Can You Get Subsidies With A Bronze Health Plan

When you get a Bronze health plan, you are eligible for premium subsidies, which are paid as a tax credit. However, you will not be eligible for other cost saving subsidies with a Bronze health plan, such as the cost-sharing subsidy. The lowest level of plan eligible for this subsidy is the Silver health plan.

What Do Bronze Plans Cover

Insurance companies cannot sell plans through Obamacares health insurance marketplace unless they meet a certain standard and cover these 10 essential health benefits:

-

Prescription drugs

-

Pediatric services, including dental and vision coverage for children

-

Preventive care, such as regular checkups with your primary care physician, screenings, and chronic disease management services

-

Hospitalization for surgery, overnight stays, and other care

-

Mental health and substance use disorder services

-

Pregnancy, maternity, and newborn care

-

Ambulatory patient services, which is outpatient care you receive without going to a hospital

-

Laboratory services

-

Rehabilitative and habilitative services and devices (treatments and devices that help gain or recover your mental and physical skills after an injury, disability, or onset of a chronic condition

Learn more about the 10 essential health benefits that all plans need to cover.

How Does Health Insurance Work

How does health insurance work? While health benefits vary based on the plan and insurance company, most health insurance providers follow the same basic concept. Individuals can choose their own plans through the health insurance marketplace, or a company offering health insurance can choose to offer a group health plan.

In the latter case, the company pays a portion of the insurance premium, while the remainder is deducted from each employees paycheck. According to an NBGH survey, employers covered nearly 70% of the cost of health insurance premiums in 2020, while employees paid 30% on average.

The plan will have a policy that dictates all the details of what healthcare costs are covered and how much is paid. When a covered person receives healthcare, the medical provider will bill the health insurance company for its determined coverage amount, while the patient is responsible for paying any deductibles, copays and noncovered costs. Most health insurance companies will offer higher premiums for lower co-sharing costs and vice versa.

You May Like: Does Usaa Offer Pet Health Insurance

Whats A Bronze Plus Policy

In addition to standard Bronze cover, a Bronze Plus policy may offer either a clinical categories or a specific additional procedure that would normally be found in Silver and/or Gold tiers. Bronze Plus health insurance policies typically cost more than standard Bronze policies, and health insurers can choose whether or not they offer this type of policy to their customers. If a fund does offer additional cover, it must be on an unrestricted* basis.

Choice Health Insurance Reviews

If you’re curious to know whether you’re overpaying for health insurance, we’ve built a tool that allows you to compare thousands of health insurance policies from 43 brands across 36 funds .

Our experts rate policies based on out-of-pocket costs, fund complaints, price and more, and we’re 100% independent, which means we don’t show sponsored results like other comparison sites.

We show you all the funds big and small, member-owned and nonprofit to help you find the best. Compare health insurance now and see whether you can change policies and save.

Our health insurance reviews are for members, but we’ve got lots of helpful free health insurance content, like advice from our experts, explainer articles and buying guides, to help you make sense of your options.

With our health insurance tool you can compare policies from 43 brands across 36 funds:

Recommended Reading: Can A Grandchild Be Added To Health Insurance

How Much Will It Cost

For any plan, your monthly premium will be based on several factors including:

- Your age

- Whether or not you smoke

- Where you live

- How many people are enrolling with you

- Your insurance company

Since your states Marketplace allows various private insurers to offer plans, a Silver plan from one company may cost more or less than the same plan offered by a different insurer. Plans offered by the same company, however, will increase in price as the actuarial value and the amount the plan pays go up.

As discussed above, the federal limit for annual out-of-pocket expenses for individuals is $8,550 the family cap is $17,100. Certain plans may have even lower out-of-pocket caps.

How Much Is Health Insurance By Family Size

Not surprisingly, the more people in your family are covered by your health insurance plan, the more youre likely to pay in premiums.

The average cost for a 40-year-old couple is $954 per month or double the cost for an individual in that age range. But adding kids isnt quite as linear. A 40-year-old couple with one child under age 14 would pay an average of $1,230 per month, and a family of five would pay around $1,782.

To estimate the average family’s health insurance cost, MoneyGeek used national averages by age and added the premiums together. Actual family premiums may vary.

Average Health Insurance Premiums by Family Size

Scroll for more

- Couple w/ Three Kids $1,782

It seems logical that families would stick together on health insurance its convenient and easy to do so. And together, youre more likely to meet the out-of-pocket maximum, after which you shouldnt have to pay out-of-pocket costs for covered services.

But some families might be better off on separate plans.

For example, if one spouse can get low-cost coverage through their job, but that plan may not be open to family members , it may make sense for that spouse to use their employer-provided insurance while the rest of the family uses a Marketplace plan.

Or, if one partner has more medical needs and higher costs, they may benefit from paying more for more coverage. But if the other partner has few health needs, they may be better off in a high-deductible plan just for themselves.

Recommended Reading: How Much Does Health Insurance Cost Per Month In Texas

You May Be Able To Lower Your Health Insurance Premiums

Are your monthly premiums too high? Do you feel like youâre not getting the best value from your medical coverage? If so, what can you do about it?

None of us is getting any younger and few of us want to move just to change how much our health insurance costs. But there may be some things you can do to trim your premiums.

See if you qualify for a free health insurance program like Medicaid, or the Childrenâs Health Insurance Program .

Consider increasing your deductible. The more you pay out of pocket â whether you have a group or individual plan â the less you will have to pay in premiums. You can sometimes pair a higher deductible plan with a health savings account .

Pre-tax contributions can be rolled into your plan each year. You pay healthcare expenses from your HSA until itâs exhausted.

If you need help with a high-deductible health plan, medical gap insurance may be able to help. This is a form of supplemental health insurance that provides lump sum coverage for a range of covered injuries and illnesses.

Find out how much a gap health plan will cost you each month by getting a free quote â it just takes a minute.

Try switching to an in-network doctor. It can be hard to switch from a physician youâre comfortable with, but itâs worth a look into your planâs provider network to avoid out-of-network charges.

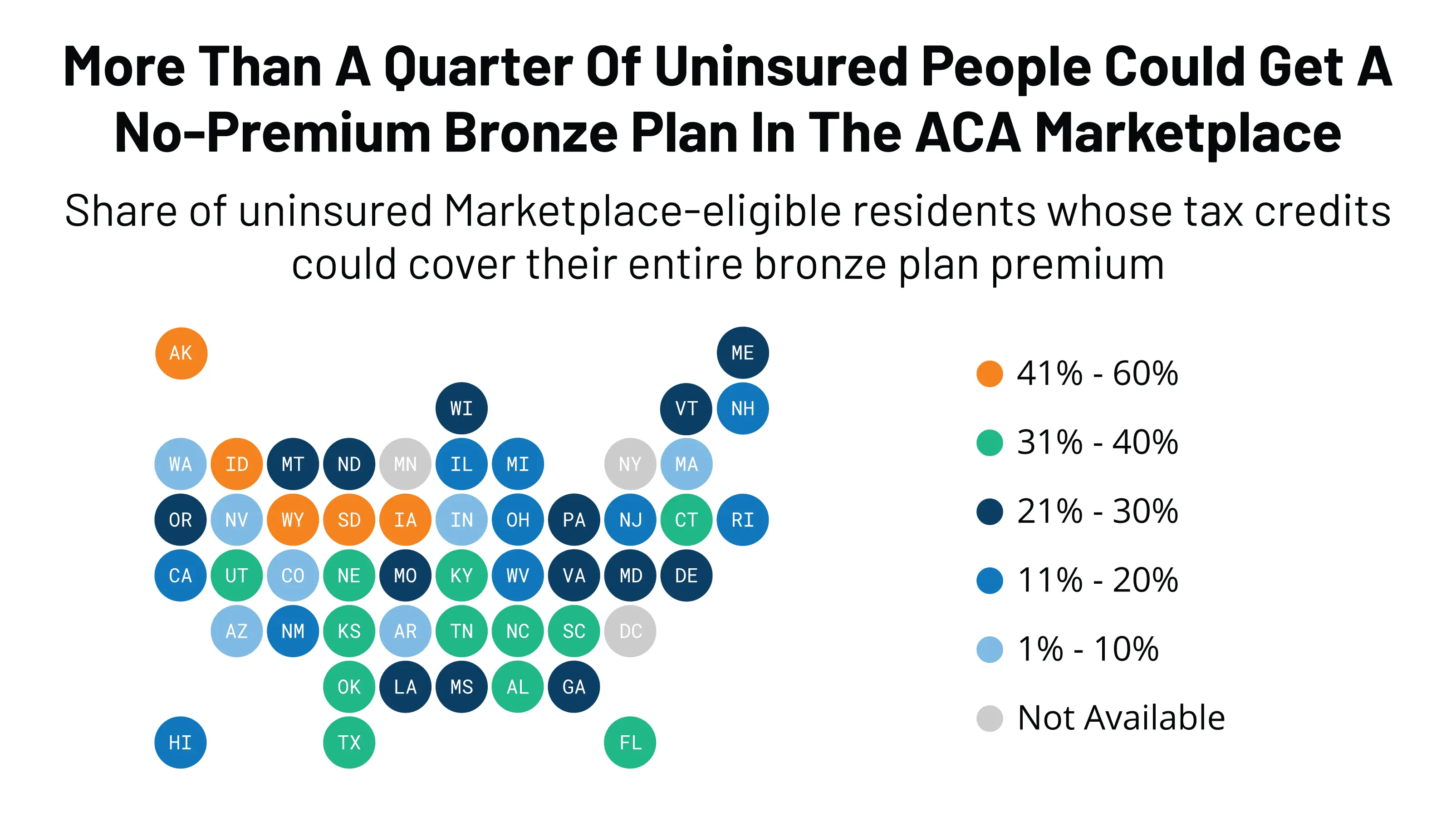

Find out if you could qualify for an ACA subsidy.

What Does The Bronze Plan Cover

All bronze plan coverage must include the 10 essential benefits that are included in all Affordable Care Act-compliant plans, which includes coverage for:

In addition to the above 10 essential benefits, health insurance companies have the opportunity to include additional coverage. You can check a specific bronze plans coverage by reviewing its Summary of Benefits, where coverage details and costs are listed.

Recommended Reading: Can You Put Your Parents On Your Health Insurance

Regular Bronze Plans Vs Expanded Bronze Plans

Regular bronze plans still come with all the benefits of Obamacare, like free preventive care. But bronze plans are designed to cover roughly only 60% of enrollees total costs , and a typical bronze plan tends to require the member to meet the deductible before the plan starts to pay for non-preventive services.

Expanded bronze plans still have actuarial values that are in roughly the same range, but they can go a little higher as well. Bronze plans must have actuarial values that can only vary from 56% to 62% , while expanded bronze plans can have an actuarial value that ranges as high as 65%. A plan with an actuarial value of 65% would cover an average of 65% of total costs for a standard population. This additional coverage can be achieved by adding extra pre-deductible benefits.

With an expanded bronze plan, you can be protected from certain runaway costs before you hit your deductible. Flat fees or co-payments for covered services mean that you dont have to spend a lot on your own before health insurance savings kick in. Those expanded services give the plan a higher actuarial value as well, meaning a higher percentage of total average costs would be covered.

If you werent sold on a health insurance plan before, expanded bronze plans might sweeten the deal. Lets take a more detailed look at the coverage these expanded bronze plans provide.

What Is The Average Cost Of Health Insurance

Updated on Thursday, March 11 2021 | 0 min. read| by Aaron Besson

While the average cost of health insurance is $452 a month, many factors can change that. How do your rates compare?

The average cost for individual health insurance in 2021 is $452 a month. This cost may vary depending on where you live and how much coverage you want. This article will cover:

You May Like: Can I Get On My Girlfriends Health Insurance

Small Business Health Insurance Costs

How much does small business health insurance cost? Determining the cost of small business health insurance is a complicated process that accounts for multiple factors. Why doesnt everyone pay the same? To understand small business group health insurance plan costs, be mindful of the following considerations.

The Average Cost Of Health Insurance By Metal Tier

Plans offered on the Health Insurance Marketplace are categorized into metallic tiers: Bronze, Silver, Gold and Platinum.

The tier corresponds to the value of the coverage, or how health plans and members split the costs. For example, in Bronze plans, the health insurer pays approximately 60% of the costs of care, and the individual typically pays 40%. The provider typically pays 90% in Platinum plans, and the individual pays 10%. These ratios are set by tier and based on expected spending for a typical health plan member.

In MoneyGeeks analysis, the lowest average premiums were $383 per month for Bronze plans. The average Platinum plan, by contrast, costs $782 per month.

Average Health Insurance Premiums by Metal Tier

Scroll for more

- $170$3,501

Recommended Reading: Where To Go If No Health Insurance

What Is Bronze Health Insurance

Bronze health insurance is a lower level of cover for private hospital insurance covering 18 categories of services in private hospital.

If you’re healthy and not planning a family but you want back-up cover for broken bones, the flu and some diabetes treatment, Bronze health insurance could work for you.

If you just want health insurance to avoid taxes and don’t actually need to use your health insurance, try the cheapest Basic policy. But if you want a higher level of cover, look for Bronze Plus, Silver or Gold health insurance.

Not sure what level of hospital insurance you need? Take our quick quiz to find out.

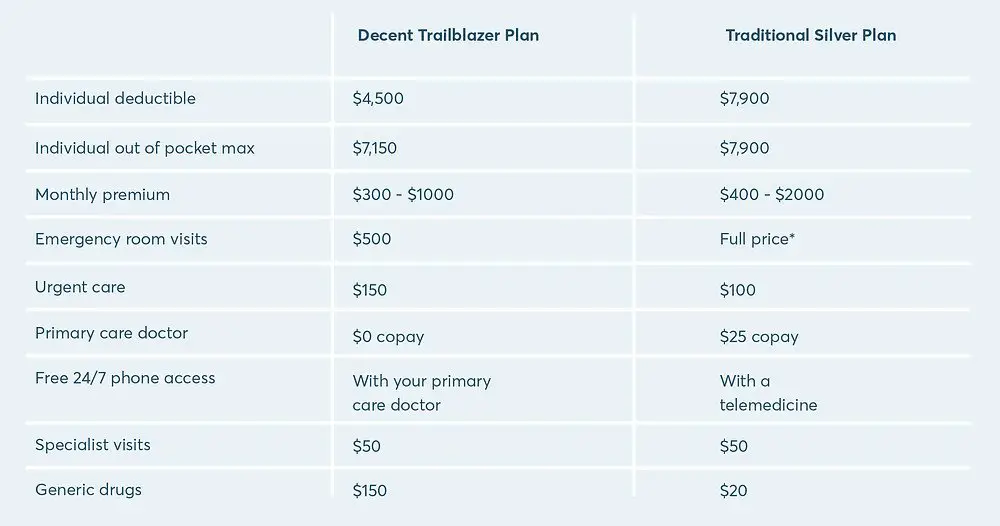

The Dangers Of A Bronze Health Plan

As an employer offering benefits for the first time or making changes to your benefits programs, you have two big decisions to make when it comes to quality of your program:

Employers with limited budgets can keep their costs in check one of two ways:

I am going to highly recommend that if you find yourself making a decision like this, you offer a better plan and pay a lower percentage of the premium. At first, this may seem detrimental to your employees, but it is actually better for them in the long run.

ACA plans come in 4 tiers: Bronze, Silver, Gold, and Platinum. Depending on industry and budget, we will recommend offering either a Gold or Platinum plan. Occasionally, for blue-collar businesses, a Silver plan is OK as it is the industry norm. But we never suggest Bronze plans.

In most cases, Bronze plans offer coverage that is essentially only useful in a catastrophic situation. With deductibles usually at $6,000 and up annually, you would have to have a major medical emergency or chronic illness to get past that deductible in a year and start using the actual benefits on the plan. So employees on a Bronze plan end up paying thousands out of pocket per year for normal procedures.

You May Like: Is Health Insurance Tax Deductible

How Much Does Health Insurance Cost

In 2022, the average cost of health insurance is $541 a month for a silver plan. However, costs will vary by location. Insurance is expensive in West Virginia and South Dakota, averaging more than $800 a month. States with cheaper health insurance include Georgia, New Hampshire and Maryland, averaging less than $375 a month.

Cost Sharing Percentages When You Use Careat A Glance

- These levels show the estimated amount of medical costs paid by you and paid by the health insurance company over the course of an entire year.

- The levels show cost sharing for the plan as a whole, the deductible, coinsurance and copayments. They do not account for monthly premiums.

- Your health insurance company covers all in network healthcare costs after you reach your out-of-pocket maximum.

Recommended Reading: Do We Need Health Insurance

Into An Aca Marketplace Enhanced By The American Rescue Plan

But change comes. Cindy is retiring this month, a little shy of her 64th birthday. The Affordable Care Act was supposed to make this feasible and since March of last year, when the American Rescue Plan provided a major boost to premium subsidies in the ACAs health insurance marketplace, the ACA has a far more credible claim than previously to reducing job lock.

The ARP subsidy boosts only extend through 2022. Democrats in Congress have intended to extend them further, but with their Build Back Better legislation long stalled, extension now is far from certain.

The ARP reduced the percentage of income required to buy a benchmark Silver plan at every income level, and it removed the notorious income cap on subsidies. Before the ARPs enactment in March 2021, people whose family income exceeded 400% of the Federal Poverty Level currently $51,520 for an individual, $106,000 for a family of four were ineligible for premium subsidies. Since premiums rise with age -at age 64, theyre triple what a 21 year-old pays paying full freight was especially challenging for 60-somethings like Cindy and me. At our age, unsubsidized benchmark premiums are typically $700-800 per month each and more in some states .

Employee Health Insurance Premiums

If you work for a large company, health insurance might cost as much as a new car, according to the 2020 Employer Health Benefits Survey from the Kaiser Family Foundation. Kaiser found that average annual premiums for family coverage were $21,342 in 2020, which was nearly identical to the base manufacturer’s suggested retail price of a 2022 Honda Civic$22,715.

Workers contributed an average of $5,588 toward the annual cost, which means employers picked up 73% of the premium bill. For a single worker in 2020, the average premium was $7,470. Of that, workers paid $1,243, or 17%.

Kaiser included health maintenance organizations , PPOs, point-of-service plans , and high-deductible health plans with savings options in arriving at the average premium figures. It found that PPOs were the most common plan type, insuring 47% of covered employees. HDHP/SOs covered 31% of insured workers.

| Average Employee Premiums in 2020 |

|---|

| Employee Share |

| $104 |

Of course, whatever employers spend on their workers’ health insurance leaves less money for wages and salaries. So workers are actually shouldering more of their premiums than these numbers show. In fact, one reason wages may not have risen much over the past two decades is because health costs have risen so much.

Which type of plan employees choose affects their premiums, deductibles, choice of healthcare providers and hospitals, and whether they can have a health savings account , among many choices.

Don’t Miss: How Do You Get Health Insurance

What Is A Bronze Health Plan

When it is time to choose a healthcare plan on the Affordable Care Act Marketplace, you have a number of options that balance monthly premiums against potential out of pocket costs. These plans are broken into tiers and then assigned a metallic level: Platinum, Gold, Silver and Bronze. A Bronze health plan is the lowest level plan and comes with the cheapest monthly premiums. While it can be tempting to go straight for the plan that costs the least per month, there are a number of factors to consider when choosing which metal level is the right one for you.