Will I Still Have Copays After My Out

Typically, you will not have to still pay copays after you meet your out-of-pocket maximum. However, there can occasionally be discrepancies on this with individual plans. Make sure you familiarize yourself with the details of your health plan to understand your financial obligations for your healthcare. And again, the HealthSherpa Consumer Advocate Team is always on-hand to go over any details about your plan while you shop and after you enroll.

The Coinsurance Rate Has Regularly Applied The Deductible

Most medical insurances approaches necessitate that a patient compensation a level of the expense of covered wellbeing-related administrations after the yearly deductible has been met. This is coinsurance. Coinsurance frequently sums to about 20% to 30% of what the wellbeing plan affirms. The wellbeing plan will at that point pay the excess 70% to 80%.

The coinsurance rate has regularly applied the deductible. Which should pay to precede the insurance agency paying anything out on their end. Exclusively after the deductible is settled completely will you offering the expense of your consideration to your wellbeing plan by paying coinsurance (this doesnt have any significant bearing to administrations that are either canvassed in full without a deductible

Coinsurance is the thing that you as the patientpay as your offer toward a case. Coinsurance is a type of cost-sharing or parting the expense of assistance or medicine between the insurance agency and purchaser. You ordinarily pay coinsurance subsequent to meet your yearly deductible

Note that numerous protection plans incorporate free preventive consideration, for example, your yearly physical, so your safety net provider takes care of the full expense and coinsurance doesnt matter.

Hmo And Types Of Managed Care

The HMO was one of the early types of managed care it was distinguished by a major commitment to preventing illnesses rather than simply treating them. Most managed care systems have some of the elements of the HMO. The below-listed items provide descriptions of HMO and the other major types of managed care.

You May Like: What To Do When You Lose Your Health Insurance

How Does A No

The biggest difference between zero-deductible health insurance and other types of health insurance is when the insurer starts paying for covered medical services. With a no-deductible plan, cost sharing starts right away, but with other plans, cost sharing starts after you pay out of pocket up to the amount of your deductible. This timing can affect the total cost that you’ll pay each year for care.

The structure of the health insurance plan will be similar to the structure of plans that do have deductibles, and there will still be some out-of-pocket costs and other standards. Here are the basics of how no-deductible plans work:

- High monthly rates: No-deductible plans will have higher monthly premiums, but the full cost-sharing benefits will kick in on day one.

- Payments for health care: You’re also responsible for the cost of copayments or coinsurance, which is the portion you pay for services like visiting your doctor. There’s also an out-of-pocket maximum, which is an annual cap on what you spend for in-network copays and coinsurance.

- Policy exclusions: Even with a no-deductible plan, you could still be fully responsible for out-of-network care or uncovered health care services. Check your plan carefully for any exclusions and specifically the type of provider network for that policy.

What Payments Does Cost Sharing Apply To

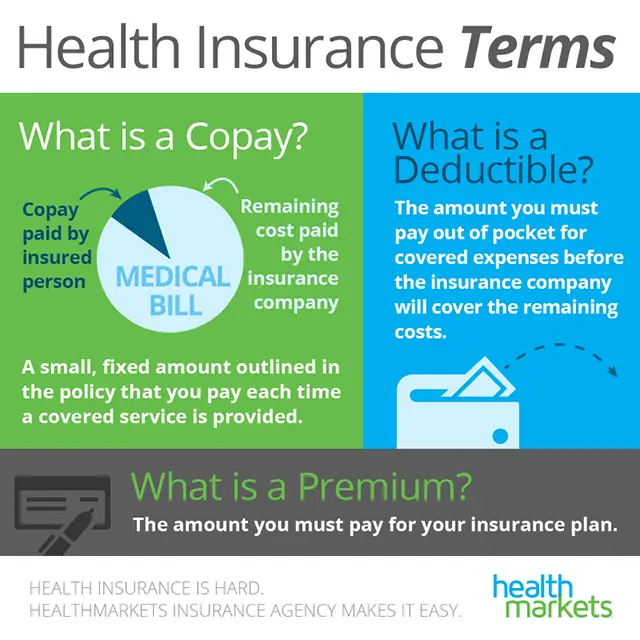

Lets look at some of the terms youll come across with your health insurance plan, and how they relate to cost sharing:

- Deductible: This is a cost that you need to meet before your insurance kicks in, and starts splitting costs with you. So if you have a $2,000 deductible, youll have to spend $2,000 on covered services yourself before insurance kicks in. Essentially, this is a portion of cost sharing that you shoulder on your own.

- Copayments: Copayments are flat fees set by the insurance company for certain covered services or products. Your insurance company may have a plan that says your copayment for a routine doctors office visit is $20 and a certain prescription you need has a copayment of $5.

- Coinsurance: The biggest difference between coinsurance and copayments is how the cost sharing is done. In the case of coinsurance, the cost is in the form of a percentage. So if your individual health insurance plan requires a 20% coinsurance payment, that means you pay 20% of the bill, and your insurance company pays 80%.

And in almost all cases, cost sharing does not refer to:

Each plan has its own terms and limitations, so be sure to check the official plan documents to understand how that specific plan works.

Read Also: When Does A Company Have To Offer Health Insurance

What Does No Charge After Deductible Mean

For policies with a set deductible amount, the consumer will pay out of pocket for their health care up until the total amount spent reaches the deductible amount. After this threshold amount is reached, the insurer will pay the remaining cost of covered medical services for the rest of the year. For example, if you have a $1,000 deductible, you could pay the first $1,000 of a $5,000 medical bill. The insurer would pay the remaining $4,000.

Editorial Note: The content of this article is based on the authorâs opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

What Happened When The Trump Administration Cut Off Funding For Csr

There was legal uncertainty surrounding cost-sharing subsidies starting in 2014, but it took on new importance under the Trump administration. In 2014, House Republicans brought a lawsuit against the Obama administration, alleging that billions of dollars in funding for the cost-sharing subsidies had never been allocated by Congress, and was thus being distributed illegally by HHS .

In 2016, a district court judge sided with House Republicans, ruling that the cost-sharing subsidies were illegal and could not continue. The ruling was stayed, however, to allow the Obama administration to appeal, which they did. Throughout that process, cost-sharing reduction money continued to flow from HHS to health insurers across the country.

Once Trump won the presidency, the issue took on a new urgency, given the GOPs efforts to eliminate the ACA. For the first several months of Trumps presidency, the lawsuit over cost-sharing subsidies was pended. But in October 2017, the Trump administration announced that CSR funding would end immediately. That meant that insurers would not receive reimbursement from the federal government for CSR benefits provided in the final quarter of 2017 and beyond.

Read Also: Can I Pay For My Employees Individual Health Insurance

Medical Expenses Are Covered

When you choose health insurance, you can get the best health care without any trouble and financial burden. Your high medical costs are covered such as daycare procedures, ambulance charges, hospitalization expenses, domiciliary expenses, etc. This would let you pay attention to your quick recovery rather than focusing on how you will pay for the medical bills.

Fffs: Fixed Fee For Services

Original Medicare is an excellent example of this type of care. The Centers for Medicare and Medicaid sets prices for services that it will pay to medical care providers that accept Medicare. The subscriber may have to pay the balance, or the provider may accept the Medicare payment in full and final settlement of the claim.

Recommended Reading: Where To Go If You Have No Health Insurance

What Does Deductible Mean In Health Insurance

Theres nothing as important as your health. In the case of an emergency, a health insurance policy can ensure that you dont end up in a tricky financial situation. Just like any other sector, the insurance industry has its own jargon. There are terms that you are likely to stumble over and wonder what they mean until you speak to a professional.If you want to sign up for health insurance, you will not miss the term deductible on that document. Its a complex term that needs your attention to avoid getting shocked later on. Lets uncover the basics.

Definition

An insurance deductible is an amount you must pay out of your pocket before the insurance coverage starts to pay for your medical expenses.Lets assume you have an insurance plan with a deductible of $1,000. During your stay in the hospital, your bill is $20,000. You will be required to pay the first $1,000 out of your pocket and then your health plan will take over and pay benefits for the remaining amount, according to the terms and conditions of the policy.The idea behind the deductible is to keep premiums low via cost-sharing and by decreasing the number of small claims and unimportant visits to the doctor. As you would expect, those whose health coverage includes a deductible will find no need to see a doctor for every cough, runny nose, bruise, or bump.

How it works

Your deductible amount

Choosing a deductible

Benefits Of Health Insurance Plans

As we talk about health insurance plans, you may have a thought that how can health insurance be beneficial for you. Not only health insurance policies work as a protective measure for your family as well as yourself from the financial expenditures but it also has many other benefits.

When you sign for a health insurance, all your visits to the doctor, emergency room trips and treatments from specialists are paid by the insurance company. It depends on which health insurance you choose. There are certain health insurances which cover hospital bills for big hospitals in case of surgery and major treatments.

Here are five major advantages of signing for a Health Insurance Plan:

Don’t Miss: What Type Of Health Insurance Do I Need

What Is Coinsurance And How Does It Work

Coinsurance is what youthe patientpay as your share toward a claim. Coinsurance is a form of cost-sharing, or splitting the cost of a service or medication between the insurance company and consumer. You typically pay coinsurance after meeting your annual deductible. Let’s use 20% coinsurance as an example.

Does The Government Subsidize Healthcare

The Affordable Care Act includes government subsidies to help people pay their health insurance costs. And the premium tax credit, aka premium subsidy, is still available for eligible enrollees who purchase coverage through the exchange in every state and DC. The premium tax credit/subsidy is complicated.

Also Check: How To Extend Health Insurance

What Is Cost Sharing

Cost sharing is the concept of sharing medical costs, some of which you pay out of pocket and some which your health insurance company covers.Cost sharing means that you will not generally be paying for all of your covered medical expenses on your own, and that your individual health insurance plan may help you with these incurred expenses. Think of cost sharing as a product youre buying with health insuranceyou pay a monthly premium in order to have the benefit of cost sharing when you do incur medical expenses.Keep in mind, though, that your health insurance plan might not cover every doctor visit or medical service. If you get a service thats not covered, then instead of paying a cost-sharing amount , you may have to pay the entire amount.At the same time, your health insurance may offer some services that may not involve cost sharing at all. For example, many individual health insurance plans offer flu shots every year, free of charge.

What Metal Tier Has No

When buying a policy through the health insurance marketplace, no-deductible plans can be found in all metal tiers, including Bronze, Silver, Gold and Platinum.

The general rule of thumb is that Gold and Platinum plans have lower deductibles than Silver or Bronze plans. However, we have recently seen new plans added in some locations, including Bronze and Silver policies with zero deductible. These plans are categorized in a lower tier because of a different aspect of coverage, such as a high out-of-pocket maximum, a limited network, high coinsurance or something else.

For example, when comparing select policies for no-deductible health insurance in Texas, the copay for an in-network X-ray is $70 with a Gold plan, $80 with a Silver plan and $140 with a Bronze plan.

Read Also: How To Apply For Health Insurance As A College Student

What Would Medicare For All Do To The Economy

Medicare for All could decrease inefficient job lock and boost small business creation and voluntary self-employment. Making health insurance universal and delinked from employment widens the range of economic options for workers and leads to better matches between workers skills and interests and their jobs.

How Does Health Insurance Work

Individual health insurance may seem a bit confusing to get a handle on.

- What do all the numbers mean?

- How do you make payments?

- How much money are you really saving by purchasing an individual health insurance plan?

The basic idea behind health insurance is that you pay a monthly premium in order to have health insurance for when you do get sick, or need some sort of medical service. Health insurance should allow you to have access to medical care, and help you pay for these services provided by practitioners such as doctors, or institutions like hospitals.Cost sharing is a major element of your typical individual health insurance plan, and it refers to the costs split between you and your health insurance company.

Read Also: What Is The Best Affordable Health Insurance

How Does A Copay Work

For most insurance plans, there is one copay amount for your primary care physician, and then another for any specialists. There are also separate copay amounts for emergency room care, urgent care, and other services ranging from speech therapy to physical therapy.

Be sure to check the details of your specific health plan, though. Some plans may allow you to pay a copay for some healthcare services even before meeting your deductible.

To break things down further, your deductible is the amount you must first pay out-of-pocket for your healthcare before your health insurance policy begins to pay for some or all of your care. Once youve met your deductible, you will only pay copayments and coinsurance amounts for your healthcare. And once youve met your annual out-of-pocket maximum, your health insurance plan will cover all your covered medical care.

When you see an in-network provider, that means your insurance company has come to an agreement with that provider on a fixed amount you will owe to see them. If you have not met your deductible, and your plan requires that you meet your deductible first, you will pay the maximum agreed upon amount for that visit. Once you have met your deductible, you will just pay your copay. A copay is always less than the maximum allowable amount for a given kind of visit.

How To Lower Coinsurance Rates

Theres a way coinsurance rates can be lowered. Cost Sharing Reduction subsidies are available to health insurance customers that purchased a silver-level plan through the public marketplace, meet the criteria for a premium tax credit, and who earn between 100% and 250% of the Federal Poverty Level.

These subsidies reduce coinsurance, copayments, deductibles and out-of-pocket maximums by increasing the actuarial value of the plan .

There are plans that offer 100% after deductible, which is essentially 0% coinsurance. This means that once your deductible is reached, your provider will pay for 100% of your medical costs without requiring any coinsurance payment.

Read Also: Is Dental Insurance Included In Health Insurance

Quick Facts About Coinsurance

There are many variables to consider when shopping around for the right health insurance plan, and coinsurance is just one of the many factors at play. The better you understand coinsurance and how it works, the better chance youll have at finding an affordable health insurance policy thats right for you.

HealthMarkets is dedicated to helping individuals learn more about their healthcare options. If youd like to know more about coinsurance and how to find a plan that best fits your budget, give us a call at or find a licensed agent near you today.

HMIA002139

https://www.nerdwallet.com/blog/health/copay-vs-coinsurance/ | https://www.moneyunder30.com/understanding-your-health-insurance | https://www.hhs.gov/healthcare/about-the-aca/benefit-limits/index.html | https://www.healthreformbeyondthebasics.org/cost-sharing-charges-in-marketplace-health-insurance-plans-answers-to-frequently-asked-questions/ | https://www.kff.org/health-reform/issue-brief/explaining-health-care-reform-questions-about-health/ | https://www.upi.com/Health_News/2013/03/27/US-average-coinsurance-rate-20-percent/28831364411100/ | https://www.kff.org/report-section/ehbs-2014-summary-of-findings/

Types Of Health Insurance

Your out-of-pocket expenses will vary based on the type of health insurance you get.

-

HMO: Lower premiums, but no out-of-network coverage. You’ll also need to pay to see your primary care doctor just to get a referral to see your specialist.

-

PPO: Higher premiums, but some coverage available out of network. No referrals required to see your specialist.

-

EPO: Combines features of HMOs and PPOs by offering specialist visits without referrals but no out-of-network coverage.

Learn more about the difference between HMOs, PPOs, and EPOs.

Also Check: Are Health Insurance Companies Open On Weekends

How Us Health Insurance Works

Health care in the United States can be very expensive. A single doctors office visit may cost several hundred dollars and an average three-day hospital stay can run tens of thousands of dollars depending on the type of care provided. Most of us could not afford to pay such large sums if we get sick, especially since we dont know when we might become ill or injured or how much care we might need. Health insurance offers a way to reduce such costs to more reasonable amounts.

The way it typically works is that the consumer pays an up front premium to a health insurance company and that payment allows you to share “risk” with lots of other people who are making similar payments. Since most people are healthy most of the time, the premium dollars paid to the insurance company can be used to cover the expenses of the small number of enrollees who get sick or are injured. Insurance companies, as you can imagine, have studied risk extensively, and their goal is to collect enough premium to cover medical costs of the enrollees. There are many, many different types of health insurance plans in the U.S. and many different rules and arrangements regarding care.

Following are three important questions you should ask when making a decision about the health insurance that will work best for you: