How Insurance Works

Health insurance is one of the best ways you can protect yourself and your family in case you get sick or injured and need medical care. It also helps you get the regular medical and dental care you need to stay healthy. With health insurance, you dont have to put off checkups, use the emergency room for everyday health needs, or go to community health clinics with long wait times. You can take care of your health today, instead of waiting until you have a health emergency. Thanks to the Affordable Care Act , millions of people can now afford health insurance.

The ACA also rules that everyone in the United States must have health insurance. If you dont buy health insurance, you may have to pay extra in your taxes as a penalty.

What Is An Example

For example, if you are in the HMO Value Rx plan and have a prescription for a drug on tier 3, 4, or 5 you would pay the first $200 of your prescriptions before your coverage begins. Once you pay your deductible in full, you would just have a copay for any prescriptions. $200 is the total amount of the deductible for Tiers 3, 4, and 5. You will not pay $200 per tier.

How Do Health Insurance Deductibles Work

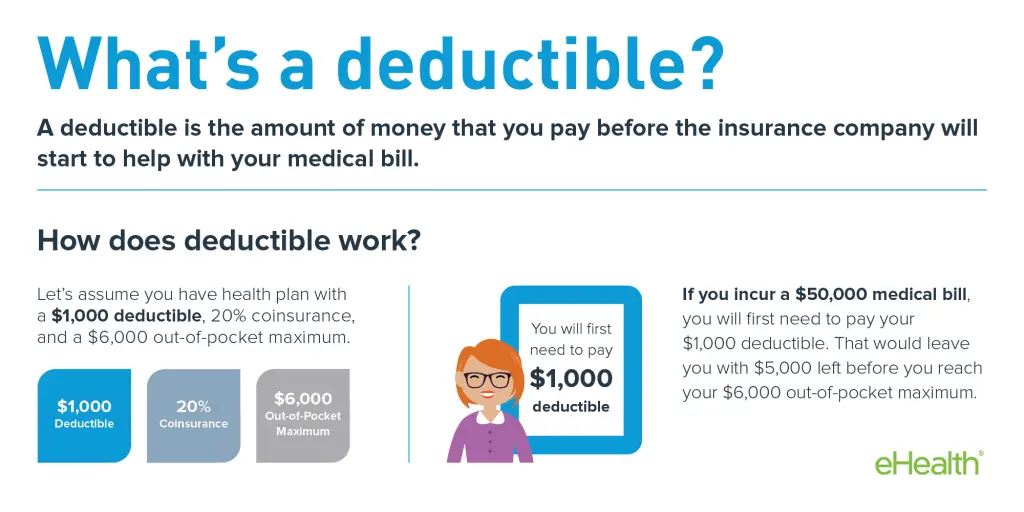

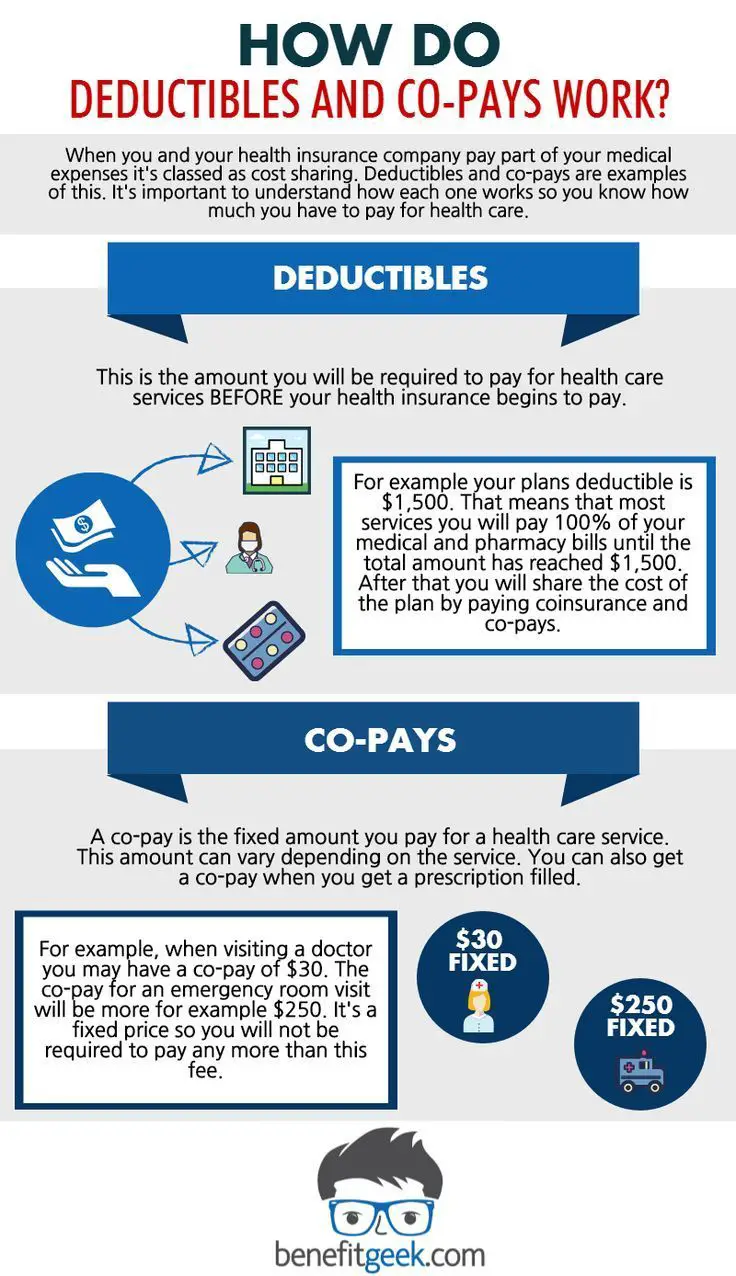

Think of a deductible in these terms: First you pay, then they pay. In other words, before your insurance company begins sharing your healthcare costs, you are required to pay 100% of your medical expenses until your deductible is met. This means that if your insurance plan has a $1,000 deductible, your insurance company will not help with your healthcare expenses until you have paid $1,000 in medical services.

Recommended Reading: Starbucks Part Time Health Insurance

What Does No Charge After Deductible Mean

This means that once you have paid your deductible for the year, your insurance benefits will kick in, and the plan pays 100% of covered medical costs for the rest of the year. After youve reached this limit, you will not have copayments, coinsurance, or other out-of-pocket costs.

In most health insurance plans, the health insurance carrier usually only pays 100% of covered medical costs once youve reached your out-of-pocket maximum. This threshold is a similar idea to your deductible, except usually higher meaning you have to spend more money on covered medical costs before reaching it.

Things To Know About Deductibles In The Health Insurance Marketplace

IMPORTANT: This page is out-of-dateGet the latest information here.

Deductibles, premiums, copayments, and coinsurance, are important for you to consider when choosing a health insurance plan. You can compare health plans and see if you qualify for lower costs before you apply. Most people who apply will be eligible for help paying for health coverage.

Here are 6 important things to know about deductibles:

You May Like: Starbucks Dental Benefits

How Health Savings Accounts Affect Your Deductible

A Health Savings Account is defined as a personal savings account utilized exclusively for qualified health insurance expenses. To qualify for an HSA, you must enroll in what is called a High Deductible Health Plan , which is an insurance plan that has a high minimum deductible for medical expenses. The benefits of creating a Health Savings Account are numerous.

Not only do they aid patients with high deductible plans to cover any out-of-pocket cost, but they also allow an annual roll-over of unspent money into your account the following year. Additionally, an HSA will cover most medical, dental, and mental health services that you may require. The convenience of owning one of these accounts is that it makes your life easier in terms of saving up money without having to deal with high tax rates. Furthermore, it provides you with a debit card that simplifies the process of paying any current expenses.

The downside of owning an HSA account is partly due to the mandated requirement of owning a high deductible plan. Under these circumstances, it could become difficult for an individual to keep up with costs, thus creating a financial burden upon them. By the same token, the monthly maintenance fees together with the tax fees of withdrawing before a certain age only adds to the burden of owning an account.

What Is A Health Insurance Deductible

A health insurance deductible is a set amount of money that an insured person must pay out of pocket every year for eligible healthcare services before the health insurance plan begins to pay any benefits.

The amount of the deductible varies depending on the health insurance plan you choose. As a general rule, the higher the monthly premium you pay, the lower your deductible will be. Your monthly premium is the amount you pay to a health insurance company to provide you with coverage.

Even after you pay off your deductible for the year, you may still have to pick up some of your healthcare costs. Most insurance plans have co-payments, which require the insured to pay a set dollar amount as their share of the cost of some services. Most also have coinsurance payments, which make the insured responsible for a set percentage of the total cost of some services.

Also Check: How To Enroll In Starbucks Health Insurance

What Is Government Health Insurance

Government Health Insurance usually refers to subsidized medical health insurance provided by the federal or state government to qualified individuals. These health insurance plans may be free or have a reduced cost to enable individuals access to health care at an affordable cost.

There are different ways you can get government health insurance, including:

High Deductible Plans And Health Savings Accounts

Another option to consider are high-deductible plans, which usually have low monthly premiums. These plans may appeal to you if youre generally healthy, dont anticipate getting sick, and dont visit the doctor often or take many prescription drugs.

While low premiums may seem initially appealing, its important to consider the amount of health care services you may need in the upcoming year both for yourself and any dependents you may have. If you do opt for a high-deductible plan, you may be eligible for a Health Savings Account . An HSA allows both you and your employers to deposit a limited amount of pre-tax dollars into this account for medical expenses. These plans usually have a high deductible amount you must meet before benefits kick in.

Recommended Reading: Does Starbucks Offer Benefits

What Deductible Plan May Be Right For Me

If you dont anticipate needing many medical expenses for the upcoming plan year, a high deductible health plan may be the most economical one for you. If you do anticipate upcoming medical expenses, a low deductible plan might help you get the most mileage out of your plan.

| High deductible health plans may appeal to those who: | Low deductible health plans may appeal to those who: |

|---|---|

| Are young and generally healthy | Are 65 or over |

When You Dont Pay The Deductible

As part of the Affordable Care Act in the United States, you dont have to pay a deductible for certain preventive care services from an in-network doctor, as long as your health plan isn’t grandfathered.

A grandfathered plan is one that was in effect prior to the Affordable Care Act that’s allowed to continue without follow all of the ACA’s regulations. If your employer has a grandfathered plan, you may have costs for some preventive care.

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

Types Of Health Insurance Plans

HMO and EPO

When you choose an HMO or EPO insurance plan, your insurance will only pay for doctors, hospitals and other care if they are part of your insurance plan’s network. If you want to use a different doctor or hospital, you will have to pay for it yourself.

HMOs also usually make you get a referral from your main doctor to see a specialist like an endocrinologist or therapist, but EPOs usually do not.

PPO and POS

With these plans, you can choose any doctor or hospital. If you pick ones that are part of the insurance plan’s network, it will cost less.

With PPO plans, you can visit any doctor without getting a referral. If you have a POS plan, you can visit any doctor within the plan without a referral, but doctors outside the plan do need a referral.

HDHP

HDHPs usually have low premiums and high deductibles compared to other plans. With an HDHP, you can use a health savings account or a health reimbursement arrangement to pay for some medical costs. This means that your employer takes some of your paycheck and puts it into a special savings account. When you need money for medical care, you can take it from that account.

Catastrophic Plan

People under age 30 or who have hardship exemptions may be able to buy a “catastrophic” plan. This plan mainly protects you from very high medical costs in the case of a major injury, such as from a car accident. The monthly premiums are low but the deductibles are high.

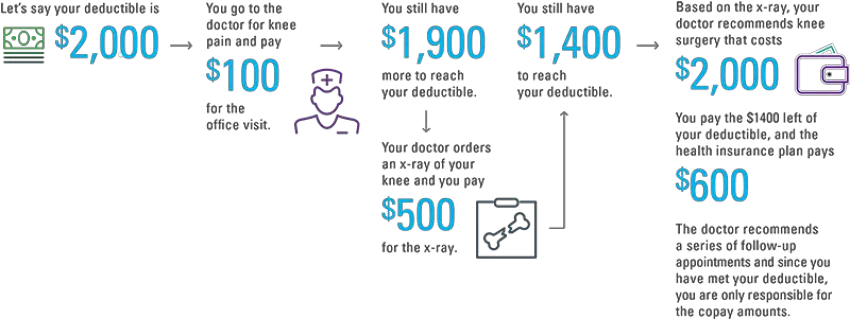

How Do Deductibles Work

The easiest way to illustrate how deductibles work would be through some simple examples.

Example 1:If person A has a deductible of $500 and required treatment equalling $4,000, then their insurance would cover $3,500 after person A met their deductible.

Additionally, further treatments during the policy would be covered in full by insurance as the deductible has already been met.

Example 2:Person B has a deductible of $2,000 and requires treatment equalling $1,000. However, later that year they require another treatment costing $5,000. In this case, person B would cover the $,1000 for the first treatment and $1,000 of the second, while the insurance would cover $4,000 of the second claim.

Its important to keep in mind that, deductibles are defined and applied differently depending on the insurance company and plan. So its always important to check both the schedule of benefits and the terms and conditions of the plan to make sure you fully understand how deductibles and any other premium saving mechanism work before you buy.

Below are some ways deductibles may differ across plans.

Recommended Reading: Starbucks Benefits For Part Time

Family Maximum Deductibles Vs Individual Deductibles

If you have a family health insurance plan through yourself or your partner, then the term cumulative deductible could be of interest to you.

In insurance plans, deductibles can be defined as individual and family. Individual deductibles focus on the amount towards a deductible that each individual in the plan has paid. When you have a family maximum deductible, once the amount that all members of the plan have paid cumulatively towards a deductible meets the deductible, then the plan considers the deductible as being met.

It does not require each individual in the plan to meet the deductible on their own first. This can help save money because every plan member’s contribution to the deductible will count.

How Do I Choose A Good Health Insurance Plan

There is no such thing as a perfect health insurance plan.

Everybody has different individualized needs and the best plan for you will depend on what your individual circumstances are.

And just as those circumstances may change over time, so will the plan that is best for you.

You should always compare different plans to figure out which one will be right for you.

Here are a few things that will help to know when comparing different plans.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

Choosing The Right Deductible Amount

The best health insurance coverage for you depends on your budget and your health history. When buying an insurance policy, youâll be able to choose your deductible amount. Many people only look at the insurance premiums when comparing health plans. But this monthly price only represents one of the expenses that contributes to how much you’ll spend on health care in a given month.

Other expenses, including your health insurance plan’s deductible and the copay and coinsurance costs, directly contribute to how much you’ll be spending overall on health insurance, as weâve seen in the example above.

Generally, individually purchased plans with a lower monthly premium will have a higher deductible, copay, and coinsurance percentage, which increases the amount you’ll spend out of pocket for medical expenses.

When choosing a health insurance company and plan, make sure to look closely at these costs. If you think you will utilize your health insurance plan frequently â because you’re managing a chronic condition or otherwise â the plan with the lowest monthly premium may not actually be the cheapest in the long run because of the high deductible.

Health insurance and life insurance work together to offer financial protection.

Health insurance can pay your medical expenses. Life insurance keeps your loved ones whole after you die.

Does Your Car Insurance Deductible Affect How Much Pay

Generally, the higher the amount you choose, the lower your insurance rate will be. For example, choosing a $2,000 deductible will have a lower premium than one with the $500 option.

You will pay $500 out of pocket in this scenario, and your insurer will pay the remaining $4,500 to cover the $5,000 of damage. You pay the deductible if you cause the accident. If you are not the cause of the accident or have accident forgiveness, your insurer may waive the fee.

Also Check: What Insurance Does Starbucks Offer

What Is A Health Insurance Policy And How Does It Work

So youve signed up for a health insurance policy, but youre still trying to figure out what it is and how much youll pay for standard procedures. Starting with the basics, health insurance is a plan that keeps you and your family protected financially against the high costs of healthcare.

Every health insurance company has an open enrollment period when you can sign up for and adjust your plan each year. Outside of that time period, you can only make adjustments to your plan when you have qualifying life events like getting married, having a child, or losing your health care coverage.

Health Insurance Deductibles And Marketplace Plans

The plans offered directly by insurers are similar to those that are available in the health insurance marketplaces that the federal government and many states have made available under the Affordable Care Act. The marketplaces offer four tiers of insurance plans:

- The Bronze plan, with the lowest monthly premium, covers an average of 60% of health costs.

- The Silver plan has a higher monthly premium and covers an average of 70% of health costs.

- The Gold plan has a higher monthly premium than the Silver plan but covers 80% of health costs.

- The Platinum plan has the highest monthly premium and the highest level of coverage at 90%.

Notably, there’s also a Catastrophic plan that has a very high deductibleâ$7,900 in 2019âfor people under age 30 or those who have a hardship or affordability exemption.

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

How Does Health Insurance Work Breaking Down The Basics

Purchasing health insurance is a significant decision. And its one that can be quite confusing and difficult. Nevertheless, buying insurance is a vital step towards a stability, as paying full price for medical procedures and doctors visits can break the bank.

Unfortunately, insurance companies offer numerous policies and use complicated jargon that makes choosing the correct health insurance very difficult.

Before you choose a certain health plan, make sure you are familiar with everything health insurance can offer you.

Like The Infographic Share It On Your Site

< /p> < br /> < br /> < br /> < p> < strong> Please include attribution to AeroflowInc.com with this graphic.< /strong> < /p> < br /> < br /> < br /> < p> < a href=https://aeroflowinc.com/copay-vs-deductible-how-does-insurance-work> < img src=https://aeroflowinc.com/app/uploads/2020/05/Insurance_Infographic_Web_Page.png alt=How Does Insurance Work? width=648px border=0 /> < /a> < /p> < br /> < br /> < br /> < p>

Information provided on the Aeroflow Healthcare blog is not intended as a substitute to medical advice or care. Aeroflow Healthcare recommends consulting a doctor if you are experiencing medical issues or concerns.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

What Has Changed In Health Insurance

The ACA changed how health insurance works. Some of the changes are:

- Parents can keep their children on their health insurance plans until they turn 26 years old.

- Insurance companies cannot turn down people who already have medical conditions, sometimes called pre-existing conditions. Before, a company could decide not to insure someone because they had a medical condition like diabetes, or because they had cancer in the past. Now, everyone must be accepted.

- Insurance companies cannot cancel peoples insurance plans if they get sick.

- Insurance companies cannot set a limit on how many medical bills they will pay for someone on their insurance plan.

- Preventive care is now free. Your insurance cannot charge you for doctor visits for babies, vaccinations, annual check-ups, screenings and other care that helps you stay healthy.

- You can buy your insurance in the Health Insurance Marketplace . Before, if your job didnt give you health insurance, you had to buy it on your own and it was usually very expensive.

- Health insurance plans now have to cover a certain amount of care. Before, each company made their own decisions about what they would pay for and to what amount.