Who Might Benefit From Visitor Health Insurance

Whether you are a first-time international traveler or a seasoned traveler who has visited the USA many times before, theres always a chance of an unexpected travel setback due to a medical illness or injury. In these cases, visitor health insurance can serve you as a financial pillow for medical coverage along with travel assistance if needed. You can benefit from visitor health insurance if you are a USA tourist or parent visiting family in the US, an international student on F or J visa, or traveling for business.

What Is The Best Health Insurance For Foreigners In Usa

The best health insurance for foreigners in USA is the one that has the highest medical expenses coverage, including some coverage for acute onset of pre-existing conditions and COVID-19 too. Most of the plans we offer will fulfill your needs. But, to name a few of the best ones they are: Safe Travels USA Comprehensive, Patriot America Plus, Atlas America, Liaison Travel, and Patriot Platinum.

How Inbound Usa Insurance Works

Once you complete your purchase, you will immediately receive a receipt, a summary of your benefits, an ID card, and a copy of the plan document. The plan document is the legal document that explains how your coverage works and describes all benefits and exclusions for our international health insurance plan. We recommend you read your plan document, so you understand how your Inbound USA insurance plan works.

Where can I travel?

If you wish to buy this plan, your travel destination must be the USA. The plan provides limited coverage for travel to additional countries for trips that originate in the USA. See the International Travel Coverage benefit for details.

Who can buy an Inbound USA plan?

Non-United States citizens who are traveling to the USA can buy Inbound USA. You may buy coverage for yourself, your spouse, your children, and your traveling companions. To be covered, you must be at least 14 days of age and younger than 100 years of age.

You may not buy this plan if you have already received a Green Card/Permanent Resident Card for the United States.

Excess Insurance

Pre-Certification

Length of Coverage

EXTENDING YOUR COVERAGE

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

Is Health Insurance Mandatory For Visitors To The Usa

As a visitor to the US, it is not mandatory to buy health insurance. However, with high medical costs in the US, you can be at risk of losing an enormous amount of money even for a minor injury. To avoid any unexpected financial burden due to your medical conditions, it would be best to buy a visitors medical insurance.

Final Thoughts On Getting Health Insurance In The Usa

Insurance provides comfort, knowing your expenses will be covered should you become ill or need emergency medical treatment. The peace of mind that health insurance plans in America bring come at a price though. However, the cost of an insurance policy is usually lower compared to out-of-pocket hospital bills you have to pay for without coverage.

To help you make a better decision on which policy to get, view our list of the top international health insurance companies and look at the benefits and exclusions of each provider.

If you need assistance, we have licensed insurance agents who are always available to walk you through the process and explain the differences of each provider. We will make the application process easier and more seamless for you, so you can worry less about getting the right health insurance in the USA.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

Travel Documents Required While Travelling From India To The Usa

It is advisable to buy health insurance for visitors to the USA. There are also several other essential travel documents that are required for travelling to the USA from India. The aforementioned documents have been listed below.

- A valid Indian passport

- A pre-approved visa

- A letter detailing the reason for your visit to the USA

- Confirmed travel tickets

- Prescription for specific medications, if necessary

- USA travel health insurance, including Covid-19 coverage.

- The particulars of the people with whom you will stay in the USA along with their addresses

- The applicable financial documents

- The proof of the funds you are carrying to the USA

Can Foreigners Buy Health Insurance In The Usa

You can buy the foreigners health insurance plans before or after the start of your trip. The duration of these plans can be anywhere between five days to three years. Most of our foreigners health insurance plans include direct payments to certain hospitals and doctors. So you can even enjoy a cashless transaction while visiting a care center in the US. Foreigners can buy these affordable plans based on the amount of coverage they prefer. These plans cover unexpected medical costs if some sudden accidents or illnesses occur.

You May Like: Does Starbucks Provide Health Insurance For Part Time Employees

Is It Worth To Buy Second Hand Car

The cost of insuring your used car will be much lower than you would pay for one brand new. Your wallet wont be damaged too much if you decide to sell it in the future since youll lose less money than if you bought a new one. First-time buyers, and especially those who are on a budget, can find that a used purchase is more affordable and practical.

Main Types Of Coverage To Consider

Health/accident insurance. Typically referred to as travel health insurance, these polices pay for doctor and hospital bills, and sometimes dental care and medications. These plans can be written for short trips and will supplement Medicare or a managed care plan. International health insurance can also be purchased as primary insurance for expats or someone relocating to another country for an extended period of time . These plans are comprehensive and include added features such as preventive services, acupuncture, chiropractic care, maternity benefits and more.

Medical Evacuation. Evacuations can be expensive . In addition to the coverage, you’ll want assistance arranging an evacuation. All of GeoBlues products offer coverage for medical evacuation.

- GeoBlue Travel Insurance

- King of Prussia, PA 19406 USA

- 1.855.481.6647

You May Like: Does Starbucks Provide Health Insurance For Part Time Employees

Visitor Health Insurance Usa Exclusions

The most common exclusions of Visitor Health Insurance in the USA are-

- Losses due to pre-existing conditions

- Travel costs if you are visiting the USA for medical treatment

- Losses due to war

- Extremely high-risk sports like sky-diving, scuba diving, bungee jumping

- Mental, psychological, and nervous disorders

- Intentionally harming themselves physically, like attempting suicide

- Venereal disease, AIDS virus, pregnancy, and abortion

- Treatment caused by alcohol or drug intoxication

Affordable Health Insurance For Visitors To Usa

Where can I find Visitors Insruance for USA?

Knowing the realities of high US medical costs, this is a common question we get from travelers. There are many types of plans, each with varying levels of coverage. Visitor Guard® has many policies for you to consider. We offer the best Visitor Insurance in USA for people traveling from India, China, and any country across the world.

You can always speak with one of our licensed agents if you have questions about the best health insurance for visitors to USA. All our licensed agents and claims administrators are based in the US. Claims are processed in conjunction with each providers office.

Also Check: Starbucks Healthcare Benefits

How Do I Sell My Car In Malaysia

How Do I Get Health Insurance If I Am Not A Us Citizen

You dont need to be a US citizen to get health insurance. There are various category of plans for US citizens, Green Card Holders and residents, international students, and visitors to the US. To be eligible for the domestic plans like the Blue Cross Blue Shield, Aetna, Cigna etc. you will need lawful proof showing you are a US citizens, permanent resident of the USA or a green cardholder, Work visa, Refugee, Student Visa lawful temporary resident of the country. Temporary visitors to the US who cannot provide proof can consider the health insurance plans for foreigners on this page.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

Health Insurance In Usa For Foreigners: What You Need To Know

Disclaimer: This article may link to products and services from one or more of ExpatDens partners. We may receive compensation when you click on those links. Although this may influence how they appear in this article, we try our best to ensure that our readers get access to the best possible products and services in their situations.

Health insurance is a major concern for everyone living in the United States.

Healthcare is a thorny issue given that healthcare costs in the United States are among the highest in the world.

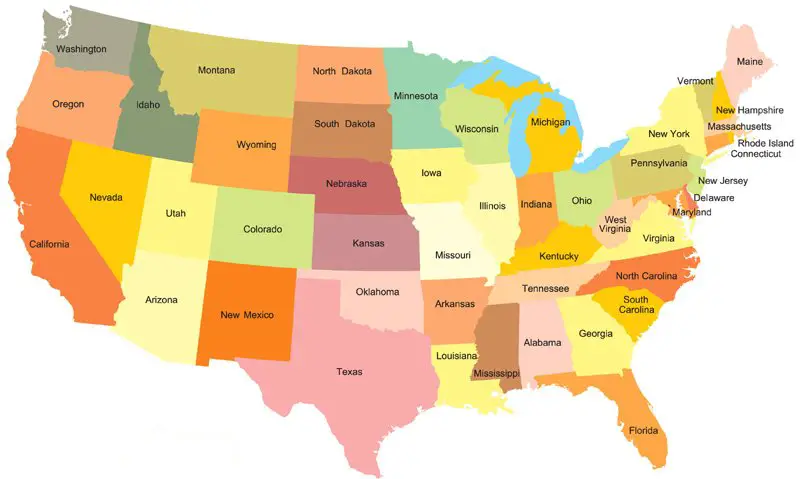

Making matters more complicated is that each state has different rules and regulations when it comes to health insurance.

For example, if you live in the state of New York, you might not be able to get international insurance because of the states regulations. But if you live in California, you can get international insurance.

With that said, this guide to health insurance in the United States will show you the public and private health insurance options available to you, the premiums you can expect to pay, and the steps you need to take to find the best coverage for your needs.

This way, when you have a medical emergency while living in the US, you wont be stuck with having to pay hundreds of thousands of dollars out-of-pocket.

Can Immigrants Select From Any Available Health Plans During Open Enrollment

Yes, as long as theyre lawfully present in the U.S. Open enrollment for individual-market health insurance coverage runs from November 1 to December 15 in most states, although the Biden administration has proposed an extension through January 15.

During this window, any non-incarcerated, lawfully present U.S. resident can enroll in a health plan through the exchange in their state or outside the exchange, if thats their preference, although financial assistance is not available outside the exchange.

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

Types Of Visitor Health Insurance Usa Plans

Limited Benefit Plans

A limited-benefit plan is a lower premium plan and often acts as supplemental insurance, rather than a stand-alone coverage. Since limited-benefit is relatively inexpensive, some users choose it instead of purchasing major medical health insurance. Usually, they include critical illness plans, indemnity plans, and hospital cash policies.

Comprehensive Plans

A comprehensive health insurance policy is extensive coverage for all kinds of health-related expenses. It acts as a financial pillow in case of health emergencies, consultations, hospital stays, and medical tests. With a higher premium, it aims to ensure that you do not have to worry about finances in case of a medical emergency.

Do Visitors To The Uk Need Medical Insurance

The UK has Government-funded medical and health care services called National Health Services for everyone living in the UK. They can use these services without being asked to pay the full cost of the treatment. All European Union citizens visiting the UK can get free healthcare if they have a valid EHIC card.

Non-EU countries who visit the UK will need to pay for medical services. If you are a non-EU citizen and traveling to the UK as a visitor, it is advisable to have medical insurance that can cover you for high medical costs.

Unlike the UK, the US does not have a National Health Service, hence if UK and EU citizens are traveling to the US, they need to buy visitor insurance to cover medical emergencies in the US.

You May Like: Does Starbucks Provide Health Insurance For Part Time Employees

Which Is The Best Travel Insurance For Visitors To The Usa

The USA is one of the most expensive areas in the world in terms of medical treatment. You might have to pay an extensive amount just for consultation and minor or routine treatment. Illnesses and injuries rarely come with a warning. If you want to avoid any unfavorable situations, it is best for you to get a good plan that meets all your requirements before you visit the US.

There are various options available for visitors to choose from. Learn the difference between a fixed benefit and a comprehensive plan and how these plans meet your requirements. Comprehensive plans like Safe Travel USA Comprehensive, Patriot America Plus, Atlas America, Liaison Travel Insurance, and fixed benefits plans like Inbound USA, Visitors Care are some of the popular plans to compare.

There is no one-size-fits-all when it comes to medical insurance. Go through the coverages of these plans and choose the one that covers all your needs and preferences.

How Family Physicians Are Set

The majority of Canadian citizens and permanent residents have a family physician. They consult their physicians for annual physical exams and ongoing healthcare management. Family physicians order tests, like blood work and X-rays, and refer patients to specialists.

Family physicians may operate out of a small office as solo practitioners. They may also form small collectives where they take turns covering after-hours drop-in services. They might also have a nurse or phlebotomist on staff.

In some areas, the family physician is also a nurse practitioner. They are specially trained nurses who take on many of the duties of a primary care physician. Nurse practitioners based in rural areas may have a rotating schedule where they cover care in communities separated by hundreds of miles. Meanwhile, those in urban areas may be part of a larger clinic that does more than just primary care by including community services like breastfeeding support groups and nutrition services.

Recommended Reading: How Much Is The Er Without Insurance

Id Challenges With Canadian Insurance

While it might feel like you have to present a lot of paperwork to receive your healthcare insurance card, this new piece of ID is not as versatile as you think. You really cannot access the healthcare system without it, but the card is not that helpful in other situations.

For instance, it is not accepted as proof of age for purchasing alcohol or for proving your identity when you vote at municipal elections. In short, this is not helpful as a piece of Canadian identification other than for healthcare eligibility.

If you are eager to take care of your paperwork as soon as possible, make sure you update your mailing addresses to start getting bills at your new home. This is really important for documenting the length of your residency in Canada. If Mom is still forwarding your Visa statement, that will not help your case.

Can Immigrants Buy Individual Health Insurance

This is the area that has changed the most for recent immigrants who are 65 or older. Prior to 2014, obtaining individual health insurance for your grandmother in the private market would have been difficult or impossible, since very few major insurers were interested in selling coverage to people over 65.

But the Affordable Care Act has changed that. Health history is no longer used to determine eligibility or premiums in the individual market, and private carriers now offer coverage to people who are 65 or older, as long as they are not enrolled in Medicare.

The ACA also stipulates that older enrollees cannot be charged more than three times the premiums that younger enrollees pay. Since most individual market enrollees are 64 or younger, this rule typically means that a 64-year-old will pay no more than three times as much as a 21-year-old for the same coverage. But if an 80-year-old enrolls in that plan, her premium will be the same as a 64-year-old.

So for the first five years that your grandmother lives in the United States , shell be able to purchase individual health insurance through the exchange in the state where she lives. Depending on her income, she may be eligible for subsidies to lower the cost of the premiums, and if her income is doesnt exceed 250% of the poverty level, shell also be eligible for cost-sharing reductions if she buys a silver plan.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

Why Should You Care About The Ppaca

PPACA is on the road to full implementation and the legislation will affect individuals, businesses, and the healthcare industry in a number of important ways. Residents and citizens, visitors to the United States, immigrants, international students, and other groups will be affected in different ways by the PPACA. While most people will be penalized if they do not have health insurance, there are some groups of people that will remain uninsured as PPACA moves into place.

Heres how PPACA will affect the following groups of people:

1. Visitors to the United States

Non-US citizens traveling to the United States on vacation or to visit friends and relatives do not need PPACA coverage. If you are a resident or a citizen of another country and you are temporarily traveling to the US then you are exempt from the PPACA rules you dont have to have health insurance and you wont be fined by the US government if you dont have health insurance.

2. US Citizens Living Abroad

US citizens that live abroad for at least 330 days out of a one-year period do not need to have PPACA coverage. These people are deemed to already have minimum essential coverage and are not required to buy PPACA insurance, nor will they be fined if they do not have any health insurance cover in place. The following details clarify the situation for US citizens not living in the US:

3. Green Card Holders