Am I Eligible For A Health Insurance Subsidy

Who is this for?

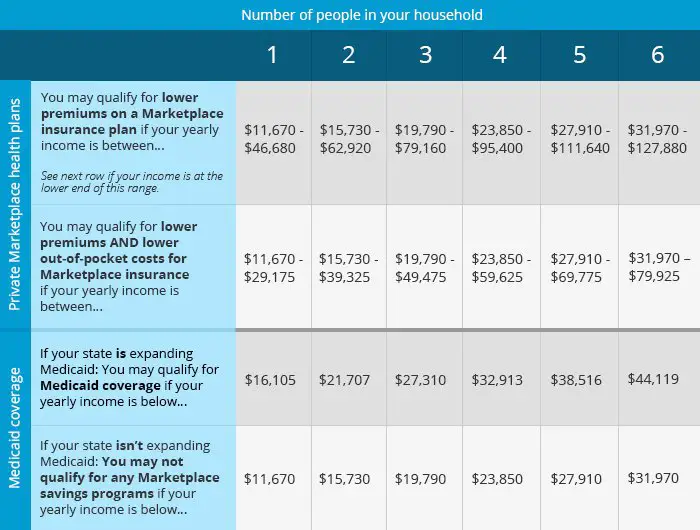

If you need to buy your own health insurance, this explains how to find out if you can get help paying for it.

With few exceptions, the Affordable Care Act requires everyone to have health insurance. If you’re insured through your employer, or eligible for programs like Medicare or Medicaid, you’re covered.

If not, you’ll need to buy your own health insurance. Otherwise you’ll have to pay a penalty.

Do you already pay for your own insurance? Are you shopping for the first time? Either way, the good news is you may be able to get help paying for individual health insurance. This help is called a subsidy.

Example: Bobs Premium Changes From 2014 To 2021 If He Gets Annual Raises That Keep His Income At 200% Of The Poverty Level

Bobs MAGI is equal to 200% of poverty. In this example, were going to assume hes received a pay raise each year in order to keep his income at 200% of the poverty level. In 2014, his applicable percentage was 6.3%, for 2018, it was 6.34%, for 2019, it was 6.54%, for 2020 it was 6.49%. For 2021, it was initially 6.52%, but the ARP has reduced it to just 2%. That means he only has to pay 2% of his income for the benchmark plan instead of 6.52%, and his subsidy amount will be larger to make up the difference.

For subsidy purposes, poverty level determinations are based on the year during which open enrollment begins. Since the open enrollment period for 2021 coverage took place in 2020, the government uses 2020 poverty level guidelines for determining subsidy-eligibility for any plans that have 2021 effective dates. .

2014: $1,448 in premiums, with an income of $22,980

If Bob was earning 200% of poverty level when he got his 2014 plan, his MAGI was $22,980 and his applicable percentage was 6.3 percent. So he had to pay $1,448 in annual premiums in 2014 . His subsidy paid the rest of the premium, assuming he selected the second-lowest-cost silver plan .

2018: $1,529 in premiums, with an income of $24,120

So while his net premium had increased, his income was also increasing .

2019: $1,588 in premiums, with an income of $24,280

2020: $1,621 in premiums, with an income of $24,980

2021: $1,664 in premiums, with an income of $25,520

What Is Household Income

Household income is generally defined as the combined gross income of all members of a household above a specified age. For some usages of the term, individuals do not have to be related in any way to be considered members of the same household. Household income is an important risk measure used by lenders for underwriting loans and is a useful economic indicator of an area’s standard of living.

You May Like: Starbucks Insurance Part Time

Lawsuit And New Hhs Guidance Protect People Whose Income Might Dip Below The Poverty Level

Starting with 2019 coverage, if an applicant in a state using the HealthCare.gov exchange attested to having an income that would have made them subsidy-eligible, and the electronic data the government already has on hand indicated that the persons income was likely below the poverty level , the exchange would request additional documentation from the applicant to verify the attested income.

If the applicant couldnt provide documentation to support the attested income, the exchange would make a subsidy eligibility determination based on the income data that the government already had in other words, the applicant would be found to be ineligible for premium subsidies and cost-sharing subsidies. This was detailed in the 2019 Benefit and Payment Parameters, finalized in April 2018.

But in March 2021, a court overturned four provisions that had been in the 2019 Notice of Benefit and Payment Parameters including the rule that had required income verification when an applicant projected income above the poverty level but federal data indicated an income below the poverty level.

People whose income ends up being below 100% of the poverty level generally do not have to repay advance premium tax credits when they file their tax return. But as noted below, that only applies if the applicant provided information to the exchange in good faith, without intentional or reckless disregard for the facts.

Here are some additional tips to keep in mind when youre enrolling:

Applicable Percentages Increased Each Year From 2015 Through 2017

Then in July 2014, the IRS released Revenue Procedure 2014-37, in which they explained the changes to the percentage of income that subsidy recipients would have to pay if they selected the second-lowest-cost Silver plan in the exchange in 2015.

A few months later, in November 2014, the IRS published Revenue Procedure 2014-62, which laid out the changes to the applicable percentage for 2016. And in 2016, they published Revenue Procedure 2016-24, which detailed the changes for 2017.

For 2015, 2016, and again for 2017, there was a slight increase in the applicable percentage numbers. Because the applicable percentage climbed each year, there was often an assumption that everyone who gets subsidies was paying more for their health insurance in each successive year. But thats not necessarily the case, as well see in a minute.

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

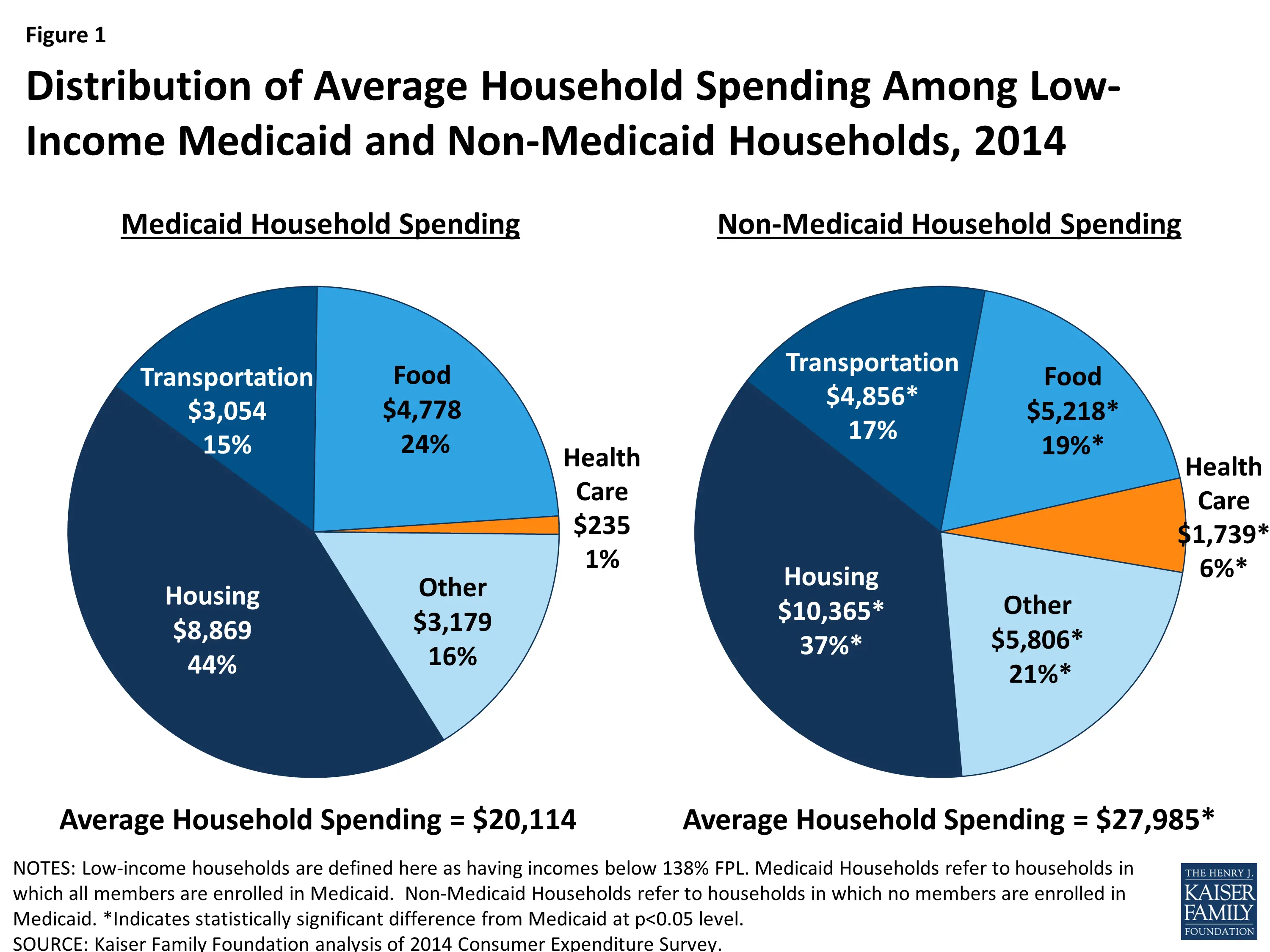

Average Household Health Insurance Expenditure

According to the U.S. Bureau of Labor Statistics, the average American household spent $4,928 on health care in 2017. This represents 8 percent of the total average household expenditure of $60,060. Out of this total expenditure for health care, almost 70 percent, or $3,414, was spent on health insurance. This was about 6 percent of total household expenditures.

Making Sense Of Applicable Percentages

Those numbers might make your eyes glaze over. But the following examples will show how they actually affect premiums from one year to the next. The first set of examples show how Bobs premiums changed from 2014 to 2021, if his income increases each year to keep pace with increases in the federal poverty level. Below that, youll see what happens if Bobs income hasnt increased since 2014. And in both cases, well show how the American Rescue Plan reduces the amount that Bob has to pay for his health coverage in 2021, making coverage more affordable than its been in any of the previous years. Yes, theres math involved, but never fear its pretty straightforward.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

How The Applicable Percentage Is Calculated Its Changed A Bit In Recent Years

The general idea behind the adjustment to the applicable percentage table is to keep up with changes in premium growth as they relate to changes in income. If health care costs increase faster than income, we all have to pay a larger chunk of our income for health care. But if the economy does well and the ACAs efforts to curb healthcare spending are successful, its also possible for the applicable percentage to decrease as was the case for 2018 and for 2020.

The formula for the adjustment to applicable percentage is just premium growth since 2013 divided by income growth since 2013. But the methodology for calculating each of those numbers has changed over time.

Premium growth used to be based on average per-enrollee premiums for employer-sponsored plans, in terms of how much those premiums had changed since 2013. But for 2020, HHS finalized a methodology change that incorporates premium changes in the individual market, as well as premium changes for employer-sponsored plans.

This was widely expected to result in an increase in applicable percentages for 2020, but when the numbers were published in July 2019, the applicable percentages for 2020 were lower than they had been for 2019 .

To Qualify For An Obamacare Tax Credit You Have To Estimate Your Household Income For The Following Year In Your Application

By Stephen Fishman, J.D.

To qualify for an Obamacare tax credit, you have to estimate your household income for the following year in your application. You can base this amount on your most recently filed tax return, taking into account any changes you expect for the following year. When you fill out your application, you must use your “modified adjusted gross income” .

For the great majority of self-employed individuals, their MAGI is the same as their adjusted gross income , which is shown on line 37 of your IRS Form 1040.

Your MAGI consists of all your income minus certain deductions.

Don’t Miss: Starbucks Health Care Benefits

More Options For Affordable Health Insurance

With the passage of the federal COVID-19 relief package, the American Rescue Plan Act, Covered California opened a special enrollment period that runs through the year, allowing people to sign up and make use of federal COVID-19 relief dollars designated for health coverage aid. This savings is on top of subsidies already provided to some low-income and middle-income Californians through the Affordable Care Act.

The American Rescue Plan Act expands eligibility for federal assistance by setting a maximum for how much of their own money families and individuals can spend on health coverage 8.5% of their income. This means you could save hundreds of dollars on the cost of your Covered California plan. This enhanced federal aid runs through the end of 2022.

If you are an American Indian or an Alaskan Native and make between 0-600% of the FPL, you typically qualify for either American Indian / Alaskan Native Zero Cost Share or AIAN Limited Cost Share.

More Help Before You Apply

-

Estimating your expected household income for 2021

- You can probably start with your households adjusted gross income and update it for expected changes.

- Learn more about estimating income, and see what to include.

Including the right people in your household

You May Like: Starbucks Employee Health Insurance

The Average Cost Of Insurance For A Married Couple

The cost of health insurance can vary widely for American households depending on whether household members are eligible for subsidized premiums. Even with subsidies, the add-on costs for health insurance can take a significant chunk out of the household budget. There are several items to consider when figuring the percentage of income that people spend on health insurance.

TL DR

Data from the U.S. Bureau of Labor Statistics shows that Americans spent on average $3,414 a year on health insurance in 2017. This worked out to around 6 percent of all their household’s expenditures.

Other Magi Factors To Keep In Mind

MAGI is based on household income, but there are different rules for how a child’s income is counted towards a family’s household MAGI depending on whether the eligibility determination is for Medicaid/CHIP or for premium subsidies.

If a married couple wants to apply for premium subsidies in the exchange , they have to file a joint tax return. But if a married couple that lives together applies for Medicaid, their total household income is counted together regardless of how they file their taxes.

Premium subsidies are a tax credit, but they differ from other tax credits in that you canand most people dotake them up-front instead of having to wait to claim them on your tax return . That also means when you’re enrolling in a health plan during open enrollment , you’ll be using a projected MAGI, based on what you estimate your income to be in the coming year.

If your income is steady from one year to the next, you can reasonably estimate your MAGI for the coming year based on your past year’s tax return. But many people who purchase their own health insurance are self-employed and their income varies from one year to anotherwhich can make it challenging to accurately project the coming year’s MAGI.

Once the year is underway, if you start to notice that your actual income is diverging significantly from what you projected, you can report your updated income to the exchange and they can adjust your premium subsidy amount in real-time .

Also Check: Starbucks Health Insurance Plan

Income Poverty And Health Insurance Coverage In The United States: 2020

The U.S. Census Bureau announced today that median household income in 2020 decreased 2.9% between 2019 and 2020, and the official poverty rate increased 1.0 percentage point. Meanwhile the percentage of people with health insurance coverage for all or part of 2020 was 91.4%. An estimated 8.6% of people, or 28.0 million, did not have health insurance at any point during 2020, according to the 2021 Current Population Survey Annual Social and Economic Supplement .

Median household income was $67,521 in 2020, a decrease of 2.9% from the 2019 median of $69,560. This is the first statistically significant decline in median household income since 2011.

Between 2019 and 2020, the real median earnings of all workers decreased by 1.2%, while the real median earnings of full-time, year-round workers increased 6.9%. The total number of people with earnings decreased by about 3.0 million, while the number of full-time, year-round workers decreased by approximately 13.7 million.

The official poverty rate in 2020 was 11.4%, up 1.0 percentage point from 2019. This is the first increase in poverty after five consecutive annual declines. In 2020, there were 37.2 million people in poverty, approximately 3.3 million more than in 2019.

Average Swiss Household Income Reaches Nearly 115000 Francs

Summary:Topics:This could be interesting, too:

The gross mean household income in Switzerland was CHF 114,984 in 2019, according to the Federal Statistical Office .

Overall, 40% of households in Switzerland had income over this mean while 60% brought in less.

73% of this income came from working, 23% came from pensions, welfare and household transfers such as alimony, and 4% from investment income.

In many places an income this high would offer a life of mild extravagance. However, in Switzerland, it disappears fairly fast.

37% went on taxes, compulsory health insurance, other unavoidable insurance and household transfers such as alimony. A further 14% went on housing and energy, 6% on food and 7% on transport, bringing the total consumed to 65%.

At this point expenditure becomes more discretionary. 6% is spent on dining and hotels, 5% on leisure and 12% on other unspecified things. At this point around 13% is left for a rainy day, amounting to average savings of CHF 14,784 a year.

For more stories like this on Switzerland follow us on and .

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

Applicable Percentages Increased For 2019 And Again For 2021 But So Did The Poverty Level And You Have To Consider Them Together

There are a lot of moving parts here. Although the applicable percentages for 2019 were the highest theyve been since this system was implemented the poverty level has continued to increase each year. So people whose incomes have not increased in several years could have found that they were paying less in total premiums in 2021 than they were paying a few years earlier, even before the American Rescue Plan boosted subsidies across the board.

Make Sure To Report Any Mid

If you or anyone in your household experiences anysignificant income changes throughout the coverage year, make sure to reportthem as soon as possible. You may become eligible or ineligible for subsidiesdepending on how your income changes.

If you experience a significant increase in youryearly income and become ineligible for subsidies, you may have to pay yoursubsidies back during tax season the following year. This is why its importantto try to be as accurate as possible when reporting your income when you applyfor subsidies at the start of the year.

Make sure to report any income changes as soon aspossible to avoid missing out on coverage or owing money at the end of theyear.

Also Check: Does Starbucks Provide Health Insurance

Panel Study Of Income Dynamics

The main part of this study uses data from the Panel Study of Income Dynamics , a nationally representative longitudinal sample of households and families interviewed annually since 1968 and biannually since 1997. The study uses data for the years 1990 to 2003, which provides the analysis 11 years of data. The PSID, the longest running U.S. panel, was specifically designed to track income dynamics over time. The survey over-samples low-income families, which is advantageous for this analysis since these households are more likely to be eligible to receive EITC. Due to its detailed information on earnings, the PSID is well-suited for calculating simulated EITC benefits through the tax simulator program NBER TAXSIM . Furthermore, by using state identifiers provided in the PSID, I am able to simulate both state-level and federal EITC benefits.Footnote 3

How Does The Calculation Work

If you’re familiar with the concept of MAGI that’s used in other settings, you know that it requires you to start with your adjusted gross income and then add back in various things, such as deductions you took for student loan interest and IRA contributions. But when it comes to ACA-specific MAGI, you don’t have to add back either of those amountsor most of the other amounts that you’d have to add to your income to get your regular MAGI.

Instead, the ACA-specific MAGI formula starts with adjusted gross income and adds back just three things:

- Non-taxable Social Security income .

- Tax-exempt interest

- Foreign earned income and housing expenses for Americans living abroad

For many people, the amounts of these three things are $0, meaning that their ACA-specific MAGI is the same as the AGI listed on their tax return. But if you do have amounts on your tax return for any of those three items, you need to add them to your AGI to determine your MAGI for premium subsidy and cost-sharing reduction eligibility.

For Medicaid and CHIP eligibility determination, some amounts are either subtracted or counted in a specific manner:

Read Also: Starbucks Health Plan