How Much Is Health Insurance By Family Size

Not surprisingly, the more people in your family are covered by your health insurance plan, the more youre likely to pay in premiums.

The average cost for a 40-year-old couple is $954 per month or double the cost for an individual in that age range. But adding kids isnt quite as linear. A 40-year-old couple with one child under age 14 would pay an average of $1,230 per month, and a family of five would pay around $1,782.

To estimate the average family’s health insurance cost, MoneyGeek used national averages by age and added the premiums together. Actual family premiums may vary.

Average Health Insurance Premiums by Family Size

Scroll for more

- Couple w/ Three Kids $1,782

It seems logical that families would stick together on health insurance its convenient and easy to do so. And together, youre more likely to meet the out-of-pocket maximum, after which you shouldnt have to pay out-of-pocket costs for covered services.

But some families might be better off on separate plans.

For example, if one spouse can get low-cost coverage through their job, but that plan may not be open to family members , it may make sense for that spouse to use their employer-provided insurance while the rest of the family uses a Marketplace plan.

Or, if one partner has more medical needs and higher costs, they may benefit from paying more for more coverage. But if the other partner has few health needs, they may be better off in a high-deductible plan just for themselves.

Health Insurance In Germany Who Needs It

The public health insurance in Germany is known as Gesetzliche Krankenversicherung , which actually translates as statutory health insurance, and covers the vast majority of people around 90 per cent. In 2018, if your gross salary is less than 59,400 per year, or 4,950 per month, it is compulsory to be insured under a public, statutory health insurance scheme, and you must choose an insurance provider.

European Health Insurance Card In Germany

Citizens of other EU countries, countries in the EEA and of Switzerland who have a European Health Insurance Card are eligible for free access to some health treatments while visiting Germany on a temporary basis. This might be useful if you are a jobseeker coming to the country to explore the possibility of living and working there. However, this isnt a substitute for German health insurance, and as soon as you take up residence and are no longer unemployed, you must ensure you have a proper policy coverage.

You May Like: Starbucks Health Insurance Cost

Which Private Health Insurance Should I Choose

There are big differences between private health insurance companies. Each offers very different options. The best option depends on your situation.

The best way to choose private health insurance is to ask a health insurance broker. Their help is free. They get paid by the insurance companies when they bring new customers.

Insurance From Other Eu Countries

If you come from another EU country, you can use your European Health Insurance Card in Germany. If you get healthcare in Germany, your health insurance in your home country pays for it.

- If you stay in Germany temporarily, your EHIC covers you. You do not need extra health insurance in Germany.

- If you are an Erasmus student from another EU country, your EHIC covers you1, 2. You can use your EHIC card even if you study in Germany for your entire degree1. You do not need extra German health insurance unless you start working.

- When you start working in Germany, your EHIC does not cover you anymore. If you make more than 450 per month, you must get a German health insurance1.

If health insurance is cheaper in your home country, using your EHIC is cheaper than getting German health insurance. You can save a lot of money every month with the EHIC.

Useful link:

You May Like: Starbucks Health Insurance Eligibility

Does My Us Health Insurance Cover Me Abroad

Most of the time, your domestic health insurance plan doesnt provide cover abroad, but there are some cases it will for instance, for emergencies, medical evacuations or during short trips. Contacting your provider is usually the best way to find out. Sometimes, even if your insurer will cover care in such cases, you may need to pay out-of-pocket and apply for reimbursement.

Private Insurance And The Hospital

Many Canadians are surprised to learn that ambulance and emergency services are not totally free. For many, private insurance helps bridge that gap. Private insurance typically covers transport by air, sea or land.

Medicare does not pay for ambulance rides unless it is to transport patients from one hospital to another. Some provinces do limit the amount of money the hospital can charge the patient for the ambulance ride. Others, however, are uncapped. This can mean it can be very expensive to ensure emergency services save your life.

The Yukon Territory does cover ambulance rides and emergency transport for its citizens. It is the only part of Canada to do so.

If you are hospitalized with private healthcare, in some hospitals, you can stay in nicer accommodations. If these accommodations are not available at the hospital you’re in, you can be eligible to receive a certain amount of money per day for up to a certain number of days. This will be the difference in what the insurance company would have paid for private accommodations versus the cost of public accommodations.

Don’t Miss: Starbucks Open Enrollment 2020

Avoiding A Financial Catastrophe

I didnt end up picking the high-deductible plan. One big reason to have insurance is to reduce the chance of a financial catastrophe. And on that score, I was worried the HSA plan would come up short.

There are three other plans listed.

Im pretty much ignoring the EPO plan it might be a good option for someone who needs to see a doctor regularly and is willing to stay within a more limited network of clinicians. The plan doesnt offer any coverage if you go to a doctor or hospital that isnt included in its network. Its a lot more expensive than the HSA plan and wouldnt make sense for me because I dont need much care.

The two PPO plans offer a broader selection of doctors than their less expensive counterparts. The High PPOplan has a lower deductible and out-of-pocket spending limit, but its upfront cost is much higher. Since Im hoping I wont end up needing much medical care, thats not a good option for me, either.

That leaves the Low PPO plan, which is the one I ended up picking.

The PPO plans, in addition to their broader networks, will also pay for out-of-network care, though it would be really expensive. The HSA and EPO plans dont cover any care provided by doctors or hospitals that arent in their network, except in an emergency.

Absence Of Direct Costs

Identified with the lack of commercialization in medical care, the absence of cost straightforwardness makes the phenomenon of healthcare insurance challenging to implement. This is one of the biggest challenges the health insurance industry is facing. There is no uniform or speedy approach to comprehending clinical choices and the expenses related to them, and clinical charging is frequently challenging for a great many people to understand.

You May Like: Shoprite Employee Benefits

You Smoke Or Use Tobacco

If you smoke or use tobacco in some other way, that may be whats causing your health insurance costs to be so high.

This is because smokers and other tobacco users usually pay for more health insurance than non-smokers. Sometimes a lot more.

Insurers can charge tobacco users up to 50% more than those who dont use tobacco, according to healthcare.gov.

The reasoning here is pretty obvious. Using tobacco products impacts your body and your health in many negative ways.

For starters, smoking harms nearly every organ of the body, says the CDC. The CDC also says that smoking causes:

- Chronic obstructive pulmonary disease .

- Diabetes.

- Lung diseases.

- Stroke.

And it raises a persons risk for tuberculosis, certain eye diseases and problems of the immune system.

Quitting may help you save money , but it wont do so right away. Insurance companies can wait up to five years after you stop using tobacco products to reduce your rates.

Searching for more ways to save money on health insurance? Youll find a handful of suggestions at the end of this article.

Why Is Healthcare So Expensive Is Something That We Often Find Ourselves Asking Continue Reading The Article To Find The Answer To This Important Question

Why is healthcare so expensive? The cost of medical care is the single greatest factor behind U.S. healthcare costs, representing 90% of expenditure. These uses mirror the expense of really focusing on those with constant or long haul medical conditions, a growing populace, and the increased expense of new drugs, methods, and treatments. The pressure on our rambling healthcare framework in the U.S. has never been more prominent. There is a pressing need to develop testing and treatment for COVID-19 for all inhabitants who need it, paying little heed to health care coverage status. Huge government cash floods have looked to support hospitals listing under the heaviness of the COVID-19 pandemic and the connected end of elective surgery and standard medical care.

Recommended Reading: Starbucks Health Insurance Part-time

How To Enroll And Get Answers To Your Questions

You can learn more about and apply for ACA health care coverage in several ways.

-

Visit HealthCare.gov to apply for benefits through the ACA Health Insurance Marketplace or youll be directed to your states health insurance marketplace website. vary by state.

-

Find a local center to apply or ask questions in person.

-

Download an application form to apply by mail

Find the answers to common ACA questions about submitting documents, getting and changing coverage, your total costs for health care, tax options, and more.

Read Also: Do Substitute Teachers Get Health Insurance

Fear Of Malpractice Lawsuits

Frequently called defensive medicine, some doctors will prescribe unnecessary tests or treatment out of fear of facing a lawsuit. The cost for these treatments add up over timea study has shown that the average cost of defensive medicine is around $100 to $180 billion each year.

This is no surprise given that our current regulatory system is structured to support the fee-for-service model of healthcare delivery and payment. The Commonwealth Fund reports that the fear that healthcare providers will withhold important services to stay under budget is a more significant concern to Americans than the overutilization of services.

Don’t Miss: Starbucks Partner Health Insurance

What Does Health Insurance Cover

Every health insurance plan could essentially include or exclude any type of coverage they wanted before the introduction of the Affordable Care Acts . This made it incredibly tedious to compare plans because there was little standard of coverage between dozens of options. Now the ACA dictates that every permanent health insurance plan must include at least the following ten essential benefits:

Your plan must also include the following benefits for women:

- Breastfeeding support: This includes counseling and equipment for nursing mothers.

- Birth control: ACA-compliant plans must include prescribed FDA-approved contraceptive methods. This includes emergency contraceptives but does not include drugs intended to terminate an already viable pregnancy.

Your employer may be exempt from covering certain contraceptives if you work for a house of worship or a religious non-profit.

Caring And Cautious Doctors

Another reason that increases the final amount on your medical bill is that doctors in Singapore are very caring and cautious, especially in the private sector. They are very likely to suggest you to do additional tests or scans and to take many pharmaceuticals to make sure you will heal quickly. They may also tell you that you have a probability to have this or that condition, not because they want you to be worried but simply because it happens that some patients sue their doctor after developing a severe disease their doctor didn’t warn them about. Do not hesitate to seek second medical opinion.

Don’t Miss: Asares Advanced Fingerprint Solutions

Medical Care For An Aging Population

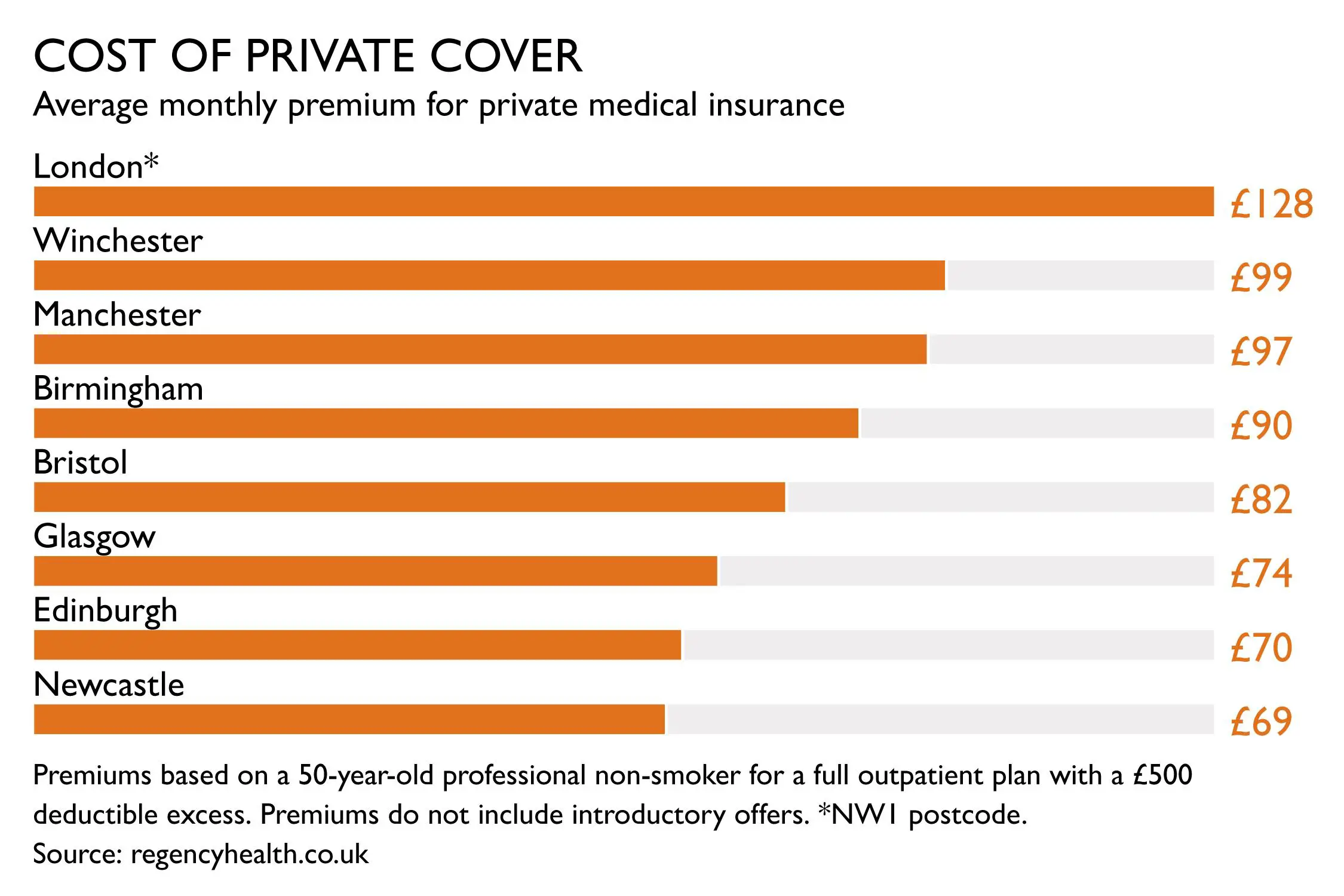

Our aging society, combined with ever advancing treatments, has seen the cost of healthcare within the NHS spiralling upwards. Naturally many of these financial pressures affect the private health sector too, forcing up the cost of private medical insurance, with AXA PPP’s price rise of 8% last year typical of the industry.

Advantages Of How Contributions Are Calculated

What is also important to note regarding the cost of private health insurance is the notion that when entering private health agreements, they should be viewed as life-long contracts. This is beneficial to an individual being insured because it means that the premium for the entire term of the contract is calculated in advance and on the basis of a persons age and health when first entering the contract. This means that although an individual may initially pay higher premiums in the first years of their private medical insurance membership, this is then offset because the individuals premiums wont increase in the later stages of life due to age when they may need increased medical care. This is associated with the ageing reserves provision that is enjoyed for those privately insured but does not exist in the public system.

Also Check: Starbucks Part Time Insurance

Conditions Of An Already Overseas Policy:

- Who can buy? â You must be an Australian citizen or resident in order to buy a policy. You can also normally buy it if you are on a 457 working visa, a spousal visa or skilled working visa. However cover is not available to those in Australia on working holiday visas.

- Homeward bound You must have a booked return trip and be travelling back to Australia in order to buy this type of cover.

- Waiting periodsâ You may not be able to claim for any medical incidents in the first few days of your cover â this is known as a waiting period. A waiting period exists to protect insurers from those whoâve not bought insurance and then decide they need it later. Usually due to accident or illness and not wanting to pay the expensive overseas medical fees that they incur.

- Age limits Just like a standard policy, already overseas policies have age restrictions saying who can and cannot buy. Check out the age limits in the table below.

- Pre-exiting medical conditions â Conditions that exist before you departed for your holiday are unlikely to be covered. Always read your insurerâs policy documentation to see what conditions they cover for free. You should always tell your insurer of any pre-existing conditions when you first purchase your policy however trivial they may seem.

Donât Miss: New Cures For Type 1 Diabetes

How To Choose German Health Insurance

-

Fact-checked by Derrick Loehr on July 19, 2021

Derrick is an insurance broker and the founder of Optimum Capital. He has a lot of experience with immigrants.

-

Fact-checked by Marvin Ewald Hammor on July 05, 2021

Marvin is the director of Barmer‘s expat hub in Berlin. Barmer is the second largest public health insurer in Germany.

-

Fact-checked by Dr. Rob Schumacher on January 11, 2021

Rob Schumacher is a health insurance broker and the founder of Feather insurance. We work together since 2018.

-

Fact-checked by Daniel DeRosa on May 13, 2020

Daniel is a health insurance broker and the co-founder of B-Protected. He has a lot of experience with immigrants. We work together since 2019.

-

Fact-checked by Mike Woodiwiss on October 29, 2018

Mike is a health insurance broker at Spectrum International.

If you live in Germany, you must have health insurance. It’s the law. You pay for health insurance every month, and health insurance pays for your healthcare.

In this guide, I help you choose the best health insurance for your situation. I also explain the difference between public health insurance and private health insurance.

You May Like: Is Umr Insurance Good

Private Vs Public Health Insurance In Germany

Every resident in Germany needs to have health insurance by law. That begs the question, which is the best German health insurance for foreigners? To shed some light on this complex topic, we compare private vs. public health insurance in Germany for expats in-depth.

Depending on your circumstances, you may have to be insured publicly or you may be able to choose between public and private insurance. For some expats, private health insurance might be the only option in Germany.

An Alternative Way To Pay For Health Care Costs

If youre struggling to pay for prescriptions, dental care, home care or any other medical expenses, and its not worth getting private health insurance , what options do you have?

For homeowners aged 55-plus, the CHIP Reverse Mortgage® from HomeEquity Bank could provide the money you need to pay all of your medical costs, without having any impact on your retirement income.

With a reverse mortgage you can receive the money in a lump sum or in monthly payments, to coincide with your monthly health care costs. And, because you dont have to pay what you owe , until you decide to sell your home, it wont stretch your finances.

If health insurance for retirees in Canada is out of reach for you, but you have considerable health care expenses, call us now at 1-866-522-2447. Well work out how much cash you can access and help you start the process.

Also Check: Kroger Health Insurance Part-time