line deductions include things like certain retirement plan contributions, tuition, and student loan interest. Your AGI will typically be less than your overall income if you can claim any of these deductions. For example, you might have earned $60,000, but your AGI would be just $54,000 if you contributed $6,000 to your IRA in that year. Your 7.5% threshold would drop from $4,500 to $4,050.

Your AGI appears on line 11 of your Form 1040 before you claim itemized deductions or the standard deduction for your filing status on line 12.

Are Health Insurance Premiums Tax

With the average cost of a day in the hospital topping $2,600, having health insurance is essential to peace of mind. But coverage comes at a cost. Fortunately, health insurance premiums and other medical expenses may be tax-deductible, as long as they exceed a certain amount and you itemize your deductions. Can you deduct the cost of your health insuranceand does it make financial sense to do so? Here’s what you need to know.

Also Check: When Is The Last Day To Enroll For Health Insurance

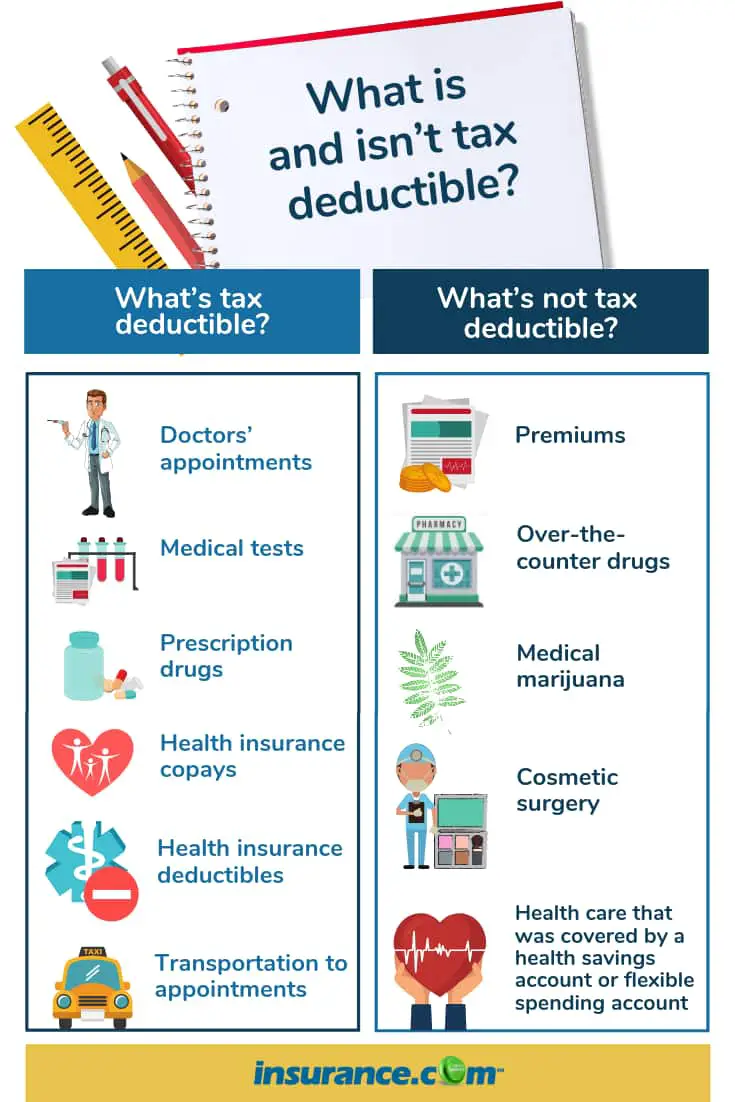

Other Medical Expenses That Are Tax

The IRS lets you deduct medical expenses that were ordered by a doctor or health care professional. For a complete list of acceptable medical expenses, you can visit the IRS.gov website. For the 2021 tax year, you can deduct the cost of personal protective equipment, such as masks, hand sanitizer and sanitizing wipes for the primary purpose of preventing the spread of the coronavirus.

Other eligible medical expenses include:

- Bandages

- Eye exams, eyeglasses and contact lenses

- Guide dog or other service animal

- Hearing aids

- Therapy

- Wheelchairs

Along with these direct medical expenses, you can deduct travel costs related to medical care. For example, for a drive to a physical therapy appointment, you could deduct the cost of gas and oil as a medical expense.

Faqs For Health Insurance Tax Deductions

Detailed medical record-keeping can help you determine if you have potential tax-saving expenses.

Taxes and health insurance on their own are complex. Taken together in order to figure out questions such as “Are health insurance premiums tax deductible?”and the complexity multiplies. Here are six considerations about taxes and health insurance to help you keep the records you need to file your return every year.

You May Like: How Do I Get Health Insurance For Myself

Who Qualifies For Medical

Anyone who has health insurance can potentially deduct some healthcare costs from their taxes. If you have dependents on your health insurance policy, like children under age 26, you can also deduct some of their expenses from your taxes.

However, not many people can write off the entirety of their health insurance premium. One group that falls into this category are individuals who have private health insurance and qualify for premium tax credits, which is based on income.

The IRS states that to qualify for a premium tax credit, your household income must be at least 100% and no more than 400% of the federal poverty line for your family size. There are other eligibility criteria based on your marital status, your state, and the number of dependents you have.

The other group that can deduct their insurance premiums is self-employed individuals. People who are self-employed and canât get insurance through an employer or spouse are allowed to deduct 100% of their private health insurance premium.

While the average person probably canât deduct their entire health insurance premium, certain medical expenses can be deducted from your federal income taxes. Next, weâll go over the general guidelines for tax deductible medical expenses.

Can I Claim Medical Expenses

Based on the 2021 tax rules, the IRS, “allows taxpayers to deduct the total qualified unreimbursed medical care expenses for the year that exceeds 7.5% of their adjusted gross income “. For example, say your AGI is $50,000 and your medical expenses are $6,000. Since 7.5% of your AGI is $3,750, you can deduct $2,250.

Also Check: When Can I Cancel My Health Insurance

How To Calculate Your Health Care Deductions

Most people dont accrue enough medical expenses to make health care deductions worth it.

Remember that a standard deduction is more than $12,000 for individuals and nearly $25,000 for joint filers. Plus, your eligible health care costs must exceed 7.5% of your AGI in 2020 and 10% in 2021.

However, if you do have enough medical expenses, heres how calculating health care deductions work.

Lets say you have an AGI of $100,000. So, 7.5% percent of the AGI is $7,500. Any qualifying medical and health care costs beyond that amount are tax deductible.

If you have $15,000 in qualified expenses, you can deduct $7,500 from your taxable income when you file your taxes if you dont take the standard deduction.

If you have a health plan from the health insurance marketplace, sometimes known as Obamacare, you shouldnt deduct money for premium tax credits. Those plans often have subsidies like tax credits that reduce the cost of Affordable Care Act plans. You shouldnt include those subsidies in your deductions.

Are Employee Paid Health Insurance Premiums Tax Deductible

As per Section 80D of the Income Tax Act, the premium of a health insurance coverage can be deductible from taxable income. Individuals can claim a tax deduction of Rs 25,000 on insurance payments for self, spouse, and dependent children.

Not just individuals, employees of an organization can enjoy analogous benefits. The legislation also states employers can claim relief on paying health insurance premiums.

You May Like: Does Health Insurance Cover Pregnancy

The Private Health Insurance Rebate: Save Up To 33%

Health insurance isn’t tax deductible, but you can get cash back in the form of the private health insurance rebate. The rebate is the government’s way of rewarding you for buying private health cover.

Every year you hold cover, you get a little bit back from the government ideally leading to a juicy refund . If you earn under $140,000, you can get back up to 33% of your health insurance spending.

If you’re eligible, you can get it one of two ways: by getting a discount on your premium, or by claiming it back on your tax. Happily, you can claim for any policy, whether that’s extras cover, hospital cover or a combined package.

Health Insurance Isnt Tax Deductible In Australia But It Can Be A Tax Offset Here Are 4 Ways To Pay Less

Were reader-supported and may be paid when you visit links to partner sites. We dont compare all products in the market, but were working on it!

What you need to know

- Private health insurance is not tax deductible in Australia, but there are other ways to save.

- The private health insurance rebate offers up to 33% back on your premiums at tax time.

- If you earn over $90k, health insurance will help you avoid the Medicare Levy Surcharge

Read Also: How Do I Apply For Husky Health Insurance

Are Healthcare Insurance Premiums Tax Deductible

The short answer is maybe. It depends on a few factors, but mainly whether or not your healthcare expenses for the year exceed 7.5% of your adjusted gross income. Your adjusted gross income is the total of all of your sources of income, including your wages, capital gains, dividends, rental income, spousal support, and more, but minus deductions from your income like student loan interest payments, retirement plan contributions and more.

Figuring out your AGI and then if your healthcare expenses exceed 7.5% of that will help you answer the question are health insurance premiums tax deductible? for your personal situation.

Give A Protected Future To Your Employees:

Employee medical insurance policies are tax deductible so they are beneficial for both employers and employees. Itâs a solicited way to boost employee morale while reducing overall tax liability for organizations.

and get a host of added features like free primary care, unlimited access to specialized doctors, and more.

Don’t Miss: Is It Too Late To Change Health Insurance

Why Is Private Health Insurance A Good Investment For Businesses

Private health insurance policies for employees prove to be an excellent investment for many types of business. Offering private healthcare to employees ensures that they have swift access to high-quality treatment in the event of an illness or injury, meaning fewer days off work, higher levels of productivity and greater financial savings in the long run.

In addition, private health insurance is a highly attractive benefit for prospective employees during the recruitment process. In workplace cultures that increasingly value wellness and work-life balance, non-financial incentives such as these can cause somebody to accept one job over another meaning that a benefit like private health insurance can help you to recruit and retain the best talent in your industry.

Details Of Medical Expenses

Acoustic coupler prescription needed.

Air conditioner $1,000 or 50% of the amount paid for the air conditioner, whichever is less, for a person with a severe chronic ailment, disease, or disorder prescription needed.

Air filter, cleaner, or purifier used by a person to cope with or overcome a severe chronic respiratory ailment or a severe chronic immune system disorder prescription needed.

Altered auditory feedback devices for treating a speech disorder prescription needed.

Ambulance service to or from a public or licensed private hospital.

Artificial eye or limb can be claimed without any certification or prescription.

Assisted breathing devices that give air to the lungs under pressure, such as a continuous positive airway pressure machine or mechanical ventilator.

Audible signal devices including large bells, loud ringing bells, single stroke bells, vibrating bells, horns, and visible signals prescription needed.

Baby breathing monitor designed to be attached to an infant to sound an alarm if the infant stops breathing. A medical practitioner must certify in writing that the infant is at risk of sudden infant death syndrome prescription needed.

Bathroom aids to help a person get in or out of a bathtub or shower or to get on or off a toilet prescription needed.

Bone conduction receiver can be claimed without any certification or prescription.

Breast prosthesis because of a mastectomy prescription needed.

You May Like: Does Health Insurance Cover Gynecologist

Compare The Medical Expense Tax Credit To A Health Spending Account

The METC and HSA are two alternatives to reduce your personal medical expense costs. They both utilize aspects of tax planning. You cannot use both as that is “double dipping”. The size of the METC is dependent on your medical expenses, net income, and province of residence. In some cases, you may receive little to no tax credit at all. On the other hand, an HSA can eliminate 100% of the taxes on your medical expenses . It does this by turning after-tax personal medical costs into before-tax business deductibles. This process occurs through your business, which is why the plan only works for small business owners.

Want to see a mathematical comparison on savings using the two methods? Read this article.

Do I Take The Standard Deduction Or Itemize My Expenses

Whether you take the standard deduction or itemize depends on your financial situation. Choosing one or the other is not permanent â you can change every year when you file your taxes. To determine what would work best for you, we suggest looking at the Schedule A . Add up all eligible itemized expenses, including medical, and compare that number with the standard deduction that would apply to you. If your itemized expenses total more than your standard deduction amount, you would save money by taking the time to itemize. You can also use this IRS tool to help you determine what medical expenses are deductible.

Also Check: Who Accepts Humana Health Insurance

Health Insurance Tax Credits For Employers

In addition to the standard tax deductions discussed above, some small employers may qualify for a health coverage tax credit.

Introduced as part of the Affordable Care Act , these tax credits help small businesses that offer qualified health plans through a Small Business Health Options Program Marketplace.

You can take advantage of these tax credits if you meet all four of the following requirements:

- Have fewer than 25 full-time equivalent employees

- Pay your employees an average wage of $56,000 or less each year

- You offer a group health insurance policy and cover at least 50% of the premium costs

- You purchased the policy through the SHOP Marketplace

Qualifying employers may receive up to 50% of the contribution made toward employee premium costs. Youll receive the highest tax credit benefit if you have less than 10 employees and pay them an average of $27,000 or less.

Thanks to amended IRS rules, you may still be eligible for a small business health tax credit if youre located in a county without a SHOP Marketplace.

Does Private Health Insurance Need To Be Reported To Hmrc

At the end of the financial year, you will need to fill out a P11D form (known as an expenses and benefits form for each of your employees. This itemises any benefits that they have received from your business in addition to their salary, and health insurance must be included in this if it has been provided.

Also Check: Does Insurance Pay For Home Health Aides

Are Health Spending Accounts Legal

Yes an HSA is legal in Canada – as long as the guidelines are adhered to. To properly satisfy the conditions set forth by CRA, make sure you choose a reputable provider and understand what you are purchasing.

Note: A Health Spending Account only works for incorporated business owners, such as an incorporated contractor, Professional Corporations, or incorporated small business with arms length employees. There are more eligible businesses, these are just a few examples.

What Health Benefits Aren’t Tax

While there are many tax-deductible health benefits and expenses, not everything is considered tax-deductible by the IRS.

Employees cant deduct any expenses you reimbursed them for. Thats because theyre essentially being paid back for those expenses.

This isnt a problem with an HRA, as youre reimbursing your employees using pre-tax money, which means that it isnt reported as income, and therefore no taxes are paid on it. This is as long as your employees have health insurance. Plus, as discussed earlier, youll be able to deduct the reimbursements you provided to your employees.

However, if you decide to reimburse employees using a health benefit stipend, that reimbursement is taxable and cant be deducted. Health stipends are considered taxable income for your employees, much like a salary. As a result, your employees pay income tax, and you wont get tax benefits as an employer.

So why would you offer a taxable health benefit like an employee stipend if you dont get to write the reimbursement off? Health stipends are a great option for organizations with employees who receive premium tax credits, as theyll still be able to use their credits and the stipend benefit. It also allows for more flexibility, as there are fewer restrictions on eligible expenses.

If youre interested in offering your employees a health stipend, PeopleKeep can help. Our WorkPerks stipend administration software makes it easy to provide custom perks to your employees.

Don’t Miss: How To Find Out If I Have Health Insurance